Shell Plc Bundle

Can Shell Plc Maintain Its Dominance in the Shifting Energy Landscape?

The energy sector is undergoing a monumental transformation, forcing established giants like Shell Plc to adapt or risk obsolescence. With geopolitical tensions and the rise of renewables reshaping the industry, understanding Shell's position is crucial. This analysis dives deep into the Shell Plc SWOT Analysis, its competitive landscape, and the strategies it employs to navigate these turbulent times.

Shell Plc's journey, from its early days to its current status as a diversified energy behemoth, offers a fascinating case study in strategic adaptation. This exploration of the Shell Plc competitive landscape will reveal its key rivals, market share analysis, and competitive advantages. We'll also examine Shell Plc's financial performance compared to competitors and its strategic partnerships, providing valuable insights into its future in the energy sector competition, including its renewable energy initiatives and downstream competition.

Where Does Shell Plc’ Stand in the Current Market?

Shell plc maintains a strong market position within the global energy sector. As of early 2024, it stands as one of the largest publicly traded oil and gas companies worldwide. Its operations span upstream (exploration and production), integrated gas, chemicals and products, and renewables and energy solutions. Shell's financial performance in the fourth quarter of 2023 showed adjusted earnings of $7.3 billion, and for the full year, cash flow from operations reached $54.2 billion, demonstrating robust financial health.

Geographically, Shell operates in over 70 countries, giving it a vast global footprint. Its main product lines include crude oil, natural gas, liquefied natural gas (LNG), refined petroleum products, chemicals, lubricants, and increasingly, biofuels, hydrogen, and renewable electricity. Shell holds a leading position in the global LNG market, a segment experiencing growing demand. The company is also a major player in the lubricants market, with its Shell Helix and Shell Rimula brands widely recognized.

Shell's strategic positioning is evolving, with a notable shift towards the energy transition. This includes significant investments in renewable energy and low-carbon solutions, aiming to diversify its portfolio beyond traditional hydrocarbons. While still heavily reliant on oil and gas, Shell's pivot towards new energy solutions indicates a long-term strategic rebalancing. In terms of financial scale, Shell's market capitalization and revenue figures consistently place it among the top-tier energy companies, often exceeding industry averages for profitability and cash generation. The company is actively working to strengthen its position in the renewables and energy solutions sector, a less mature but rapidly growing area.

Shell's core operations encompass upstream activities like exploration and production of oil and gas, integrated gas including LNG, and downstream operations such as refining and marketing of petroleum products. The company also has a significant chemicals business and is expanding its renewables and energy solutions segment. These diverse operations contribute to Shell's integrated business model, allowing it to capture value across the energy value chain.

Shell's value proposition centers on providing energy solutions to meet global demand, while also transitioning towards cleaner energy sources. This includes delivering reliable and efficient oil and gas products, developing low-carbon alternatives, and investing in renewable energy projects. The company aims to provide value to shareholders through strong financial performance and long-term sustainable growth, balancing current energy needs with future sustainability goals.

Shell holds a substantial market share in the global oil and gas industry, particularly in LNG and lubricants. The company's revenue is consistently among the highest in the sector, reflecting its extensive operations and global presence. For the full year 2023, Shell's cash flow from operations was $54.2 billion, showcasing its financial strength and market position. Shell's market share analysis reveals a strong position in key segments.

Shell is actively pursuing strategic initiatives focused on the energy transition, including investments in renewable energy, biofuels, and hydrogen. The company is also optimizing its existing portfolio through asset sales and acquisitions to improve efficiency and focus on core areas. These initiatives are designed to position Shell for long-term sustainability and growth in a changing energy landscape. Shell's strategic partnerships are also crucial.

Shell's competitive advantages include its global scale, integrated business model, and technological expertise. Its extensive global presence allows it to access diverse resources and markets, while its integrated operations improve efficiency and resilience. The company's investments in research and development, as well as its strategic partnerships, enhance its ability to innovate and adapt to changing market conditions. Shell's financial performance compared to competitors is strong.

- Global scale and reach in over 70 countries.

- Integrated business model spanning upstream, midstream, and downstream operations.

- Strong financial performance, with $54.2 billion cash flow from operations in 2023.

- Investments in renewable energy and low-carbon solutions.

Shell Plc SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Shell Plc?

The competitive landscape for Shell plc is complex, encompassing a wide array of players across various sectors of the energy industry. Understanding the key competitors is crucial for assessing Shell's market position, strategic challenges, and growth opportunities. The company faces competition from integrated energy majors, national oil companies, renewable energy developers, and chemical producers, each with distinct strengths and strategic priorities.

The dynamics of the Shell Plc competitive landscape are constantly evolving due to technological advancements, shifts in energy demand, and the global transition toward cleaner energy sources. This environment requires Shell to adapt its strategies, invest in new technologies, and form strategic partnerships to maintain and enhance its competitive edge. The following analysis provides a detailed overview of Shell's key competitors and the competitive pressures it faces across different business segments.

The 'supermajors' are Shell's most direct competitors. These companies, including ExxonMobil, Chevron, BP, and TotalEnergies, compete across the entire value chain, from upstream oil and gas production to downstream refining and marketing. They have significant financial resources, global operations, and diversified portfolios.

ExxonMobil is a major competitor in upstream oil and gas, refining, and chemicals. It has a strong presence in North America and focuses on large-scale projects. In 2024, ExxonMobil reported revenues of approximately $338.3 billion.

Chevron competes across the upstream and downstream sectors, with a significant footprint in the Permian Basin and a growing LNG portfolio. Chevron's revenue for 2024 was around $197.6 billion.

BP is actively investing in the energy transition while maintaining substantial fossil fuel operations. BP's total revenue for 2024 was approximately $221.6 billion.

TotalEnergies competes across the value chain, particularly in LNG and renewables. TotalEnergies reported revenues of around $234.8 billion in 2024.

NOCs such as Saudi Aramco, ADNOC, and QatarEnergy control vast hydrocarbon reserves and significantly impact global oil and gas prices. These companies often have different strategic priorities and cost structures compared to publicly traded companies.

In the renewables and energy solutions segment, Shell faces competition from specialized renewable energy developers, utility companies, and technology firms. The Owners & Shareholders of Shell Plc must consider these dynamics when evaluating the company's long-term strategy and market position. This also includes the chemicals sector, where Shell competes with large chemical producers such as BASF, Dow, and Sinopec, which have diverse product portfolios and global manufacturing capabilities.

Shell's competitive landscape is shaped by several key pressures, including the need to balance traditional fossil fuel operations with investments in renewable energy and the energy transition. The company must also navigate geopolitical risks, fluctuating commodity prices, and increasing regulatory scrutiny. The following points summarize the main competitive pressures:

- Energy Transition: The shift towards renewable energy sources and lower-carbon fuels requires Shell to invest heavily in new technologies and business models.

- Geopolitical Risks: Political instability and conflicts in key oil and gas-producing regions can disrupt supply chains and impact prices.

- Commodity Price Volatility: Fluctuations in oil and gas prices directly affect Shell's profitability and financial performance.

- Regulatory and Environmental Pressures: Increasing environmental regulations and carbon emission targets require Shell to adapt its operations and invest in sustainable practices.

- Technological Disruptions: The rapid development of new technologies, such as advanced biofuels, hydrogen production, and carbon capture, creates both opportunities and threats.

Shell Plc PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Shell Plc a Competitive Edge Over Its Rivals?

Understanding the Shell Plc competitive landscape involves assessing its core strengths and how it differentiates itself within the global energy market. The company's strategy is built around a vast, integrated value chain, which includes exploration, production, refining, and a significant retail network. This integrated approach helps to optimize resource allocation and improve cost efficiencies, providing resilience against volatile commodity prices.

Shell Plc market analysis reveals a company that has a strong brand reputation, built over a century, which fosters customer loyalty, especially in its retail fuel and lubricants businesses. The extensive distribution network, comprising thousands of retail sites worldwide, provides unparalleled market access and customer touchpoints. Furthermore, technological expertise and intellectual property are key advantages, especially in complex energy projects like deepwater exploration and LNG liquefaction.

The company's strategic flexibility comes from its diversified portfolio, which includes both traditional oil and gas and growing investments in renewables and low-carbon solutions. This diversification allows the company to hedge against long-term shifts in energy demand and regulatory environments. The sustainability of these advantages depends on its continued ability to innovate, adapt to regulatory changes, and effectively manage the transition away from fossil fuels while maintaining profitability. For more insights into the company's strategic direction, consider reading about the Growth Strategy of Shell Plc.

Shell Plc's global operations, spanning exploration to retail, create significant economies of scale. This integration helps in optimizing resource allocation and improving cost efficiencies. The integrated model provides resilience against commodity price volatility, as downstream profits can offset upstream fluctuations.

The 'Shell' brand is globally recognized and associated with quality and reliability, driving customer loyalty, particularly in retail fuel and lubricants. Its extensive distribution network, including thousands of retail sites, provides unparalleled market access. This strong brand recognition is a key differentiator in the Shell Plc industry.

Shell Plc has a long history of innovation, particularly in complex energy projects, including deepwater exploration and LNG liquefaction. The company continues to invest heavily in R&D, especially in areas related to the energy transition, such as advanced biofuels and hydrogen technologies. This focus aims to provide a competitive edge in emerging energy markets.

Shell Plc's diversified portfolio, encompassing traditional oil and gas alongside growing investments in renewables and low-carbon solutions, offers strategic flexibility. This diversification allows the company to hedge against long-term shifts in energy demand and regulatory environments. This positions Shell to capitalize on future growth opportunities.

In 2024, Shell Plc's focus on the energy transition is evident through its investments in renewable energy projects. The company's operational excellence and strategic partnerships are key to maintaining its competitive edge. These initiatives are designed to improve its market position within the oil and gas companies sector.

- Shell Plc's capital expenditure in 2024 is focused on energy transition projects and sustainable solutions.

- The company is actively involved in strategic partnerships to accelerate its renewable energy goals.

- Shell Plc is investing in carbon capture and storage technologies to reduce its carbon footprint.

- Shell Plc's global presence and integrated operations contribute to its resilience in the energy sector competition.

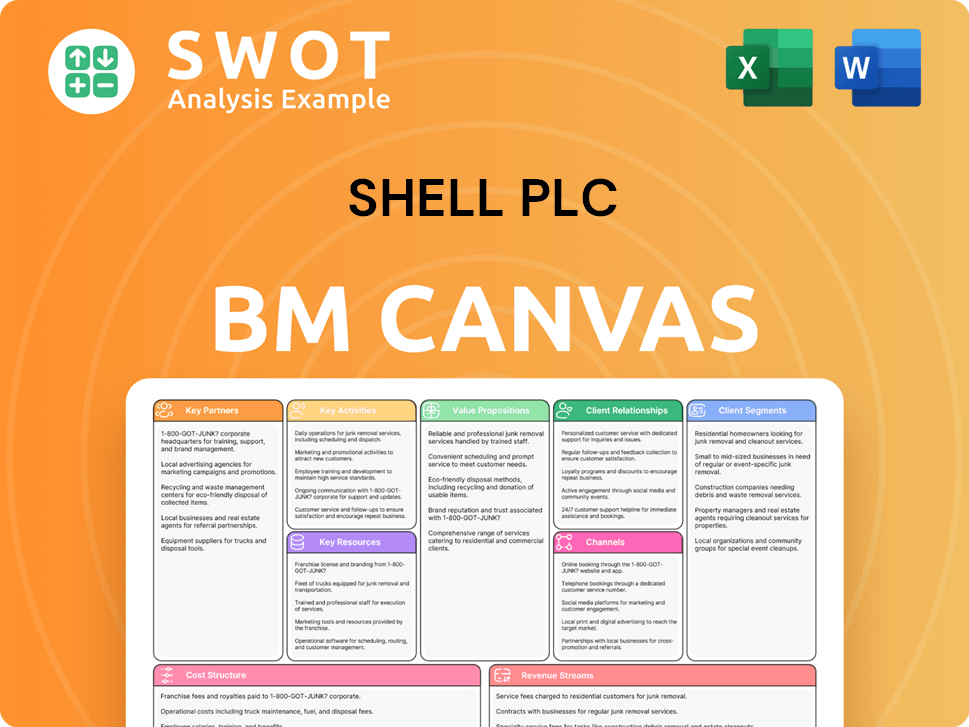

Shell Plc Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Shell Plc’s Competitive Landscape?

The competitive landscape of Shell plc is significantly influenced by the global energy transition and the increasing demand for sustainable energy solutions. Industry trends like the growth of renewable energy and electric vehicles, along with stringent environmental regulations, are reshaping the strategies of oil and gas companies. Marketing Strategy of Shell Plc highlights how the company is adapting to these shifts.

Shell faces both risks and opportunities in this evolving market. Risks include declining demand for fossil fuels and the need for substantial investments in new technologies. However, opportunities arise from the expansion of renewable energy, hydrogen production, and carbon capture, which can lead to new revenue streams and a stronger market position. The future outlook for Shell involves a strategic shift toward a more diversified energy portfolio, with a focus on sustainable solutions and integrated energy services.

The energy sector is undergoing a major transition, with a shift from fossil fuels to renewable energy sources. Technological advancements in solar, wind, and energy storage are driving this change. Regulatory pressures and consumer preferences are also pushing for cleaner energy solutions, impacting the competitive dynamics within the oil and gas industry.

Shell faces challenges in managing the decline of its hydrocarbon assets while simultaneously scaling up its new energy businesses. The company must balance capital allocation, talent development, and strategic partnerships. Scrutiny from investors and activists regarding decarbonization efforts adds further pressure.

The growing demand for low-carbon energy solutions presents vast market opportunities for Shell. Shell can leverage its existing infrastructure, global reach, and technical expertise to become a major player in renewables, biofuels, and hydrogen. Strategic partnerships and investments in carbon capture and storage (CCS) technologies also provide avenues for growth.

Shell is expected to evolve towards a diversified energy company, emphasizing integrated power, hydrogen, and sustainable mobility solutions. The company’s strategy involves disciplined capital allocation, operational excellence, and a focus on high-value products and services. This approach aims to ensure resilience in a rapidly changing energy landscape.

In 2024, Shell's investments in renewable energy and low-carbon solutions are expected to reach approximately $5 billion, representing a significant portion of its capital expenditure. Shell aims to reduce its net carbon emissions by 20% by 2030, and by 100% by 2050, compared to 2016 levels. The company is expanding its electric vehicle charging network, with plans to operate over 500,000 charging points globally by 2025.

- Shell's strategic partnerships include collaborations with technology firms and renewable energy developers.

- The company is focusing on carbon capture and storage (CCS) projects to reduce emissions from its existing operations.

- Shell's downstream business is adapting to the changing market by focusing on sustainable mobility solutions.

- Upstream investments are being carefully managed to balance current production with future energy transition needs.

Shell Plc Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Shell Plc Company?

- What is Growth Strategy and Future Prospects of Shell Plc Company?

- How Does Shell Plc Company Work?

- What is Sales and Marketing Strategy of Shell Plc Company?

- What is Brief History of Shell Plc Company?

- Who Owns Shell Plc Company?

- What is Customer Demographics and Target Market of Shell Plc Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.