Shell Plc Bundle

How Does Royal Dutch Shell Thrive in the Global Energy Arena?

Shell Plc, a titan in the energy sector, consistently demonstrates its formidable influence, boasting impressive financial results. In 2023, Shell reported adjusted earnings of $28.3 billion, a testament to its profitability and scale in a fluctuating global energy market. This financial success underscores Shell's crucial role in meeting global energy demands and generating substantial returns for investors. Understanding the inner workings of Shell Company is key for anyone looking to understand the energy market.

Shell's vast operations span over 70 countries, making it a supermajor in the energy landscape. Its integrated approach, from oil and gas exploration to renewable energy solutions, positions it as a pivotal player. To gain deeper insight, consider a Shell Plc SWOT Analysis to understand its strengths, weaknesses, opportunities, and threats. This exploration is vital for investors, customers, and industry observers keen on understanding how Shell Plc generates revenue, its strategic investments, and its impact on the environment.

What Are the Key Operations Driving Shell Plc’s Success?

The core operations of Shell Plc are centered on integrated energy operations, serving a wide range of customers globally. This includes everything from individual consumers at retail stations to large industrial clients requiring significant energy solutions. The company's activities span the entire energy value chain, from exploration and production to marketing and sales.

Shell's value proposition lies in its ability to provide energy security and accessibility through a diverse portfolio of products and services. This includes oil and natural gas, petrochemicals, and renewable energy sources. The company's integrated model allows for synergies across different segments, optimizing resource allocation and cost efficiencies.

Shell leverages strategic partnerships and a vast distribution network to ensure efficient delivery of energy products worldwide. The company's global presence and investments in research and development, particularly in low-carbon technologies, further differentiate it in the market. Its brand strength and scale contribute to competitive pricing and efficient resource utilization, benefiting its diverse customer base.

Shell's business is divided into several key segments. These include Integrated Gas, which focuses on liquefied natural gas (LNG) and gas-to-liquids (GTL) projects. The Upstream segment concentrates on exploration and production of crude oil and natural gas. The Downstream segment handles refining, marketing, and chemicals production.

Shell's integrated model allows for optimization across the entire energy value chain. This integration helps in managing risks and improving profitability. For example, the company can optimize resource allocation and cost efficiencies by combining upstream production with liquefaction and marketing.

Shell operates in numerous countries, with a significant presence in Europe, North America, and Asia. Its global operations are supported by extensive infrastructure, including refineries, chemical plants, and a vast retail network. This global footprint enables Shell to serve a diverse customer base and adapt to regional market demands.

Shell is investing in renewable energy projects to reduce its carbon footprint. This includes biofuels, hydrogen, and wind power initiatives. The company aims to offer more sustainable energy choices to its customers. These efforts are part of a broader strategy to transition towards a lower-carbon energy system.

Shell's integrated business model, global presence, and sustainability initiatives are key differentiators. The company's focus on operational efficiency and strategic partnerships enhances its market position. Shell continues to adapt to changing market dynamics and customer needs.

- Integrated operations across the energy value chain.

- Extensive global presence with a diverse product portfolio.

- Investments in research and development for low-carbon technologies.

- Strong brand reputation and operational scale.

Shell Plc SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Shell Plc Make Money?

The revenue streams of Shell Plc are diverse, reflecting its integrated energy business model. The company generates income from various segments, including Integrated Gas, Upstream, Chemicals and Products, and Renewables and Energy Solutions. In 2023, Shell Company reported a total revenue of $316.6 billion.

Understanding how Shell Plc generates revenue is crucial for investors and stakeholders. The company employs various monetization strategies across its segments. These strategies include long-term contracts, spot market sales, and retail operations.

The evolution of Shell's business model, as detailed in a brief history of Shell Plc, shows a strategic expansion into lower-carbon energy solutions. This diversification aims to create a more sustainable energy portfolio.

The Integrated Gas segment, which includes liquefied natural gas (LNG) and gas-to-liquids (GTL) products, is a significant contributor. In 2023, adjusted earnings for Integrated Gas were $10.1 billion. The Upstream segment, focused on the exploration and extraction of crude oil and natural gas, also contributes substantially to revenue. The Chemicals and Products segment, which includes refining, trading, and marketing of oil products and chemicals, represents another major revenue stream.

- Integrated Gas: Monetizes through LNG sales to utilities and industrial customers, often under long-term contracts, and spot market sales.

- Upstream: Generates revenue through the sale of crude oil and natural gas on global commodity markets.

- Chemicals and Products: Revenue is derived from the sale of refined petroleum products and petrochemicals through its retail network and to commercial customers.

- Renewables and Energy Solutions: Includes the production and sale of biofuels, hydrogen, and renewable electricity.

Shell Plc PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Shell Plc’s Business Model?

Shell plc has undergone significant transformations, marked by strategic shifts and key milestones that have reshaped its operations and financial performance. A central strategic move is its commitment to transitioning towards a net-zero emissions energy business, targeting net-zero emissions by 2050. This involves substantial investments in low-carbon energy solutions and a rebalancing of its portfolio to adapt to evolving market demands.

The company's journey includes navigating volatile commodity prices, geopolitical instability, and increasing environmental scrutiny. In response, Shell has optimized its traditional oil and gas portfolio while investing in new energy technologies. This adaptability has been crucial for maintaining its operational and financial strength, as demonstrated by its adjusted earnings.

Shell's competitive advantages are multifaceted, encompassing brand strength, economies of scale, technological leadership, and an extensive global retail network. These elements contribute to customer loyalty, cost efficiencies, and diverse revenue streams. Shell's ongoing investments in biofuels, hydrogen, and renewable power generation ensure its continued relevance and competitive standing in the evolving energy landscape, solidifying its position within the Competitors Landscape of Shell Plc.

Shell's history is marked by significant milestones, including its formation and expansion through mergers and acquisitions. A major milestone is the ongoing transition towards renewable energy sources. The company's commitment to reducing carbon emissions and investing in sustainable energy solutions is a key aspect of its future.

Shell's strategic moves include diversifying its energy portfolio. This involves significant investments in electric vehicle (EV) charging infrastructure, aiming for over 200,000 charge points by 2030. Another strategic move is the optimization of its oil and gas operations to improve efficiency and profitability.

Shell's competitive advantages include its brand strength, built over a century, fostering customer loyalty. Its vast global operations create economies of scale. Technological leadership, particularly in upstream projects and advanced fuels, also provides a significant edge.

In 2023, Shell's adjusted earnings reached $28.3 billion, demonstrating resilience. The company's ability to adapt to volatile markets and geopolitical challenges is a key factor in its financial success. Shell's financial performance reflects its strategic investments and operational efficiencies.

Shell's sustainability initiatives are central to its long-term strategy, with a focus on reducing carbon emissions and investing in renewable energy. The company is actively involved in various renewable energy projects. Shell is also investing in carbon capture and storage technologies.

- Investing in biofuels and hydrogen projects.

- Expanding its electric vehicle (EV) charging network.

- Setting targets to become a net-zero emissions energy business by 2050.

- Focusing on reducing the carbon footprint of its operations.

Shell Plc Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Shell Plc Positioning Itself for Continued Success?

The position of Shell Plc within the global energy sector is undeniably strong, consistently ranking among the leading international energy companies. Its market share is significant across various segments, from liquefied natural gas (LNG) to lubricants, and its global footprint spans over 70 countries and territories. The company benefits from strong customer loyalty, especially in its retail fuel and lubricant businesses, supported by a well-established brand and a vast service station network. Shell's integrated business model, encompassing upstream, midstream, and downstream operations, provides a comprehensive market presence that few competitors can match.

However, Shell faces several risks that could impact its operations and revenue. Regulatory changes, particularly those aimed at decarbonization and stricter environmental standards, pose significant challenges. The emergence of new competitors in the renewable energy sector could challenge Shell's expansion in these markets. Technological disruption could render some of its traditional assets less competitive if not continually modernized. Changing consumer preferences toward lower-carbon energy sources necessitate strategic adaptation.

Shell Plc is a major player in the global energy market, recognized for its extensive operations. It holds a strong market share in sectors like LNG and lubricants. Its global presence and integrated business model are key strengths.

The company faces risks from regulatory changes, particularly those related to decarbonization. Competition from new renewable energy companies is a challenge. Technological advancements and changing consumer preferences also pose risks.

Shell is investing in its Powering Progress strategy to transition to net-zero emissions by 2050. This includes investments in renewables and energy solutions. The goal is to rebalance its portfolio for a diversified energy future.

Shell is focused on its Powering Progress strategy, aiming for net-zero emissions by 2050. The company is expanding its EV charging network and developing hydrogen infrastructure. Shell is balancing investments in both oil and gas and low-carbon businesses.

In 2023, Shell reported a strong financial performance, with adjusted earnings of $28.3 billion. The company's focus is on transitioning its business while meeting global energy demands. Shell is actively investing in renewable energy sources and expanding its EV charging network.

- Shell’s Powering Progress strategy aims to accelerate the transition to net-zero emissions by 2050.

- The company is investing heavily in renewable energy projects, including solar and wind power.

- Shell is expanding its electric vehicle (EV) charging infrastructure globally.

- The company is exploring opportunities in hydrogen production and distribution.

Shell is actively pursuing strategic initiatives and innovation roadmaps to address these challenges. The company is committed to its Powering Progress strategy, which aims to accelerate the transition of its business to net-zero emissions by 2050, while continuing to provide the energy the world needs. This includes significant investments in renewables and energy solutions, such as expanding its EV charging network and developing hydrogen infrastructure. Shell's leadership statements emphasize a balanced approach, continuing to invest in its resilient oil and gas assets while growing its low-carbon businesses. The future outlook for Shell involves a strategic rebalancing of its portfolio, aiming to sustain and expand its ability to generate profit by transitioning to a diversified energy company that continues to meet global energy demands while contributing to a lower-carbon future. For a deeper understanding of how Shell plans to grow, consider reading about the Growth Strategy of Shell Plc.

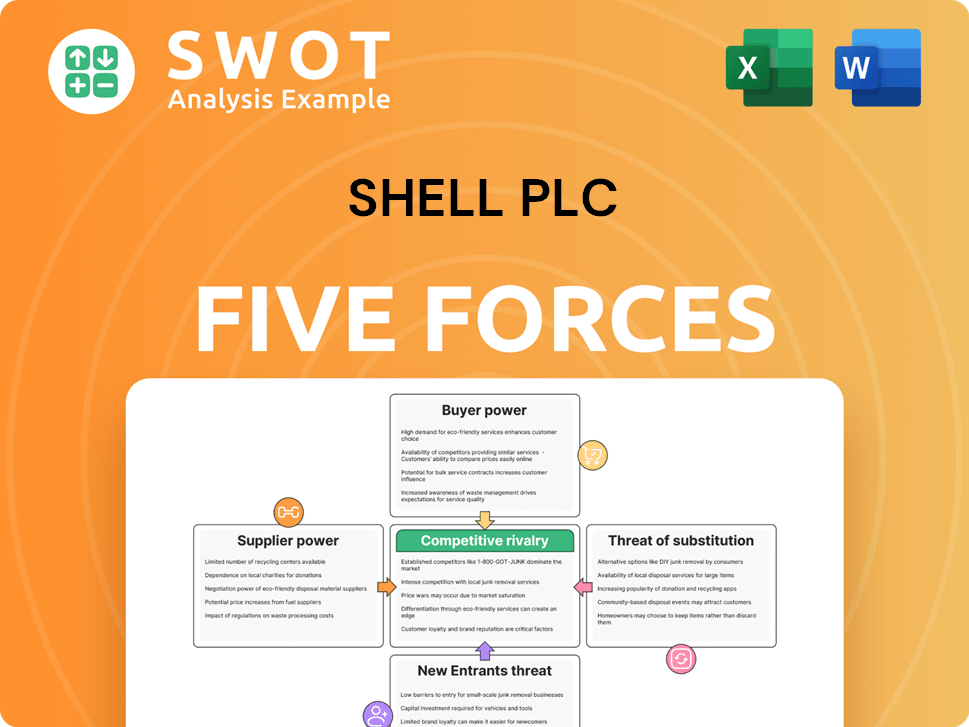

Shell Plc Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Shell Plc Company?

- What is Competitive Landscape of Shell Plc Company?

- What is Growth Strategy and Future Prospects of Shell Plc Company?

- What is Sales and Marketing Strategy of Shell Plc Company?

- What is Brief History of Shell Plc Company?

- Who Owns Shell Plc Company?

- What is Customer Demographics and Target Market of Shell Plc Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.