Spotify Technology Bundle

Can Spotify Maintain Its Dominance in the Cutthroat Audio Streaming Arena?

Spotify, a pioneer in the digital audio market, has revolutionized how we consume music and podcasts. From its humble beginnings in Sweden, Spotify has surged to global prominence, captivating hundreds of millions of users. But in an industry fueled by innovation and intense competition, how does Spotify truly stack up?

This exploration of the Spotify Technology SWOT Analysis dives into the heart of the Spotify competitive landscape, dissecting its strengths and weaknesses while analyzing its key rivals. We'll examine Spotify's market share analysis, its financial performance compared to competitors, and the strategic moves that will shape its future in the dynamic streaming industry. Understanding these factors is crucial for anyone looking to navigate or invest in this evolving sector.

Where Does Spotify Technology’ Stand in the Current Market?

Spotify Technology S.A. holds a commanding position in the audio streaming industry, distinguished by its extensive user base and diverse content offerings. The company's core operations revolve around providing music streaming, podcasts, and audiobooks through both ad-supported and premium subscription models. This dual approach allows Spotify to cater to a broad audience, from users who prefer free access to those willing to pay for enhanced features and ad-free listening.

The value proposition of Spotify lies in its vast content library, personalized recommendations, and user-friendly interface, which collectively enhance the listening experience. The platform's strategic investments in podcasting and audiobooks have further broadened its appeal, transforming it into a comprehensive audio platform. This diversification is crucial in the dynamic digital audio market, helping Spotify maintain its competitive edge. The Growth Strategy of Spotify Technology has been pivotal.

As of the first quarter of 2024, Spotify's market presence is substantial, with a global footprint spanning over 180 markets. The company's financial performance in Q1 2024 showed total revenue of €3.64 billion, marking a 20% year-over-year increase. Spotify's success is evident in its user engagement metrics. The company reported 618 million monthly active users (MAUs) and 239 million premium subscribers, reflecting growth rates of 19% and 14% year-over-year, respectively. The company's strong performance solidifies its leadership in terms of user base and premium subscribers, significantly outpacing its closest competitors.

Spotify's market share in the global music streaming market was approximately 30.5% as of Q4 2023, making it the largest player. However, local services and tech giants present significant competitive pressure in certain regions. This dominance is a key factor in understanding the Spotify competitive landscape.

Spotify's financial strategy includes diversifying revenue streams through advertising and premium subscriptions. Recent quarters show improvements in profitability, with an operating income of €168 million in Q1 2024. The company's podcasting strategy and content library size are also crucial.

Spotify's user base demographics are diverse, with a global reach that includes users from various age groups and cultural backgrounds. The platform's focus on personalized recommendations and user-friendly interfaces is designed to increase user engagement. This is a key aspect of Spotify's growth strategy.

Spotify's competitive advantages include its vast content library, personalized recommendations, and user-friendly interface. Its early mover advantage in the music streaming industry has allowed it to build a strong brand and a loyal user base. These advantages are crucial in the streaming industry.

Spotify's strengths include its large user base, extensive content library, and strong brand recognition. The company's weaknesses include high content costs and the challenge of maintaining profitability. Understanding these aspects is crucial for a comprehensive Spotify market analysis.

- Strong user base and brand recognition.

- Diversified content offerings including podcasts and audiobooks.

- High content costs impacting profitability.

- Competition from tech giants and local services.

Spotify Technology SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Spotify Technology?

The Spotify competitive landscape is a dynamic environment, shaped by a diverse array of rivals vying for dominance in the digital audio market. Understanding the key players and their strategies is crucial for analyzing Spotify's market analysis and its position within the streaming industry. This landscape includes both direct and indirect competitors, each with unique strengths and approaches to capturing user attention and revenue.

The competition extends beyond music streaming, encompassing podcasts, live audio, and even social media platforms that incorporate audio content. The Spotify competitive landscape is constantly evolving due to mergers, acquisitions, and strategic partnerships that reshape content distribution and licensing agreements. This environment demands continuous adaptation and innovation from all players to maintain relevance and attract subscribers.

The Spotify competitive landscape is complex, involving direct and indirect competitors. Direct competitors focus on music streaming, while indirect competitors include traditional radio and social media platforms. The competition is fierce, with players constantly battling for market share and user engagement.

The most significant direct competitors include Apple Music, Amazon Music, and YouTube Music. These services offer similar core functionalities, such as on-demand music streaming, curated playlists, and personalized recommendations. They compete directly for subscribers and advertising revenue.

Apple Music is a major rival, leveraging its deep integration with Apple's ecosystem. As of June 2024, Apple Music had an estimated 100 million subscribers. This integration provides a significant advantage, especially for iPhone users, as the service is often bundled with Apple devices.

Amazon Music benefits from its vast Amazon Prime subscriber base and its dominance in the smart speaker market. This offers a compelling value proposition for existing Prime members. Amazon's strategy also includes offering various tiers, including a free, ad-supported version.

YouTube Music, backed by Google's resources, has a strong presence in emerging markets and benefits from its extensive video catalog. The platform's integration with YouTube provides a unique advantage, allowing users to seamlessly transition between music and video content.

Indirect competitors include traditional radio, satellite radio services like SiriusXM, and social media platforms that increasingly host audio content. These platforms compete for user attention and advertising revenue, diverting potential users from music streaming services.

Regional streaming services, such as Tencent Music Entertainment in China, also pose competitive challenges. These services often cater to specific cultural preferences and offer localized content, giving them an edge in their respective markets.

The podcasting space has seen increased competition, with platforms like Audible and dedicated podcast apps vying for listener attention. High-profile content deals, such as Spotify's deals with popular podcasters, are often used to attract listeners. Emerging players in user-generated audio and live audio could disrupt the traditional competitive landscape. For more insights, consider exploring the Target Market of Spotify Technology.

Several factors influence the competitive dynamics within the digital audio market. These include the size and quality of the content library, pricing strategies, user experience, platform integration, and marketing efforts.

- Content Library: The breadth and depth of music and podcast catalogs are crucial.

- Pricing: Competitive pricing models, including free, ad-supported tiers and premium subscriptions.

- User Experience: The ease of use, personalized recommendations, and social features.

- Platform Integration: Seamless integration with devices and ecosystems.

- Marketing: Effective marketing campaigns to attract and retain users.

Spotify Technology PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Spotify Technology a Competitive Edge Over Its Rivals?

Analyzing the Owners & Shareholders of Spotify Technology reveals a complex competitive landscape. Understanding the competitive advantages of the company is crucial for assessing its position within the dynamic digital audio market. This includes evaluating its strengths against key rivals and forecasting its future prospects.

The Spotify competitive landscape is defined by its pioneering approach to audio streaming. Its early mover advantage in the streaming industry allowed it to build a substantial global user base and establish strong brand recognition. This has fostered significant network effects, attracting both users and content creators, which in turn strengthens its market position.

The company's proprietary recommendation algorithms, fueled by extensive user data, provide personalized playlists and discovery features, enhancing user engagement and loyalty. This algorithmic advantage is a key differentiator, making it challenging for competitors to replicate the same level of personalized experience. The company's financial performance compared to competitors is also a key factor to consider.

The company boasts a massive global user base. As of Q1 2024, it had around 615 million monthly active users (MAUs) worldwide, demonstrating its extensive reach. This large user base contributes to strong network effects, drawing in more content and further expanding its user base.

The platform's sophisticated recommendation algorithms are a core competitive advantage. These algorithms analyze vast amounts of user data to offer personalized playlists and discovery features. This personalization enhances user engagement and loyalty, making it difficult for competitors to replicate.

The company has cultivated strong relationships with artists, record labels, and podcast creators. This enables it to offer a comprehensive and diverse content library. It has an early mover advantage in securing licensing deals, which ensures a vast selection of music and podcasts.

The freemium business model is a significant competitive advantage, acting as a powerful funnel for user acquisition. It allows widespread accessibility, lowering barriers to entry for new users. This model drives conversion to premium subscriptions.

The platform's strengths include a large user base, advanced recommendation algorithms, and a strong content library. Its freemium model and data analytics capabilities further solidify its position. These advantages are largely sustainable due to its scale, continuous investment in technology, and the cumulative effect of its user data.

- Large User Base: A global reach of over 615 million MAUs as of Q1 2024, fostering network effects.

- Algorithmic Prowess: Sophisticated recommendation engines offering personalized experiences.

- Content Library: Extensive music and podcast offerings through strong industry relationships.

- Freemium Model: Drives user acquisition and conversion to premium subscriptions.

Spotify Technology Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Spotify Technology’s Competitive Landscape?

The Spotify competitive landscape is currently shaped by dynamic industry trends, presenting both challenges and opportunities. The digital audio market is evolving rapidly, with new technologies and consumer behaviors constantly reshaping the playing field for music streaming services. This analysis explores these trends, future challenges, and potential growth areas for the company.

Spotify's market analysis reveals a complex environment. The company faces intense competition from well-established tech giants and must navigate rising content acquisition costs. However, significant growth opportunities exist in emerging markets and through strategic innovation. Understanding these factors is crucial for assessing Spotify's future prospects.

The audio streaming industry is experiencing significant shifts. Podcasting continues to grow, and new formats like live audio are emerging. Technological advancements in AI-driven content creation and personalized experiences are also redefining the competitive environment. These trends impact Spotify's competitive landscape.

Spotify's main rivals include well-capitalized tech companies. Rising content costs and the need for sustained profitability are significant hurdles. Evolving consumer preferences, especially among Gen Z, also pose a challenge. Balancing the interests of artists, labels, and users is a constant balancing act.

Emerging markets offer significant growth potential due to expanding internet penetration and smartphone adoption. Spotify can capitalize on its podcasting leadership. Strategic partnerships and innovations in personalized experiences can strengthen its competitive position. Further exploring Spotify's growth strategy is key.

Spotify's market share analysis shows a need for agility in adapting to industry trends. Commitment to innovation and strategic content investments are vital. Understanding Spotify's strengths and weaknesses is essential for long-term success. The company must also navigate regulatory changes.

The digital audio market is seeing increased competition. Platforms like TikTok and Clubhouse are attracting listener attention. Regulatory changes impact content licensing, data privacy, and antitrust concerns.

- Spotify vs. Amazon Music comparison reveals Amazon Music's increasing subscriber base, potentially impacting Spotify.

- Spotify's pricing strategy must remain competitive to retain users.

- Spotify's advertising revenue is crucial for financial performance, with the company continually seeking to optimize its ad offerings.

- Spotify's podcasting strategy is a key area of growth, with continued investment in exclusive content.

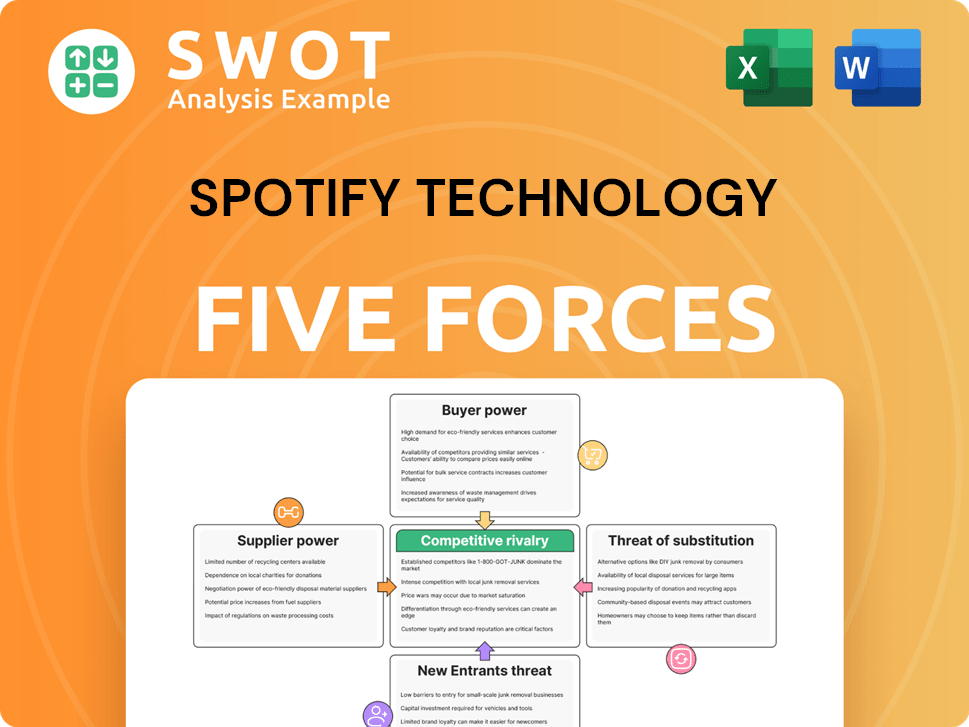

Spotify Technology Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Spotify Technology Company?

- What is Growth Strategy and Future Prospects of Spotify Technology Company?

- How Does Spotify Technology Company Work?

- What is Sales and Marketing Strategy of Spotify Technology Company?

- What is Brief History of Spotify Technology Company?

- Who Owns Spotify Technology Company?

- What is Customer Demographics and Target Market of Spotify Technology Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.