Spotify Technology Bundle

Can Spotify Maintain Its Dominance in the Ever-Changing Audio Landscape?

Spotify, the titan of the music streaming market, has fundamentally reshaped how we consume audio. From its inception in 2006, the Spotify Technology SWOT Analysis reveals a company that has consistently innovated to stay ahead. This exploration delves into the Spotify growth strategy and its future prospects, examining its evolution from a disruptive startup to a global digital audio platform.

With a massive user base and a proven business model, understanding Spotify's trajectory is crucial for investors and industry watchers alike. This analysis will dissect Spotify's expansion plans, its investment in podcasts, and its strategies for user engagement, providing insights into the future of music streaming services and the company's long-term vision. We'll explore how Spotify technology company plans to navigate challenges and capitalize on opportunities in the competitive landscape.

How Is Spotify Technology Expanding Its Reach?

The company's growth strategy is centered on expanding its global footprint and diversifying its content offerings. This approach aims to capture a larger share of the digital audio market and increase user engagement. The company's future prospects are closely tied to its ability to execute these expansion initiatives effectively.

The company, a leading technology company in the music streaming market, is constantly seeking new avenues for growth. It focuses on both geographical expansion and content diversification to attract and retain users. Understanding the company's strategic moves is crucial for anyone interested in the digital audio platform landscape.

The company's business model relies on a combination of subscription revenue and advertising. Its ability to innovate and adapt to changing consumer preferences will be key to its long-term success. This strategy is designed to enhance its competitive advantages in the music streaming industry.

The company consistently evaluates new markets, prioritizing regions with high internet penetration and smartphone adoption. While specific launches are not always announced in advance, emerging markets have historically been crucial for subscriber growth. The company's expansion plans in new markets are a significant part of its growth strategy.

A key focus is the continued push into podcasts, which has proven to be a significant growth driver. The company has invested heavily in exclusive podcast content and acquisitions. This strategy aims to transform the platform into a comprehensive digital audio platform.

The company is exploring new revenue streams, including enhancing advertising capabilities and experimenting with new subscription tiers. For example, a 'Basic' plan has been tested. The company's subscription model is designed to provide flexibility for users.

The company's foray into audiobooks, available to Premium subscribers in several markets, represents a significant product expansion. This initiative aims to capture a share of the growing audiobook market. This move is part of its long-term vision to offer a wide range of audio content.

The company's expansion initiatives are designed to drive user growth and increase revenue. These strategies include geographical expansion, content diversification, and the introduction of new business models. These efforts are crucial for the company's future prospects.

- Geographical Expansion: Targeting emerging markets and regions with high internet penetration.

- Podcast Investments: Continuing to invest in exclusive content and acquisitions to grow its podcast library.

- Subscription Tiering: Testing new subscription plans to cater to different user preferences.

- Audiobook Integration: Offering audiobooks to Premium subscribers to increase the value of subscriptions.

For a deeper understanding of the company's target market, consider reading about the Target Market of Spotify Technology. The company's strategic moves in the music streaming market, including its investments in podcasts and audiobooks, are designed to maintain its competitive advantages. In early 2024, the company reported double-digit year-over-year growth in podcast consumption, demonstrating the effectiveness of its content diversification strategy. The company's financial performance analysis shows that these initiatives are contributing to its revenue streams and overall growth.

Spotify Technology SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Spotify Technology Invest in Innovation?

The Spotify growth strategy is significantly driven by its commitment to innovation and technological advancements. The company continually invests in research and development to enhance its core streaming capabilities and improve user experience. This focus on technology is crucial for maintaining its competitive edge in the dynamic music streaming market.

Spotify's future prospects are closely tied to its ability to leverage technology to expand its offerings and attract new users. The company's strategic use of AI and machine learning for personalized recommendations, content discovery, and ad targeting is a key factor in user engagement and retention. Furthermore, Spotify's investments in its platform infrastructure ensure scalability and reliability as its user base grows.

The Spotify technology company consistently explores strategic collaborations and acquisitions to enhance its technological capabilities. This approach allows Spotify to integrate cutting-edge technologies and expand its offerings, such as podcasts and immersive audio experiences. Continuous updates to its mobile and desktop applications ensure a seamless and intuitive user interface, contributing to the overall growth objectives.

AI and machine learning are central to Spotify's strategy. These technologies power personalized recommendation engines, content discovery, and ad targeting. This personalization is crucial for user engagement and retention, driving growth.

Spotify focuses on in-house development of its platform infrastructure. This ensures scalability and reliability as its user base expands. This approach is critical for handling the increasing volume of users and content.

Spotify engages in strategic collaborations and acquisitions to bolster its technological capabilities. The integrations of companies like Anchor and Megaphone have significantly enhanced Spotify's podcasting infrastructure and monetization tools. This strategy expands offerings.

Continuous updates to mobile and desktop applications ensure a seamless and intuitive user interface. This commitment to user experience directly contributes to growth objectives by improving user satisfaction and attracting new subscribers. User experience is a key factor.

Spotify explores cutting-edge technologies like immersive audio formats. These innovations could shape the future of audio and enhance the listening experience. This forward-thinking approach is crucial.

AI-powered content discovery is a key aspect of Spotify's platform. The algorithms continually refine to ensure seamless streaming across diverse network conditions and devices. This enhances user satisfaction.

Spotify's technological advancements are integral to its growth strategy. The company's investment in AI, machine learning, and platform infrastructure directly impacts user engagement, content discovery, and overall user satisfaction. These advancements are critical for maintaining a competitive position in the digital audio platform market. For more details, consider reading about the Spotify stock forecast.

- AI-Driven Personalization: Personalized recommendations enhance user engagement.

- Platform Scalability: Robust infrastructure supports a growing user base.

- Strategic Acquisitions: Integrations like Anchor and Megaphone expand offerings.

- User Experience: Continuous updates improve user satisfaction.

Spotify Technology PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Spotify Technology’s Growth Forecast?

The financial outlook for the Spotify technology company appears promising, supported by its growing subscriber base and diversified revenue streams. The Spotify growth strategy focuses on expanding its user base and increasing monetization opportunities, particularly through podcasts and audiobooks.

In the first quarter of 2024, the company demonstrated strong financial performance. Total revenue reached €3.6 billion, a 20% increase year-over-year. This growth was driven by a 21% rise in Premium Revenue and a 19% increase in Ad-Supported Revenue, showcasing the effectiveness of its Spotify business model.

Furthermore, Spotify achieved significant improvements in profitability. The company reported an operating income of €168 million in Q1 2024, a substantial turnaround from an operating loss of €156 million in the same period last year. This positive shift indicates enhanced operational efficiency and the benefits of scale, contributing to a positive Spotify future prospects.

Spotify's revenue streams are diversified, with Premium and Ad-Supported revenue contributing significantly. Premium Revenue for Q1 2024 was €3.2 billion, while Ad-Supported Revenue was €440 million, demonstrating the effectiveness of their Spotify's revenue streams and growth.

The company's improved profitability, with an operating income of €168 million in Q1 2024, is a key indicator of financial health. The focus on podcasts and audiobooks is expected to improve gross margins over time, enhancing the Spotify's financial performance analysis.

Spotify's Monthly Active Users (MAU) are expected to reach 695 million in Q2 2024, with Premium Subscribers projected at 276 million. The company's user engagement strategies are crucial for retaining and attracting users in the music streaming market.

Spotify continues to invest in content acquisition, technology development, and market expansion. These investments are crucial for sustaining growth and competing in the digital audio platform landscape. The company's expansion plans in new markets are a key part of its strategy.

For Q2 2024, Spotify forecasts total revenue of €3.8 billion. The company's long-term financial goals include achieving sustainable profitability and expanding its gross margins. Spotify's strong cash flow generation, reported at €396 million in Q1 2024, provides a solid foundation for strategic investments without significant reliance on external funding. For more details on how Spotify generates revenue, consider reading about the Revenue Streams & Business Model of Spotify Technology.

Spotify Technology Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Spotify Technology’s Growth?

The Spotify growth strategy faces several potential risks and obstacles that could affect its future. Intense competition in the music streaming market and the broader digital audio landscape poses a significant challenge. Furthermore, regulatory changes and technological disruptions could also impact the company's operations and business model.

Competitive pressures from rivals like Apple Music and Amazon Music, along with evolving regulations concerning intellectual property and data privacy, require continuous adaptation. Internal constraints and external factors such as economic conditions also present challenges to the company's growth plans. Understanding these potential hurdles is crucial for evaluating the Spotify future prospects.

Despite these challenges, the company has shown resilience and adaptability. For example, the company has consistently adapted to evolving licensing agreements with record labels and publishers. The company also employs robust risk management frameworks, including scenario planning, to assess and prepare for potential disruptions. However, emerging risks such as increased content costs due to inflation or changes in consumer spending habits in a challenging economic climate could shape its future trajectory and require agile strategic responses.

The music streaming market is highly competitive, with major players like Apple Music, Amazon Music, and YouTube Music. These competitors have significant financial resources and established ecosystems, which they leverage to attract and retain users. This competition can lead to increased marketing expenses and pressure on pricing strategies for the Spotify technology company.

Regulatory changes, particularly concerning intellectual property rights, data privacy, and antitrust regulations, pose a risk. Governments globally are scrutinizing large tech companies, and adverse rulings could impact operations and content licensing agreements. Ongoing debates about artist compensation and copyright could increase content costs.

Emerging technologies, such as AI-generated music and new decentralized content platforms, could disrupt the audio landscape. Internal resource constraints, including attracting and retaining top talent, could hinder innovation. These factors could affect the Spotify business model and its ability to stay ahead.

Increased content costs due to inflation and evolving licensing agreements could impact profitability. Changes in consumer spending habits in a challenging economic climate also pose a risk. These factors require agile strategic responses from the company to maintain its growth trajectory.

Attracting and retaining top engineering and creative talent is crucial for innovation and product development. Competition for skilled professionals can be intense. The ability to maintain a strong and innovative team directly impacts the company's ability to compete and expand.

Economic downturns can lead to reduced consumer spending on non-essential services like music streaming. This can impact subscription numbers and revenue. The company must be prepared to adapt to changes in consumer behavior during times of economic uncertainty.

The music streaming market is dominated by major players, including Apple Music, Amazon Music, and YouTube Music. These competitors have significant resources and established user bases. The competition extends beyond music to podcasts and audiobooks, with platforms like Audible also vying for listeners. Understanding the competitive landscape is essential to assess Spotify's challenges and opportunities.

Regulatory changes regarding data privacy and intellectual property rights pose significant risks. The company must comply with evolving laws and regulations in various jurisdictions. Ongoing debates about artist compensation and copyright in the streaming era could significantly impact the company’s business model and content costs. For more details, you can read a Brief History of Spotify Technology.

Technological disruptions, such as AI-generated music, could alter content creation and distribution dynamics. The company must invest in research and development to stay ahead of these advancements. Adapting to new technologies is crucial for maintaining its competitive edge and ensuring long-term success. The company's ability to integrate new technologies will shape its Spotify's technological advancements.

Economic downturns can lead to decreased consumer spending on streaming services. Inflation and changing consumer spending habits pose financial risks. The company needs strategies to adapt to these economic pressures, such as adjusting pricing or expanding into new markets with different economic conditions to ensure its Spotify's revenue streams and growth.

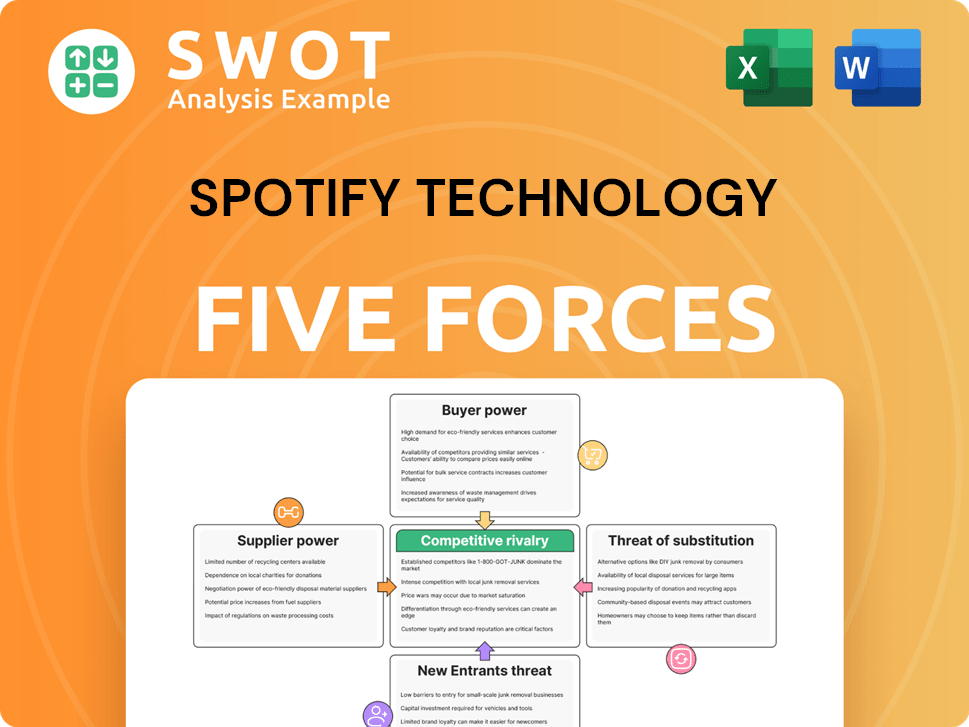

Spotify Technology Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Spotify Technology Company?

- What is Competitive Landscape of Spotify Technology Company?

- How Does Spotify Technology Company Work?

- What is Sales and Marketing Strategy of Spotify Technology Company?

- What is Brief History of Spotify Technology Company?

- Who Owns Spotify Technology Company?

- What is Customer Demographics and Target Market of Spotify Technology Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.