Stillfront Group Bundle

How Does Stillfront Group Conquer the Mobile Games Industry?

The mobile games industry is a dynamic battlefield, and Stillfront Group has carved a significant niche within it. Founded in Sweden, the company has strategically built a diverse portfolio of games, primarily in the free-to-play (F2P) segment. Their success stems from a blend of organic growth and strategic acquisitions, making them a compelling player in the global market.

This analysis will delve into the Stillfront Group SWOT Analysis, examining its competitive positioning within the mobile games industry. We'll explore its key rivals and dissect how Stillfront Group's game development and acquisition strategy contributes to its market share. Understanding the competitive landscape is crucial for investors and industry watchers alike, offering insights into Stillfront Group's financial performance and future outlook.

Where Does Stillfront Group’ Stand in the Current Market?

Stillfront Group holds a significant market position within the free-to-play (F2P) online games genre, characterized by its diverse portfolio and global reach. The company's primary product lines span various F2P genres, including strategy, simulation, and casual games, catering to a broad customer base primarily through mobile and browser-based platforms. This positions Stillfront Group favorably within the competitive landscape of the mobile games industry.

Stillfront's geographic presence is global, with studios and player bases across North America, Europe, and Asia. This widespread presence allows the company to tap into diverse markets and player preferences, enhancing its ability to compete effectively. The company's consistent revenue growth and strategic acquisitions further solidify its strong and expanding presence in the market.

Over time, Stillfront has strategically shifted its positioning through a continuous acquisition strategy, integrating studios that enhance its genre diversity and geographic footprint. This has allowed the company to capture new market segments and diversify its revenue streams. Stillfront's focus on long-lifecycle games ensures sustained revenue generation from existing titles, complementing new releases.

Recent financial reports for 2024 indicate a strong performance. The company achieved net sales of SEK 7,125 million, an increase of 2% year-over-year. The adjusted EBITDA for 2024 was SEK 2,656 million. This demonstrates the company's financial health and scale.

Stillfront's acquisition strategy has been a key driver of its market position. By acquiring profitable studios, the company has expanded its game portfolio and geographic reach. This strategy allows Stillfront to diversify its offerings and capture new market segments, enhancing its competitive advantages.

Stillfront maintains a particularly strong position in the mobile strategy game segment, leveraging its expertise in player engagement and monetization. This focus allows the company to capitalize on the growing demand for strategy games on mobile platforms. This focus is a key element of the company's growth strategy.

Stillfront's global presence, with studios and player bases across North America, Europe, and Asia, provides a strong foundation for market expansion. This broad geographic footprint allows the company to tailor its games and marketing efforts to local preferences, enhancing its competitive edge. Learn more about the company's performance in this detailed article about Stillfront Group.

Stillfront Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Stillfront Group?

The Stillfront Group operates within the highly dynamic mobile games industry, facing a complex competitive landscape. This landscape includes a diverse range of competitors, from established giants to emerging startups, all vying for market share and player engagement. Understanding these competitors is crucial for analyzing Stillfront Group's strategic positioning and future growth prospects.

The mobile games industry is characterized by rapid innovation, frequent acquisitions, and intense competition for user attention and revenue. Stillfront Group must continually adapt its strategies to stay competitive. This includes refining its game portfolio, optimizing marketing efforts, and exploring strategic partnerships or acquisitions.

The competitive landscape is constantly evolving, with new players and technologies reshaping the market. For a deeper dive into the company's ownership structure, you can explore Owners & Shareholders of Stillfront Group.

Direct competitors are companies that directly compete with Stillfront Group in the free-to-play (F2P) mobile games market. These companies have similar business models, targeting the same player demographics and genres.

Playtika is a major player in the social casino and casual games segment. It competes directly with Stillfront Group by offering similar game types and targeting a broad audience. Playtika's revenue in 2023 was approximately $2.7 billion.

Scopely has a diverse portfolio of mobile games, competing with Stillfront Group across multiple genres. The company focuses on acquiring and developing popular mobile games. Scopely's revenue in 2023 was around $2.3 billion.

AppLovin not only develops its own games but also provides a platform for game developers, influencing the broader mobile gaming ecosystem. AppLovin's revenue in 2023 was approximately $3.3 billion.

Indirect competitors include companies that may not directly compete in the same genres but still impact Stillfront Group's market share. These include console and PC game developers entering the F2P space and emerging independent studios.

Major console and PC game developers are increasingly entering the F2P space, diversifying their revenue streams and competing for the same player base. Companies like Electronic Arts and Activision Blizzard are significant players.

Several factors drive competition in the mobile games industry, including game development capabilities, marketing effectiveness, and the ability to acquire and retain players. Stillfront Group must excel in these areas to maintain its market position.

- Game Quality and Innovation: The ability to create engaging and innovative games is crucial.

- Marketing and User Acquisition: Effective marketing campaigns and user acquisition strategies are essential for attracting new players.

- Acquisitions: Strategic acquisitions can expand a company's portfolio and market reach. For example, Take-Two Interactive's acquisition of Zynga in 2022 for $12.7 billion.

- Platform Policies: App store policies and algorithms influence game visibility.

- Emerging Technologies: Leveraging new technologies, such as blockchain gaming, can provide a competitive edge.

Stillfront Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Stillfront Group a Competitive Edge Over Its Rivals?

The Revenue Streams & Business Model of Stillfront Group are significantly shaped by its competitive advantages in the dynamic mobile games industry. Stillfront Group's strategy centers around acquiring and nurturing game studios, creating a diverse portfolio of titles. This approach allows for a decentralized structure where studios retain creative independence while benefiting from centralized support.

Stillfront Group's competitive landscape is defined by its unique acquisition strategy and operational efficiency. The company focuses on acquiring studios with promising game titles and integrating them into its ecosystem. This model has allowed Stillfront to build a strong portfolio, supported by a robust infrastructure that enhances the performance of its acquired studios.

Stillfront Group's success in the mobile games industry is underpinned by several key competitive advantages. These advantages include a strategic acquisition approach, a diversified portfolio of games, and operational expertise in player engagement and monetization. The company's model allows acquired studios to maintain their creative independence while leveraging the group's centralized resources.

Stillfront Group's core strength lies in its acquisition strategy. This involves identifying and acquiring studios with successful game titles and strong growth potential. The company's approach focuses on acquiring studios with established games and loyal player bases, which provides a foundation for sustained revenue and growth. This strategy is a key differentiator in the competitive landscape.

The 'Stillfront Studios' model is a significant competitive advantage. Acquired studios retain creative independence while benefiting from the group's support functions. This model fosters innovation and allows studios to focus on game development. The decentralized approach combined with centralized support is a key element of its success.

Stillfront Group's diverse portfolio of games is a key competitive advantage. The company's portfolio includes a range of titles across different genres, reducing its reliance on any single game or genre. This diversification helps mitigate risks associated with the volatility of the mobile games market. This diversification strategy contributes to the company's resilience and growth.

Stillfront Group's operational expertise in player engagement and monetization is a significant advantage. The company's ability to optimize game performance, player retention, and monetization strategies is crucial in the free-to-play (F2P) model. This expertise drives revenue growth and improves the overall financial performance of its games. Sophisticated data analytics capabilities enable optimized game performance and player retention.

Stillfront Group's competitive advantages have a direct impact on its financial performance and market position. The acquisition strategy allows the company to expand its portfolio and enter new markets. The decentralized studio model fosters innovation and creativity. The operational expertise ensures that games are optimized for player engagement and revenue generation.

- Intellectual Property: The company's established titles with loyal player bases provide a strong foundation for revenue.

- Economies of Scale: Leveraging scale in user acquisition and marketing provides a cost advantage.

- Data Analytics: Sophisticated data analytics optimize game performance, player retention, and monetization.

- Cash Flow: Strong cash flow generation from established titles fuels new acquisitions and game development.

Stillfront Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Stillfront Group’s Competitive Landscape?

The Stillfront Group operates within the dynamic mobile games industry, navigating a landscape shaped by continuous technological advancements, evolving player preferences, and regulatory changes. Understanding the competitive landscape requires a close look at the industry's trends, potential challenges, and available opportunities. The company's success hinges on its ability to adapt to these factors and maintain a competitive edge.

Stillfront Group's position is influenced by its ability to innovate within the game development sector and its strategic approach to acquisitions. The risks include intense competition and the need for constant evolution to retain player engagement. The future outlook is tied to its capacity to diversify its portfolio, expand into emerging markets, and explore new monetization models.

Technological advancements in mobile hardware and 5G connectivity are enhancing game complexity. Cloud gaming platforms are shifting distribution methods. Consumer preferences are moving towards more social and cross-platform experiences. Regulatory changes impact game design and monetization.

Maintaining player engagement through constant innovation and updates is crucial. The rising costs of user acquisition and increasing competition pose threats. Economic downturns can impact in-game purchases. The industry is sensitive to shifts in consumer spending.

Emerging markets in Asia and Latin America offer significant growth potential due to expanding internet access. Esports and user-generated content provide avenues for deeper player engagement. Expanding geographic reach and exploring new game genres are key strategies. Innovative monetization strategies are also important.

The mobile games industry is projected to reach a value of over $100 billion in 2024. In 2023, the top 10 mobile game publishers generated over $30 billion in revenue. The global games market is expected to continue growing, offering opportunities for strategic acquisitions and portfolio diversification. For a deeper understanding, consider reading about the Target Market of Stillfront Group.

Stillfront Group must focus on data-driven decision-making and strategic acquisitions to maintain its competitive advantage. The company's growth strategy involves expanding its geographic reach, investing in new game genres, and exploring innovative monetization methods. Key performance indicators (KPIs) include user acquisition cost, player retention rates, and revenue per user.

- Diversifying the game portfolio to reduce reliance on single titles.

- Expanding into emerging markets with high growth potential.

- Investing in new game genres that align with player preferences.

- Exploring innovative monetization strategies, such as subscriptions.

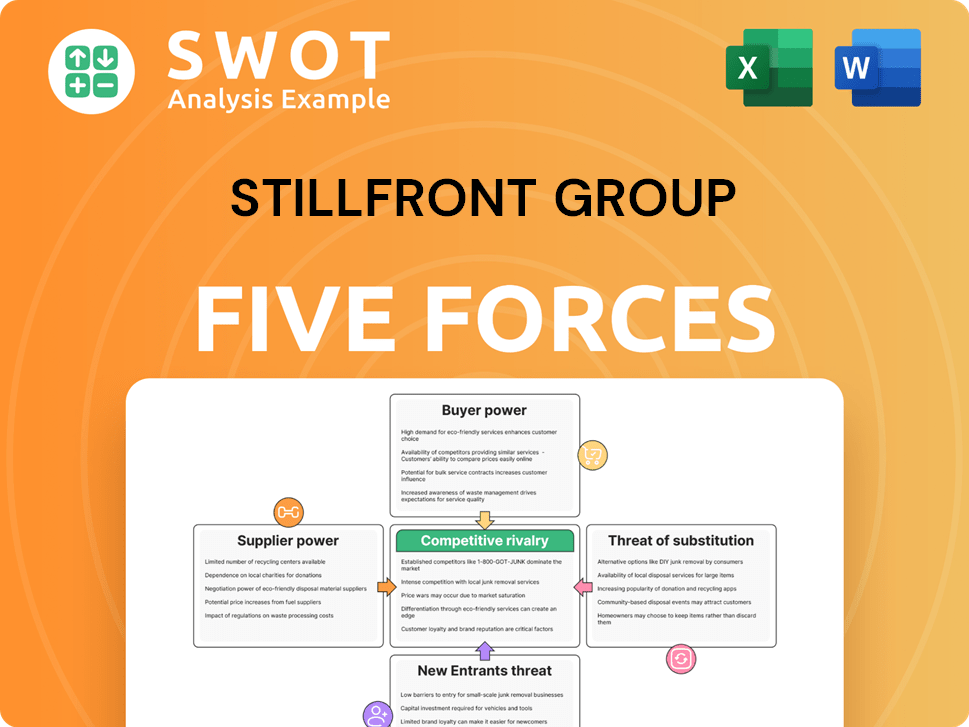

Stillfront Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Stillfront Group Company?

- What is Growth Strategy and Future Prospects of Stillfront Group Company?

- How Does Stillfront Group Company Work?

- What is Sales and Marketing Strategy of Stillfront Group Company?

- What is Brief History of Stillfront Group Company?

- Who Owns Stillfront Group Company?

- What is Customer Demographics and Target Market of Stillfront Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.