STV Group Plc Bundle

Can STV Group Plc Thrive in Today's Media Wars?

In the ever-shifting realm of media, understanding the STV Group Plc SWOT Analysis is crucial for any investor or strategist. As digital platforms reshape audience habits, STV Group Plc, a key player in the UK's media industry, faces both threats and opportunities. This analysis dives deep into the competitive landscape to assess STV's position and future prospects.

This STV Group Plc company analysis will explore the broadcast media landscape, examining key competitors and STV's market share. We'll dissect STV Group Plc's business strategy, identify its competitive advantages, and evaluate the impact of streaming services on its financial performance. Gain actionable insights into STV Group Plc's challenges and opportunities, and understand its strategic initiatives for future growth.

Where Does STV Group Plc’ Stand in the Current Market?

STV Group Plc's core operations revolve around broadcasting and content creation, primarily within the Scottish media market. The company's value proposition centers on delivering high-quality news, entertainment, and local programming to a wide audience, leveraging both traditional broadcasting and digital platforms. This approach allows it to maintain a strong presence in its core market while expanding its reach and diversifying its revenue streams.

The company's strategic focus includes linear television broadcasting, digital streaming through the STV Player, and content production via STV Studios. This multi-faceted approach enables STV to cater to evolving consumer preferences and capitalize on opportunities within the broader media industry. STV aims to extend its influence beyond its traditional geographic confines and diversify its revenue streams.

STV Group Plc holds a strong market position in Scotland, primarily through its broadcast channel. It reaches approximately 3.2 million viewers weekly in Scotland, demonstrating its significant influence in the broadcast media landscape. The company's digital platform, the STV Player, has also seen substantial growth, with a 15% increase in viewing in 2023.

STV's financial health appears robust, with total revenue for 2023 reported at £168.4 million. The company also reported an adjusted operating profit of £20.1 million, indicating strong financial management. These figures reflect STV's ability to generate revenue and maintain profitability in a competitive market. For more context, you can read a Brief History of STV Group Plc.

The STV Player plays a crucial role in STV's digital strategy, with monthly active users reaching 1.4 million in 2023, a 13% increase. This growth highlights the company's success in adapting to changing consumer habits and expanding its digital footprint. STV's focus on digital streaming and content production aims to extend its influence beyond its traditional geographic confines and diversify its revenue streams.

While STV's core strength lies in Scotland, where it operates the Channel 3 license, STV Studios produces content for the broader UK and international markets. This expansion strategy allows STV to diversify its revenue streams and reduce its reliance on the Scottish market alone. STV's ability to produce content for various networks beyond its own channel is a key component of its business strategy.

STV Group Plc benefits from several competitive advantages, including its strong brand recognition in Scotland and its established broadcast infrastructure. Its successful expansion into digital streaming through the STV Player provides a competitive edge. The company's ability to produce and distribute content across multiple platforms strengthens its market position.

- Strong market position in Scotland.

- Growing digital presence with STV Player.

- Diversified revenue streams through content production.

- Adaptability to changing consumer behavior and industry trends.

STV Group Plc SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging STV Group Plc?

The STV Group Plc operates within a dynamic and multifaceted competitive landscape, encompassing traditional broadcasting, digital streaming, and content production. A thorough company analysis reveals a complex interplay of established players and emerging challengers, each vying for audience attention and market share. Understanding these competitive dynamics is crucial for evaluating STV Group Plc's strategic positioning and future prospects within the media industry.

The broadcasting market share is fiercely contested, with significant implications for advertising revenue and overall financial performance. STV Group Plc's ability to navigate these challenges and capitalize on opportunities will be key to its continued success. This analysis delves into the key competitors, their strategies, and the broader industry trends shaping the broadcast media landscape.

STV Group Plc's revenue streams and monetization strategies are primarily centered around advertising, content licensing, and subscription services. Advertising revenue is generated through the sale of commercial airtime on its broadcast channels and digital platforms. Content licensing involves selling programming rights to other broadcasters and streaming services. Subscription revenue comes from its streaming service, STV Player. The company's strategic initiatives are geared towards maximizing these revenue streams and diversifying its income sources.

In traditional linear broadcasting, STV Group Plc competes with established players like the BBC and ITV plc. These competitors have a significant impact on STV Group Plc's ability to attract viewers and secure advertising revenue. The BBC's public funding and ITV's commercial strength create a challenging environment.

The BBC, a public service broadcaster, offers a wide array of channels and content. It competes directly with STV Group Plc for audience share, particularly in news, drama, and sports programming. The BBC's extensive reach and diverse programming portfolio pose a significant challenge.

ITV plc, as the largest commercial broadcaster in the UK, is a direct competitor to STV Group Plc. ITV competes for advertising revenue and national audiences, especially in popular entertainment and drama programming. The success of ITVX (formerly ITV Hub) is also a key factor.

STV Player faces competition from global streaming giants and other BVOD platforms. These platforms invest heavily in original content and offer extensive on-demand libraries. This competition impacts viewer engagement and the market position in UK.

Netflix, Amazon Prime Video, Disney+, and Apple TV+ are major competitors in the streaming arena. These platforms offer extensive on-demand libraries, often investing heavily in original content. They pose a significant challenge for viewer engagement and STV Group Plc's streaming service.

Free ad-supported streaming television (FAST) services and other broadcaster video-on-demand (BVOD) platforms also compete for audience attention. These platforms offer alternative viewing options, influencing STV Group Plc's ability to retain viewers and generate revenue.

STV Studios competes with numerous independent production companies. The content production landscape is highly competitive, with intense bidding for commissions. Emerging digital content creators also represent an indirect competitive threat, impacting advertising spend.

- Independent Production Companies: Ranging from large established players to smaller outfits, these companies bid for commissions from broadcasters and streaming platforms. This competition influences STV Group Plc's ability to secure commissions and produce content.

- Digital Content Creators: Social media platforms and independent online creators capture audience attention and advertising spend. This indirect competition affects the overall media landscape and STV Group Plc's financial performance.

- Competitive Dynamics: The content production landscape is characterized by intense competition for talent, intellectual property, and commissioning budgets. This environment requires STV Group Plc to be innovative and strategic.

- Recent Developments: The media industry is constantly evolving, with new entrants and changing audience preferences. For a deeper dive into STV Group Plc's strategic response to these dynamics, consider reading about the Growth Strategy of STV Group Plc.

STV Group Plc PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives STV Group Plc a Competitive Edge Over Its Rivals?

In the dynamic media industry, understanding the competitive landscape of STV Group Plc is crucial. A thorough company analysis reveals several key milestones and strategic moves that have shaped its market position. STV Group Plc's ability to adapt to industry trends and leverage its strengths is vital for sustained success. This analysis explores the competitive advantages that position STV Group Plc within the broadcast media landscape.

STV Group Plc has consistently demonstrated a commitment to innovation and audience engagement. Recent strategic initiatives, including investments in digital platforms and content production, reflect its forward-thinking business strategy. These moves are designed to enhance its market share and navigate the challenges and opportunities presented by the evolving media environment. A review of these initiatives provides insights into STV Group Plc's competitive advantages.

The competitive edge of STV Group Plc is further defined by its financial performance and strategic partnerships. Analyzing recent acquisitions and mergers, along with the impact of streaming services, offers a comprehensive view of its operational efficiency. This analysis also considers the future outlook and growth potential of STV Group Plc, highlighting its ability to adapt to market dynamics and maintain a strong stakeholder analysis.

STV Group Plc benefits from a strong regional identity, particularly in Scotland, holding the Channel 3 license. This local focus allows STV to provide hyper-local news and programming, fostering strong brand loyalty. The company's deep connection with Scottish audiences translates into a significant market share, providing a stable foundation for advertising revenue. This advantage is difficult for national broadcasters to replicate.

The growth of the STV Player is a key competitive advantage. STV has strategically invested in its digital platform, offering extensive catch-up and on-demand content. The STV Player's growing user base and engagement demonstrate its success in adapting to changing consumption habits. This digital reach also provides valuable first-party data for more targeted advertising.

STV Studios, the content production arm, is a significant asset. By producing a diverse range of programmes across genres, STV reduces reliance on third-party content and creates additional revenue streams. Creating compelling original content, both for its own channels and for external clients, positions STV as a creative force in the industry. This focus supports its business strategy.

STV's focus on cost efficiencies and strategic partnerships contributes to its operational strengths. The company's financial reports often highlight these aspects, which enhance its competitive edge. These operational strategies allow STV to maintain profitability and adapt to market changes. This is crucial for long-term success.

STV Group Plc's competitive advantages are multifaceted, including a strong regional focus, digital platform growth, content production capabilities, and operational efficiencies. These elements collectively contribute to its strong market position and ability to navigate the complexities of the media industry. For more insights, explore the Target Market of STV Group Plc.

- Strong regional identity and audience loyalty in Scotland.

- Growing digital platform with increasing user engagement.

- Robust content production capabilities through STV Studios.

- Focus on cost efficiencies and strategic partnerships.

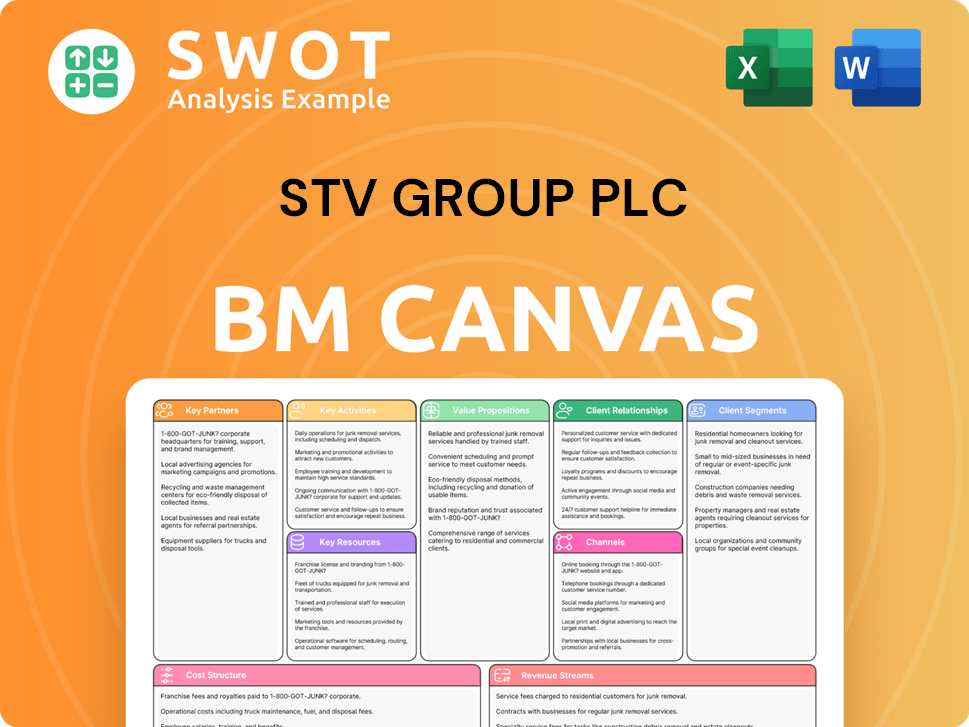

STV Group Plc Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping STV Group Plc’s Competitive Landscape?

The media industry is experiencing significant shifts, creating both challenges and opportunities for companies like STV Group Plc. The Revenue Streams & Business Model of STV Group Plc is adapting to the changing demands of viewers. Understanding the competitive landscape is crucial for STV Group Plc's long-term success.

STV Group Plc faces a dynamic environment where traditional broadcasting competes with digital platforms. The company's ability to navigate these changes will shape its future. This necessitates a deep dive into the industry trends, potential future challenges, and the opportunities that lie ahead.

The media industry is undergoing a significant transformation. The shift from linear television to on-demand streaming services is a major trend. The increasing consumption of content on digital platforms is reshaping the competitive landscape.

STV Group Plc faces challenges from global streaming giants with large content budgets. Regulatory changes related to advertising and content quotas could impact operations. Economic fluctuations, particularly in advertising spend, pose a constant challenge.

There is a growing demand for localized content, which aligns with STV's strengths. STV Studios can produce more original content for both Scottish and broader UK audiences. The growth of connected TV (CTV) advertising offers new revenue opportunities.

STV Group Plc could explore strategic partnerships to enhance content offerings. Data-driven insights from digital platforms can optimize content commissioning. The company's focus on innovation and digital expansion will be crucial.

STV Group Plc must balance its traditional broadcast strengths with digital expansion. The company needs to innovate to remain competitive in the fragmented media landscape. Adapting to changing viewer habits and advertising trends is essential.

- Focus on original content production to cater to local audiences.

- Leverage data analytics to inform content and advertising strategies.

- Explore partnerships to enhance content offerings and expand reach.

- Invest in digital platforms and CTV advertising capabilities.

STV Group Plc Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of STV Group Plc Company?

- What is Growth Strategy and Future Prospects of STV Group Plc Company?

- How Does STV Group Plc Company Work?

- What is Sales and Marketing Strategy of STV Group Plc Company?

- What is Brief History of STV Group Plc Company?

- Who Owns STV Group Plc Company?

- What is Customer Demographics and Target Market of STV Group Plc Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.