Swire Pacific Bundle

How Does Swire Pacific Navigate Its Competitive Arena?

Swire Pacific, a global conglomerate with a rich history, is currently adapting to the ever-changing global market. Its strategic focus on key regions like Greater China and the United States highlights its ambition for growth. Understanding the Swire Pacific SWOT Analysis is crucial for investors and strategists.

This in-depth analysis will dissect Swire Pacific's competitive landscape, providing a comprehensive business analysis of its market position and the strategies it employs. We'll explore Swire Group's key business segments and evaluate its industry rivals, offering insights into its competitive advantages and how it maintains its market share. Furthermore, we'll delve into Swire Pacific's financial performance compared to competitors and its strategic positioning within the dynamic global economy, considering its strengths and weaknesses in a competitive environment.

Where Does Swire Pacific’ Stand in the Current Market?

Swire Pacific demonstrates a strong market position across its diverse business segments, primarily within Greater China and the United States. The company's strategic focus and operational excellence have allowed it to maintain a competitive edge. This is evident in its property division, aviation sector, and beverages division, where it holds significant market shares and brand recognition.

The company's commitment to digital transformation and operational efficiency further strengthens its market position. This is supported by robust financial health, allowing for significant investments and sustained competitive standing. The company's diversified portfolio and strategic initiatives contribute to its resilience and growth in the competitive landscape.

Swire Properties is a leading developer and operator of mixed-use commercial properties, particularly in Hong Kong and Mainland China. Its developments, such as Pacific Place and Taikoo Place, are well-known for their prime locations and integrated designs. In 2023, Swire Properties reported a recurring underlying profit of HKD 5,907 million, highlighting its strong performance.

Cathay Pacific Airways, a major shareholder of Swire Pacific, is a leading international airline based in Hong Kong. Despite industry challenges, Cathay Pacific is revitalizing its operations, aiming to restore pre-pandemic capacity by early 2025. The airline's strategic importance reinforces Hong Kong's position as an international aviation hub.

Swire Coca-Cola, the beverages division, is one of the largest Coca-Cola bottlers globally by volume, with a vast consumer base in Mainland China and Hong Kong. The division benefits from the strong brand equity of Coca-Cola and Swire's extensive distribution network. In 2023, Swire Coca-Cola reported a profit attributable to shareholders of HKD 1,514 million.

Swire Pacific's robust financial health, evidenced by a profit attributable to shareholders of HKD 12,049 million in 2023, enables significant investments. The company continues to explore growth opportunities and diversification, particularly in the US property market, to maintain its competitive standing. For further insights, explore the Target Market of Swire Pacific.

Swire Pacific's competitive advantages stem from its strong brand reputation, prime asset locations, and diversified business segments. The company's focus on digital transformation and operational efficiency further enhances its market position. These factors collectively contribute to its resilience and growth in a competitive environment.

- Strong brand recognition and customer loyalty across various sectors.

- Strategic locations of properties and extensive distribution networks for beverages.

- Financial strength allowing for significant investments and expansion.

- Adaptability and focus on digital transformation to enhance customer experience.

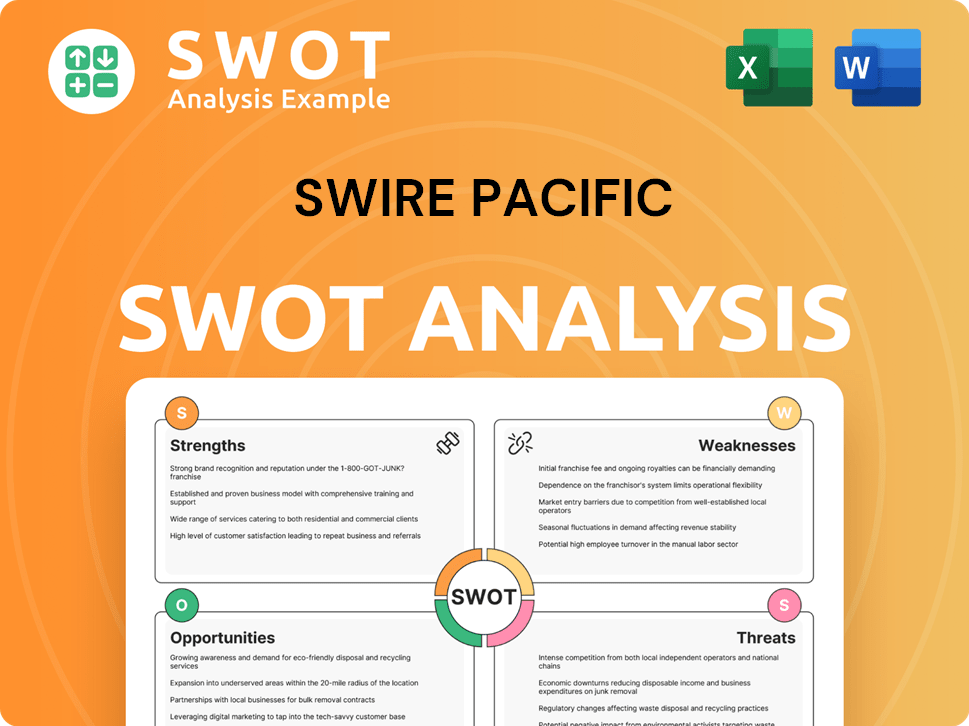

Swire Pacific SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Swire Pacific?

Understanding the Swire Pacific's competitive landscape requires a deep dive into its diverse business segments. The Swire Group operates in property, aviation, beverages, and trading & industrial sectors, each facing unique competitive pressures. A thorough business analysis reveals the key players challenging Swire Pacific across these varied markets, influencing its strategic positioning and market share.

The competitive environment for Swire Pacific is dynamic, shaped by factors such as economic conditions, consumer preferences, and technological advancements. Analyzing the industry rivals and their strategies provides insights into Swire Pacific's strengths and weaknesses. This analysis helps in understanding how Swire Pacific compares to its peers and its future outlook within the competitive landscape.

For a detailed look at the company's growth strategy, consider reading Growth Strategy of Swire Pacific.

In the property sector, Swire Pacific competes with major developers. Key rivals include Henderson Land Development, Sun Hung Kai Properties, and CK Asset Holdings in Hong Kong. In mainland China, competitors include China Resources Land and Longfor Group.

The aviation segment, dominated by Cathay Pacific Airways, faces intense competition. Major competitors include Singapore Airlines, China Southern Airlines, and China Eastern Airlines. Budget carriers like AirAsia and Scoot also contribute to the competitive pressure.

Swire Coca-Cola competes primarily with PepsiCo in the carbonated soft drinks market. The company also faces competition from a growing number of non-alcoholic beverage companies. Consumer preferences for healthier options drive innovation.

This segment faces competition from various specialized firms. Competition is often driven by product quality, supply chain efficiency, and pricing. Emerging players leveraging e-commerce platforms are disrupting traditional distribution channels.

Competitive dynamics are influenced by mergers and alliances. Consolidation within the airline industry and strategic partnerships in property development reshape market shares. These changes impact Swire Pacific's competitive positioning.

The recovery of international travel in 2024-2025 has intensified competition in aviation. Airlines are rapidly restoring capacity and introducing new routes. In the beverage sector, the focus on sustainable packaging is growing.

Several factors drive competition across Swire Pacific's business segments. These include pricing strategies, route networks, service quality, and direct connectivity in aviation. In property, land acquisition and diverse portfolios are key.

- Pricing: Competitive pricing strategies impact market share.

- Service Quality: High-quality service is crucial in aviation and property.

- Innovation: Innovation in products and packaging is essential in beverages.

- Efficiency: Supply chain and operational efficiency are vital in trading and industrial businesses.

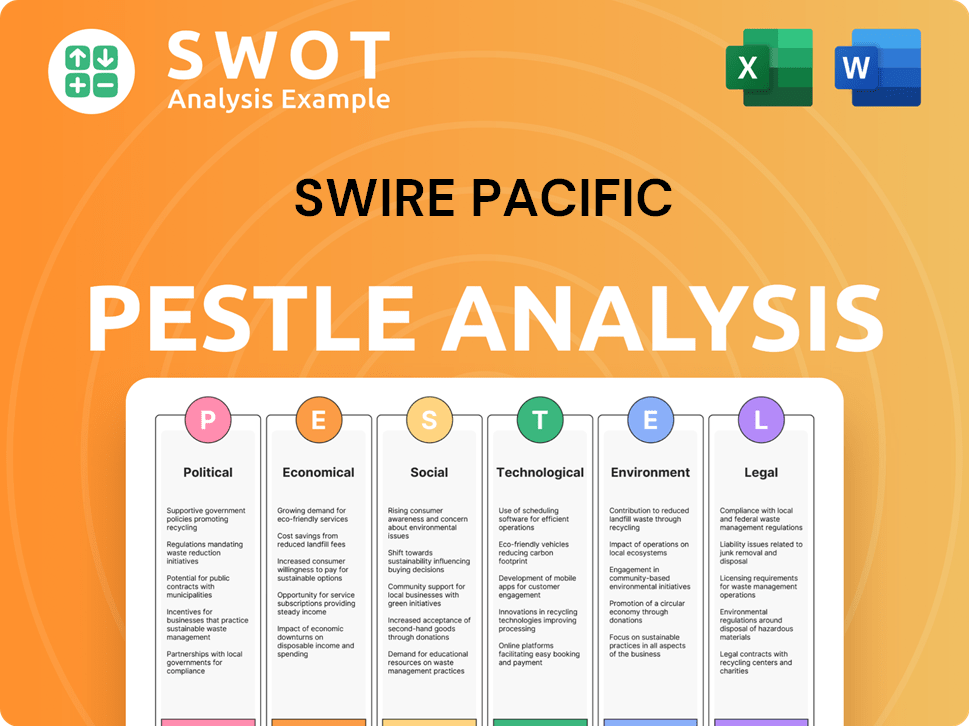

Swire Pacific PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Swire Pacific a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of Swire Pacific requires a deep dive into its core strengths. The company, part of the Swire Group, has cultivated a robust market position through a diversified portfolio and strategic focus. A comprehensive business analysis reveals that Swire Pacific's competitive advantages are multifaceted and deeply ingrained in its operational history.

The company's success is underpinned by its premium property portfolio, particularly through Swire Properties, which focuses on developing and managing high-quality, integrated mixed-use developments in prime urban locations. In the aviation sector, Cathay Pacific Airways leverages its strong brand reputation and strategic hub at Hong Kong International Airport. Swire Coca-Cola benefits from the formidable brand power of Coca-Cola and its extensive distribution network.

Swire Pacific's diversified business model provides resilience against economic downturns in any single sector. The company's long-term investment horizon and commitment to sustainable development also foster strong stakeholder relationships and enhance its reputation. These advantages have evolved through consistent investment in infrastructure, brand building, and talent development, allowing Swire Pacific to maintain its leadership positions.

Swire Properties' focus on premium properties in prime locations provides stable recurring rental income and capital appreciation. Properties like Pacific Place and Taikoo Place command premium rents and foster strong tenant relationships. This strategy is supported by a robust balance sheet, enabling new developments and acquisitions.

Cathay Pacific Airways benefits from its strong brand reputation and strategic hub at Hong Kong International Airport. Its extensive network and loyalty programs contribute to customer retention. Digital initiatives enhance customer experience, further solidifying its competitive edge within the industry.

Swire Coca-Cola leverages the brand power of Coca-Cola and its well-established distribution network across China and the US. This extensive reach allows for unparalleled market penetration and economies of scale. The long-standing relationship with The Coca-Cola Company provides access to global marketing strategies and product innovations.

Swire Pacific's diversified business model provides a degree of resilience against economic downturns in any single sector. Diversification helps mitigate risks and allows for cross-segment synergies. The company's long-term investment horizon and commitment to sustainable development also foster strong stakeholder relationships.

Swire Pacific's competitive advantages are rooted in its operational history, diversified portfolio, and strategic geographic focus. The company's ability to develop and manage large-scale, integrated mixed-use developments in prime urban locations provides stable recurring rental income and capital appreciation. The company's commitment to sustainable development also fosters strong stakeholder relationships.

- Strong Brand Equity: Cathay Pacific and Coca-Cola are globally recognized brands.

- Strategic Geographic Focus: Prime locations in Hong Kong and mainland China.

- Diversified Portfolio: Resilience against economic downturns across different sectors.

- Operational Efficiency: Well-established distribution networks and economies of scale.

The competitive environment for Swire Pacific includes rapid technological changes, increasing regulatory scrutiny, and the potential for imitation by well-capitalized competitors. To maintain its market position, continuous innovation and strategic adaptation are crucial. For more insights, explore the Marketing Strategy of Swire Pacific.

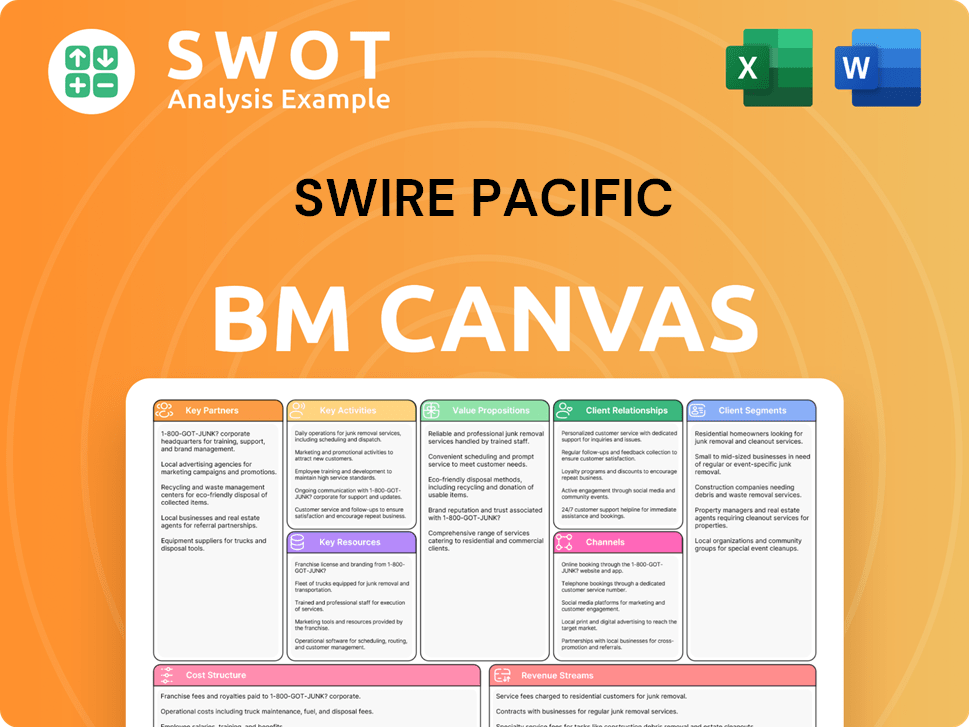

Swire Pacific Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Swire Pacific’s Competitive Landscape?

The Swire Group, including Swire Pacific, operates within diverse sectors, each facing unique challenges and opportunities. A thorough business analysis reveals that technological advancements, regulatory changes, and evolving consumer preferences are key drivers shaping the competitive landscape. Understanding these trends is crucial for assessing Swire Pacific's market position and future prospects.

Swire Pacific's strategic approach involves adapting to these shifts through digital transformation, sustainability initiatives, and strategic diversification. The competitive environment is dynamic, requiring continuous adaptation to maintain and enhance its market share. For more insights, consider reading a Brief History of Swire Pacific.

Technological advancements, such as digitalization and automation, are transforming core businesses. Regulatory changes, particularly in Greater China, pose ongoing considerations. Consumer preferences are shifting towards sustainability, health, and personalized experiences.

Intense competition from agile, digitally native companies and well-capitalized global players. The aviation industry faces ongoing volatility from fuel prices and geopolitical events. The property market in Hong Kong and mainland China is subject to policy changes and economic cycles.

Expanding into emerging markets, particularly in Southeast Asia for aviation. Product innovation, such as new beverage categories or advanced building materials. Strategic partnerships can unlock new revenue streams.

Continued investment in digital transformation. A strong focus on sustainability initiatives. Strategic diversification within existing and new geographies. Adaptation to meet evolving consumer demands.

Swire Pacific's ability to navigate the competitive landscape depends on several factors. These include its capacity to invest in digital technologies, respond to regulatory changes, and meet evolving consumer demands. Strategic diversification and expansion into new markets are also critical for growth.

- Digital Transformation: Integrating advanced technologies across all business segments to improve efficiency and customer experience.

- Sustainability Initiatives: Focusing on sustainable design and operation of buildings, and offering eco-friendly products.

- Strategic Partnerships: Forming alliances to leverage expertise and expand market reach.

- Geographic Expansion: Targeting growth in emerging markets, particularly in Southeast Asia.

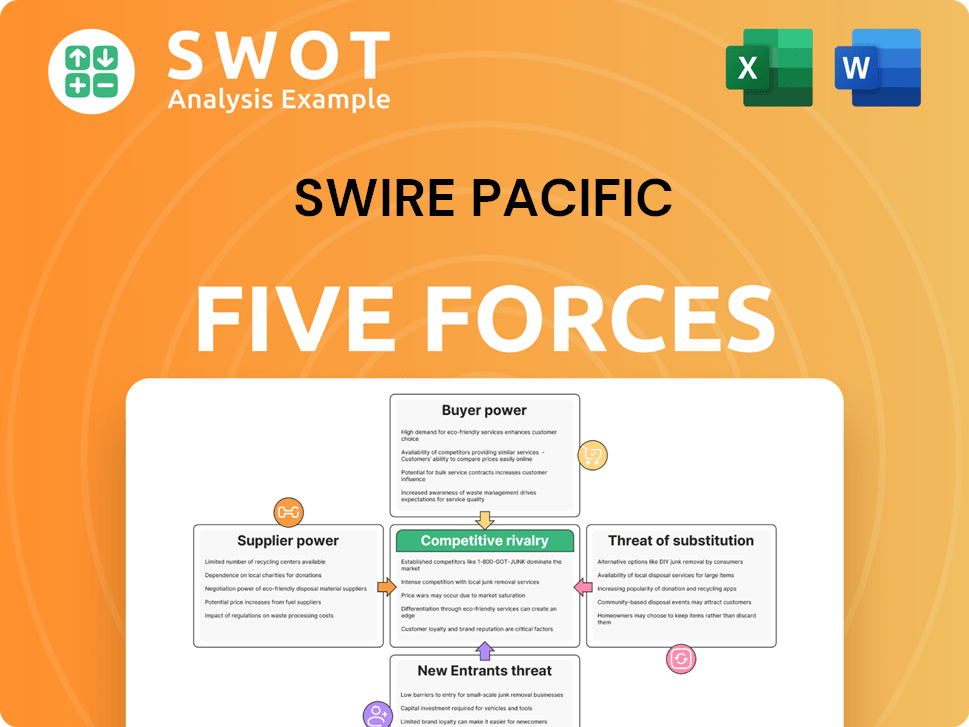

Swire Pacific Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Swire Pacific Company?

- What is Growth Strategy and Future Prospects of Swire Pacific Company?

- How Does Swire Pacific Company Work?

- What is Sales and Marketing Strategy of Swire Pacific Company?

- What is Brief History of Swire Pacific Company?

- Who Owns Swire Pacific Company?

- What is Customer Demographics and Target Market of Swire Pacific Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.