Swire Pacific Bundle

Can Swire Pacific Continue Its Century-Long Ascent?

From its humble beginnings in 1816, Swire Pacific SWOT Analysis has transformed into a global powerhouse. This evolution underscores the critical role of a robust growth strategy in today's dynamic markets. This analysis will explore Swire Pacific's strategic initiatives to understand its future prospects and investment potential.

Swire Pacific's journey from a trading company to a diversified conglomerate showcases its ability to adapt and thrive. This exploration will delve into the company's current growth strategy, examining its expansion plans and innovation strategies. We will analyze how Swire Pacific's business development efforts and strategic financial planning are shaping its long-term growth potential, considering factors like the impact of economic trends and its competitive advantages.

How Is Swire Pacific Expanding Its Reach?

Swire Pacific's Growth Strategy is driven by significant expansion initiatives aimed at strengthening its market presence and diversifying its revenue streams. The company is actively pursuing opportunities to enter new markets and expand within existing ones, particularly in Greater China and the United States. This strategic approach is designed to capitalize on emerging trends and enhance long-term value.

The company's focus on business development is evident through strategic partnerships and investments. These moves are intended to complement existing businesses and create synergistic growth opportunities. The goal is to diversify revenue streams and mitigate risks associated with market fluctuations, ensuring a competitive edge across its diverse industries. For a deeper understanding of the company's foundational principles, consider exploring the Mission, Vision & Core Values of Swire Pacific.

Swire Pacific's investment portfolio is also a key area of expansion. The company is focused on growing its investment property portfolio, particularly in mainland China. This includes strategic partnerships and new commercial complex developments to tap into urban development trends and access new customer bases.

Swire Properties, a key segment, has been actively expanding its investment property portfolio, particularly in mainland China. In early 2024, a strategic partnership was announced with Shanghai Yangpu District to develop a new commercial complex. This initiative is part of the company's plan to capitalize on urban development trends and access new customer bases.

Cathay Pacific, a subsidiary, is focused on rebuilding its network and capacity post-pandemic. The goal is to reach 80% of pre-pandemic passenger capacity by the end of 2024 and 100% by early 2025. This involves reintroducing routes and increasing flight frequencies to meet the rising travel demand.

Swire Coca-Cola continues to expand its product portfolio with new beverage options and packaging innovations. This is done to meet evolving consumer preferences and maintain a competitive edge in the market. The company also looks for strategic partnerships and potential mergers and acquisitions.

Swire Pacific actively seeks strategic partnerships and potential mergers and acquisitions. These initiatives aim to complement existing businesses and offer synergistic growth opportunities. This approach is intended to diversify revenue streams and mitigate risks associated with market fluctuations.

Swire Pacific's expansion strategy focuses on real estate, aviation, and beverages, with a strong emphasis on Greater China and the U.S. The company's initiatives include strategic partnerships, new product development, and capacity rebuilding in the aviation sector. These efforts are designed to drive long-term growth and enhance shareholder value.

- Expansion of investment property portfolio in mainland China.

- Rebuilding aviation capacity to pre-pandemic levels.

- Expanding the beverage product portfolio and exploring new packaging innovations.

- Seeking strategic partnerships and M&A opportunities for synergistic growth.

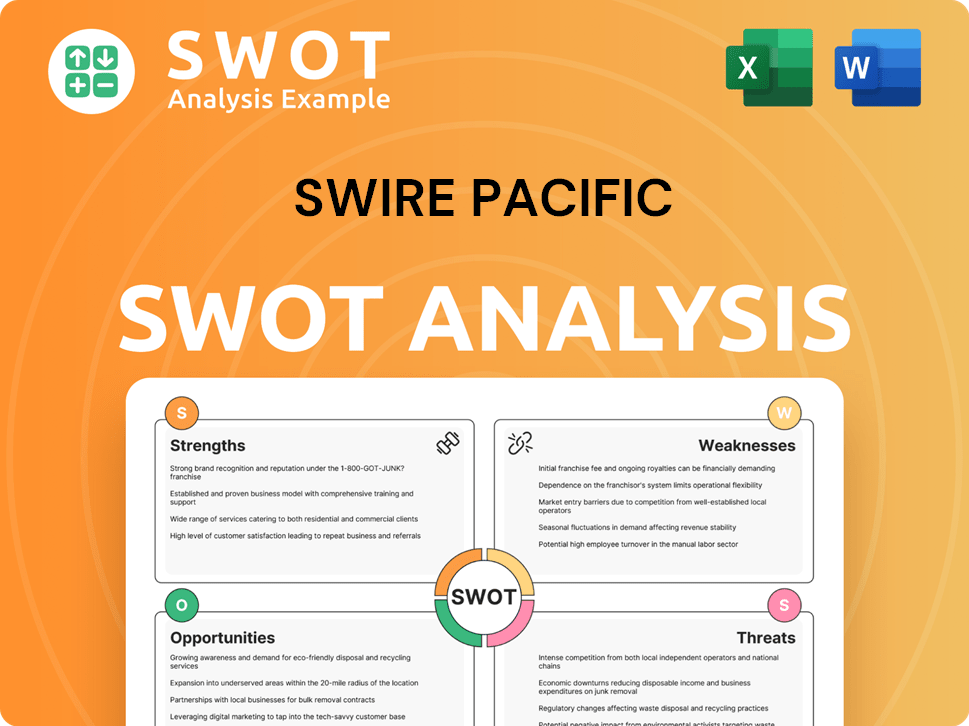

Swire Pacific SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Swire Pacific Invest in Innovation?

Swire Pacific's Growth Strategy heavily relies on innovation and technology to enhance its diverse business operations. This approach is central to the company's Future Prospects, as it navigates a rapidly evolving market landscape. The company's commitment to integrating new technologies and fostering innovation is evident across its various sectors, from property to aviation and beverages.

The company invests significantly in research and development to stay ahead of the curve. This includes in-house innovation initiatives and collaborations with external technology providers and startups. These efforts are designed to improve operational efficiency, enhance customer experiences, and achieve sustainability goals across its various business segments, ensuring long-term value creation.

Swire Pacific's focus on digital transformation and sustainability is a key element of its Growth Strategy. The company is actively implementing advanced technologies, such as AI-powered systems, to optimize energy consumption and reduce its carbon footprint. This commitment to integrating green technologies and practices demonstrates its dedication to environmental and social value.

Swire Properties uses smart building technologies to enhance operational efficiency. Data analytics are employed to optimize building performance and reduce costs. Proptech solutions are also adopted to improve customer experience.

AI-powered energy management systems are implemented in commercial buildings. These systems optimize energy consumption, contributing to sustainability goals. This reduces the carbon footprint and enhances operational efficiency.

Cathay Pacific explores advanced technologies to improve operational efficiency. Digital platforms are used to personalize travel experiences. Sustainable aviation fuel (SAF) initiatives are also implemented.

Digital platforms are used to personalize travel experiences. These platforms offer customized services and enhance passenger satisfaction. This includes features like personalized entertainment and travel information.

Swire Coca-Cola leverages automation in its bottling and distribution processes. Data analytics are used to optimize supply chain management. AI is explored for demand forecasting and personalized marketing.

Swire Pacific integrates green technologies and practices across its businesses. This helps achieve long-term environmental and social value. Sustainability is a core part of their Growth Strategy.

These technological advancements and innovative approaches are critical for developing new products, improving operational capabilities, and achieving the company's overarching Growth Strategy. The company's commitment to these areas positions it well for future success. For a deeper understanding of the competitive environment, consider reading about the Competitors Landscape of Swire Pacific.

Swire Pacific is making significant investments in technology across its diverse business segments to drive efficiency and enhance customer experiences. These investments are crucial for maintaining a competitive edge and achieving long-term growth.

- Property Sector: Implementation of smart building technologies and data analytics for operational efficiency and customer experience.

- Aviation Segment: Investments in new-generation aircraft and digital platforms for personalized travel experiences.

- Beverage Sector: Automation and data analytics in bottling and distribution, with AI for demand forecasting.

- Sustainability: Integration of green technologies and practices to achieve environmental and social value.

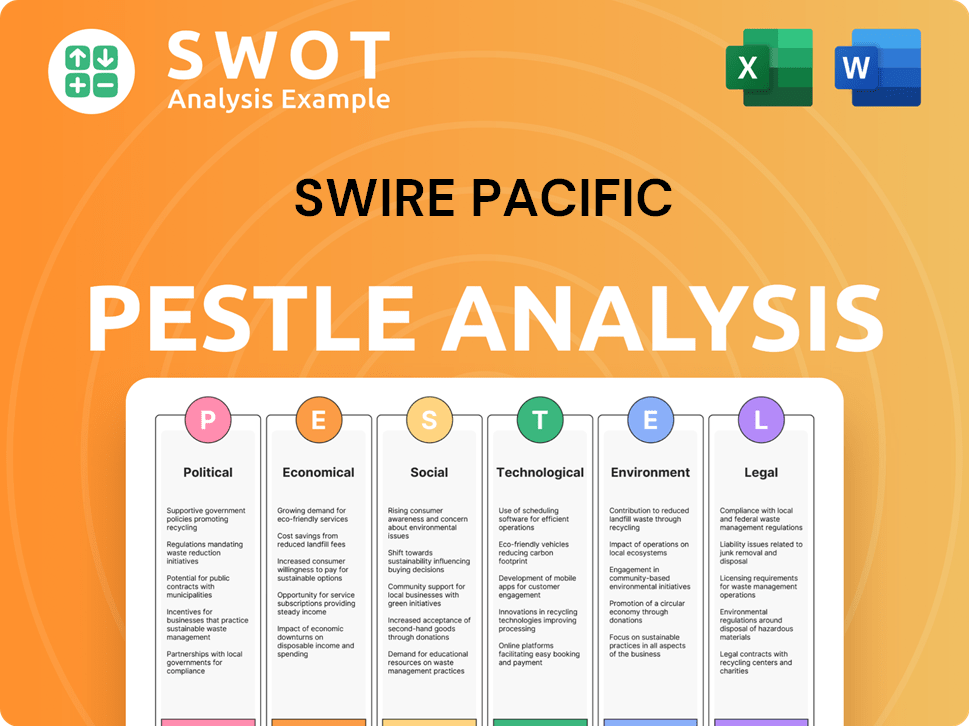

Swire Pacific PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Swire Pacific’s Growth Forecast?

The financial outlook for Swire Pacific is geared towards sustained growth and value creation, supported by strong performance and strategic investments. The company's 2023 financial results reflect a robust recovery and growth trajectory. The underlying profit attributable to shareholders reached HK$8,299 million, a significant improvement from the previous year. This performance was largely driven by the strong recovery in its aviation segment and solid contributions from its property division. Looking ahead to 2024 and beyond, Swire Pacific aims to continue this positive momentum.

Swire Properties, for instance, has a substantial development pipeline, with significant capital expenditure planned for new projects in mainland China and Hong Kong. This anticipates continued growth in rental income and property sales. The aviation segment, particularly Cathay Pacific, is expected to see further improvements in passenger capacity and profitability as global travel continues to normalize, with a target to restore pre-pandemic passenger capacity by early 2025. The beverages and food divisions are also projected to maintain steady growth, driven by market expansion and product innovation.

The company's financial strategy emphasizes disciplined capital allocation, aiming to balance investments in growth initiatives with maintaining a healthy balance sheet and providing attractive returns to shareholders. While specific revenue targets and profit margins for future years are subject to market conditions, Swire Pacific's historical performance and ongoing strategic investments suggest a positive financial trajectory, aligning its financial ambitions with its broader growth strategies. For a detailed Swire Pacific company overview, you can refer to this article: 0.

Cathay Pacific, a key part of Swire Pacific's aviation segment, is targeting a full restoration of pre-pandemic passenger capacity by early 2025. This recovery is crucial for driving overall financial performance. The aviation sector's rebound is a significant factor in the Swire Pacific's Growth Strategy.

Swire Properties has a substantial development pipeline, with significant capital expenditure planned for new projects in mainland China and Hong Kong. These investments are expected to contribute to future rental income and property sales growth. This is a key element of the Business Development strategy.

The beverages and food divisions are projected to maintain steady growth through market expansion and product innovation. This diversification helps to stabilize overall financial performance. These divisions contribute to the overall Investment Portfolio.

Swire Pacific emphasizes disciplined capital allocation, balancing investments in growth with maintaining a healthy balance sheet. This approach aims to provide attractive returns to shareholders. This strategy is central to the company's Future Prospects.

In 2023, Swire Pacific reported an underlying profit attributable to shareholders of HK$8,299 million. This represents a significant increase, demonstrating the company's recovery and growth. This data is crucial for Company Analysis.

Specific revenue targets and profit margins for future years are subject to market conditions. However, the company's historical performance and strategic investments suggest a positive financial trajectory. The Swire Pacific's Future Prospects are promising.

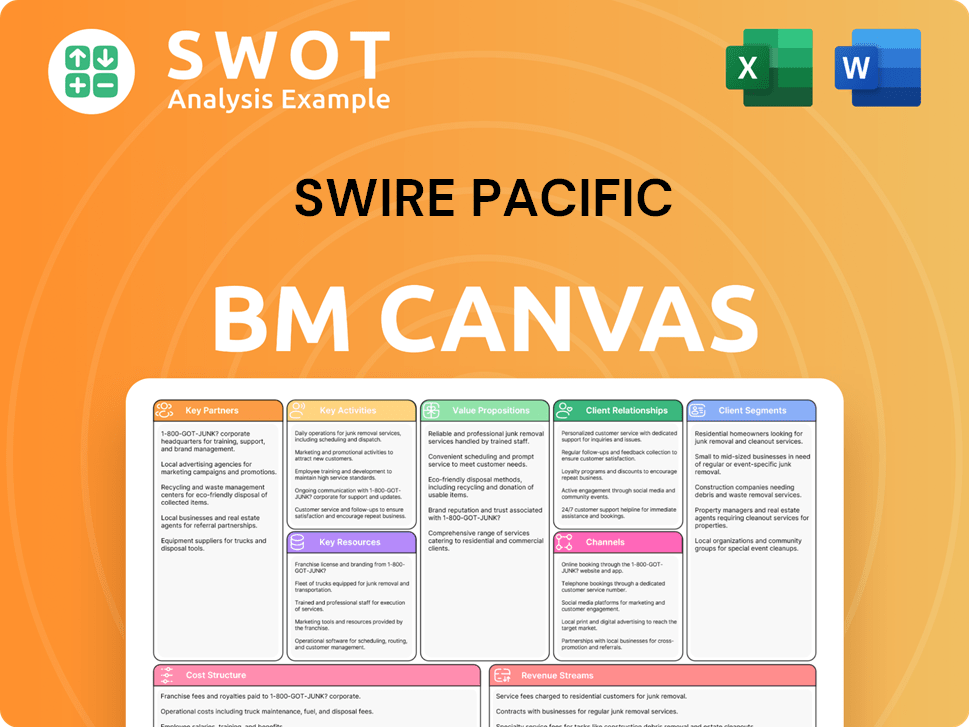

Swire Pacific Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Swire Pacific’s Growth?

The Growth Strategy and future prospects of Swire Pacific are subject to several risks and obstacles. These challenges span across various sectors, from property and aviation to beverages and trading, potentially impacting the company's financial performance and strategic goals. Understanding these risks is crucial for assessing the long-term viability of Swire Pacific and its ability to navigate an evolving market landscape.

Swire Pacific faces market competition in its property sector, particularly in Hong Kong and mainland China. The aviation industry is highly sensitive to geopolitical events and fuel price volatility. Additionally, regulatory changes, especially in Greater China, and supply chain vulnerabilities pose significant challenges.

To understand the full scope of Swire Pacific and its operations, you can explore the Revenue Streams & Business Model of Swire Pacific. This overview provides insights into the company's diverse business segments and revenue generation.

Intense competition from developers in key markets like Hong Kong and mainland China could pressure rental yields and property values. This is a constant challenge for the property segment of Swire Pacific, requiring continuous innovation and strategic adjustments. The competitive landscape in the real estate sector is dynamic, influencing the company's Growth Strategy.

The aviation industry is vulnerable to geopolitical events, fuel price fluctuations, and health crises. Recent events, such as the COVID-19 pandemic, have severely impacted Cathay Pacific's operations, highlighting the sector's volatility. Economic downturns can also significantly affect the aviation business, impacting Swire Pacific's financial results.

Evolving policies in Greater China related to property, environmental standards, and trade could affect business operations and investment strategies. These changes necessitate proactive adaptation and strategic planning to ensure compliance and maintain a competitive edge. Regulatory shifts can impact the Future Prospects of Swire Pacific.

Supply chain disruptions, especially for its beverages and food divisions, can lead to increased operational costs and reduced profitability. These vulnerabilities require robust supply chain management and diversification strategies. The ability to manage supply chain risks is crucial for Swire Pacific's overall performance.

Rapid technological advancements require continuous and significant investments in innovation to maintain a competitive edge. Staying ahead of technological changes is essential for Swire Pacific to remain relevant and efficient. Digital transformation is a key aspect of the Business Development.

Climate change and increasing cybersecurity threats are also emerging risks that require proactive management. Swire Pacific is actively monitoring and addressing these through sustainable practices and enhanced digital security measures. These initiatives are shaping the company's Future Prospects.

Swire Pacific addresses these risks through a comprehensive risk management framework. This includes diversification of its business portfolio to mitigate segment-specific downturns. For example, the company has focused on strengthening its financial resilience and optimizing operational efficiencies across its businesses. This approach helps to safeguard the Investment Portfolio.

In response to recent global economic uncertainties, Swire Pacific has focused on strengthening its financial resilience and optimizing operational efficiencies across its businesses. This includes careful management of costs and strategic allocation of resources. The company's ability to adapt to changing market conditions is crucial for its long-term success. In 2024, the company continues to adapt its strategies to navigate these challenges. The company's financial performance analysis shows a commitment to robust risk management.

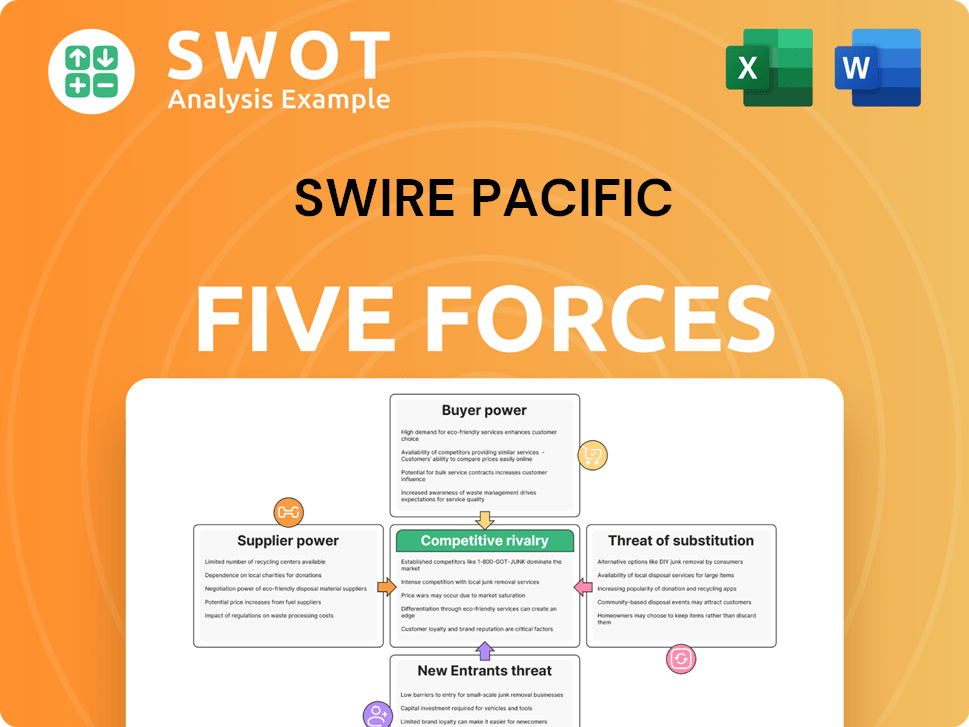

Swire Pacific Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Swire Pacific Company?

- What is Competitive Landscape of Swire Pacific Company?

- How Does Swire Pacific Company Work?

- What is Sales and Marketing Strategy of Swire Pacific Company?

- What is Brief History of Swire Pacific Company?

- Who Owns Swire Pacific Company?

- What is Customer Demographics and Target Market of Swire Pacific Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.