Swire Pacific Bundle

How Does Swire Pacific Thrive in Today's Markets?

Swire Pacific, a venerable conglomerate with over 150 years of experience, stands as a significant player in Greater China and beyond. Its diverse portfolio, encompassing property, aviation, beverages, and trading, demands a closer look at its operational strategies. Understanding the Swire Pacific SWOT Analysis is key to unlocking the secrets behind its enduring success.

Delving into Swire Pacific's operations reveals a complex yet resilient business model. Exploring its subsidiaries and their roles provides valuable insights into how this Swire Group entity generates revenue and navigates market challenges. This analysis of Swire Pacific's financial performance, including its strategic investments and future outlook, is essential for anyone seeking to understand the dynamics of this influential company.

What Are the Key Operations Driving Swire Pacific’s Success?

Swire Pacific, a prominent conglomerate, generates value through its diverse operations spanning property, beverages, aviation, and trading & industrial sectors. The company's core strategy revolves around long-term investments, with a focus on maintaining controlling interests in its businesses. This approach allows Swire Pacific to contribute expertise and drive value creation across its various divisions.

The company's diversified portfolio enables it to leverage cross-divisional synergies, fostering a resilient business model. This structure allows the company to navigate economic cycles effectively. The operational effectiveness is enhanced by its ability to adapt and innovate within its core sectors, ensuring sustained growth and value creation.

The value proposition of Swire Pacific lies in its ability to create and deliver value through its core divisions and strategic investments. The company's commitment to operational excellence and long-term strategic planning is evident in its diverse portfolio and ability to adapt to changing market dynamics. Swire Pacific's diversified business model allows it to weather economic fluctuations and capitalize on growth opportunities across various sectors.

Swire Properties develops, owns, and manages commercial, retail, hotel, and residential properties. The property investment portfolio, as of December 31, 2024, comprised approximately 34.6 million square feet of investment properties and hotels. Key properties include Pacific Place and Taikoo Place in Hong Kong, and mixed-use developments in mainland China.

Swire Coca-Cola is one of the largest Coca-Cola bottlers globally, holding exclusive rights in mainland China, Hong Kong, Taiwan, Vietnam, Cambodia, Laos, and Thailand. As of the end of 2024, it manufactured 41 beverage brands. The franchise population served reached 910 million people.

The Aviation Division includes the Hong Kong Aircraft Engineering Company (HAECO) and an associate interest in the Cathay Group. HAECO provides aircraft maintenance and repair services. The Cathay Group, with 236 aircraft at the end of 2024, offers passenger and cargo services to 88 destinations.

Trading & Industrial businesses include Swire Resources, Taikoo Motors, Swire Foods, and Swire Environmental Services. These businesses cover sports and lifestyle products, vehicle distribution, food manufacturing, and waste management. This segment contributes to the overall diversification of the Swire Group.

Swire Pacific's operational effectiveness is underpinned by its long-term investment approach and preference for controlling interests. This approach allows the company to contribute expertise and add value to its businesses. The diversified portfolio allows for cross-divisional synergies, contributing to a resilient business model.

- Long-term investment strategy focused on sustainable growth.

- Controlling interests in key businesses to drive operational excellence.

- Cross-divisional synergies to enhance overall performance.

- Diversified portfolio mitigating risks and maximizing opportunities.

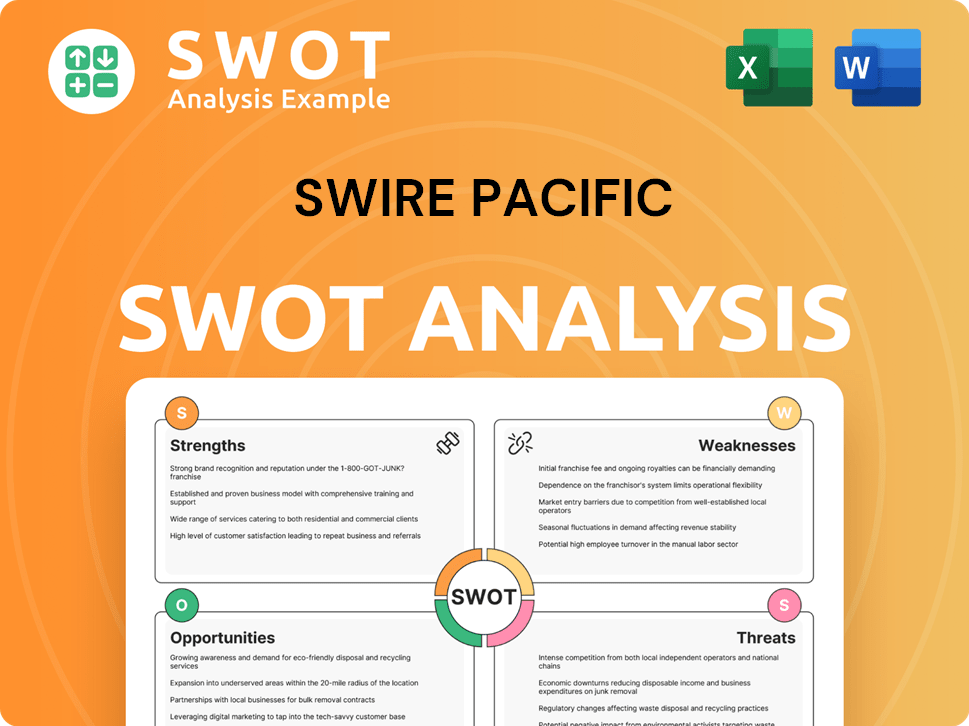

Swire Pacific SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Swire Pacific Make Money?

Swire Pacific, a prominent conglomerate, generates revenue through a diversified portfolio of businesses. Understanding the revenue streams and monetization strategies of Swire Pacific's operations is crucial for investors and stakeholders alike. The company's financial performance is shaped by its strategic approach across various sectors.

The company's primary revenue sources include property investment and trading, beverages, aviation, and trading & industrial activities. These diverse segments contribute to the overall financial health of the company. Each division employs specific monetization strategies tailored to its respective industry.

In 2024, Swire Pacific's total revenue amounted to HK$81,969 million, reflecting a 14% decrease compared to HK$94,823 million in 2023. This decrease was influenced by several factors, including strategic disposals and the dynamic performance of its various business segments.

The following is a breakdown of the revenue streams for 2024:

- Property: Generated HK$14,379 million, a 2% decrease from 2023. This segment focuses on property investment (rental income) and trading (property sales). Gross rental income from the retail portfolio in Hong Kong was HK$2,369 million in 2024.

- Beverages: Contributed the largest revenue share at HK$36,607 million, though this was a 29% decrease from 2023. This division manufactures, markets, and distributes Coca-Cola products. The decrease was mainly due to the disposal of Swire Coca-Cola, USA.

- Aviation: Saw a 22% increase, reaching HK$21,662 million. This segment includes passenger and cargo services by Cathay Pacific and aircraft maintenance services.

- Trading & Industrial: Revenue was HK$9,032 million, a 14% decrease. This includes sports and lifestyle products, vehicle sales, food manufacturing, and waste management. Swire Resources' revenue was HK$2,279 million, and Taikoo Motors' was HK$5,216 million.

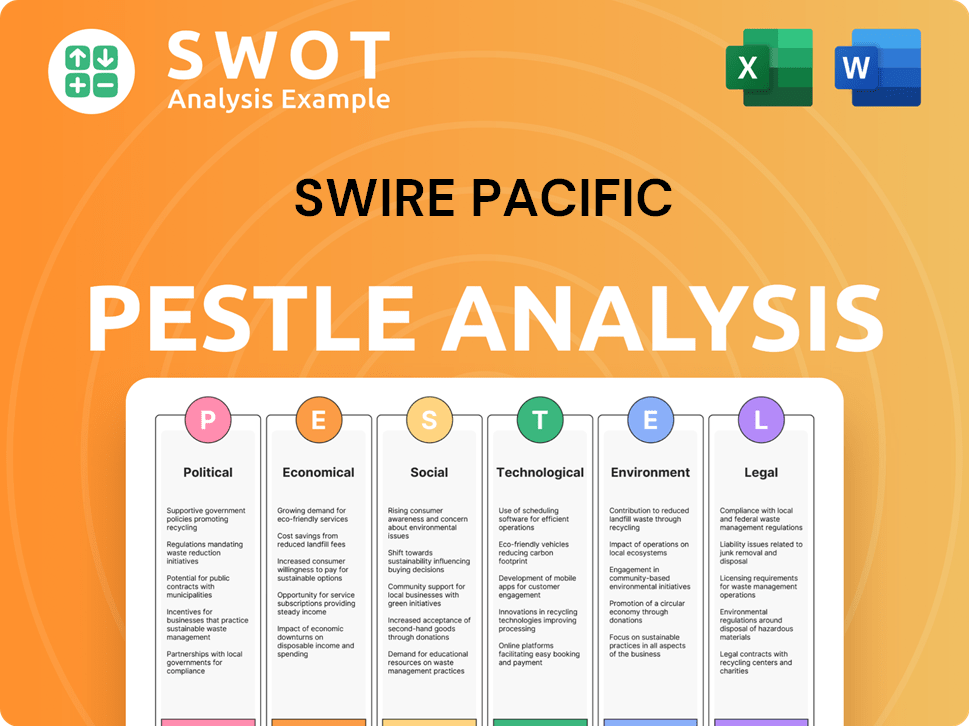

Swire Pacific PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Swire Pacific’s Business Model?

Swire Pacific has undertaken significant strategic initiatives and achieved key milestones in recent years, aimed at enhancing its operational efficiency and financial performance. These moves reflect the company's commitment to growth and its ability to adapt to evolving market dynamics. The company's strategic investments and expansions across its diverse portfolio demonstrate its long-term vision and dedication to creating value for its stakeholders.

A core element of Swire Pacific's strategy involves substantial investments in its various sectors. The company's focus on sustainability and its strong financial position, with significant available liquidity, further support its ability to navigate economic uncertainties and capitalize on emerging opportunities. These strategic moves highlight Swire Pacific's proactive approach to maintaining a competitive edge and driving future growth.

The company's diversified portfolio and long-standing presence in Greater China are key competitive advantages. Furthermore, Swire Pacific's commitment to sustainability, as demonstrated by the SwireTHRIVE strategy, underscores its dedication to responsible business practices. These elements collectively position Swire Pacific for continued success in the dynamic global market.

Swire Properties' HK$100 billion investment plan is a major strategic move, with approximately 67% of the pipeline committed as of early 2025. The Taikoo Place Redevelopment Project was completed in November 2024, transforming it into a global business district. In June 2024, Swire Properties increased its stake in INDIGO Phase Two in Beijing, now Taikoo Place Beijing.

Swire Coca-Cola expanded in Southeast Asia by acquiring a majority stake in ThaiNamthip Corporation Ltd. in February 2024. In May 2024, Swire Coca-Cola broke ground on the Greater Bay Area Intelligent Green Factory in Guangdong, a RMB1.25 billion investment. The Aviation division, particularly Cathay Group, is rebuilding, with passenger flights reaching 80% of pre-pandemic levels by Q2 2024.

Swire Pacific's competitive advantages include a diversified portfolio and a long-standing presence in Greater China. The company's SwireTHRIVE strategy, launched in 2024, focuses on sustainability, with a net-zero carbon emissions target by 2050. Its strong financial position, with HK$43.1 billion in available liquidity at the end of 2024, supports continued investment. Learn more about the Marketing Strategy of Swire Pacific.

The company's gearing ratio was 22.1% at the end of 2024, reflecting a solid financial structure. Investments in healthcare, such as the acquisition of a controlling stake in DeltaHealth in April 2024 and a minority investment in Indonesia Healthcare Corporation in July 2024, demonstrate adaptability. Cathay Pacific returned to the world's top five airlines in industry rankings in June 2024.

Swire Pacific's investment strategy is multifaceted, focusing on long-term growth and diversification. The company's investments span various sectors, including property, beverages, aviation, and healthcare. These strategic moves are designed to enhance the company's market position and drive sustainable growth.

- HK$100 billion investment plan by Swire Properties.

- Expansion of Swire Coca-Cola in Southeast Asia.

- Cathay Pacific's rebuild journey with significant investments.

- Focus on sustainability through the SwireTHRIVE strategy.

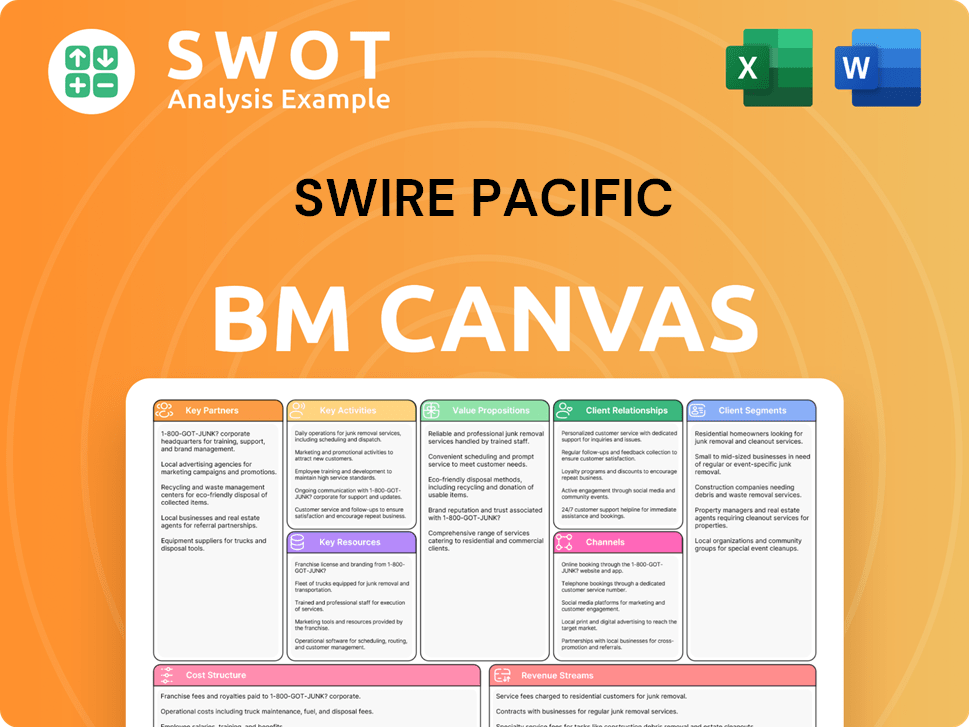

Swire Pacific Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Swire Pacific Positioning Itself for Continued Success?

Understanding the industry position, risks, and future outlook for Swire Pacific is crucial for investors. The company, a diversified conglomerate, holds a significant market presence in Greater China and Southeast Asia. Its operations span property, beverages, and aviation, making it a key player in multiple sectors.

However, Swire Pacific faces various challenges, including economic uncertainties and regulatory changes. Despite these hurdles, the company is strategically positioned to capitalize on growth opportunities and maintain its long-term value.

Swire Pacific's diversified portfolio includes market-leading businesses. Swire Properties is one of Hong Kong's largest commercial landlords. Swire Coca-Cola is a major bottler for The Coca-Cola Company. The Cathay Group, including Cathay Pacific, is a key player in aviation. The company has a strong foothold in its core markets. Brief History of Swire Pacific can give you a better understanding of its background.

The company faces risks from economic uncertainty and changing consumer behavior. Retail and office markets in Hong Kong are challenging. Retail sales in Swire Properties' Hong Kong malls decreased in 2024. The Beverages division saw a profit decrease in 2024. Regulatory changes and new competitors also pose ongoing risks.

Swire Pacific is focused on executing its recent investments across core markets. Swire Properties plans to continue its HK$100 billion investment plan. Swire Coca-Cola is expanding its green, intelligent plants. The Cathay Group is investing over HK$100 billion. Sustainability through the SwireTHRIVE strategy is central to its future growth.

Cathay Pacific's passenger flights recovered to approximately 80% of pre-pandemic levels by Q2 2024. The Mall at Pacific Place saw an 11% decrease in retail sales. Swire Pacific is committed to achieving net-zero carbon emissions by 2050. The company aims for sustainable growth in shareholder value and ordinary dividends.

Swire Pacific's investment strategy emphasizes long-term value creation and sustainable growth. The company is focused on expanding its presence in key markets. The investment plan includes strategic projects in property, beverages, and aviation.

- Property: Focus on completing new projects in mainland China, such as Taikoo Li Xi'an and Taikoo Li Sanya, and expanding in the Greater Bay Area.

- Beverages: Expansion of green, intelligent, and diversified plants.

- Aviation: Investment in the Three-Runway System at Hong Kong International Airport.

- Sustainability: Commitment to net-zero carbon emissions by 2050 and increasing sustainable finance to 55% of total financing.

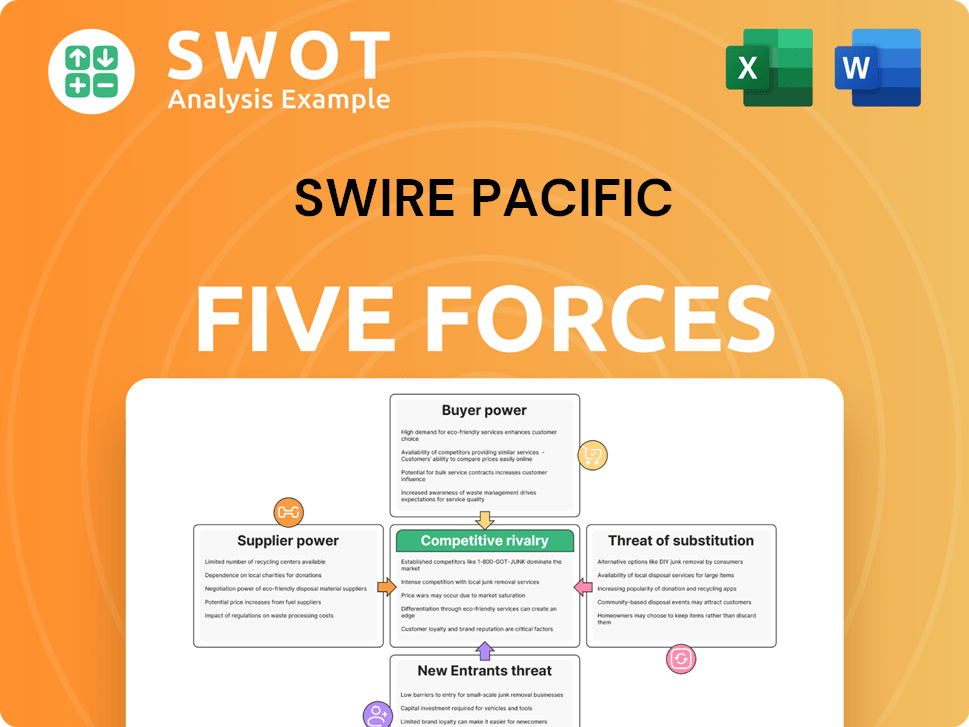

Swire Pacific Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Swire Pacific Company?

- What is Competitive Landscape of Swire Pacific Company?

- What is Growth Strategy and Future Prospects of Swire Pacific Company?

- What is Sales and Marketing Strategy of Swire Pacific Company?

- What is Brief History of Swire Pacific Company?

- Who Owns Swire Pacific Company?

- What is Customer Demographics and Target Market of Swire Pacific Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.