Synsam Bundle

How Does Synsam Navigate the Optical Retail Battlefield?

The optical retail industry is undergoing a seismic shift, with digital disruption and evolving consumer demands reshaping the landscape. Synsam Group, a major player in the Nordic region, has risen to prominence. This report explores Synsam's journey from its Swedish roots to its current position as a leading optical retailer.

This analysis will dissect the Synsam SWOT Analysis, its competitors, and its strategic moves in the dynamic eyewear market. We'll conduct a thorough Synsam market analysis, identifying its key rivals and evaluating its competitive advantages within the optical retail industry. Understanding Synsam's business strategy is crucial for grasping its future potential and its position in the competitive Nordic market.

Where Does Synsam’ Stand in the Current Market?

The company, a prominent player in the optical retail industry, holds a strong market position within the Nordic region. Its operations encompass a wide range of eyewear products and optometry services, catering to a diverse customer base. The company's strategic focus includes both affordability and premium offerings, supported by a robust digital transformation strategy.

As of 2023, the company reported net sales of SEK 5,479 million, showcasing consistent revenue growth. The company's adjusted EBITA also increased to SEK 1,073 million in 2023, reflecting strong operational efficiency. Its business model is further enhanced by its subscription service, 'Synsam Lifestyle,' which had approximately 508,000 subscribers as of 2023, contributing to recurring revenue and customer engagement.

The company's extensive network of stores, with 545 locations as of December 31, 2023, primarily in Sweden, Norway, Denmark, and Finland, underpins its market leadership. This widespread presence allows it to effectively serve customers across the Nordic region, solidifying its competitive edge. The company's strategic store locations and operational efficiency contribute to its strong market position.

The company offers a comprehensive range of eyewear, including prescription glasses, sunglasses, and contact lenses, alongside optometry services. This broad portfolio caters to various customer needs, from basic eye care to fashion-forward eyewear. The subscription service, 'Synsam Lifestyle,' enhances customer engagement and provides flexible eyewear options.

The company's financial health is demonstrated by its increasing net sales and EBITA, generally exceeding industry averages. This strong financial performance solidifies its dominant role in the Nordic optical retail landscape. The company's ability to maintain profitability and growth indicates effective business strategies and operational excellence.

The company has strategically positioned itself to emphasize both affordability and premium offerings, alongside a robust digital transformation. This approach allows it to capture a wider customer base and adapt to changing market demands. Investments in digital platforms enhance online sales and customer engagement, complementing its physical store network.

While specific market share figures for 2024-2025 are not yet fully available, the company’s consistent revenue growth and expanding store count suggest a sustained strong or growing market share in its core Nordic markets. For more insights into the target demographic, you can explore the Target Market of Synsam. The company's focus on innovation, customer engagement, and strategic partnerships further strengthens its competitive position within the optical retail industry.

The company's strengths include its extensive store network, strong financial performance, and innovative subscription model. These factors contribute to its competitive advantages in the eyewear market. The company's ability to adapt to market changes and leverage digital platforms further enhances its position.

- Extensive store network across the Nordics.

- Strong financial performance with increasing net sales and EBITA.

- Innovative 'Synsam Lifestyle' subscription service.

- Strategic focus on both affordability and premium offerings.

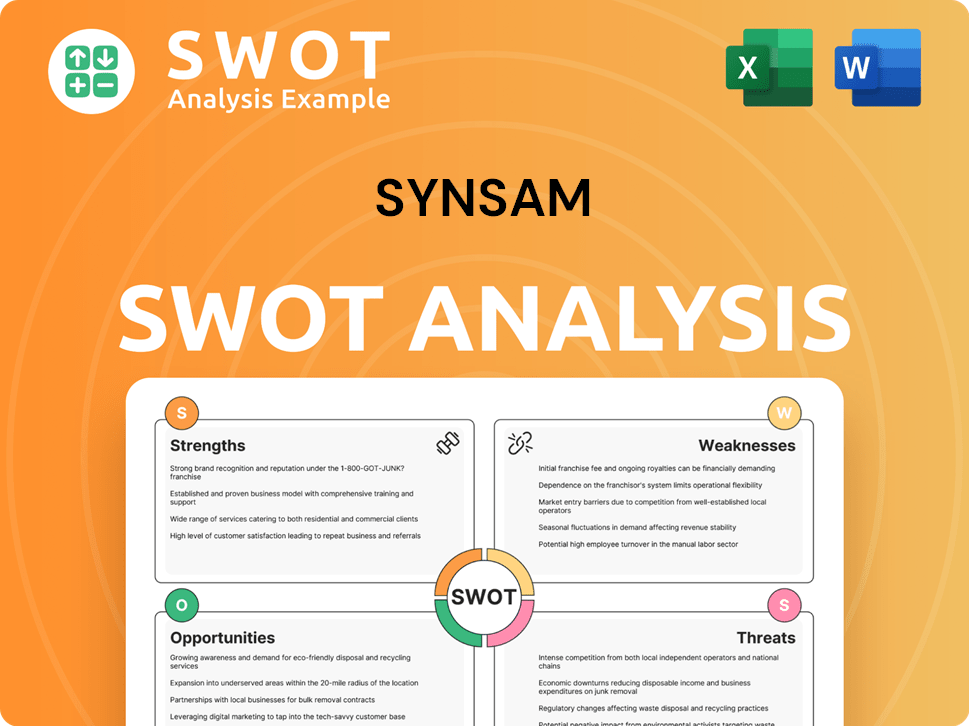

Synsam SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Synsam?

In the dynamic optical retail industry, understanding the Synsam competitive landscape is crucial for strategic decision-making. The company faces competition from both established chains and emerging online retailers, necessitating a keen awareness of market dynamics and competitor strategies. A thorough Synsam market analysis reveals a complex environment where pricing, customer experience, and technological innovation play pivotal roles.

Synsam's business strategy must adapt to the evolving demands of the eyewear market share. The company's ability to maintain and grow its market position depends on its capacity to differentiate itself, innovate, and respond effectively to competitive pressures. This analysis aims to provide a detailed overview of Synsam competitors and the strategies they employ.

The optical retail industry in the Nordics is highly competitive, with Synsam's main rivals in Scandinavia including major players like Specsavers and GrandVision. These competitors utilize various strategies to gain market share, such as competitive pricing, extensive store networks, and strong brand recognition. Understanding these strategies is vital for evaluating Synsam's financial performance compared to competitors.

Specsavers is a significant international competitor, known for its aggressive pricing strategies. They often leverage their global purchasing power to offer affordable eyewear and optometry services. Their wide accessibility through numerous locations makes them a strong contender in the market.

GrandVision, operating various brands like Synoptik in the Nordics, focuses on brand recognition and customer loyalty. They offer a broad selection of products and services, often emphasizing convenience and a comprehensive product portfolio. Their extensive store network contributes to their market presence.

Specsavers' competitive pricing and widespread accessibility challenge Synsam. GrandVision focuses on maintaining strong brand recognition and customer loyalty. These strategies often manifest in promotional campaigns and expansions into new geographical areas or customer segments.

Online-only eyewear providers like Zenni Optical and Warby Parker indirectly compete with Synsam. These companies often challenge traditional retailers with lower overheads and direct-to-consumer models. Their virtual try-on technologies also impact consumer expectations.

Mergers and acquisitions, such as EssilorLuxottica's acquisition of GrandVision, reshape the competitive landscape. These consolidations create stronger, more integrated competitors with enhanced supply chain efficiencies and broader brand portfolios. This can significantly impact Synsam's expansion plans and competitive positioning.

The expansion of online eyewear retailers has led to increased competition in the digital space. Traditional players like Synsam are pushed to enhance their e-commerce platforms and subscription services. This shift necessitates continuous adaptation to stay competitive.

To further understand Synsam's strengths and weaknesses analysis, considering the competitive advantages and disadvantages is essential. For instance, the ability to offer premium services and a wide product range can be a significant advantage. However, the higher price points might be a disadvantage compared to budget-focused competitors. The company's response to market changes, including technological advancements and changing consumer preferences, will also shape its future. Read more about the Growth Strategy of Synsam by clicking here.

Competitive advantages of Synsam may include a strong brand reputation, premium product offerings, and a well-established retail network. However, Synsam's market share in Sweden and other Nordic countries could be affected by its pricing strategy. Understanding Synsam's customer acquisition strategies and Synsam's pricing strategy compared to rivals is crucial for assessing its market position.

- Premium Products and Services: Offering high-quality eyewear and comprehensive eye care services can attract customers willing to pay a premium.

- Strong Brand Reputation: A well-established brand can build customer loyalty and trust, which is essential in the eyewear market.

- Extensive Retail Network: A broad network of physical stores provides convenience and accessibility, allowing customers to try products and receive personalized service.

- Higher Price Points: Compared to budget competitors, Synsam's higher prices might deter price-sensitive consumers.

- Online vs. Offline Presence: Balancing a strong online presence with physical stores is essential to cater to diverse consumer preferences.

- Partnerships and Collaborations: Forming partnerships with other brands or healthcare providers can enhance market reach and provide additional value to customers.

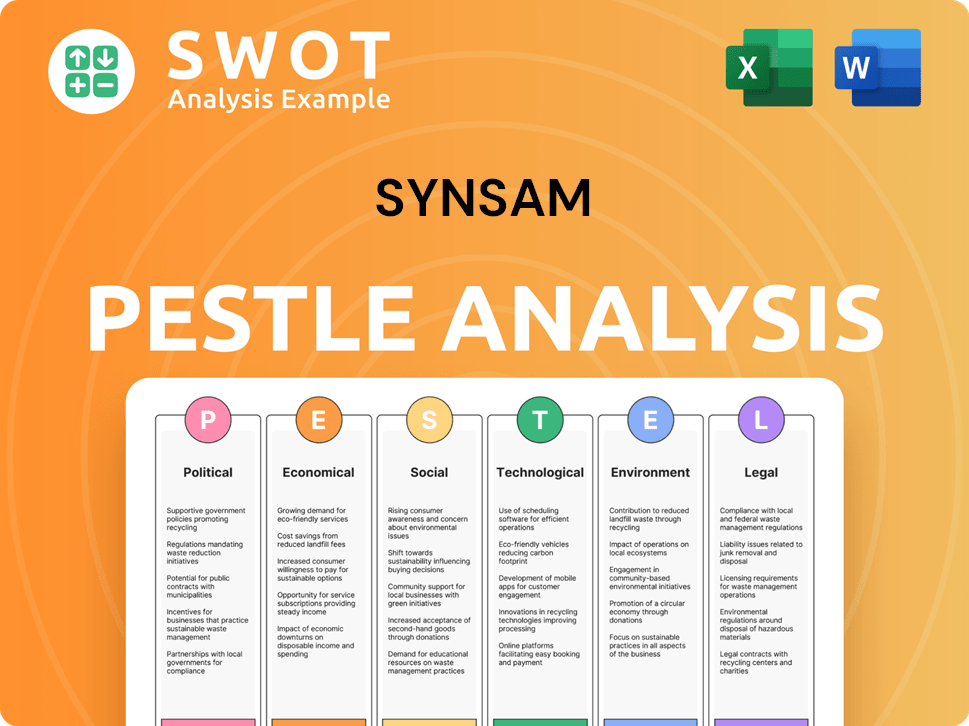

Synsam PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Synsam a Competitive Edge Over Its Rivals?

Understanding the Brief History of Synsam is crucial to analyzing its competitive advantages. The company has carved a strong position in the optical retail industry within the Nordic region. Synsam's strategic moves and market positioning have been key to its success, allowing it to maintain a competitive edge against rivals.

Synsam's competitive landscape is shaped by its ability to adapt and innovate. Its focus on customer service, combined with a strong retail presence and subscription model, sets it apart. This approach has allowed it to capture a significant share of the eyewear market and build brand loyalty.

Synsam's business strategy emphasizes a blend of physical and digital channels. This integrated approach enhances customer convenience and broadens its reach. The company's commitment to sustainability and in-house design further differentiate it, contributing to its sustained market leadership.

Synsam's widespread physical presence is a significant advantage. As of December 31, 2023, the company operated 545 stores across the Nordics. This extensive network ensures high accessibility and allows for personalized customer service, including eye examinations and fitting services.

The 'Synsam Lifestyle' subscription service is a key differentiator. In 2023, the company had approximately 508,000 subscribers. This model fosters strong customer loyalty and provides a stable, recurring revenue stream, setting it apart from competitors relying on one-off sales.

Synsam's commitment to sustainability enhances its brand equity. The 'Synsam Recycling' program and use of recycled materials in new products contribute to a positive brand image. This focus attracts environmentally conscious consumers, differentiating Synsam in the market.

Synsam has invested in digital transformation to offer a seamless omni-channel experience. This includes online booking, virtual try-on tools, and e-commerce capabilities. These enhancements increase customer convenience and broaden its reach in the competitive eyewear market.

Synsam's strengths in the Synsam competitive landscape include its extensive retail network, innovative subscription model, and commitment to sustainability. These factors contribute to its strong Synsam market analysis and help it stand out against its Synsam competitors.

- Extensive retail network with 545 stores as of December 2023.

- Subscription service ('Synsam Lifestyle') with approximately 508,000 subscribers in 2023.

- Commitment to sustainability through recycling programs and use of recycled materials.

- Integrated omni-channel experience with online and offline retail presence.

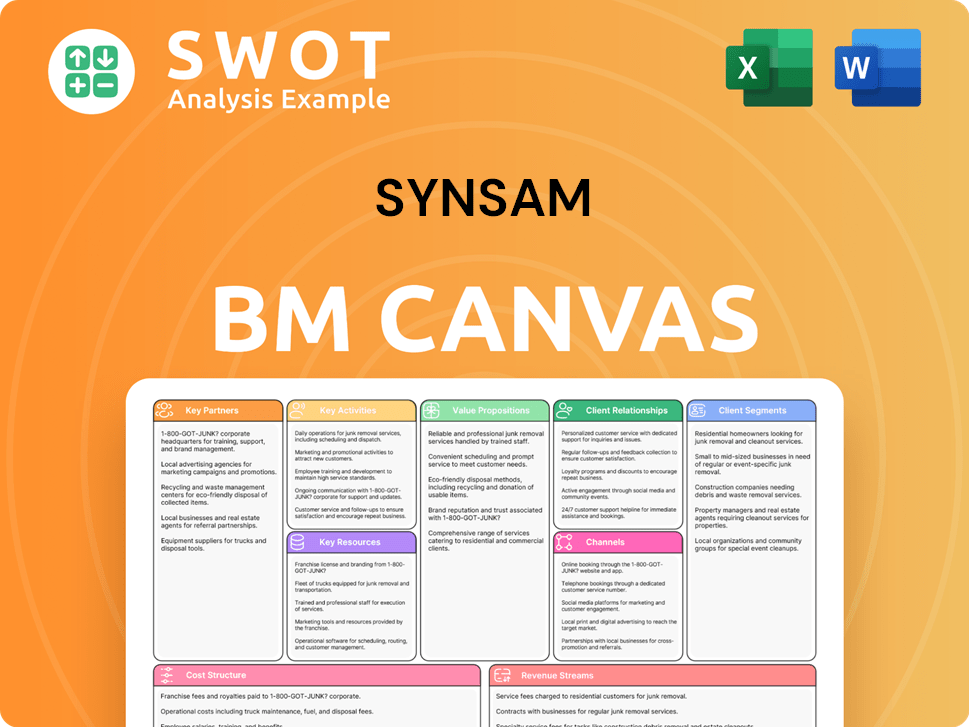

Synsam Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Synsam’s Competitive Landscape?

The optical retail industry is currently experiencing significant shifts driven by technological advancements, evolving consumer preferences, and a growing emphasis on sustainability. These trends are reshaping the Synsam competitive landscape, presenting both challenges and opportunities for the company. Understanding these dynamics is crucial for assessing Synsam's market analysis and its ability to maintain and grow its position in the eyewear market share.

Synsam's business strategy is heavily influenced by these industry trends, requiring continuous adaptation and innovation. The company faces intensifying competition from online retailers and direct-to-consumer brands while needing to invest in technology and digital infrastructure. Economic fluctuations and changes in consumer spending also pose potential risks. However, the increasing focus on eye health, demand for sustainable products, and the potential of its subscription model offer avenues for growth.

Technological advancements are transforming the industry, with innovations like AI-powered virtual try-ons and personalized lens solutions. Consumer preferences are shifting toward convenience, personalized experiences, and subscription models. Sustainability is becoming increasingly important, with consumers seeking ethically produced products.

Intensifying competition from online retailers and direct-to-consumer brands, potentially eroding market share. Continuous investment in technology and digital infrastructure to keep pace with innovations. Potential economic downturns or changes in disposable income affecting consumer spending on eyewear.

Increasing awareness of eye health among aging populations in the Nordics, creating a growing market for optometry services. Capitalizing on its physical presence and professional expertise to offer comprehensive eye care. Rising demand for sustainable products aligns with existing recycling and circular economy initiatives.

Evolving towards an integrated omni-channel model, leveraging physical stores for personalized service and eye health examinations. Enhancing digital platforms for convenience and broader reach. Strategic investments in technology, sustainable practices, and subscription services to reinforce its market leadership.

Synsam's focus on an omni-channel approach, integrating physical stores with digital platforms, is crucial for maintaining a competitive edge. Expanding the subscription model and offering personalized services are key strategies. Investments in sustainability and circular economy initiatives are also important for attracting environmentally conscious consumers.

- Enhancing digital platforms for online sales and customer service.

- Expanding the subscription model to attract new customer segments.

- Investing in sustainable practices to meet consumer demand.

- Focusing on personalized services to differentiate from competitors.

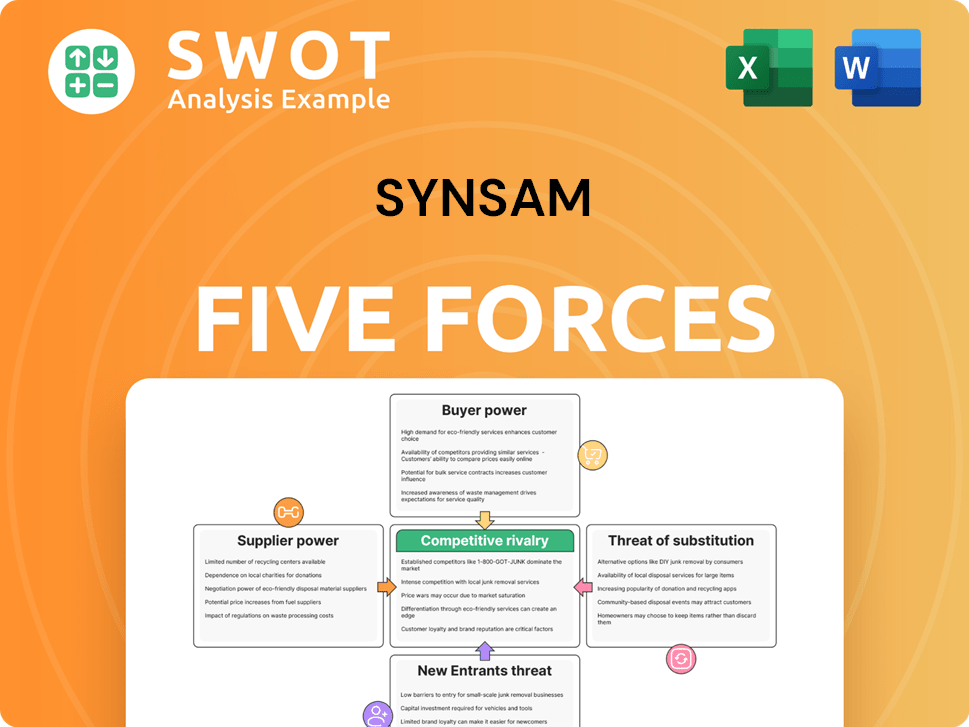

Synsam Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Synsam Company?

- What is Growth Strategy and Future Prospects of Synsam Company?

- How Does Synsam Company Work?

- What is Sales and Marketing Strategy of Synsam Company?

- What is Brief History of Synsam Company?

- Who Owns Synsam Company?

- What is Customer Demographics and Target Market of Synsam Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.