TDIndustries, Inc. Bundle

How Does TDIndustries Stack Up Against the Competition?

For over 78 years, TDIndustries has been a leading force in mechanical construction and facility services. From its humble beginnings in Dallas, Texas, to its current status as a top-performing contractor, the company's journey is a testament to strategic adaptation and innovation. But how does TDIndustries maintain its edge in a fiercely competitive market?

This exploration of the TDIndustries, Inc. SWOT Analysis delves into the heart of its competitive environment. We'll dissect the TDIndustries competitive landscape, identifying key TDIndustries competitors and analyzing their strategies. This deep dive will provide a crucial TDIndustries market analysis, revealing the factors that shape its TDIndustries industry and the TDIndustries services it provides, ultimately impacting its TDIndustries revenue and future prospects.

Where Does TDIndustries, Inc.’ Stand in the Current Market?

TDIndustries holds a strong market position in the mechanical construction and facility services sector, particularly in the Southwest United States. The company provides a comprehensive suite of services, including engineering, mechanical construction, and facilities management. This positions them as a key player in the industry, offering end-to-end solutions for various building needs.

The company's operations span across key states like Texas, Arizona, and Colorado, with a focus on providing services throughout the entire lifecycle of a building. This includes HVAC, plumbing, and electrical services. Their ability to offer a wide range of services contributes to their strong market presence and competitive advantage.

TDIndustries is recognized as one of the top specialty companies in the U.S., and among the top three in Texas. Their geographic market presence is concentrated in the Southwest, covering major cities in Texas, Arizona, and Colorado. This regional focus allows for a strong understanding of local market dynamics and customer needs.

In 2024, TDIndustries reported an estimated annual revenue of $583.0 million, with some sources indicating revenue as high as $1.2 billion. The company's revenue per employee was approximately $364,375 in 2024. This financial performance reflects their strong position in the market and efficient operations.

TDIndustries offers a comprehensive range of services, including mechanical construction, prefabrication, HVAC, plumbing, and electrical services. They also provide facilities management, including building automation and controls with their BrightBlue® Analytics. This broad service portfolio allows them to serve a diverse customer base.

TDIndustries serves a wide array of customer segments, including aviation, commercial buildings, data centers, education, and healthcare. Their ability to cater to diverse sectors highlights their adaptability and market reach. This diversification helps mitigate risks associated with market fluctuations.

TDIndustries' ability to compete effectively is evident in its recent successes, such as securing a $150 million contract in 2024, despite increased competition in the mechanical contracting market. The company's focus on specialized services and complex mechanical systems contributes to a 15% increase in repeat business in 2023. Their 100% employee-owned model fosters a culture of accountability and investment in project success.

- Employee Ownership: The employee-owned model promotes a strong sense of ownership and dedication.

- Specialized Services: Focus on complex mechanical systems provides a competitive edge.

- Repeat Business: High rate of repeat business indicates customer satisfaction and loyalty.

- Market Resilience: Demonstrated ability to survive and thrive through economic downturns.

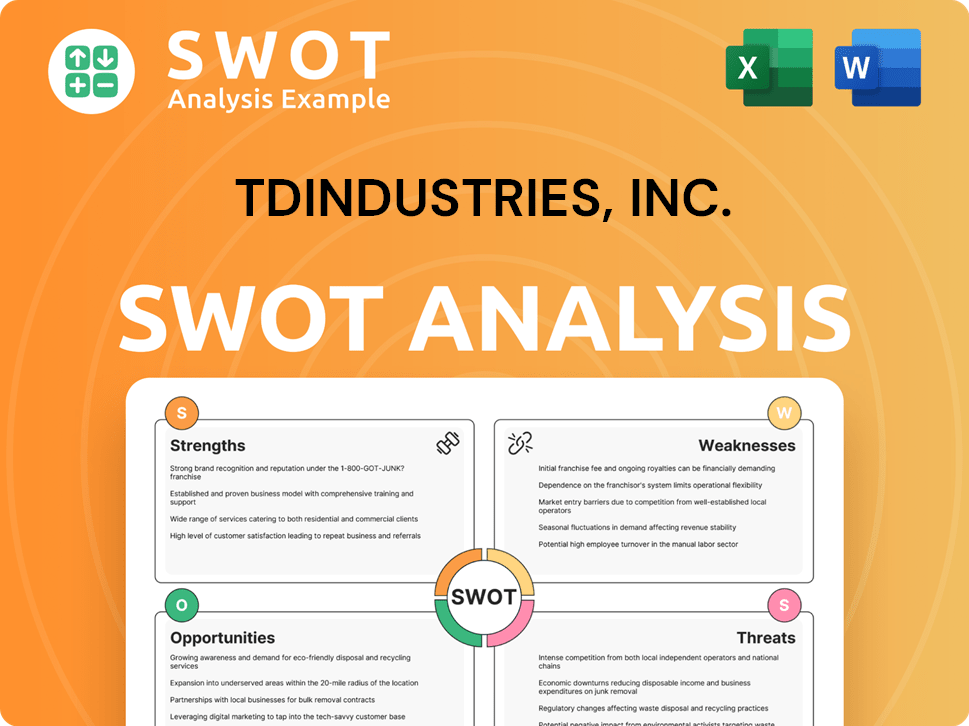

TDIndustries, Inc. SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging TDIndustries, Inc.?

The Owners & Shareholders of TDIndustries, Inc. faces a dynamic competitive landscape. The construction and facility services sector is highly competitive, with numerous players vying for market share. Understanding the key competitors is crucial for strategic decision-making and market analysis.

TDIndustries' competitive position is influenced by various factors, including the size and scope of its rivals, the services offered, and the geographic markets served. The company's ability to differentiate itself through service quality, safety, and innovation is key to maintaining a strong market presence. Analyzing the strategies and strengths of its competitors provides insights into potential challenges and opportunities.

The mechanical contracting market saw increased competition in 2024, which can lead to price wars and reduced profit margins. The availability of alternative mechanical service solutions, such as modular construction and prefabricated MEP systems, also presents a substitution threat, with the prefab market showing growth in 2024.

Direct competitors offer similar services within the construction and facility services sector. These companies directly compete for the same projects and clients as TDIndustries. Evaluating these competitors is critical for understanding the TDIndustries competitive landscape.

Indirect competitors offer alternative solutions or services that can satisfy the same customer needs. These companies may not directly compete in all areas but can still impact TDIndustries' market share. Understanding these TDIndustries competitors helps in a comprehensive TDIndustries market analysis.

Key players in the industry include Comfort Systems USA, EMCOR, and ARS/Rescue Rooter. These companies have significant market presence and resources. They represent the primary competition for TDIndustries in the construction and facility services sector.

Specific to mechanical services, U.S. Engineering, Fluidics, Inc., and POLK Mechanical are identified as primary rivals. These companies focus on mechanical systems, HVAC, plumbing, and electrical services. They directly compete with TDIndustries' mechanical services offerings.

In the Texas market, TDIndustries faces competition from Letsos, EcoLab, Trane, Brandt (Dallas), DSI, and Neva Corporation. These companies have a strong presence in the Texas region. They compete with TDIndustries for projects and clients in the state.

Other notable competitors include W.E. O'Neil Construction, Faith Technologies, ACCO Engineered Systems, SpawGlass, Hill & Wilkinson General Contractors, Balfour Beatty US, Intertech Mechanical Services, and Robins & Morton. These companies represent a broad range of competition within the TDIndustries industry.

The competitive landscape is dynamic, with factors such as pricing, service quality, and innovation influencing market share. Customers gain bargaining power when they have the capacity to handle mechanical, plumbing, electrical, or facility management tasks internally, with internal maintenance teams saving companies an average of 15% on service costs compared to outsourcing in 2024. TDIndustries' ability to win work based on merit is supported by its commitment to safety, quality, and talent management, including inclusion, diversity, and merit, through programs like ABC's STEP Safety Management System and Accredited Quality Contractor (AQC) credential.

- Price Competition: Increased competition in the mechanical contracting market can lead to price wars.

- Service Alternatives: The availability of modular construction and prefabricated MEP systems presents a substitution threat.

- Customer Bargaining Power: Customers can opt for internal maintenance teams, saving costs.

- Differentiation: TDIndustries' recognition for excellence, such as the 2024 ABC National Safety Excellence Award, helps it stand out.

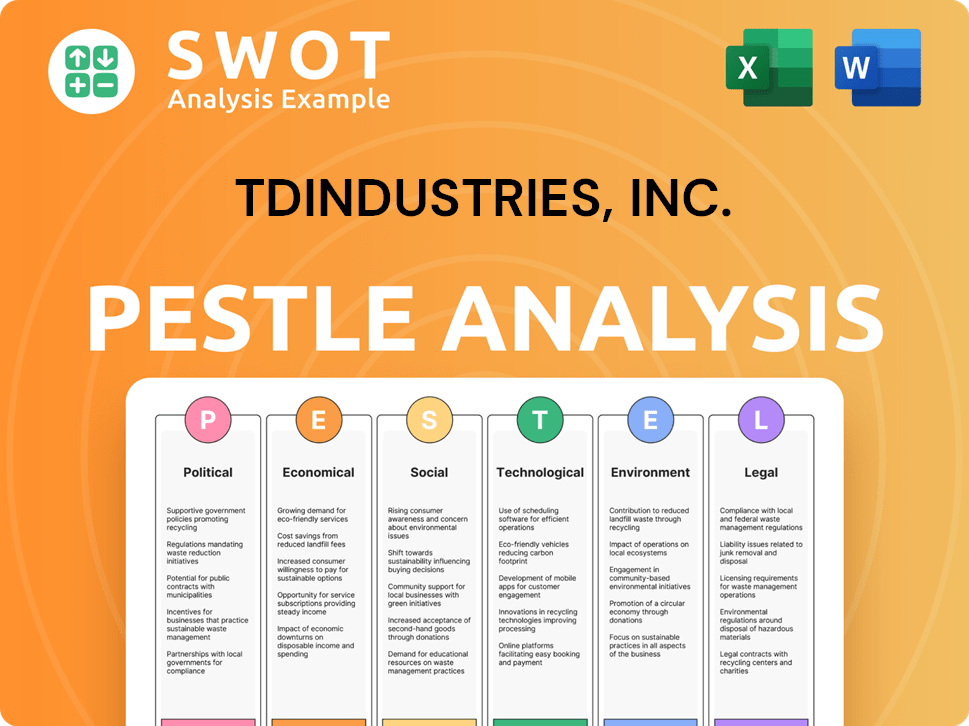

TDIndustries, Inc. PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives TDIndustries, Inc. a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of TDIndustries involves recognizing its unique strengths and strategies. The company's approach focuses on delivering value through a combination of employee ownership, comprehensive in-house capabilities, and a strong commitment to safety and quality. This positions it favorably within the mechanical construction, engineering, and facilities services industry. A deeper dive into its history and evolution can be found in this Brief History of TDIndustries, Inc.

TDIndustries' competitive advantages are multifaceted, allowing it to compete effectively in a market that demands both technical expertise and operational excellence. These advantages not only differentiate the company from its competitors but also contribute to its sustained success and ability to secure repeat business. By focusing on these key areas, the company has built a robust foundation for future growth and market leadership.

The company's employee-owned model is a key differentiator. This structure fosters a culture of accountability and commitment, contributing to industry-leading employee tenure. CEO Frank Musolino highlighted the importance of the team's dedication in the 2025 letter, emphasizing how investing in their growth strengthens the company. This ownership model directly impacts project success and overall company performance.

TDIndustries' 100% employee-owned model fosters a culture of accountability and commitment. This structure contributes to industry-leading employee tenure and a focus on quality and safety. The dedication of its people drives exceptional service and strengthens the company.

Comprehensive in-house capabilities enable self-performed construction, installation, and service across various systems. This includes mechanical construction, HVAC, plumbing, and electrical services. Operating the largest pipe fabrication facility in Texas reduces reliance on subcontractors.

A strong reputation for safety and quality allows the company to compete on value rather than price. The '2025 Vision: Zero Harm' initiative focuses on reducing serious injuries. In 2024, the company achieved Diamond Status in ABC's STEP Safety Management System.

TDIndustries leverages technology to enhance its services. The company utilizes AI to improve safety processes and focuses on innovations like direct liquid cooling solutions for data centers. These advancements demonstrate a forward-thinking approach.

TDIndustries' competitive advantages include its employee-owned structure, comprehensive in-house capabilities, and strong focus on safety and quality. These factors allow the company to differentiate itself in the market and deliver superior value to its clients. The company's commitment to innovation and technological advancements further strengthens its position.

- Employee Ownership: Fosters a culture of accountability and commitment, leading to industry-leading employee tenure.

- In-House Capabilities: Reduces reliance on subcontractors, potentially leading to cost savings and increased value for clients.

- Safety and Quality: A strong reputation for safety and quality allows the company to compete on value rather than price.

- Technological Adoption: Utilizing AI to enhance safety processes and focusing on innovations.

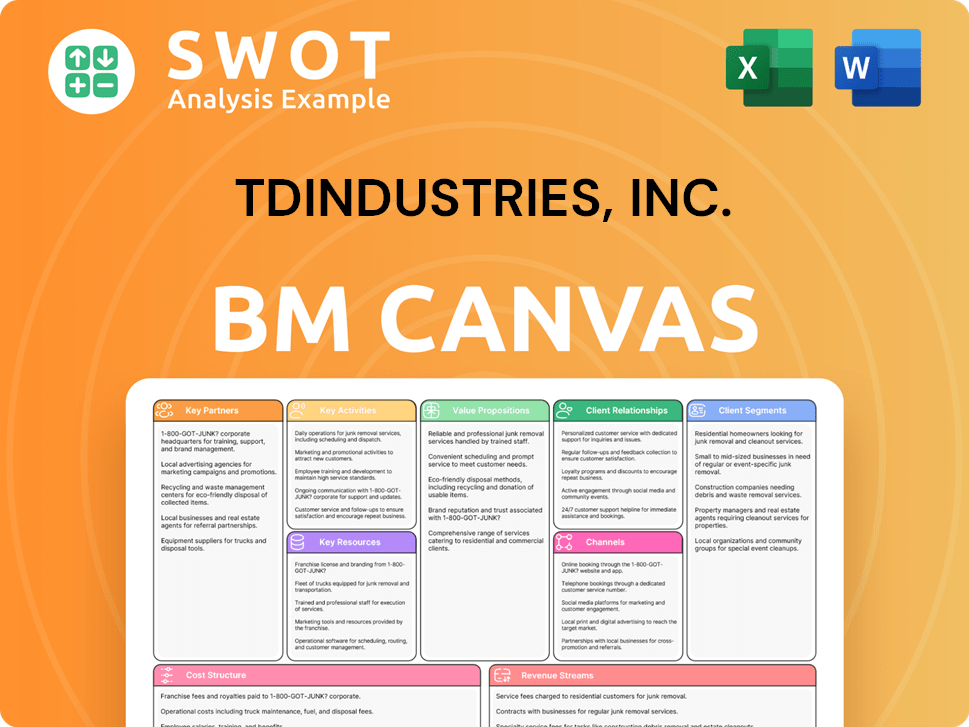

TDIndustries, Inc. Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping TDIndustries, Inc.’s Competitive Landscape?

The mechanical construction and facility services sector is currently experiencing rapid transformation, creating both challenges and opportunities for companies like TDIndustries. Technological advancements, sustainability demands, and workforce dynamics are significantly influencing the sector's trajectory. Understanding these trends is crucial for a comprehensive TDIndustries competitive landscape analysis and for making informed investment decisions.

The industry faces pressures from labor shortages and evolving regulatory standards, but also benefits from the growth in data center construction and the focus on energy-efficient solutions. TDIndustries' strategic investments in technology, workforce development, and specialized services position it to navigate these complexities and capitalize on emerging market opportunities, as detailed in a recent Target Market of TDIndustries, Inc. article.

Technological advancements such as Building Information Modeling (BIM), digital twins, robotics, and automation are reshaping the industry. Energy-efficient solutions and sustainable practices are also becoming increasingly important, especially for sectors like data centers. These trends require companies to adapt and invest in new technologies and strategies.

A critical shortage of skilled labor presents a major challenge. The construction industry faces an estimated shortage of approximately 500,000 workers in 2024. Regulatory changes and increasing demand for specialized services also require companies to adapt their offerings. These challenges can increase startup costs and project delays.

The rapid expansion of data center construction, driven by AI demand, presents a significant opportunity. The global data center market was valued at approximately $242 billion in 2024. Regulatory changes, particularly energy codes, drive demand for new HVAC and plumbing solutions.

TDIndustries leverages its established workforce, extensive training programs, and partnerships with educational institutions to address labor shortages. The company is expanding its process piping capabilities to meet the demand for high-purity prefabrication services. TDIndustries differentiates its services through specialized expertise and innovation, such as BrightBlue® Analytics.

To succeed, TDIndustries must focus on several key areas. These include technological investments, workforce development, and adapting specialized services to meet the demands of high-growth sectors like data centers and advanced manufacturing. The company’s employee-ownership culture is also a critical factor in its resilience and competitive advantage.

- Investing in advanced technologies like VDC and AI.

- Expanding process piping capabilities for data centers and related markets.

- Leveraging its employee-ownership model for workforce retention and engagement.

- Focusing on sustainability and energy-efficient solutions.

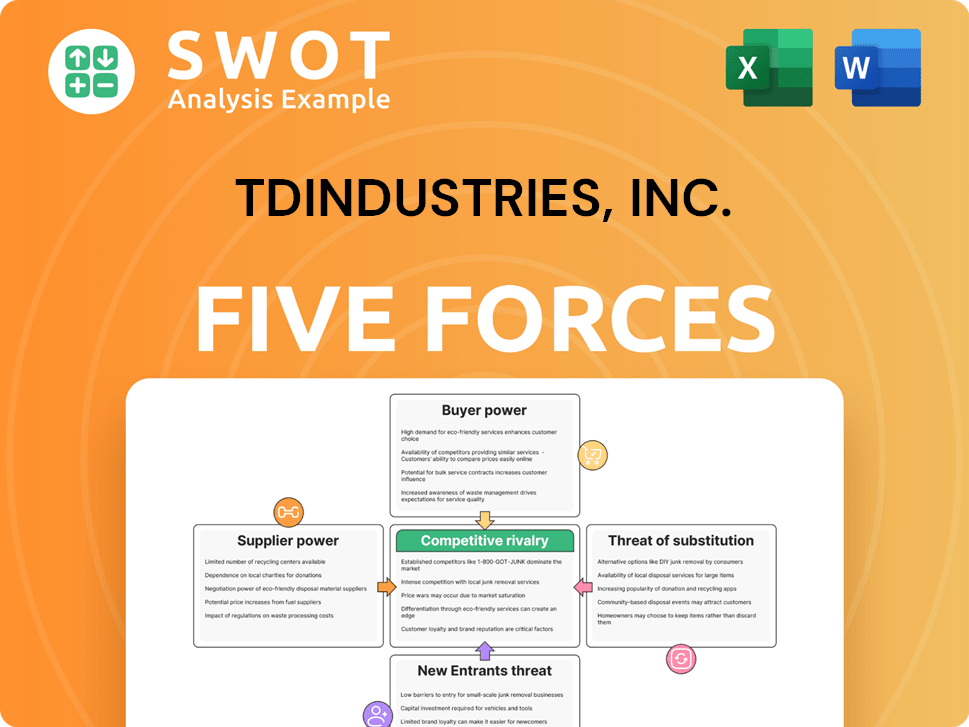

TDIndustries, Inc. Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of TDIndustries, Inc. Company?

- What is Growth Strategy and Future Prospects of TDIndustries, Inc. Company?

- How Does TDIndustries, Inc. Company Work?

- What is Sales and Marketing Strategy of TDIndustries, Inc. Company?

- What is Brief History of TDIndustries, Inc. Company?

- Who Owns TDIndustries, Inc. Company?

- What is Customer Demographics and Target Market of TDIndustries, Inc. Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.