TDIndustries, Inc. Bundle

Can TDIndustries Continue Its Ascent in the Construction and Facilities Services Industry?

TDIndustries, Inc., a leader in mechanical construction and facility management since 1946, has consistently demonstrated the power of a well-defined growth strategy. From its roots in Dallas, Texas, the company has built a reputation for exceptional service and a people-first approach. Today, we explore the TDIndustries, Inc. SWOT Analysis to understand its current standing and future trajectory.

This deep dive into TDIndustries' business model will examine its market position, financial performance, and strategic initiatives for 2024 and beyond. We'll analyze the company's competitive advantages, including its employee-ownership model, and explore its expansion plans and strategies within the HVAC and plumbing services markets. Furthermore, we'll assess the company's long-term investment potential considering its sustainability initiatives and innovation in energy solutions offerings.

How Is TDIndustries, Inc. Expanding Its Reach?

TDIndustries is actively pursuing several expansion initiatives to broaden its market reach and enhance its service offerings. A key element of their TDIndustries growth strategy involves geographical expansion, particularly within the Southwest and Southeast United States. This strategic focus aims to capitalize on the rising demand for mechanical construction and facility management services in these high-growth regions.

This expansion includes strengthening its presence in established markets such as Houston, Dallas-Fort Worth, Austin, San Antonio, Phoenix, and Denver. Simultaneously, the company is exploring new metropolitan areas with significant commercial and industrial development. Securing large-scale projects often drives this expansion, allowing them to establish a strong foothold and build local teams. This approach is crucial for sustained TDIndustries future prospects.

Beyond geographical expansion, TDIndustries company analysis reveals a focus on diversifying its service portfolio. This includes enhancing capabilities in specialized areas such as energy efficiency solutions, smart building technologies, and sustainable construction practices. These initiatives align with growing industry trends and client demands for environmentally conscious and technologically advanced facilities.

Focusing on high-growth regions like the Southwest and Southeast US. This includes strengthening presence in existing markets and exploring new metropolitan areas.

Enhancing capabilities in energy efficiency, smart building technologies, and sustainable construction. This diversification aligns with industry trends and client demands.

Considering strategic partnerships and potential acquisitions to quickly gain market share or access niche technologies. This approach supports rapid growth and market penetration.

Adapting to evolving market conditions and client needs. This includes staying competitive and resilient in a dynamic industry environment.

TDIndustries' TDIndustries expansion plans and strategies include both geographical and service diversification. This dual approach is designed to enhance market share and adapt to changing industry demands. They are also exploring strategic partnerships and acquisitions to accelerate growth.

- Geographical expansion into high-growth areas in the Southwest and Southeast.

- Diversification into energy efficiency and smart building technologies.

- Strategic partnerships and potential acquisitions for market share growth.

- Focus on TDIndustries HVAC services market and TDIndustries plumbing services outlook.

The company aims to leverage its expertise in these areas to attract new clients and deepen relationships with existing ones. Furthermore, strategic partnerships and potential acquisitions of smaller, specialized firms are considered to quickly gain market share or access niche technologies. As of early 2025, specific recent examples were not publicly detailed. These initiatives are designed to ensure TDIndustries remains competitive and resilient in an evolving market, consistently seeking opportunities to expand its customer base and revenue streams. For more insights into their competitive landscape, consider reading about the Competitors Landscape of TDIndustries, Inc.

TDIndustries, Inc. SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does TDIndustries, Inc. Invest in Innovation?

TDIndustries recognizes that innovation and technology are crucial for its sustained growth and operational efficiency. The company actively invests in research and development to explore new methodologies and technologies within mechanical construction and facility management. This strategic focus allows the company to enhance its service offerings and maintain a competitive edge in the market.

The integration of advanced technologies is a key component of TDIndustries' approach. This includes the adoption of Building Information Modeling (BIM) for precise project planning and execution, and the use of prefabrication techniques to speed up construction and reduce on-site labor. These technological advancements contribute to higher-quality outcomes and faster project delivery, which directly supports the company's growth objectives by increasing capacity and client satisfaction. For a deeper dive into the company's financial structure, consider exploring Revenue Streams & Business Model of TDIndustries, Inc.

The company's commitment to digital transformation extends to facility management, where it employs building automation systems and data analytics to optimize building performance. This includes reducing energy consumption and providing predictive maintenance services. These value-added services position TDIndustries as a comprehensive solutions provider, meeting the evolving needs of its clients.

BIM adoption allows for more precise project planning and execution. This technology helps in visualizing projects before construction, reducing errors and improving efficiency. The use of BIM is a key component of TDIndustries growth strategy.

Prefabrication improves construction speed and lowers on-site labor needs. This approach allows for the creation of components off-site, which are then assembled on location. This contributes to faster project delivery and cost savings.

These systems optimize building performance and reduce energy consumption. They provide real-time data and control over various building systems, leading to improved efficiency. This is a key aspect of TDIndustries' energy solutions offerings.

Data analytics provides predictive maintenance services. By analyzing data from building systems, potential issues can be identified and addressed before they become major problems. This enhances customer satisfaction metrics.

TDIndustries incorporates energy-efficient designs and renewable energy solutions. This commitment to sustainability addresses the increasing demand for green building practices. This supports their long-term investment potential.

The company continuously integrates cutting-edge tools and processes. This dedication to innovation underscores their commitment to staying ahead in the industry. This contributes to their competitive advantages.

TDIndustries' innovation strategy focuses on integrating advanced technologies and sustainable practices to enhance operational efficiency and customer satisfaction. This approach supports their market position and drives revenue growth drivers.

- Building Information Modeling (BIM): Used for precise project planning and execution, reducing errors and improving efficiency.

- Prefabrication: Improves construction speed and reduces on-site labor needs, leading to faster project delivery.

- Building Automation Systems: Optimize building performance, reduce energy consumption, and provide predictive maintenance services.

- Data Analytics: Used for predictive maintenance, identifying and addressing potential issues before they become major problems.

- Sustainable Initiatives: Incorporating energy-efficient designs and renewable energy solutions to meet the growing demand for green building practices.

TDIndustries, Inc. PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is TDIndustries, Inc.’s Growth Forecast?

While specific financial details for TDIndustries, Inc. are not publicly available due to its private status, the company's financial outlook appears stable and promising, given its position in the mechanical construction and facility management sectors. The firm operates primarily in growing markets such as Texas, Arizona, and Colorado, which supports its TDIndustries growth strategy. These regions have demonstrated consistent commercial and industrial development, creating a favorable environment for the company's services.

The company's TDIndustries business model, emphasizing long-term client relationships and recurring service contracts, contributes to a stable revenue base. This stability is crucial in mitigating the risks associated with fluctuations in the construction industry. The focus on facility management provides a dependable income stream that complements project-based mechanical construction work. This diversified approach helps in maintaining consistent financial performance.

TDIndustries' reputation for quality and its employee-owned structure likely contribute to operational efficiencies and a dedicated workforce. These factors positively impact profit margins and support the company's competitive advantages. The company's commitment to its employees and its focus on customer satisfaction are key elements of its operational strategy, which enhances its market position and supports its long-term investment potential.

The primary drivers of revenue growth include expansion in existing markets and strategic diversification into new service areas. The company's HVAC services market and plumbing services outlook are particularly strong in the regions where it operates. These services are essential for both new construction and ongoing facility management, ensuring a consistent demand for the company's offerings.

TDIndustries maintains a strong market position in the mechanical construction and facility management sectors within its key operating areas. Its presence in Texas, Arizona, and Colorado allows it to capitalize on the robust construction and infrastructure development in these states. This strategic geographic focus enhances its ability to secure and execute projects efficiently.

TDIndustries expansion plans and strategies likely involve organic growth through increased market penetration and potential acquisitions to broaden its service offerings and geographic reach. Strategic initiatives may include investments in technology and innovation to improve operational efficiency and enhance customer service. The company's focus on sustainability initiatives could also drive growth.

Key competitive advantages include its employee-owned structure, which fosters a dedicated workforce, and its strong reputation for quality and customer service. The company's ability to maintain long-term client relationships and offer comprehensive services, including energy solutions offerings, further strengthens its market position. These advantages contribute to higher customer satisfaction metrics.

TDIndustries strategic initiatives 2024 likely encompass investments in technology, such as Building Information Modeling (BIM) and other digital tools, to improve project management and efficiency. These initiatives also include strengthening employee retention strategies through competitive benefits and professional development programs. The company's focus on innovation and technology supports its long-term growth objectives.

While specific financial data is not public, the company's performance is expected to be stable, driven by its diversified revenue streams and strong market position. The focus on recurring service contracts and long-term client relationships provides a solid foundation for consistent financial results. The company's employee-owned structure also contributes to operational efficiency.

TDIndustries significantly impacts the construction industry by providing essential mechanical and facility management services. Its projects contribute to the development of commercial and industrial infrastructure, supporting economic growth in its operating regions. The company's commitment to quality and sustainability sets a standard for other firms.

Details regarding TDIndustries recent acquisitions and mergers are not publicly available. However, any such activities would likely be aimed at expanding its service offerings, geographic footprint, or technological capabilities. These strategic moves would support its long-term growth objectives and enhance its market share.

The company's sustainability initiatives may include the adoption of energy-efficient technologies and practices in its projects and operations. This commitment to sustainability aligns with the growing demand for green building solutions and enhances its competitive advantage. These efforts are part of its broader strategy.

The long-term investment potential of TDIndustries is supported by its stable financial outlook, strong market position, and strategic initiatives. Its focus on customer satisfaction and employee retention strategies contributes to sustained growth. The company's ability to adapt to market changes and embrace innovation further enhances its investment potential.

The TDIndustries future prospects are positive, driven by its strategic positioning in growing markets and its diversified service offerings. The company is well-positioned to capitalize on the continued demand for mechanical construction and facility management services. Its commitment to innovation and customer satisfaction supports its long-term growth.

- Continued expansion in key markets.

- Strategic investments in technology and innovation.

- Focus on sustainability and energy-efficient solutions.

- Strengthening of employee retention and development programs.

TDIndustries, Inc. Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow TDIndustries, Inc.’s Growth?

The growth strategy and future prospects of TDIndustries are subject to various risks and obstacles. These challenges span market competition, regulatory changes, supply chain vulnerabilities, and technological disruptions. Understanding these potential pitfalls is crucial for a comprehensive TDIndustries company analysis.

Market dynamics, including the emergence of new competitors and the strategies of established players, could intensify pricing pressures. Additionally, adapting to evolving building codes, environmental standards, and labor laws presents ongoing operational complexities. The company's ability to navigate these hurdles will significantly influence its financial performance and long-term investment potential.

Supply chain issues, fluctuating material costs, and the availability of skilled labor pose inherent operational risks. External factors such as economic downturns can exacerbate these challenges, potentially leading to project delays and cost overruns. To mitigate these risks, TDIndustries has likely implemented robust project management and procurement strategies.

The construction and facility management sectors are highly competitive, with numerous firms vying for projects. This can lead to pricing pressures, potentially impacting profit margins. Continuous differentiation through service quality and innovation is crucial for maintaining a strong market position.

Changes in building codes, environmental standards, and labor laws can introduce complexities and increase operational costs. Stricter energy efficiency mandates, for example, may require significant adjustments to current practices and investments in new technologies. Staying compliant is essential for long-term sustainability.

Fluctuations in material costs and the availability of skilled labor present ongoing operational risks. Global events or economic downturns can exacerbate these issues, potentially leading to project delays and cost overruns. Effective supply chain management is key to mitigating these risks.

Technological advancements, while offering opportunities, also pose risks if the company fails to adapt quickly. Competitors gaining a technological advantage could erode market share. Investing in innovation and technology is vital for sustained growth. TDIndustries's strategic initiatives 2024 should address this.

Economic downturns can significantly impact the construction industry, leading to reduced project demand and financial instability. Companies need to be prepared for economic fluctuations. Diversification of services and markets can help to mitigate these risks.

The construction industry often faces skilled labor shortages, which can lead to project delays and increased labor costs. Employee retention strategies and training programs are crucial for addressing this challenge. The outlook for plumbing services and HVAC services market depends on skilled labor availability.

To overcome these obstacles, TDIndustries likely employs several strategies, including service and market diversification, continuous investment in employee training, and proactive engagement with industry trends and regulatory changes. Their established reputation and strong client relationships also provide a buffer. For more information on TDIndustries' core values, refer to Mission, Vision & Core Values of TDIndustries, Inc.

TDIndustries' long-standing presence and established reputation provide a significant competitive advantage. Strong client relationships and a history of successful projects build trust and facilitate repeat business. These factors contribute to the company's ability to navigate market challenges effectively. TDIndustries' market share in Texas is also strengthened by these advantages.

Diversifying services and markets helps reduce dependence on any single project type or geographic area. Investing in employee training and development ensures a skilled workforce. Proactive engagement with industry trends and regulatory changes allows for timely adaptation. These strategies are crucial for TDIndustries' business model.

Fluctuations in material costs and labor expenses can impact project profitability. Economic downturns can decrease demand, affecting revenue growth drivers. Managing cash flow and maintaining financial flexibility are essential for weathering economic cycles. TDIndustries' financial performance is closely tied to these factors.

Failing to adopt new technologies can put TDIndustries at a disadvantage. Investing in digital tools and innovative solutions is crucial for maintaining a competitive edge. Continuous improvement in processes and embracing technological advancements are key. TDIndustries' expansion plans and strategies should incorporate these aspects.

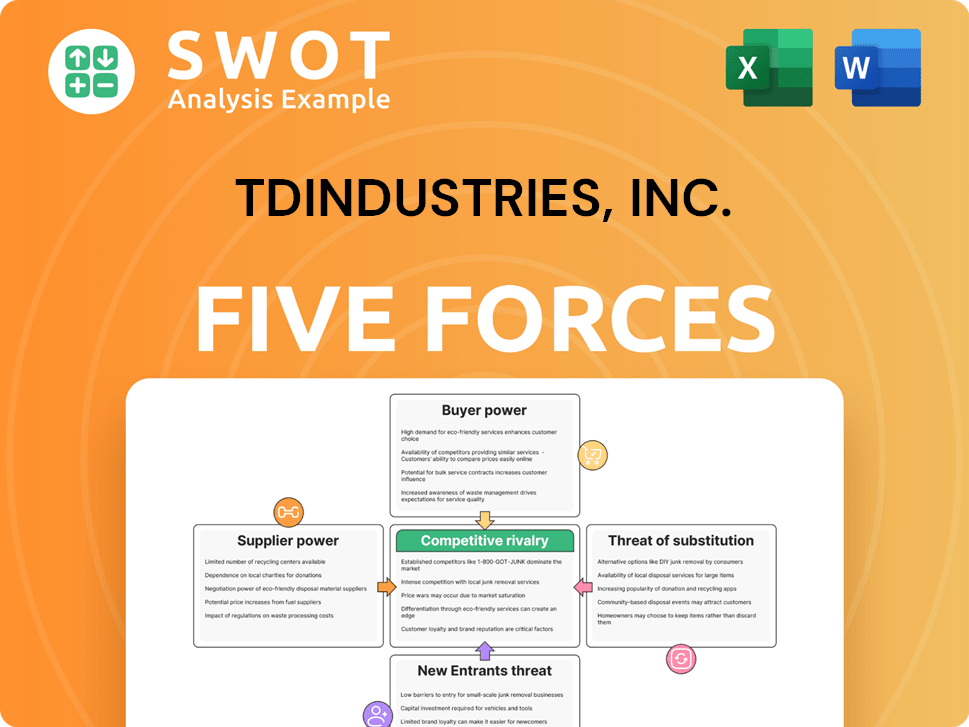

TDIndustries, Inc. Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of TDIndustries, Inc. Company?

- What is Competitive Landscape of TDIndustries, Inc. Company?

- How Does TDIndustries, Inc. Company Work?

- What is Sales and Marketing Strategy of TDIndustries, Inc. Company?

- What is Brief History of TDIndustries, Inc. Company?

- Who Owns TDIndustries, Inc. Company?

- What is Customer Demographics and Target Market of TDIndustries, Inc. Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.