Teleflex Bundle

How Does Teleflex Navigate the Fierce Medical Device Arena?

In the ever-evolving world of medical technology, Teleflex Company is a major player, constantly innovating to improve patient care. A recent strategic move, potentially a key acquisition or product launch in early 2025, highlights its ambition to lead the market and enhance healthcare outcomes globally. This aggressive approach sets the stage for a deep dive into its competitive environment.

This analysis provides a comprehensive Teleflex SWOT Analysis, examining the company's standing within the Teleflex competitive landscape. We'll explore its key competitors, dissect its competitive advantages and disadvantages, and conduct a thorough Teleflex market analysis to understand its financial performance and business strategy. This examination will also cover Teleflex industry trends and future market trends, providing insights into its growth strategies and initiatives.

Where Does Teleflex’ Stand in the Current Market?

Teleflex holds a strong market position within the medical technology industry, especially in specialized areas like vascular access, interventional cardiology, and surgical solutions. The company is a leading provider in the vascular access market, offering a broad range of catheters and related devices. Its primary product lines include a wide array of medical devices for hospitals and healthcare providers, serving critical care, surgical, and interventional specialties. This strong foundation is crucial for understanding the Teleflex competitive landscape.

Geographically, Teleflex has a significant presence across North America, Europe, Asia, and other international markets. It maintains a robust distribution network that reaches various customer segments, including large hospital systems and individual clinics. Over time, Teleflex has strategically shifted its positioning, emphasizing high-value, clinically differentiated solutions rather than competing solely on price. This move into premium markets has been supported by continuous innovation and the development of advanced technologies. For a deeper dive into the company's mission, consider reading about the Growth Strategy of Teleflex.

Financially, Teleflex demonstrates strong performance relative to industry averages. Reported revenues for fiscal year 2023 reached approximately $2.9 billion, and analysts project continued growth into 2024 and 2025. This financial health supports sustained investment in research and development and strategic acquisitions. Teleflex's strong position in North America and Europe provides a competitive edge, while emerging markets offer further expansion opportunities. This positions Teleflex well for future market trends.

Teleflex consistently ranks among the top-tier providers in its key segments. While specific market share figures for 2024-2025 are subject to ongoing market dynamics, the company maintains a leading position in vascular access and other critical areas. This strong market share is a key indicator of its competitive positioning in medical devices.

Teleflex offers a comprehensive portfolio of medical devices, including catheters, surgical solutions, and interventional cardiology products. The company focuses on high-value, clinically differentiated solutions, which supports its premium market positioning. This focus on innovation helps Teleflex maintain a competitive advantage.

Teleflex has a significant global presence, with a strong distribution network across North America, Europe, and Asia. Its ability to reach diverse customer segments, from large hospital systems to individual clinics, enhances its market reach. The company's global market presence is a key factor in its success.

Teleflex reported revenues of approximately $2.9 billion in fiscal year 2023, with analysts projecting continued growth into 2024 and 2025. This strong financial performance supports ongoing investment in research and development and strategic acquisitions. The company's financial health is a key aspect of its business strategy.

Teleflex's competitive advantages include its strong brand reputation, extensive product portfolio, and global distribution network. The company's focus on innovation and high-value solutions also contributes to its success. However, regulatory challenges and the competitive nature of the medical device industry present ongoing challenges. Understanding these factors is crucial for a Teleflex market analysis.

- Strong Brand Reputation: Established presence and trust in the medical technology industry.

- Extensive Product Portfolio: A wide range of medical devices catering to various specialties.

- Global Distribution Network: Reach across North America, Europe, Asia, and other international markets.

- Regulatory Challenges: Compliance with evolving regulations in the medical device sector.

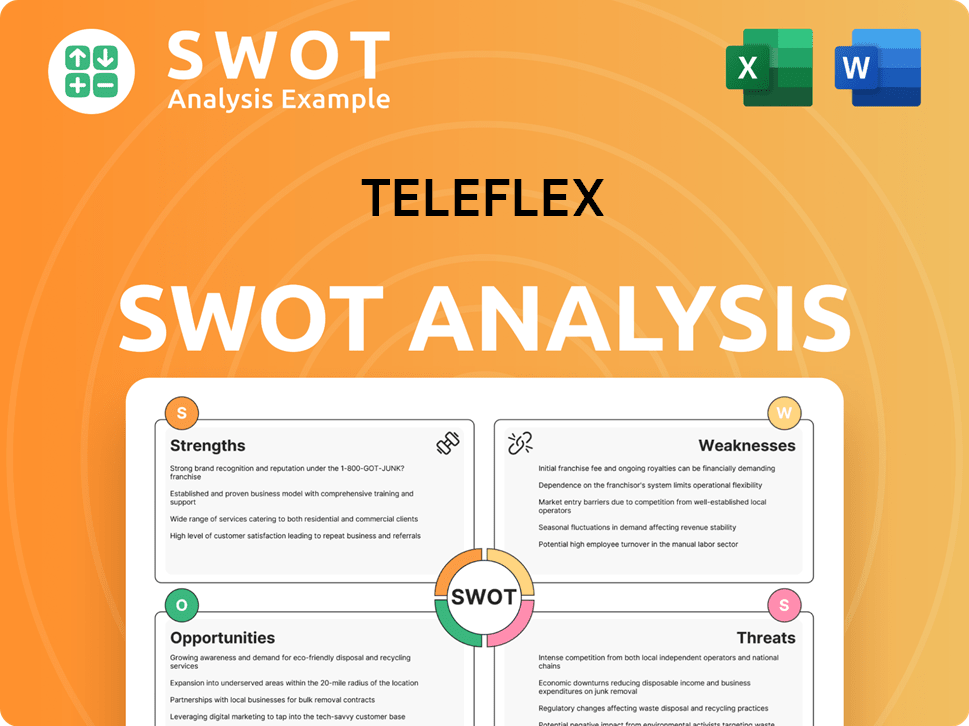

Teleflex SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Teleflex?

The Teleflex competitive landscape is characterized by intense competition within the medical technology sector. The company faces challenges from both large, diversified medical device companies and more specialized firms. Understanding the competitive dynamics is crucial for assessing Teleflex's business strategy and financial performance.

Teleflex market analysis reveals a need to adapt to evolving market conditions, including technological advancements and regulatory changes. This competitive environment influences Teleflex's growth strategies and initiatives as it seeks to maintain and expand its market share. The company's ability to innovate and form strategic partnerships is critical for its future success.

Teleflex's success hinges on its ability to differentiate itself from its competitors. This involves a deep understanding of the Teleflex product portfolio comparison and the competitive advantages and disadvantages each product offers. The company must also navigate regulatory challenges and anticipate future market trends to remain competitive.

Teleflex competitors include large, diversified medical device companies like Becton, Dickinson and Company (BD), Medtronic, and B. Braun Melsungen AG. These companies compete directly with Teleflex across various product lines and geographic markets.

BD leverages its extensive global presence and product offerings, while Medtronic often leads in innovation, particularly in complex interventional procedures. B. Braun competes on pricing and portfolio breadth, especially in certain regions. The competition often involves tenders for large hospital contracts, focusing on product performance and cost-effectiveness.

In urology, Boston Scientific and Coloplast offer targeted solutions, while ResMed and Philips Respironics compete in respiratory care. Emerging players focused on minimally invasive techniques and digital health solutions also pose a challenge. These specialized companies often focus on specific market segments, presenting focused competition.

Mergers and alliances reshape the competitive landscape, creating larger entities that challenge established players. These consolidations can lead to increased market power and broader product portfolios. The evolving market dynamics require Teleflex to adapt and potentially consider its own strategic partnerships or acquisitions.

Teleflex's company market share analysis is influenced by the strategies of its competitors and market trends. Factors such as innovation, pricing, and distribution capabilities play a crucial role in determining market share. The company's ability to maintain and grow its market share depends on its competitive advantages.

Teleflex's competitive advantages and disadvantages are defined by its product portfolio, market presence, and operational efficiency. The company needs to leverage its strengths and address its weaknesses to maintain a competitive edge. Understanding these factors is essential for Teleflex's strategic planning.

A detailed Teleflex competitive landscape analysis requires a deep dive into each competitor's strengths, weaknesses, and strategies. This includes examining their product offerings, pricing models, and market positioning. For example, comparing Teleflex vs. Boston Scientific in the urology market reveals specific competitive dynamics. The analysis also considers the impact of Teleflex's global market presence and its ability to navigate regulatory challenges.

- Teleflex key competitors 2024 include BD, Medtronic, and B. Braun, among others.

- Teleflex faces competition in vascular access, surgical solutions, and interventional cardiology.

- Teleflex's ability to innovate and adapt to market changes is crucial for its success.

- Understanding Teleflex's competitive positioning in medical devices is essential for strategic planning.

- For further insights, see Target Market of Teleflex.

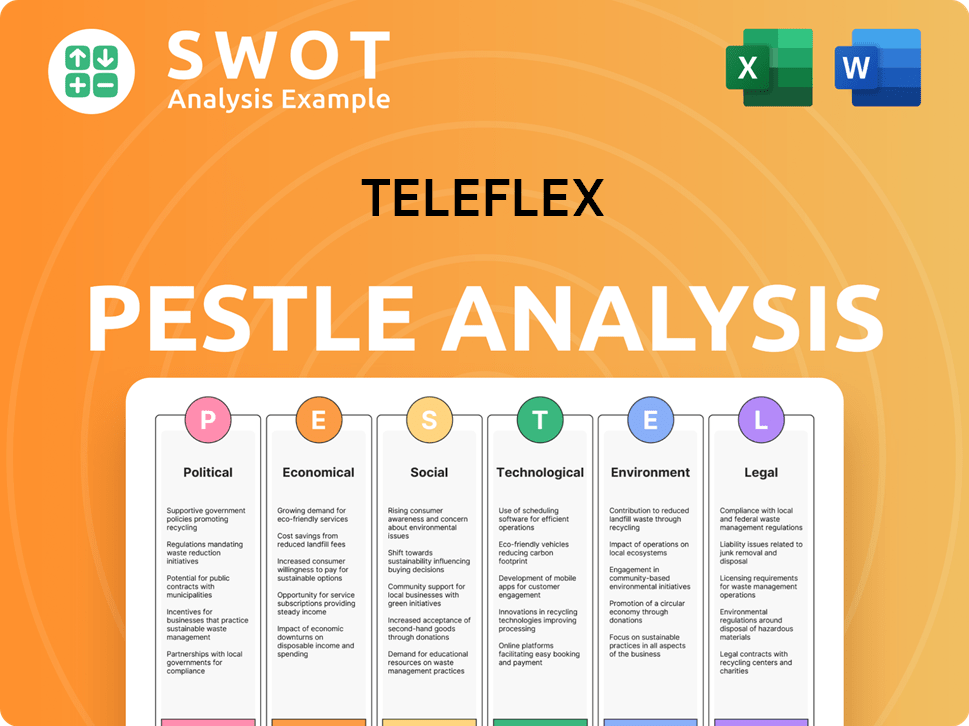

Teleflex PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Teleflex a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of a company like Teleflex requires a deep dive into its core strengths. Teleflex's competitive advantages are rooted in its proprietary technologies and robust intellectual property. The company's focus on innovation, especially in critical care areas, provides a significant differentiator in the medical device industry. This approach allows Teleflex to maintain a strong position in the market.

Teleflex's brand reputation and customer loyalty are crucial advantages. Healthcare providers often rely on established brands for critical medical devices. Teleflex's long-standing presence and track record have fostered strong relationships with clinicians and hospital systems. This loyalty is further reinforced by the company's robust distribution networks, ensuring timely delivery and comprehensive support for its products globally. Teleflex's business strategy also includes economies of scale in manufacturing and procurement, which allow it to maintain competitive pricing while investing in research and development.

These advantages have evolved over time, with Teleflex increasingly leveraging its R&D capabilities to develop next-generation devices that address evolving clinical needs and regulatory requirements. The company strategically integrates its advantages in marketing by highlighting clinical evidence and patient outcomes. For more insights into the company's structure, consider exploring the details for Owners & Shareholders of Teleflex.

Teleflex holds numerous patents related to its catheter designs, material science, and delivery systems, which act as barriers to entry for competitors. This robust IP portfolio protects its innovations and provides a competitive edge. Teleflex's focus on advanced vascular access products demonstrates its commitment to innovation. The company's commitment to R&D is evident in its consistent investment in new technologies.

Teleflex's long-standing presence in the market has built strong relationships with clinicians and hospital systems. The company's established brand is a significant advantage in the medical device industry. Teleflex's distribution networks ensure timely delivery and comprehensive support. Customer loyalty is reinforced by the reliability and clinical efficacy of its products.

Economies of scale in manufacturing and procurement allow Teleflex to maintain competitive pricing. This operational efficiency supports the company's financial performance. Teleflex's ability to manage costs effectively contributes to its overall profitability. The company's streamlined operations enhance its ability to compete in the market.

Teleflex strategically acquires complementary technologies to enhance its product offerings. These acquisitions strengthen its market position and expand its portfolio. Partnerships also play a key role in Teleflex's growth strategy. Such moves support the company's ability to compete effectively.

Teleflex mitigates threats from imitation and rapid technological advancements through continuous innovation. The company's commitment to R&D is crucial for maintaining a leading edge in product performance and safety. Teleflex's strategic acquisitions and partnerships further strengthen its competitive position.

- Continuous innovation in product development.

- Strategic acquisitions to expand the product portfolio.

- Focus on clinical evidence and patient outcomes.

- Maintaining a strong global market presence.

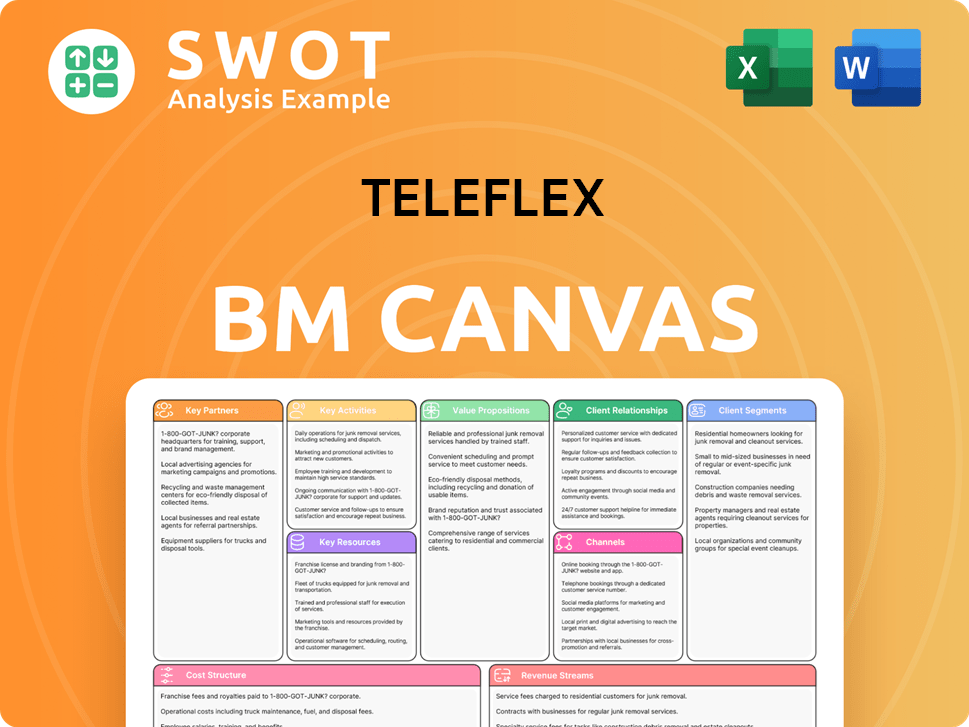

Teleflex Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Teleflex’s Competitive Landscape?

The medical technology industry is experiencing dynamic shifts, driven by technological advancements, regulatory changes, and evolving patient preferences. This environment presents both challenges and opportunities for companies like Teleflex. Understanding the Teleflex competitive landscape is crucial for navigating these complexities and formulating effective business strategies.

The competitive landscape for Teleflex is influenced by trends such as the increasing demand for minimally invasive procedures, the growth of digital health solutions, and the emphasis on value-based care. Companies must adapt to these changes to maintain their market position. The focus on cost containment and regulatory scrutiny also significantly impacts the industry, requiring companies to demonstrate the economic benefits of their products and comply with stringent regulations.

Key trends include the rising adoption of minimally invasive procedures, the integration of digital health, and the push for value-based care. These trends are reshaping how medical devices are developed, marketed, and used. The industry is also seeing increased regulatory scrutiny and a focus on cost-effectiveness.

Challenges include intense competition, rapid technological obsolescence, and the need to demonstrate product value to secure reimbursement. Companies must also navigate complex regulatory environments and adapt to evolving patient demands. The ability to innovate and secure market access will be key.

Opportunities exist in emerging markets with expanding healthcare infrastructure, product innovation, and strategic partnerships. Companies can also capitalize on the growing demand for smart medical devices and personalized healthcare solutions. Strategic acquisitions and global distribution expansion are also beneficial.

Teleflex is focusing on continuous R&D investment, strategic acquisitions, and strengthening its global distribution channels. The company aims to become a more integrated solutions provider, offering devices, data, and services to enhance clinical workflows. This approach supports its long-term growth and market position.

In 2024, the global medical devices market is estimated at over $500 billion, with significant growth expected in the coming years. Teleflex, as a key player, must navigate this landscape strategically. To understand the financial aspects, you can explore Revenue Streams & Business Model of Teleflex.

- Market Expansion: Teleflex's expansion into emerging markets, particularly in Asia-Pacific, is a key growth strategy.

- Product Innovation: Investment in R&D, especially in areas like interventional cardiology and urology, drives product portfolio enhancements.

- Strategic Partnerships: Collaborations with digital health companies can integrate data and services, improving patient outcomes.

- Competitive Positioning: The company’s focus on integrated solutions positions it well against competitors.

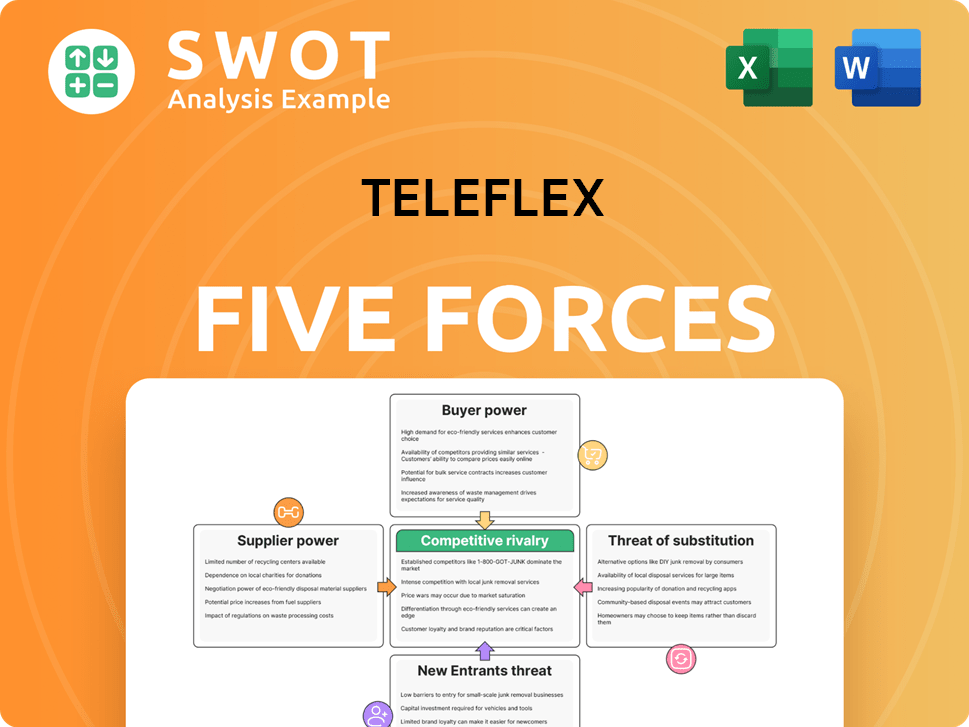

Teleflex Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Teleflex Company?

- What is Growth Strategy and Future Prospects of Teleflex Company?

- How Does Teleflex Company Work?

- What is Sales and Marketing Strategy of Teleflex Company?

- What is Brief History of Teleflex Company?

- Who Owns Teleflex Company?

- What is Customer Demographics and Target Market of Teleflex Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.