Teleflex Bundle

Can Teleflex Continue Its Growth Trajectory in the Medical Technology Sector?

Teleflex Incorporated, a global leader in medical technologies, has undergone a remarkable transformation, evolving from its industrial roots to become a focused player in the healthcare industry. Its strategic acquisition of NeoTract, Inc., and the introduction of the UroLift System, exemplify this shift, significantly impacting its market position. Founded in 1943, Teleflex's journey showcases its adaptability and commitment to innovation.

This Teleflex SWOT Analysis provides a detailed examination of Teleflex's strategic moves and future outlook. Understanding Teleflex's market position and financial performance is crucial for investors and strategists alike. We'll delve into the company's Teleflex growth strategy, exploring its Teleflex future prospects and how it plans to navigate the ever-changing competitive landscape analysis, including its Teleflex company analysis and Teleflex business model.

How Is Teleflex Expanding Its Reach?

Teleflex's growth strategy is heavily reliant on its aggressive expansion initiatives, particularly in new geographical markets and product categories. The company is actively pursuing international expansion, notably with its UroLift System, aiming to increase its presence in existing markets and penetrate underserved regions. This strategy is designed to access new patient populations and diversify revenue streams, maintaining a competitive edge in the evolving healthcare market.

A key focus of the Teleflex growth strategy is the international expansion of the UroLift System. The company is working on obtaining regulatory approvals and market access in countries across the Asia-Pacific and Latin America regions. This strategic move aims to replicate the success seen in North America and Europe. This expansion is a critical component of Teleflex's plan to broaden its market reach and drive revenue growth.

Teleflex's product pipeline includes advancements in its vascular access portfolio, with next-generation PICC (Peripherally Inserted Central Catheter) and midline catheters incorporating enhanced safety features and material innovations. The company also leverages strategic partnerships to co-develop and distribute specialized medical technologies, thereby expanding its market reach without solely relying on in-house development. These partnerships and product launches are critical milestones, with several new products anticipated to launch in late 2024 and early 2025, contributing to Teleflex's projected revenue growth.

Teleflex is prioritizing international expansion, particularly in the Asia-Pacific and Latin American regions. This includes securing regulatory approvals and establishing market access for products like the UroLift System. These efforts are designed to replicate the success seen in North America and Europe, expanding its global footprint.

The company is investing in its interventional cardiology portfolio, with plans to introduce new devices. Teleflex is also focusing on its vascular access portfolio, with next-generation PICC and midline catheters. These initiatives aim to address unmet clinical needs and diversify revenue streams.

Teleflex utilizes strategic partnerships to co-develop and distribute medical technologies. Recent collaborations focus on integrating digital health solutions with existing devices. These partnerships help to expand market reach and improve patient outcomes, streamlining clinical workflows.

Several new products are anticipated to launch in late 2024 and early 2025, contributing to Teleflex's projected revenue growth. These launches are critical milestones for the company. These new products are expected to drive significant revenue growth.

Teleflex's expansion strategy is multifaceted, focusing on geographical growth, product diversification, and strategic partnerships. These initiatives are supported by a strong pipeline of new products and collaborations, driving the company's future prospects. For more information, you can read about the Marketing Strategy of Teleflex.

- International Market Entry: Focus on Asia-Pacific and Latin America for UroLift System.

- Product Innovation: Advancements in vascular access and interventional cardiology.

- Strategic Alliances: Collaborations for digital health solutions and technology distribution.

- Revenue Projections: New product launches expected to boost revenue in 2024-2025.

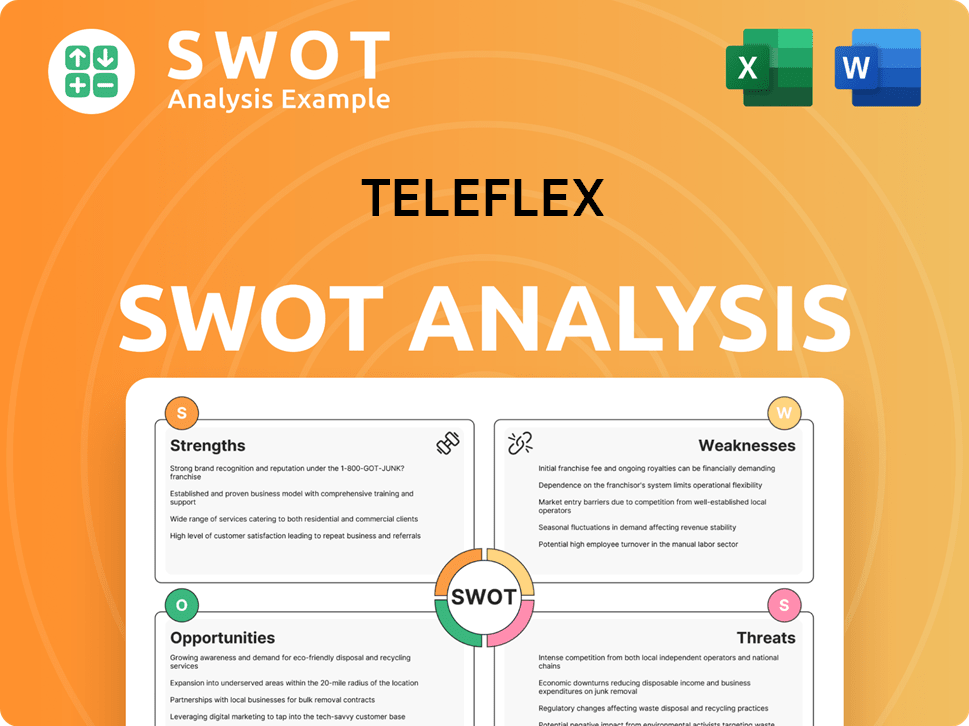

Teleflex SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Teleflex Invest in Innovation?

Teleflex's growth strategy heavily relies on innovation and technological advancements. The company consistently invests in research and development (R&D) to create new medical devices and enhance existing product lines. This commitment is crucial for maintaining a strong market position and driving future growth.

The company's approach to innovation is multifaceted, combining internal development efforts with external collaborations. These partnerships, including those with academic institutions and startups, accelerate the introduction of novel solutions to the market. This strategy allows Teleflex to stay at the forefront of medical technology.

Teleflex's focus on technological advancement includes digital transformation, particularly the integration of smart technologies into its devices. This involves exploring AI-driven analytics for patient monitoring and predictive diagnostics, as well as the application of IoT for connected healthcare solutions. These technologies aim to provide real-time data to healthcare providers, improving patient care pathways.

Teleflex allocates a significant portion of its resources to research and development. This investment is a key driver for new product development and enhancements to existing product lines, which is essential for long-term growth.

The company is actively integrating digital technologies, such as AI and IoT, into its medical devices. This enhances data collection and analysis, leading to improved patient monitoring and more effective healthcare solutions.

Teleflex focuses on automating its manufacturing processes to boost efficiency and reduce costs. This strategy contributes to higher profit margins and supports the company's overall financial performance.

The development of new product platforms, such as advanced catheter technologies, is a key area of innovation. These advancements aim to improve precision in complex medical procedures.

Teleflex maintains a robust patent portfolio to protect its proprietary technologies. This strengthens its market position and supports its competitive advantage in the medical device industry.

Teleflex actively engages in strategic partnerships to accelerate innovation. These collaborations with external innovators, including academic institutions and startups, bring new solutions to market faster.

The company's focus on automation within its manufacturing processes is designed to enhance efficiency and reduce costs. This, in turn, contributes to higher profit margins and supports the company's financial performance. New product platforms, such as advanced catheter technologies with improved navigation and sensing capabilities, are under development to address complex medical procedures with greater precision. Teleflex's commitment to innovation is further demonstrated by its robust patent portfolio, which protects its proprietary technologies and strengthens its market position. For a deeper understanding of the competitive landscape, consider exploring the Competitors Landscape of Teleflex.

Teleflex's innovation strategy encompasses several key areas of technological advancement, including digital transformation, automation, and new product development. These initiatives support the company's long-term growth and market leadership.

- AI and IoT Integration: Utilizing AI for advanced patient monitoring and applying IoT for connected healthcare solutions.

- Manufacturing Automation: Implementing automation to enhance efficiency and reduce operational costs.

- New Product Platforms: Developing advanced catheter technologies for improved precision in medical procedures.

- Patent Portfolio: Protecting proprietary technologies through a strong patent portfolio to maintain a competitive edge.

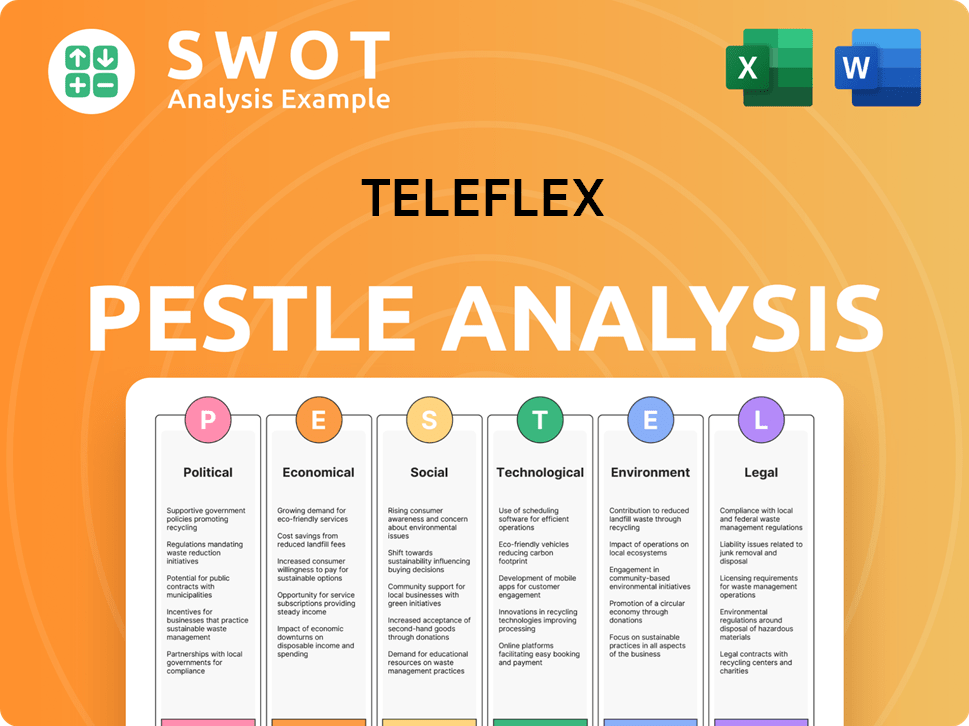

Teleflex PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Teleflex’s Growth Forecast?

The financial outlook for Teleflex is centered around achieving sustained growth, supported by ambitious revenue targets and strategic investments. The company's Teleflex growth strategy is designed to capitalize on market opportunities and enhance its competitive edge. This approach is reflected in its financial projections and strategic initiatives.

For the full year 2024, Teleflex anticipates net revenue growth in the range of 5.5% to 6.5% on a constant currency basis. This translates to projected net revenues between $3.13 billion and $3.16 billion. These figures demonstrate the company's confidence in its diverse product portfolio and ongoing market expansion efforts, which are key components of its Teleflex future prospects.

Adjusted earnings per share (EPS) for 2024 are expected to be between $13.70 and $14.00, indicating robust profitability. This financial performance is supported by consistent historical results, including a 6.7% constant currency revenue growth reported in the first quarter of 2024. These projections highlight the company's strong financial performance and its ability to generate value for shareholders.

Key revenue drivers include new product launches, expansion into emerging markets, and strategic acquisitions. These initiatives are integral to the Teleflex business model and contribute significantly to its revenue growth. The company's focus on innovation and market diversification supports its long-term growth objectives.

Teleflex is heavily investing in R&D and strategic acquisitions to foster future growth. These investments are crucial for enhancing its technological capabilities and expanding its market presence. The company's capital allocation strategy prioritizes initiatives that support long-term value creation.

Teleflex maintains a strong market position through its diverse product portfolio and global presence. The company's ability to adapt to changing market dynamics and regulatory environments is critical to its success. Its strategic focus allows it to maintain a competitive edge.

The company's financial discipline is evident in its efficient capital management and commitment to delivering shareholder value. Teleflex aims to maintain a strong balance sheet to support its growth objectives. This approach ensures financial stability and supports its long-term goals.

Teleflex's commitment to organic growth, strategic mergers and acquisitions (M&A), and efficient capital management are central to its financial strategy. The company aims to deliver long-term shareholder value through these initiatives. For more detailed insights, you can refer to a comprehensive Teleflex company analysis.

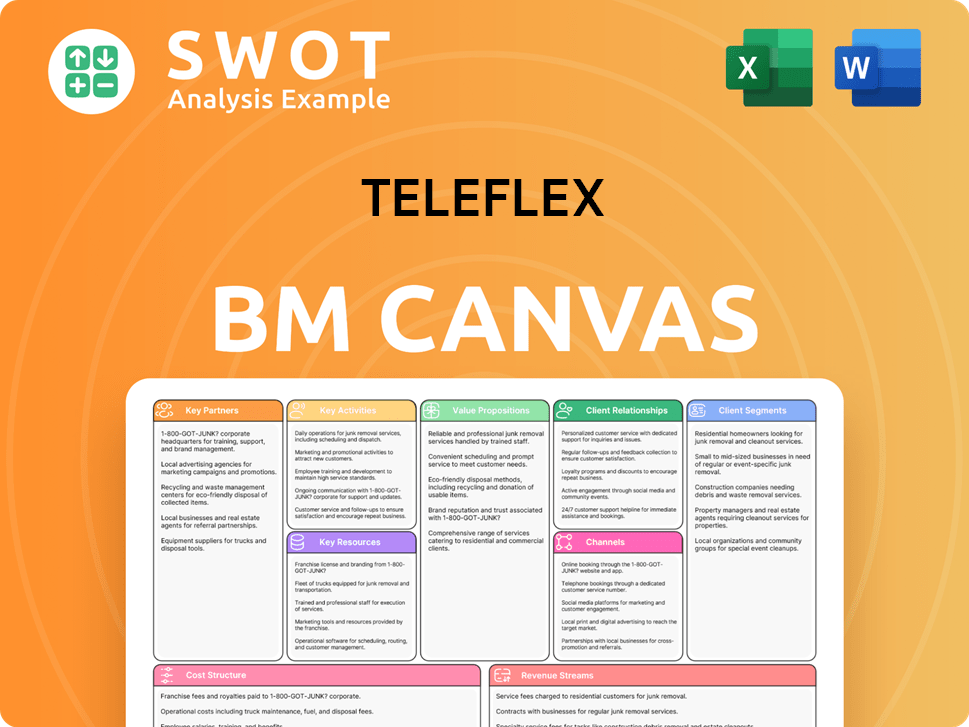

Teleflex Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Teleflex’s Growth?

Assessing the potential risks and obstacles is crucial for understanding the Teleflex growth strategy and its future prospects. Several factors could impede Teleflex's expansion, including market competition, regulatory changes, and supply chain disruptions. A comprehensive Teleflex company analysis should account for these challenges to provide a realistic outlook.

The medical technology sector is highly competitive, with established players and emerging innovators vying for market share. This intense rivalry can influence pricing, necessitate continuous innovation, and impact the company's Teleflex market position. Furthermore, the healthcare industry is subject to evolving regulations, which can increase costs and delay product launches, affecting Teleflex's financial performance.

Supply chain vulnerabilities and internal resource constraints also pose significant risks. These factors can disrupt operations and limit growth potential. A thorough understanding of these risks is essential for investors and stakeholders evaluating Teleflex's long-term growth potential and strategic initiatives.

The medical device market is highly competitive, with numerous companies vying for market share. This competition can lead to pricing pressures and the need for continuous innovation. Teleflex must invest in R&D and maintain a strong product pipeline to stay competitive.

Stricter regulations in key markets, such as the U.S. and Europe, can significantly impact product approvals and manufacturing processes. These changes can increase costs and delay product launches. Compliance with evolving regulations, particularly in areas like medical device cybersecurity, is essential.

Global events and geopolitical tensions can disrupt manufacturing and distribution, leading to product shortages. Teleflex addresses this risk through supplier diversification and robust inventory management. The COVID-19 pandemic highlighted the importance of flexible supply chain strategies.

Failing to adapt to new technologies or the emergence of superior solutions by competitors poses a risk. Teleflex invests heavily in R&D and maintains an agile innovation pipeline. Staying ahead of technological advancements is crucial for long-term success.

Talent acquisition and retention in specialized medical fields can impact growth. Management addresses these risks through comprehensive risk management frameworks and strategic investments in talent development. Securing and retaining skilled professionals is critical.

Economic downturns can affect healthcare spending and demand for medical devices. Teleflex's financial performance may be impacted by reduced capital expenditures by hospitals and clinics. Diversifying revenue streams can help mitigate these risks.

To mitigate these risks, Teleflex employs a multifaceted approach. This includes diversification of suppliers to reduce supply chain vulnerabilities and significant investments in research and development to foster innovation. Furthermore, the company focuses on strategic partnerships and collaborations to enhance its market position.

Healthcare regulations significantly influence the medical device industry. Compliance with these regulations is essential for product approvals and market access. Teleflex must navigate evolving regulatory landscapes to maintain its competitive edge and ensure patient safety. The company's ability to adapt to these changes will be a key factor in its success.

For a deeper understanding of Teleflex's business model and revenue streams, you can read this article: Revenue Streams & Business Model of Teleflex. Teleflex's strategic focus includes expanding its product portfolio, exploring global market expansion plans, and leveraging strategic partnerships. These initiatives, while promising, must be carefully managed to address the inherent risks and capitalize on the opportunities within the dynamic healthcare landscape. Analyzing the Teleflex stock forecast 2024 requires a thorough understanding of these risks and the company's mitigation strategies.

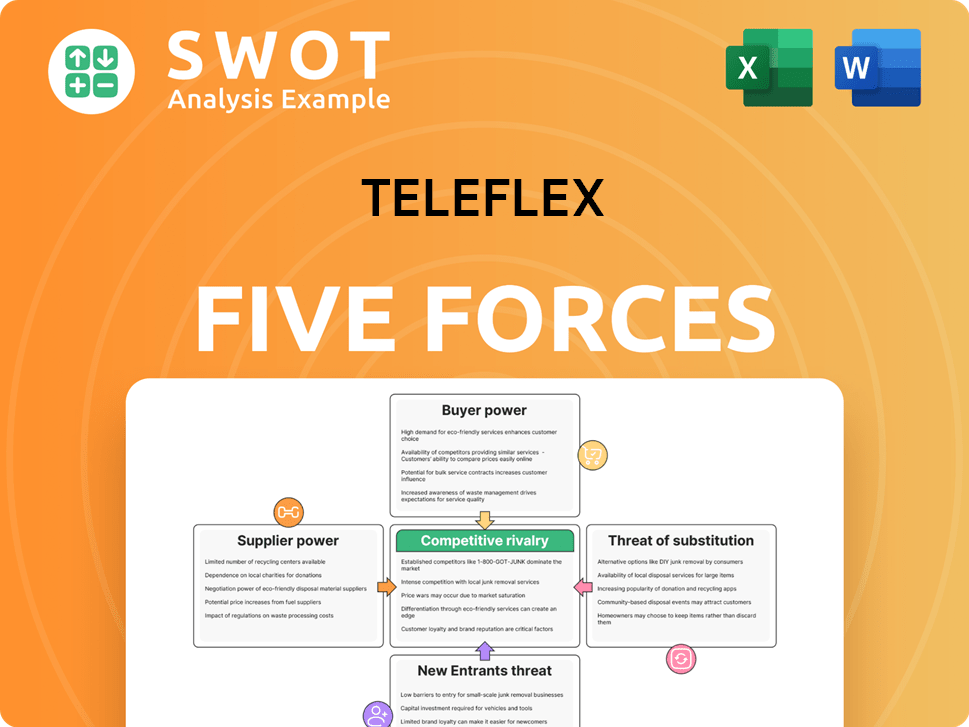

Teleflex Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Teleflex Company?

- What is Competitive Landscape of Teleflex Company?

- How Does Teleflex Company Work?

- What is Sales and Marketing Strategy of Teleflex Company?

- What is Brief History of Teleflex Company?

- Who Owns Teleflex Company?

- What is Customer Demographics and Target Market of Teleflex Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.