Telesat Bundle

How Does Telesat Stack Up in the Satellite Industry's Fierce Competition?

The satellite industry is undergoing a dramatic transformation, with companies like Telesat at the forefront of innovation. As demand for global connectivity surges, understanding the Telesat SWOT Analysis and its position within the competitive landscape is crucial for investors and strategists alike. This analysis will explore the key players, market dynamics, and strategic moves shaping Telesat's future.

This deep dive into the Telesat competitive landscape will explore Telesat's market share compared to competitors and its strategic positioning in the face of evolving technologies. We'll dissect Telesat's strengths, weaknesses, and opportunities, considering its LEO satellite constellation and GEO satellite services. Furthermore, the analysis will examine Telesat's main rivals in satellite internet, providing insights into how Telesat plans to capitalize on its competitive advantages and navigate regulatory challenges in the space-based internet market.

Where Does Telesat’ Stand in the Current Market?

The Telesat competitive landscape is primarily shaped by its position in the global satellite communications industry. Historically, the company has been a key player in the fixed satellite services (FSS) market, offering services that include broadband internet, video distribution, and data communications solutions. The company serves a diverse customer base, including governments, enterprises, and telecommunication providers.

Telesat's value proposition centers on providing reliable and extensive satellite communication services. Its geostationary (GEO) satellite fleet offers broad coverage across the Americas, Europe, and parts of Asia and Africa. With the shift towards its Low Earth Orbit (LEO) constellation, Telesat Lightspeed, the company aims to deliver high-speed, low-latency connectivity, targeting enterprise, government, and mobility markets.

The company's strategic focus on LEO technology is a direct response to the evolving needs of the market and a bid to compete with new entrants in the space-based internet sector. This move signals a significant diversification of its offerings, positioning Telesat to capture a share of the growing demand for advanced connectivity solutions.

While specific market share figures for 2024-2025 are still emerging for the rapidly evolving LEO segment, Telesat has historically been a key player in the FSS market. The company's strong presence in the GEO market provides a stable foundation as it expands into the LEO market. The company is working to compete with other key players in the satellite industry.

Telesat has a strong presence across North and South America, Europe, and parts of Asia and Africa. This extensive coverage is enabled by its fleet of geostationary satellites. The company's strategic shift towards LEO with Telesat Lightspeed aims to extend its reach and enhance service capabilities globally, increasing the customer base.

For the year ended December 31, 2023, Telesat reported total revenues of CAD $750 million and adjusted EBITDA of CAD $556 million. This financial performance supports its ongoing investment in the Lightspeed constellation, a multi-billion dollar project. This strong financial standing supports its ability to invest in new technologies and expand its market reach.

The development of Telesat Lightspeed represents a significant strategic shift. This LEO constellation is designed to capture a share of the growing demand for high-speed, low-latency connectivity. The company's proactive investment in LEO technology aims to secure its long-term competitive positioning. This effort enhances the company's ability to compete with other Telesat competitors.

The Telesat market analysis reveals several key competitive factors. These include the company's GEO satellite services, its investment in LEO technology, and its financial performance. Telesat's ability to adapt to the changing demands of the satellite communication market is also critical.

- Strong GEO presence providing a stable revenue base.

- Strategic shift towards LEO to capture new market opportunities.

- Financial stability supporting investments in new technologies.

- Focus on enterprise, government, and mobility markets.

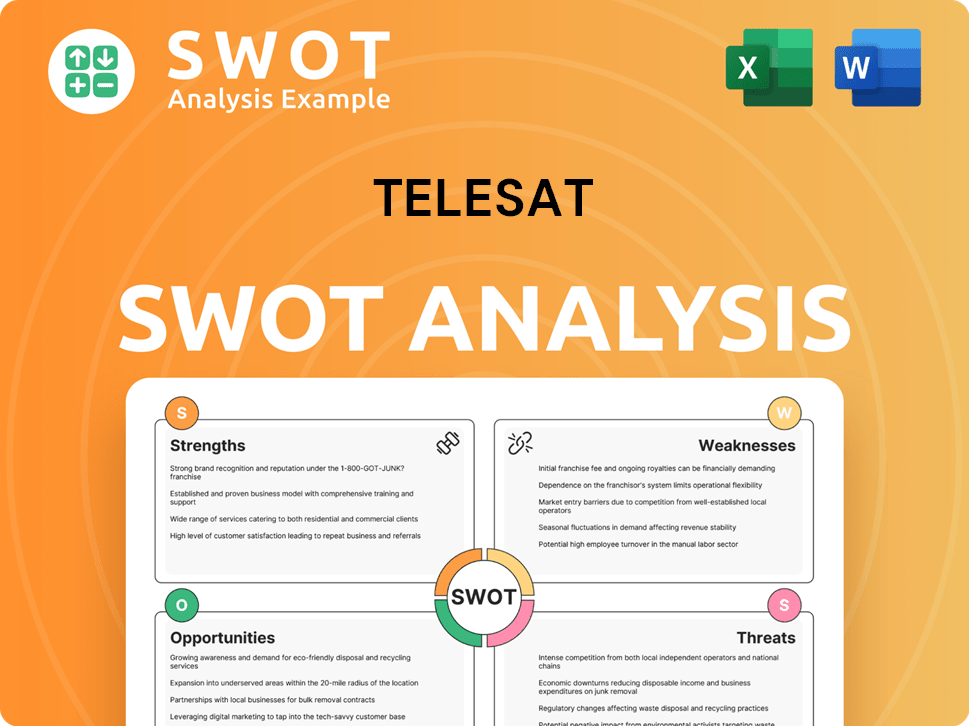

Telesat SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Telesat?

The Telesat competitive landscape is characterized by intense competition in both its established geostationary (GEO) satellite services and its emerging Low Earth Orbit (LEO) initiatives. The satellite industry is dynamic, with established players and new entrants vying for market share in space-based internet and satellite communication. Understanding Telesat's market position requires a detailed analysis of its key competitors and their strategies.

Telesat faces a multifaceted competitive environment. Its GEO services compete with established global operators, while its LEO ambitions encounter disruptive forces from new entrants. The competitive dynamics are shaped by technological advancements, financial backing, and evolving customer demands. Analyzing these factors is crucial for assessing Telesat's competitive advantages and future growth strategies.

Telesat's market analysis reveals a landscape where innovation and adaptation are essential for survival. The company's ability to navigate this competitive environment will determine its success in the satellite communication sector. The following sections detail Telesat's key competitors and their impact on the company's market position.

In the traditional GEO satellite market, Telesat competes with established global operators. These companies offer extensive satellite fleets and established customer bases. Competition is often based on price, reliability, and global reach.

SES is a leading global content connectivity provider. They offer a wide range of video and data services, utilizing a large fleet of GEO and MEO satellites. SES competes with Telesat by offering diverse services and a broad global presence.

Intelsat provides extensive network services for media, government, and enterprise customers globally. They are a major player in the satellite industry, competing with Telesat through their extensive network services and global reach.

Eutelsat, a European-based operator, focuses on broadcast, broadband, and mobile connectivity services. They compete with Telesat, particularly across Europe, the Middle East, and Africa, with a focus on broadcast and broadband services.

The most significant competitive challenge for Telesat comes from new LEO satellite operators. These companies are disrupting the market with high-speed internet access and aggressive deployment schedules. They pose a significant threat due to their advanced technology and financial backing.

SpaceX's Starlink has rapidly emerged as a dominant force in the LEO broadband market. They offer high-speed internet access globally, leveraging a rapidly expanding constellation of thousands of satellites. Starlink's aggressive deployment and pricing strategies present a major challenge to Telesat's LEO ambitions.

Other LEO operators are also significant competitors, challenging Telesat with advanced technology and scalability. The competitive landscape is further influenced by mergers and alliances, creating stronger entities. These companies are pushing all operators to innovate and differentiate their offerings. Some of the key players in this space include:

- Amazon's Project Kuiper: With plans to deploy over 3,000 LEO satellites, Project Kuiper aims to provide global broadband connectivity.

- OneWeb: Now part of Eutelsat, OneWeb offers direct competition in the LEO enterprise and government sectors.

- Other National and Private Initiatives: Various other players are focused on LEO or MEO constellations, adding to the dynamic market.

- Competitive Advantages of LEO Operators: LEO operators often offer services with significantly lower latency compared to traditional GEO satellites.

- Market Dynamics: The satellite industry is influenced by ongoing mergers and alliances, such as the Eutelsat-OneWeb merger, creating stronger, more diversified entities.

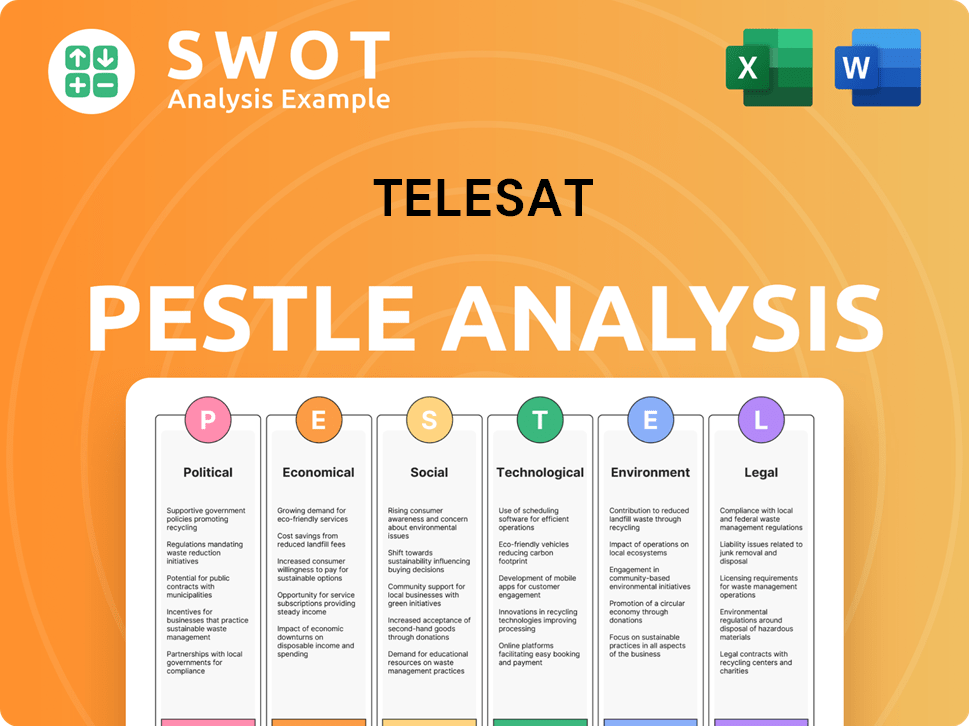

Telesat PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Telesat a Competitive Edge Over Its Rivals?

Understanding the Revenue Streams & Business Model of Telesat is crucial for assessing its competitive standing. Telesat's competitive advantages are rooted in its long-standing presence in the satellite industry and strategic investments in next-generation technology. This positions it uniquely within the dynamic Telesat competitive landscape.

A key advantage for Telesat is its extensive experience in operating geostationary satellites, providing reliable communications for over five decades. This expertise translates into strong operational capabilities and customer relationships. Telesat's development of the Telesat Lightspeed Low Earth Orbit (LEO) constellation is a significant evolution, aiming to offer superior performance with low latency and global coverage. This positions Telesat to compete effectively in the satellite industry.

Telesat benefits from strong governmental support, particularly from the Canadian government. The company focuses on high-value customer segments, such as government and telecommunications, allowing it to build strong, long-term relationships. While the LEO market is competitive, Telesat's unique LEO design, combined with its heritage in serving demanding clients, positions it to capture a distinct segment. This is reflected in the Telesat market analysis and its strategic approach to satellite communication.

Telesat has a long history of over 50 years in the satellite industry, providing reliable services. This legacy has enabled it to build strong customer relationships and a reputation for dependability. Its experience in operating GEO satellites provides a stable revenue stream.

Telesat is developing the Lightspeed LEO constellation, designed for enterprise-grade services with low latency and high capacity. The system is built with advanced phased array antennas and on-board processing. This positions Telesat to offer differentiated services compared to consumer-focused LEO constellations.

Telesat receives significant support from the Canadian government, including financial backing for the Lightspeed project. This support strengthens the project's credibility and facilitates market access. The government's involvement helps to ensure the project's long-term viability.

Telesat focuses on high-value customer segments such as government, aerospace, and telecommunications. This allows the company to tailor solutions and build strong, long-term relationships. This targeted approach fosters customer loyalty and supports premium pricing.

Telesat's competitive advantages include its established GEO satellite services, the development of the Lightspeed LEO constellation, and strong governmental support. These factors enable Telesat to compete effectively in the satellite communication market. The company's focus on enterprise-grade services differentiates it from competitors.

- Experience and Expertise: Over 50 years of operating GEO satellites, ensuring reliable service.

- Lightspeed Technology: Advanced LEO constellation designed for enterprise-grade services.

- Government Support: Financial backing and market access facilitated by the Canadian government.

- Targeted Market Focus: Strong relationships with high-value customers in government and telecommunications.

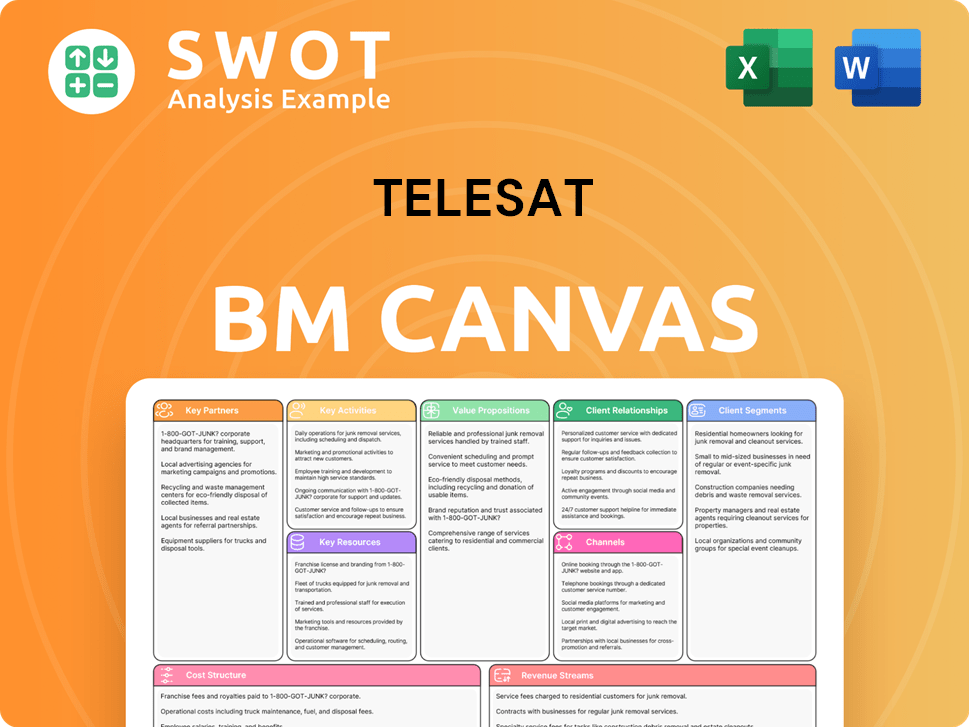

Telesat Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Telesat’s Competitive Landscape?

The satellite communications industry is experiencing a period of significant transformation, with the Telesat competitive landscape evolving rapidly. Key trends like the deployment of Low Earth Orbit (LEO) constellations and technological advancements are reshaping the market. This creates both challenges and opportunities for companies like Telesat. A thorough Telesat market analysis is crucial to understanding its position.

Telesat's position is influenced by its established presence in the Geostationary Earth Orbit (GEO) market and its ambitious plans for a LEO constellation. The company faces increasing competition from well-funded LEO operators, such as Starlink, and must navigate regulatory complexities. However, the growing demand for global broadband and enterprise solutions presents substantial growth prospects. Understanding the Telesat competitors and their strategies is essential for assessing its future outlook.

The satellite industry is seeing a surge in LEO satellite deployments, offering lower latency and higher bandwidth. Technological advancements, including improved antenna technology and software-defined satellites, are enhancing capabilities. Regulatory changes concerning spectrum allocation also play a significant role.

Telesat faces intense competition from LEO operators like Starlink and Project Kuiper, which are rapidly gaining market share. The substantial capital expenditure needed for its Lightspeed constellation poses a financial challenge. Market saturation in certain LEO segments and the need for continuous innovation are ongoing hurdles.

The growing demand for global broadband, especially in underserved areas, and for enterprise and government applications creates a vast market. The unique enterprise-grade design of Lightspeed can target specific niche markets. Integration with 5G networks and the Internet of Things (IoT) offers new growth avenues.

Telesat's strategy involves the successful deployment of Lightspeed, leveraging its hybrid GEO-LEO capabilities. The company aims to offer a diversified portfolio of services and forge strategic alliances to expand its market reach. This approach is designed to provide differentiated, high-quality satellite solutions.

Telesat's competitive position is defined by its GEO services and its LEO constellation, Lightspeed. The company competes with established GEO operators and emerging LEO providers. Success depends on factors like network performance, service offerings, and pricing.

- Market Share: Telesat's market share in the satellite industry is a key performance indicator.

- Technological Innovation: Advancements in satellite technology, including antenna design and on-board processing, are crucial.

- Regulatory Compliance: Navigating spectrum allocation and orbital debris regulations is essential.

- Financial Performance: The financial health of Telesat, including revenue and profitability, is critical.

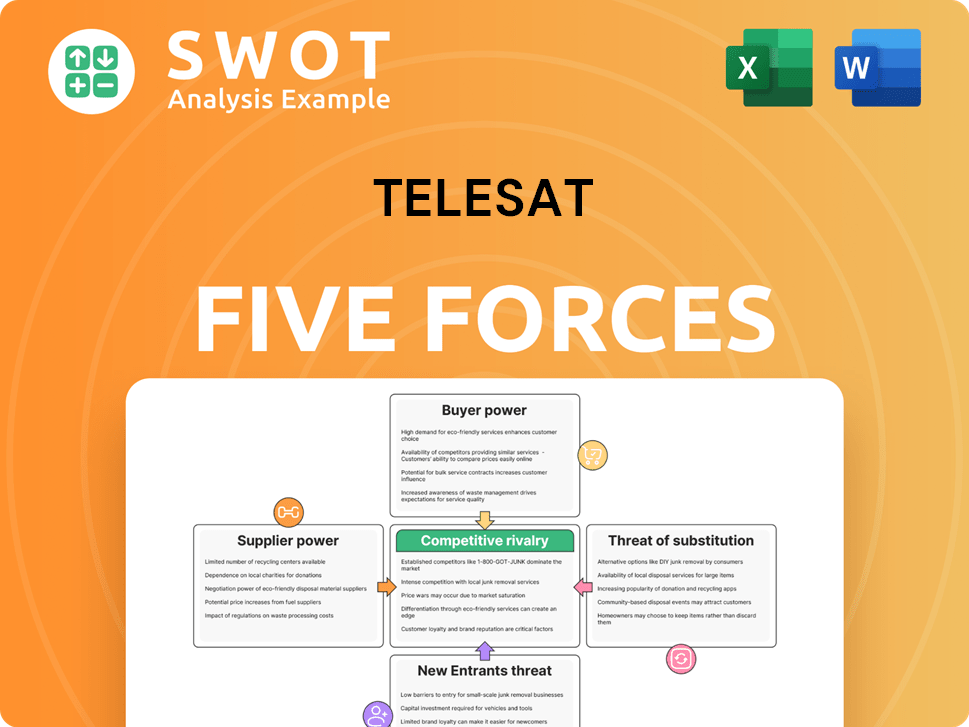

Telesat Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Telesat Company?

- What is Growth Strategy and Future Prospects of Telesat Company?

- How Does Telesat Company Work?

- What is Sales and Marketing Strategy of Telesat Company?

- What is Brief History of Telesat Company?

- Who Owns Telesat Company?

- What is Customer Demographics and Target Market of Telesat Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.