Craneware Bundle

How Does Craneware Stack Up in the Healthcare Tech Arena?

In the complex world of US healthcare, where financial health is paramount, Craneware SWOT Analysis reveals a company navigating a dynamic landscape. Founded in 1999, Craneware has become a key player in cloud-based solutions, optimizing the financial well-being of healthcare providers. This article dives deep into the Craneware competitive landscape.

This analysis of the Craneware competitive landscape will explore its market position, pinpoint key Craneware competitors, and dissect its competitive advantages. We'll conduct a thorough Craneware market analysis, examining industry trends and future challenges. Understanding Craneware's financial performance and its position within the healthcare financial software and revenue cycle management sectors is crucial for investors and strategists alike.

Where Does Craneware’ Stand in the Current Market?

Craneware holds a significant position within the US healthcare financial software market, focusing on cloud-based solutions for revenue cycle management, pricing, and cost management. The company primarily serves hospitals and large healthcare systems across the United States, offering solutions that streamline financial operations from patient registration to claims processing and payment. Its geographic presence is predominantly concentrated within the US healthcare market, reflecting the unique regulatory and operational environment it addresses.

The company's core operations revolve around providing software and services that enhance financial performance and operational efficiency for healthcare providers. Craneware's value proposition lies in its ability to improve revenue integrity, optimize charge capture, and provide deeper financial insights through advanced analytics. This helps healthcare organizations navigate complex financial challenges and regulatory changes effectively.

Over time, Craneware has solidified its positioning by consistently enhancing its cloud-based offerings, adapting to shifts in healthcare regulations, and integrating advanced analytics to provide deeper financial insights to its clients.

Craneware specializes in the US healthcare market, providing cloud-based financial software. Its solutions target hospitals and large healthcare systems, streamlining financial operations. The company's focus is on revenue cycle management, pricing, and cost management.

Craneware offers solutions for revenue integrity and charge capture. These solutions help healthcare providers optimize financial performance. The company's offerings include advanced analytics for deeper financial insights.

Craneware's primary market is the United States. This focus allows the company to address specific regulatory and operational needs. The company's solutions are tailored to the US healthcare landscape.

Craneware's financial health is evidenced by consistent revenue streams and strategic acquisitions. For the fiscal year ending June 30, 2023, Craneware reported total revenue of $170.1 million. This indicates a robust financial standing within its market.

Craneware's market position is strong within the US healthcare financial software sector. The company is recognized as a leader in revenue integrity and charge capture solutions. Owners & Shareholders of Craneware can see how the company has grown.

- Craneware's focus is on cloud-based solutions.

- The company serves hospitals and large healthcare systems.

- Solutions improve financial performance and operational efficiency.

- Financial data from 2023 shows robust revenue.

Craneware SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Craneware?

The competitive landscape for companies like Craneware is complex, shaped by both direct and indirect rivals in the healthcare technology sector. The market analysis reveals a dynamic environment where various players vie for market share within revenue cycle management (RCM) and related areas. Understanding these competitors is crucial for assessing Craneware's market position and strategic options.

Direct competitors often offer comprehensive electronic health record (EHR) systems that include integrated RCM functionalities. Indirect competitors include specialized software vendors and in-house IT departments. The industry is also influenced by emerging technologies, such as artificial intelligence and machine learning, which are changing traditional approaches.

The Growth Strategy of Craneware highlights the importance of understanding the competitive environment to maintain and improve market position. This analysis is vital for strategic planning and decision-making within the healthcare financial software industry.

Key direct competitors include major EHR providers like Epic Systems, Oracle Health (formerly Cerner), and Meditech. These companies often provide end-to-end solutions, appealing to healthcare systems looking for a single vendor. Their extensive client bases and broad solution portfolios pose significant competition in the RCM space.

Specialized RCM providers, such as R1 RCM and Waystar, also compete directly with Craneware. R1 RCM focuses on end-to-end RCM services, while Waystar offers cloud-based solutions for claims management and payment integrity. These companies often provide focused solutions that can be attractive to healthcare providers seeking specific RCM functionalities.

Indirect competitors include smaller, specialized software vendors focusing on specific aspects of revenue cycle, pricing, or cost management. In-house IT departments of large healthcare systems also act as indirect competitors. These entities may develop or customize RCM solutions internally, reducing the need for external vendors.

The competitive landscape is evolving with the rise of artificial intelligence (AI) and machine learning (ML). Companies leveraging AI and ML offer more predictive and automated financial solutions, potentially disrupting traditional approaches. These technologies can improve efficiency and accuracy in RCM processes.

Mergers and acquisitions, such as Oracle's acquisition of Cerner, reshape the competitive dynamics by consolidating market power and expanding integrated offerings. These changes can impact market share and competitive positioning. The healthcare IT market is subject to constant change.

Craneware's competitive advantages may include specialized software, customer service, and a focus on specific RCM needs. The company's ability to adapt to regulatory changes and technological advancements is also crucial. Understanding these advantages is key to maintaining a strong market position.

Craneware's success depends on several factors, including its ability to differentiate its product offerings, maintain strong customer relationships, and adapt to changing market conditions. The company must also navigate the complexities of healthcare regulations and technological advancements. These factors are critical for long-term success.

- Product Differentiation: Craneware must continue to innovate and offer unique solutions that meet the evolving needs of healthcare providers.

- Customer Relationships: Maintaining strong customer relationships is essential for customer retention and growth.

- Market Adaptation: Adapting to regulatory changes and technological advancements is crucial for staying competitive.

- Strategic Partnerships: Forming strategic partnerships can help Craneware expand its market reach and enhance its product offerings.

Craneware PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Craneware a Competitive Edge Over Its Rivals?

Analyzing the Craneware competitive landscape reveals several key advantages. The company has carved a niche by specializing in healthcare financial software, particularly focusing on revenue cycle management (RCM) within the US healthcare system. This focused approach allows for tailored solutions, setting it apart from broader healthcare IT providers. Craneware's competitive edge is further strengthened by its cloud-based solutions and strong customer loyalty.

Craneware's market analysis indicates its success is built on delivering tangible financial improvements to its clients. This is often reflected in high client retention rates and long-term contracts, demonstrating customer satisfaction. The company's ability to provide actionable insights through its extensive dataset and analytics capabilities helps clients identify revenue leakage and cost inefficiencies. These factors contribute significantly to Craneware's industry position.

The company's intellectual property, including algorithms for pricing optimization and revenue cycle analytics, provides a distinct advantage. However, Craneware faces potential threats from rapid technological advancements by competitors and the increasing integration capabilities of larger healthcare IT providers. Continuous investment in research and development is crucial to maintain compliance with evolving healthcare regulations and leverage the latest technological advancements.

Craneware's specialized product suite directly addresses the complex challenges of revenue integrity, charge capture, and cost management within the US healthcare system. This focus allows for more tailored and effective solutions compared to broader RCM modules offered by larger EHR vendors. The company's solutions are designed to integrate seamlessly with existing healthcare IT infrastructure.

Craneware's algorithms for pricing optimization and revenue cycle analytics provide a distinct competitive edge. This intellectual property enables the company to offer unique and valuable insights to its customers. These proprietary tools help healthcare providers improve financial performance and operational efficiency.

Craneware benefits from strong customer loyalty, built on its reputation for delivering tangible financial improvements to its clients. High client retention rates and long-term contracts are common, reflecting customer satisfaction. This loyalty is a key indicator of the company's success in the healthcare financial software market.

The company's cloud-based platform offers scalability and accessibility, aligning with the increasing demand for flexible and secure healthcare IT solutions. This platform allows for easier integration and data management. Cloud solutions also provide cost-effective options for healthcare providers.

Craneware's competitive advantages are multifaceted, stemming from its specialized focus, deep expertise, and proprietary technology. These advantages have enabled the company to maintain a strong position in the healthcare financial software market. The company continuously invests in research and development to stay ahead of the curve.

- Specialized Focus: Craneware's focus on healthcare financial software allows for tailored solutions.

- Intellectual Property: Proprietary algorithms for pricing optimization and revenue cycle analytics provide a competitive edge.

- Customer Loyalty: High client retention rates and long-term contracts demonstrate customer satisfaction.

- Cloud-Based Platform: Offers scalability, accessibility, and cost-effectiveness.

Craneware Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Craneware’s Competitive Landscape?

The US healthcare industry's competitive landscape is undergoing significant transformations, creating both challenges and opportunities for companies like Craneware. Technological advancements, especially in artificial intelligence (AI) and machine learning (ML), are reshaping revenue cycle management, offering potential for greater efficiency and accuracy. Regulatory changes, such as the shift towards value-based care, require healthcare providers to focus on cost management, aligning with Craneware's expertise.

However, the industry faces challenges, including cybersecurity threats and market consolidation. New competitors leveraging disruptive technologies could challenge existing market positions. The ongoing evolution of the healthcare sector necessitates continuous adaptation and strategic expansion for companies aiming to thrive in this dynamic environment. This article will provide a detailed Craneware competitive landscape analysis, exploring Craneware competitors, and conducting a thorough Craneware market analysis.

Technological advancements like AI and ML are driving efficiency in revenue cycle management. Regulatory shifts towards value-based care are increasing the focus on cost management. Consolidation within the healthcare provider market is creating larger, more complex clients.

Increasing cybersecurity threats require continuous investment in security measures. Consolidation may favor vendors with broader solution portfolios. The emergence of new competitors could challenge existing market positions. Adapting to rapid technological changes is crucial.

Expanding into new market segments, such as ambulatory care centers. Strategic partnerships with other healthcare technology providers can broaden solution offerings. Further embedding AI/ML into offerings to enhance competitive edge. Adapting to evolving client needs is key.

Rapid innovation and adaptation to regulatory shifts are essential. Strategic expansion of offerings to meet dynamic market needs is important. Maintaining a focus on financial optimization for clients remains a core strategy. Continuous improvement is key.

To succeed, Craneware needs to focus on innovation, adaptation, and strategic partnerships. Addressing cybersecurity threats and the evolving regulatory landscape is crucial. Expanding into new market segments and leveraging AI/ML capabilities are key to maintaining a competitive edge.

- Focus on AI and ML integration to enhance product offerings.

- Invest in robust cybersecurity measures for cloud-based platforms.

- Explore strategic partnerships to broaden solution portfolios.

- Adapt to value-based care models and evolving regulations.

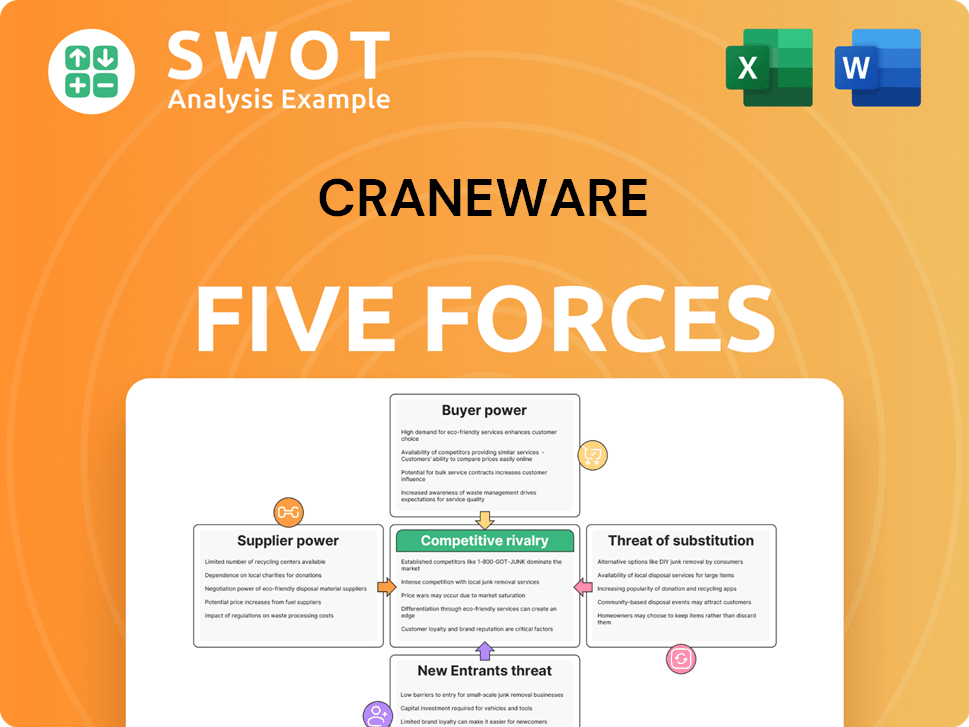

Craneware Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Craneware Company?

- What is Growth Strategy and Future Prospects of Craneware Company?

- How Does Craneware Company Work?

- What is Sales and Marketing Strategy of Craneware Company?

- What is Brief History of Craneware Company?

- Who Owns Craneware Company?

- What is Customer Demographics and Target Market of Craneware Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.