Craneware Bundle

How Does Craneware Thrive in the US Healthcare Market?

Craneware, a leading Craneware SWOT Analysis reveals, is revolutionizing healthcare finance. The Edinburgh-based

This in-depth exploration will uncover how Craneware's

What Are the Key Operations Driving Craneware’s Success?

The core operations of the Craneware company revolve around its Trisus cloud ecosystem, a Software-as-a-Service (SaaS) platform. This platform is designed to unify data, revenue intelligence, margin intelligence, and advanced analytics. It empowers healthcare organizations to optimize their financial performance.

Craneware's value proposition lies in its ability to improve revenue integrity, pricing intelligence, decision support, labor productivity, business of pharmacy, and 340B program management. The company serves a broad customer base, including over 12,000 US hospitals, health systems, affiliated retail pharmacies, and clinics.

Operational processes include continuous technology development and strategic partnerships. Craneware's solutions are built on insights from its extensive datasets, covering over 200 million patient encounters. This data-driven approach allows for solutions that enhance efficiency and optimize administrative and operational functions, leading to tangible financial returns for customers. Craneware's offerings are grouped into six Trisus Optimization Suites, making it easier for customers to identify solutions that address specific strategic and tactical issues. You can learn more about the company's origins in the Brief History of Craneware.

The core of Craneware's operations is the Trisus cloud ecosystem. It's a SaaS platform that integrates data and analytics to help healthcare providers. This platform focuses on improving financial performance.

Craneware uses extensive datasets from over 200 million patient encounters. This data helps develop solutions that improve efficiency. These solutions lead to better financial outcomes for clients.

Craneware serves a wide customer base. This includes over 12,000 US hospitals, health systems, and clinics. This diverse customer base highlights the broad applicability of their solutions.

The company offers six Trisus Optimization Suites. These suites help customers address specific issues. This structured approach simplifies the process of finding the right solutions.

Craneware's operations focus on technology development and strategic partnerships. They also offer professional services, including customer success management and various consulting services. This approach ensures a customer-centric focus.

- Continuous technology development to stay current.

- Strategic partnerships to expand capabilities.

- Professional services for comprehensive support.

- Independent position within the US healthcare ecosystem.

Craneware SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Craneware Make Money?

The primary revenue streams for the Craneware company are centered around the development, licensing, and support of its cloud-based software solutions, specifically tailored for the US healthcare sector. The company's financial model is largely driven by Annual Recurring Revenue (ARR), which encompasses the annual value derived from licenses and related recurring revenues, including transaction revenues.

This approach ensures a steady and predictable income flow, crucial for sustaining and expanding its operations. The company's focus on recurring revenue models, coupled with high customer retention rates, positions it well for continued growth in the competitive healthcare technology market.

As of December 31, 2024, the company's ARR reached $177.3 million, reflecting a 3% increase from $171.4 million in the first half of FY24. In the first half of FY25, ending December 31, 2024, the company reported a record group revenue of $100.0 million, marking a 10% increase compared to $91.2 million in the first half of FY24.

The company employs various monetization strategies to maximize revenue from its healthcare finance solutions. These strategies include a focus on recurring revenue models, bundled services, tiered pricing, and cross-selling to enhance customer value and drive growth.

- Annual Recurring Revenue (ARR): The company emphasizes ARR, which includes the annual value of license and related recurring revenues, including transaction revenues.

- Recurring Professional Services: Recurring professional services contribute to the overall recurring platform revenues.

- Bundled Services: Applications are packaged into Trisus Optimization Suites to encourage customers to unlock immediate value from additional applications.

- Customer Retention: The company maintains strong customer retention, consistently above 90% across all measures.

- Net Revenue Retention (NRR): The company has a Net Revenue Retention (NRR) greater than 100%, underscoring the stability and growth potential of its recurring revenue streams.

Craneware PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Craneware’s Business Model?

The journey of the Craneware company is marked by significant achievements and strategic maneuvers that have shaped its trajectory. A key highlight is the consistent recognition of its Trisus Chargemaster solution, which has been ranked first in the 'Best In KLAS Awards: Software & Services' for Chargemaster Management for the 14th time in 2025. This sustained leadership underscores its commitment to excellence in healthcare technology.

A pivotal strategic move in July 2024 was the alliance with Microsoft, designating Craneware as a Microsoft Global Partner Solution provider. This partnership aims to deliver differentiated offerings and increase value through cutting-edge data analytics, AI, and modern platform technology. The initial major customer contract was executed via the Microsoft Azure Marketplace. Craneware is also collaborating with Microsoft on AI innovation, including the launch of Trisus Assist, an AI-powered personal assistant designed to streamline healthcare finance and operations.

Furthermore, the company has reinforced its relationship with Oracle, integrating its Oracle and Azure-based technology stacks for enhanced data flow and analysis, which supports ongoing product innovation. These strategic alliances and product enhancements demonstrate Craneware's proactive approach to meeting the evolving needs of the healthcare industry.

Craneware's Trisus Chargemaster solution has been recognized as the best in its category for the 14th time in 2025. The company formed an alliance with Microsoft in July 2024, becoming a Microsoft Global Partner Solution provider. They are also working on AI innovations, such as Trisus Assist, to improve healthcare finance and operations.

The Microsoft partnership aims to provide advanced data analytics and AI solutions. Craneware is integrating its technology with Oracle and Azure to improve data flow and analysis. These moves highlight Craneware's commitment to innovation and strategic growth within the healthcare sector.

Craneware's competitive edge comes from its specialization in healthcare, extensive data assets, and a broad customer base. The company's independence allows it to focus on customer benefits. Craneware is investing in research and development, allocating approximately 25% of revenues to R&D, and developing AI enhancements to its offerings.

Craneware's strong financial position supports its growth strategy. The company has growing cash reserves of $72.2 million (H1 FY25) and reduced bank debt of $31.6 million (H1 FY25). This financial stability allows Craneware to invest in innovation and expand its market presence, as shown in the Target Market of Craneware.

Craneware's competitive advantages are rooted in its deep healthcare specialization and extensive data assets. Its independence within the US healthcare ecosystem allows it to focus solely on customer benefit. These factors, coupled with a strong financial foundation, including growing cash reserves of $72.2 million (H1 FY25) and reduced bank debt of $31.6 million (H1 FY25), provide stability and flexibility for future growth.

- Deep healthcare specialization allows for tailored solutions.

- Extensive data assets provide valuable insights.

- A broad customer base ensures market reach.

- Strong financial foundations support innovation.

Craneware Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Craneware Positioning Itself for Continued Success?

Craneware, a key player in the healthcare technology sector, holds a significant position within the US healthcare industry. Its software solutions are utilized by approximately 40% of all registered US hospitals, encompassing over 12,000 hospitals, health systems, and affiliated entities. This widespread adoption underscores the company's strong market penetration and its critical role in healthcare finance.

The company's success is further highlighted by its high customer retention rates, exceeding 90% across all measures, with Net Revenue Retention greater than 100%. This indicates not only customer loyalty but also the ability to expand revenue within the existing customer base. Craneware's focus on innovation and strategic partnerships positions it well for sustained growth in the evolving healthcare landscape.

Craneware's software is essential for revenue cycle management, helping healthcare providers optimize financial performance. The company's broad customer base and high retention rates demonstrate its strong market position. Craneware's solutions are integral for improving hospital finances and ensuring compliance within the healthcare industry.

Craneware faces risks related to data security and macroeconomic conditions, despite its robust financial health. Regulatory changes in the US healthcare market can influence demand for its solutions. The company must navigate evolving cybersecurity threats and adapt to changes in healthcare regulations.

Craneware aims to maintain double-digit growth by expanding its Trisus platform and strategic partnerships. The company is investing in R&D, particularly in AI enhancements. Craneware seeks to become the "ubiquitous 4th pillar of software within a hospital".

Craneware is focusing on expanding its platform and partner programs to generate additional revenue. Strategic initiatives include exploring mergers and acquisitions to accelerate growth. Continued investment in R&D and innovation, especially in AI, is central to its future direction.

Craneware's success in the healthcare technology sector hinges on its ability to adapt to evolving market dynamics and technological advancements. The company's focus on innovation, particularly in areas like AI, is critical for maintaining its competitive edge. For a deeper dive into Craneware's strategies, consider reading the Growth Strategy of Craneware.

- Craneware's software solutions are designed to improve healthcare finance by helping hospitals with charge capture and patient accounting.

- The company's integration with EHR systems and its data analytics capabilities further enhance its value proposition.

- Craneware's recent acquisitions and partnerships are aimed at expanding its product offerings and market reach.

- The company's strategic focus on the Trisus platform is a key element in its future growth strategy.

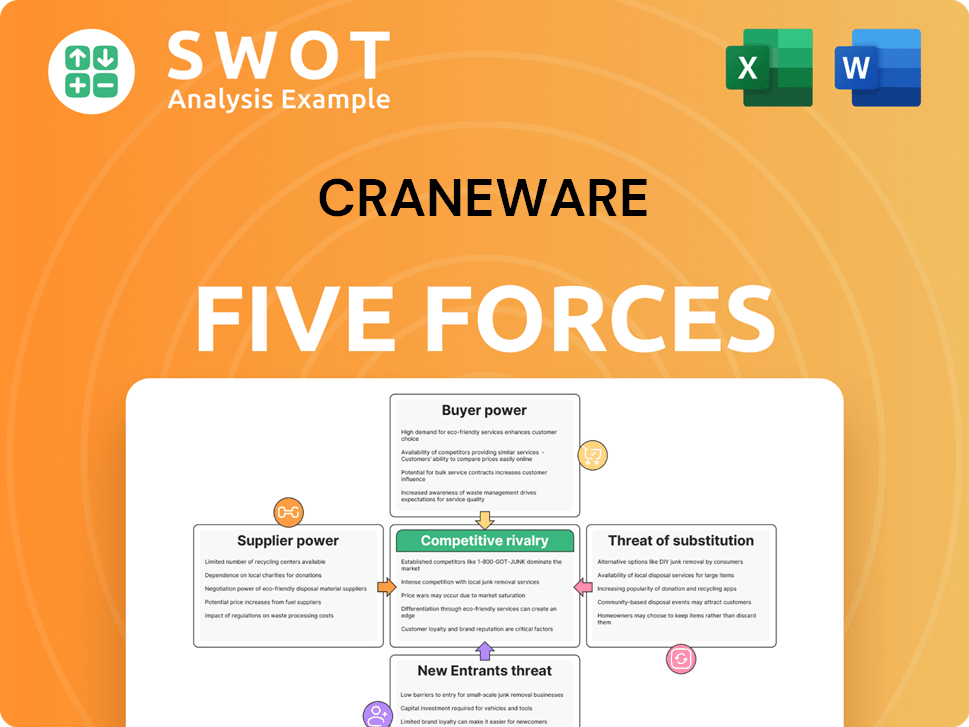

Craneware Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Craneware Company?

- What is Competitive Landscape of Craneware Company?

- What is Growth Strategy and Future Prospects of Craneware Company?

- What is Sales and Marketing Strategy of Craneware Company?

- What is Brief History of Craneware Company?

- Who Owns Craneware Company?

- What is Customer Demographics and Target Market of Craneware Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.