Shenzhen Transsion Holding Bundle

Can a Chinese Company Outmaneuver Tech Giants?

In a global arena dominated by tech titans, Shenzhen Transsion Holdings has quietly built a mobile phone empire, particularly in emerging markets. Its success story offers a fascinating case study in strategic focus and understanding underserved consumer needs. This Shenzhen Transsion Holding SWOT Analysis can provide a deeper understanding of its strategic approach.

This deep dive into the competitive landscape of Transsion Holdings will analyze its market position, examining its key rivals and the strategies that have propelled its growth. We will explore the company's impressive market share, its diverse portfolio of smartphone brands, and the factors contributing to its success in the fiercely competitive mobile phone market. Furthermore, this analysis will provide insights into the company's future outlook and its impact on the African economy.

Where Does Shenzhen Transsion Holding’ Stand in the Current Market?

In the global mobile phone industry, Shenzhen Transsion Holding Company, also known as Transsion Holdings, holds a significant market position, particularly in its primary target markets. The company's success is rooted in its strategic focus on emerging markets, especially in Africa, where it has established a strong foothold. Transsion's brands, including Tecno, Itel, and Infinix, have collectively captured a substantial market share, demonstrating the company's dominance in these regions.

Transsion's core operations revolve around the design, development, and sale of mobile phones and related accessories. The company's value proposition lies in its ability to offer affordable, feature-rich devices tailored to the specific needs of consumers in emerging markets. This includes features like dual-SIM support, long battery life, and camera technology optimized for diverse skin tones, which are highly valued in these regions. The company's approach has allowed it to effectively compete with established players like Samsung and others.

Transsion Holdings' product portfolio includes smartphones and feature phones under the Tecno, Itel, and Infinix brands. Tecno focuses on the mid-range smartphone market, emphasizing camera technology and design. Infinix targets the youth segment with gaming-centric features and trendy designs. Itel concentrates on the entry-level smartphone and feature phone markets, emphasizing affordability and durability. This multi-brand strategy allows Transsion to cater to a wide range of consumers and price points.

In 2023, Transsion's brands collectively held the largest smartphone market share in Africa. This highlights its strong position in the region. This dominance is a result of its understanding of local consumer needs and preferences.

Transsion's presence is strongest in Africa, South Asia, and Southeast Asia. The company has strategically expanded its reach, adapting its product offerings to suit local preferences and economic conditions. This expansion is a key part of their growth strategy.

In Q4 2023, Transsion Holdings ranked among the top five smartphone vendors globally. The company shipped 28.2 million units and captured an 8.1% market share. This shows their significant scale in the industry.

Transsion has gradually introduced more premium-featured smartphones. The company is moving beyond budget-friendly devices while maintaining a strong presence in the entry-level segment. This diversification allows them to capture a broader range of consumers.

Transsion's success is driven by several key factors. Their strong understanding of local consumer needs, such as multi-SIM support and enhanced camera features, is a key differentiator. They also focus on affordability and durability, making their products accessible to a wider audience. For a deeper dive into their target market, consider reading about the Target Market of Shenzhen Transsion Holding.

- Focus on emerging markets with high growth potential.

- Multi-brand strategy to cover various price points and consumer segments.

- Adaptation of product features to meet local consumer preferences.

- Strong distribution networks and marketing strategies.

Shenzhen Transsion Holding SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Shenzhen Transsion Holding?

The competitive landscape for Shenzhen Transsion Holding Company is dynamic, shaped by both global and regional players vying for market share in the mobile phone market, particularly in emerging economies. Transsion's success hinges on understanding and effectively navigating this complex environment, which includes adapting to rapid technological advancements, shifting consumer preferences, and aggressive marketing strategies employed by its rivals. The company's ability to innovate and differentiate itself, especially in key markets like Africa, is crucial for maintaining its competitive edge.

Transsion Holdings faces diverse competitors across its target markets, ranging from global giants to regional players. The company's strategic positioning and product offerings must constantly evolve to meet the challenges posed by these competitors. The competitive dynamics are further influenced by factors such as supply chain efficiency, brand recognition, and the ability to offer competitive pricing and features tailored to local market needs. Understanding these competitive pressures is essential for evaluating Transsion's long-term prospects and growth potential.

In the smartphone segment, Transsion Holdings directly competes with established global brands and other Chinese manufacturers. Samsung, Xiaomi, and Huawei are among its primary competitors. These companies have a significant global presence and offer a wide range of devices across various price points. They challenge Transsion through their vast resources, established supply chains, and continuous innovation in areas like chip technology and software ecosystems.

Samsung is a long-standing leader in the mobile phone market, challenging Transsion with brand recognition, extensive R&D, and premium offerings. Samsung's global presence and diverse product portfolio allow it to compete across various market segments. In 2024, Samsung's global smartphone market share was approximately 19.6%, making it a formidable competitor.

Xiaomi competes aggressively on price-to-performance ratio and a strong online sales strategy. Xiaomi's focus on offering feature-rich devices at competitive prices has made it a significant player in emerging markets. Xiaomi's global smartphone market share in 2024 was around 14.1%, posing a direct challenge to Transsion's mid-range offerings.

Despite recent challenges, Huawei still maintains a presence and offers competitive devices, particularly in areas like camera technology and 5G capabilities. Huawei's focus on innovation and its strong brand recognition in certain regions allow it to compete effectively. Huawei's global smartphone market share in 2024 was approximately 4.4%, indicating a continued presence in the market.

Oppo and Vivo are other Chinese brands increasingly expanding into emerging markets, often focusing on design, camera capabilities, and aggressive marketing. These brands are known for their innovative designs and strong marketing campaigns. Oppo and Vivo's combined global smartphone market share in 2024 was approximately 17.6%, representing a significant competitive force.

Transsion's Itel brand competes with local manufacturers and other budget-focused brands in the feature phone segment. Itel's focus on affordability and basic functionality caters to a specific market niche. Itel's success in the feature phone segment is a key part of Transsion's strategy in emerging markets.

Emerging players in the competitive landscape include various regional brands and even some local assembly operations that cater to specific market niches. These brands often focus on localized marketing and distribution strategies. The competition from these brands is particularly intense in specific African countries, where Transsion's dominance is constantly challenged.

The mobile phone market is highly competitive, with market share shifts frequently occurring. Transsion's dominance in specific regions, such as Africa, is constantly challenged by the aggressive entry and expansion strategies of its rivals. For instance, Xiaomi has been making inroads into African markets, directly competing with Transsion's mid-range offerings. Understanding the competitive landscape is essential for evaluating Shenzhen Transsion Holding Company competitors and their impact on the market.

- The African mobile phone market is a key battleground, with Transsion, Samsung, and Xiaomi vying for market share.

- Mergers and alliances, though less common in this specific segment, could also impact competitive dynamics by consolidating market power or creating new distribution channels.

- Brief History of Shenzhen Transsion Holding provides context on the company's evolution and its competitive positioning.

- Transsion's ability to maintain its market share depends on its product portfolio analysis, including Itel mobile phone reviews, Tecno smartphone specifications, and Infinix phone price comparison.

- The company's growth strategy must consider the impact of Transsion Holdings vs Samsung and the broader Africa mobile phone market trends.

Shenzhen Transsion Holding PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Shenzhen Transsion Holding a Competitive Edge Over Its Rivals?

Shenzhen Transsion Holding Company, a prominent player in the mobile phone market, has carved a significant niche for itself, particularly in emerging markets. The company's success is largely attributed to its strategic focus and understanding of consumer needs in these regions. Transsion's competitive advantages are multifaceted, enabling it to maintain a strong position against both local and international competitors.

The company's strategic approach includes tailoring products to specific regional demands, building robust distribution networks, and fostering strong brand equity. This focused strategy has allowed Transsion to achieve considerable market share. Transsion's growth trajectory is worth noting, as it continues to adapt and innovate within the dynamic mobile phone market.

Transsion's ability to offer competitive pricing while maintaining profitability is a key factor in its success. This cost-effectiveness is crucial in price-sensitive emerging markets. The company's financial performance reflects its strategic advantages and operational efficiency.

Transsion designs mobile phones specifically for the needs of consumers in emerging markets. Features like multi-SIM card slots, long battery life, and cameras optimized for darker skin tones are incorporated. This localized approach helps differentiate Transsion from global brands.

Transsion has built a robust offline distribution network, especially in Africa, reaching remote areas. This widespread presence ensures product availability and accessibility for a large customer base. The company's distribution strategy is a core strength.

Tecno, Itel, and Infinix have become well-known brands, fostering customer loyalty. Consistent quality and relevant features help build brand recognition. Transsion's brands have a strong presence in their target markets.

Transsion leverages an efficient supply chain to offer competitive pricing. This cost-effectiveness is crucial in price-sensitive emerging markets. The company's operational efficiency contributes to its profitability.

Transsion Holdings' competitive advantages are a combination of tailored products, extensive distribution, and strong brand recognition. These elements have allowed the company to capture a significant share of the mobile phone market, particularly in Africa. These advantages have been instrumental in the company's growth and market position.

- Localized Product Strategy: Transsion's phones are designed with specific regional needs in mind, including features like dual SIM capabilities and optimized camera technology.

- Robust Distribution Network: The company has built a strong offline distribution network, especially in Africa, ensuring product availability in remote areas.

- Strong Brand Presence: Tecno, Itel, and Infinix have become well-known brands, fostering customer loyalty through consistent quality and relevant features.

- Cost-Effective Operations: Efficient supply chains and economies of scale enable Transsion to offer competitive pricing while maintaining profitability.

Shenzhen Transsion Holding Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Shenzhen Transsion Holding’s Competitive Landscape?

The mobile phone industry is currently experiencing significant shifts, primarily driven by the increasing penetration of smartphones in emerging markets, the expansion of 5G connectivity, and advancements in AI and camera technologies. These trends present both challenges and opportunities for companies like Shenzhen Transsion Holding Company. The competitive landscape is intensifying, with established global players and new entrants vying for market share, especially in regions where Transsion has a strong presence. Understanding these dynamics is crucial for assessing Transsion's future prospects.

Transsion Holdings faces a complex environment. The company must navigate the transition from feature phones to smartphones, the adoption of 5G, and the competitive pressures from rivals. Regulatory changes and economic fluctuations add further layers of complexity. However, opportunities for growth exist, especially in underserved markets and through strategic innovations in technology and partnerships. This analysis aims to provide a detailed overview of Transsion's position, the associated risks, and the outlook for the future.

The mobile phone market is seeing a rise in smartphone adoption, particularly in Africa and other emerging markets. 5G technology is becoming more widespread, driving demand for advanced devices. AI and camera technology are key differentiators, with consumers seeking improved features. These trends influence product development and market strategies.

Increased competition from global smartphone brands such as Samsung and Xiaomi is a major challenge. Regulatory changes, including import tariffs and local content requirements, can impact operations. Economic factors like inflation and currency fluctuations affect consumer spending. New market entrants with disruptive models also pose a threat.

Expanding into new emerging markets, such as Latin America and Southeast Asia, presents significant growth potential. Developing affordable smartphone technology can strengthen the company's competitive edge. Strategic partnerships with local telecom operators and content providers can enhance market presence. The company's growth strategy is crucial.

Shenzhen Transsion faces intense competition in the mobile phone market. Key competitors include established brands like Samsung and Xiaomi. The company's success depends on balancing affordability with premium features. Understanding the competitive landscape is essential for strategic planning. For more insights, consider reading about Owners & Shareholders of Shenzhen Transsion Holding.

In 2024, the African mobile phone market saw continued growth, with smartphones taking a larger share. Transsion's brands, including Itel, Tecno, and Infinix, have a significant presence in this market. The company's focus on affordability and features tailored to local needs has been a key competitive advantage.

- Market Share: Transsion holds a significant market share in Africa, estimated at over 40% in 2024.

- Product Portfolio: The company offers a diverse range of smartphones, catering to different price points and consumer preferences.

- Financial Performance: Transsion's financial performance has been strong, driven by sales in emerging markets.

- Future Outlook: The company is expected to continue its growth trajectory, focusing on innovation and market expansion.

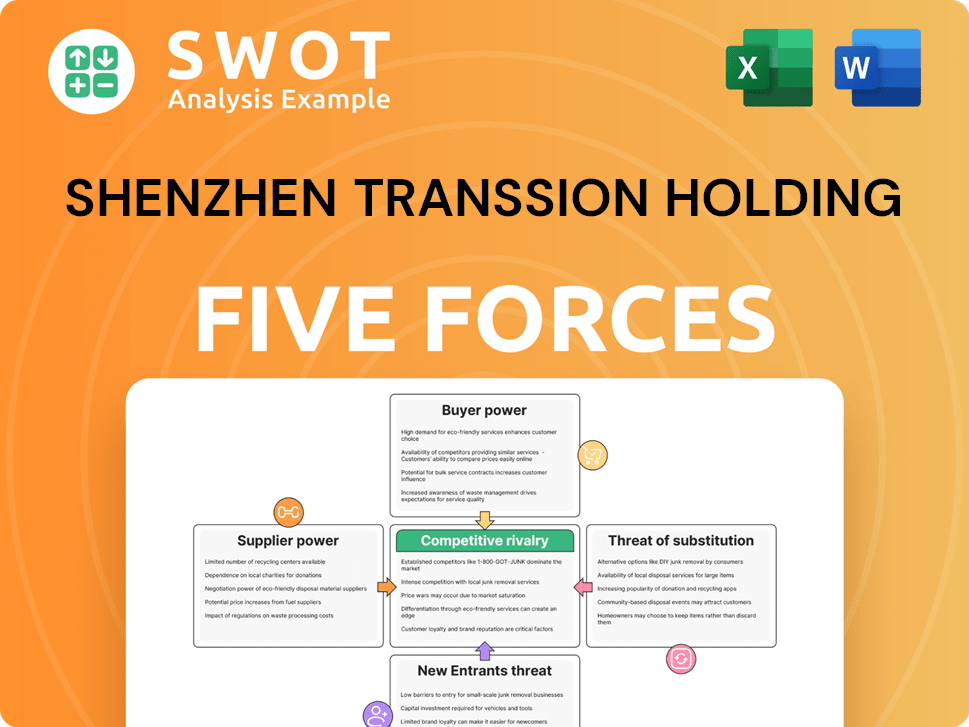

Shenzhen Transsion Holding Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Shenzhen Transsion Holding Company?

- What is Growth Strategy and Future Prospects of Shenzhen Transsion Holding Company?

- How Does Shenzhen Transsion Holding Company Work?

- What is Sales and Marketing Strategy of Shenzhen Transsion Holding Company?

- What is Brief History of Shenzhen Transsion Holding Company?

- Who Owns Shenzhen Transsion Holding Company?

- What is Customer Demographics and Target Market of Shenzhen Transsion Holding Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.