Trinity Industries Bundle

How Does Trinity Industries Navigate the Rail Industry's Competitive Terrain?

Trinity Industries, a cornerstone of North America's rail transportation sector, commands attention. Its significant presence in railcar manufacturing and leasing makes it a key player shaping the industry's direction. Understanding Trinity's strategic moves is vital for anyone tracking the evolution of infrastructure and logistics across the continent.

Founded in 1933, Trinity Industries has evolved from a steel fabricator into a rail solutions provider, demonstrating remarkable adaptability. This Trinity Industries SWOT Analysis delves into the company's competitive advantages and market position analysis, examining its financial performance and business strategy. Analyzing the Trinity Industries competitive environment, including its industry rivals and recent acquisitions, is crucial for understanding its long-term growth opportunities and market share within the railcar market.

Where Does Trinity Industries’ Stand in the Current Market?

Trinity Industries holds a significant position in the North American rail transportation sector, particularly in railcar manufacturing and leasing. The company is a major player, known for its extensive fleet and diverse railcar offerings. Their core operations revolve around providing essential equipment and services to various industries, making them a key component of the rail infrastructure.

The value proposition of Trinity Industries lies in its ability to offer comprehensive solutions for rail transportation needs. This includes manufacturing a wide range of railcars, leasing them to customers, and providing related services. By focusing on both manufacturing and leasing, Trinity Industries can generate revenue from multiple sources, enhancing its financial stability and market presence. The company's strategic shift towards emphasizing recurring revenue from railcar leasing has further solidified its position in the industry.

As of the end of 2023, Trinity Rail Leasing managed a fleet of approximately 130,000 railcars, showcasing its leadership in the market. This extensive fleet supports a broad customer base across various sectors, including energy, chemicals, agriculture, and construction. Trinity Industries reported total revenues of approximately $2.6 billion in fiscal year 2023, reflecting its strong financial performance and market position. The company's focus on optimizing fleet utilization and expanding service offerings further enhances its competitive standing.

Trinity Industries has a significant market share in the North American railcar market. Its strong position is supported by its large fleet and comprehensive product offerings. The company's focus on both manufacturing and leasing contributes to its robust market presence.

Trinity Industries offers a diverse product portfolio, including various types of freight railcars. These include tank cars, covered hopper cars, and open-top hopper cars, among others. The company also provides related parts and services to support its customers.

The company's primary geographic focus is North America, with manufacturing facilities and service centers located across the United States and Mexico. This strategic presence supports its operations and customer base, ensuring efficient service and support.

Trinity Industries has strategically emphasized recurring revenue streams from railcar leasing. This shift has reduced its reliance on cyclical manufacturing sales, contributing to a more stable financial profile. This strategy has enhanced its ability to navigate market fluctuations.

Trinity Industries' competitive advantages include its extensive fleet, diverse product offerings, and strategic focus on railcar leasing. The company benefits from a strong market position and a proven ability to generate consistent revenue. The company's focus on optimizing fleet utilization and expanding service offerings presents further growth opportunities.

- Leading position in railcar leasing with a fleet of approximately 130,000 railcars.

- Diverse product portfolio including various railcar types and related services.

- Strategic shift to emphasize recurring revenue from railcar leasing.

- Geographic focus on North America with manufacturing facilities in the United States and Mexico.

- Strong financial performance, with approximately $2.6 billion in revenue in fiscal year 2023.

To understand more about the company, you can read a Brief History of Trinity Industries.

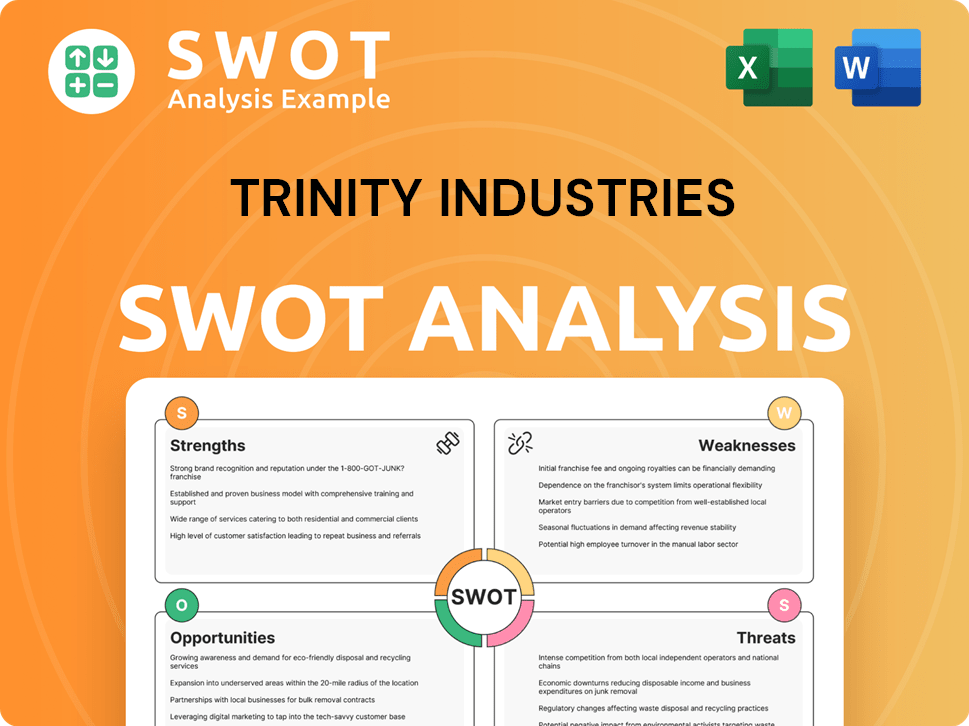

Trinity Industries SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Trinity Industries?

The competitive landscape for Trinity Industries is shaped by a dynamic mix of direct and indirect competitors in the North American railcar manufacturing and leasing sectors. Understanding these competitors is crucial for a comprehensive Trinity Industries analysis, helping to assess its market position and strategic challenges.

The industry is influenced by factors such as market share, industry trends, and the strategic moves of Trinity Industries competitors. This analysis considers both established players and emerging threats, providing a detailed view of the competitive environment.

The railcar market is subject to fluctuations, influenced by economic cycles, infrastructure projects, and shifts in transportation demand. The competitive dynamics are also affected by technological advancements and the evolving needs of customers, impacting Trinity Industries' growth opportunities and overall financial performance.

The Greenbrier Companies is a major direct competitor, offering a wide array of freight cars and related services. FreightCar America also competes, focusing on specialized railcar types.

GATX Corporation is a significant competitor in the railcar leasing segment, with a large and diversified fleet. Smaller, specialized leasing companies also pose indirect competition.

Competitors challenge Trinity Industries through product innovation, pricing strategies, and manufacturing efficiency. Leasing companies compete through fleet size, service offerings, and contract terms.

Mergers and acquisitions in the transportation sector impact the competitive landscape. Technological advancements, such as telematics, also introduce new competitive pressures.

Industry trends, including demand for specific railcar types and the adoption of new technologies, influence the competitive environment. These trends affect Trinity Industries' market position analysis.

Understanding the financial performance of Trinity Industries and its competitors is essential. This includes analyzing revenue, profitability, and market capitalization.

To fully grasp the competitive landscape, it's important to consider the strengths and weaknesses of each competitor. A detailed Trinity Industries SWOT analysis can highlight its competitive advantages, such as its product portfolio and infrastructure projects involvement, as well as areas where it faces challenges. For example, in 2024, The Greenbrier Companies reported revenues of approximately $3.3 billion, while GATX Corporation reported revenues of about $1.3 billion, illustrating the scale of these competitors. Further insights into the Growth Strategy of Trinity Industries can also provide a deeper understanding of its strategic direction and how it aims to maintain its market position amid these competitive pressures.

Several factors define the competitive landscape for Trinity Industries, influencing its market share and strategic decisions.

- Product Innovation: Developing new and improved railcar designs to meet evolving customer needs.

- Pricing Strategies: Offering competitive pricing to secure contracts and maintain profitability.

- Manufacturing Efficiency: Optimizing production processes to reduce costs and improve delivery times.

- Fleet Management: Providing comprehensive leasing and maintenance services to attract and retain customers.

- Customer Relationships: Building strong relationships with customers to understand their needs and provide tailored solutions.

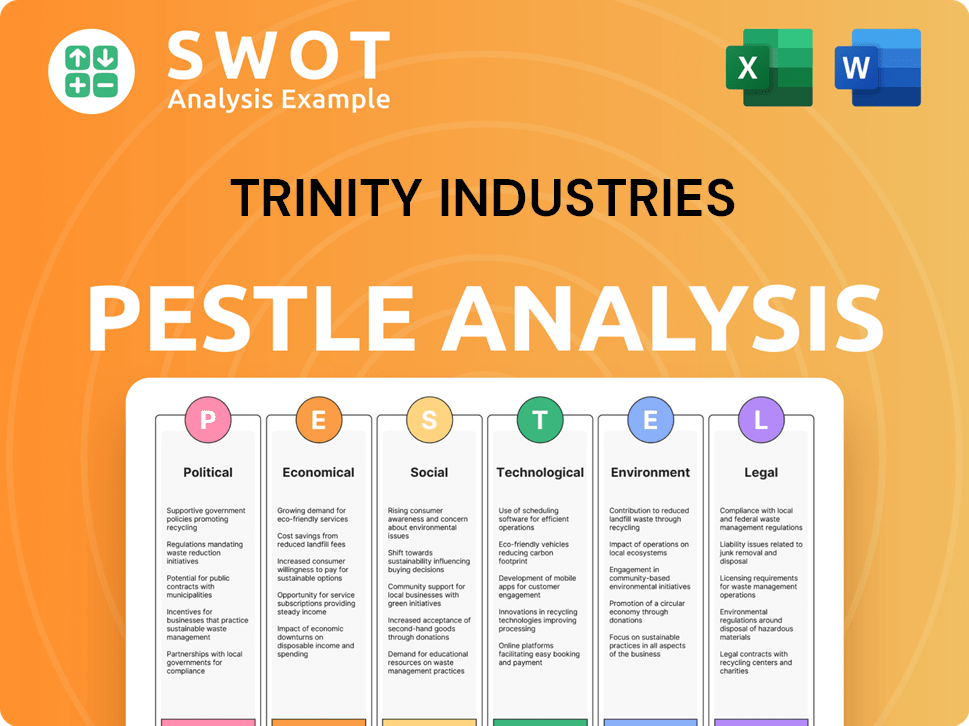

Trinity Industries PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Trinity Industries a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of Trinity Industries involves examining its key strengths and how it positions itself within the rail transportation sector. The company's strategic moves and operational efficiencies have shaped its market position, making it a significant player in the industry. A deep dive into its competitive advantages reveals the factors that contribute to its sustained success and resilience against competitors.

Trinity Industries analysis shows that the company has a robust business model that combines railcar manufacturing with leasing services. This integrated approach allows for better control over quality and design, which is a key element in maintaining its competitive edge. The company’s ability to adapt to market demands and manage its assets effectively is a testament to its strategic prowess.

The company's financial performance and stock performance are indicators of its overall health and ability to compete. Its ability to navigate industry trends and capitalize on growth opportunities is crucial for maintaining its market share and staying ahead of industry rivals. Recent acquisitions and infrastructure projects further enhance its competitive environment.

Trinity Industries' large and diversified railcar leasing fleet is a primary competitive advantage. This fleet generates stable, recurring revenue streams, providing a solid financial foundation. The variety of railcar types allows Trinity to serve diverse customer needs across multiple industries.

The company's integrated business model, merging railcar manufacturing and leasing, is a significant advantage. This integration allows for better control over quality and design, and quicker responses to market shifts. It also facilitates more effective management of asset lifecycles.

Trinity's proprietary railcar designs and manufacturing processes, often protected by patents, offer a technological edge. This innovation allows the company to provide technologically advanced and efficient railcars. These designs contribute to its competitive advantage in the railcar market.

Trinity benefits from established brand equity and long-standing customer relationships. Decades of reliable service and product delivery have built strong customer loyalty. Its robust distribution and service network further support these relationships.

Trinity Industries' competitive advantages are multifaceted, ensuring its strong market position. These advantages include a large railcar fleet, an integrated business model, proprietary designs, and strong customer relationships. These factors collectively contribute to the company's ability to withstand competition and maintain its industry leadership.

- Extensive Railcar Fleet: Generates stable revenue.

- Integrated Model: Controls quality and design.

- Proprietary Designs: Offers technological edge.

- Customer Relationships: Built on reliable service.

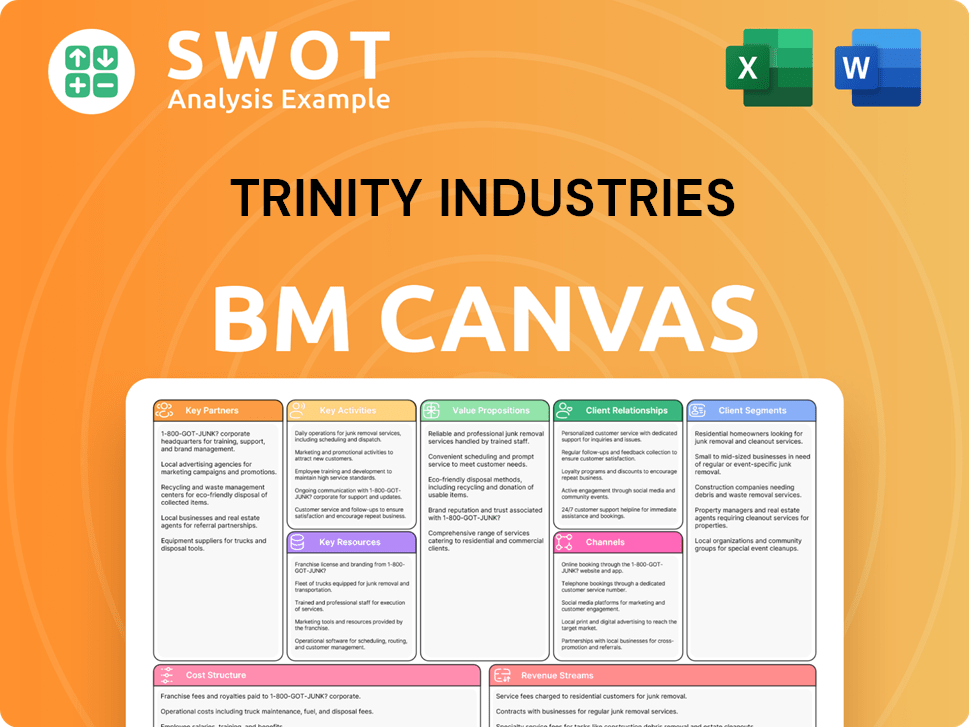

Trinity Industries Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Trinity Industries’s Competitive Landscape?

The North American rail transportation sector is experiencing significant shifts, driven by technological advancements, evolving regulations, and alterations in global trade dynamics. The Owners & Shareholders of Trinity Industries should understand these trends to navigate the competitive landscape effectively. Technological integrations, such as advanced telematics and automation, are reshaping operational efficiency and safety standards. Regulatory changes, particularly concerning environmental standards, are influencing railcar design and operational costs.

Future challenges for Trinity Industries include potential economic downturns, competition from other transport modes, and the need for fleet modernization. Raw material price volatility, especially steel, poses a continuous cost challenge. However, opportunities exist in sustainable transportation, e-commerce growth, and nearshoring trends. Capitalizing on these requires investment in technology, environmentally friendly designs, and strategic partnerships.

Technological advancements, such as IoT sensors for railcar monitoring and automation, are increasing efficiency and safety. Regulatory changes, especially in environmental standards, affect railcar design and operational costs. Shifts in global trade patterns and supply chain dynamics influence demand for rail transport.

Economic downturns could reduce freight volumes and demand for railcars. Competition from intermodal transport and trucking poses a threat. The need to modernize the fleet and manage raw material price volatility are constant challenges. These challenges can impact Trinity Industries' market share and financial performance.

Growing demand for sustainable transportation solutions favors rail. The expansion of e-commerce and nearshoring trends in North America increases freight demand. Strategic partnerships and investment in new technologies can drive growth. These opportunities can enhance Trinity Industries' competitive advantages.

Invest in new technologies to improve efficiency and safety. Develop environmentally friendly railcar designs to meet sustainability demands. Explore strategic partnerships to expand service offerings and geographic reach. These strategies can improve Trinity Industries' market position analysis.

The rail industry is evolving due to technology, regulations, and trade patterns. Trinity Industries faces challenges like economic downturns and competition but has opportunities in sustainable transport and e-commerce. Strategic responses include tech investments, green designs, and partnerships.

- Technological advancements are crucial for efficiency and safety.

- Regulatory changes impact railcar design and operational costs.

- Economic conditions and competition influence freight volumes.

- Sustainability and e-commerce trends offer growth prospects.

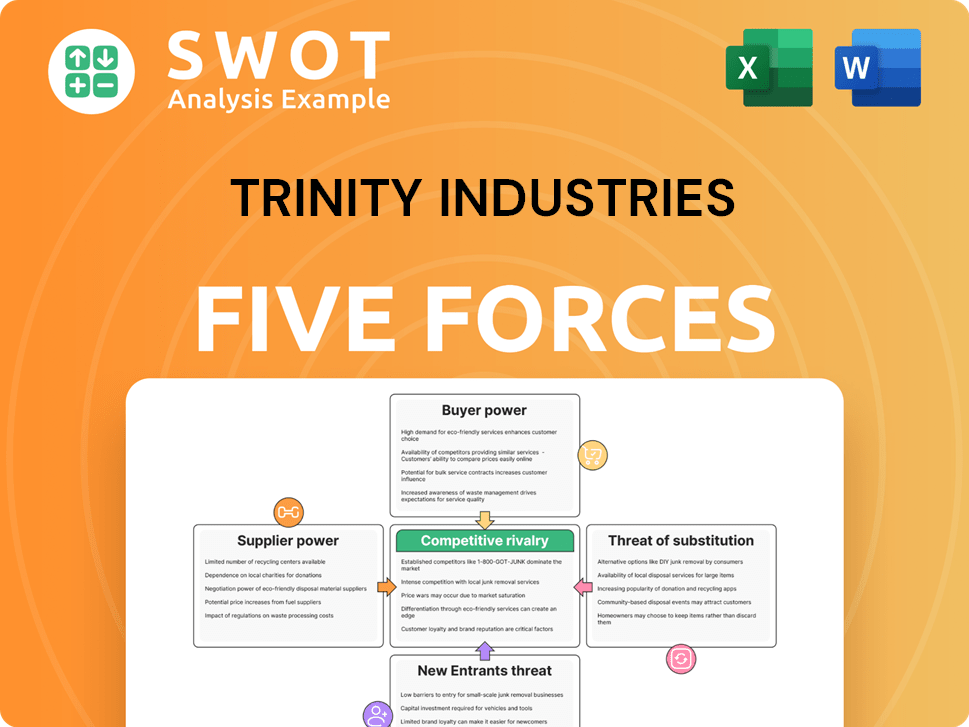

Trinity Industries Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Trinity Industries Company?

- What is Growth Strategy and Future Prospects of Trinity Industries Company?

- How Does Trinity Industries Company Work?

- What is Sales and Marketing Strategy of Trinity Industries Company?

- What is Brief History of Trinity Industries Company?

- Who Owns Trinity Industries Company?

- What is Customer Demographics and Target Market of Trinity Industries Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.