Trinity Industries Bundle

Who Does Trinity Industries Really Serve?

Understanding the Trinity Industries SWOT Analysis is crucial for grasping its customer base. Founded in 1933, Trinity Industries has undergone a significant transformation. From a broad steel fabricator, it now primarily serves the North American rail transportation sector. This evolution reflects a strategic focus on a specific, high-value target market.

This shift in Trinity Industries target market highlights the importance of strategic adaptation. A deep dive into customer demographics and customer segmentation reveals the company's ability to meet evolving market demands. We'll explore the company's customer profile analysis, examining who their main customers are and how they cater to their specific needs. This market analysis will provide valuable insights into Trinity Industries's success.

Who Are Trinity Industries’s Main Customers?

Understanding the customer demographics and target market of Trinity Industries involves recognizing its business-to-business (B2B) focus within the North American rail transportation sector. Their primary customers are not defined by age, gender, or income, but rather by their industry, operational scale, and specific logistical needs. This targeted approach allows Trinity Industries to tailor its products and services to meet the unique demands of each sector.

The Trinity Industries target market primarily includes large corporations and enterprises that rely on railcars for shipping goods or require railcar leasing services. These customers are typically involved in industries such as energy, chemicals, agriculture, transportation, and construction. These sectors are crucial because they have consistent demands for specialized railcars to transport various commodities efficiently. A deep dive into Trinity Industries' customer profile analysis reveals how these industries drive the company's revenue.

The largest share of revenue for Trinity Industries comes from its railcar manufacturing and leasing businesses. This indicates that companies with significant shipping volumes or those seeking flexible fleet management solutions represent their most significant customer groups. For example, chemical companies transporting hazardous materials or agricultural firms moving bulk commodities are key clients due to their consistent demand for specialized railcars. For insights into their growth strategies, you can explore the Growth Strategy of Trinity Industries.

Key customer segments include energy, chemical, agriculture, transportation, and construction. These sectors require railcars for shipping goods or railcar leasing services. The demand is consistent, especially in sectors like chemicals and agriculture.

Railcar manufacturing and leasing are the primary revenue drivers. Companies with high shipping volumes and those needing flexible fleet management are key. Chemical and agricultural firms are significant clients due to their consistent needs.

Market shifts influence target segments, such as energy market fluctuations. Increased crude oil production boosts tank car demand. Changes in agricultural trade impact demand for covered hoppers.

Trinity Industries focuses on industrial sectors, adapting to evolving transportation demands. This focus ensures they meet the changing needs of their core customer base. Their ability to adapt is crucial for sustained success.

Market analysis reveals that Trinity Industries' customer base is heavily concentrated in industries with high transportation needs. Key clients include major players in the energy sector, which often require specialized tank cars for transporting crude oil and other petroleum products. The agricultural sector, particularly those involved in the movement of grains and other bulk commodities, also forms a significant portion of their customer base. The construction sector, requiring flat cars and other specialized railcars, is another important segment.

- Energy Sector: Demand for tank cars.

- Agriculture: Demand for covered hoppers.

- Chemicals: Consistent need for specialized railcars.

- Transportation: Companies requiring railcar leasing.

- Construction: Use of flat cars and other specialized railcars.

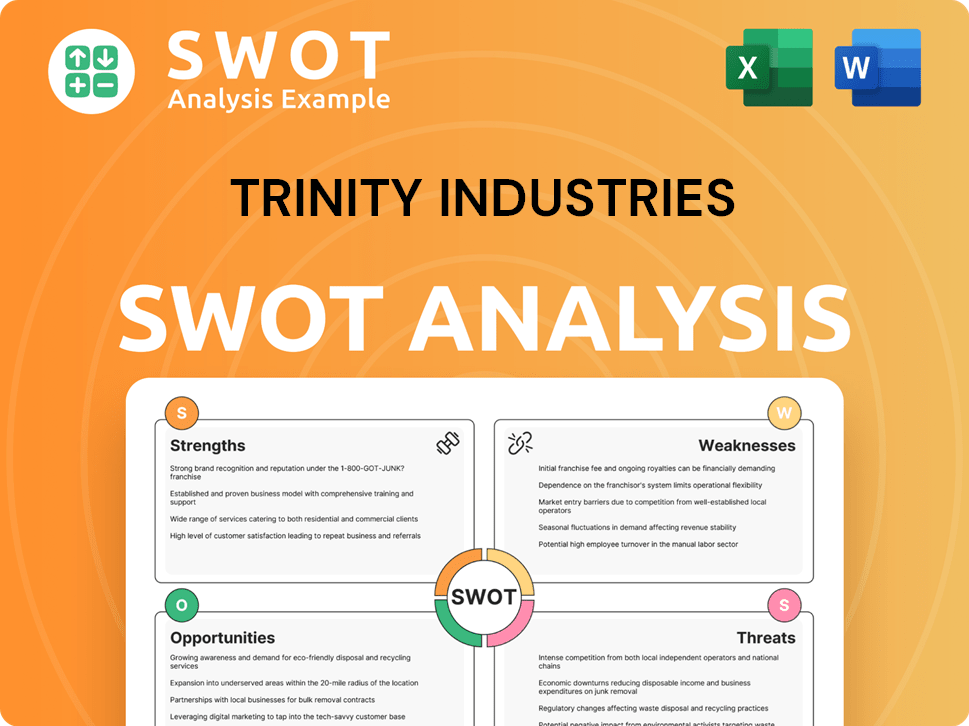

Trinity Industries SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Trinity Industries’s Customers Want?

Understanding the customer needs and preferences is crucial for any business, and for Trinity Industries, this means focusing on the rail transportation sector. The primary drivers for their customers revolve around efficiency, reliability, safety, and cost-effectiveness. This focus helps Trinity Industries maintain its position in the market.

The target market for Trinity Industries includes sectors like energy, chemicals, agriculture, and construction. These industries require specialized railcars designed to transport specific goods safely and efficiently. Their purchasing decisions are influenced by factors such as railcar capacity, regulatory compliance, and maintenance requirements.

The primary needs of Trinity Industries' customers are centered on efficient and safe rail transportation. Customers are looking for solutions that minimize downtime and ensure regulatory compliance. This leads to long-term asset utilization, with railcars often used for decades, highlighting the importance of consistent performance and strong customer service.

Customers prioritize efficiency, reliability, and safety in rail transportation. They also need cost-effective solutions for moving goods. These needs drive purchasing decisions.

Customers are motivated by the need to transport goods safely and efficiently. They also seek solutions that minimize operational costs and ensure regulatory compliance. Long-term asset utilization is a key factor.

Customers prefer railcars tailored to their specific industry and cargo type. They value strong customer service and tailored solutions. This leads to long-term relationships.

Purchasing decisions are influenced by railcar capacity, regulatory compliance, and maintenance needs. The total cost of ownership, including acquisition and operational costs, is a critical factor. Leasing and purchasing agreements are also important.

Railcars are used as long-term assets, often in service for decades. Consistent performance and strong customer service build loyalty. Tailored solutions are also key.

Customers face fleet management complexities, maintenance burdens, and regulatory compliance challenges. These are addressed through comprehensive leasing and service offerings. These offerings help to solve the pain points.

The company addresses common pain points through its railcar leasing and service offerings, tailoring its offerings to meet specific needs. For example, chemical companies prioritize railcars designed to stringent safety standards for hazardous materials, while agricultural clients focus on efficient loading and unloading mechanisms. Feedback from customers, along with market trends in commodity production and transportation logistics, directly influences product development, leading to innovations in railcar design and material handling. To further understand the market, one can review a detailed investor presentation from the company.

Trinity Industries provides a diverse fleet of railcars, including tank cars, covered hoppers, and gondolas, each designed to meet the specific needs of different industries and cargo types. This approach allows the company to serve a broad range of customers.

- Chemical Industry: Prioritizes safety and specialized tank cars.

- Agricultural Sector: Focuses on efficient loading and unloading mechanisms.

- Energy Sector: Needs robust railcars for transporting various energy products.

- Construction: Requires railcars suitable for transporting construction materials.

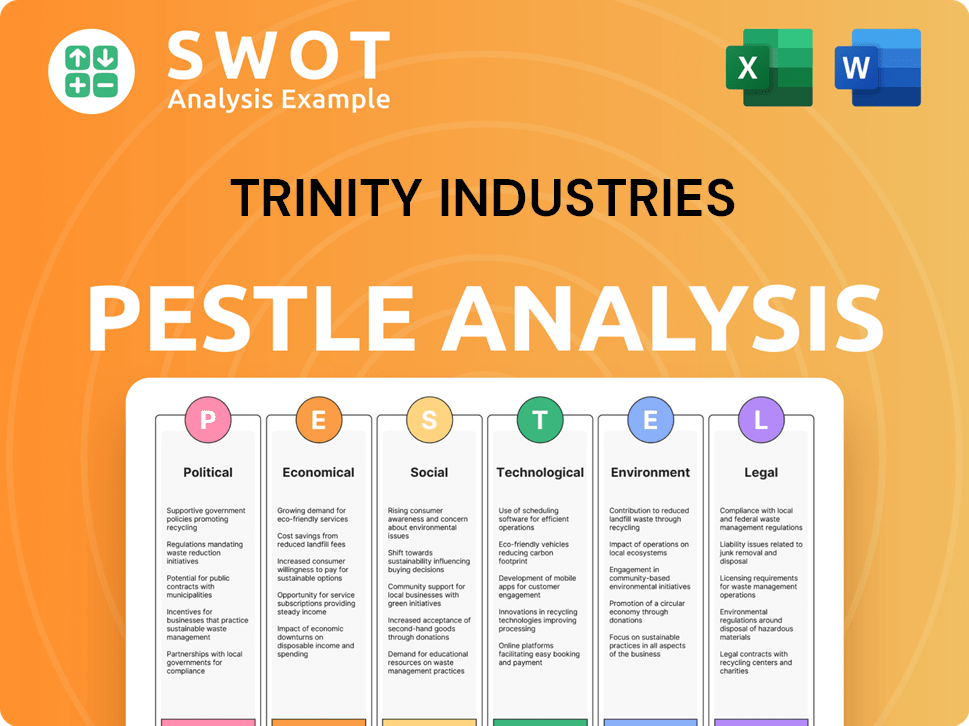

Trinity Industries PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Trinity Industries operate?

The geographical market presence of Trinity Industries is primarily concentrated in North America. This encompasses the United States, Canada, and Mexico, with the strongest market share and brand recognition within these regions. The company focuses on areas with significant industrial activity, particularly those involved in energy production, agriculture, and chemical manufacturing.

Key operational areas for Trinity Industries include major rail corridors and industrial hubs across the U.S. Midwest, Gulf Coast, and Canadian prairies. This strategic focus allows the company to leverage established infrastructure and customer relationships, ensuring efficient delivery and maintenance of its products.

While Trinity Industries' competitors may have different geographical focuses, Trinity Industries maintains a strong presence in North America. The distribution of sales and growth largely mirrors the distribution of industrial output and rail freight volumes across these North American markets.

The primary focus is on the North American market, including the United States, Canada, and Mexico. This strategic decision allows for better customer service and logistics.

Customer demographics and preferences vary regionally, but the core customer base remains B2B industrial clients. Specific railcar demands are influenced by regional commodity production, such as oil and gas in Texas.

Manufacturing and service facilities are strategically located near major rail networks and customer bases. This ensures efficient delivery and maintenance services, improving customer satisfaction.

The company's market share and brand recognition are strongest in regions with significant industrial activity. This is a result of the company's focus on the North American market.

The company’s geographic strategy is closely tied to its target market, ensuring that its products and services meet the specific needs of its customers. The company's approach includes a deep understanding of customer segmentation and customer acquisition strategies.

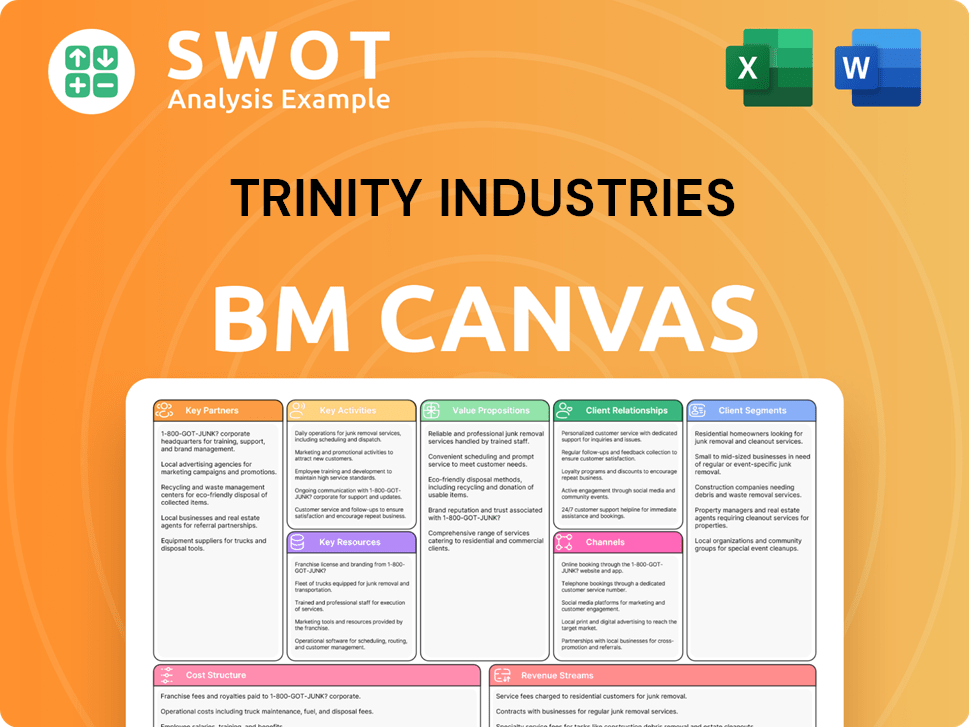

Trinity Industries Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Trinity Industries Win & Keep Customers?

The focus of customer acquisition and retention at Trinity Industries centers on its business-to-business (B2B) model, primarily targeting the rail transportation sector. Their strategies are tailored to the specific needs of industrial clients. This involves direct sales teams, strategic partnerships, and a strong emphasis on service and reliability, given the specialized nature of their offerings.

Customer acquisition often involves long sales cycles due to the significant capital investment associated with railcar purchases or long-term leasing agreements. Building strong relationships and demonstrating expertise in railcar design, manufacturing, and maintenance are paramount. For retention, Trinity Industries focuses on providing comprehensive after-sales support, including maintenance and repair services through its extensive network.

Successful retention initiatives are often tied to the reliability and longevity of their railcars, as well as the efficiency of their leasing and maintenance operations, contributing to high customer lifetime value within this specialized industrial sector. The company utilizes customer data, though not in the typical B2C sense, to understand fleet utilization patterns and anticipate future needs, thereby enabling proactive service and renewal discussions.

Direct sales teams are crucial for engaging with large industrial clients. These teams understand specific rail transportation needs. This approach facilitates customized solutions and long-term partnerships, essential for acquiring and retaining customers.

Partnerships with key players in the logistics and transportation industries are vital. These collaborations can enhance market reach and offer integrated solutions. They also provide access to a broader customer base within the target market.

Comprehensive after-sales support, including maintenance and repair services, is a key retention strategy. A strong service network ensures customer satisfaction and extends the lifespan of railcars. This approach is crucial for fostering long-term customer relationships.

Analyzing customer data to understand fleet utilization patterns is essential. This enables proactive service and renewal discussions. This data-driven approach helps anticipate future needs and improve customer service.

Understanding the customer demographics is crucial for companies like Trinity Industries. Their target market consists primarily of businesses involved in rail transportation, including freight companies, leasing companies, and industrial manufacturers. A detailed market analysis provides insights into customer needs and preferences, which is essential for effective customer acquisition strategies. The focus is on building long-term relationships and providing reliable service.

The main customer segments include freight companies, which use railcars for transporting goods. Leasing companies also form a significant portion, providing railcars to various industries. Industrial manufacturers are another crucial segment, often requiring specialized railcars.

Direct sales teams engage with potential clients, understanding their needs. Industry trade shows and specialized publications provide platforms to reach the target audience. Digital platforms and online marketing are also used to connect with logistics professionals.

Providing comprehensive after-sales support, including maintenance and repair services. Offering flexible leasing options and preferred customer agreements. Proactive technical support and anticipating future needs through data analysis.

Regular market research helps understand customer needs and preferences. Analyzing industry trends and competitor activities is essential. This data informs product development and service improvements.

Focusing on the reliability and longevity of railcars increases customer lifetime value. Efficient leasing and maintenance operations contribute to long-term customer relationships. High customer lifetime value is a key measure of success.

Using customer data to understand fleet utilization and anticipate future needs. This approach enables proactive service and renewal discussions. Data analytics is crucial for informed decision-making.

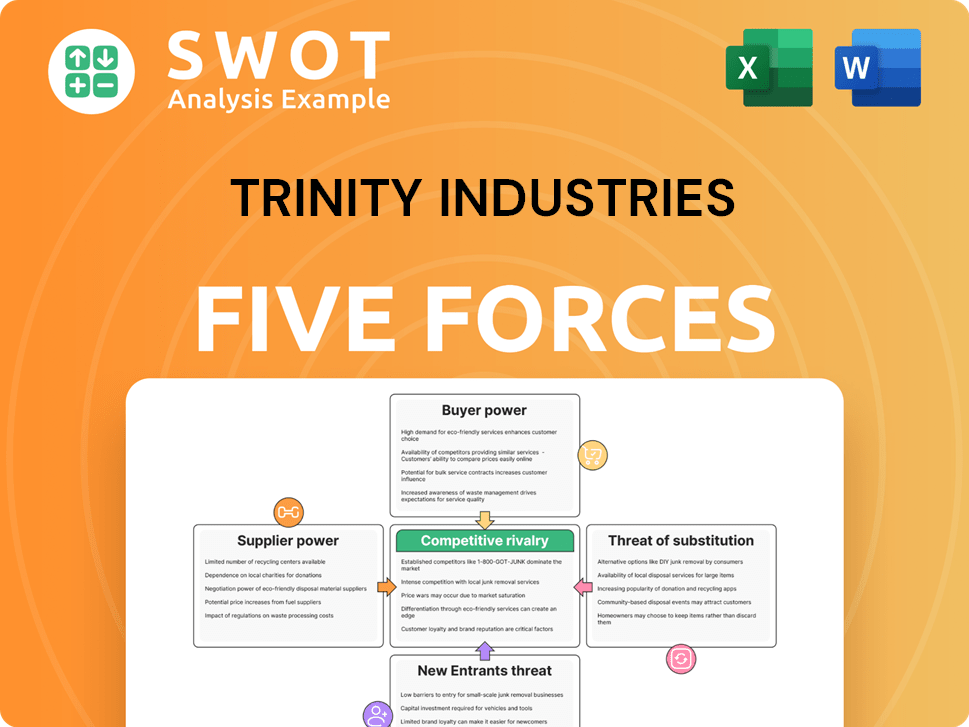

Trinity Industries Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Trinity Industries Company?

- What is Competitive Landscape of Trinity Industries Company?

- What is Growth Strategy and Future Prospects of Trinity Industries Company?

- How Does Trinity Industries Company Work?

- What is Sales and Marketing Strategy of Trinity Industries Company?

- What is Brief History of Trinity Industries Company?

- Who Owns Trinity Industries Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.