Tyson Foods Bundle

Can Tyson Foods Maintain Its Dominance in a Crowded Market?

Tyson Foods, a titan in the global protein industry since 1935, has built an empire on chicken, beef, and pork. From its humble beginnings, the company has transformed into a multinational food processing giant. But how does Tyson Foods navigate the complex Tyson Foods SWOT Analysis and intense competition in today's dynamic market?

This analysis dives deep into the Tyson Foods competitive landscape, providing a comprehensive market analysis of its position within the meat industry competition. We'll explore who the Tyson Foods competitors are, examining their strategies and how Tyson differentiates itself. Understanding these dynamics is crucial for anyone seeking insights into the company's performance and future prospects, including its Tyson Foods market share 2024 and strategic positioning.

Where Does Tyson Foods’ Stand in the Current Market?

Tyson Foods holds a significant market position within the global protein industry, particularly in North America. It is recognized as one of the largest processors and marketers of chicken, beef, and pork worldwide. This places it at the forefront of the meat industry competition.

The company's core operations revolve around processing and distributing a wide array of protein products. These include fresh meats, prepared foods under well-known brands such as Tyson, Jimmy Dean, and Hillshire Farm, and a growing presence in alternative proteins. Its value proposition centers on providing high-quality, accessible protein products to retail consumers, foodservice operators, and industrial customers. For a deeper understanding of the company's ownership structure, you can explore Owners & Shareholders of Tyson Foods.

Tyson Foods' extensive geographic presence spans across North America and includes a substantial international footprint, allowing it to serve a diverse customer base effectively.

Tyson Foods consistently ranks among the top players in its core segments. The company is a leading producer of chicken, beef, and pork in the United States, showcasing its strong market share. This position is a key factor in the overall Tyson Foods competitive landscape.

The company's product lines include fresh meats, prepared foods, and a growing presence in alternative proteins. This diversification strategy helps Tyson Foods navigate the volatility of the meat industry competition. It provides a buffer against fluctuations in specific protein markets.

In fiscal year 2023, Tyson Foods reported sales of $52.8 billion. This financial performance underscores its substantial presence within the food industry and its ability to maintain financial resilience. Understanding Tyson Foods' financial performance is crucial for a comprehensive Tyson Foods market analysis.

Tyson Foods has strategically emphasized diversification beyond fresh meat into higher-margin prepared foods. This move reflects a focus on value-added products and adaptation to evolving consumer preferences. This strategic positioning is a key aspect of its business strategy analysis.

Tyson Foods' market position is influenced by several factors, including its scale, diversified offerings, and strategic focus on value-added products. Its strong presence in North America and its international footprint contribute to its competitive advantages and disadvantages. The company's ability to adapt to market trends and consumer preferences is essential for long-term success.

- Market Share: Tyson Foods holds a leading market share in key protein categories, particularly in the U.S.

- Product Portfolio: The company's diverse product portfolio, including fresh meats, prepared foods, and alternative proteins, enhances its market position.

- Financial Strength: With reported sales of $52.8 billion in fiscal year 2023, Tyson Foods demonstrates substantial financial strength.

- Strategic Initiatives: The company's focus on value-added products and international expansion supports its competitive positioning.

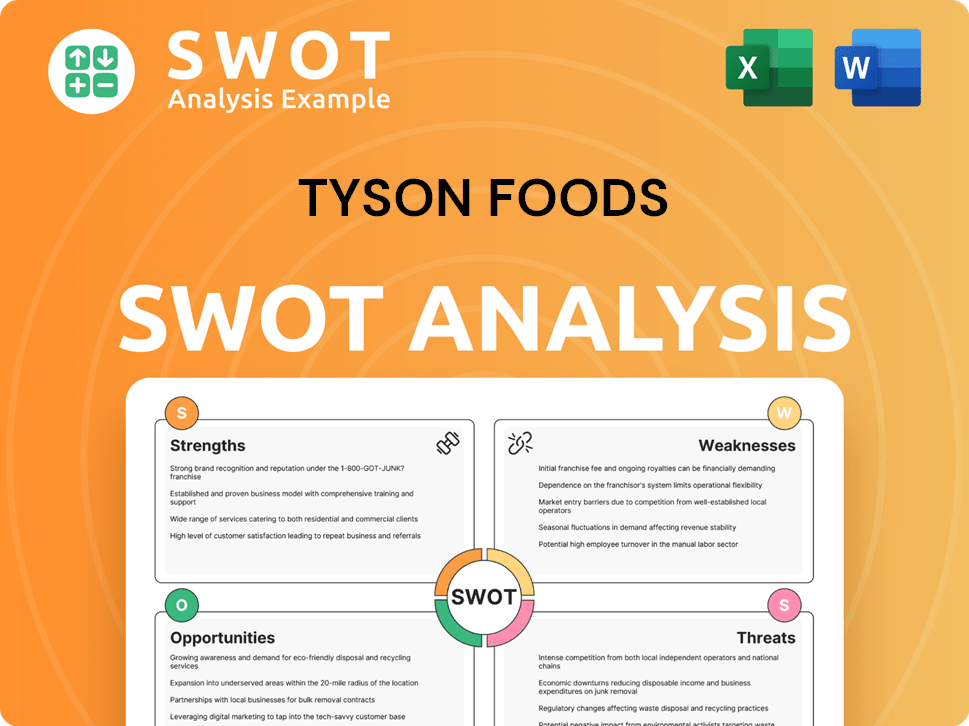

Tyson Foods SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Tyson Foods?

The competitive landscape for Tyson Foods is complex, shaped by a mix of direct and indirect rivals across its diverse business segments. A thorough understanding of the Tyson Foods competitive landscape is crucial for assessing its market position and future prospects. This analysis considers both traditional meat industry competitors and emerging players challenging the status quo.

Tyson Foods market analysis reveals a dynamic environment where competition drives innovation and influences strategic decisions. The company's ability to navigate this landscape is critical for maintaining and growing its market share. This involves adapting to shifts in consumer preferences, supply chain dynamics, and technological advancements within the food industry.

Tyson Foods competitors span various sectors, from established meatpackers to innovative plant-based protein companies. The intensity of competition varies across different product categories, with poultry, beef, and pork markets each presenting unique challenges and opportunities. Understanding these competitive pressures is essential for evaluating Tyson's performance and strategic direction.

In the poultry sector, Tyson Foods faces strong competition. Key rivals include Pilgrim's Pride Corporation, Wayne-Sanderson Farms, and Perdue Farms. These companies compete on factors like production scale, product offerings, and brand reputation.

The beef and pork segments see intense competition from major players. JBS S.A. and Cargill are significant competitors, leveraging their extensive processing capabilities and global reach. These companies often compete on price and volume.

Tyson Foods also faces indirect competition from the plant-based protein sector. Companies like Beyond Meat and Impossible Foods are gaining traction, impacting the traditional protein market. This shift requires strategic adaptation.

Tyson Foods market share 2024 is influenced by the performance of its competitors and overall market trends. The company's ability to maintain or grow its market share depends on its strategic responses to competitive pressures.

Mergers and alliances reshape the competitive environment. The formation of Wayne-Sanderson Farms, for example, has created a larger, more integrated competitor. These changes can significantly impact market dynamics.

To maintain its position, Tyson Foods must continually evaluate its strategies. This includes innovation, supply chain optimization, and adapting to changing consumer demands. The company's ability to respond to these challenges will determine its future success.

Several factors drive competition in the meat industry competition. These include production capacity, distribution networks, pricing strategies, and brand reputation. Tyson Foods must excel in these areas to remain competitive.

- Production Capacity: The ability to produce large volumes of meat efficiently.

- Distribution Networks: Effective logistics and supply chain management.

- Pricing Strategies: Competitive pricing to attract customers.

- Brand Reputation: Building trust and loyalty among consumers.

For a deeper understanding of how Tyson Foods approaches its growth and strategy, consider reading Growth Strategy of Tyson Foods. This article provides additional insights into the company's strategic initiatives and market positioning.

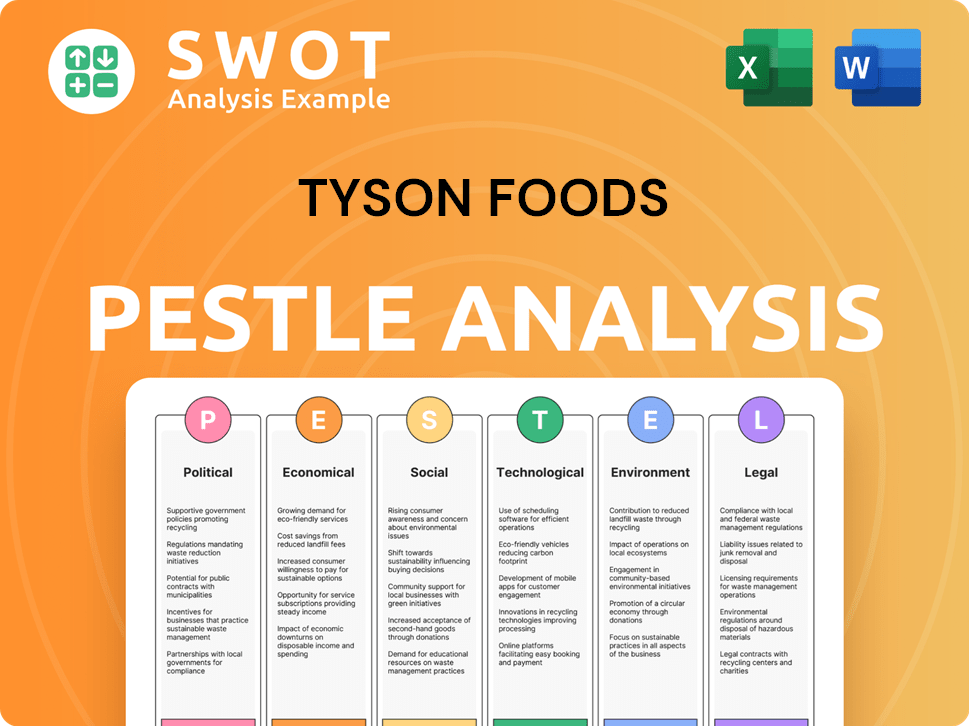

Tyson Foods PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Tyson Foods a Competitive Edge Over Its Rivals?

Understanding the Tyson Foods competitive landscape involves recognizing its core strengths. The company's substantial scale and extensive distribution network are significant advantages. As one of the largest meat processors globally, Tyson benefits from economies of scale in procurement, processing, and logistics, which can lead to lower per-unit costs compared to smaller rivals. Its vast distribution network enables efficient reach across retail, foodservice, and international markets.

Another key aspect of Tyson Foods market analysis is its strong brand portfolio. Brands such as Tyson, Jimmy Dean, and Hillshire Farm have considerable brand equity and consumer loyalty, helping to secure shelf space and consumer preference. This recognition is a result of years of marketing investment and consistent product quality. The company's integrated supply chain, from animal sourcing to packaged products, also provides a degree of control over quality and consistency, though it also exposes them to commodity price fluctuations.

Tyson Foods' competitive advantages and disadvantages are constantly evolving. The company's investments in innovation, particularly in prepared foods and alternative proteins, allow it to adapt to changing consumer preferences and create new revenue streams. The meat industry competition is intense, and Tyson's ability to innovate within its product lines and explore new categories helps it maintain its market position. However, these advantages face ongoing threats from competitors who also pursue scale, brand building, and innovation, requiring continuous investment and adaptation.

Tyson's massive scale allows for cost efficiencies. Its extensive distribution network ensures broad market reach. This network is crucial for delivering products efficiently to various customer segments.

Strong brands like Tyson and Jimmy Dean drive consumer preference. These brands have built-in consumer loyalty, which is a significant advantage. Brand recognition supports market share and pricing power.

Investment in new product development is key to staying relevant. Innovation in prepared foods and alternative proteins helps Tyson adapt. This focus supports long-term growth and market relevance.

The integrated supply chain provides control over quality. It helps manage costs and ensure consistent product standards. This integration is vital for operational efficiency.

Tyson Foods competitors are constantly evolving, requiring Tyson to adapt. Commodity price volatility and changing consumer preferences pose ongoing challenges. The company must continuously invest in innovation and operational efficiency to maintain its competitive edge. For a deeper dive into the company's history, consider reading the Brief History of Tyson Foods.

- Market Dynamics: The meat industry is highly competitive, with fluctuating commodity prices impacting profitability.

- Consumer Trends: Shifting consumer preferences towards plant-based proteins and health-conscious options require adaptation.

- Operational Efficiency: Maintaining and improving supply chain efficiency is critical for cost management and product quality.

- Sustainability: Addressing environmental concerns and promoting sustainable practices are increasingly important.

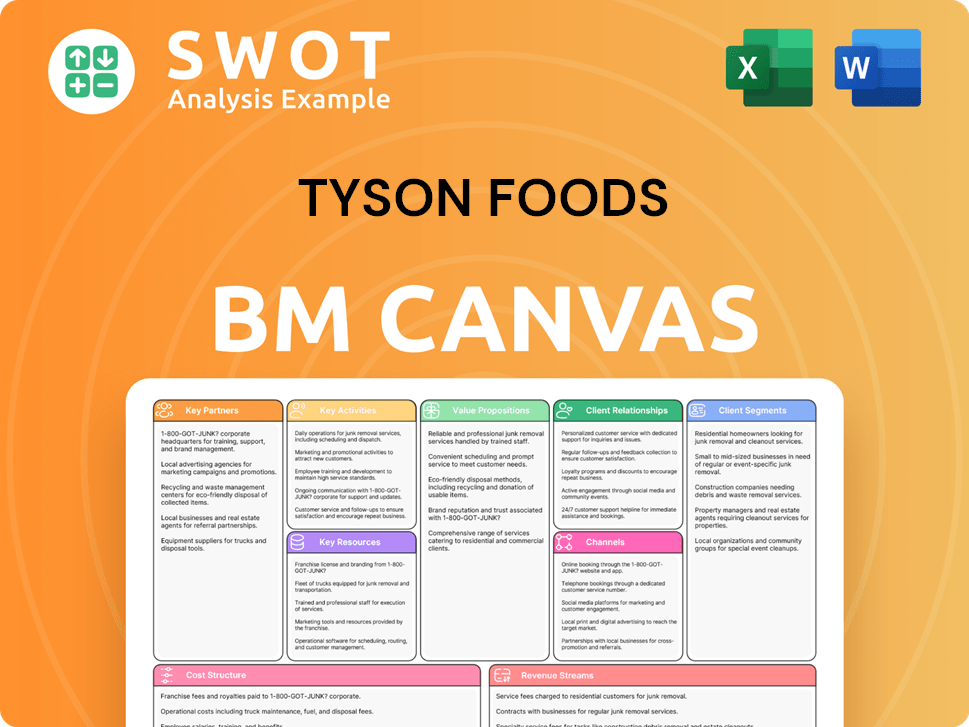

Tyson Foods Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Tyson Foods’s Competitive Landscape?

The competitive landscape for Tyson Foods is shaped by evolving industry trends, future challenges, and significant opportunities. The Target Market of Tyson Foods faces a dynamic environment influenced by technological advancements, shifting consumer preferences, and regulatory changes. Understanding these factors is crucial for assessing the company's strategic positioning and future prospects. A thorough Tyson Foods market analysis is essential to navigate the complexities of the meat industry.

The meat industry is currently experiencing several key shifts. These include increased demand for sustainable and plant-based protein options, which presents both challenges and opportunities. Regulatory pressures related to animal welfare and environmental impact are also increasing. Furthermore, global economic factors, such as trade policies and fluctuating commodity prices, significantly influence the company's profitability and market access. Analyzing Tyson Foods competitors and their strategies is crucial for maintaining a competitive edge.

Technological advancements, such as automation and data analytics, are driving efficiency. Consumer demand is shifting towards sustainable and plant-based protein options. Regulatory changes concerning animal welfare and environmental impact are also significant. Global economic shifts, including trade policies, impact profitability.

Further growth in alternative proteins and cellular agriculture could intensify competition. Sustained declines in per capita meat consumption in developed markets pose a threat. Increased competition from international players and the volatility of feed costs are ongoing concerns. Global disease outbreaks affecting livestock could disrupt supply chains.

Emerging markets with rising protein demand offer significant growth potential. Continued innovation in value-added and prepared foods can drive revenue. Strategic partnerships can facilitate expansion into new product categories and geographies. Leveraging technological advancements to enhance operational efficiency and reduce costs.

Tyson Foods is diversifying its product portfolio, investing in sustainable practices, and expanding its global footprint. These strategies aim to capitalize on opportunities and mitigate challenges. The company's ability to adapt to changing consumer preferences and market dynamics will be crucial for future success. A proactive approach to these factors is essential for long-term growth.

To maintain its competitive position, Tyson Foods must focus on several key areas. These include innovation, sustainability, and global expansion. A robust Tyson Foods SWOT analysis is important for strategic planning.

- Diversifying product offerings to include more plant-based and value-added options.

- Investing in sustainable practices to meet evolving consumer and regulatory demands.

- Expanding into emerging markets with high growth potential.

- Optimizing supply chains to mitigate the impact of fluctuating commodity prices.

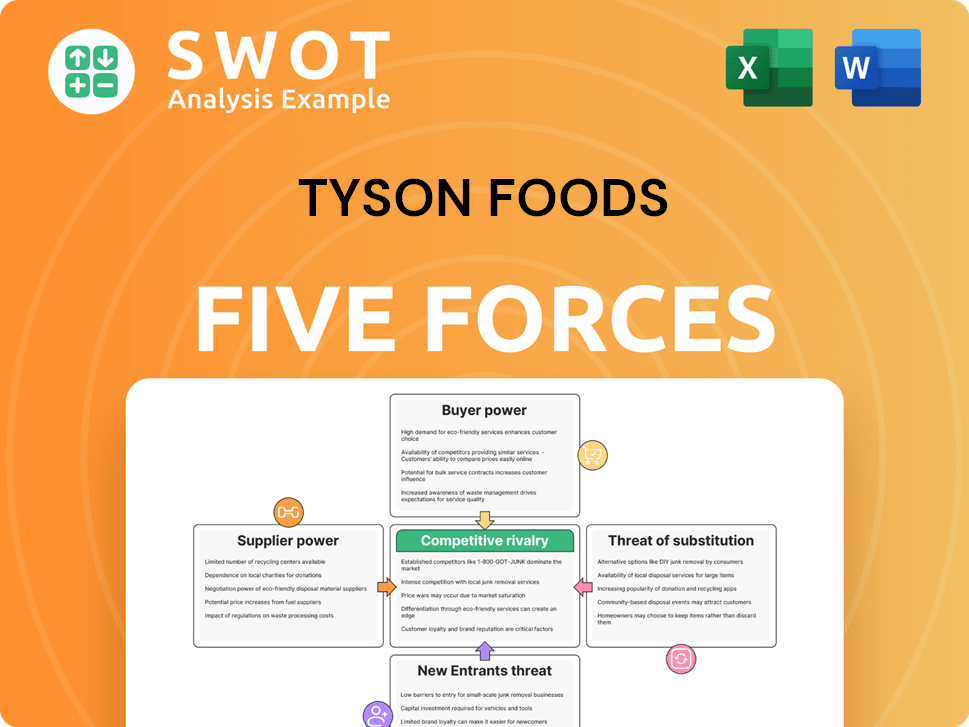

Tyson Foods Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Tyson Foods Company?

- What is Growth Strategy and Future Prospects of Tyson Foods Company?

- How Does Tyson Foods Company Work?

- What is Sales and Marketing Strategy of Tyson Foods Company?

- What is Brief History of Tyson Foods Company?

- Who Owns Tyson Foods Company?

- What is Customer Demographics and Target Market of Tyson Foods Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.