Tyson Foods Bundle

How Does Tyson Foods Thrive in the Food Industry?

Tyson Foods, a titan in the Tyson Foods SWOT Analysis, has been feeding the world for over 85 years. From its humble beginnings, the Tyson Company has grown to become a global force in meat processing, boasting an impressive portfolio of brands. With billions in annual sales and a presence in over 100 countries, understanding the Tyson Foods business model is key to grasping the dynamics of the food production landscape.

This deep dive will explore the intricacies of Tyson Foods, examining its operations, revenue streams, and strategic evolution. We'll uncover how this industry giant navigates the complexities of the poultry industry, from farm to table, and analyze its impact on the global economy. Whether you're curious about how Tyson Foods makes chicken nuggets or interested in its sustainability initiatives, this analysis provides valuable insights.

What Are the Key Operations Driving Tyson Foods’s Success?

The core operations of the Tyson Foods revolve around the production and distribution of protein products. This includes chicken, beef, and pork, along with a growing segment of prepared foods. The company serves a diverse customer base, including retail consumers, foodservice operators, and international markets, making it a significant player in the food production industry.

Tyson Foods' value proposition lies in its integrated approach to meat processing. They manage the entire process from sourcing livestock and poultry to manufacturing and packaging finished products. This vertical integration, particularly in the chicken business, allows for greater control over the supply chain and economies of scale.

The company's main products include fresh and frozen cuts of meat, sausages, bacon, deli meats, and frozen meals. The operational processes involve complex manufacturing and processing facilities with advanced technologies for food safety and quality control. A vast distribution network ensures timely delivery to grocery stores, restaurants, and institutional buyers, making it a key element of the Tyson Foods business model.

Tyson Foods sources livestock and poultry through long-standing relationships with independent farmers. They operate numerous processing plants where animals are processed, cut, and packaged. Advanced technologies are used to ensure food safety and efficient production.

The supply chain is a critical component, involving extensive logistics for transporting raw materials and finished products. Tyson Foods uses a vast distribution network, including its own fleet and third-party logistics providers. This ensures timely delivery to various customers.

Tyson Foods offers a wide variety of products, including fresh and frozen cuts of meat, sausages, bacon, deli meats, and frozen meals. This diverse product range caters to different consumer preferences and market segments.

A key differentiator is its vertically integrated chicken business, providing greater control over the supply chain. This integration, along with its scale in beef and pork, allows for economies of scale and consistent product quality.

Tyson Foods' operational success is driven by its focus on efficiency, food safety, and customer satisfaction. The company's vast network of processing plants and distribution centers ensures that products reach consumers and businesses efficiently. In 2024, Tyson Foods reported revenues of approximately $52.9 billion.

- Meat processing is a core activity, with significant investments in advanced technologies.

- Food production involves a wide range of products, catering to diverse consumer needs.

- The poultry industry is a significant part of Tyson Foods' business, with a vertically integrated model.

- Supply chain management is crucial for the timely delivery of products, leveraging both internal and external logistics.

Tyson Foods SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Tyson Foods Make Money?

The revenue streams and monetization strategies of Tyson Foods are centered around the sale of its protein products. The company generates revenue through its Beef, Pork, Chicken, Prepared Foods, and International/Other segments. In the first quarter of fiscal year 2025, the company reported substantial net sales, demonstrating its significant market presence.

The Tyson Foods business model relies heavily on volume-driven sales, brand recognition, and product innovation. The company leverages its established brand portfolio to secure shelf space and consumer preference in retail channels. Furthermore, it utilizes its scale and product variety to serve a wide range of clients in the foodservice industry. Pricing strategies are influenced by commodity cycles, supply and demand dynamics, and competitive pressures.

Over time, Tyson Foods has strategically focused on its Prepared Foods segment, which typically yields higher margins due to added value and brand equity. This diversification helps reduce its vulnerability to the volatile commodity markets of fresh meat.

In Q1 2025, the company's net sales reached $13.07 billion. The Beef segment contributed $4.75 billion, and Chicken sales were $3.93 billion. Pork sales amounted to $1.41 billion, while the Prepared Foods segment generated $2.36 billion. International/Other sales accounted for $583 million. The company's monetization strategies include volume-driven sales, brand recognition, and product innovation. For more insights, read about the Marketing Strategy of Tyson Foods.

- The Beef segment is a major revenue driver.

- The Chicken segment consistently provides significant sales.

- The Prepared Foods segment offers higher margins and diversification.

- International/Other sales contribute to overall revenue.

Tyson Foods PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Tyson Foods’s Business Model?

The evolution of Tyson Foods, a major player in the meat processing and food production industries, has been marked by significant milestones and strategic shifts. The company's journey includes key acquisitions, adaptations to market changes, and a focus on maintaining its competitive edge within the poultry industry and beyond. Understanding these elements provides insight into how the

A pivotal moment in

The

The acquisition of IBP, Inc. in 2001 was a major step, expanding its beef and pork operations. The 2017 acquisition of AdvancePierre Foods strengthened its prepared foods segment. These acquisitions have been instrumental in shaping its current business structure.

The company has focused on automation to increase efficiency. It has also invested in its supply chain and sustainability programs. These strategic moves reflect a response to market dynamics and consumer expectations.

Its large scale allows for significant economies of scale in procurement and distribution. Strong brand recognition, with brands like Tyson and Jimmy Dean, boosts consumer loyalty. Vertical integration in its chicken business provides a competitive advantage.

Tyson Foods is investing in plant-based protein alternatives. It is also exploring new technologies for food production. The company is also expanding its global presence to meet rising international demand.

In fiscal year 2024,

- Tyson Foods' market capitalization as of May 2024 was around $20 billion.

- The company operates numerous processing plants across the United States and internationally, ensuring a broad distribution network.

has been focusing on reducing its environmental impact, with goals for water usage and greenhouse gas emissions. - The company's financial performance is closely tied to factors such as commodity prices, consumer demand, and operational efficiency.

Tyson Foods Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Tyson Foods Positioning Itself for Continued Success?

Tyson Foods, a major player in the global protein industry, holds a significant market position. It is consistently among the largest producers of chicken, beef, and pork, with a substantial market share across various categories. The company's global presence extends to over 100 countries, solidifying its international reach.

However, the company faces several key risks, including volatility in commodity prices and regulatory changes. The emergence of new competitors, especially in plant-based proteins, and changing consumer preferences pose additional challenges. Supply chain disruptions, such as those experienced during the COVID-19 pandemic, highlight the vulnerability of large-scale food production.

Tyson Foods is a leading company in the poultry industry. It maintains a strong market share in the beef, chicken, and pork sectors. The company's extensive distribution networks and brand recognition support its dominant position in the meat processing industry.

Tyson Foods faces risks from fluctuating commodity prices and regulatory changes. Competition from plant-based protein companies and shifting consumer preferences also pose challenges. Supply chain disruptions and potential food safety issues can impact the company's operations.

Tyson Foods is focused on operational efficiency and strategic investments. The company is expanding its prepared foods segment and growing in international markets. Innovation, sustainability, and meeting consumer needs are key priorities for long-term success.

In fiscal year 2023, Tyson Foods reported revenues of approximately $52.8 billion. The company's operating income was about $2.5 billion. Net debt stood at roughly $8.4 billion. These figures reflect the company's scale and financial health in a competitive market.

Tyson Foods is investing in automation and technology to enhance efficiency. The company is focused on strengthening its prepared foods segment. It is also actively pursuing growth in international markets, especially in Asia.

- Investing in automation to improve operational efficiency.

- Expanding the prepared foods segment for higher margins.

- Focusing on international market growth, particularly in Asia.

- Prioritizing innovation, sustainability, and consumer needs.

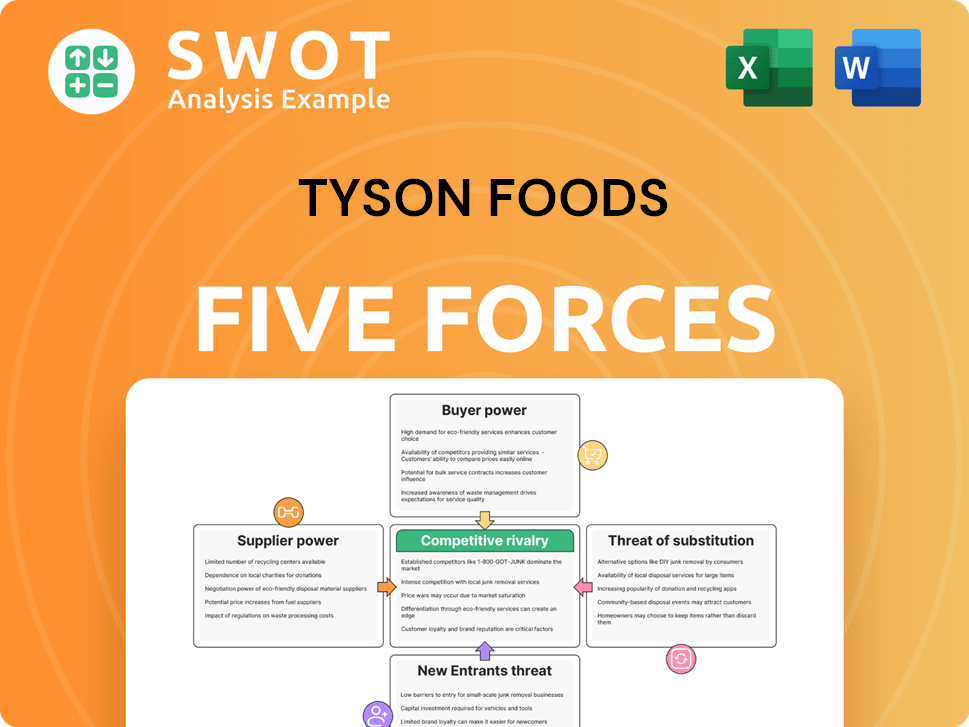

Tyson Foods Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Tyson Foods Company?

- What is Competitive Landscape of Tyson Foods Company?

- What is Growth Strategy and Future Prospects of Tyson Foods Company?

- What is Sales and Marketing Strategy of Tyson Foods Company?

- What is Brief History of Tyson Foods Company?

- Who Owns Tyson Foods Company?

- What is Customer Demographics and Target Market of Tyson Foods Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.