Unum Group Bundle

How Does Unum Group Stack Up in the Cutthroat Insurance Arena?

In an era of economic flux and evolving employee expectations, understanding the competitive dynamics of financial protection providers is paramount. Unum Group, a stalwart in the insurance industry since 1848, offers a comprehensive suite of financial protection benefits, including disability, life, and critical illness coverage. But how does Unum navigate the complex Unum Group SWOT Analysis to stay ahead?

This analysis dives deep into the Unum Group competitive landscape, providing a detailed market analysis to identify Unum Group competitors and their strategies. We'll dissect Unum Group's business strategy and evaluate its financial performance against key rivals to determine its position in the group benefits market. Our goal is to equip you with actionable insights into Unum Group's industry analysis, including its strengths, weaknesses, and growth strategies within a challenging competitive environment.

Where Does Unum Group’ Stand in the Current Market?

Unum Group holds a significant market position within the financial protection benefits sector. Its core operations center around providing group disability and life insurance, making it a key player in the industry. The company's value proposition lies in offering comprehensive benefits solutions to employers, supporting their employees with financial security.

The company primarily operates in the United States, the United Kingdom, and Poland, serving employer-sponsored groups. Unum strategically positions itself by enhancing digital capabilities and expanding voluntary benefits offerings. This approach reflects a broader industry trend towards personalized and flexible employee benefits, ensuring it remains competitive in the market.

Unum's financial performance demonstrates its strong foothold in its core markets. In the first quarter of 2024, the company reported an adjusted operating income of $440.6 million. Premium income increased by 4.1% to $3.1 billion compared to the same period in the previous year, underscoring its robust financial health. The Unum US segment saw a 4.4% increase in premium income, reaching $1.9 billion in the first quarter of 2024.

Unum consistently ranks among the top providers in the U.S. for group disability income insurance. While specific market share figures fluctuate, its strong presence is well-established. The company’s ability to maintain a leading position highlights its competitive advantages.

Unum's primary product lines include group long-term and short-term disability, group life, and voluntary benefits. Voluntary benefits include accident, critical illness, and hospital indemnity, as well as dental and vision insurance. This diverse portfolio allows Unum to cater to a wide range of employee needs.

The United States accounts for the majority of Unum's business. The company also maintains a significant presence in the United Kingdom and Poland. This geographic diversification supports its overall market position and growth potential.

Unum primarily serves employer-sponsored groups, ranging from small businesses to large corporations. This focus allows the company to build strong relationships with employers. Offering benefits solutions to their employees is a core aspect of its business model.

Unum's financial performance showcases its strength and strategic focus. The company's adjusted operating income was $440.6 million in the first quarter of 2024. Overall premium income increased by 4.1% to $3.1 billion. These figures demonstrate Unum's solid financial health and its strong market position. To learn more about the company's strategic direction, consider reading about the Growth Strategy of Unum Group.

- Unum US segment saw a 4.4% increase in premium income, reaching $1.9 billion in Q1 2024.

- The company continues to invest in digital capabilities and expand voluntary benefits.

- These initiatives support Unum's competitive position and growth strategies.

- Unum's focus on employer-sponsored groups helps maintain its market share.

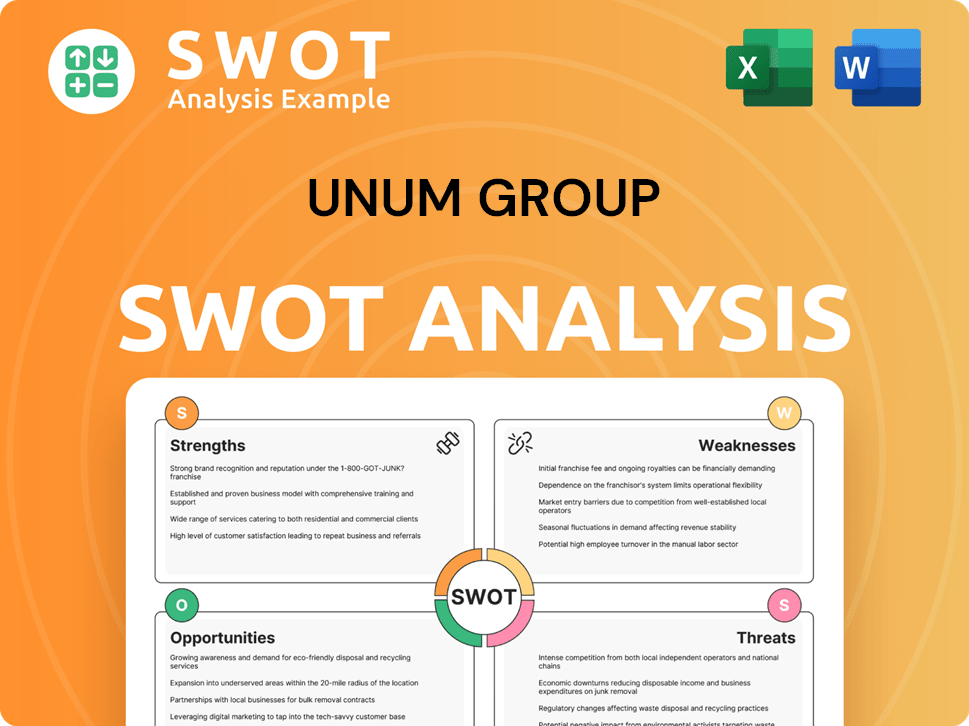

Unum Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Unum Group?

The Marketing Strategy of Unum Group operates within a highly competitive financial protection benefits market. This landscape is shaped by both direct and indirect competitors, requiring Unum to constantly adapt its business strategy. Understanding the Unum Group competitive landscape is crucial for assessing its market position and future prospects.

Unum Group faces challenges from established insurance carriers and emerging players. Its market analysis reveals a need for continuous innovation and strategic partnerships. The company's financial performance is directly influenced by its ability to compete effectively in this dynamic environment.

Direct competitors include large, well-established insurance carriers that offer similar group and individual benefits. These rivals often compete on scale, product offerings, and customer service. The competitive advantages of Unum Group in the US are continuously tested by these major players.

Lincoln Financial Group is a significant competitor, offering life insurance, annuities, and employee benefits. It often competes with Unum on scale and integrated solutions. As of late 2023, Lincoln Financial reported total revenues of approximately $19.9 billion.

MetLife is a formidable rival with a broad portfolio including life insurance and employee benefits. MetLife's group benefits segment competes directly with Unum. In 2023, MetLife's total revenues were around $68.9 billion.

Prudential Financial offers a wide array of group insurance products. Prudential leverages its brand recognition and distribution networks. Prudential reported total revenues of approximately $51.8 billion in 2023.

The Hartford is a key competitor in the group disability and property & casualty insurance space. The Hartford often bundles its offerings to attract and retain clients. The Hartford's total revenues were around $22.2 billion in 2023.

Aflac is known for its supplemental insurance products and increasingly competes in the voluntary benefits arena. Aflac's total revenues for 2023 were about $24.9 billion.

Insurtech startups are disrupting the traditional landscape by offering more streamlined, technology-driven solutions. This puts pressure on established players like Unum to accelerate their digital transformation. The rise of these players is a key factor in Unum Group's industry analysis.

These competitors challenge Unum through various strategies, including competitive pricing and continuous innovation. Unum Group's strengths and weaknesses analysis reveals areas for improvement. The push towards digital platforms is a common battleground. Mergers and alliances reshape competitive dynamics.

- Competitive Pricing: Offering competitive premiums to attract and retain customers.

- Product Innovation: Continuously developing new insurance products and features.

- Digital Transformation: Enhancing customer experience through online platforms and mobile apps.

- Distribution Channels: Leveraging strong distribution networks to reach a wider audience.

- Brand Recognition: Building and maintaining a strong brand reputation.

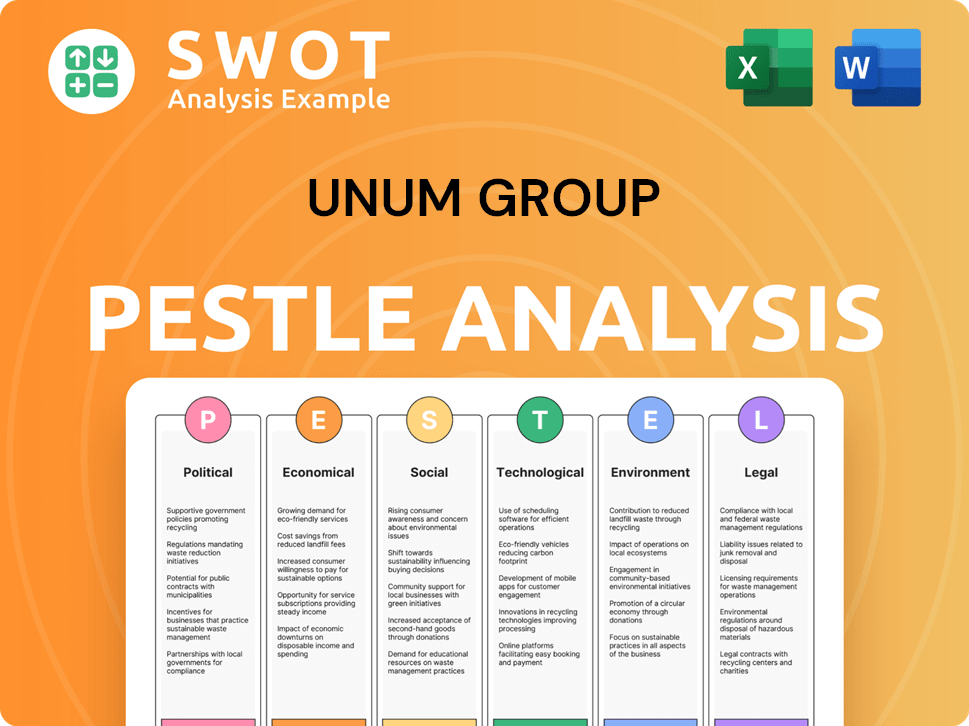

Unum Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Unum Group a Competitive Edge Over Its Rivals?

The competitive advantages of the Unum Group are deeply rooted in its extensive experience and strong brand equity. With over 175 years in the financial protection business, Unum has cultivated significant expertise in underwriting, claims management, and risk assessment. This translates into stable and reliable benefit solutions for its clients. Unum's brand is particularly strong in the U.S. group disability market, where it is recognized as a leading provider, a key factor in the Unum Group competitive landscape.

Unum's diversified product portfolio, encompassing disability, life, accident, critical illness, dental, and vision coverage, allows it to offer comprehensive solutions to employers. This often leads to higher client retention and cross-selling opportunities. Its expansive distribution networks, primarily through brokers and consultants, are a key asset, enabling it to reach a vast number of employers and employees across various sectors. These advantages have evolved over time with strategic investments in technology to enhance customer service and streamline operations.

Furthermore, Unum's financial strength and disciplined underwriting practices contribute to its sustainability. The company's consistent profitability and capital position allow it to invest in product innovation and technology, further solidifying its market standing. However, these advantages face threats from imitation by well-capitalized competitors and rapid industry shifts driven by new technologies and changing customer expectations. Unum continuously leverages its deep industry knowledge and financial stability to adapt and maintain its competitive edge in a dynamic market, which is essential for its business strategy.

Unum's journey includes over a century of providing financial protection. Key milestones include acquisitions and expansions that have broadened its product offerings and market reach. These strategic moves have helped solidify its position in the group benefits market.

Recent strategic moves include investments in digital platforms to enhance customer service and streamline operations. Unum focuses on innovation in product development and distribution channels. These initiatives aim to improve the customer experience and increase operational efficiency.

Unum's competitive edge stems from its strong brand reputation and diversified product portfolio. Its extensive distribution network provides a significant advantage in reaching a broad customer base. The company's financial strength allows it to invest in innovation and maintain a competitive edge.

Unum holds a leading position in the U.S. group disability market. The company's focus on customer satisfaction and product innovation supports its market share. Unum's strategic partnerships and alliances further enhance its position in the competitive landscape.

Unum's financial performance is marked by consistent profitability and a strong capital position. The company's market share in the U.S. group disability market is a key indicator of its success. Unum's ability to maintain a competitive edge is supported by its financial stability and strategic investments. For more detailed insights, you can explore a comprehensive analysis of Unum Group's financial performance in this article: 0.

- Unum's strong brand equity contributes to customer loyalty.

- Diversified product offerings enhance market penetration.

- Strategic investments in technology improve operational efficiency.

- Consistent profitability supports sustainable growth.

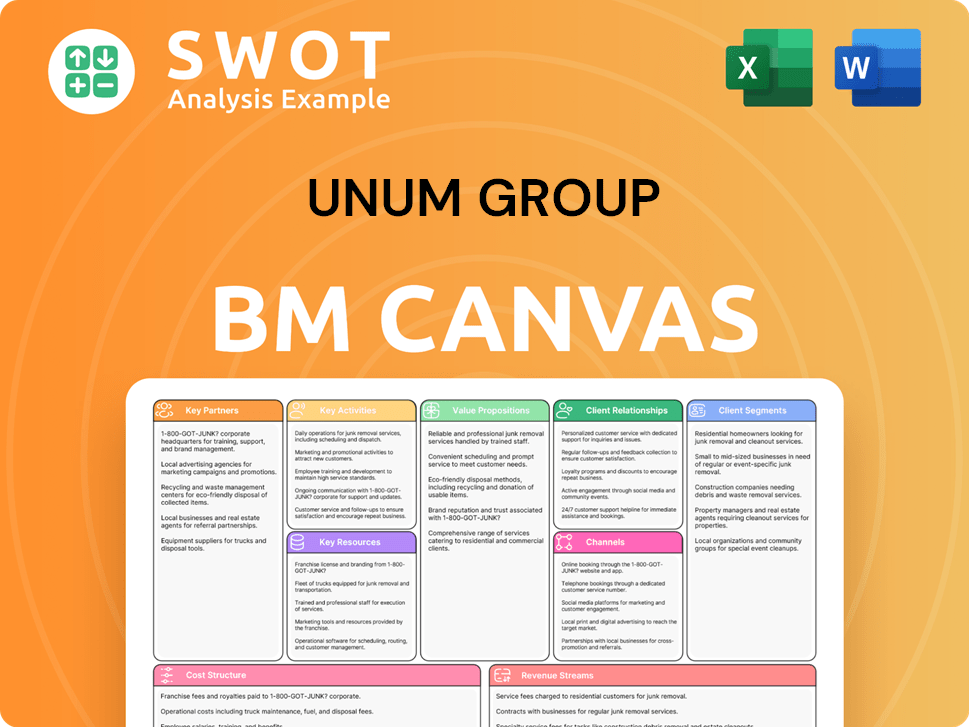

Unum Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Unum Group’s Competitive Landscape?

The financial protection benefits sector is experiencing significant shifts, influencing the Unum Group competitive landscape. These changes present both challenges and opportunities for companies like Unum. Understanding these trends is crucial for assessing Unum Group's market analysis and future prospects.

Several factors shape the industry's trajectory. Technological advancements, regulatory changes, and evolving consumer preferences are key drivers. These elements impact Unum Group's business strategy and overall financial performance.

Technology, including AI and data analytics, is transforming benefits administration and customer interactions. Regulatory changes, such as those related to healthcare and data privacy, continuously impact product design. Consumer demand is shifting towards more flexible and holistic benefits packages.

Intensified competition from insurtech startups poses a threat. Economic downturns could affect employment and demand for group benefits. Adapting to rapid technological changes and maintaining compliance with evolving regulations are ongoing challenges.

Expanding voluntary benefits offerings and penetrating underserved markets offer growth potential. Leveraging data analytics for personalized solutions is another avenue. Strategic partnerships could provide new growth opportunities.

Unum's ability to invest in technology, adapt to regulations, and innovate its product portfolio will be critical. The aim is to maintain resilience and market leadership. Examining the company's Revenue Streams & Business Model of Unum Group can provide further insights.

The Unum Group's competitive landscape is dynamic, requiring continuous adaptation. Understanding Unum Group's competitors and their strategies is essential. Analyzing Unum Group's strengths and weaknesses analysis helps in formulating effective responses to industry changes.

- Focus on technological advancements to enhance efficiency and customer experience.

- Adapt to evolving regulatory requirements to ensure compliance and maintain product competitiveness.

- Innovate product offerings to meet the changing demands of a diverse workforce.

- Explore strategic partnerships to expand market reach and diversify service offerings.

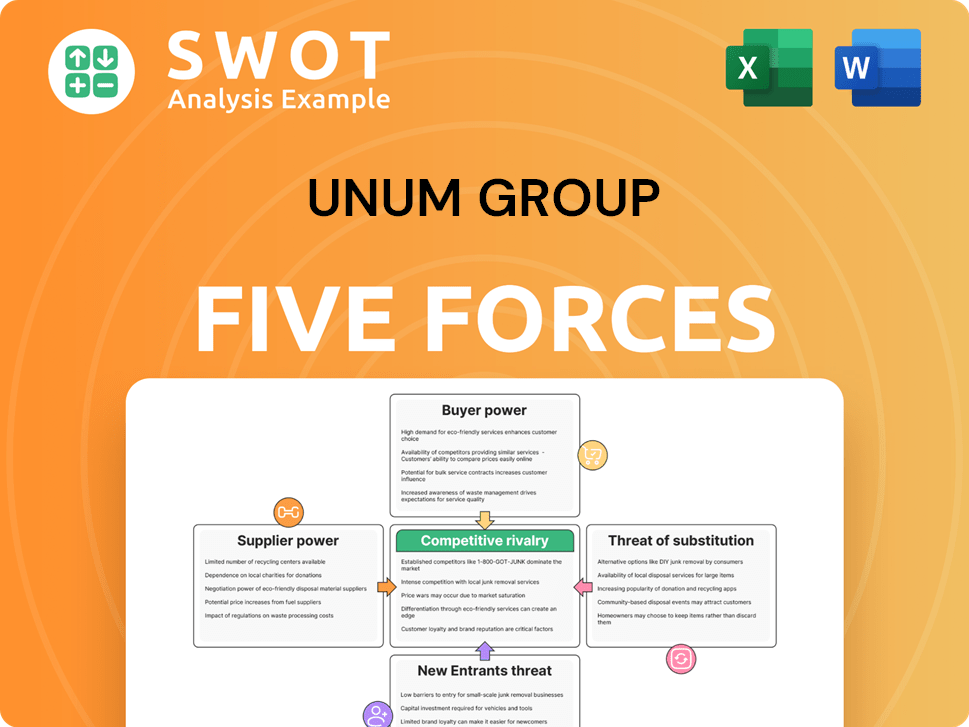

Unum Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Unum Group Company?

- What is Growth Strategy and Future Prospects of Unum Group Company?

- How Does Unum Group Company Work?

- What is Sales and Marketing Strategy of Unum Group Company?

- What is Brief History of Unum Group Company?

- Who Owns Unum Group Company?

- What is Customer Demographics and Target Market of Unum Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.