Unum Group Bundle

Who Does Unum Group Serve?

In an ever-changing financial landscape, understanding the "who" behind a leading Unum Group SWOT Analysis is paramount. Unum Group, a major player in the insurance company sector, must meticulously define its customer demographics and target market to thrive. This detailed analysis is crucial for crafting effective strategies and maintaining a competitive edge in the employee benefits arena.

This exploration delves into the core of Unum Group's customer profile, revealing how it strategically segments its market. We'll uncover the key demographics, including age range, income levels, and geographic locations, that shape Unum Group's approach. Furthermore, we'll examine how Unum Group adapts its marketing strategies and customer acquisition approaches to resonate with its defined target market, ensuring its continued success in a dynamic environment.

Who Are Unum Group’s Main Customers?

Understanding the Customer Demographics and Target Market for Unum Group involves examining its primary customer segments. As an insurance company, Unum primarily focuses on businesses (B2B) and their employees (B2E, indirectly B2C). This market segmentation strategy allows Unum to offer tailored solutions that meet the diverse needs of both employers and employees.

The B2B segment includes a wide array of employers, ranging from small businesses to large corporations across various industries. These businesses are driven by the need to provide competitive benefits packages, comply with regulations, and promote employee well-being. Unum's offerings help employers manage risks associated with employee absences and provide financial safety nets. This approach is crucial for attracting and retaining talent.

The employee segment, the ultimate beneficiaries of Unum's policies, exhibits significant demographic variation. While specific data on age, gender, and income levels is proprietary, industry trends indicate that employees seeking financial protection span all age groups. Income often correlates with the type and extent of coverage sought, and occupations are diverse, reflecting the broad industries Unum serves.

Unum targets businesses of all sizes across various industries. These employers seek to offer competitive benefits, comply with regulations, and support employee well-being. They utilize Unum's products to manage risks associated with employee absences and provide financial security.

Employees are the end-users of Unum's insurance products. This segment includes a wide range of individuals with diverse demographics. Their needs vary based on age, income, occupation, and family status, influencing their demand for specific coverage types.

Unum is increasingly emphasizing voluntary benefits, where employees can purchase additional coverage. This shift caters to the growing demand for personalized benefits and gives employees more control over their financial protection. Employers benefit from offering flexible benefits without increasing costs.

In Q1 2024, Unum's group long-term disability segment saw a 3.9% increase in in-force premiums compared to Q1 2023. The group life segment experienced a 2.4% rise in in-force premiums during the same period. These figures highlight the strength of Unum's core offerings and its continued focus on the employer market.

Several factors influence the customer profile within Unum's target market. These include age, income levels, occupation, and family status. Understanding these elements helps Unum tailor its products and marketing strategies effectively. For a deeper dive into their marketing strategies, you can explore the Marketing Strategy of Unum Group.

- Age: Impacts the need for different types of coverage.

- Income: Influences the affordability and scope of coverage.

- Occupation: Affects the risks and benefits relevant to specific jobs.

- Family Status: Determines the need for life and dependent coverage.

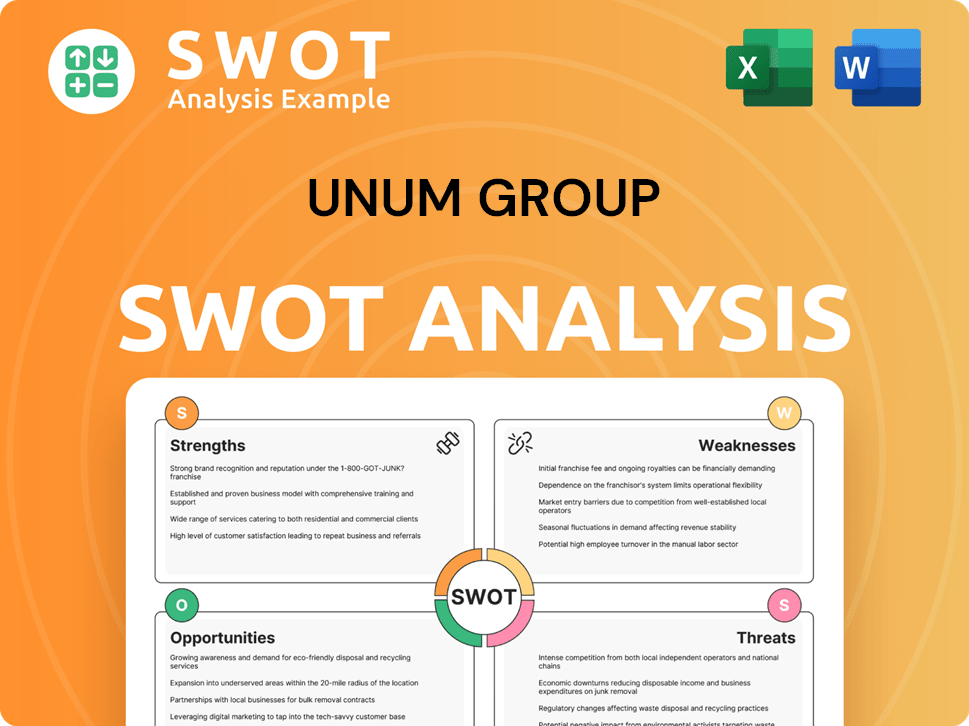

Unum Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Unum Group’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any business, especially within the insurance industry. For Owners & Shareholders of Unum Group, this involves a deep dive into the motivations and behaviors of both employers and employees who utilize their services. This analysis helps in tailoring products and strategies to meet specific demands and expectations.

The core focus revolves around providing financial security, risk mitigation, and comprehensive support during challenging life events. Employers seek cost-effective and easily managed benefits solutions that enhance employee satisfaction and productivity. Employees, on the other hand, prioritize income protection, financial stability, and access to affordable healthcare.

These needs and preferences drive the company's product development and marketing efforts. By addressing the pain points and offering tailored solutions, the company aims to maintain and expand its customer base. The understanding of customer demographics and target market segmentation is key to this strategy.

Employers are primarily looking for reliable, cost-effective, and easily administered benefits solutions. Key decision factors include coverage options, ease of integration with HR systems, and competitive pricing.

Employees seek income protection during illness or injury and financial stability for their families. They also look for access to affordable healthcare services. Peace of mind is a significant psychological driver.

The company leverages feedback and market trends to influence product development. This includes integrating mental health support and offering customizable plans.

Marketing and product features are tailored to specific segments. This includes providing clear, accessible information about benefits, often through digital platforms.

The company addresses pain points such as the complexity of insurance claims and the stress associated with unexpected life events. This is crucial for customer satisfaction.

Employers value insurers who provide robust data and insights to optimize their benefits programs. This data-driven approach helps in making informed decisions.

The company's strategy involves understanding and catering to the specific needs of both employers and employees. This approach ensures customer satisfaction and loyalty. The company's understanding of the customer profile and customer demographics is key to success.

- Market Segmentation: Tailoring products and services to different segments based on needs and preferences.

- Customer Profile: Understanding the characteristics, behaviors, and motivations of both employers and employees.

- Product Customization: Offering flexible plans that allow employers to select benefits relevant to their workforce.

- Digital Platforms: Providing clear and accessible information about benefits through digital channels.

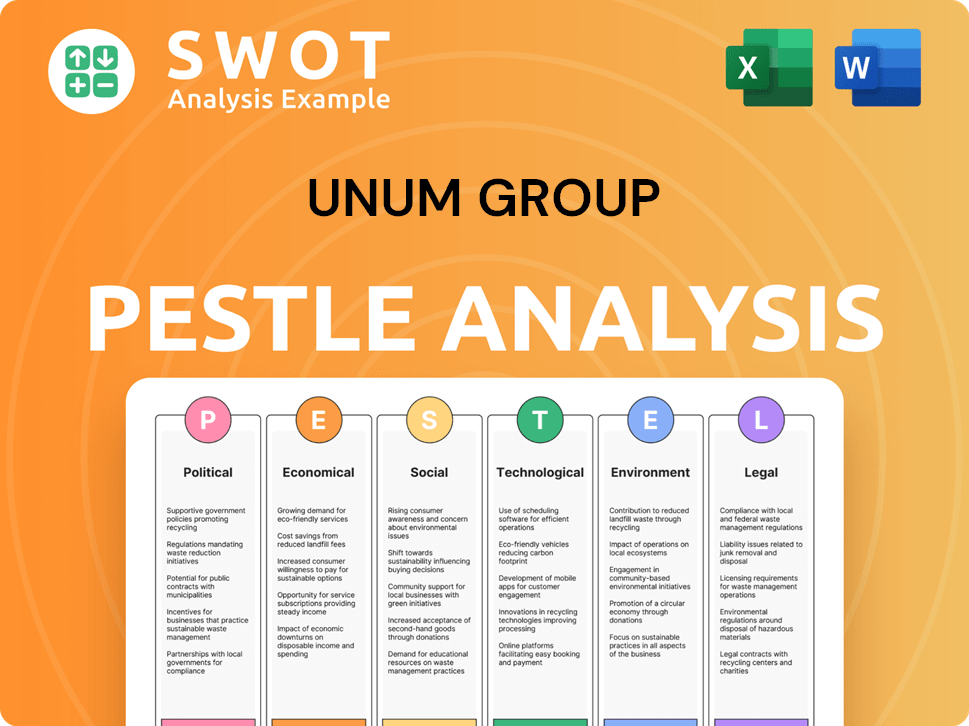

Unum Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Unum Group operate?

The geographical market presence of Unum Group, an insurance company, is primarily concentrated in the United States, the United Kingdom, and Poland. These regions represent the core markets where Unum has established a strong foothold and significant market share. The company's strategic focus involves tailoring its offerings to meet the specific needs and regulatory environments of each market, ensuring its services resonate with local customer preferences.

In the United States, Unum is a leading provider of group disability insurance, serving a diverse range of businesses across all states. The UK market sees Unum as a prominent player in employee benefits, offering disability, life, and critical illness coverage. Poland serves as a strategic hub for certain operational functions, contributing to Unum's European footprint. This strategic distribution allows Unum to effectively manage its operations and customer service across different regions.

Understanding the nuances of each market is crucial for Unum's success. The company employs localized strategies, including country-specific product development and tailored marketing messages. This approach enables Unum to build strong relationships with local intermediaries and adapt to evolving benefit trends. For instance, Unum UK reported a 10.5% increase in adjusted operating income in the first quarter of 2024, demonstrating its robust performance in the region.

Unum holds a significant market share in the US, particularly in group disability insurance. Its presence spans across all states, catering to a wide array of businesses. The company's success in the US market is driven by its extensive sales networks and strong broker relationships.

In the UK, Unum is a key player in employee benefits, offering disability, life, and critical illness coverage. The company adapts its offerings to align with the UK's regulatory environment and cultural nuances. Unum focuses on well-being and integrated health solutions, which are crucial in this market.

Poland serves as a strategic hub for Unum, supporting its European operations. While not a primary sales market, Poland contributes to Unum's overall footprint. This strategic location enhances Unum's operational efficiency and supports its broader business objectives.

Unum employs localized strategies to cater to the specific needs of each market. This includes developing country-specific products and tailoring marketing messages. The company builds partnerships with local intermediaries to enhance its market penetration and customer engagement.

Unum's approach to its target market involves understanding the unique dynamics of each region. This includes adapting to different regulatory environments, customer preferences, and buying power. The company's focus on localized strategies reflects its commitment to meeting the diverse needs of its customers.

- Customer Demographics: Unum analyzes customer demographics such as age, income, and occupation to tailor its products.

- Market Segmentation: The company segments its market based on industry, lifestyle, and needs, ensuring targeted marketing.

- Customer Profile: Unum creates detailed customer profiles to understand needs and preferences, enhancing customer acquisition.

- Marketing Strategies: Unum's marketing strategies are customized to resonate with local audiences, driving customer engagement.

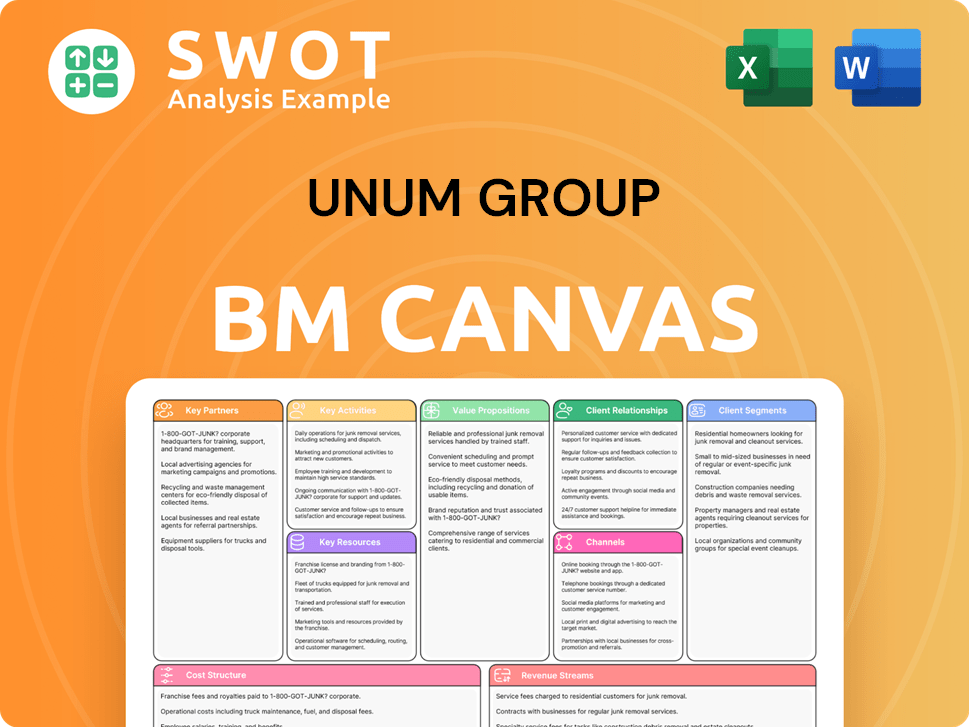

Unum Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Unum Group Win & Keep Customers?

The customer acquisition and retention strategies of the Unum Group are multifaceted, focusing on both attracting new clients and maintaining long-term relationships. The company uses a blend of traditional and digital marketing to reach its target audience, which includes employers and their employees. A key element is the utilization of brokers and consultants, who play a crucial role in recommending Unum's insurance solutions to corporate clients.

For customer acquisition, Unum leverages direct sales teams, particularly for larger accounts, and digital marketing efforts, such as online advertising and social media, to increase brand awareness. Customer retention is prioritized through exceptional service, efficient claims processing, and proactive account management. Personalized experiences, supported by dedicated account managers, are a core part of maintaining customer loyalty and understanding their evolving needs.

Unum's approach involves providing employers with resources to optimize their benefits programs and promote employee well-being. This includes mental health support services, aligning with current market demands. The company's financial performance, such as a 9.3% increase in adjusted operating income per share in the first quarter of 2024, reflects a stable and growing customer base. Unum continually adapts its strategies based on market feedback and competitive dynamics, focusing on enhancing digital capabilities to improve customer experience.

Unum employs a variety of channels to acquire customers. These include a strong network of brokers and consultants who recommend Unum's services to corporate clients. Direct sales teams also target larger accounts. Digital marketing, including the website, social media, and targeted advertising, is used to generate leads and increase brand awareness.

Customer retention is a priority for Unum, achieved through excellent customer service, efficient claims processing, and proactive account management. Personalized experiences are provided through dedicated account managers. Loyalty programs and tools for employers to manage benefits and promote employee well-being are also implemented.

Brokers and consultants are essential intermediaries for Unum, recommending its solutions to corporate clients. They act as trusted advisors, helping employers select and implement the best benefits programs. This B2B sales approach is a key element of Unum's customer acquisition strategy, providing a direct line to potential clients.

Digital marketing plays an important role in Unum's acquisition efforts. They use their website, social media platforms like LinkedIn, and targeted online advertising to raise brand awareness. These digital channels educate potential clients about their offerings and generate leads, contributing to their overall marketing strategy.

Unum's customer acquisition and retention strategies are reflected in its financial performance. The company reported an increase in adjusted operating income per share of 9.3% in the first quarter of 2024, indicating a stable and growing customer base. Unum's focus on customer service and digital capabilities is crucial for future growth.

- Financial Stability: Strong financial performance supports customer retention.

- Customer-Centric Approach: Prioritizing customer needs and providing excellent service.

- Digital Transformation: Investing in digital capabilities to improve customer experience.

- Market Adaptation: Continuously adapting strategies based on market feedback.

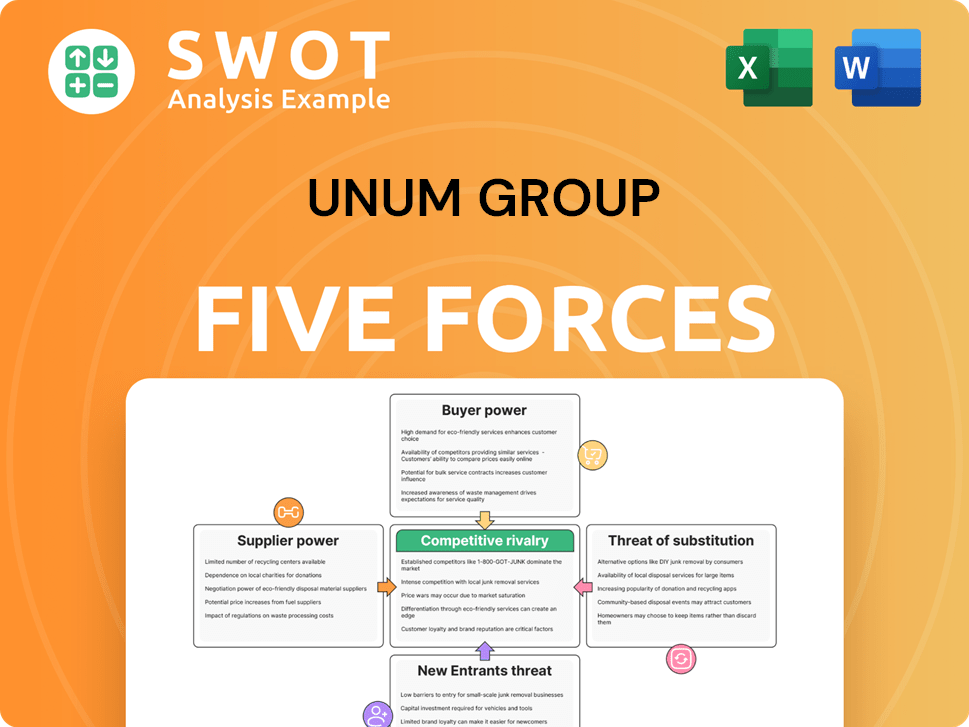

Unum Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Unum Group Company?

- What is Competitive Landscape of Unum Group Company?

- What is Growth Strategy and Future Prospects of Unum Group Company?

- How Does Unum Group Company Work?

- What is Sales and Marketing Strategy of Unum Group Company?

- What is Brief History of Unum Group Company?

- Who Owns Unum Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.