Union Pacific Bundle

Can Union Pacific Maintain Its Dominance in the Evolving Freight Rail Industry?

The North American freight rail industry is a dynamic arena, constantly reshaped by technological innovation and shifting supply chain demands. Union Pacific, a cornerstone of this sector since 1862, faces a complex competitive landscape. This analysis delves into Union Pacific's strategic positioning, its key rivals, and the factors that will determine its future success.

To understand the Union Pacific SWOT Analysis and its place in the railroad industry analysis, we must examine its Union Pacific competitors and their strategies. This involves a deep dive into UPRR market analysis to assess Union Pacific's market share and how it navigates the challenges of freight transportation competition. By exploring Union Pacific's main rivals in 2024, we can evaluate its competitive advantages of Union Pacific and how it compares to industry leaders like BNSF Railway.

Where Does Union Pacific’ Stand in the Current Market?

Union Pacific (UPRR) holds a significant position in the North American freight rail industry. It operates as one of the two major Class I railroads in the western United States. Its extensive network and robust financial performance underscore its market dominance, making it a key player in freight transportation competition.

As of early 2024, Union Pacific's market capitalization reflects its substantial scale and influence within the industry. The company's financial health remains strong, as evidenced by its recent performance. For the first quarter of 2024, Union Pacific reported a net income of $1.6 billion and an operating ratio of 59.4%, showcasing its operational efficiency.

The company's core operations involve transporting various commodities, including agricultural products, automotive parts, chemicals, coal, industrial goods, and intermodal freight. This diverse portfolio serves a broad range of customer segments, such as manufacturing, agriculture, and retail. To learn more about the company's growth strategy, you can read this article about Growth Strategy of Union Pacific.

Union Pacific's network spans 23 states in the western two-thirds of the United States. This extensive reach connects key ports and production hubs, facilitating transcontinental trade. This vast coverage is a critical component of its market dominance, allowing it to serve major population centers effectively.

The company transports agricultural products, automotive parts, chemicals, coal, industrial goods, and intermodal freight. Union Pacific has strategically shifted its focus to emphasize intermodal services. This adaptation meets the growing demand for efficient containerized shipping, enhancing its competitive position.

In the first quarter of 2024, Union Pacific reported operating revenue of $6.0 billion. This strong financial performance indicates its substantial scale within the railroad industry. The company's ability to maintain profitability and efficiency is crucial in the competitive landscape.

Union Pacific continuously adapts its strategies to address evolving market dynamics and competitive pressures. The company focuses on intermodal services and remains strong in the western U.S. and in transporting agricultural and industrial products. This adaptability is key to maintaining its market position.

Union Pacific's competitive advantages include its extensive network, diverse service offerings, and strong financial performance. These factors contribute to its market dominance in the railroad industry. Analyzing the UPRR market analysis reveals its strategic positioning and operational efficiency.

- Extensive network across 23 states in the western U.S.

- Diverse portfolio of transported commodities, including intermodal freight.

- Strong financial results, with $1.6 billion net income in Q1 2024.

- Focus on operational efficiency, reflected in a 59.4% operating ratio.

Union Pacific SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Union Pacific?

The Revenue Streams & Business Model of Union Pacific faces a dynamic competitive landscape, primarily shaped by its rivals in the railroad industry and other modes of freight transportation. Understanding the competitive dynamics is crucial for assessing its market position and strategic initiatives. Analyzing the competitive landscape involves evaluating direct competitors, such as BNSF Railway, and indirect competitors, including trucking companies, waterways, and air cargo services.

In 2024, the freight transportation sector continues to evolve, with technological advancements and economic shifts influencing the competitive dynamics. The strategies employed by Union Pacific and its competitors are key to understanding the market share and future growth prospects. This analysis provides insights into the challenges and opportunities within the railroad industry, focusing on the competitive positioning of Union Pacific.

Union Pacific's competitive landscape is primarily shaped by the presence of direct and indirect competitors. The railroad industry is highly competitive, with Union Pacific and BNSF Railway being the two major players in the western United States. The trucking industry also poses a significant challenge, especially for shorter hauls. Other modes of transportation, such as waterways and air cargo, offer alternative options for specific types of freight.

BNSF Railway, owned by Berkshire Hathaway, is Union Pacific's main direct competitor. They both operate extensive rail networks across the western United States. The competition is intense, focusing on market share in key freight corridors and securing lucrative shipping contracts.

The trucking industry offers greater flexibility and door-to-door service. Major trucking firms and numerous smaller carriers compete with Union Pacific, especially for shorter distances and time-sensitive deliveries. Trucking's adaptability presents a significant challenge to rail transport.

Inland waterways and air cargo services provide alternative transportation options. These are particularly relevant for bulk commodities and high-value, time-critical goods, respectively. These modes indirectly compete with Union Pacific.

Emerging players in logistics and supply chain management use data analytics and multimodal solutions. They indirectly challenge traditional rail services by optimizing overall transportation costs and efficiency for shippers. The ongoing consolidation within the logistics sector and strategic alliances among carriers further intensify the competitive landscape.

The rivalry between Union Pacific and BNSF often involves investments in infrastructure and technology. Both companies aim to improve efficiency and service. The trucking industry's flexibility and door-to-door service pose a significant challenge, especially for shorter hauls.

Union Pacific and BNSF compete for market share in key corridors and shipping contracts. Both companies invest in infrastructure and technology. Trucking companies focus on shorter hauls and time-sensitive deliveries. Waterways and air cargo serve specific market segments.

Union Pacific's strategies for market dominance involve enhancing operational efficiency, investing in technology, and improving customer service. These strategies are critical for maintaining a competitive edge in the freight transportation market. The company also focuses on expanding its service offerings and optimizing its network to meet the changing needs of shippers. Understanding the competitive landscape and adapting to market dynamics are essential for Union Pacific's long-term success.

- Operational Efficiency: Improving train speeds, reducing dwell times, and optimizing fuel consumption.

- Technological Advancements: Implementing advanced analytics, automation, and digital platforms.

- Customer Service: Enhancing communication, providing real-time tracking, and offering customized solutions.

- Network Optimization: Strategically expanding and improving the rail network to reach new markets.

- Service Offerings: Diversifying services to include intermodal, agricultural, and industrial products.

Union Pacific PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Union Pacific a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of Union Pacific (UPRR) is crucial for investors and industry analysts. The company's strengths lie in its extensive rail network and operational efficiencies, providing significant advantages in the freight transportation competition. Analyzing Union Pacific's market share and strategies is essential for assessing its long-term prospects.

The Marketing Strategy of Union Pacific highlights the company's focus on customer service and technological advancements. These factors are key to maintaining its competitive edge in the railroad industry analysis. Union Pacific's ability to adapt to economic trends and respond to emerging competitors is also critical for its success.

Union Pacific's main rivals in 2024 include BNSF Railway, among others, and understanding their competitive dynamics is key to evaluating UPRR's performance. The company's financial performance versus competitors and its strategies for market dominance are constantly under scrutiny. The impact of economic trends on Union Pacific's competition is a significant factor to consider.

Union Pacific operates a vast network of approximately 32,200 route miles across 23 states. This extensive reach allows it to connect major production centers, ports, and consumption markets. This network is a significant barrier to entry for new competitors.

The company benefits from substantial economies of scale, enabling cost-effective transportation of large volumes of goods. This advantage is particularly pronounced for bulk commodities like coal, grains, and industrial products. This allows Union Pacific to offer competitive pricing.

Union Pacific leverages its network density and operational efficiencies to provide reliable service. Investments in technology, such as Positive Train Control (PTC), enhance safety and optimize routes. These efficiencies are crucial for maintaining customer satisfaction.

Strong, long-standing relationships with a diverse customer base contribute to significant customer loyalty. These relationships are built over decades and are a key factor in maintaining market share. Customer satisfaction is a priority for Union Pacific.

Union Pacific's competitive advantages are rooted in its infrastructure, economies of scale, and strategic network. The company continually invests in these areas to maintain its edge in the freight transportation competition. The company is focused on technological advancements vs competitors.

- Extensive Rail Network: Over 32,200 route miles provide unparalleled reach.

- Economies of Scale: Cost-effective transportation of large volumes.

- Operational Efficiency: Investments in technology and optimized routes.

- Customer Loyalty: Strong relationships built over decades.

Union Pacific Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Union Pacific’s Competitive Landscape?

The Owners & Shareholders of Union Pacific find themselves navigating a dynamic freight rail industry. This industry is shaped by technological advancements, evolving supply chain demands, and the increasing need for sustainable practices. Understanding the competitive landscape, including key rivals and market dynamics, is crucial for assessing Union Pacific's strategic positioning and future prospects.

Union Pacific's competitive landscape is influenced by economic trends, labor availability, and the necessity for continuous infrastructure investment. Analyzing its market share, service offerings, and pricing strategies compared to competitors like BNSF Railway provides insights into its strengths and challenges. This analysis helps stakeholders understand the competitive advantages of Union Pacific and its strategies for market dominance.

The freight rail industry is experiencing significant technological advancements, including automation and predictive analytics, enhancing efficiency and safety. There's a growing emphasis on environmental sustainability, driving demand for rail as a lower-emission transportation alternative. Supply chain demands are also evolving, necessitating more flexible and efficient logistics solutions.

Fluctuating commodity prices and economic downturns can directly impact freight volumes, posing financial risks. Labor availability and the need for skilled workers remain a challenge in a competitive market. Regulatory changes, particularly concerning environmental standards and safety, require ongoing adaptation and investment.

Expanding intermodal services to capitalize on e-commerce growth presents a significant opportunity for revenue expansion. Developing new logistics solutions for specialized cargo can attract new customers and increase market share. Strategic partnerships can extend reach into new markets and enhance service offerings.

Union Pacific's extensive network and investments in technology provide a strong foundation for competitive advantage. Its focus on sustainability and commitment to operational efficiency can attract environmentally conscious shippers and improve profitability. These advantages help the company maintain its position within the railroad industry.

Union Pacific's market share is consistently strong, supported by its vast network and diverse service offerings. The company competes with BNSF Railway and other regional railroads, focusing on operational efficiency and customer service. Technological investments and sustainable practices are key to maintaining a competitive edge.

- Market Share: Union Pacific holds a significant market share in the western United States, with approximately 20% of the total U.S. rail freight revenue in 2024.

- Revenue: In 2024, Union Pacific reported revenues of approximately $24.5 billion, demonstrating its substantial scale and market presence.

- Operational Efficiency: The company continues to invest in precision scheduled railroading (PSR) to improve efficiency, aiming for a train speed of over 20 mph and reducing dwell time.

- Sustainability: Union Pacific is committed to reducing greenhouse gas emissions, targeting a 60% reduction in emissions intensity by 2030.

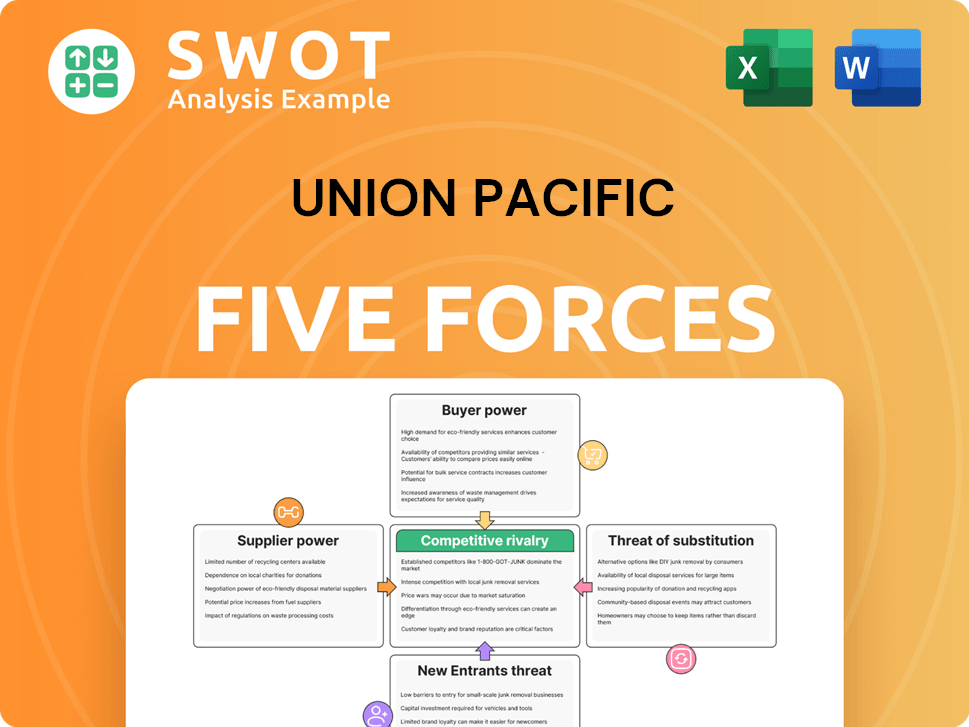

Union Pacific Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Union Pacific Company?

- What is Growth Strategy and Future Prospects of Union Pacific Company?

- How Does Union Pacific Company Work?

- What is Sales and Marketing Strategy of Union Pacific Company?

- What is Brief History of Union Pacific Company?

- Who Owns Union Pacific Company?

- What is Customer Demographics and Target Market of Union Pacific Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.