Vesuvius Bundle

How Does Vesuvius Stack Up in the Global Market?

Vesuvius plc, a titan in molten metal flow engineering, is pivotal to the steel and foundry sectors. Its innovative solutions, including refractories and advanced services, are crucial for enhancing manufacturing efficiency and sustainability. But how does Vesuvius truly perform in the face of stiff competition?

Understanding the Vesuvius SWOT Analysis is key to grasping its position within the Vesuvius competitive landscape. This analysis will delve into Vesuvius competitors and their strategies, offering a detailed Vesuvius market analysis to reveal the company's strengths and weaknesses. Furthermore, we'll explore Vesuvius market share dynamics and Vesuvius financial performance relative to its rivals, providing a comprehensive view of its competitive standing within the Vesuvius industry.

Where Does Vesuvius’ Stand in the Current Market?

Vesuvius holds a leading position in the molten metal flow engineering and technology sector, primarily serving the steel and foundry industries worldwide. The company operates through two main divisions: Steel and Foundry. It provides flow control solutions, advanced refractories, and other consumable products, supported by technical services, including data capture. This positions Vesuvius as a key player in its industry.

The company's global presence includes manufacturing plants strategically located near customer facilities and supported by global technology centers. This setup allows Vesuvius to offer tailored solutions and maintain strong relationships with its clients. Its focus on innovation and service contributes to its market position in the Vesuvius competitive landscape.

In 2024, Vesuvius demonstrated resilience despite difficult market conditions, achieving market share gains in its Flow Control and Foundry divisions. This performance highlights the company's ability to adapt and succeed in a competitive environment. For a deeper dive into how the company approaches its market, consider exploring the Marketing Strategy of Vesuvius.

Vesuvius's revenue for 2024 was £1,820.1 million, reflecting its significant presence. The company saw market share gains in Flow Control and Foundry divisions. Despite an underlying decrease of 1.8%, the reported decline was 5.7% due to foreign exchange headwinds, indicating strong underlying performance.

Trading profit reached £188.0 million, declining by only 0.2% on an underlying basis. The return on sales was 10.3%, slightly down from 10.4% in 2023. The company's financial health is further supported by a current ratio of 1.57, indicating strong financial flexibility.

The Foundry division experienced challenges outside of India, while India showed significant progress. Vesuvius continues to gain market share in key regions like India and Asia. This highlights the company's strategic focus on high-growth markets and its ability to adapt to regional dynamics.

Vesuvius anticipates its trading profit in 2025 to be broadly similar to 2024 on a constant currency basis, including the contribution from the PiroMET acquisition. The company is targeting a mid-term Return on Sales of at least 12.5% by 2028. It aims to deliver cumulative free cash flow of £400 million by 2027.

Vesuvius's Vesuvius market share is strong, particularly in Flow Control and Foundry. Its financial performance, including a return on sales of 10.3% in 2024, demonstrates its profitability. These factors contribute to a positive outlook for the company.

- Strong market position in molten metal flow engineering.

- Resilient performance in 2024 despite market challenges.

- Strategic focus on growth in key regions like India and Asia.

- Positive financial health with a healthy current ratio.

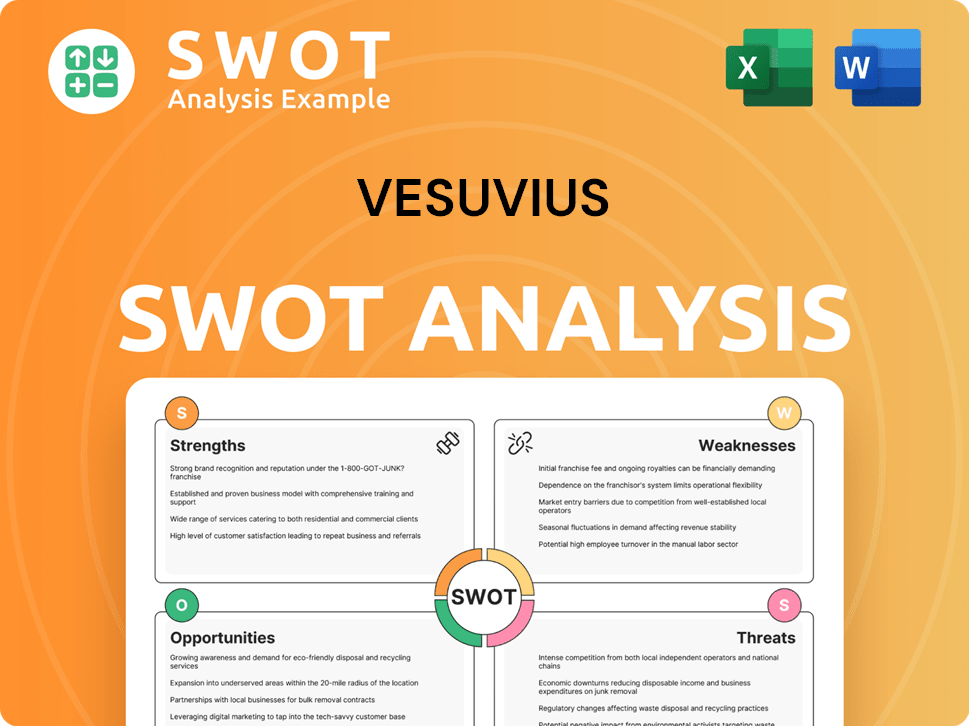

Vesuvius SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Vesuvius?

The competitive landscape for Vesuvius is primarily within the basic materials sector, specifically the molten metal flow engineering and technology market, serving the steel and foundry industries. A thorough Vesuvius market analysis reveals a complex interplay of direct and indirect competitors, each vying for market share and influencing Vesuvius's financial performance.

Understanding the Vesuvius competitive landscape requires a look at key players and their strategies. These competitors challenge Vesuvius through product innovation, pricing, and distribution. Recent developments, such as Vesuvius's acquisition of PiroMet, signal efforts to strengthen its market position and adapt to evolving competitive dynamics.

The Vesuvius industry faces constant change, driven by technological advancements and shifts in the global economy. The company must continually innovate and adapt to maintain its competitive edge. For more insights into the company's strategic focus, consider reading about the Target Market of Vesuvius.

RHI Magnesita and HarbisonWalker are the most significant direct competitors, focusing on refractory products. These companies directly challenge Vesuvius in its core markets.

Companies like Honeywell, CG Power & Industrial Solutions, and Schneider Electric offer industrial solutions that can indirectly compete with Vesuvius's offerings.

EVRAZ, Ferrexpo, and Johnson Matthey are among the other players in the broader basic materials sector, influencing the overall competitive environment.

Competitors employ strategies such as product innovation, aggressive pricing, and extensive distribution networks to gain market share. For example, in 2024, Vesuvius showed resilience due to technological differentiation.

Mergers, acquisitions, and technological advancements constantly reshape the industry. Vesuvius's acquisition of PiroMet is an example of this. Rising raw material costs and labor expenses impact trading profit.

The integration of PiroMet is expected to enhance Vesuvius's competitive standing, allowing it to better serve its customer base and expand its product offerings.

Vesuvius's competitive advantages include its technological differentiation and strategic acquisitions. However, it faces challenges from intense competition and rising costs. A detailed Vesuvius competitor analysis report reveals the strategies of its rivals and their impact on Vesuvius's market share.

- Vesuvius key competitors and their strategies: RHI Magnesita and HarbisonWalker focus on refractory products, competing on innovation and pricing.

- Vesuvius market position analysis: Vesuvius aims to maintain and grow its market share through technological advancements and strategic acquisitions.

- Vesuvius challenges in the market: Rising raw material and labor costs, coupled with intense competition, pose significant challenges.

- Vesuvius industry outlook and competitive dynamics: The industry is dynamic, with constant changes driven by technology, mergers, and economic shifts.

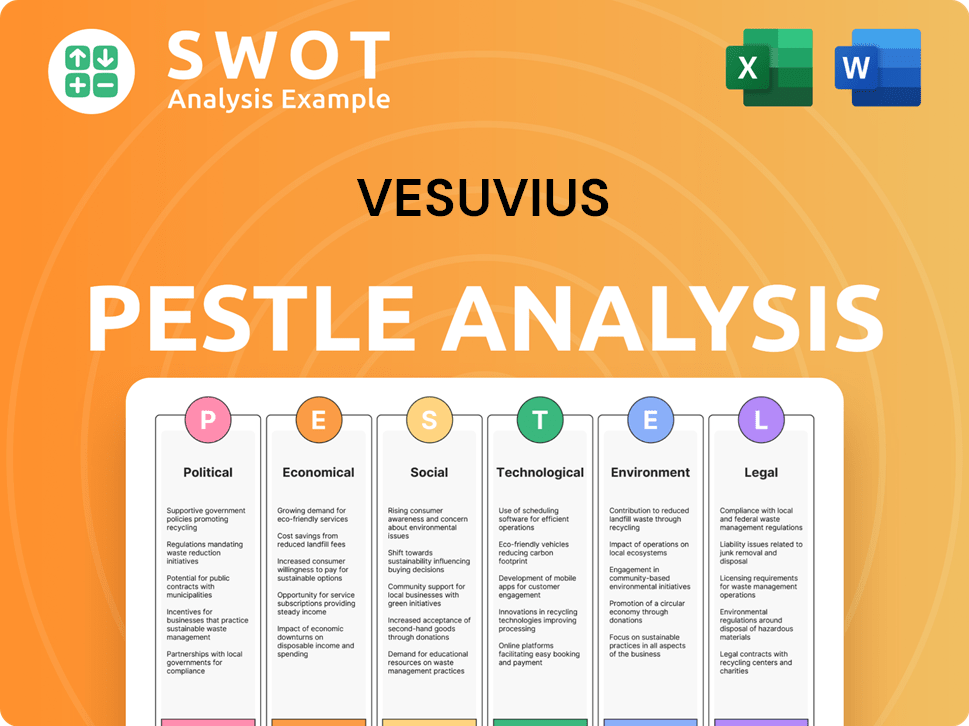

Vesuvius PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Vesuvius a Competitive Edge Over Its Rivals?

The Vesuvius competitive landscape is shaped by its significant technological advancements and strategic market positioning. The company consistently invests in research and development (R&D) to maintain a competitive edge, focusing on innovative solutions that enhance manufacturing processes, particularly in high-temperature environments. This commitment to innovation, combined with a global presence, allows it to serve a diverse customer base effectively.

Key milestones include the introduction of robotic solutions to reduce human error and improve steel yield, alongside capacity expansions for key products. These strategic moves have fortified its market position. The company's focus on sustainable innovation is underscored by its environmental, social, and governance (ESG) achievements, such as maintaining an AA rating from MSCI and receiving a silver medal from EcoVadis in 2024.

The company's competitive edge is further bolstered by a robust cost reduction program, aiming for at least £45 million in annual savings by 2028. This, combined with resilient pricing strategies, has enabled the company to navigate challenging market conditions effectively. For more insights into the company's growth strategy, see the article: Growth Strategy of Vesuvius.

The company's competitive advantage is significantly driven by its proprietary technologies and continuous innovation. This includes the development of advanced refractories, sensors, and probes. New product sales are targeted to reach 20% in 2024, demonstrating the company's commitment to introducing cutting-edge solutions.

Serving customers through a worldwide network of cost-efficient manufacturing plants located near their facilities is a key strength. This global presence, combined with close customer proximity, fosters strong relationships and facilitates market expansion. This approach is critical for maintaining a strong position in the Vesuvius industry.

A strong and growing presence in developing markets, such as India, provides a significant competitive advantage. The company's performance in both Steel and Foundry divisions in these regions has been noteworthy. This strategic focus allows the company to capitalize on expanding industrial landscapes and boost its Vesuvius market share.

The company benefits from economies of scale due to its global operations. A significant cost reduction program is in place, with a target of at least £45 million in recurring annual savings by 2028. This program, along with resilient pricing, helps maintain robust Vesuvius financial performance even in challenging market conditions.

The company's competitive advantages are rooted in its technological prowess, global reach, and strategic focus on developing markets. Continuous investment in technology and strategic expansion, such as the capital expenditure program for capacity expansion in Flow Control and Advanced Refractories, further underpins future growth and profitability. These strengths position the company well in the Vesuvius competitive landscape.

- Proprietary technologies and innovation drive the development of advanced solutions.

- Strong customer relationships and a global network enhance market penetration.

- A well-established presence in developing markets supports growth.

- Economies of scale and cost reduction programs improve profitability.

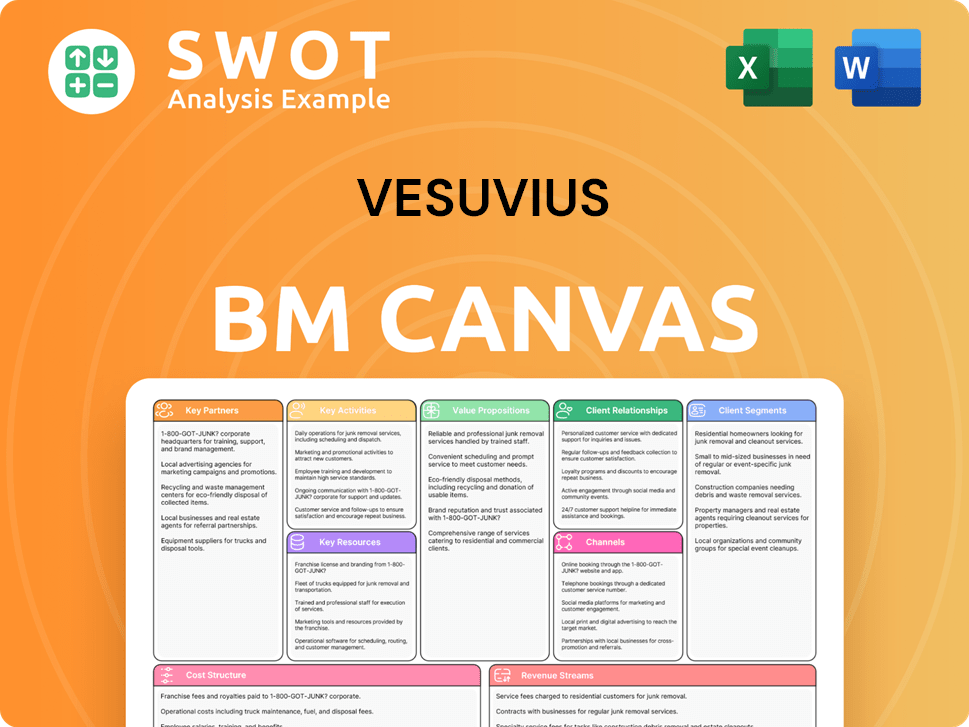

Vesuvius Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Vesuvius’s Competitive Landscape?

The Vesuvius competitive landscape is significantly influenced by industry trends, challenges, and opportunities. Technological advancements and digitalization are reshaping the molten metal flow engineering sector, driving the need for innovative solutions. Vesuvius market analysis reveals a dynamic environment where adaptability and strategic foresight are crucial for sustained growth.

The company faces various challenges, including subdued global steel production and geopolitical volatility. However, Vesuvius industry outlook remains positive, particularly in high-growth regions. Understanding these factors is essential for assessing Vesuvius market position analysis and its ability to capitalize on emerging opportunities.

Technological advancements are crucial, pushing for more efficient and sustainable solutions. Digitalization is also playing a key role, with customers expecting quicker responses and personalized services. Vesuvius's focus on innovation, such as robotic applications and advanced refractories, is a direct response to these trends.

Global steel production saw a 0.8% decline (excluding China, Iran, Russia, and Ukraine) in Q1 2024 compared to Q1 2023. Foundry end-markets were down approximately 8% in Q1 2024 compared to Q1 2023. Geopolitical instability and rising raw material costs also pose significant challenges. Recovering cost increases through pricing remains difficult.

India presents a significant growth opportunity, with steel production up 6.8% in Q1 2024. South-East Asia and South America show slight growth potential. Vesuvius is investing in new plants and expanding its cost reduction program to enhance resilience. The company is targeting a return on sales of at least 12.5% by 2028.

Vesuvius is focusing on new product sales, targeting a long-term goal of 20%. The company is also expanding its cost reduction program to £45 million by 2028. Vesuvius anticipates its trading profit in 2025 to be broadly similar to 2024 and expects cash flow to be significantly ahead, driven by working capital focus.

Vesuvius is aiming for cumulative free cash flow of £400 million by 2027. The company's ability to navigate challenges and capitalize on opportunities will be crucial for its future success. For more insights, read about Revenue Streams & Business Model of Vesuvius.

- Focus on India and other growth markets.

- Strategic investments in new manufacturing plants.

- Expansion of cost reduction programs.

- Targeting at least 12.5% return on sales by 2028.

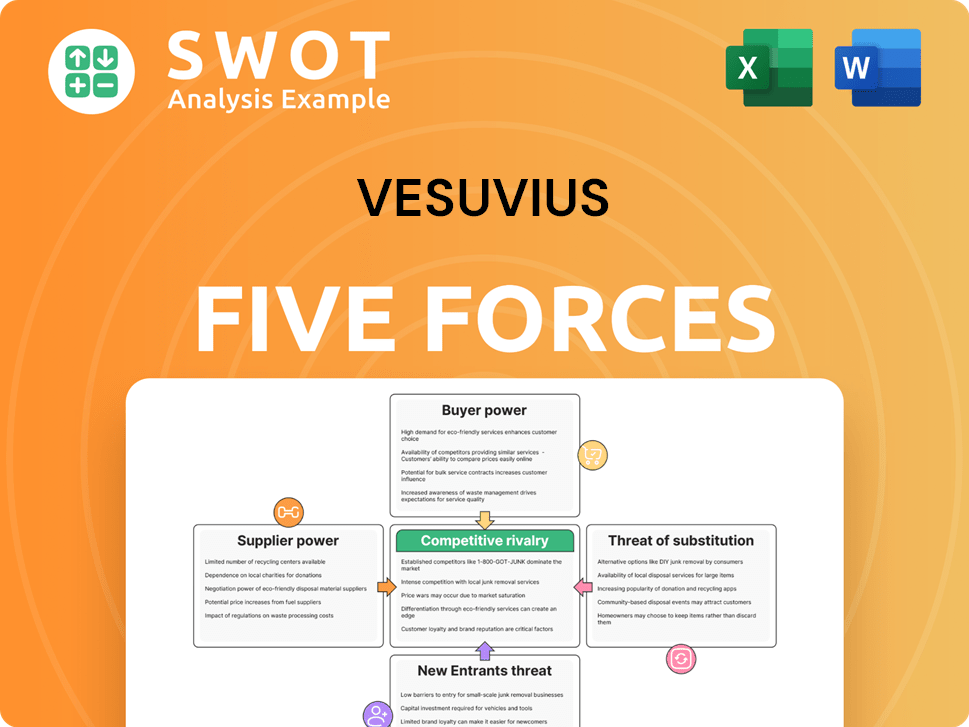

Vesuvius Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vesuvius Company?

- What is Growth Strategy and Future Prospects of Vesuvius Company?

- How Does Vesuvius Company Work?

- What is Sales and Marketing Strategy of Vesuvius Company?

- What is Brief History of Vesuvius Company?

- Who Owns Vesuvius Company?

- What is Customer Demographics and Target Market of Vesuvius Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.