Vesuvius Bundle

Can Vesuvius Forge Ahead?

Vesuvius, a titan in molten metal flow engineering, is making strategic moves to solidify its dominance. Its recent acquisition of PiroMet in early 2025 signals a strong commitment to expanding its footprint and capabilities. This Vesuvius SWOT Analysis will delve into the company's growth trajectory and future prospects.

This exploration will examine Vesuvius's Vesuvius growth strategy, assessing its Vesuvius future prospects within the context of the steel and foundry industries. We'll analyze the company's recent performance, including its impressive 2024 revenue figures, and evaluate its strategic initiatives, including expansion plans and acquisitions, to understand its Vesuvius company analysis and long-term growth potential. The Vesuvius market share and Vesuvius financial performance are key indicators of its success.

How Is Vesuvius Expanding Its Reach?

The company is actively pursuing several expansion initiatives to drive future growth. This strategy is focused on emerging markets and strategic acquisitions. These initiatives are critical for enhancing the company's market share and overall financial performance.

A key aspect of the company's growth strategy is its expansion into emerging markets. Significant investments are being made to capitalize on the increasing demand for its products and services in these regions. This approach is designed to ensure sustainable growth and improve the company's long-term growth potential.

Recent strategic moves, such as acquisitions, are aimed at strengthening the company's position in key markets and enhancing its capabilities. These actions reflect the company's commitment to innovation and product development, which are crucial for navigating market trends and challenges.

In February 2025, the company acquired a 61.65% stake in PiroMet, a refractory and robotics company in Turkey. The acquisition cost was €26.2 million. This strategic move strengthens the company's presence in the growing EEMEA region.

India is a key priority for geographical expansion. The company plans to increase its investment in India to nearly ₹1,000 crores over the next few years, surpassing the initial plan of ₹500 crore. This expansion aligns with the 'Make in India' initiative.

The company is establishing new manufacturing facilities in India. A new Mould Flux manufacturing facility in Visakhapatnam became operational in April 2024. New alumina-silica (AlSi) and basic monolithic manufacturing facilities were inaugurated in Visakhapatnam in November 2024.

The company is consistently launching new offerings. In 2024, 33 new products were launched, a 50% increase compared to 2023. This demonstrates a systematic development pipeline. The company is also seeing growing customer interest in its robotics solutions.

The company's strategic expansion program includes capacity expansion in Flow Control and Advanced Refractories. This program is expected to be mostly completed by the end of H1 2025, leading to a reduction in capital expenditure from 2025. For more insights into the company's structure, consider reading about Owners & Shareholders of Vesuvius.

- The company is expanding capacity in Flow Control in India, Southeast Asia, and EEMEA markets.

- Advanced Refractories expansion includes pre-cast, AlSi, and Basic monolithics in India, and Foundry fluxes in China.

- Nine new Flow Control robotics contracts were signed in 2024, compared to five in 2023.

- These initiatives are designed to drive revenue growth and enhance the company's competitive landscape.

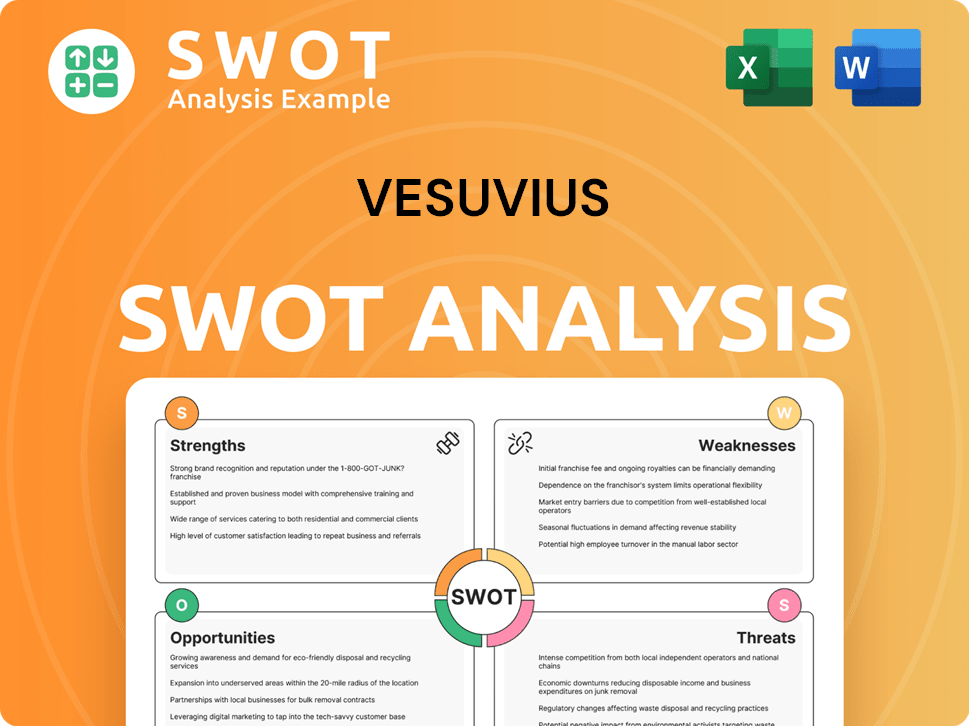

Vesuvius SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Vesuvius Invest in Innovation?

The Vesuvius growth strategy is heavily reliant on innovation and technological advancements. The company consistently invests in research and development to stay ahead in the market. This commitment to innovation is crucial for maintaining its competitive edge and driving future growth.

Vesuvius's future prospects are closely tied to its ability to develop and implement cutting-edge technologies. By focusing on digital transformation, automation, and sustainable solutions, the company aims to meet evolving customer needs and industry demands. This approach supports its long-term goals and reinforces its position in the market.

Vesuvius company analysis reveals a strong emphasis on technological innovation. The company's strategic initiatives are designed to enhance operational efficiency, reduce environmental impact, and provide superior value to its customers. This focus on innovation is a key driver of its financial performance and market share.

In 2024, Vesuvius invested £36.9 million in R&D, representing 2.0% of its revenue. This consistent investment level, similar to the £37.4 million in 2023, supports the development of new products and technologies.

The company launched 33 new products in 2024, a significant increase from 21 in 2023. This robust new product pipeline is a direct result of its sustained R&D efforts.

New product sales accounted for 19.1% of total sales in 2024, approaching the long-term target of 20%. This indicates the success of its innovation strategy and its ability to bring new products to market.

Vesuvius integrates robotics and mechatronic installations into its flow control solutions. These solutions help reduce costs, enhance safety, and improve operational efficiency for customers.

Nine new Flow Control robotics contracts were signed in 2024, demonstrating growing customer interest in these advanced solutions. This highlights the demand for automation in the industry.

The company is focused on sustainability through technological innovation. Its refractory products and engineering solutions are designed to improve casting processes and reduce environmental impact.

The company's commitment to innovation is further demonstrated by its sustainability initiatives. Brief History of Vesuvius shows how the company has consistently evolved. Vesuvius aims to achieve net-zero CO2e emissions by 2050 (Scope 1 and Scope 2) and assists its customers in reducing their CO2 emissions. In 2024, Vesuvius maintained an AA rating from MSCI, received a silver medal from EcoVadis, and a B grade from CDP, reflecting its progress in sustainability.

Vesuvius is actively involved in several key technological advancements that contribute to its Vesuvius company growth strategy.

- Robotics and Automation: Integration of robotics and mechatronics to reduce costs, enhance safety, and improve efficiency.

- Sustainable Solutions: Development of refractory products and engineering solutions to improve casting processes and reduce energy consumption.

- New Product Development: Launch of innovative products like new coatings for tundish shrouds and new tundish linings, such as BasiVibe QuickStart.

- Subsidiary Initiatives: Vesuvius India invests in state-of-the-art facilities and technologies, including new Al-Si monolithic, basic monolithic, and flux plants.

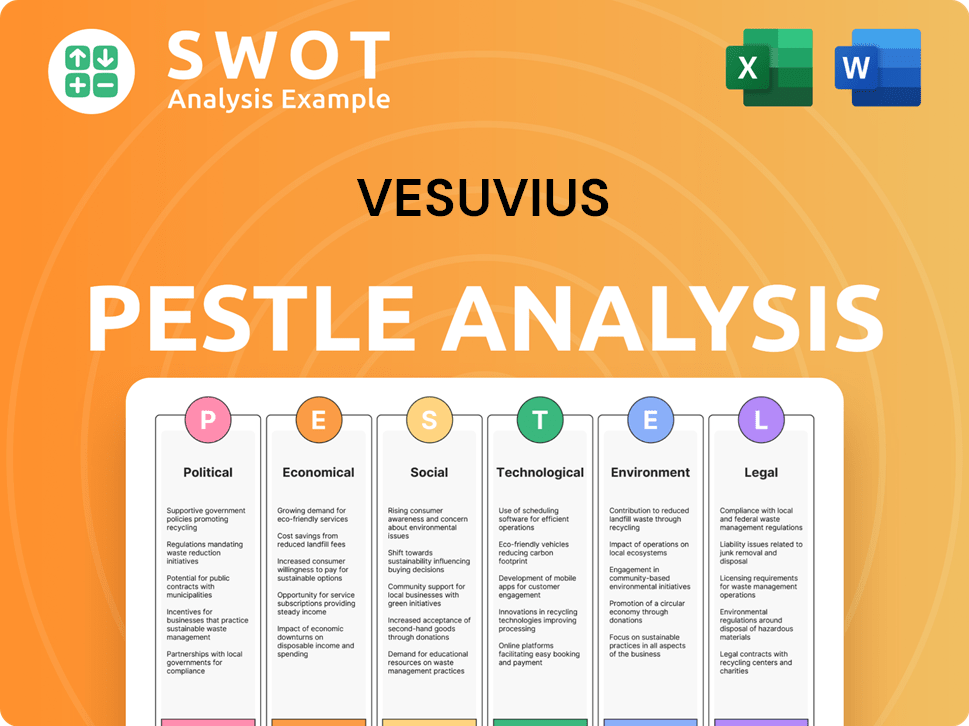

Vesuvius PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Vesuvius’s Growth Forecast?

The financial outlook for Vesuvius reflects a strategic navigation of current market conditions. The company's 2024 performance showed resilience, with a focus on cost management and strategic investments for long-term growth. This approach is designed to position the company favorably within the competitive landscape, as detailed in an analysis of Competitors Landscape of Vesuvius.

Vesuvius is adapting to global economic challenges while pursuing its strategic objectives. The company's financial strategies include managing costs, optimizing capital expenditure, and maintaining a strong balance sheet. These measures are crucial for sustaining growth and enhancing shareholder value in the face of fluctuating market dynamics.

The company's 2024 results show a revenue of £1,820.1 million, with an underlying decrease of 1.8%. Trading profit was £188.0 million, and profit before tax declined to £138.6 million. These figures highlight the immediate financial situation and inform the company's future strategic decisions, including its growth strategy.

In 2024, Vesuvius reported revenue of £1,820.1 million, reflecting a 1.8% underlying decrease. Trading profit reached £188.0 million, with a return on sales of 10.3%. Profit before tax was £138.6 million, indicating the impact of market pressures.

For 2025, Vesuvius anticipates trading profit to be slightly lower than 2024 on a constant currency basis. The company aims for a mid-term Return on Sales of at least 12.5% by 2028. Free cash flow is expected to improve significantly in 2025.

Vesuvius is accelerating its cost reduction program, targeting at least £45 million in recurring annual savings by 2028. The company is also focusing on working capital management and maintaining a normalized level of capital expenditure.

Vesuvius maintains a strong balance sheet with a net debt/EBITDA ratio of 1.3x. A final dividend of 16.4 pence per share is recommended for 2024, bringing the total to 23.5 pence per share. Share buyback programs are ongoing.

The company's revenue for 2024 was £1,820.1 million, with a trading profit of £188.0 million. The return on sales was 10.3%, a slight increase from the previous year. These figures are critical for understanding the company's financial performance.

Vesuvius is accelerating its cost reduction program, aiming for at least £45 million in annual savings by 2028. In 2024, £13 million in-year savings were delivered. This initiative is crucial for improving profitability.

Free cash flow in 2024 was £60.8 million, and the company anticipates significant improvement in 2025. Capex is expected to be £80-£85 million in 2025, returning to normal levels afterward.

A final dividend of 16.4 pence per share is recommended, bringing the total dividend to 23.5 pence per share. The company continues its share buyback programs to enhance shareholder value.

Vesuvius is targeting a mid-term Return on Sales of at least 12.5% by 2028. The company also aims to deliver a cumulative £400 million free cash flow by 2027. These targets guide the company's long-term strategy.

The net debt/EBITDA ratio at the end of 2024 was 1.3x, which is at the lower end of the target range. This demonstrates the company's commitment to financial stability and responsible debt management.

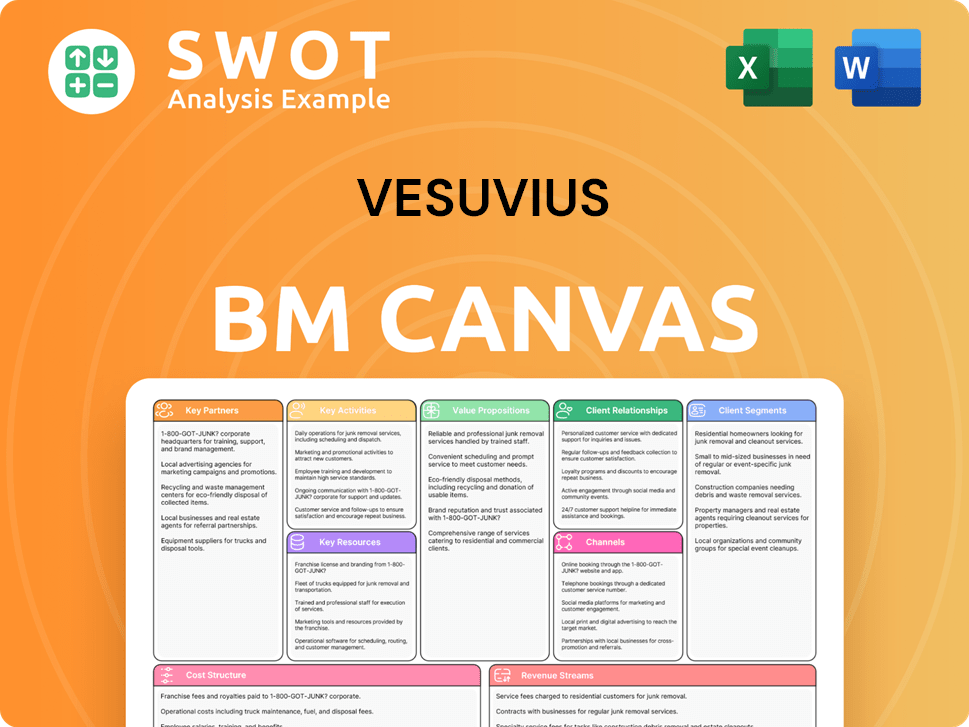

Vesuvius Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Vesuvius’s Growth?

The Vesuvius company analysis reveals several potential risks and obstacles impacting its Vesuvius growth strategy. These challenges stem from a dynamic global environment, including volatile markets and economic pressures. Understanding these factors is crucial for assessing the Vesuvius future prospects and making informed investment decisions.

One of the primary concerns is the uncertain market conditions, particularly the weakness in the steel and foundry sectors, especially in Europe. Geopolitical instability and changing trade tariffs further complicate the landscape. These external factors necessitate a careful evaluation of Vesuvius's strategic initiatives.

Increased raw material and labor costs also present challenges. The ability to fully offset these inflationary pressures through price increases remains a key concern for the company. Addressing these risks is vital for maintaining Vesuvius's financial performance and achieving its growth targets.

The steel and foundry markets face structural weaknesses, especially in Europe. Global steel production (excluding China, Iran, Russia, and Ukraine) declined by 0.8% in Q1 2025 compared to Q1 2024. Foundry end-markets were down approximately 8% year-on-year.

Rising raw material and labor costs pressure trading profit. While price increases are planned for 2025, fully offsetting these costs is a challenge. The company is focused on mitigating these effects through various strategies.

Supply chain vulnerabilities and macroeconomic conditions could affect global steel production and operational efficiency. Dependence on stable Chinese exports poses a risk. These factors impact the Vesuvius industry outlook.

Geopolitical volatility and evolving trade tariffs add to the uncertainty. These factors can disrupt markets and impact Vesuvius's global operations. Strategic diversification is key to navigating these challenges.

High Chinese steel exports continue to impact the global market. Maintaining a competitive edge requires innovation and efficient operations. Understanding the competitive landscape is essential.

Ensuring operational efficiency amidst these challenges is crucial. The company's strategies include cost reduction programs and strong financial management. Further insights can be found in the Revenue Streams & Business Model of Vesuvius article.

Vesuvius is implementing various strategies to address these risks. These include leveraging its technologically differentiated business model and investing in R&D to gain Vesuvius market share. Diversification across geographical markets, such as the strong growth in India (6.8% in Q1 2025), is also a key focus. A group-wide cost reduction program aims for at least £45 million in recurring annual savings by 2028, with £13 million in-year savings in 2024.

Maintaining a strong balance sheet and focusing on working capital management are crucial for financial flexibility. These measures help Vesuvius navigate economic uncertainties and support its Vesuvius company's strategic initiatives. The company's focus on cost control and efficiency is also important for its Vesuvius revenue growth drivers.

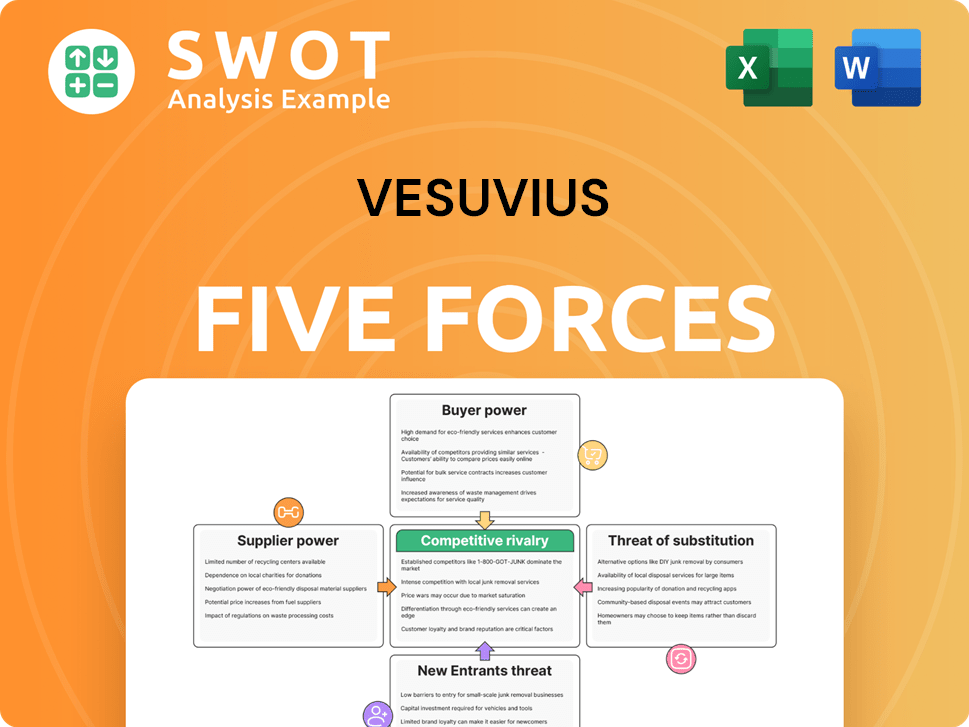

Vesuvius Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vesuvius Company?

- What is Competitive Landscape of Vesuvius Company?

- How Does Vesuvius Company Work?

- What is Sales and Marketing Strategy of Vesuvius Company?

- What is Brief History of Vesuvius Company?

- Who Owns Vesuvius Company?

- What is Customer Demographics and Target Market of Vesuvius Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.