Vesuvius Bundle

Who Really Controls Vesuvius?

Understanding the Vesuvius SWOT Analysis is crucial, but have you ever wondered who pulls the strings at a global powerhouse like Vesuvius Company? The ownership structure of Vesuvius plc dictates its strategic direction, influencing everything from innovation to market dominance. Knowing who owns Vesuvius is key to grasping its long-term potential and navigating the complexities of the steel and foundry industries.

This exploration into Vesuvius ownership will unveil the company's foundational stakes, significant investors, and public shareholdings. We'll examine the evolution of Vesuvius Group, from its roots to its current standing as a FTSE 250 constituent. Discovering the details of Vesuvius shareholders and how they shape the company's future is critical for any investor or industry observer seeking a deeper understanding of the business.

Who Founded Vesuvius?

The story of Vesuvius Company, a global leader in molten metal flow engineering, begins with Isaac Cookson's establishment of metal and glass businesses in 1704 in Tyneside. These early ventures laid the groundwork for the future Vesuvius Group. While detailed ownership structures from the early 18th century are not readily available, Cookson's initial enterprise marked the start of a long journey.

A pivotal moment in Vesuvius's history, particularly concerning its core business, was the founding of the Vesuvius Crucible Company in Pittsburgh, USA, in 1916. This company was established by Francis L. Arensberg, Charles F. Covert Arensberg, and Arthur J. Jackman, with financial support from Edith Arensberg. Their goal was to produce high-quality clay graphite crucibles for the booming American steel industry. This marked an important step toward the company's specialization in refractory products.

In 1932, Eric Weiss and Dr. Kossy Strauss founded Foundry Services Ltd (later known as Foseco) in Birmingham, UK, with an initial working capital of £250. This company, now part of Vesuvius's Foundry business, focused on providing specialized products for the foundry industry. These early initiatives, driven by the founders' dedication to specialized industrial solutions, established the technological and market focus that continues to define Vesuvius today.

Isaac Cookson's metal and glass businesses in 1704 were the starting point for the Vesuvius Company.

Founded in 1916 in Pittsburgh, USA, by the Arensbergs and Jackman.

Established in 1932 in Birmingham, UK, by Weiss and Strauss.

These early ventures established the core technological and market focus.

Foundry Services Ltd started with £250 in working capital.

Vesuvius Crucible Company produced crucibles for the American steel industry.

Understanding the initial ownership and founders provides context for the current Vesuvius ownership structure. The journey from Isaac Cookson's early businesses to the specialized companies of the 20th century highlights the evolution of the company. For those interested in the competitive landscape, it's worth exploring the Competitors Landscape of Vesuvius.

- Isaac Cookson's early businesses formed the foundation.

- Vesuvius Crucible Company focused on crucibles for steel.

- Foundry Services Ltd (Foseco) specialized in foundry products.

- These early ventures shaped the core technological focus.

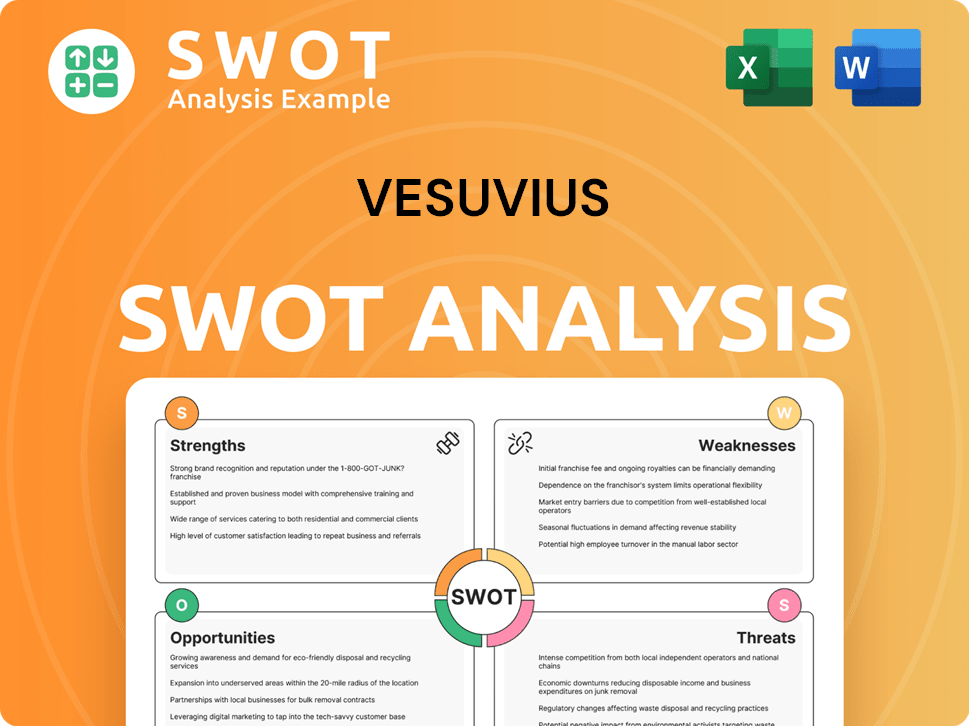

Vesuvius SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Vesuvius’s Ownership Changed Over Time?

The evolution of the Vesuvius Company's ownership structure has been marked by its transition to a publicly traded entity. Initially listed on the London Stock Exchange in 1930 under the name Associated Lead Manufacturers, the company has seen significant shifts in its shareholder base over the years. This transformation reflects broader trends in the financial markets, with institutional investors playing an increasingly prominent role in shaping the company's ownership landscape. The changes in major shareholding directly influence company strategy and governance through the engagement of these large institutional investors.

The Vesuvius ownership structure has seen considerable changes over time, particularly with the involvement of institutional investors. The company's history includes a listing on the London Stock Exchange, which opened up its ownership to a wider range of shareholders. These shifts in ownership have influenced the company's strategic direction and governance, reflecting the evolving dynamics of the financial markets. For more insights into the company's strategic direction, you can read about it in Growth Strategy of Vesuvius.

| Shareholder | Percentage of Shares (as of March 27, 2024) | Shares Held (as of April 30, 2025) |

|---|---|---|

| Cevian Capital AB | 22.92% | - |

| GLG Partners LP | 6.924% | - |

| Martin Currie Investment Management Ltd | 5.342% | - |

| Aberforth Partners LLP | 5.207% | - |

| Vanguard Group Inc. | 4.38% | 10,712,506 |

| BlackRock, Inc. | 3.23% | 7,899,246 |

As of March 2025, the Vesuvius Group, UK, holds a significant 55.57% stake in its subsidiary, Vesuvius India Limited. This illustrates the parent company's concentrated ownership in its Indian operations. The major shareholding shifts have largely involved the accumulation of shares by institutional investors and asset management firms, demonstrating their confidence in the company's long-term prospects. Understanding Vesuvius shareholders is crucial for investors and stakeholders alike.

The ownership of Vesuvius plc is primarily influenced by institutional investors. Cevian Capital AB holds the largest stake, followed by other significant shareholders like GLG Partners LP and Martin Currie Investment Management Ltd.

- Cevian Capital AB is a major shareholder as of March 27, 2024.

- Vanguard and BlackRock also hold notable stakes as of April 30, 2025.

- The Vesuvius Group, UK, holds a majority stake in Vesuvius India Limited as of March 2025.

- These details are essential for understanding who owns Vesuvius and its subsidiaries.

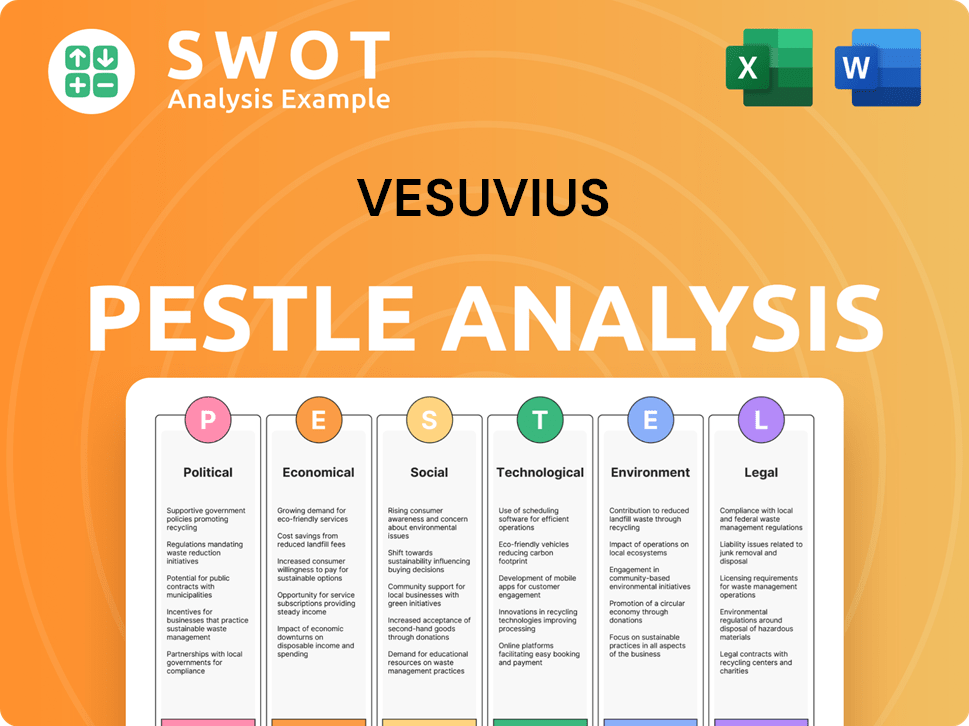

Vesuvius PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Vesuvius’s Board?

The current Board of Directors of the Vesuvius Company, as of March 2025, is led by Carl-Peter Forster as Chairman. Patrick André serves as Chief Executive, and Mark Collis holds the position of Chief Financial Officer. The board includes independent Non-executive Directors such as Eva Lindqvist, who was appointed Senior Independent Director on May 15, 2024, and Italia Boninelli, who became Chair of the Remuneration Committee on July 31, 2024. Other independent directors are Carla Bailo, Dinggui Gao, and Robert MacLeod, who chairs the Audit Committee.

Friederike Helfer, a Partner of Cevian Capital, also serves as a Non-executive Director, reflecting the influence of major shareholders in the company's governance. This composition ensures a blend of executive leadership, independent oversight, and representation from significant stakeholders within Vesuvius plc.

| Director | Role | Appointment Date |

|---|---|---|

| Carl-Peter Forster | Chairman | Not Specified |

| Patrick André | Chief Executive | Not Specified |

| Mark Collis | Chief Financial Officer | Not Specified |

| Eva Lindqvist | Senior Independent Director | May 15, 2024 |

| Italia Boninelli | Chair of the Remuneration Committee | July 31, 2024 |

| Robert MacLeod | Chairman of the Audit Committee | September 1, 2023 |

| Friederike Helfer | Non-executive Director | Not Specified |

Vesuvius plc operates with a one-share-one-vote structure, with a total of 248,171,717 shares with voting rights as of May 1, 2025. Cevian Capital, a major shareholder, held a 22.92% stake as of March 27, 2024, which gives it considerable influence over the company's decision-making. The company encourages shareholder engagement, providing avenues for shareholders to submit questions in advance of the Annual General Meeting (AGM), such as the one scheduled for May 16, 2025. For more insights, consider exploring the Target Market of Vesuvius.

The voting structure at Vesuvius Company is straightforward, with each ordinary share typically carrying one vote. This structure ensures that shareholder votes directly reflect their ownership stake. Major shareholders, like Cevian Capital, can significantly influence the company's direction.

- One-share-one-vote structure.

- Total shares with voting rights: 248,171,717 as of May 1, 2025.

- Cevian Capital's stake: 22.92% as of March 27, 2024.

- Shareholder engagement through AGMs.

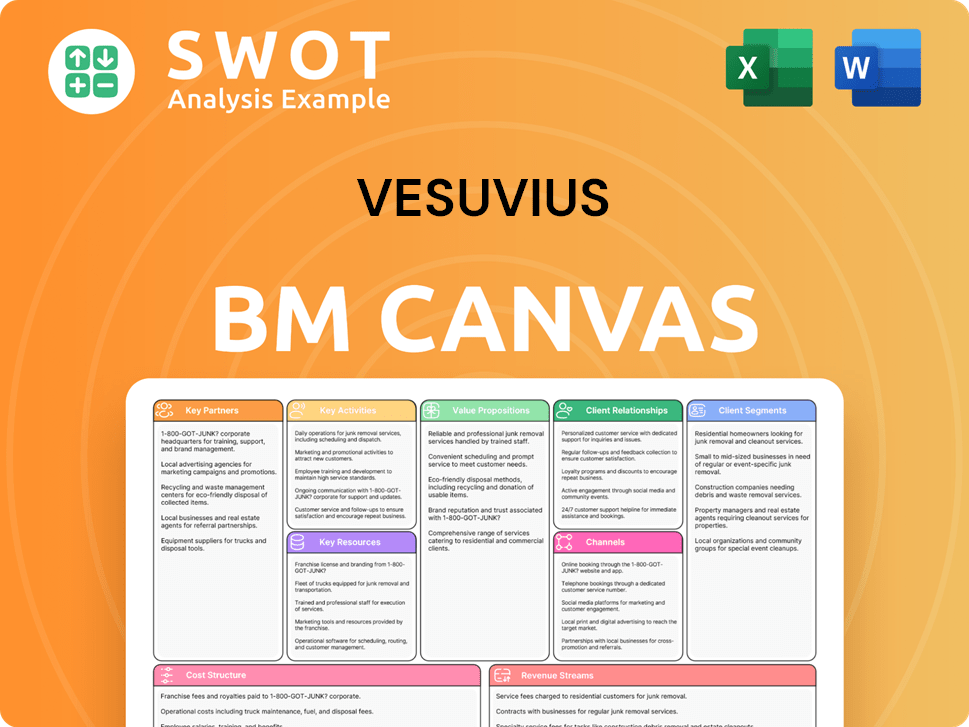

Vesuvius Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Vesuvius’s Ownership Landscape?

Over the past few years, Vesuvius Company, or Vesuvius plc, has actively managed its capital structure. This includes share buyback programs aimed at returning surplus cash to shareholders and reducing share capital. A share buyback program, announced on December 4, 2023, concluded on August 22, 2024, with the repurchase of 10,821,465 ordinary shares for approximately £49.9 million. Furthermore, a subsequent share buyback program of up to £50 million was announced on November 19, 2024, targeting completion by late May 2025.

As of March 20, 2025, the second buyback program saw the repurchase of approximately 12,220,715 shares, representing 4.82% of the company's shares, for £50 million. These actions highlight Vesuvius's commitment to shareholder value. Leadership changes have also been observed, with Eva Lindqvist appointed as a Non-executive Director effective April 1, 2025, and set to become Senior Independent Director at the 2025 Annual General Meeting. In addition, the company acquired a 61.65% stake in piroMET for €26.2 million on February 25, 2025.

| Shareholder | Percentage of Ownership (as of April 30, 2025) |

|---|---|

| Cevian Capital II Master Fund, L.P. | 23.43% |

| The Vanguard Group, Inc. | 4.38% |

| BlackRock, Inc. | 3.23% |

The ownership structure of Vesuvius Company reflects a trend towards increased institutional ownership. Major institutional holders, such as Cevian Capital II Master Fund, L.P. (23.43%), The Vanguard Group, Inc. (4.38%), and BlackRock, Inc. (3.23%), hold significant stakes. This pattern is common in mature public companies, where large investment firms play a key role. This concentration of ownership can lead to greater scrutiny of corporate governance and a focus on long-term value creation for Vesuvius shareholders.

Vesuvius plc has seen active capital management through share buybacks. Recent buybacks aim to reduce share capital and return value to shareholders. Key institutional investors hold significant stakes in the company.

Cevian Capital II Master Fund, L.P. is a major shareholder with 23.43% ownership. The Vanguard Group, Inc. holds 4.38%, and BlackRock, Inc. holds 3.23%. These institutional investors influence corporate governance.

Vesuvius completed a share buyback program in August 2024 for £49.9 million. A new buyback program of up to £50 million was announced in November 2024. The company also acquired a stake in piroMET.

Eva Lindqvist was appointed as a Non-executive Director in April 2025. She is set to become the Senior Independent Director. These moves reflect changes in Vesuvius's leadership.

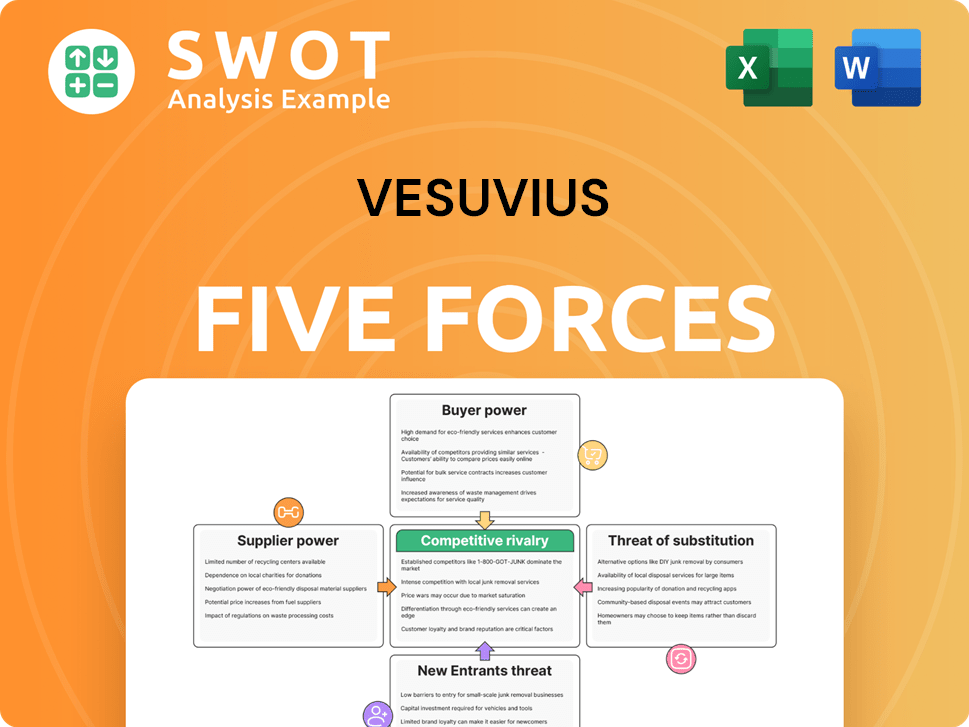

Vesuvius Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vesuvius Company?

- What is Competitive Landscape of Vesuvius Company?

- What is Growth Strategy and Future Prospects of Vesuvius Company?

- How Does Vesuvius Company Work?

- What is Sales and Marketing Strategy of Vesuvius Company?

- What is Brief History of Vesuvius Company?

- What is Customer Demographics and Target Market of Vesuvius Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.