Vodafone Group Bundle

Can Vodafone Conquer the Ever-Changing Telecom Arena?

In the fast-paced world of telecommunications, Vodafone Group faces a relentless battle for market dominance. From its humble beginnings in the UK, Vodafone has evolved into a global giant, but how does it stack up against its rivals? This analysis dives deep into the Vodafone Group SWOT Analysis, exploring its strengths, weaknesses, opportunities, and threats in a fiercely competitive environment.

Understanding the Vodafone competitive landscape is crucial for anyone looking to navigate the telecom industry. This comprehensive Vodafone market analysis will examine key players in the mobile telecommunications market, evaluating Vodafone's market share and strategies. We'll explore Vodafone's global presence, dissecting its competitive advantages and disadvantages, and assessing its response to 5G competition, providing actionable insights for investors and strategists alike. This detailed examination will also analyze Vodafone's financial performance versus competitors, offering a clear picture of its position in the evolving telecom sector.

Where Does Vodafone Group’ Stand in the Current Market?

The Owners & Shareholders of Vodafone Group, a major player in the global telecommunications market, holds a significant market position, especially in Europe and Africa. As of late 2024 and early 2025, it remains one of the largest mobile and fixed-line operators. Vodafone's core operations revolve around providing mobile connectivity, fixed-line broadband, TV services, and enterprise solutions.

Vodafone's value proposition centers on offering comprehensive communication services to both consumers and businesses. This includes voice and data services, bundled packages, and advanced technology solutions like IoT and cloud services. The company's strategic shift towards converged services aims to capture a larger share of household spending and provide integrated technology solutions for enterprises, reflecting its move towards higher-value services.

Financially, Vodafone reported a 2.8% increase in service revenue for Q3 FY24 (ending December 31, 2023), driven by strong performance in Germany and Africa. Adjusted EBITDAaL for the first nine months of FY24 was €11.0 billion. While the company faces intense competition, it holds segment leadership in specific areas, such as IoT connectivity.

Vodafone's competitive landscape is characterized by intense competition in the telecom industry. Key players include other major mobile network operators. Vodafone's market share varies across different regions and service segments.

Vodafone's market position is strong in several European countries, especially Germany and the UK. It also has a significant presence in numerous African countries through its Vodacom subsidiary. Vodafone's global presence and competitive positioning are key aspects of its strategy.

Vodafone aims to gain market share through converged services and enterprise solutions. The company focuses on both customer acquisition and retention strategies. Vodafone is also responding to 5G competition with infrastructure investments.

A detailed analysis of Vodafone's financial performance versus competitors reveals key insights. Regulatory changes impact Vodafone's competition, and the company's pricing strategies play a crucial role. Vodafone's innovation and technology adoption are also critical.

Vodafone's competitive landscape is shaped by several factors, including its response to 5G competition and its ability to adapt to regulatory changes. The company faces challenges in mature markets like Italy and Spain, leading to strategic reviews and potential divestments. Vodafone's partnerships and alliances also play a crucial role.

- Intense competition in the telecom industry.

- Focus on converged services and enterprise solutions.

- Geographic presence in Europe and Africa.

- Strategic reviews and potential divestments in some markets.

Vodafone Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Vodafone Group?

The Vodafone Group operates in a highly competitive environment, facing a diverse range of rivals across various markets. Understanding the Vodafone competitive landscape is crucial for assessing its market position and future prospects. This analysis delves into Vodafone Group competitors, providing a detailed Vodafone market analysis to highlight key players and competitive dynamics.

Vodafone's competitive landscape is shaped by both direct and indirect competitors. Direct competitors include major telecommunications providers offering similar services, while indirect competitors encompass over-the-top (OTT) service providers and cloud service providers that compete for customer engagement and revenue. This competitive pressure necessitates continuous innovation and strategic adaptation from Vodafone to maintain its market share and profitability.

Vodafone's competitive advantages and disadvantages are constantly being tested in the market. The company's global presence and competitive positioning are critical factors, alongside its ability to adapt to technological advancements and regulatory changes. Vodafone's strategies to gain market share are essential for its long-term success.

In Europe, Vodafone's main rivals include large integrated telecommunications providers. These competitors offer a broad range of services, including mobile, fixed-line broadband, and enterprise solutions. The competitive landscape is intense, with each company vying for market share and customer loyalty.

Deutsche Telekom is a significant competitor, particularly in Germany, where its T-Mobile brand challenges Vodafone's services. Deutsche Telekom's strong network performance and extensive customer base make it a formidable rival. In 2024, Deutsche Telekom reported revenues of approximately €111.8 billion.

Orange competes directly with Vodafone in mobile, broadband, and enterprise solutions across Europe, the Middle East, and Africa. Orange often leverages its strong brand and converged offerings to gain market share. In 2024, Orange reported revenues of around €44.1 billion.

Telefónica provides a similar range of services, particularly in Spain and Latin America, often engaging in fierce price competition and bundled service offerings. Telefónica's competitive strategies include aggressive pricing and innovative service bundles. In 2024, Telefónica's revenue was approximately €40.7 billion.

BT Group is a major rival in both consumer and enterprise segments, especially in the UK, competing across mobile, fixed-line broadband, and TV services, notably through its EE mobile network. BT's strong presence in the UK market makes it a significant competitor. BT Group's revenue for the fiscal year 2024 was around £20.8 billion.

Vodafone also faces competition from over-the-top (OTT) service providers and cloud service providers. These players impact traditional voice and messaging services and compete for business clients. The rise of these indirect competitors necessitates strategic adaptation by Vodafone.

OTT service providers like Netflix, WhatsApp, and Zoom compete for customer engagement and revenue, impacting traditional voice and messaging services. These services offer alternatives that can reduce reliance on traditional telecom offerings. The global OTT market is projected to reach $423.9 billion by 2025.

In the enterprise segment, cloud service providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform compete for business clients seeking digital transformation solutions. These providers offer comprehensive solutions that can replace traditional telecom services. The cloud computing market is expected to reach $791.48 billion by 2026.

Regional players and low-cost operators often disrupt the competitive landscape through aggressive pricing strategies. These operators can gain market share by offering lower prices and targeting specific customer segments. The rise of these operators adds to the Vodafone competitive landscape.

The telecom industry is subject to significant merger and acquisition activity, which reshapes competitive dynamics. Vodafone's strategic responses to these changes are crucial for maintaining its market share and profitability. Understanding the impact of regulatory changes on Vodafone's competition is also essential.

- Mergers and Acquisitions: The proposed merger between Vodafone UK and Three UK would reduce the number of major mobile network operators in the UK from four to three, reshaping competitive dynamics.

- 5G Competition: Vodafone's response to 5G competition involves significant investments in 5G infrastructure and service offerings. The global 5G market is expected to reach $1.6 trillion by 2025.

- Pricing Strategies: Vodafone's pricing strategies compared to rivals are critical for attracting and retaining customers. Competitive pricing is essential in a market with numerous options.

- Innovation and Technology: Vodafone's innovation and technology adoption compared to competitors, including investments in new technologies and services, is crucial for staying ahead.

- Customer Acquisition and Retention: Vodafone's customer acquisition and retention strategies, including loyalty programs and enhanced customer service, are vital for maintaining a strong customer base.

Vodafone Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Vodafone Group a Competitive Edge Over Its Rivals?

Analyzing the Vodafone competitive landscape reveals a company leveraging its global reach and brand strength to maintain a competitive edge. Key milestones include continuous investments in 5G and fiber optic networks, expanding its enterprise solutions, and strategic partnerships to enhance operational efficiencies. These moves are crucial in a dynamic telecom industry.

Vodafone market analysis shows a focus on diversified revenue streams beyond traditional connectivity. This includes a strong presence in emerging markets through its Vodacom subsidiary. The company's success hinges on its ability to adapt to rapid technological changes and maintain customer loyalty.

The company's strategy involves a blend of infrastructure development, brand building, and service diversification. Vodafone Group competitors face a formidable rival that is consistently evolving to meet market demands. This approach is critical in a sector where innovation and customer experience are paramount.

Vodafone's vast network infrastructure is a cornerstone of its competitive advantage. It spans across numerous countries, providing seamless connectivity. Continued investment in 5G and fiber optic networks allows the company to deliver high-speed, low-latency services.

Vodafone is a globally recognized brand, associated with reliability and innovation. This strong brand presence fosters customer loyalty and reduces customer acquisition costs. Its diverse geographic presence mitigates risks from economic downturns or regulatory changes.

The company's increasing focus on enterprise solutions, including IoT, cloud, and security services, provides a competitive edge. Its global IoT platform, connecting over 175 million devices as of March 2024, demonstrates its leadership in this segment. Strategic partnerships and digital transformation initiatives enhance operational efficiencies.

Vodafone's global presence reduces its vulnerability to regional economic fluctuations. The company's operations in Africa, particularly through Vodacom, provide a significant growth engine. This diversification ensures a more stable financial performance.

Vodafone's competitive advantages are rooted in its extensive global infrastructure, strong brand equity, and diversified service portfolio. The company's strategy includes continuous investment in advanced technologies, strategic partnerships, and a focus on enterprise solutions. These elements contribute to its ability to maintain a strong position in the competitive telecommunications market.

- Extensive Network Coverage: A broad network ensures consistent service across multiple regions.

- Brand Recognition: A well-established brand fosters customer loyalty and trust.

- Enterprise Solutions: Expanding into IoT, cloud, and security services diversifies revenue streams.

- Strategic Partnerships: Collaborations enhance service offerings and market reach.

Vodafone Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Vodafone Group’s Competitive Landscape?

The Vodafone competitive landscape is significantly shaped by rapid technological advancements, evolving consumer preferences, and intense competition within the telecom sector. The company faces both challenges and opportunities in a market undergoing constant transformation. Understanding the dynamics of Vodafone Group competitors and the broader telecom industry analysis is crucial for evaluating its strategic positioning and future prospects.

Vodafone's market analysis reveals a complex interplay of factors influencing its performance, including regulatory changes, economic conditions, and the rise of new technologies. The company's ability to adapt to these shifts and capitalize on emerging opportunities will determine its success in the years to come. The competitive landscape is dynamic, requiring continuous strategic adjustments to maintain and enhance market share.

The telecom industry is experiencing a surge in 5G network deployments and fiber broadband expansions, enabling faster connectivity and new services. Consumer demand is shifting towards converged services, integrating mobile, fixed-line, and entertainment offerings. The rise of over-the-top (OTT) services continues to challenge traditional revenue streams. These trends are reshaping the mobile network operators landscape.

Intense price competition, particularly in mature European markets, poses a significant challenge. Continuous innovation is essential to stay ahead of disruptive technologies and new market entrants. Geopolitical factors and macroeconomic uncertainties, such as inflation and interest rate fluctuations, also impact investment plans and consumer spending. The need for substantial capital expenditure for network upgrades is a financial burden.

Growing demand for enterprise solutions, including IoT, cloud computing, and cybersecurity services, offers a lucrative avenue for diversification. Expansion in emerging markets, particularly in Africa through Vodacom, presents substantial growth potential. Strategic partnerships and targeted mergers can help consolidate market positions and achieve greater efficiencies. The company can leverage its network assets and adapt to evolving consumer needs.

Vodafone is focusing on network modernization to enhance 5G capabilities and expand fiber broadband coverage. The company is actively pursuing partnerships and acquisitions to strengthen its market position. Investments in enterprise solutions and expansion in emerging markets are key strategic priorities. A focus on customer experience and loyalty programs is also a priority.

The competitive landscape is influenced by various factors. For instance, in 2024, the telecom sector saw significant investments in 5G infrastructure, with operators like Vodafone allocating substantial capital expenditure. The Growth Strategy of Vodafone Group highlights the importance of adapting to these changes. The company’s ability to leverage its network assets, adapt to evolving consumer needs, and strategically invest in high-growth areas will be crucial.

Several elements influence Vodafone's competitive position, including pricing strategies, network quality, and customer service. Vodafone's market share and financial performance are directly impacted by these factors. The ability to innovate and adapt to technological advancements is also a critical differentiator.

- Pricing Strategies: Competitive pricing models and promotional offers are essential for attracting and retaining customers.

- Network Quality: The reliability and speed of the network are crucial for customer satisfaction and loyalty.

- Customer Service: Providing excellent customer service helps build a strong brand reputation and customer loyalty.

- Innovation: Continuous investment in new technologies and services is necessary to stay ahead of the competition.

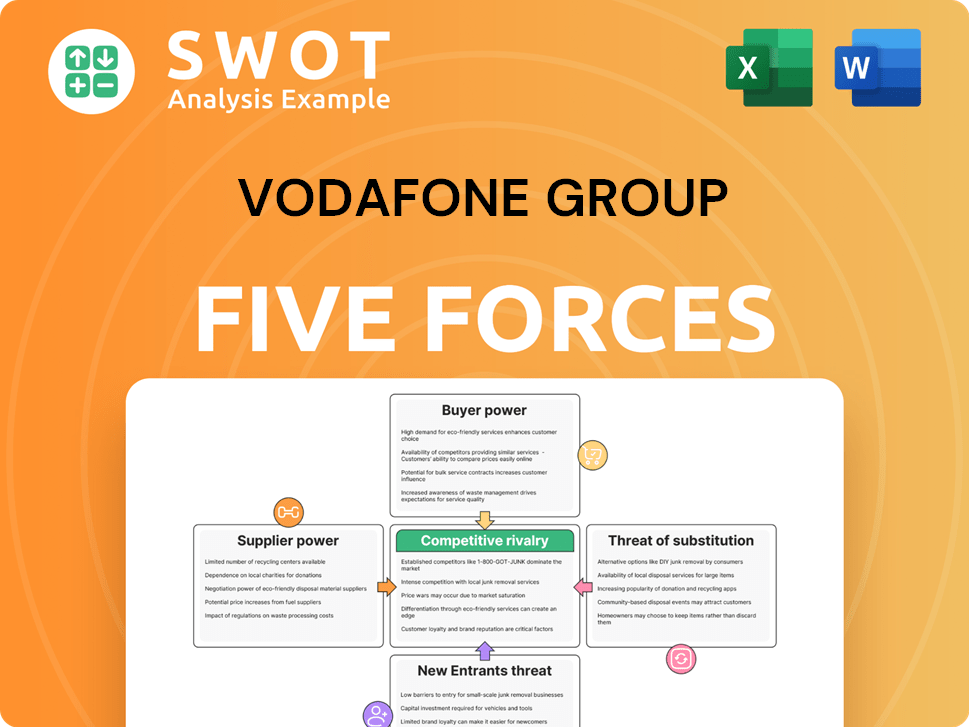

Vodafone Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vodafone Group Company?

- What is Growth Strategy and Future Prospects of Vodafone Group Company?

- How Does Vodafone Group Company Work?

- What is Sales and Marketing Strategy of Vodafone Group Company?

- What is Brief History of Vodafone Group Company?

- Who Owns Vodafone Group Company?

- What is Customer Demographics and Target Market of Vodafone Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.