GOL Bundle

Can GOL Airlines Soar Again Amidst Turbulence?

The Brazilian airline industry is a battleground, and GOL Linhas Aéreas is currently navigating a particularly challenging phase. Following its Chapter 11 filing in early 2024, the company's GOL SWOT Analysis becomes crucial for understanding its position. This strategic move highlights the intense competition and economic pressures within the sector, making a deep dive into GOL's competitive landscape essential.

This analysis delves into the core of GOL's challenges and opportunities, examining its market position and the strategies it employs to compete. We'll dissect GOL's competitive advantages, scrutinize its key rivals, and assess the broader industry trends shaping its future. Understanding the GOL competitive landscape is vital for anyone seeking to grasp the dynamics of the Airline industry Brazil and the strategic moves of GOL Airlines analysis.

Where Does GOL’ Stand in the Current Market?

GOL Linhas Aéreas, despite its Chapter 11 restructuring initiated in early 2024, maintains a significant market position in the Brazilian and South American aviation sectors. The airline's core operations center around passenger air transportation, focusing on affordable travel options. GOL's value proposition emphasizes accessible air travel, serving a broad customer base within Brazil and select international destinations.

Before its restructuring, GOL was a key player in the Brazilian domestic market, often competing for the top spot in market share alongside LATAM and Azul. The company's extensive route network and competitive pricing have been central to its strategy. For a deeper dive into the company's origins, consider reading this Brief History of GOL.

GOL's geographic presence is primarily focused on Brazil, with a robust domestic network. It also serves various international destinations across South America and the Caribbean. The airline's strategic focus has largely remained on the budget-friendly segment, adapting to include more business-oriented services and partnerships to cater to a broader audience.

In 2023, GOL, LATAM, and Azul collectively held a substantial majority of the domestic air travel market in Brazil. Before the restructuring, GOL was a major competitor in the domestic market. The exact market share figures for 2024 are still emerging, but the competitive landscape remains dominated by these three airlines.

Prior to its Chapter 11 filing, GOL reported significant revenues. However, the airline also carried substantial debt, contributing to the financial challenges that led to the restructuring. The restructuring aims to optimize the capital structure and operations to ensure long-term viability. The financial challenges highlight the intense competition and economic pressures in the airline industry.

GOL's competitive advantages include its extensive domestic network, focus on affordable travel, and strategic partnerships. These factors have allowed GOL to maintain a strong presence in key Brazilian hubs. The airline's ability to adapt its offerings to cater to a broader customer base is also a key strength.

GOL faces intense competition from rivals offering extensive networks and competitive pricing. The airline's restructuring efforts are aimed at strengthening its financial standing and competitive posture. The company is focused on optimizing its operations to navigate ongoing industry pressures and ensure long-term viability in the competitive market.

GOL's market position is shaped by its strategic focus on the budget-friendly segment and its extensive domestic network. The airline's competitive landscape includes LATAM and Azul, which also hold significant market shares. The airline's financial performance is crucial to understanding its position in the airline industry Brazil.

- GOL competitive landscape is dominated by LATAM and Azul.

- The airline's GOL market position is strong in key Brazilian hubs.

- GOL's GOL strategy includes affordable travel and a broad customer base.

- The impact of economic conditions significantly affects GOL's performance.

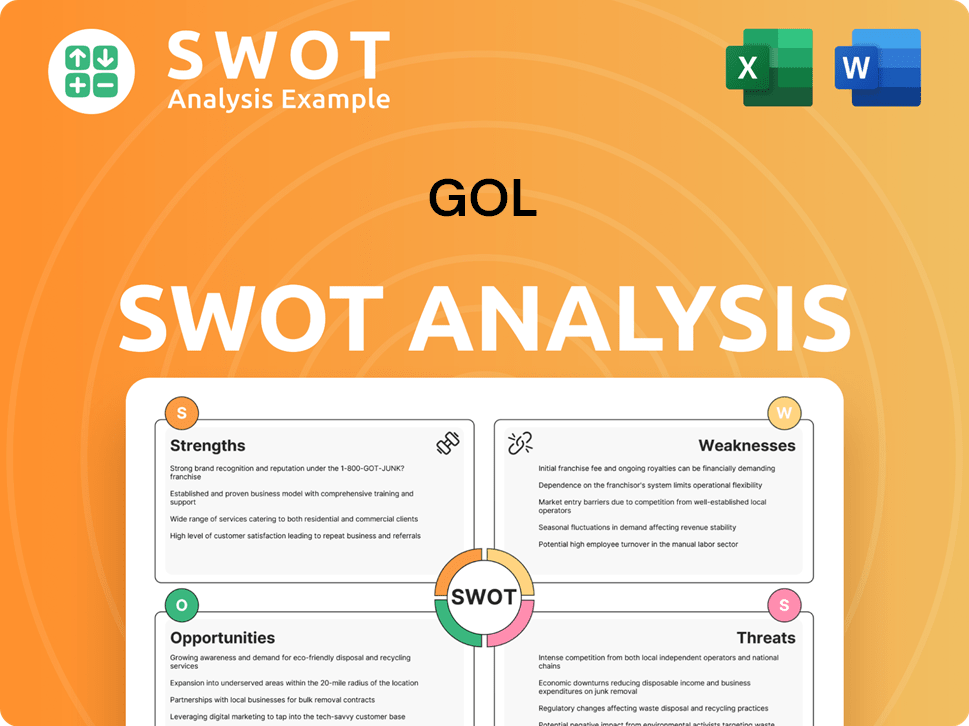

GOL SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging GOL?

The Marketing Strategy of GOL is significantly shaped by the competitive dynamics within the Brazilian airline industry. Understanding the GOL competitive landscape is crucial for assessing its market position and strategic choices. GOL Airlines analysis reveals a constant battle for market share, profitability, and customer loyalty.

GOL faces intense competition, primarily from LATAM Airlines Group and Azul S.A., which together with GOL, dominate the Brazilian domestic aviation market. These airlines employ diverse strategies to attract customers and maintain their positions. The airline industry in Brazil is dynamic, with shifts in market share and strategic responses to economic conditions.

GOL's strategic approach involves a mix of cost-efficiency, route network optimization, and customer-focused services. Analyzing GOL's financial performance compared to competitors provides insights into its operational efficiency and financial health. GOL's response to competitor actions, such as pricing adjustments and route expansions, is a key factor in its competitive strategy.

GOL's primary competitors are LATAM Airlines Group and Azul S.A. These airlines compete fiercely in the Brazilian domestic market.

LATAM is a larger airline with a broader international network. They often compete on price and offer a more premium experience.

Azul focuses on regional routes and is known for its customer service and modern fleet. They sometimes operate at higher price points.

Market share distribution among these three players is fluid. Each airline strives for dominance on key routes. The competitive landscape is constantly evolving.

GOL also faces indirect competition from bus services for shorter routes. International carriers also compete on long-haul flights.

The Brazilian market may see new, smaller players or increased activity from international low-cost carriers. The established trio maintains a strong hold.

GOL's competitive advantages include its low-cost model and extensive domestic route network. GOL's route network analysis reveals its focus on key Brazilian cities and regional connectivity. The airline's pricing strategy is designed to attract price-sensitive travelers.

- Market Share: In 2024, GOL, LATAM, and Azul continue to compete for market share, with fluctuations based on route offerings and pricing.

- Pricing: GOL often competes on price, but also offers services to differentiate itself.

- Alliances: Strategic partnerships and alliances are key to expanding reach without direct route competition.

- Customer Service: GOL's customer service is an area where they continuously aim to improve to compete with Azul and LATAM.

- Financial Performance: GOL's financial performance is affected by economic conditions and competitor actions.

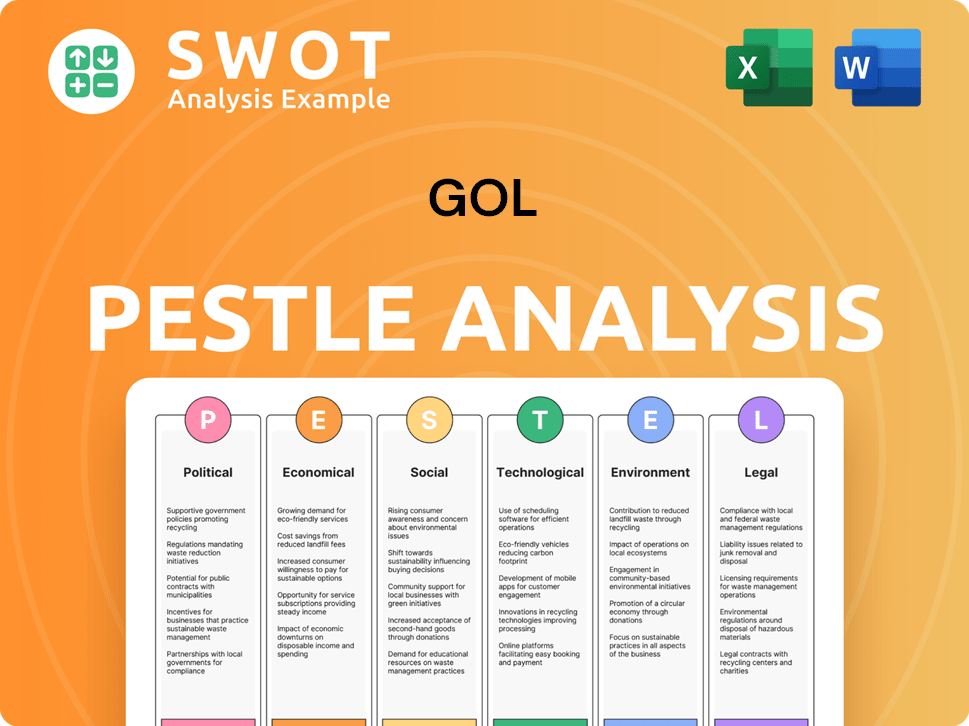

GOL PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives GOL a Competitive Edge Over Its Rivals?

The Growth Strategy of GOL has historically been shaped by its competitive advantages in the Brazilian airline market. These advantages include a strong brand presence, operational efficiency, and a well-established domestic network. Despite recent challenges, these elements remain crucial to its market position.

GOL's ability to offer competitive fares has been a key differentiator, supported by its standardized fleet of Boeing 737 aircraft. The company's investment in technology and digital platforms has enhanced the customer experience, further solidifying its competitive edge. Strategic slot allocations at key airports also provide a significant distribution advantage.

The airline's competitive landscape is dynamic, with rivals constantly seeking to emulate or surpass its strengths. Understanding these advantages is vital for assessing GOL's future prospects and its ability to navigate the complexities of the airline industry in Brazil.

GOL has built strong brand recognition in Brazil, fostering customer loyalty, particularly among price-sensitive travelers. This has been a key factor in its market position. This brand strength has been developed over two decades as a pioneer of low-cost air travel.

The airline's standardized Boeing 737 fleet contributes to operational efficiency, streamlining maintenance and training. This operational model supports cost advantages, allowing GOL to offer competitive fares. This efficiency is critical in a cost-sensitive market.

GOL has invested in robust digital platforms for booking and customer service, improving the customer experience. These technological advancements enhance the airline's competitive edge. This investment is crucial in today's digital age.

GOL's extensive domestic network and strategic slots at key Brazilian airports provide a significant distribution advantage. This ensures broad coverage and accessibility for its passengers. This network is a key asset in the competitive landscape.

GOL's competitive advantages include brand recognition, operational efficiency, and a strong domestic network. These factors have enabled GOL to maintain a significant market share in Brazil's airline industry. However, the company faces challenges such as financial restructuring and intense competition.

- Brand Equity: Strong brand recognition and customer loyalty.

- Operational Efficiency: Standardized fleet and streamlined operations.

- Network: Extensive domestic route network and strategic airport slots.

- Challenges: Financial restructuring and intense competition.

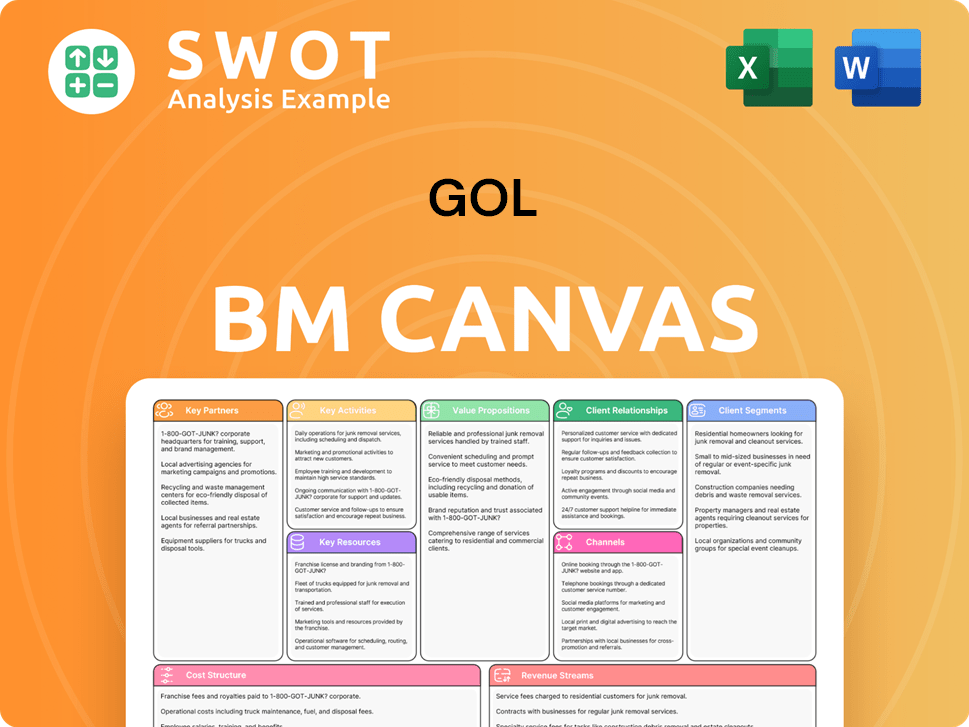

GOL Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping GOL’s Competitive Landscape?

The competitive landscape for GOL Linhas Aéreas in Brazil is significantly shaped by industry trends, future challenges, and emerging opportunities. The airline's strategic positioning is crucial amidst fluctuating fuel prices, economic uncertainties, and intense competition. A thorough GOL Airlines analysis reveals the need for adaptability and innovation to maintain and enhance its market position.

GOL's ability to navigate these dynamics will determine its long-term success. The airline industry in Brazil faces both internal and external pressures, influencing GOL's strategic decisions and operational performance. Understanding these factors is key to assessing GOL's current standing and future prospects.

Technological advancements are driving efficiency and enhancing customer experience through digitalization. Regulatory changes, especially regarding environmental sustainability and consumer protection, are becoming more impactful. Consumer preferences are shifting towards flexible booking, personalized services, and sustainable travel options.

GOL faces challenges in financial restructuring while competing with well-capitalized rivals like LATAM and Azul. Volatile fuel prices, currency fluctuations, and the Brazilian economic climate pose significant risks. Increased competition from new entrants or existing rivals expanding into GOL's core routes could erode its market share.

The growth of the Brazilian middle class presents a large customer base for affordable air travel. Innovations in sustainable aviation fuels and fuel-efficient aircraft could lead to cost savings. Strategic partnerships, both domestically and internationally, could expand GOL's network.

Optimizing the loyalty program and enhancing digital customer engagement can strengthen GOL's competitive position. The airline is focusing on a leaner operation, enhanced customer value, and strategic responses to market dynamics. Growth Strategy of GOL shows how GOL is adapting to the changing market.

GOL's competitive landscape requires careful navigation of industry trends, financial challenges, and strategic opportunities. The airline must adapt to technological advancements, regulatory changes, and evolving consumer preferences. GOL's success hinges on its ability to manage costs, expand its network, and enhance customer value.

- GOL's Market Share: GOL's market share in 2024 is approximately between 30% and 35%, competing with LATAM and Azul.

- Financial Performance: GOL's financial performance in 2024 is influenced by fuel costs, currency fluctuations, and economic conditions in Brazil.

- Strategic Initiatives: GOL is focusing on fleet modernization, route optimization, and strategic partnerships to improve its market position.

- Competitive Advantages: GOL's competitive advantages include its strong domestic network, brand recognition, and loyalty program.

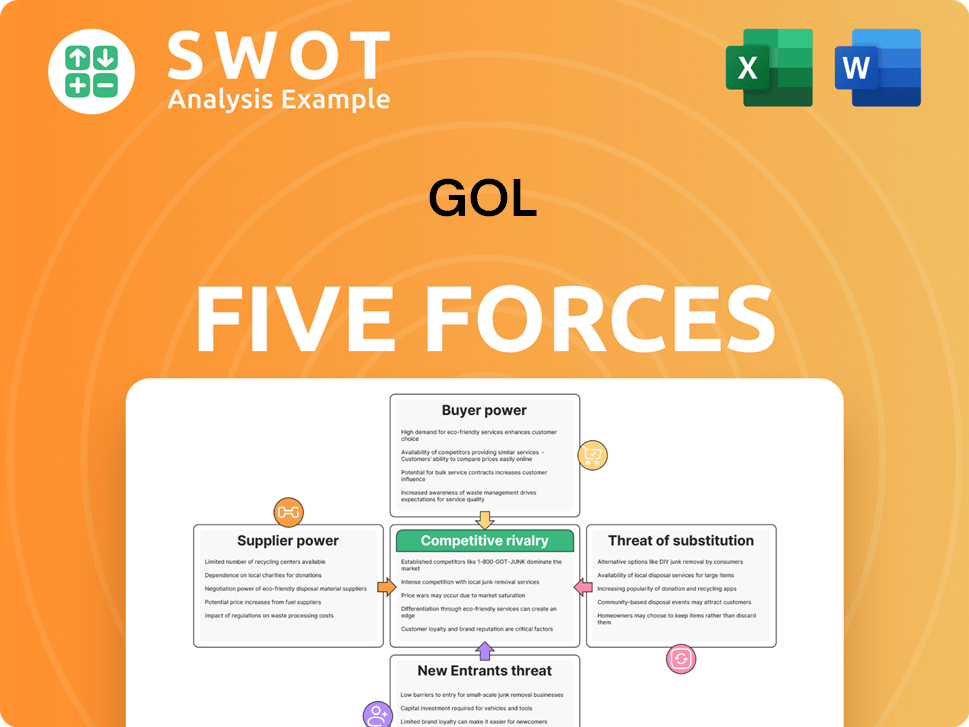

GOL Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of GOL Company?

- What is Growth Strategy and Future Prospects of GOL Company?

- How Does GOL Company Work?

- What is Sales and Marketing Strategy of GOL Company?

- What is Brief History of GOL Company?

- Who Owns GOL Company?

- What is Customer Demographics and Target Market of GOL Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.