GOL Bundle

How Does GOL Airlines Thrive in a Competitive Market?

GOL Linhas Aéreas, a Brazilian aviation giant, revolutionized South American air travel with its low-cost model, and now, post-restructuring, it's poised for even greater heights. Founded in 2001, GOL SWOT Analysis reveals how this airline, once Brazil's largest domestic carrier, has navigated turbulent skies. Understanding the inner workings of GOL Company is essential for anyone seeking to grasp the dynamics of the aviation industry.

This exploration into How GOL Works will uncover the strategies behind its success, especially after emerging from Chapter 11 in June 2025. We'll dissect its core operations, revenue models, and competitive advantages, offering insights into GOL's ability to provide affordable GOL Flights and navigate the complexities of the market. From GOL Brazil's domestic network to its international routes, discover how GOL Airlines continues to adapt and grow.

What Are the Key Operations Driving GOL’s Success?

The core of how the GOL Company operates revolves around providing air transportation services, focusing on affordable travel for both domestic and international routes. In 2024, GOL Airlines served approximately 30 million passengers, highlighting its significant presence in the market. This value proposition is centered on offering accessible air travel, connecting passengers across various destinations in South America and the Caribbean.

Operational efficiency is a key aspect of How GOL Works. The company streamlines its processes through online sales, check-in options, seat assignments, and in-flight services. This operational focus has led to impressive on-time performance, making it the most punctual airline in Brazil in 2024, and the most punctual low-cost airline globally in January 2025, with an 89.4% on-time performance in Q1 2025.

The company's value proposition is enhanced by its commitment to operational excellence, competitive pricing, and a comprehensive route network. GOL Brazil leverages a standardized fleet of Boeing 737 aircraft to maintain low unit costs, a crucial factor in the competitive Latin American market. The airline's focus on punctuality and customer service further solidifies its position, making it a preferred choice for travelers.

GOL operates a fleet of 139 Boeing 737 aircraft, which helps maintain low operational costs. The airline serves 65 domestic and 16 international destinations. The airline's network expansion and fleet modernization are ongoing, with new aircraft expected in 2025.

GOL focuses on punctuality and customer service to enhance its value proposition. The airline was the most punctual in Brazil in 2024, and the most punctual low-cost airline globally in January 2025. This reliability builds customer trust and provides a competitive edge.

GOL has strong partnerships with American Airlines and Air France-KLM. It also has over 60 codeshare and interline agreements. These partnerships expand its network and connectivity for customers, improving its reach.

GOLLOG, GOL's logistics unit, plays a crucial role in cargo transportation. It serves various regions in Brazil and abroad. This diversification enhances the company's revenue streams and operational capabilities.

Customers benefit from competitive pricing, a comprehensive network, and a reliable travel experience when flying with GOL. The airline's focus on affordability and punctuality makes it a strong choice. For more insights into GOL's strategic growth, check out the Growth Strategy of GOL.

- Competitive Pricing: Affordable fares attract a wide range of travelers.

- Extensive Network: Wide range of destinations across South America and the Caribbean.

- Reliable Service: High on-time performance and efficient operations enhance the travel experience.

- Strategic Partnerships: Codeshare agreements offer increased connectivity.

GOL SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does GOL Make Money?

Understanding the revenue streams and monetization strategies of the GOL Company is crucial for grasping its financial health and operational approach. GOL Airlines, a prominent player in the Brazilian aviation market, employs a multifaceted strategy to generate income and maximize profitability. This involves leveraging its core air transportation services, a robust loyalty program, and a dedicated cargo logistics unit.

The company's revenue model is designed to capture value across various touchpoints, from ticket sales to ancillary services and partnerships. By diversifying its income sources, GOL aims to mitigate risks associated with fluctuations in the airline industry and enhance its overall financial resilience. This integrated approach allows GOL to cater to a wide range of customer needs while optimizing its revenue generation capabilities.

GOL's primary revenue stream is passenger air transportation. In Q1 2025, the company reported a total net revenue of R$5.6 billion, reflecting a 19.4% increase compared to Q1 2024. The passenger business net revenue also grew by 19.4% during the same period, driven by a 6.6% increase in Revenue per Available Seat Kilometer (RASK). This growth indicates strong demand and efficient revenue management.

The Smiles loyalty program is a significant contributor to GOL's revenue. In 2024, Smiles celebrated its 30th anniversary and achieved its highest-ever revenue, totaling R$5.3 billion. The program reached 24 million customers in 2024, and its revenue continued to grow by 12.4% in Q1 2025.

- Miles redeemed increased by 17.9% in Q1 2025.

- Redemptions for non-airline products and services increased by 1.4 percentage points.

- Smiles reinforces its position as a comprehensive loyalty platform.

GOLLOG, GOL's logistics unit, is another key revenue stream. In 2024, GOLLOG surpassed R$1 billion in annual revenue for the first time, achieving a 32% growth compared to 2023, reaching nearly R$1.3 billion. In Q1 2025, the transported weight for GOLLOG increased by 6.8%. GOLLOG holds a 36% market share in Brazil's logistics market. GOL also utilizes technology solutions to personalize ancillary offers and optimize pricing in real-time.

GOL PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped GOL’s Business Model?

The recent emergence of GOL Company from Chapter 11 bankruptcy in June 2025 marks a crucial turning point. This restructuring, initiated in January 2024, has significantly strengthened its financial standing. The airline secured US$1.9 billion in exit financing and now holds approximately US$900 million in liquidity.

GOL's strategic moves include a focus on cost competitiveness and operational efficiency. A US$181 million annual profit improvement program is underway to help maintain a strong financial position. Furthermore, the airline is concentrating on fleet modernization and capacity expansion to enhance its operational capabilities.

GOL's competitive edge stems from its brand recognition and leading on-time performance within Brazil. The Abra Group's support, along with global partnerships, provides significant advantages. The company also continuously adapts to new trends by enhancing customer experience through technology, such as its partnership with Sabre for personalized offers and rebooking options.

GOL's emergence from Chapter 11 bankruptcy in June 2025 is a major achievement. The restructuring involved significant debt reduction, including the conversion or elimination of approximately US$1.6 billion in pre-bankruptcy funded debt and around US$850 million in other obligations. This financial reset has positioned GOL for future growth and stability.

GOL is implementing a US$181 million annual profit improvement program to boost cost competitiveness. The airline is actively modernizing its fleet, with over 50 engines overhauled in 2024. The delivery of five new Boeing 737 MAX aircraft in 2025 further supports its fleet renewal strategy. These actions are critical for Marketing Strategy of GOL and long-term success.

GOL Airlines benefits from a strong brand presence and leading on-time performance in Brazil. Its extensive network and global partnerships enable profitable expansion into new routes. The Abra Group provides significant know-how and financial support, enhancing its competitive position. GOL continuously enhances customer experience through technology, such as its partnership with Sabre.

Despite challenges, GOL reported a 19.4% revenue increase in Q1 2025, reaching R$5.62 billion. This growth demonstrates the airline's resilience and ability to recover. The focus on cost management and operational efficiency is expected to further improve financial results in the coming quarters.

GOL's focus on fleet renewal and operational improvements is evident. The airline aims to have all aircraft operational by early 2026. The delivery of new Boeing 737 MAX aircraft will enhance efficiency. These improvements are key to maintaining a competitive edge in the market.

- Fleet modernization with new Boeing 737 MAX aircraft deliveries in 2025.

- Over 50 engines overhauled in 2024, improving operational efficiency.

- A 19.4% revenue increase in Q1 2025, reaching R$5.62 billion.

- Implementation of a US$181 million annual profit improvement program.

GOL Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is GOL Positioning Itself for Continued Success?

GOL Linhas Aéreas, also known as GOL Airlines, holds a significant position in the Brazilian aviation market. Understanding how GOL works involves assessing its industry standing, the risks it faces, and its future outlook. This analysis is crucial for anyone looking at GOL Brazil or considering GOL flights.

The company's strategic moves, including fleet modernization and network optimization, are designed to strengthen its position and address financial challenges. This overview provides insights into GOL booking, GOL flight destinations, and other key aspects of the airline's operations.

In November 2024, GOL Airlines held a 29.7% share of the domestic market in Brazil, placing it among the top airlines. GOL served approximately 30 million passengers in 2024, reaching 65 domestic and 16 international destinations. Its customer loyalty program, Smiles, had 24 million members in 2024, driving record revenue.

GOL reported a net loss of R$440 million in April 2025 and a 63.7% profit drop in Q1 2025. The company's net debt was R$30.945 billion (approximately US$5.89 billion) at the end of April 2025. Rising costs, including fuel and airport fees, and a weaker Brazilian real have negatively impacted financial performance. Potential mergers could reshape the competitive landscape.

GOL plans to sustain and expand profitability via a five-year financial plan. This strategy includes fleet modernization, with five Boeing 737 MAX aircraft deliveries expected in 2025. The company aims to expand its fleet to 169 aircraft by 2029. GOL is focused on network optimization, improving fleet efficiency, and integrating loyalty programs.

GOL is cutting distribution costs and increasing ancillary revenues. The successful completion of its Chapter 11 restructuring is expected to help the company capitalize on recovering market demand. GOL's focus is on strengthening its leadership position in Latin American aviation. For more details, consider reading about the Growth Strategy of GOL.

GOL faces challenges due to economic factors and high operational costs. The airline's strategy includes fleet expansion and network optimization to improve profitability and market share. Understanding these factors is essential for anyone considering GOL flights or looking at GOL booking options.

- The airline's ability to manage its debt and reduce costs is crucial.

- Fleet modernization and network optimization are key to future growth.

- The competitive landscape in the Brazilian aviation market remains dynamic.

- Customer loyalty programs, such as Smiles, play a vital role in revenue.

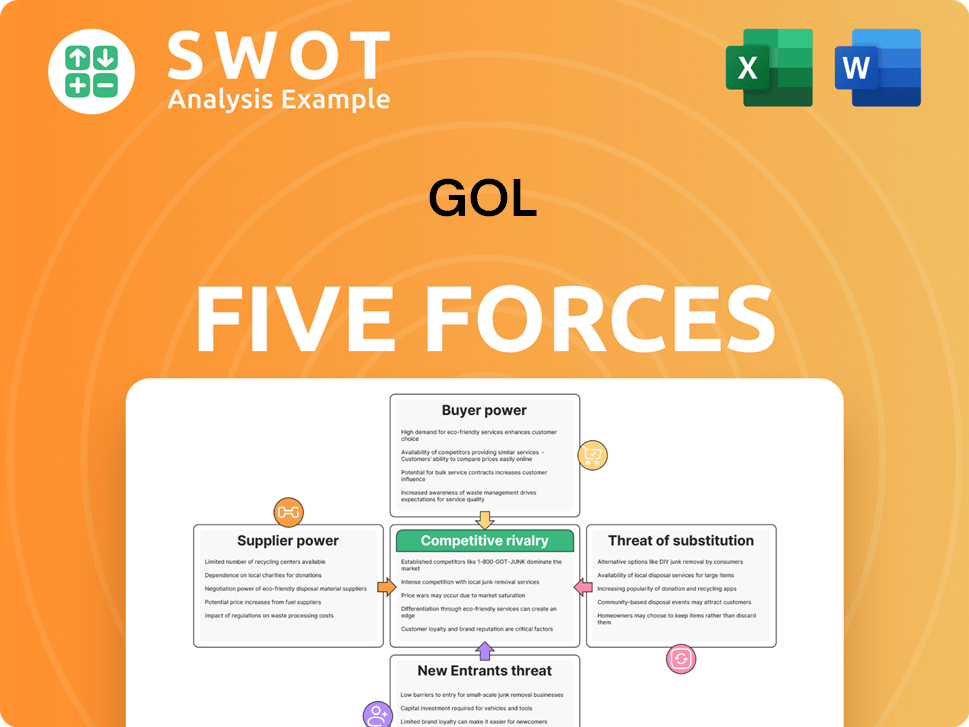

GOL Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of GOL Company?

- What is Competitive Landscape of GOL Company?

- What is Growth Strategy and Future Prospects of GOL Company?

- What is Sales and Marketing Strategy of GOL Company?

- What is Brief History of GOL Company?

- Who Owns GOL Company?

- What is Customer Demographics and Target Market of GOL Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.