Warner Bros. Discovery Bundle

Can Warner Bros. Discovery Conquer the Entertainment World?

The Warner Bros. Discovery SWOT Analysis reveals a media giant navigating a fiercely competitive arena. The entertainment industry is in constant flux, with streaming services reshaping how we consume content. Understanding the competitive landscape of Warner Bros. Discovery is crucial for anyone seeking to grasp the future of media.

This media company analysis dives deep into the Warner Bros. Discovery's position, examining its rivals and market share. By exploring its content strategy and financial performance, we'll uncover the challenges and opportunities shaping its future outlook. From comparing its streaming services to understanding its acquisition history, this analysis provides actionable insights for investors and industry watchers alike, offering a comprehensive view of the competitive landscape.

Where Does Warner Bros. Discovery’ Stand in the Current Market?

Warner Bros. Discovery (WBD) holds a significant position within the global media and entertainment industry. The company operates across film, television, and streaming, with a presence in over 220 countries and territories. Its core offerings include theatrical releases, television production and distribution, linear television networks, and direct-to-consumer streaming services like Max and Discovery+.

The company serves a diverse customer base, from general entertainment audiences to niche interest groups. WBD's extensive brand portfolio allows it to cater to various consumer preferences. The company's market position is constantly evolving, particularly in the streaming sector, where it competes with established players and new entrants. For a deeper dive into their marketing approach, check out the Marketing Strategy of Warner Bros. Discovery.

WBD's financial health reflects the challenges of integrating two large companies and navigating a capital-intensive streaming landscape. Despite these challenges, the company is working to improve its financial performance and strengthen its market position. WBD's strategy involves a focus on content creation, distribution, and strategic partnerships to drive growth and profitability.

WBD is a top-tier contender in the global streaming market. While specific market share figures fluctuate, the company trails leaders like Netflix and Disney+. As of Q4 2023, WBD reported 97.7 million global direct-to-consumer subscribers. This indicates a competitive position in the streaming landscape.

For the full year 2023, WBD reported total revenues of $41.3 billion. The company reported a net loss of $3.1 billion, although adjusted EBITDA showed positive growth. These figures highlight the financial dynamics of the company.

WBD has consolidated its streaming offerings under the Max brand. This move aims for a more unified and competitive platform. The company is heavily invested in digital transformation to secure its future growth.

WBD maintains a strong position in traditional linear television, particularly with its factual and lifestyle networks. Regions where the company holds a strong position include North America and parts of Europe. However, it faces intense competition in emerging global markets.

WBD's market position is influenced by its content strategy, competitive landscape, and financial performance. The company faces challenges and opportunities in the rapidly evolving entertainment industry.

- The company is focused on content creation, distribution, and strategic partnerships.

- WBD is competing with major players like Netflix and Disney+.

- The company is working to improve its financial performance.

- WBD is adapting to the changing media consumption habits.

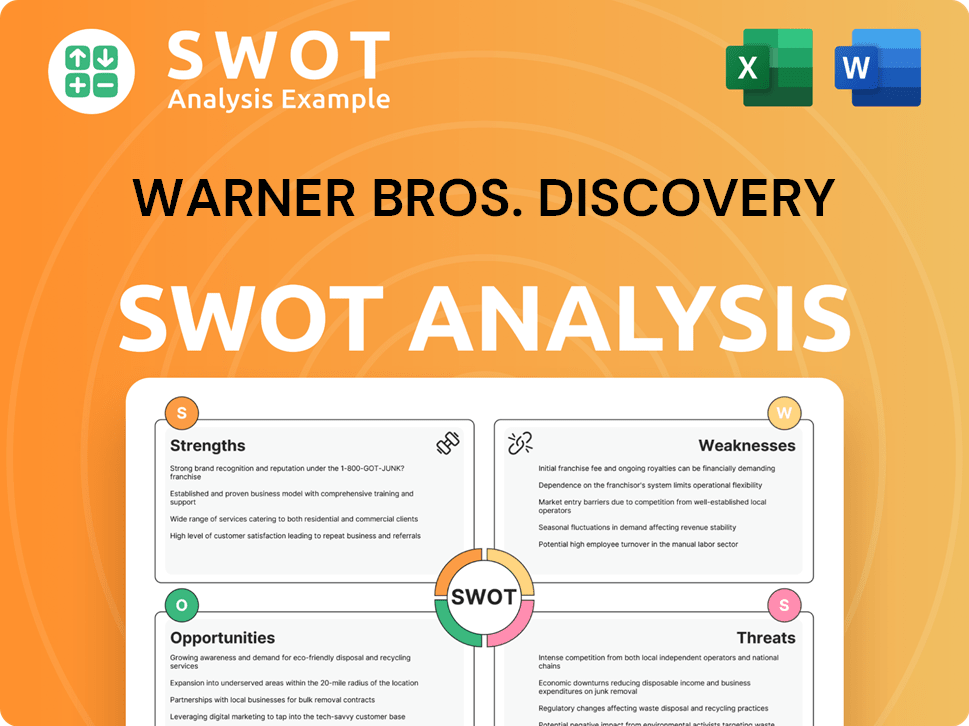

Warner Bros. Discovery SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Warner Bros. Discovery?

The Warner Bros. Discovery (WBD) operates within a dynamic and highly competitive entertainment industry. Its competitive landscape is shaped by a diverse array of players, from established media giants to emerging digital platforms. Understanding the competitive environment is crucial for assessing WBD's market position and future prospects.

This analysis delves into WBD's key competitors, examining their strengths, strategies, and the challenges they pose. It also considers the broader industry trends influencing the competitive dynamics, including the rise of streaming services and the ongoing battle for audience attention and content dominance. For a deeper understanding of WBD's financial structure, consider reading about the Revenue Streams & Business Model of Warner Bros. Discovery.

Warner Bros. Discovery faces a complex competitive environment, with rivals spanning various segments of the entertainment industry. Its primary competitors include major media companies, streaming services, and digital platforms, all vying for market share and consumer engagement.

Netflix is a direct competitor in the streaming market. It boasts a significant global subscriber base, reporting 269.6 million paid memberships as of Q1 2024. Netflix's strength lies in its original content and international reach.

Disney is another major competitor, particularly with its streaming services (Disney+, Hulu, ESPN+) and film/television studios. Disney's competitive advantage stems from its iconic franchises and family-friendly brand recognition.

Amazon competes through Amazon Prime Video, bundling streaming with its e-commerce services. Amazon invests heavily in original programming, including sports rights, to attract and retain subscribers.

Paramount Global offers its Paramount+ streaming service and possesses a strong portfolio of film and television assets. Paramount's content library and distribution capabilities make it a significant player.

NBCUniversal, owned by Comcast, competes with Peacock and its extensive content library. NBCUniversal's diversified portfolio and distribution networks provide a competitive edge.

Indirect competition comes from various entertainment forms, including video games (e.g., Sony, Microsoft, Nintendo), social media platforms (e.g., Meta Platforms, TikTok), and user-generated content platforms (e.g., YouTube). These platforms compete for audience attention and advertising revenue.

The Warner Bros. Discovery competitors analysis reveals a highly contested landscape. The streaming services market is particularly competitive, with companies investing heavily in original content and acquiring premium assets. The battle for market share is ongoing, influenced by mergers, alliances, and the emergence of new players. Warner Bros. Discovery's ability to navigate this environment will determine its future success. Key factors include content strategy, subscriber growth, and financial performance. Recent developments and strategic moves will significantly shape WBD's market position and future outlook.

The competitive landscape is shaped by factors such as content acquisition, subscriber growth, and strategic partnerships. Companies are constantly seeking to enhance their content offerings and expand their reach.

- Content Acquisition: Securing exclusive rights to premium content, including sports and original series, is crucial.

- Subscriber Growth: Attracting and retaining subscribers in a saturated market is a key challenge.

- Mergers and Alliances: Consolidation and partnerships are used to expand reach and resources.

- Emerging Players: Niche content and ad-supported streaming services disrupt traditional models.

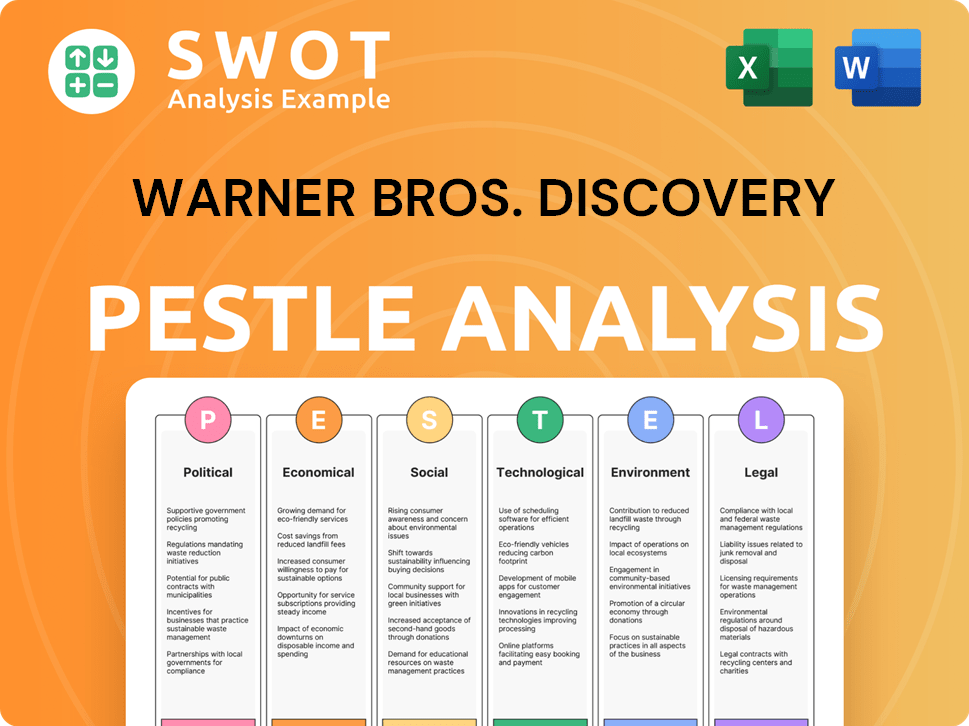

Warner Bros. Discovery PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Warner Bros. Discovery a Competitive Edge Over Its Rivals?

The competitive landscape for Warner Bros. Discovery (WBD) is shaped by its unique strengths and the dynamic nature of the entertainment industry. Understanding its competitive advantages is crucial for a thorough media company analysis. WBD's position is influenced by its extensive content library, global distribution capabilities, and strategic focus on streaming services.

Key milestones, strategic moves, and competitive edge of Warner Bros. Discovery include the merger of WarnerMedia and Discovery in 2022, which significantly reshaped the company's structure and content offerings. This merger aimed to create a more competitive entity in the entertainment industry by combining diverse assets. Recent developments have focused on streamlining operations and optimizing its streaming strategy to enhance its market share.

WBD faces both challenges and opportunities in a rapidly evolving market. The company is constantly adapting its content strategy and distribution methods to stay ahead. Analyzing its competitive advantages provides insights into its potential for future growth and sustainability in the entertainment sector. For a deeper dive, consider exploring the Growth Strategy of Warner Bros. Discovery.

One of WBD's primary advantages is its vast intellectual property (IP) portfolio. This includes iconic franchises like Harry Potter, DC Comics, and Looney Tunes. This extensive library supports its streaming services and linear networks, fostering strong brand equity and customer loyalty. This deep content well provides a strong foundation for its streaming services, linear networks, and theatrical releases.

WBD boasts a robust global distribution network, reaching over 220 countries and territories. This network includes linear television channels, theatrical distribution, and a growing direct-to-consumer streaming presence. This broad reach allows WBD to monetize its content across multiple platforms and geographies, reaching diverse audiences worldwide.

WBD benefits from economies of scale, particularly in content production and acquisition. These efficiencies can lead to cost savings compared to smaller players. The company's size allows it to invest heavily in high-quality content, which is crucial for attracting and retaining subscribers in the competitive streaming market.

The company leverages a strong talent pool, including renowned filmmakers and creative executives. WBD also benefits from the ability to cross-promote content across its various brands and platforms. This synergistic approach enhances content visibility and drives engagement across its portfolio.

WBD's competitive advantages are substantial, yet they face threats from competitors investing heavily in original content and global expansion. The sustainability of these advantages hinges on WBD's continued investment in new IP, effective content curation, and agile adaptation to changing consumer behaviors and technological advancements. For example, in Q1 2024, WBD reported a streaming subscriber count of approximately 99.6 million across its platforms, demonstrating its strong market position. The company's strategic focus on cost-cutting measures, such as achieving $4 billion in cost synergies by the end of 2024, further enhances its competitive edge.

- Content Library: A vast library of content, including popular franchises, provides a competitive edge.

- Global Reach: Extensive distribution networks allow WBD to reach audiences worldwide.

- Strategic Synergies: Cross-promotion and integration of content across various platforms.

- Financial Performance: The company's focus on profitability and debt reduction.

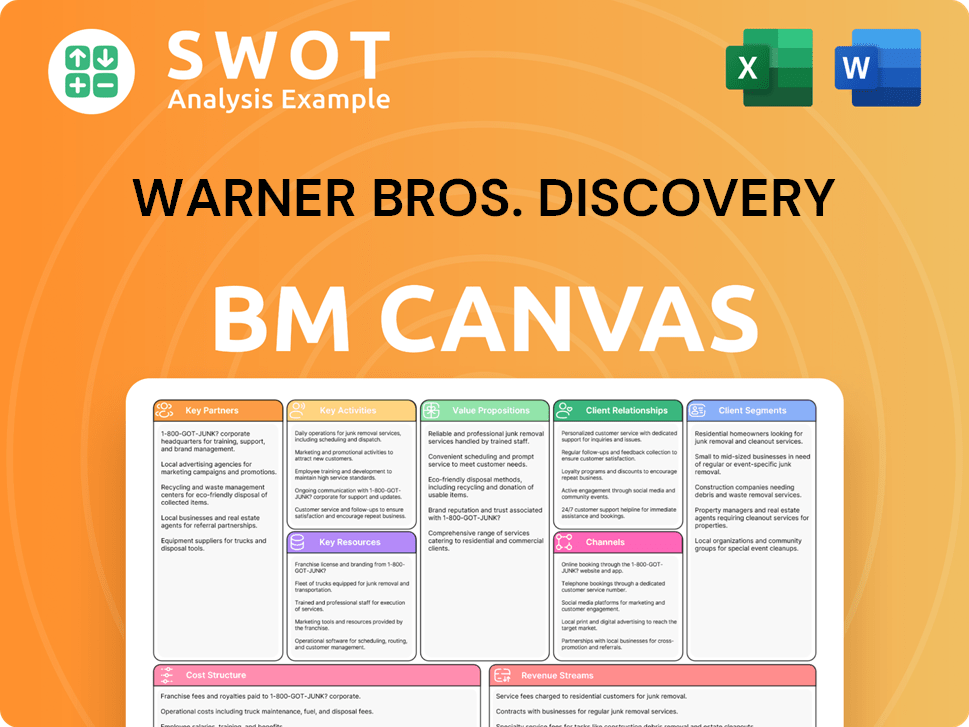

Warner Bros. Discovery Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Warner Bros. Discovery’s Competitive Landscape?

The competitive landscape for Warner Bros. Discovery (WBD) is shaped by dynamic industry trends, presenting both challenges and opportunities. As a major media company, WBD navigates a rapidly evolving entertainment industry, marked by shifts in consumer behavior and technological advancements. Understanding its market position and the strategies of its rivals is crucial for assessing its future outlook.

WBD faces risks associated with the transition to streaming, including the need for substantial investment in content and technology. However, the company also benefits from its vast content library and global reach, offering avenues for growth. For a deeper understanding of WBD's strategic direction, consider exploring the Growth Strategy of Warner Bros. Discovery.

The entertainment industry is experiencing a significant shift from linear television to direct-to-consumer (DTC) streaming services. This requires media companies to invest heavily in content production and technology infrastructure. Regulatory changes and evolving consumer preferences further influence the industry's trajectory.

Anticipated disruptions include the rise of generative AI in content creation and increased audience fragmentation. WBD must integrate its diverse assets and optimize its streaming strategy while addressing declining linear TV viewership. Increased content costs present an ongoing challenge.

The global streaming market's continued expansion, especially in emerging markets, offers subscriber growth potential. Innovations like interactive content and strategic partnerships can unlock new revenue streams. WBD's vast content library and global reach are key assets.

WBD competes with major players like Netflix and Disney, as well as other streaming services and traditional media companies. The company's ability to balance subscription-based and ad-supported streaming models will be crucial. Market share and financial performance are key indicators.

WBD's content strategy, including its ability to leverage its extensive library and create new content, is critical. The company must adapt to changing consumer preferences and explore new distribution models. Strategic partnerships and acquisitions will also play a role in its future.

- Content is King: Investing in high-quality content is essential for attracting and retaining subscribers.

- Streaming Strategy: Optimizing the streaming service, including pricing and content offerings, is crucial for success.

- Global Expansion: Targeting growth in international markets can significantly increase subscriber numbers.

- Financial Performance: Improving profitability and managing debt are key to long-term sustainability.

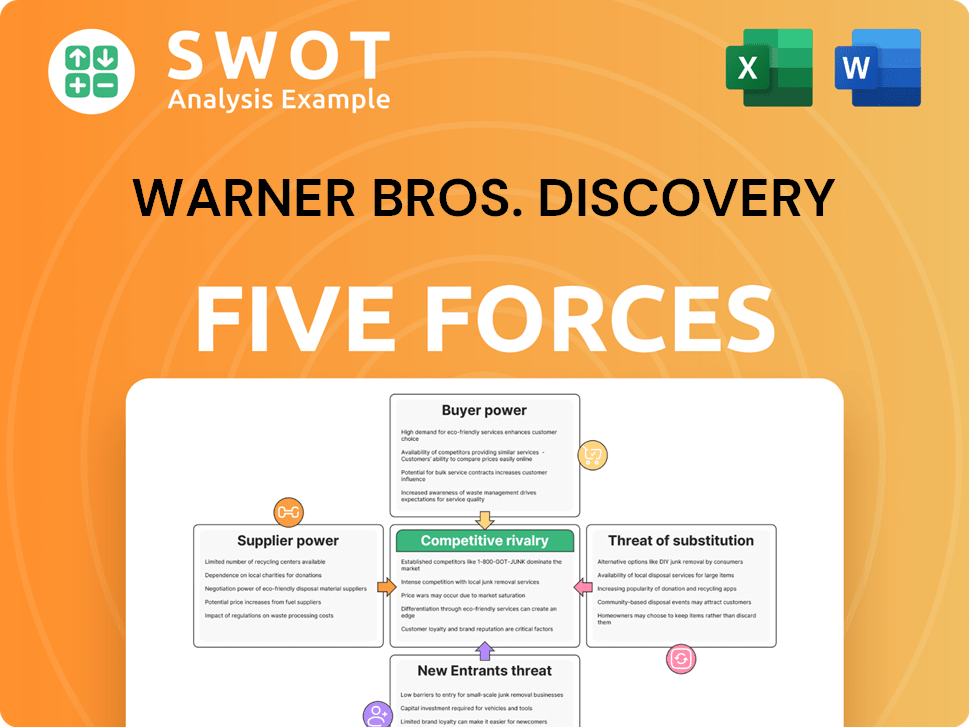

Warner Bros. Discovery Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Warner Bros. Discovery Company?

- What is Growth Strategy and Future Prospects of Warner Bros. Discovery Company?

- How Does Warner Bros. Discovery Company Work?

- What is Sales and Marketing Strategy of Warner Bros. Discovery Company?

- What is Brief History of Warner Bros. Discovery Company?

- Who Owns Warner Bros. Discovery Company?

- What is Customer Demographics and Target Market of Warner Bros. Discovery Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.