Warner Bros. Discovery Bundle

How is Warner Bros. Discovery Dominating the Entertainment Market?

Witness the dramatic transformation of Warner Bros. Discovery, a media giant redefining entertainment in the digital age. From its humble beginnings in 1903 to its current status, the company's journey showcases a dynamic adaptation to changing consumer behaviors. This evolution underscores the critical importance of a powerful sales and marketing strategy in today's fiercely competitive landscape.

This analysis explores the core of Warner Bros. Discovery SWOT Analysis, examining its shift towards a direct-to-consumer model with the global rollout of Max and its ambitious subscriber goals. We'll dissect their innovative marketing tactics, brand positioning, and key campaigns, providing insights into how WBD sales and marketing leverages its vast content library and global footprint. Understanding Warner Bros Discovery's sales strategy and Warner Bros Discovery marketing strategy is key to grasping its future trajectory in the entertainment industry.

How Does Warner Bros. Discovery Reach Its Customers?

The sales and marketing strategy of Warner Bros. Discovery (WBD) is multifaceted, leveraging both traditional and digital channels to reach a global audience. A key focus is on direct-to-consumer (DTC) sales through its streaming service, Max, complemented by robust distribution through linear television networks. This approach allows WBD to engage consumers across various platforms, maximizing revenue streams and content reach.

WBD's strategy includes strategic partnerships and content licensing to further expand its sales channels. The company actively seeks agreements with cable, satellite providers, and other distributors to broaden the availability of its content. This multi-channel approach supports WBD's goal of increasing subscriber numbers and revenue, adapting to the evolving media landscape.

As of December 31, 2024, Max (formerly HBO Max) had 116.9 million global subscribers, an increase of 19 million throughout 2024. WBD aims to reach at least 150 million global subscribers by the end of 2026.

Max, the primary DTC channel, drives significant subscriber growth. WBD is expanding Max internationally, with plans for the UK, Ireland, Germany, and Italy in 2025 and 2026. This expansion is crucial for achieving its subscriber targets and increasing revenue through streaming subscriptions.

WBD's linear networks, including HBO, TNT, and CNN, generate substantial distribution revenue. These networks have agreements with cable and satellite providers. In Q4 2024, distribution revenues increased by 2% due to global DTC subscriber growth, partially offset by declines in domestic linear pay TV subscribers.

WBD forms strategic partnerships to broaden content distribution. A non-exclusive agreement with Sky in the UK and Ireland will bring Max to approximately 10 million of Sky's subscribers by Q2 2026. A multi-year deal with Comcast expands access to ad-supported Max and Discovery+ for Xfinity subscribers.

The studio business generates revenue through content licensing. This involves selling content to third parties, which can be a 'lumpy' revenue stream. Partnerships with distributors like Rogers in Canada also contribute to content availability through streaming and distribution partners.

WBD employs a mix of DTC, linear TV, and strategic partnerships to maximize content reach and revenue. The focus on streaming growth, combined with established distribution channels, allows WBD to adapt to changing consumer preferences. This multi-faceted approach supports the company's overall sales performance.

- Expanding Max's global presence to reach more subscribers.

- Leveraging linear networks for distribution revenue through cable and satellite agreements.

- Forming strategic partnerships to broaden content availability and reach.

- Licensing content to third parties to generate additional revenue streams.

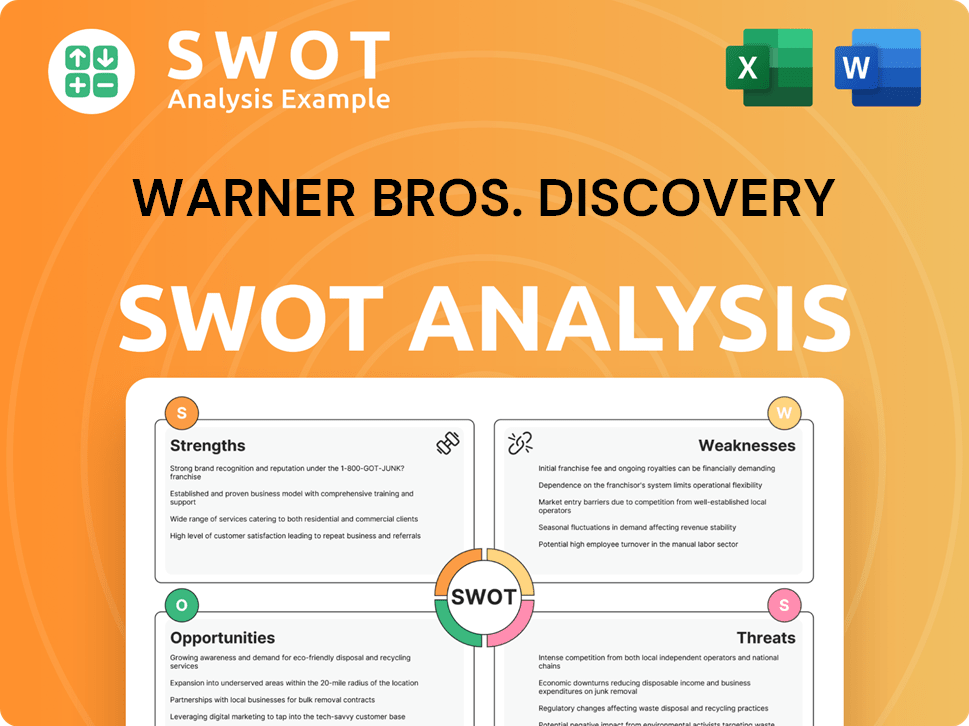

Warner Bros. Discovery SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Warner Bros. Discovery Use?

The marketing tactics employed by Warner Bros. Discovery (WBD) are multifaceted, designed to boost awareness, generate leads, and drive sales across its wide-ranging portfolio. Their approach blends digital innovation with traditional media strategies. A key component is data-driven marketing, leveraging unified assets across streaming, linear, and theatrical platforms to create a cohesive advertising experience.

WBD's strategy emphasizes digital marketing, including content marketing, SEO, paid advertising, email marketing, and influencer partnerships. Social media platforms are heavily utilized to engage audiences and promote movies and TV shows. Furthermore, WBD has introduced advanced advertising solutions like NEO and DemoDirect to enhance ad performance and audience targeting.

Traditional media still plays a role, with TV, radio, and print advertising supporting major releases and network programming. Events like the Upfront presentations are crucial for showcasing new content and advertising solutions. The company's marketing mix has evolved to embrace hybrid subscription models, with streaming advertising revenue increasing significantly, up 35% ex-FX in Q1 2025, driven by growth in ad-lite subscribers.

WBD utilizes data-driven marketing through its 'One WBD' system, unifying assets across platforms. Their first-party data platform, Olli, taps into data from 100 million households and 700 million devices for converged targeting.

Digital tactics are paramount, including content marketing, SEO, and paid advertising. Social media platforms are heavily used to engage audiences and promote content. WBD also employs email marketing and influencer partnerships.

In 2025, WBD introduced NEO, a next-generation ad platform, and DemoDirect, a proprietary linear optimization technology. NEO promises ad performance up to three times more effective than traditional campaigns.

Traditional media, including TV, radio, and print advertising, still supports major releases. Events like Upfront presentations are crucial for showcasing new content to partners and advertisers.

WBD embraces hybrid subscription models, with streaming advertising revenue increasing significantly. This growth is driven by an increase in ad-lite subscribers.

WBD explores 'newstalgia,' providing advertisers access to its vast intellectual property for custom campaigns. This approach aims to resonate with younger consumers discovering classic content.

WBD's marketing strategy is a blend of data-driven and traditional methods, focusing on digital innovation and audience engagement to drive sales and build brand awareness.

- Data-Driven Advertising: Leveraging platforms like Olli for targeted content distribution.

- Digital Engagement: Utilizing content marketing, SEO, and social media.

- Innovative Ad Solutions: Implementing NEO and DemoDirect for enhanced ad performance.

- Hybrid Subscription Models: Increasing streaming advertising revenue.

- 'Newstalgia' Campaigns: Engaging younger audiences with classic content.

- Strategic Partnerships: Collaborating with influencers and advertisers.

For a deeper understanding of the competitive landscape, explore the Competitors Landscape of Warner Bros. Discovery.

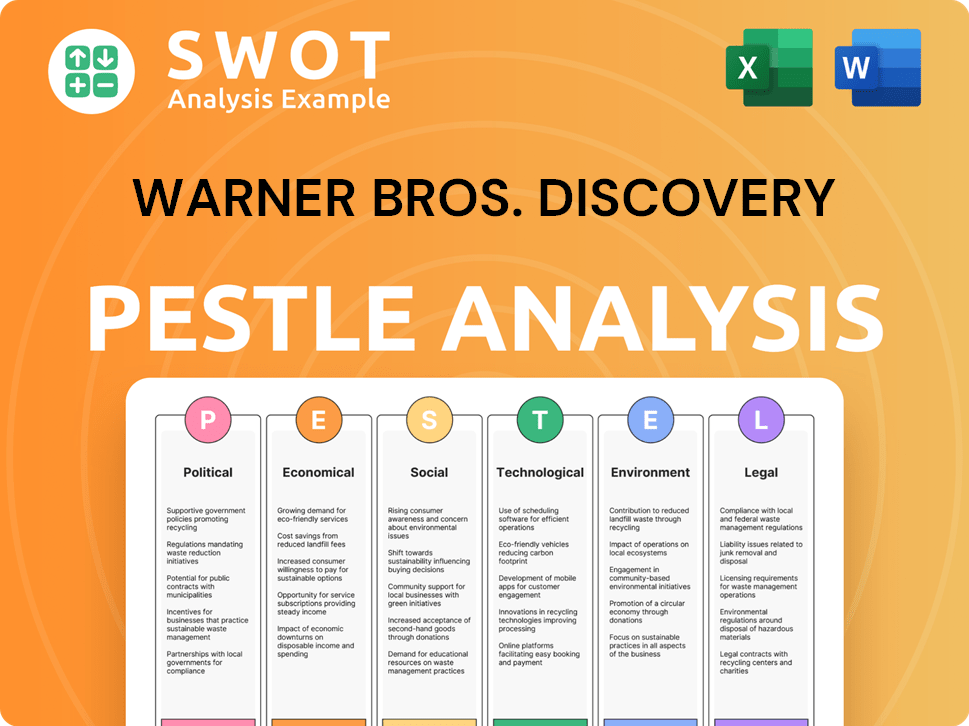

Warner Bros. Discovery PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Warner Bros. Discovery Positioned in the Market?

Warner Bros. Discovery (WBD) strategically positions itself as a leading global media and entertainment entity. Their core message focuses on delivering high-quality entertainment and information to a worldwide audience. This strategy leverages a diverse portfolio of iconic brands and franchises, spanning film, television, and streaming services, to maintain a strong market presence.

The company's brand positioning emphasizes quality content and storytelling, differentiating it within the competitive media landscape. WBD's approach includes tailoring its visual identity and tone of voice to resonate with audiences across its varied brands. This ensures that each brand, from HBO to Discovery Channel, maintains a distinct identity while contributing to the overall corporate strategy.

WBD's brand consistency is maintained through strategic content distribution and cross-promotion across its various channels and touchpoints, which is a key element of their Warner Bros Discovery sales strategy. The company's commitment to 'One WBD' aims to unify its assets and provide a seamless experience for advertisers and consumers. This integrated approach supports the overall Warner Bros Discovery marketing strategy.

WBD differentiates itself through its expansive portfolio, including iconic brands like HBO and Warner Bros. Pictures. The diversity of content, from factual programming to blockbuster movies, allows WBD to target a broad audience. This wide range supports various content distribution sales strategies.

The company emphasizes high-quality content and compelling storytelling across all platforms. HBO is a prime example of this, known for its award-winning programming. This focus on quality is a cornerstone of their entertainment industry marketing approach.

WBD appeals to its target audience through a mix of prestige content from HBO, the broad appeal of Discovery's factual programming, and the excitement of franchises like DC Universe. This diversified approach helps in WBD's digital marketing initiatives.

WBD adapts to market changes, such as rebranding Max (formerly HBO Max) to emphasize quality and global expansion. They also acknowledge the importance of new technologies like generative AI. For more context, you can read a Brief History of Warner Bros. Discovery.

WBD employs various marketing tactics to maintain its position in the market. These include strategic content distribution and cross-promotion.

- Content Licensing: Licensing content to various platforms generates revenue.

- Partnerships: Collaborations with other companies to expand reach.

- Digital Marketing: Utilizing social media and online platforms for promotion.

- Advertising Campaigns: Creating campaigns to promote movies and TV shows.

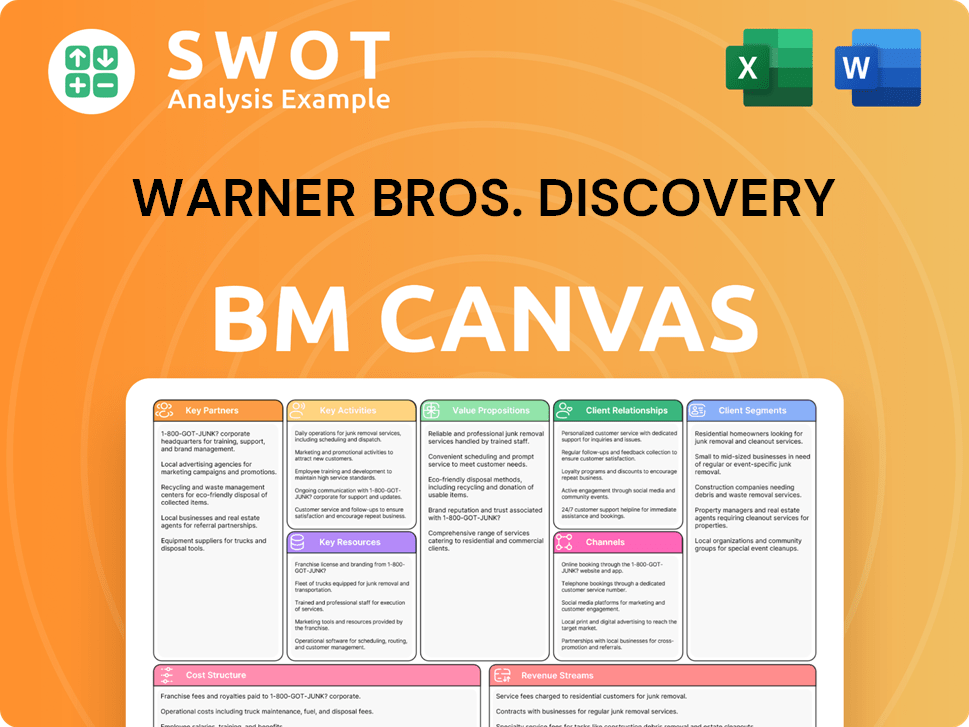

Warner Bros. Discovery Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Warner Bros. Discovery’s Most Notable Campaigns?

Key campaigns have been crucial for defining the brand and driving growth for the company, particularly with the global rollout and ongoing promotion of its streaming service, Max. The launch of Max in over 70 countries in 2024 was a pivotal campaign, contributing to a 20% year-over-year increase in direct-to-consumer (DTC) subscribers, adding 19 million total subscribers in 2024.

Content-specific campaigns for HBO series like 'The Penguin' and 'True Detective: Night Country' in 2024 demonstrated success in growing premiere-night audiences and garnering critical acclaim. These campaigns leveraged the strength of HBO's content pipeline to drive subscriber engagement and reinforce Max's value proposition. In Q1 2025, Max experienced significant month-over-month growth among streaming services, up 6% in March, largely driven by popular titles.

The company's strategy involves maximizing its vast library and new releases to drive viewership and subscriber acquisition. This includes cross-platform content-driven campaigns, such as the March Madness coverage on TBS, TNT, and truTV, which was also available to stream on Max. For more insights, you can explore the Target Market of Warner Bros. Discovery.

The global rollout of Max in 2024 was a key campaign. This expansion contributed to a 20% year-over-year increase in DTC subscribers. The goal is to reach 150 million DTC subscribers by the end of 2026.

Campaigns for series like 'The Penguin' and 'True Detective: Night Country' increased premiere-night audiences. 'True Detective: Night Country' received 19 Emmy nominations. These campaigns boosted subscriber engagement.

Max saw a 6% month-over-month growth in March 2025. Titles like 'The White Lotus' (4.5 billion viewing minutes) and 'The Pitt' (2.3 billion viewing minutes) drove this growth.

March Madness coverage on TBS, TNT, and truTV, also on Max, grew television viewing by 3%. This strategy targets younger consumers. Content licensing is a key element of the sales strategy.

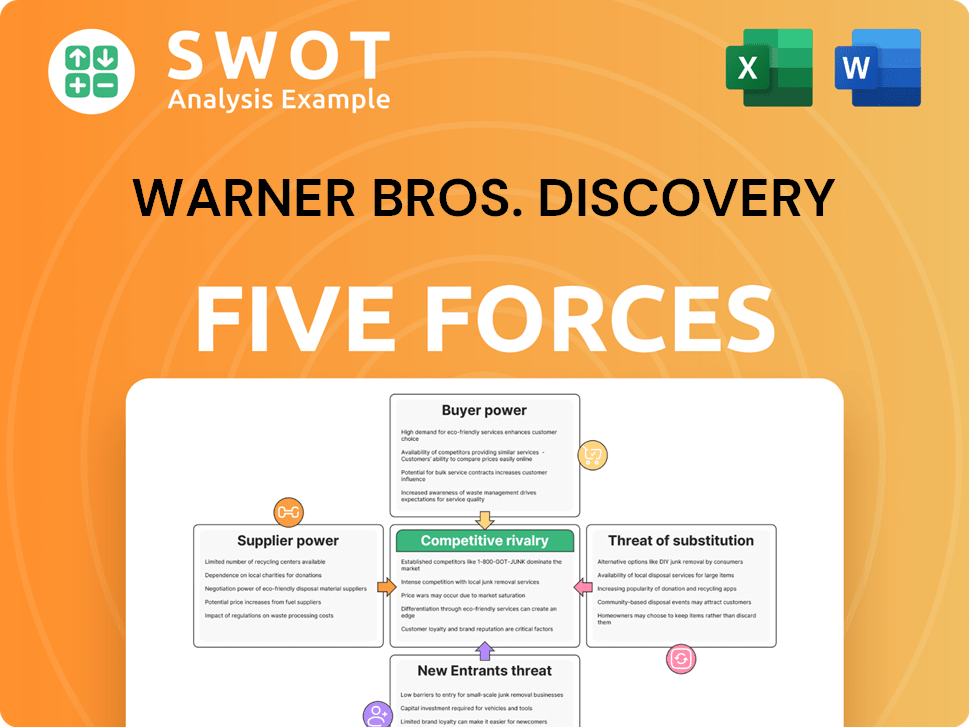

Warner Bros. Discovery Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Warner Bros. Discovery Company?

- What is Competitive Landscape of Warner Bros. Discovery Company?

- What is Growth Strategy and Future Prospects of Warner Bros. Discovery Company?

- How Does Warner Bros. Discovery Company Work?

- What is Brief History of Warner Bros. Discovery Company?

- Who Owns Warner Bros. Discovery Company?

- What is Customer Demographics and Target Market of Warner Bros. Discovery Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.