Warner Bros. Discovery Bundle

How Does Warner Bros. Discovery Thrive in Today's Media Landscape?

The entertainment world is in constant flux, with streaming services and content dominating the conversation. Warner Bros. Discovery (WBD), a major Warner Bros. Discovery SWOT Analysis, is a significant player in this dynamic environment. Formed from a strategic merger, WBD boasts a vast portfolio of iconic brands and an extensive content library.

This WBD company, a leading media conglomerate, has a complex Warner Bros. Discovery structure, making it a fascinating subject for investors and industry watchers alike. Understanding how Warner Bros. Discovery operates, from its revenue streams to its strategic initiatives, is crucial for grasping its position within the competitive entertainment industry. This exploration will provide insights into questions such as: How does Warner Bros. Discovery make money, and what are Warner Bros. Discovery's main assets?

What Are the Key Operations Driving Warner Bros. Discovery’s Success?

The core operations of Warner Bros. Discovery (WBD) center on creating, aggregating, and distributing content across multiple platforms. This media conglomerate generates value through film production and distribution via Warner Bros. Pictures, television programming including channels like HBO and Discovery Channel, and direct-to-consumer streaming services, primarily Max. WBD serves a diverse customer base, from individual entertainment consumers to advertisers and other media companies through content licensing.

WBD's operational processes are complex, involving content development, production, post-production, marketing, and global distribution. This includes a network of writers, directors, actors, and production crews supported by advanced technology for visual effects and editing. Content distribution occurs through theatrical releases, linear television broadcasts, and streaming platforms. The company’s supply chain is integrated, utilizing its studios and production facilities and engaging in strategic partnerships for co-productions and content acquisitions. Distribution networks are global, reaching audiences in over 220 countries and territories.

A key differentiator for WBD is its extensive intellectual property library and vertically integrated approach to content creation and distribution. This allows for significant synergy, leveraging popular franchises across films, television series, games, and consumer products. For instance, DC Comics properties can be developed into blockbuster movies, then spun off into series on Max, and further monetized through merchandise. This integration translates into customer benefits through a consistent stream of high-quality, recognizable content, and for the company, it fosters strong brand loyalty and differentiation in a competitive market.

WBD's primary operations involve content creation and distribution across various platforms. This includes film production through Warner Bros. Pictures, television programming via channels like HBO and Discovery, and streaming services such as Max. The company's global distribution network reaches over 220 countries and territories.

WBD serves a broad range of customers, including individual consumers, advertisers, and other media companies. The value proposition lies in providing high-quality entertainment and information, reaching targeted audiences for advertisers, and licensing content to other media outlets. Understanding the Target Market of Warner Bros. Discovery is crucial.

WBD's operational processes include content development, production, post-production, marketing, and global distribution. These processes involve a complex ecosystem of writers, directors, actors, and production crews, supported by advanced technological infrastructure. The company leverages its own studios and production facilities while also engaging in strategic partnerships.

WBD benefits from its extensive intellectual property library and vertically integrated approach. This allows for synergy, such as developing DC Comics properties into movies, series, and merchandise. This integration strengthens brand loyalty and differentiates the company in the entertainment industry.

In 2024, WBD's revenue was approximately $41.9 billion. The company reported a net loss of $2.3 billion for the same year, reflecting the impact of merger-related costs and strategic investments. WBD's streaming services, including Max, continue to be a key area of focus, with subscriber numbers and content investments driving future growth. WBD aims to achieve significant cost synergies through the integration of its various assets.

- Revenue: Approximately $41.9 billion in 2024.

- Net Loss: $2.3 billion in 2024.

- Streaming Focus: Emphasis on Max and other streaming services.

- Cost Synergies: Integration efforts to reduce operational expenses.

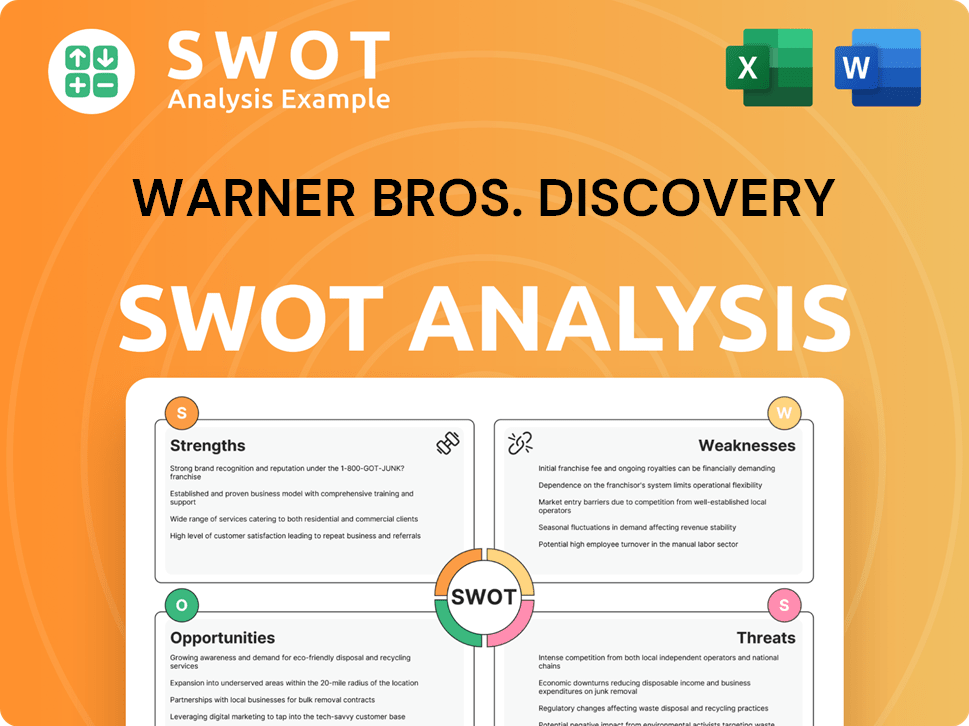

Warner Bros. Discovery SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Warner Bros. Discovery Make Money?

The Warner Bros. Discovery (WBD) company generates revenue through a multifaceted approach. The WBD company's financial model is built upon diverse revenue streams, ensuring resilience in the dynamic entertainment industry. This strategy includes a blend of traditional and modern monetization methods.

Warner Bros. Discovery structure relies on three main segments: Studios, Networks, and Direct-to-Consumer (DTC). These segments each contribute significantly to the company's overall financial performance. The media conglomerate leverages its vast content library and distribution channels to maximize revenue across different platforms.

The Studios segment is a significant contributor to WBD's revenue, deriving income from film production and distribution. This includes theatrical releases, home entertainment sales, and TV licensing deals. For the full year 2024, the Studios segment is projected to be a major revenue driver, reflecting the success of its theatrical releases and content licensing agreements. The entertainment industry continues to evolve, and WBD adapts its strategies to stay competitive.

The Networks segment generates revenue from advertising sales on linear television channels and affiliate fees from cable and satellite providers. While still substantial, this segment's contribution is influenced by shifts in traditional TV viewership. The Direct-to-Consumer (DTC) segment, spearheaded by Max, is a rapidly growing revenue source. This segment primarily relies on subscriptions, with tiered pricing strategies to attract a broad audience. WBD is also expanding advertising-supported tiers on Max to diversify monetization. For more insights, explore the Growth Strategy of Warner Bros. Discovery.

- Studios: Revenue from theatrical releases, home entertainment, and TV licensing.

- Networks: Income from advertising and affiliate fees.

- Direct-to-Consumer (DTC): Primarily subscription revenue from Max, with advertising-supported tiers.

- Other: Content licensing, merchandising, and theme park experiences.

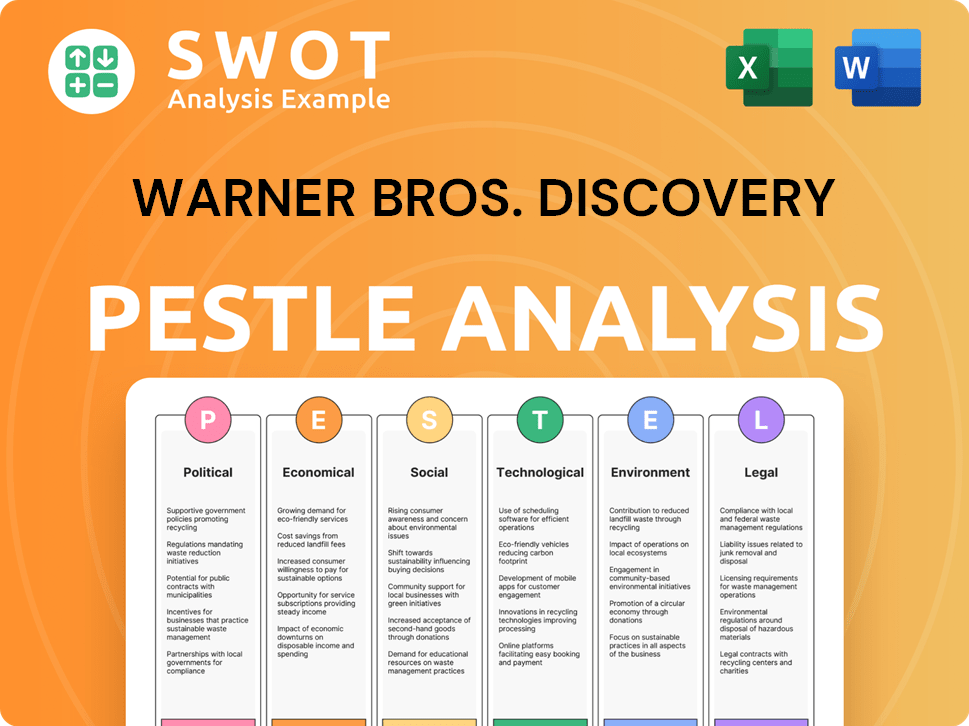

Warner Bros. Discovery PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Warner Bros. Discovery’s Business Model?

The most significant milestone for the WBD company was its formation in April 2022 through the merger of WarnerMedia and Discovery, Inc. This merger and acquisition aimed to create a global streaming powerhouse and a more diversified media conglomerate. This strategic move has reshaped the Warner Bros. Discovery structure and its position within the entertainment industry.

Since the merger, a key operational challenge has been the integration of different corporate cultures, content libraries, and technological infrastructures. The company responded by consolidating its streaming services, culminating in the launch of Max in May 2023, which unified content from HBO Max and Discovery+. This move aimed to streamline offerings, reduce churn, and enhance subscriber value. The company has had to adapt to a changing market, including a slowdown in advertising spending and intense competition in the streaming landscape.

In response to market challenges, Warner Bros. Discovery has focused on cost efficiencies, content rationalization, and optimizing its content distribution strategies. For example, WBD has undertaken efforts to reduce its debt load, aiming for a net leverage ratio of 2.5x to 3.0x by the end of 2024. The company’s competitive advantages are rooted in its unparalleled brand strength and extensive content library. Iconic brands like HBO, Warner Bros. Pictures, and the Discovery Channel provide a strong foundation of recognizable and highly valued intellectual property. This allows WBD to leverage established franchises across various platforms, creating an ecosystem effect that drives consumer engagement.

The merger in April 2022 was a pivotal moment, creating a major player in the entertainment industry. The launch of Max in May 2023 streamlined streaming services, offering a unified content experience. These moves aimed to enhance subscriber value and streamline operational efficiency.

WBD has focused on cost efficiencies and content optimization to navigate market challenges. The company is actively managing its debt, targeting a net leverage ratio between 2.5x and 3.0x by the end of 2024. These strategic adjustments are crucial for long-term financial health and market competitiveness.

The company benefits from strong brand recognition and a vast content library, including HBO and Warner Bros. Pictures. Its global reach and diverse revenue streams provide resilience against market fluctuations. WBD continues to invest in original content and explore new monetization models.

In Q1 2024, Warner Bros. Discovery reported total revenues of $9.95 billion. Streaming revenues increased by 2% to $2.5 billion. The company's focus on cost-cutting and strategic content decisions is aimed at improving profitability and shareholder value. For more insights, explore the Competitors Landscape of Warner Bros. Discovery.

WBD is actively adapting to new trends by investing in original content and exploring new monetization models, such as ad-supported streaming tiers. The company strategically manages its content windowing to maximize revenue across platforms. These strategies are designed to maintain a competitive edge in the evolving media landscape.

- Focus on original content creation to attract and retain subscribers.

- Explore ad-supported streaming tiers to diversify revenue streams.

- Strategic content windowing to maximize revenue across platforms.

- Leveraging established franchises to drive consumer engagement.

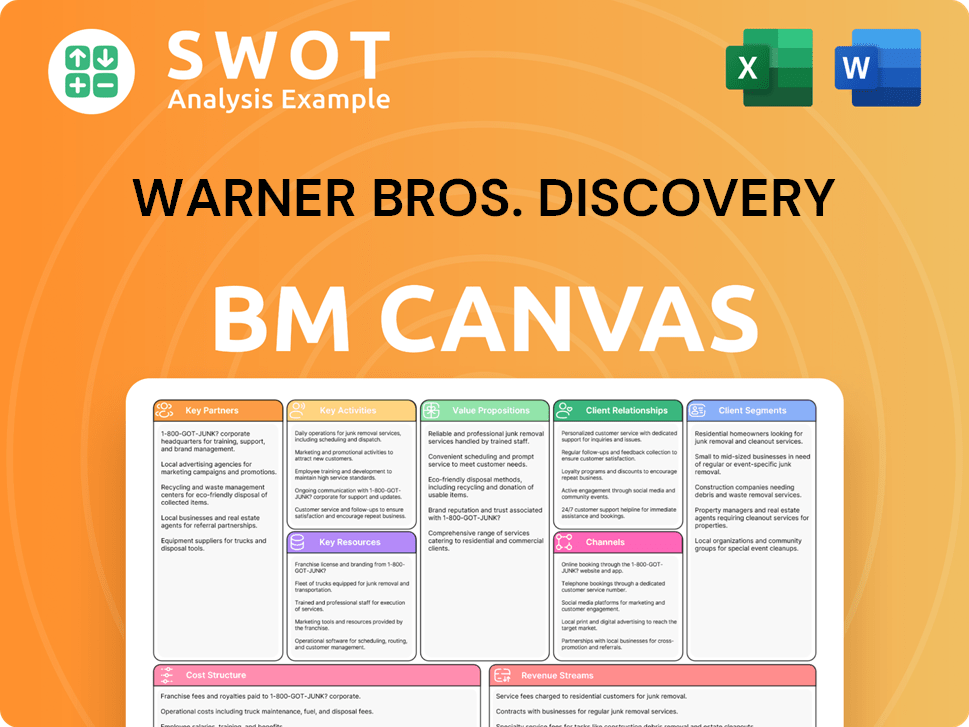

Warner Bros. Discovery Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Warner Bros. Discovery Positioning Itself for Continued Success?

Warner Bros. Discovery (WBD) holds a prominent position within the global media and entertainment industry. As a significant media conglomerate, it competes with industry giants like Disney and Netflix. Its market share in both linear television and streaming is substantial, underpinned by its extensive content library and well-known brands.

The company's diverse factual programming and premium offerings, such as HBO, contribute to strong customer loyalty. With a global footprint spanning over 220 countries and territories, WBD has a broad audience reach. However, the company faces challenges including regulatory changes and intense competition in the streaming market. These factors, along with technological disruptions and changing consumer preferences, require continuous adaptation.

WBD is a major player in the entertainment industry, competing with companies like Disney and Netflix. It has a significant market share in both traditional TV and streaming. WBD benefits from its extensive content library and strong brand recognition.

WBD faces risks from regulatory changes and competition in the streaming market. Technological advancements and shifting consumer habits also pose challenges. The company's debt load is a financial consideration that needs management.

WBD is focused on achieving profitability in its Direct-to-Consumer segment by 2025. The company aims to reduce debt and maximize the value of its intellectual property. Strategic initiatives include international expansion and partnerships.

WBD plans to produce high-quality content and leverage its global distribution networks. The company is adapting its monetization strategies to the evolving media landscape. A strong focus is placed on achieving sustainable free cash flow.

WBD is actively working on reducing its substantial debt, which stood at approximately $43.8 billion as of the end of Q1 2024. The company aims to achieve global profitability in its Direct-to-Consumer segment by 2025. Leadership is focused on maximizing the value of its intellectual property across all platforms.

- The company is heavily invested in Max, its streaming service, aiming to expand its subscriber base.

- WBD is exploring international expansion opportunities to reach new audiences.

- Strategic partnerships are being considered to bolster content offerings and distribution.

- A major emphasis is placed on creating high-quality, diverse content.

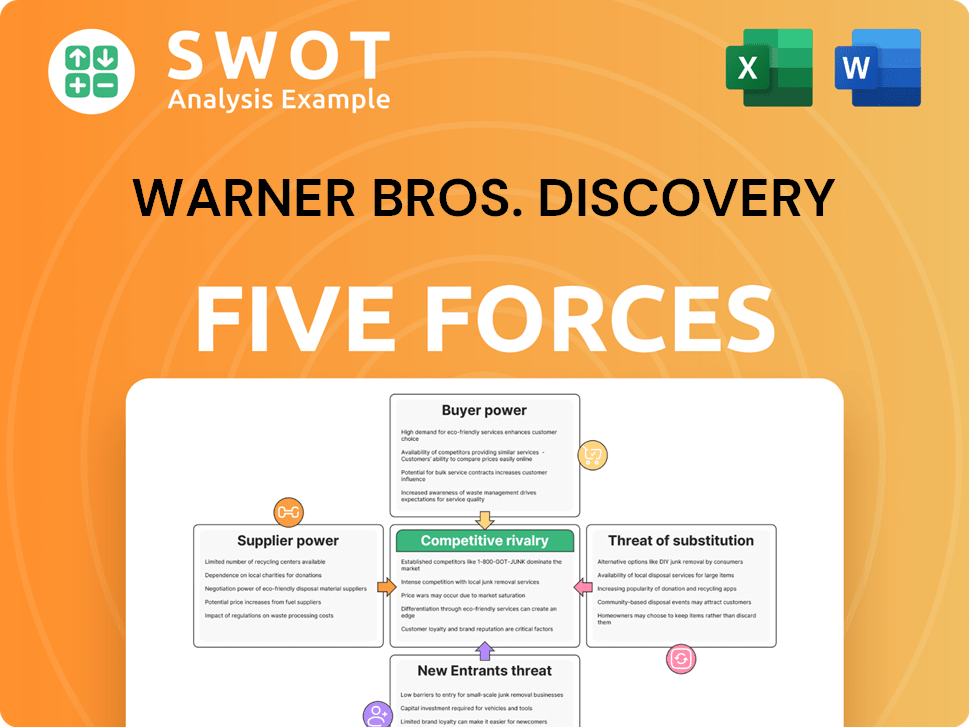

Warner Bros. Discovery Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Warner Bros. Discovery Company?

- What is Competitive Landscape of Warner Bros. Discovery Company?

- What is Growth Strategy and Future Prospects of Warner Bros. Discovery Company?

- What is Sales and Marketing Strategy of Warner Bros. Discovery Company?

- What is Brief History of Warner Bros. Discovery Company?

- Who Owns Warner Bros. Discovery Company?

- What is Customer Demographics and Target Market of Warner Bros. Discovery Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.