WinCo Foods Bundle

How Does WinCo Foods Thrive in a Cutthroat Market?

The grocery retail sector is a battlefield, with giants and niche players constantly vying for consumer dollars. Understanding the WinCo Foods SWOT Analysis is crucial to assess its position. This analysis delves into the dynamics of the WinCo Foods competitive landscape, revealing how the company navigates intense grocery store competition and the strategies it employs to maintain its edge. Explore the strategies that allow WinCo Foods to challenge established players.

This exploration of the WinCo Foods market analysis will dissect its unique business model, focusing on its pricing strategy and operational efficiencies. We'll identify key WinCo Foods competitors, comparing their strengths and weaknesses to understand WinCo's position within the retail food industry. Furthermore, we'll examine WinCo's expansion plans and financial performance, offering a comprehensive view of its past and future prospects, including its WinCo Foods market share analysis.

Where Does WinCo Foods’ Stand in the Current Market?

The core operations of WinCo Foods revolve around providing a wide array of groceries at low prices, primarily through bulk offerings. This strategy, combined with a 'no-frills' approach, allows the company to maintain competitive pricing. WinCo's business model focuses on efficiency, including direct purchasing from manufacturers and farmers, which helps in reducing operational costs and passing savings to customers.

WinCo Foods' value proposition centers on offering value to budget-conscious consumers. The company's extensive bulk food sections, featuring over 900 items, enable customers to purchase in larger quantities, thereby minimizing packaging costs and waste. This, along with the absence of bagging services and the non-acceptance of credit cards, further contributes to the company's cost-saving model, making it a preferred choice for shoppers seeking affordability.

WinCo Foods holds a strong position in the grocery market, distinguished by its focus on low prices and bulk offerings. According to the Dunnhumby's 2024 Retailer Preference Index, it ranked as the No. 4 preferred grocer in the U.S., reflecting its success in meeting consumer demand for value. This places WinCo among top budget-focused retailers, highlighting its competitive advantage within the retail food industry.

As of May 2025, WinCo Foods operates 142 stores across 10 states, with California leading the way with 37 stores. The company's expansion plans are focused on strategic growth within existing and new regions. This expansion strategy aims to increase its market share and cater to a broader customer base. To learn more about its history, read Brief History of WinCo Foods.

WinCo offers a wide range of products, including groceries, fresh produce, meat, bulk foods, and health and beauty products. Its extensive bulk foods section is a key differentiator, allowing customers to buy in bulk at reduced prices. This, combined with a 'no-frills' approach, enables WinCo to maintain lower prices compared to many competitors, enhancing its appeal to budget-conscious consumers.

In June 2025, WinCo's annual revenue reached $501 billion, demonstrating its substantial scale in the industry. While specific market share figures for 2024-2025 are not readily available, a 2023 assessment indicated WinCo held approximately 3% of the grocery market. The employee-owned model further boosts its financial health by fostering operational efficiency and employee investment in the company's success. This model contributes to its competitive landscape.

WinCo's success is driven by its low-price strategy, extensive bulk offerings, and operational efficiency. The company's focus on value and its ability to offer competitive pricing make it a strong player in the discount grocery stores segment. This market analysis reveals that WinCo's strategic approach to cost management and customer value is central to its competitive advantage.

- Low prices and bulk offerings attract budget-conscious consumers.

- Employee-owned model fosters operational efficiency.

- Strategic store locations and expansion plans support growth.

- 'No-frills' approach reduces operating costs.

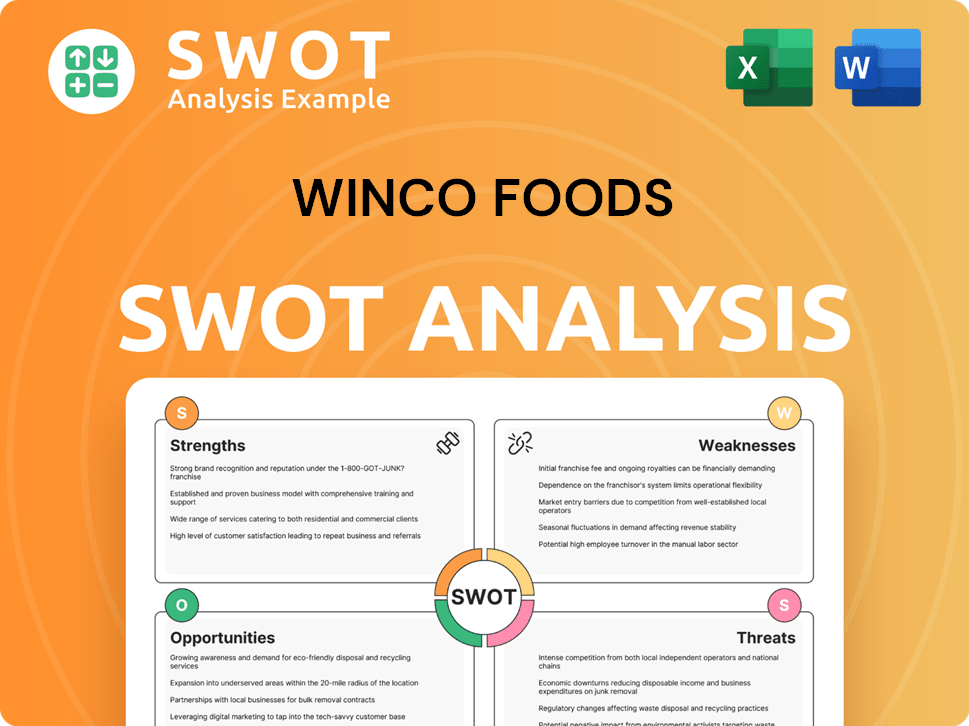

WinCo Foods SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging WinCo Foods?

The Revenue Streams & Business Model of WinCo Foods operates in a highly competitive grocery retail sector. Understanding the WinCo Foods competitive landscape is crucial for assessing its market position and strategic challenges. This analysis involves evaluating its direct and indirect competitors, their strategies, and the overall dynamics of the retail food industry.

WinCo Foods competitors include a mix of national chains, discount retailers, and regional players. These entities employ diverse strategies, such as competitive pricing, technological innovation, branding, and distribution efficiency, to gain market share. Analyzing these strategies provides insight into the pressures and opportunities within the grocery store competition.

WinCo Foods market analysis reveals its position relative to key players in the retail food industry. The company's success hinges on its ability to differentiate itself through its value proposition and operational efficiencies. This includes assessing its pricing strategy, store locations, and expansion plans in comparison to competitors.

The primary competitors of WinCo Foods include large national chains and other discount retailers. These competitors, such as Walmart, Costco, and Aldi, directly challenge WinCo's market share. Their strategies often focus on competitive pricing and value offerings.

Walmart is a significant competitor, holding a substantial share of the grocery market. As of 2023, Walmart held over 26% of the grocery market share. This large market presence puts considerable pressure on WinCo and other competitors.

Costco also poses a strong competitive threat, particularly due to its bulk-buying model and competitive pricing. Costco held approximately 14% of the grocery market share in 2023, significantly impacting the competitive landscape.

Aldi, known for its discount offerings and private-label brands, is another key competitor. Aldi held around 8% of the market share in 2023, further intensifying the competition in the discount grocery segment.

WinCo Foods has a smaller market share compared to its major competitors. As of 2023, WinCo held approximately 3% of the market share. This highlights the challenges WinCo faces in competing with larger, established chains.

Other notable competitors include Kroger, H-E-B, Smart & Final, Trader Joe's, Price Chopper, Food City, Hy-Vee, Schnucks, Wegmans, and Whole Foods Market. These competitors challenge WinCo through various strategies, including price, innovation, branding, and distribution.

The competitive landscape is shaped by various strategies employed by grocery retailers. Discount grocery stores like Aldi and Costco directly compete on price, often offering private-label brands and bulk options. Larger chains invest heavily in e-commerce and digital transformation.

- Price Competition: Intense price wars are common, especially with rising consumer price sensitivity. Grocery prices have increased significantly since 2020 and are expected to rise further in 2025.

- Innovation and Technology: Companies like Kroger and Walmart are investing in e-commerce, online ordering, and digital transformation.

- Branding and Customer Experience: Whole Foods Market focuses on quality and a premium shopping experience, while Wegmans enhances convenience with digital tools.

- Distribution and Scale: Walmart and Kroger benefit from vast distribution networks and economies of scale.

- WinCo's Performance: WinCo's rise in the Dunnhumby Retailer Preference Index to No. 4 in 2024, surpassing many established chains, shows its success in meeting consumer demand for savings.

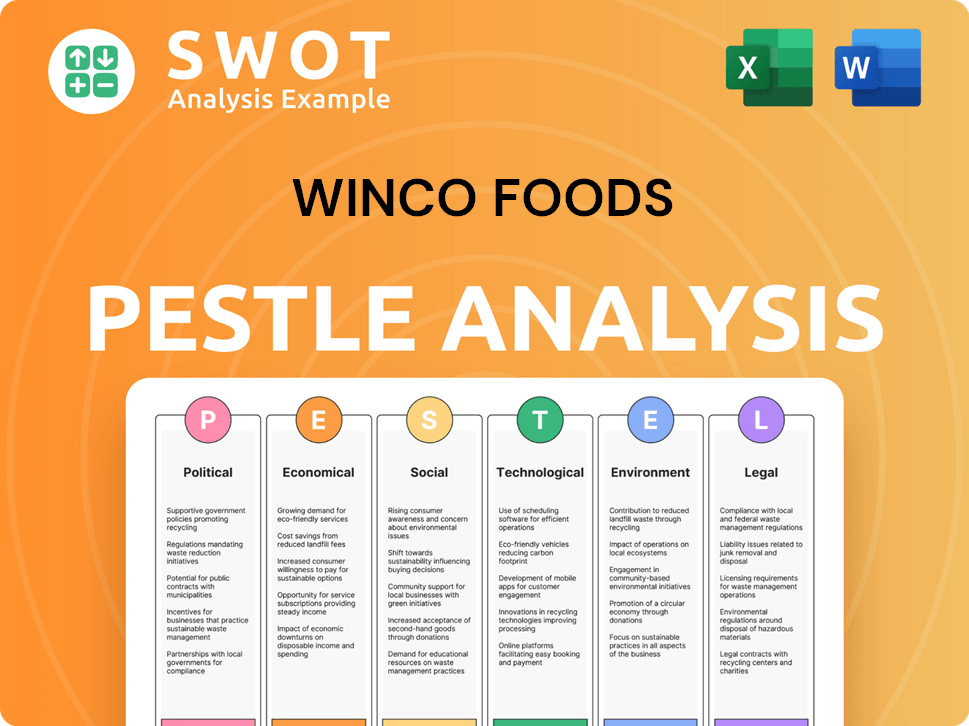

WinCo Foods PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives WinCo Foods a Competitive Edge Over Its Rivals?

The competitive landscape of WinCo Foods is shaped by its unique operational model and strategic focus on value. The company distinguishes itself through its low-cost structure, employee ownership, and extensive bulk foods offerings. These factors contribute to its ability to compete effectively within the discount grocery stores sector. Understanding its competitive advantages is crucial for a comprehensive WinCo Foods market analysis.

WinCo Foods faces competition from a variety of players in the retail food industry, including both national and regional grocery chains, as well as other discount grocery stores. Its success hinges on maintaining its cost advantages, enhancing its customer experience, and adapting to the evolving demands of the market. The company's ability to navigate these challenges will determine its future growth and market share.

Key to WinCo's strategy is its commitment to providing value to its customers. This is achieved through a combination of operational efficiencies, strategic sourcing, and a focus on customer satisfaction. The company's employee-owned structure plays a significant role in fostering a culture of dedication and customer service, contributing to its competitive edge in the grocery store competition.

WinCo Foods leverages a low-cost model and bulk purchasing strategy to offer competitive prices. This approach involves direct purchasing from manufacturers and farmers, minimizing overhead costs, and operating basic 'no-frills' stores. This strategy allows the company to attract budget-conscious shoppers and maintain a strong position in the discount grocery stores segment. The company's pricing strategy is a key factor in its market share.

The employee-owned structure is a significant differentiator for WinCo. This model fosters a strong sense of ownership and dedication among employees. This vested interest translates into higher productivity and improved customer service, which directly benefits the company's overall performance. The employee benefits also contribute to the company's success.

WinCo's robust in-house distribution and transportation network provides a competitive edge. This network allows the company to control costs, maintain product quality, and ensure efficient inventory management. By eliminating middlemen and optimizing supply chain logistics, WinCo achieves operational efficiencies that are difficult for competitors to match. The company's supply chain is a critical component of its success.

The extensive bulk foods section is a unique selling proposition for WinCo. Offering over 900 items, this feature allows customers to buy only the amount they need, often at lower prices than pre-packaged goods. This appeals to customers seeking savings and flexibility in their purchases. This offering contributes to the company's customer demographics.

WinCo Foods' competitive advantages extend beyond its core strategies. The company's focus on operational efficiency, combined with its employee-owned structure, creates a sustainable model. This is further enhanced by its ability to adapt to market changes. For more insights into the company's marketing approach, explore the Marketing Strategy of WinCo Foods.

- Low Spoilage Rates: WinCo boasts one of the lowest spoilage rates in the industry, at just 1.5%, compared to an industry average of around 2.7% (as of 2022), highlighting its logistical mastery.

- Direct Sourcing: WinCo's direct purchasing from manufacturers and farmers allows it to bypass intermediaries, reducing costs and increasing efficiency.

- Customer Loyalty: The employee-owned model fosters strong customer loyalty due to the enhanced customer service and dedication of the workforce.

- Strategic Expansion: WinCo continues to expand its store locations, focusing on areas where it can leverage its cost advantages and attract a loyal customer base.

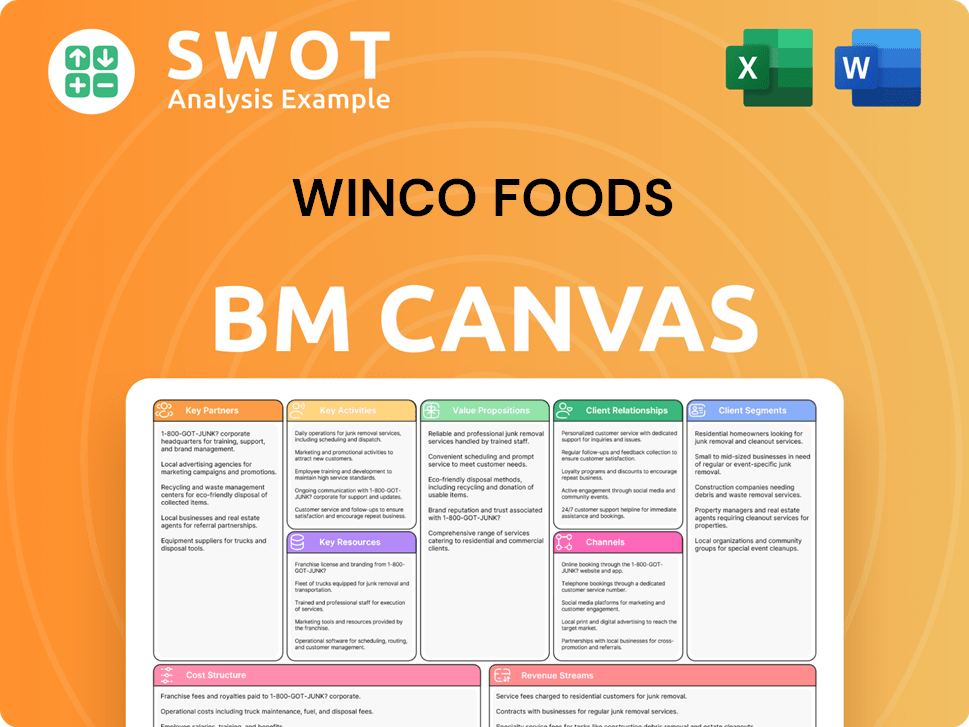

WinCo Foods Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping WinCo Foods’s Competitive Landscape?

The grocery industry is dynamic, with trends significantly impacting the WinCo Foods competitive landscape. Understanding these trends is crucial for assessing its position, the risks it faces, and its future outlook. The company's focus on value and operational efficiency positions it well, but it must navigate challenges like digital transformation and supply chain complexities.

WinCo Foods market analysis reveals a strong emphasis on low prices, attracting cost-conscious consumers. However, its success depends on adapting to evolving consumer preferences and maintaining a robust supply chain. The company's expansion plans and employee-owned structure offer opportunities for growth and differentiation in the competitive retail food industry.

The grocery sector is shaped by price sensitivity and digital transformation. Inflation, with food prices up 25% since January 2020, drives consumers to seek value. E-commerce is growing, with online grocery sales reaching $104.4 billion in 2024. These trends influence how WinCo Foods competitors operate.

Challenges include adapting to digital demands and managing supply chain disruptions. Investment in technology is rising, with a 400% increase in grocers' tech investments expected by 2025. Supply chain resilience is critical due to global issues and outbreaks like Avian Flu. This impacts the strategies of discount grocery stores.

Opportunities include geographic expansion and leveraging its employee-owned model. New store openings in Colorado, Arizona, and Oregon are planned. A strong employee-owned culture can enhance customer loyalty. These strategies are part of the company's growth plan, as discussed in Growth Strategy of WinCo Foods.

Key considerations include aggressive pricing strategies from rivals and the need for innovation. Regulatory scrutiny and changing consumer preferences, such as demand for organic products, also play a role. Data-driven decision-making and a customer-centric approach are essential for sustained success.

To thrive, WinCo must focus on several key areas. This includes optimizing operations and adapting to digital trends, with a focus on its WinCo Foods pricing strategy. Maintaining a strong supply chain and expanding into new markets will also be important.

- Enhance online presence and e-commerce capabilities.

- Strengthen supply chain management and logistics.

- Expand store locations and geographic reach.

- Maintain a focus on value and customer satisfaction.

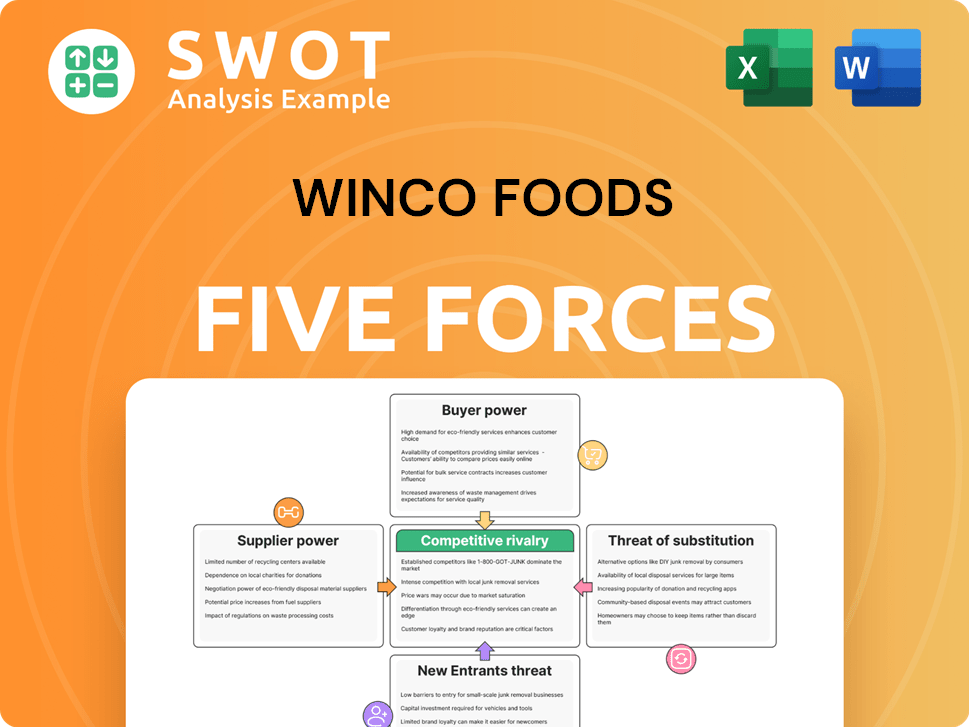

WinCo Foods Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of WinCo Foods Company?

- What is Growth Strategy and Future Prospects of WinCo Foods Company?

- How Does WinCo Foods Company Work?

- What is Sales and Marketing Strategy of WinCo Foods Company?

- What is Brief History of WinCo Foods Company?

- Who Owns WinCo Foods Company?

- What is Customer Demographics and Target Market of WinCo Foods Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.