WinCo Foods Bundle

How Does Employee-Owned WinCo Foods Thrive in the Grocery Wars?

Discover the inner workings of WinCo Foods, a unique grocery store chain that has disrupted the retail food sector. Founded in 1967, WinCo has grown to operate 142 stores across 10 states by May 2025. This employee-owned powerhouse distinguishes itself with a warehouse-style approach, offering low prices and an extensive bulk foods section.

This deep dive will explore WinCo's operational strategies, focusing on how WinCo Foods SWOT Analysis can illuminate its competitive advantages. From its employee-ownership model to its commitment to discount grocery offerings, understand how WinCo store locations across the Western and Southwestern regions maintain their edge. Learn how WinCo keeps prices low and what makes this grocery store a compelling alternative in today's market.

What Are the Key Operations Driving WinCo Foods’s Success?

The core operations of WinCo Foods revolve around its 'everyday low price' strategy, designed to provide value to budget-conscious consumers. This strategy is achieved by maintaining a no-frills, warehouse-style operation, which allows the WinCo store to offer a wide array of grocery items at competitive prices. The WinCo model emphasizes cost efficiency in every aspect of its business, from procurement to distribution.

WinCo Foods offers a diverse selection of products, including fresh produce, meats, bakery goods, and a significant bulk foods section. The bulk foods section is a key differentiator, featuring over 900 items, allowing customers to purchase desired quantities, often at lower prices than pre-packaged alternatives. This bulk offering contributes approximately 25% of WinCo's total revenue, highlighting its importance to the company's value proposition.

WinCo primarily targets budget-conscious consumers seeking quality and affordability. Its operational processes are meticulously designed to minimize expenses, ensuring it can offer competitive WinCo prices. This focus on efficiency and value has made WinCo Foods a popular choice for shoppers looking to save money on their groceries.

WinCo achieves cost efficiencies through direct purchasing from manufacturers and farmers. This approach eliminates intermediaries and leverages economies of scale. An in-house distribution network, including six distribution centers, optimizes supply chain logistics.

The company's operational model includes a minimalist approach, such as not providing bagging services and historically not accepting credit cards. These measures reduce overhead and contribute to lower prices. This lean operational model, combined with its employee-ownership structure, enhances its ability to offer competitive pricing.

The extensive bulk foods section is a key differentiator. It offers a wide variety of items, allowing customers to purchase only what they need. This helps reduce food waste and offers significant savings compared to pre-packaged options. The bulk foods section accounts for a substantial portion of WinCo's revenue.

WinCo operates under an employee-ownership model, which fosters a culture of shared responsibility and commitment. This structure aligns employee interests with the company's success, contributing to higher productivity and efficiency. This model also helps in maintaining low operational costs.

WinCo Foods focuses on providing value through everyday low prices, a wide selection of products, and a unique bulk foods offering. The company's operational efficiency, including direct sourcing and an in-house distribution network, enables it to maintain low prices. The employee-ownership model further enhances efficiency and aligns employee interests with the company's financial success.

- Everyday Low Prices: The primary value proposition, achieved through cost-efficient operations.

- Extensive Bulk Foods: A key differentiator, offering variety and savings.

- Direct Sourcing: Cutting out intermediaries to reduce costs.

- Employee Ownership: Fostering a culture of efficiency and commitment.

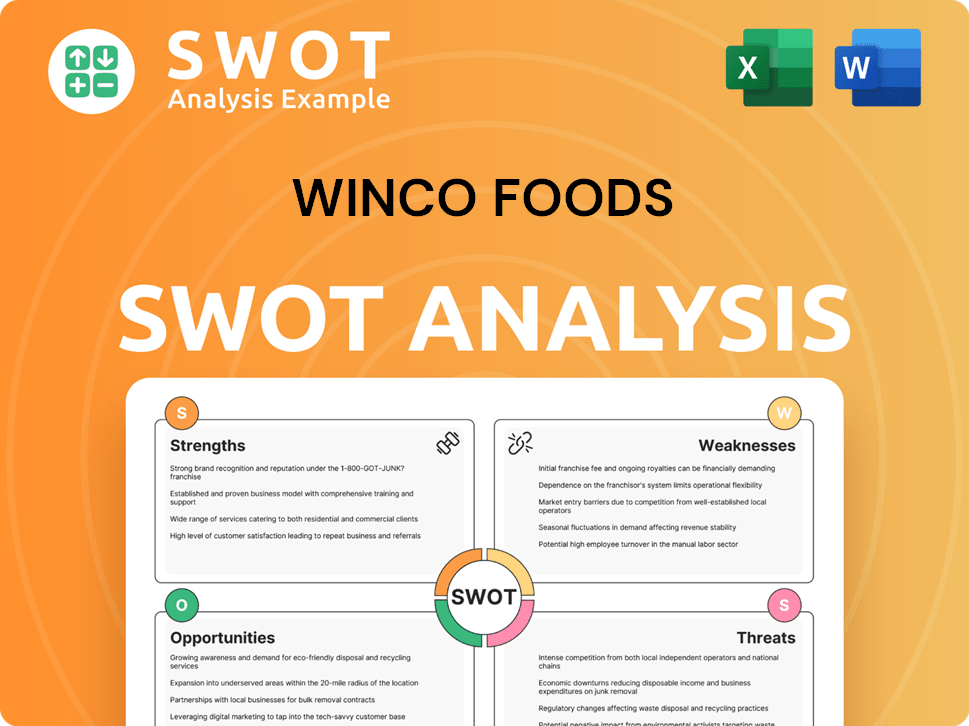

WinCo Foods SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does WinCo Foods Make Money?

The revenue model of WinCo Foods is built on high-volume sales, driven by low operating costs and competitive pricing. The primary revenue stream comes from direct product sales across various grocery categories, including fresh produce, bulk foods, meat, and general merchandise. WinCo, as a privately held company, does not disclose detailed financial data, but its annual revenue was reported as $9.8 billion in 2024.

A key monetization strategy involves the bulk food section, which accounts for approximately 25% of the company's total revenue. This approach encourages larger purchases and repeat visits. WinCo also offers private label brands, providing high-quality products at competitive prices. This strategy enhances its value proposition and attracts price-sensitive consumers.

The 'Wall of Values' at the store entrances highlights good pricing on popular items, serving as a direct promotional and monetization tool. WinCo's avoidance of credit card payments also reduces transaction fees, supporting its low-cost model and lower prices, which drives sales volume. Over time, WinCo has expanded its e-commerce capabilities, integrating online ordering systems to enhance convenience and potentially broaden its customer base.

WinCo Foods employs several strategies to generate revenue and maintain its competitive edge in the grocery store market. These include:

- Bulk Foods: The bulk food section is a significant revenue driver, accounting for about 25% of total revenue. This encourages larger basket sizes and repeat visits.

- Private Label Brands: Offering private label brands provides high-quality products at competitive prices, attracting price-sensitive customers.

- Low-Cost Operations: Avoiding credit card fees and focusing on operational efficiency helps keep prices low. This is part of how WinCo keeps prices low.

- 'Wall of Values': This promotional tool highlights particularly good pricing on popular items, driving sales.

- E-commerce Expansion: Online ordering systems enhance convenience and broaden the customer base.

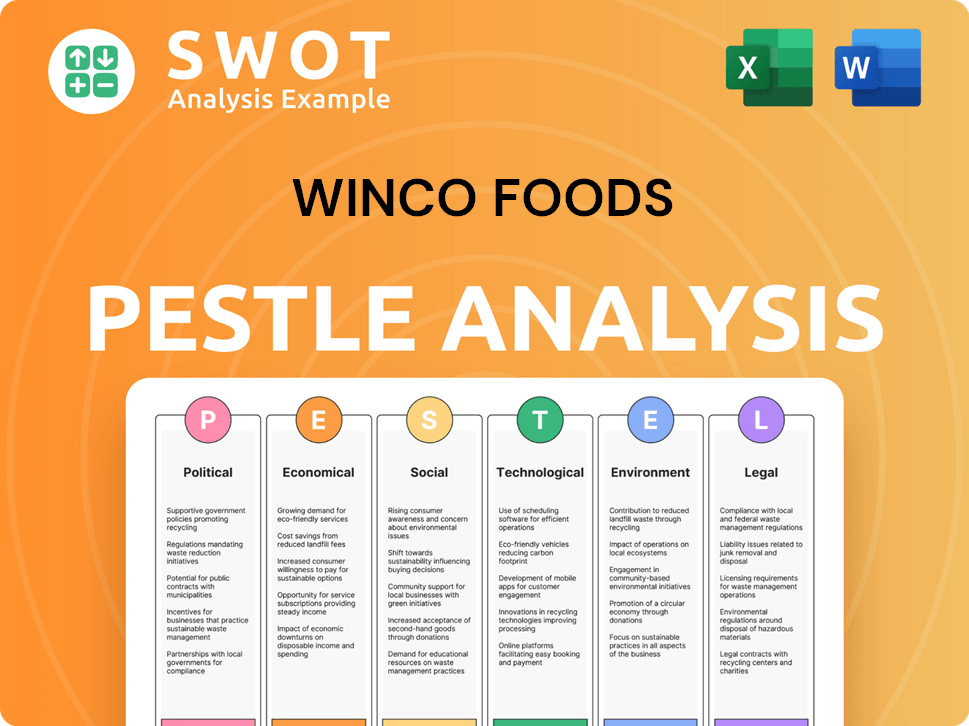

WinCo Foods PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped WinCo Foods’s Business Model?

Founded as Waremart in 1967, the company's evolution into WinCo Foods marks a significant journey. A pivotal moment came in 1985 when employees took ownership through an Employee Stock Ownership Plan (ESOP). This transition to employee ownership has profoundly shaped the company's culture and operational strategies, setting it apart in the competitive grocery market.

The company officially rebranded to WinCo Foods in October 1998. This strategic move was designed to create a distinct identity and avoid confusion with other retailers. This rebranding was a crucial step in establishing the brand recognition that WinCo enjoys today.

WinCo Foods' competitive advantage is rooted in its operational efficiency and strategic decisions. The company's low-price leader strategy, warehouse-style model, and direct purchasing practices contribute to its ability to offer competitive prices. The employee ownership model further aligns employee interests with the company's success, fostering a culture of cost reduction and customer satisfaction.

The establishment of the ESOP in 1985, making it employee-owned, was a defining moment. Rebranding to WinCo Foods in 1998 solidified its unique identity. These milestones highlight the company's commitment to employee ownership and brand recognition.

The 'low-price leader' strategy, combined with direct purchasing, is a key move. Expansion, particularly in the Western U.S., has been a consistent strategy. Adapting to online grocery shopping through enhanced e-commerce capabilities is also a strategic focus.

Its primary advantage is its low-price strategy, achieved through a no-frills, warehouse-style model and efficient operations. The ESOP model fosters employee dedication and reduces turnover. Strong customer loyalty and strategic expansion also contribute to its edge.

Supply chain disruptions, like those during the COVID-19 pandemic, presented challenges. Adapting to the rise of online grocery shopping is crucial. WinCo is enhancing its e-commerce capabilities to meet changing consumer demands.

WinCo Foods maintains its competitive edge through a combination of strategic pricing, operational efficiency, and employee engagement. The company's success is evident in its ability to attract budget-conscious shoppers and maintain strong customer loyalty. Further insights into its target demographic can be found in this article about the Target Market of WinCo Foods.

- Low-Price Strategy: WinCo store prices are consistently competitive, attracting a large customer base.

- Employee Ownership: The ESOP model fosters high employee motivation and lower turnover rates, around 20% annually, which is below the industry average.

- Strategic Expansion: Consistent expansion, including a new store in Goodyear, Arizona, set to open in late 2024, and exploration of the Colorado market in 2025.

- Supply Chain Management: Utilizing advanced inventory management technologies to mitigate supply chain disruptions and ensure product availability.

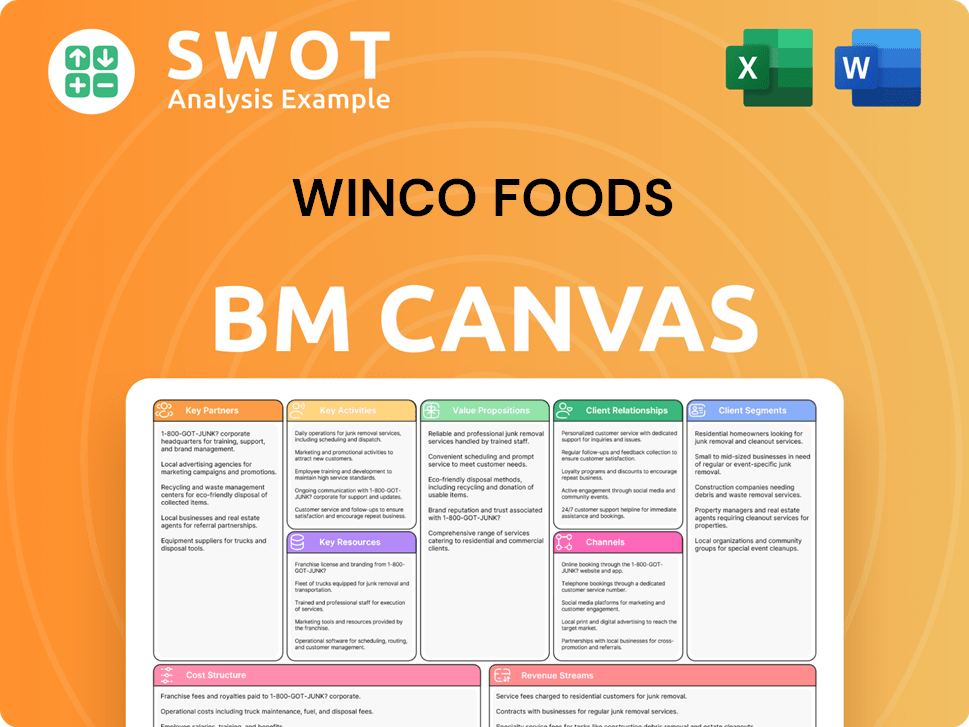

WinCo Foods Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is WinCo Foods Positioning Itself for Continued Success?

In the competitive retail grocery landscape, WinCo Foods carves out a strong niche, recognized as a 'low-price leader' and distinguished by its employee-owned model. As of May 2025, the company operates 142 stores across 10 states, primarily in the Western and Southwestern U.S. In 2024, Forbes ranked WinCo as the 53rd largest private company in America, with revenues reaching $9.8 billion. The company's value-driven approach and community engagement have fostered strong customer loyalty.

Despite its robust market position, WinCo faces several risks, including evolving consumer preferences, like the rising demand for convenience and ready-to-eat meals. The increasing popularity of online grocery shopping presents another challenge, as WinCo's business model has historically relied heavily on physical store visits. Supply chain disruptions and management complexities associated with its employee-ownership model also pose potential challenges.

WinCo Foods is a leading discount grocery store known for its low prices and bulk foods. The company's employee-owned structure contributes to its competitive pricing strategy. In January 2025, the Retailer Preference Index showed a significant rise, highlighting strong consumer perception.

Changing consumer preferences, such as a shift towards convenience and online shopping, are key risks. Supply chain disruptions and the need to adapt to digital transformation pose ongoing challenges. Maintaining its employee-owned model and efficient decision-making are also important.

WinCo Foods is expanding strategically with new store openings, including its entry into an eleventh state. Investments in technology, including enhanced e-commerce capabilities and AI-driven supply chain optimization, are underway. A continued focus on sustainability aligns with consumer demand and reinforces its community-oriented approach.

The company is actively pursuing strategic initiatives to drive future profitability. This includes expanding its physical store presence and growing its online platform. A commitment to sustainability and leveraging its employee-owned model are key components of its strategy. The Marketing Strategy of WinCo Foods provides further insights.

WinCo's success hinges on several key strategies. These include continued expansion and technological advancements. It also involves maintaining low prices, enhancing the customer experience, and strengthening its employee-owned structure.

- Strategic Expansion: Opening new WinCo store locations to increase market reach.

- Technological Integration: Improving e-commerce and supply chain management.

- Sustainability: Focusing on energy efficiency and ethical sourcing.

- Employee Ownership: Leveraging the employee-owned model to drive low prices and enhance customer service.

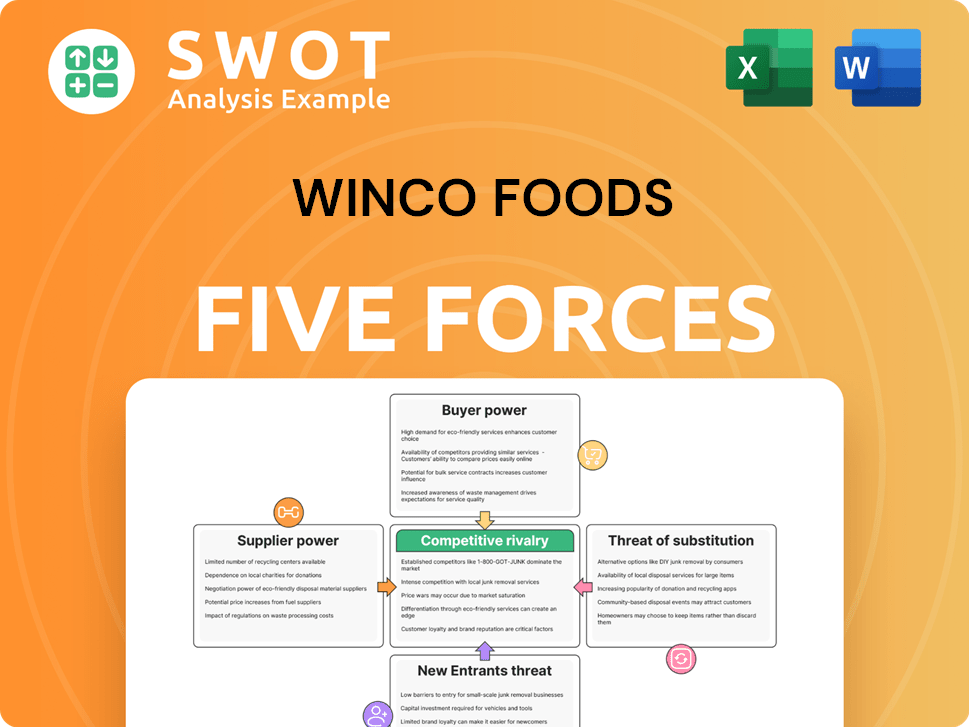

WinCo Foods Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of WinCo Foods Company?

- What is Competitive Landscape of WinCo Foods Company?

- What is Growth Strategy and Future Prospects of WinCo Foods Company?

- What is Sales and Marketing Strategy of WinCo Foods Company?

- What is Brief History of WinCo Foods Company?

- Who Owns WinCo Foods Company?

- What is Customer Demographics and Target Market of WinCo Foods Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.