WinCo Foods Bundle

Can WinCo Foods Continue Its Winning Streak?

Discover the compelling story of WinCo Foods, an employee-owned grocery chain that has disrupted the retail landscape with its low-price, no-frills approach. From its origins in Boise, Idaho, to its current status as a major player in the grocery market, WinCo's journey is a testament to its unique business model. Explore how this WinCo Foods SWOT Analysis can provide valuable insights.

This in-depth analysis will delve into WinCo Foods' growth strategy, examining its successful expansion and competitive advantages within the discount supermarket chain sector. We'll explore its future prospects, including potential new store locations and how it plans to maintain its market share in 2024 and beyond. Furthermore, we'll investigate how WinCo Foods attracts customers and its employee ownership benefits, providing a comprehensive company analysis and long-term growth potential.

How Is WinCo Foods Expanding Its Reach?

The expansion initiatives of WinCo Foods are a key element of its growth strategy, focusing on entering new markets and strengthening its presence in existing ones. The company's approach involves strategic decisions about new store locations and operational efficiencies to maintain its competitive edge. This expansion is crucial for increasing market share and reinforcing its position as a discount supermarket chain.

A significant aspect of WinCo's expansion strategy is its commitment to community engagement. This includes creating jobs and supporting local suppliers, which helps to foster customer loyalty and integrate the stores into the local economies. This approach, combined with its no-frills business model, allows WinCo to offer competitive prices and attract budget-conscious shoppers.

The company's growth is also supported by its employee-owned structure, which can lead to increased employee engagement and productivity, contributing to its success. WinCo's expansion plans often consider factors such as community feedback and local demand, as demonstrated by the upcoming store in Goodyear, Arizona.

WinCo Foods is actively opening new stores to expand its market presence. The new store in Goodyear, Arizona, is scheduled to open in late 2024. This location will be the company's eighth store in Arizona, and its 141st store nationwide. The expansion demonstrates a responsive approach to community demand.

WinCo focuses on controlled growth within the Western and Southwestern United States. The company uses its efficient distribution network and direct supplier negotiations to maintain low prices. This strategy supports its ability to offer competitive prices in new markets. The business model, including bulk food sections, is a key draw for budget-conscious shoppers.

WinCo's in-house distribution network plays a key role in minimizing costs and ensuring a consistent supply of fresh products. This supports its ability to offer competitive prices in new markets. The company's no-frills approach and extensive bulk food sections are attractive to budget-conscious shoppers.

WinCo prioritizes community integration, aiming to foster loyalty and embed itself as a community staple. This is achieved through job creation and support for local suppliers. The company's commitment to community engagement is a key part of its strategy. The company is an employee-owned company.

WinCo Foods' future expansion strategy focuses on controlled growth within the Western and Southwestern United States. The company aims to maintain its low-price leadership through logistical efficiency and direct supplier negotiations. The Goodyear, Arizona, store, spanning 85,675 square feet, is a prime example of this strategy.

- Focus on new store locations.

- Leveraging logistical efficiency.

- Community engagement and local supplier support.

- Employee-owned structure.

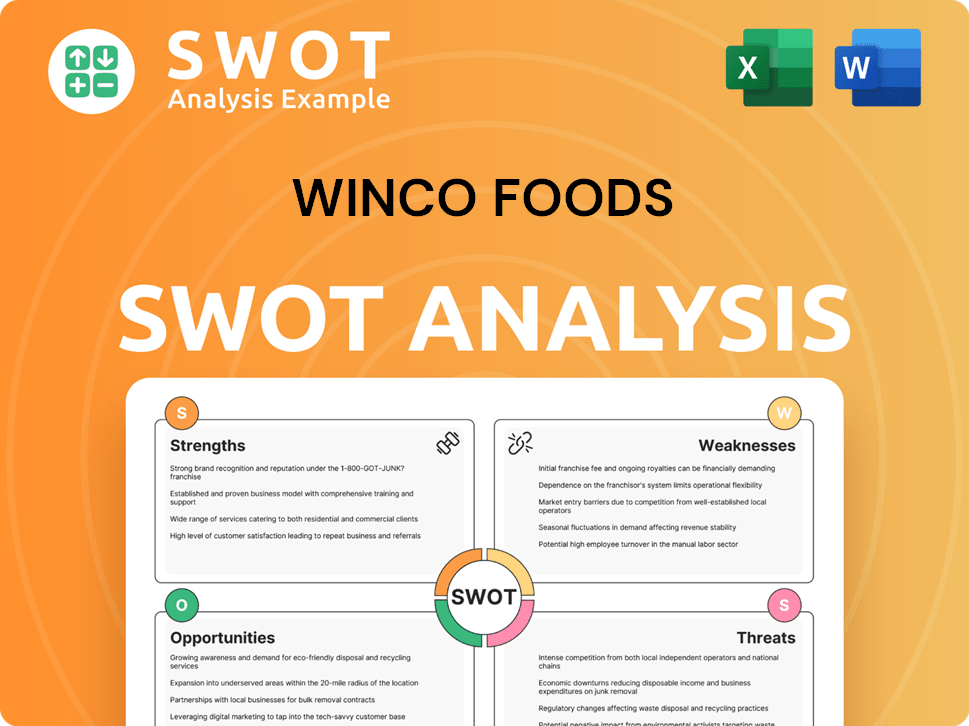

WinCo Foods SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does WinCo Foods Invest in Innovation?

To maintain its growth and enhance the customer experience, WinCo Foods is heavily investing in technology and innovation. This strategic move is crucial for a discount supermarket chain like WinCo to stay competitive. The company is adapting to evolving consumer needs by integrating advanced systems.

WinCo's approach involves significant investments in e-commerce capabilities, including online ordering systems. They are also enhancing their website and mobile app to make product navigation easier. These efforts are part of a broader trend in the grocery industry.

WinCo's focus on data-driven decision-making and customer-centric strategies is championed by CEO Grant Haag. The company is also committed to sustainability, emphasizing energy efficiency, waste reduction, and recycling across its stores. A Brief History of WinCo Foods highlights the company's evolution and its current strategies.

WinCo Foods has integrated sophisticated online ordering systems to simplify the shopping process for consumers. This includes improvements to its website and mobile app to make it easier to navigate product offerings. These enhancements are designed to meet the growing demand for convenient shopping options.

The company uses advanced inventory management technologies and real-time analytics. This helps ensure product availability and freshness. It also minimizes waste and reduces costs within the supply chain, which is crucial for maintaining its competitive edge.

WinCo utilizes AI and machine learning for demand forecasting, especially in fresh departments like deli, foodservice, and seafood. This technology optimizes production planning, reduces shrink, and improves in-stock levels. This data-driven approach is key to operational efficiency.

WinCo is committed to sustainability, integrating energy efficiency, waste reduction, and recycling into its operational practices. These efforts align with broader industry trends towards environmentally responsible operations. This approach enhances its brand image and operational efficiency.

WinCo is shifting towards a paperless employee environment to streamline access to information. This digital transformation aims to enhance efficiency and reduce operational costs. It empowers the workforce by providing streamlined access to essential data.

The grocery industry is seeing increased investment in technological innovations. Forecasts suggest a 400% increase by 2025 in areas like smart carts and redesigned self-checkout stations. This highlights the importance of staying current with technological advancements.

The integration of technology is central to WinCo Foods' growth strategy and future prospects. These innovations support the company's business model by enhancing operational efficiency and customer satisfaction. The company's focus on technology is designed to maintain its competitive advantage within the discount supermarket chain sector.

- Improved operational efficiency through automation and data analysis.

- Enhanced customer experience via online ordering and user-friendly apps.

- Reduced waste and optimized inventory management.

- Support for sustainable practices and cost reduction.

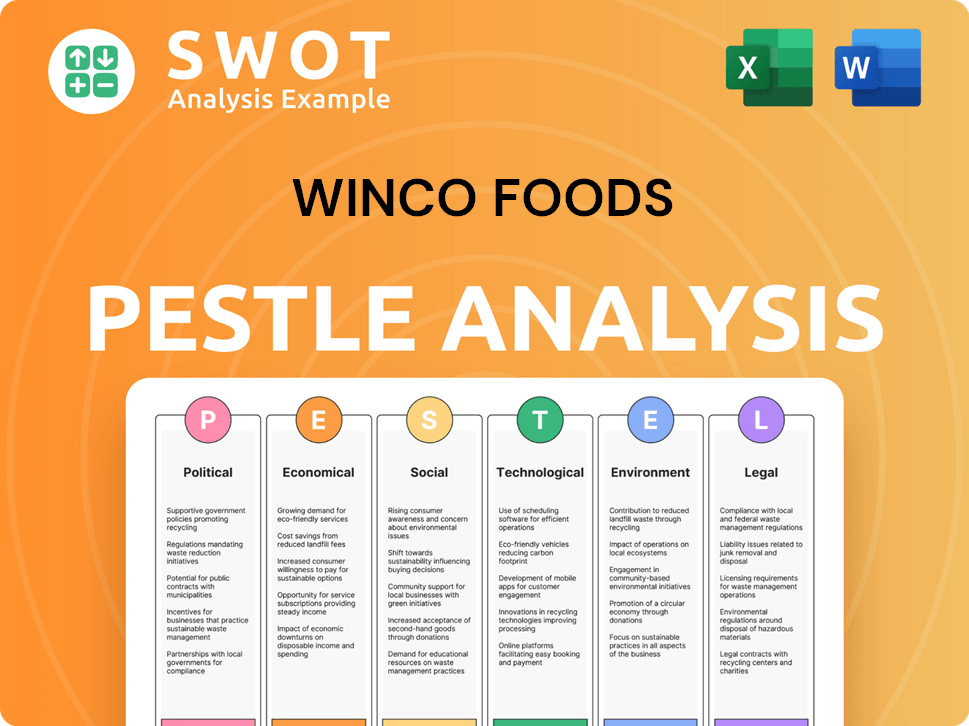

WinCo Foods PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is WinCo Foods’s Growth Forecast?

Understanding the financial outlook for WinCo Foods requires acknowledging its unique structure as a privately held, employee-owned entity. Unlike publicly traded companies, detailed financial reports are not routinely released. However, available data and insights into its operational strategies provide a clear picture of its financial health and future trajectory. The company's consistent growth, driven by its low-cost business model and employee ownership, positions it favorably within the competitive grocery market.

The WinCo Foods growth strategy is built on a foundation of efficiency and value. This is achieved through direct sourcing, an in-house distribution network, and a focus on high-volume sales. These strategies enable the company to offer competitive pricing. This approach has allowed WinCo to expand its market presence and maintain a loyal customer base. The employee ownership model further strengthens this strategy by aligning employee interests with the company's long-term financial success.

The financial performance of WinCo Foods reflects a pattern of steady growth. The reported revenue figures show a consistent upward trend. Specifically, revenues were US$8.2 billion in 2021, US$8.5 billion in 2022, US$9.5 billion in 2023, and an estimated US$9.8 billion in 2024. This sustained growth underscores the effectiveness of its business model. It also highlights its ability to adapt to market changes and maintain a strong position within the discount supermarket chain sector.

The company's revenue has consistently increased year over year. This growth is a key indicator of its financial health and market competitiveness. This sustained revenue growth reflects successful execution of its business model.

The Employee Stock Ownership Plan (ESOP) is a central element of WinCo’s financial strategy. The ESOP contributes to employee retention and productivity. The value of employee shares has increased by an average of 18% compounded annually since the ESOP began in 1986.

WinCo's ability to offer low prices indicates a lean operational structure. Direct purchasing and an in-house distribution network contribute to efficient cost management. This focus on cost control supports its competitive pricing strategy.

While specific expansion plans are not always publicly detailed, the company's history suggests continued growth. The focus remains on strategic locations and efficient operations. The company is likely to continue its strategy of controlled expansion.

The WinCo Foods future prospects are closely tied to its ability to maintain its core strengths. These include its low-price strategy, efficient operations, and employee ownership model. The company's commitment to these principles will likely drive continued growth and market share gains. Its success is also dependent on its ability to adapt to changing consumer preferences and competitive pressures within the grocery industry. For more insights into the company's operations, consider reading about Revenue Streams & Business Model of WinCo Foods.

WinCo Foods holds a strong position in the discount supermarket chain sector. Its low-cost model allows it to compete effectively with larger chains. The company's focus on value attracts a broad customer base.

Key competitive advantages include its low prices, efficient operations, and employee ownership. These factors contribute to customer loyalty and operational efficiency. The company's direct sourcing also helps it maintain low costs.

The employee ownership model fosters a culture of productivity and retention. Employees have a vested interest in the company's success. This structure contributes to lower turnover rates and improved operational efficiency.

The company's expansion strategy focuses on strategic locations and efficient operations. This approach allows for controlled growth and maintains its financial stability. WinCo is likely to continue its expansion in the coming years.

Customer satisfaction is high due to the consistently low prices and wide product selection. The company's focus on value resonates with budget-conscious consumers. WinCo's commitment to customer satisfaction supports its long-term growth.

WinCo's financial performance is marked by steady revenue growth and efficient cost management. The company's financial stability is a key factor in its continued success. Its ability to offer low prices indicates a lean operational structure.

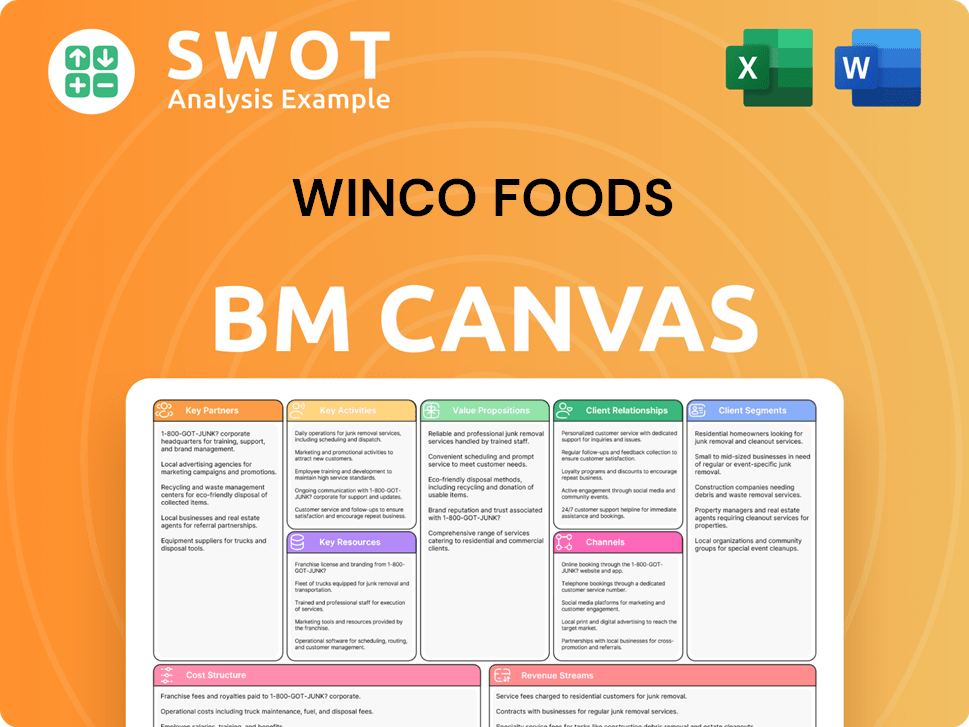

WinCo Foods Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow WinCo Foods’s Growth?

The path forward for WinCo Foods, while promising, is not without potential pitfalls. The grocery industry is fiercely competitive, and the company must navigate several challenges to maintain its growth trajectory. Understanding these risks is crucial for assessing the long-term viability of WinCo Foods and its ability to execute its growth strategy.

One primary concern involves the intense competition from both established players and emerging discount retailers. Furthermore, external factors like supply chain disruptions and technological advancements present ongoing hurdles. These challenges demand strategic foresight and adaptability to sustain WinCo Foods' success.

The company's employee-owned model, while a strength, also presents unique challenges, particularly regarding internal communication and ensuring all employee-owners are aligned with the company's goals.

The discount supermarket chain faces intense competition from established players like Walmart and Kroger, as well as other discount grocers such as Aldi and Costco. This pressure necessitates maintaining competitive pricing and continually seeking ways to increase market share. The competitive landscape demands constant innovation and operational efficiency.

High inflation, particularly in food prices, poses a significant risk. The USDA projects a 2.2% increase in food prices for 2025. This could affect consumer spending and WinCo Foods' ability to sustain its low-price leadership. The company must carefully manage its costs to maintain its competitive pricing advantage.

Disruptions in the supply chain can impact product availability and pricing. While WinCo Foods operates its distribution network to manage costs, external supply chain issues can still create challenges. These disruptions can affect the company's ability to meet customer demand and maintain profitability.

The rapid evolution of technology in the grocery industry, including advancements in AI, e-commerce, and personalized shopping experiences, requires continuous investment. Failure to keep pace with these innovations could impact customer attraction and retention. Adapting to these changes is essential for long-term success.

Changes in food safety regulations, labor laws, or environmental standards can increase operational costs. Compliance with evolving regulations requires ongoing monitoring and adjustments. These regulatory changes can impact the company's financial performance and operational efficiency.

Ensuring all employee-owners fully understand their roles and the financial aspects of the business is an ongoing challenge. Effective communication and training are crucial for maintaining the company's unique employee-ownership model. Addressing these internal aspects is vital for sustaining productivity and efficiency.

While the employee-ownership model fosters a self-policing culture that aims to reduce waste and boost productivity, it also presents challenges. Ensuring all employee-owners are aligned with the company's goals requires consistent communication and education. The success of this model depends on the active participation and understanding of all employees.

The company has faced legal challenges, such as the class action settlement in 2023 regarding shoplifter handling. These types of challenges can impact operations and require careful risk management. Mitigating these risks requires proactive measures and adherence to legal and operational best practices.

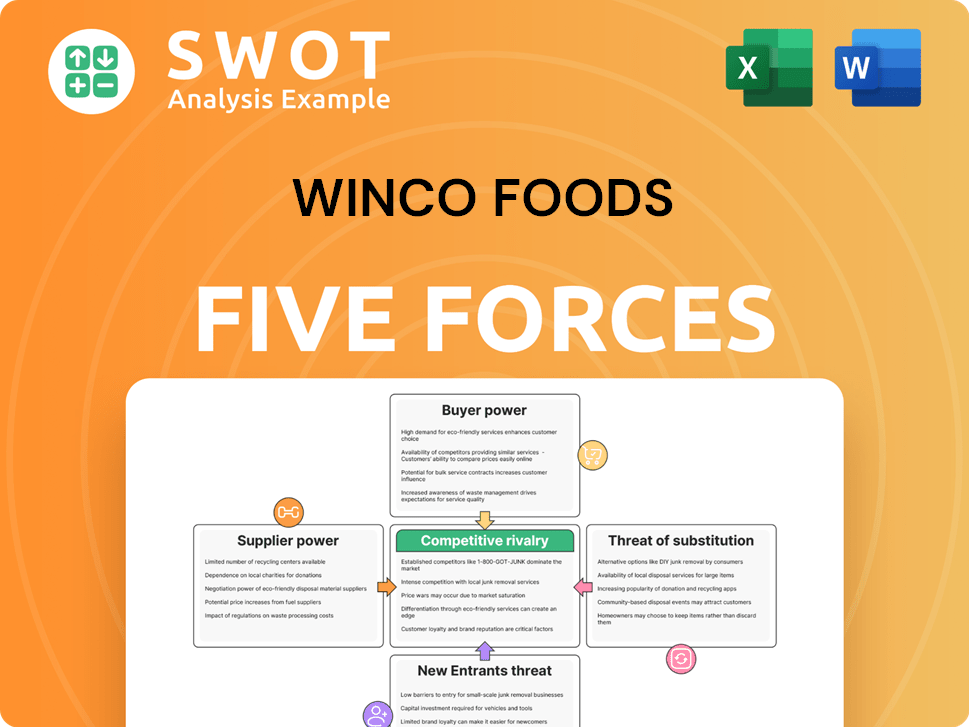

WinCo Foods Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of WinCo Foods Company?

- What is Competitive Landscape of WinCo Foods Company?

- How Does WinCo Foods Company Work?

- What is Sales and Marketing Strategy of WinCo Foods Company?

- What is Brief History of WinCo Foods Company?

- Who Owns WinCo Foods Company?

- What is Customer Demographics and Target Market of WinCo Foods Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.