Zotefoams Bundle

Can Zotefoams Maintain Its Edge in a Changing Market?

Zotefoams, a titan in cellular material technology, is facing a dynamic shift in its Zotefoams SWOT Analysis. From its humble beginnings in 1921, the company has evolved into a global leader, consistently pushing the boundaries of innovation. With record-breaking revenue and profits in 2024, the question now becomes: How does Zotefoams navigate its competitive landscape and sustain its impressive

This analysis dives deep into the

Where Does Zotefoams’ Stand in the Current Market?

Zotefoams holds a strong market position as a world leader in supercritical foams, particularly in cross-linked and low-density polyethylene block foams. The company's core operations involve the manufacture of high-performance foams used across various industries. Their value proposition lies in providing innovative, sustainable, and high-quality foam solutions that meet diverse customer needs.

In 2024, the company achieved record group revenue of £147.8 million, demonstrating its strong market presence. This success highlights Zotefoams' ability to adapt and thrive in the competitive landscape. The company's focus on innovation and customer partnerships is key to its continued growth and market leadership.

Zotefoams' financial health is robust, with a strong balance sheet and net debt down 20% to £24.1 million (excluding leases) in 2024, and a leverage ratio reduced to 0.9x from 1.2x. This financial stability supports its strategic initiatives and future growth plans. For further insights into the company's ownership structure, you can refer to Owners & Shareholders of Zotefoams.

Zotefoams is a world leader in supercritical foams, especially in cross-linked and low-density polyethylene block foams. The company's strong market position is supported by its innovative product lines and global manufacturing footprint. This leadership is further solidified by its financial performance and strategic initiatives.

The company's primary product lines include AZOTE® polyolefin foams (Plastazote®, Evazote®, Supazote®) and ZOTEK® high-performance foams. These products are manufactured from fluoropolymers, engineering polymers, and specialty elastomers. Zotefoams also produces T-FIT® advanced insulation.

Zotefoams has a diversified manufacturing footprint across the UK, USA (Kentucky and Oklahoma), Poland (Brzeg), and a significant presence in Asia, including a facility in Jiangsu Province, China, and planned new facilities in Vietnam and South Korea. This global presence supports its ability to serve customers worldwide.

In 2025, Zotefoams is undergoing a shift to a market-driven approach, organizing its business across three key verticals: Consumer & Lifestyle, Transport & Smart Technologies, and Construction & Other Industrial. This move aims to strengthen customer partnerships and unlock new opportunities.

Zotefoams' financial performance in 2024 was strong, with record group revenue. The company's financial health is robust, with a strong balance sheet and reduced net debt.

- Record group revenue of £147.8 million in 2024.

- High Performance Products (HPP) sales reached £79.6 million, a 37% increase from 2023.

- Footwear sales increased by 46% to £66.1 million in 2024.

- Net debt down 20% to £24.1 million (excluding leases) in 2024.

Zotefoams SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Zotefoams?

The Zotefoams competitive landscape is shaped by its position as a world leader in cellular material technology, especially in cross-linked block foams. The company faces competition from various manufacturers of specialized foams and cellular materials, operating within the broader polyolefin and engineered polymer foam markets. A thorough Zotefoams market analysis reveals a competitive environment characterized by both established players and emerging innovators.

Zotefoams' business strategy involves navigating a market estimated at £4 billion for global polyolefin foams, with the company's core business currently addressing approximately £0.8 billion within these segments. Competitors challenge through alternative materials, different manufacturing processes, and market-specific solutions. Strategic moves, such as the alliance with Suzhou Shincell New Materials Co., Ltd, highlight the company's approach to leverage external intellectual property and expand its market reach.

The Zotefoams industry faces challenges and opportunities, as seen in its strategic decisions and market positioning. The company's exclusive supply agreement with Nike for footwear product cushioning, extending until December 31, 2029, provides a significant competitive advantage in this area. However, the global athletic footwear market's concentration in Asia, with China, Vietnam, and Indonesia producing approximately 94% of the world's athletic shoes, means Zotefoams faces competition from local and international suppliers in these regions.

Direct competitors are often other manufacturers of specialized foams and cellular materials. These companies compete by offering similar products or solutions in the same market segments.

Competitors may use alternative materials to compete with Zotefoams' products. These materials could offer different properties or cost advantages.

Different manufacturing processes can be a source of competition. Competitors may use more efficient or cost-effective methods to produce similar products.

Competitors may focus on providing solutions tailored to specific market needs. This could involve customizing products or offering specialized services.

Alliances, such as the one with Suzhou Shincell, indicate how companies may collaborate to compete more effectively. These partnerships can leverage external intellectual property and expand market reach.

Competition varies by region. For example, the athletic footwear market's concentration in Asia means Zotefoams faces competition from local and international suppliers in these regions.

The decision to wind down its MuCell Extrusion LLC business unit and pause investment in ReZorce® circular packaging in December 2024, due to an inability to secure a strategic investing partner, highlights the challenges of competing in certain high-capital, evolving markets. This move frees up resources to focus on the core supercritical foams businesses. For more insights, you can read a detailed Zotefoams financial performance review.

Zotefoams' competitive advantages include its exclusive supply agreement with Nike and its expertise in cross-linked block foams. However, the company faces challenges in certain markets and geographic regions.

- Competitive Advantages: Exclusive supply agreement with Nike, expertise in cross-linked block foams.

- Market Challenges: Competition from local and international suppliers in Asia, challenges in high-capital markets.

- Strategic Moves: Alliances to expand market reach, focus on core businesses.

- Geographic Focus: Concentration in the athletic footwear market and global polyolefin foams market.

- Financial Performance: Addressing approximately £0.8 billion within the global polyolefin foams market segments.

Zotefoams PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Zotefoams a Competitive Edge Over Its Rivals?

Understanding the Zotefoams competitive landscape involves recognizing its unique strengths in the foam manufacturing industry. The company's core competitive advantages stem from its proprietary cellular material technology and specialized manufacturing processes. These factors, coupled with strategic investments and partnerships, position it favorably within the market.

Key milestones for Zotefoams business include its expansion into new markets and the development of innovative products. Recent strategic moves, such as the appointment of a new Group CEO in May 2024, signal a renewed focus on innovation and profitable growth. These initiatives are vital for maintaining a competitive edge and capitalizing on market opportunities.

Zotefoams market analysis reveals a company that has built a strong foundation through technological innovation and strategic partnerships. Its commitment to sustainable practices and expanding manufacturing capabilities further strengthens its position. This approach is essential for navigating the challenges and opportunities within the foam industry.

The company's use of environmentally friendly nitrogen expansion for its AZOTE® and ZOTEK® foams sets it apart. This process yields foams with superior properties compared to other methods, which is a significant competitive advantage. The focus on innovation is further demonstrated by its new Group CEO, Ronan Cox, who joined in May 2024, emphasizing a refreshed, focused strategy prioritizing innovation and profitable growth.

Zotefoams retains the intellectual property for its ReZorce® technology, even after pausing investment in its commercialization. This preserves the potential to realize value if market conditions improve. This strategic approach shows the company's ability to adapt and capitalize on future opportunities.

The exclusive supply agreement with Nike for footwear product cushioning, extending until 2029, highlights strong customer loyalty. This long-term partnership in the footwear market, which represents the Group's largest segment by revenue (over £65 million in 2024), showcases a high degree of customer retention and reliance on Zotefoams' specialized foams.

A diversified manufacturing footprint across the UK, USA, Poland, and Vietnam supports economies of scale. The investment in new manufacturing and innovation facilities in Vietnam and South Korea, totaling approximately £26 million, aims to bring capacity closer to customer supply chains. The US expansion, a £10 million investment, is on schedule for early second half 2025 commissioning.

Zotefoams benefits from its proprietary technology, strong partnerships, and strategic investments. These advantages are crucial for its market position and future growth potential. The company's focus on innovation, as highlighted in Revenue Streams & Business Model of Zotefoams, is a key factor in its success.

- Proprietary Cellular Material Technology: Unique manufacturing processes and environmentally friendly practices.

- Intellectual Property: Ownership of key technologies and know-how.

- Strategic Partnerships: Long-term agreements with major customers, such as Nike.

- Global Manufacturing Footprint: Diversified locations to serve customers efficiently.

- Investment in Innovation: Ongoing investments in new facilities and product development.

Zotefoams Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Zotefoams’s Competitive Landscape?

The cellular materials industry is experiencing significant shifts driven by technological advancements, changing consumer demands, and global economic conditions. The Growth Strategy of Zotefoams is adapting to these trends by focusing on market-driven approaches in key verticals like Consumer & Lifestyle, Transport & Smart Technologies, and Construction & Other Industrial sectors.

The Zotefoams competitive landscape is influenced by its ability to navigate technological challenges and capitalize on global economic dynamics. While facing potential threats from declining demand in certain sectors and increased competition, the company aims for growth in 2025, supported by a strong order book and opportunities across all geographies.

Technological advancements and sustainability are key drivers in the Zotefoams industry. The company is increasing its focus on innovation, including investment in a new innovation center in the UK and an innovation hub in South Korea. The market is also affected by regulatory changes and global economic shifts, such as trade tariffs, which impact supply chains.

One of the main challenges for Zotefoams business is the potential for declining demand in certain sectors. Increased regulation and competition from new entrants may also pose risks. Furthermore, the decision to pause investment in ReZorce® circular packaging technology highlights the difficulties in commercializing new technologies without the right strategic partners.

Zotefoams market analysis shows significant opportunities in emerging markets and through product innovations. Strategic partnerships, like the one with Suzhou Shincell New Materials Co Ltd, also offer growth potential. The increasing adoption of supercritical foams in athletic footwear, currently at 4-6% of the total market, presents a significant growth opportunity.

Zotefoams is investing in a second low-pressure vessel in its US subsidiary, expected to be commissioned in Q3 2025, to enhance its ability to serve the North American market. The company aims to grow Group organic revenue well in excess of £200 million and operating profit in excess of £40 million. This reflects a strategic focus on expanding its market presence and improving its Zotefoams performance.

The company faces challenges such as declining demand in specific sectors and the impact of increased regulation or new competitors. However, Zotefoams is addressing these challenges through a diversified manufacturing footprint and strategic partnerships to navigate uncertainties. The focus on high-value manufacturing and direct market access supports its growth ambitions.

- Diversified Manufacturing: Manufacturing facilities across the UK, USA, Poland, and Vietnam.

- Strategic Partnerships: The global alliance agreement with Suzhou Shincell New Materials Co Ltd.

- Market Expansion: Investment in the US subsidiary for enhanced North American market access.

- Product Innovation: Focusing on sustainable materials and supercritical foams.

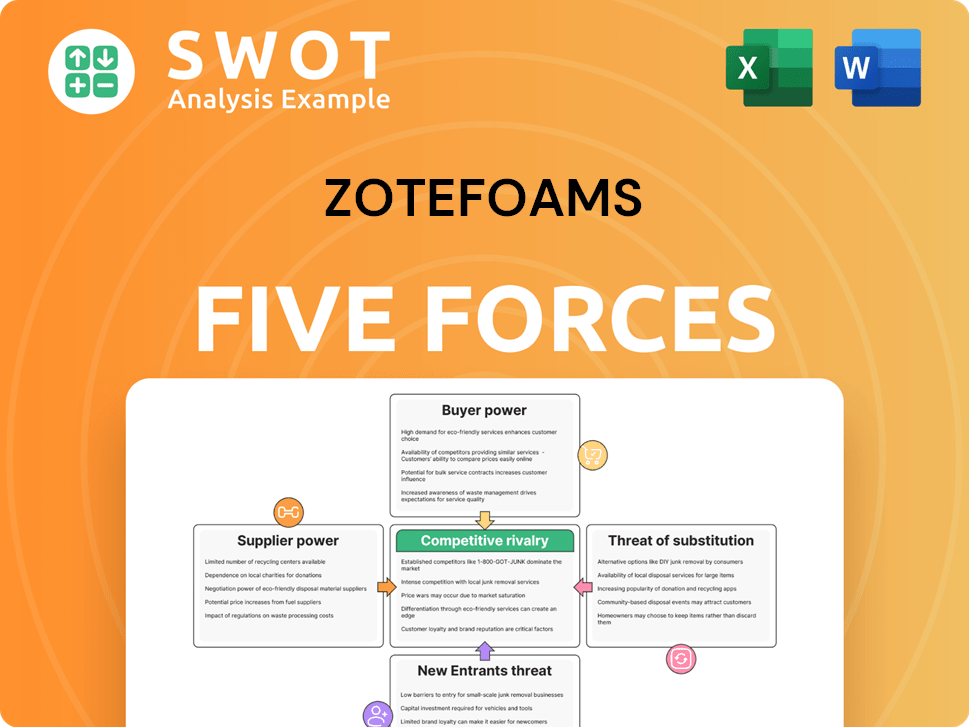

Zotefoams Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Zotefoams Company?

- What is Growth Strategy and Future Prospects of Zotefoams Company?

- How Does Zotefoams Company Work?

- What is Sales and Marketing Strategy of Zotefoams Company?

- What is Brief History of Zotefoams Company?

- Who Owns Zotefoams Company?

- What is Customer Demographics and Target Market of Zotefoams Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.