AGCO Bundle

Can AGCO Continue to Cultivate Growth in the Agricultural Machinery Market?

AGCO Corporation, a titan in the agricultural machinery market, has built its success on strategic acquisitions and a farmer-focused approach. Founded in 1990, AGCO quickly evolved from a regional player into a global force, now ranking as the world's third-largest manufacturer of tractors and farm equipment. This AGCO SWOT Analysis will help to understand the company's strengths and weaknesses.

This in-depth AGCO company analysis will explore the company's AGCO growth strategy, examining its expansion plans, technological innovations, and financial outlook. We'll also delve into the future prospects for AGCO, considering its position within the farm equipment industry and its response to challenges like supply chain disruptions. Understanding AGCO's approach to precision agriculture and its sustainability initiatives will be key to assessing its long-term goals and impact on global food production.

How Is AGCO Expanding Its Reach?

The expansion initiatives of AGCO are focused on strategic acquisitions, market entry, and enhancing product offerings, particularly in high-margin areas like precision agriculture. These initiatives are driven by the need to access new customers, diversify revenue streams, and maintain a competitive edge in the agricultural machinery market. The company's approach involves targeted investments and strategic partnerships to capitalize on emerging opportunities and strengthen its position in the global farm equipment industry. These efforts are crucial for driving long-term growth and adapting to the evolving needs of the agricultural sector.

A key element of AGCO's growth strategy involves leveraging technology to improve farming practices. The company is investing in smart farming solutions to meet the increasing demand for efficient and sustainable agricultural methods. This includes integrating advanced technologies into its machinery and services to help farmers optimize their operations and increase productivity. These initiatives are designed to position AGCO as a leader in the future of agriculture, catering to the growing need for precision and sustainability in farming.

AGCO's future prospects are closely tied to its ability to execute these expansion plans effectively. By focusing on strategic acquisitions, market expansion, and technological advancements, the company aims to strengthen its market position and drive sustainable growth. These initiatives are supported by a commitment to innovation and a customer-centric approach, ensuring that AGCO remains competitive in the dynamic agricultural machinery market. For more details on the company's ownership structure, you can refer to Owners & Shareholders of AGCO.

The acquisition of Trimble's ag assets through the PTx Trimble joint venture is a pivotal move. AGCO holds an 85% stake in this joint venture, which is a key component of its smart farming solutions. This strategic move allows AGCO to integrate advanced technologies and expand its offerings in precision agriculture.

AGCO is focused on expanding the global reach of its premium Fendt brand, targeting increased sales in North and South America. The company aims to increase Fendt sales in North and South America to $1.7 billion. This expansion is part of AGCO's strategy to capitalize on market opportunities.

The company plans to grow its parts sales and increase the market share of genuine AGCO parts. AGCO aims to grow its parts sales to $2.3 billion. This focus on parts sales is crucial for supporting its existing customer base and driving revenue growth.

AGCO is implementing a new 'FarmerCore' distribution model to bring products and services directly to farms. This model was launched across its North and South American dealer networks in 2024 and will continue to expand. This initiative is designed to improve customer service and enhance market reach.

AGCO's expansion strategy includes key initiatives aimed at driving growth and enhancing market position. These initiatives are supported by specific financial targets and strategic partnerships, which are critical for achieving long-term success. The company's focus on precision agriculture and market expansion reflects its commitment to innovation and customer satisfaction.

- The PTx Trimble joint venture aims to grow precision ag sales to $2 billion by 2029, showcasing AGCO's commitment to smart farming.

- Expanding the Fendt brand in North and South America to $1.7 billion demonstrates AGCO's focus on premium product offerings.

- Growing parts sales to $2.3 billion and increasing market share highlights AGCO's dedication to customer support and revenue diversification.

- The 'FarmerCore' distribution model enhances market reach and customer service, improving the overall customer experience.

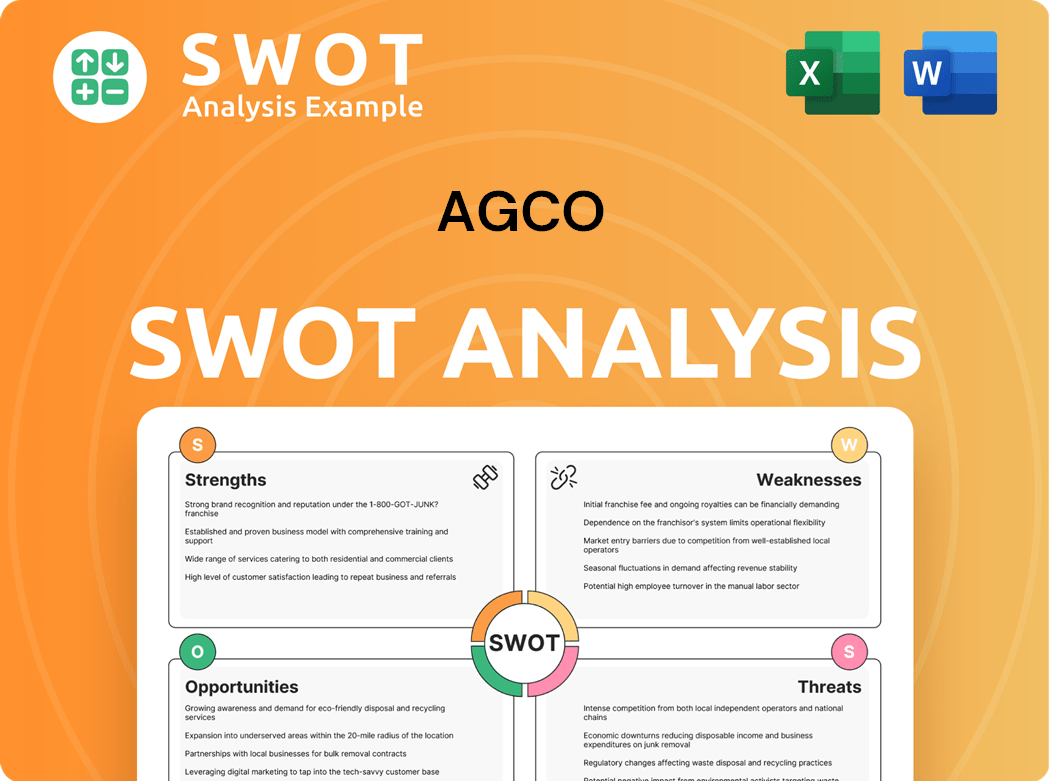

AGCO SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does AGCO Invest in Innovation?

Innovation and technology are central to the growth strategy of the company, focusing on precision agriculture and sustainable solutions. This approach is designed to meet the evolving needs of farmers and enhance operational efficiency. The company's commitment to research and development is a key driver of its future prospects.

The company is heavily investing in research and development to drive innovation. This investment is crucial for maintaining a competitive edge in the agricultural machinery market. The company's future success hinges on its ability to deliver cutting-edge solutions to farmers worldwide.

The company's focus on innovation is evident in its substantial R&D spending. The company allocated $493 million to research and development in 2024. This investment underscores the company's commitment to technological advancements and its long-term growth strategy.

The company's precision agriculture portfolio, known as PTx, is a core part of its innovation strategy. This portfolio integrates technologies from Precision Planting and the PTx Trimble joint venture. The company aims to launch several new PTx products annually to enhance farming efficiency.

A key element of the company's technology strategy is the implementation of a Connected Cloud strategy. This approach is designed to improve data management and connectivity for farmers. The Connected Cloud strategy is expected to enhance the efficiency of farm operations.

The PTx data platform is designed to help farmers manage mixed fleet operations. The platform will provide comprehensive data analysis and operational insights. Partial launch of the PTx data platform is planned for 2025, with full deployment by 2027.

The company is actively involved in sustainability initiatives, focusing on clean energy solutions. The company is developing battery-electric tractors and engines compatible with renewable fuels. These initiatives are crucial for reducing the environmental impact of farming.

The company has set ambitious targets to reduce its emissions. It aims to decrease Scope 1 and 2 absolute emissions by 55% by 2030 and 90% by 2050. These targets demonstrate the company's commitment to environmental sustainability.

The company plans to finalize a Climate Transition Plan in 2025. This plan will outline the specific steps the company will take to achieve its emission reduction targets. The Climate Transition Plan is a key component of the company's sustainability strategy.

These technological advancements and sustainability efforts contribute to the company's growth objectives. By providing farmers with solutions to increase productivity and minimize environmental impact, the company is well-positioned for future success. The company's focus on innovation and sustainability is central to its long-term strategy.

- The company's investment in precision agriculture, such as the PTx brand, enhances its competitive advantages in the tractor market.

- The development of electric tractors and engines compatible with renewable fuels aligns with the growing demand for sustainable farming practices.

- The company's commitment to reducing emissions and finalizing a Climate Transition Plan demonstrates its dedication to environmental stewardship.

- The Connected Cloud strategy and the PTx data platform are designed to improve operational efficiency and data management for farmers.

- These initiatives support the company's long-term goals for sustainable farming and contribute to its overall AGCO growth strategy.

For more insights into the company's core values, consider reading Mission, Vision & Core Values of AGCO.

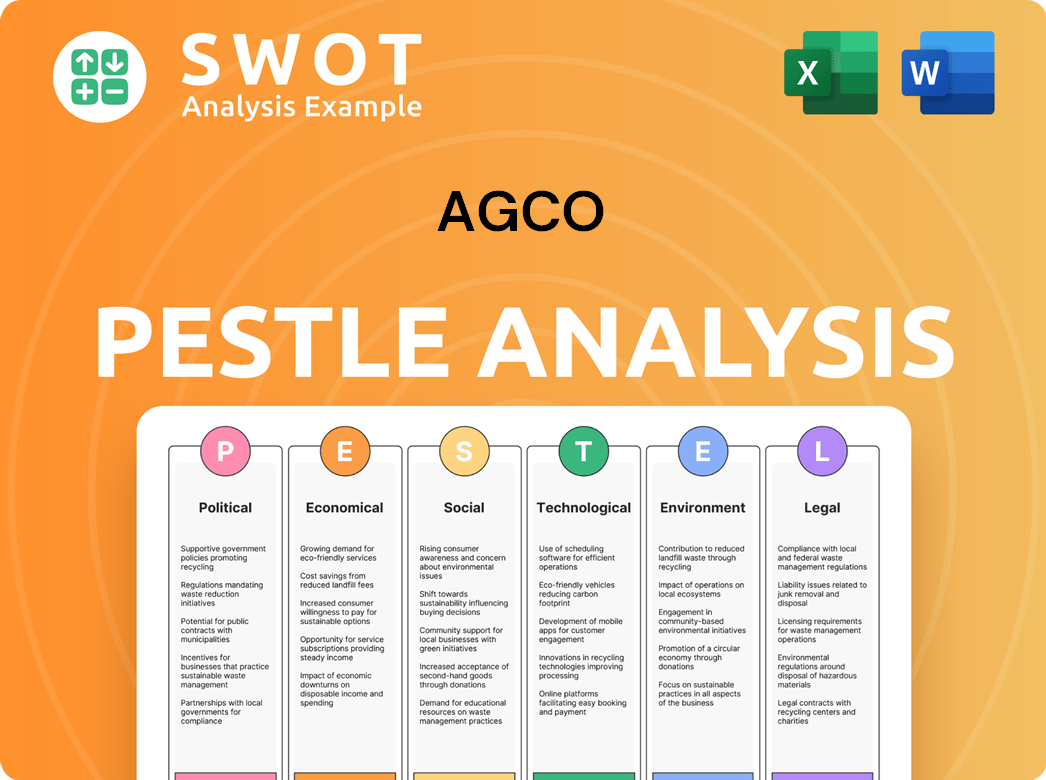

AGCO PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is AGCO’s Growth Forecast?

The financial outlook for AGCO in 2025 points towards a strategic recalibration. The company anticipates a slight decrease in net sales, projecting roughly $9.6 billion. This adjustment primarily stems from anticipated lower sales volumes and the impact of unfavorable foreign currency translations. Despite these challenges, the company is focused on maintaining profitability and operational efficiency.

AGCO's approach includes stringent cost controls and moderated investments in engineering, aiming to mitigate the effects of reduced sales. The projected adjusted operating margins for 2025 are targeted between 7% and 7.5%. Furthermore, the company's earnings per share (EPS) are estimated to be in the range of $4.00 to $4.50, reflecting the overall financial strategy for the year. This outlook demonstrates the company's proactive measures to navigate market dynamics and maintain financial stability.

In 2024, AGCO's net sales decreased to $11.7 billion, a 19.1% drop from the previous year. However, the adjusted operating margin of 8.9% in 2024 reflects a robust performance amid an industry downturn. This resilience underscores AGCO's ability to manage its financial health effectively. The company's long-term financial strategy, as highlighted in the Target Market of AGCO, is designed to foster sustainable growth and profitability.

AGCO anticipates net sales of approximately $9.6 billion in 2025. This projection accounts for lower sales volumes and currency fluctuations. The company is focusing on cost controls to maintain profitability.

The projected adjusted operating margins for 2025 are between 7% and 7.5%. This reflects the company's efforts to manage costs and investments effectively. These margins are crucial for maintaining profitability.

AGCO targets an earnings per share (EPS) of approximately $4.00 to $4.50 for 2025. This target reflects the company's overall financial strategy. The EPS is a key indicator of financial performance.

In 2024, AGCO's net sales were $11.7 billion, with an adjusted operating margin of 8.9%. This strong performance highlights the company's resilience. The 2024 results set a baseline for future growth.

AGCO has set ambitious goals for 2029, aiming for an adjusted mid-cycle operating margin of 14-15%. The company also targets an annual industry outgrowth of 4-5% and a free cash flow conversion of 75-100%. These targets demonstrate AGCO's commitment to long-term financial success and enhanced profitability within the agricultural machinery market.

- Adjusted mid-cycle operating margins: 14-15%

- Annual industry outgrowth: 4-5%

- Free cash flow conversion: 75-100%

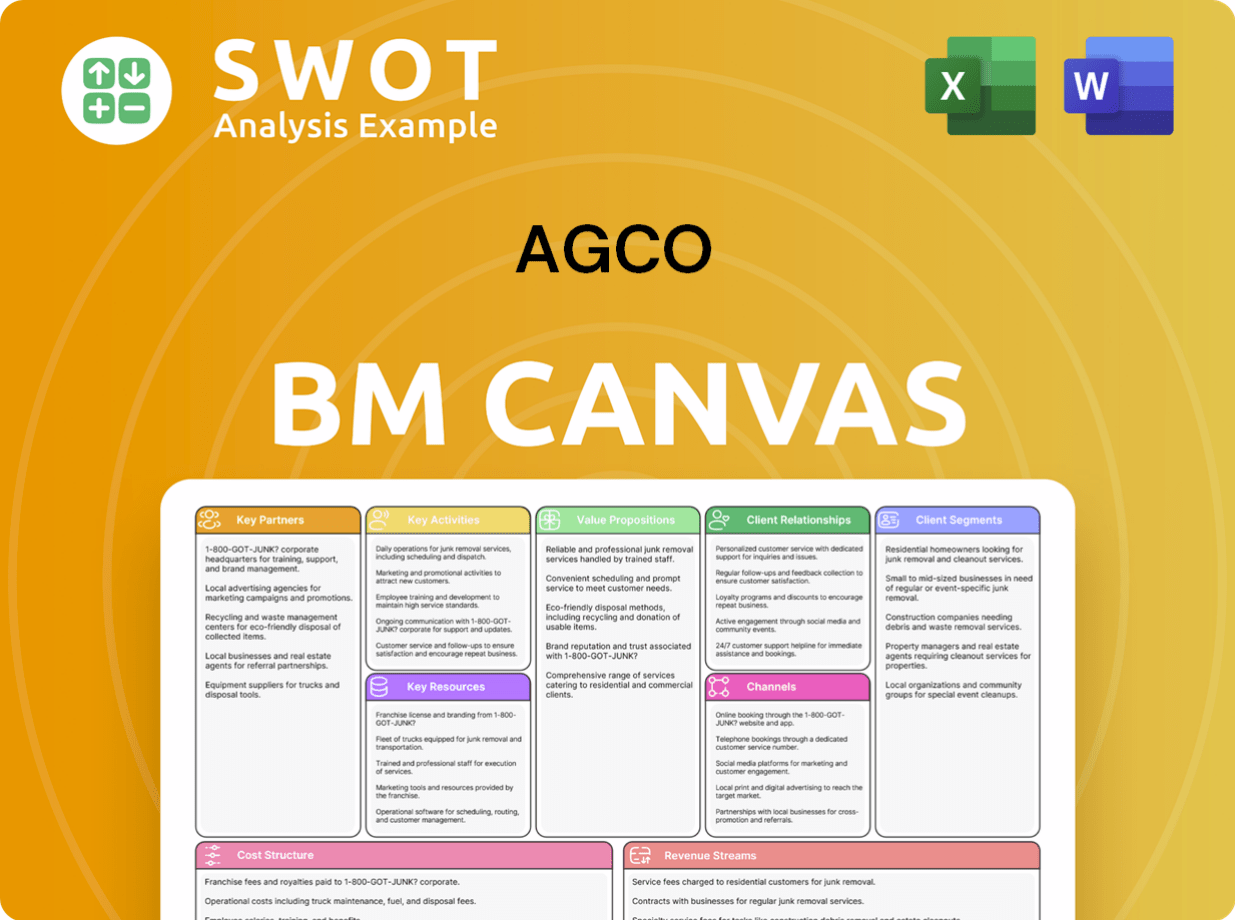

AGCO Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow AGCO’s Growth?

The success of the company's AGCO growth strategy and its AGCO future prospects are subject to various risks and challenges. These include the inherent cyclicality of the agricultural sector, which directly affects demand for farm equipment. External factors such as geopolitical instability and supply chain disruptions also play a significant role in shaping the company's performance.

The company's financial health is closely tied to farm income, commodity prices, and weather conditions, leading to potential fluctuations in demand. Furthermore, trade restrictions and regulatory changes introduce market and operational risks. To mitigate these risks, the company employs an Enterprise Risk Management (ERM) Framework.

Operational risks, including supply chain disruptions, particularly concerning components and raw materials, can impact production. Additionally, integrating acquired businesses, such as the PTx Trimble joint venture, presents further operational challenges. The company must navigate these obstacles to maintain its competitive edge in the agricultural machinery market.

The agricultural sector's inherent cyclicality poses a significant risk, with farm income, commodity prices, and weather conditions influencing demand. Fluctuations in these factors can lead to unpredictable sales and revenue streams for the company. This industry dynamic requires the company to adapt and manage its resources effectively to navigate periods of low demand.

Geopolitical instability, including tariffs and trade restrictions, creates market risks, particularly impacting the company's international operations. Changes in trade policies can disrupt supply chains and affect the cost of goods sold. These factors require the company to closely monitor global economic trends and adapt its strategies accordingly.

Operational risks include potential supply chain disruptions, especially concerning the availability of components and raw materials. Furthermore, integrating acquired businesses presents challenges. These operational hurdles can impact production efficiency and profitability, requiring the company to prioritize streamlined processes and effective integration strategies.

Stringent environmental laws and potential changes in tax and trade policies pose regulatory risks. These regulations can increase operational costs and impact the company's ability to compete effectively. The company must stay compliant with evolving regulations to maintain its operations and ensure long-term sustainability.

Decreased sales and production volumes can lead to lower profitability. In response to weakening demand, the company has implemented production cuts and a restructuring program to reduce structural costs and enhance global efficiencies. The company must continually monitor market demand and adjust its operations accordingly to maintain profitability.

The company utilizes an Enterprise Risk Management (ERM) Framework to identify, assess, and mitigate risks, including business continuity and information security risks. This framework allows the company to proactively address potential challenges and maintain operational resilience. The ERM Framework is a key component of the company's risk management strategy.

The company's financial performance is influenced by its ability to manage these risks effectively. As discussed in Revenue Streams & Business Model of AGCO, understanding the company's revenue streams and business model is crucial for assessing its resilience to these challenges. The company's financial results and stock performance are directly impacted by its ability to navigate these complexities and maintain its market position.

The company's financial performance is subject to the cyclical nature of the agricultural industry, which can lead to fluctuations in demand and revenue. In response to these challenges, the company has implemented measures to reduce structural costs and improve global efficiencies. The company's ability to adapt to market conditions and maintain profitability is critical.

Supply chain disruptions, including the availability of components and raw materials, pose a significant operational risk. Geopolitical instability and trade restrictions can exacerbate these issues. The company must proactively manage its supply chains to mitigate the impact of these disruptions and ensure production continuity.

Market risks include the impact of farm income, commodity prices, and weather conditions on demand for agricultural equipment. Operational risks involve the integration of acquired businesses. The company's ability to manage these risks is essential for sustaining its competitive position in the farm equipment industry.

Stringent environmental laws and potential changes in tax and trade policies present regulatory risks. The company must comply with evolving regulations to maintain its operations and avoid penalties. These regulatory challenges require the company to adapt its strategies and ensure long-term sustainability.

AGCO Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AGCO Company?

- What is Competitive Landscape of AGCO Company?

- How Does AGCO Company Work?

- What is Sales and Marketing Strategy of AGCO Company?

- What is Brief History of AGCO Company?

- Who Owns AGCO Company?

- What is Customer Demographics and Target Market of AGCO Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.