AGCO Bundle

How Does AGCO Corporation Thrive in the Agricultural Sector?

AGCO Corporation, a global powerhouse in agricultural machinery, is at the forefront of modern farming. Founded in 1990, AGCO has rapidly expanded, offering a comprehensive suite of AGCO products and technologies. With a diverse portfolio of brands like Fendt and Massey Ferguson, AGCO is dedicated to empowering farmers worldwide.

This deep dive into the AGCO SWOT Analysis will explore the AGCO company's operational strategies, revenue models, and competitive advantages. We'll examine how AGCO manufactures tractors and other farm equipment, its global footprint, and its commitment to innovation. Understanding AGCO's business model is key to appreciating its impact on food production and the evolving agricultural landscape.

What Are the Key Operations Driving AGCO’s Success?

The AGCO company creates value by providing a comprehensive range of agricultural machinery and smart farming solutions. Its core offerings include tractors, combines, hay tools, sprayers, and tillage equipment. These products serve a diverse customer base, from individual farmers to large agricultural enterprises globally.

AGCO Corporation's operational processes are extensive, encompassing manufacturing, sourcing, technology development, logistics, and customer service. The company's global footprint includes manufacturing facilities across multiple continents. It utilizes a robust network of independent dealers and distributors to reach customers in over 140 countries, ensuring widespread market access for its AGCO products.

A key element of AGCO's strategy is its 'Farmer-First' approach, which focuses on delivering innovative solutions through a differentiated portfolio of leading brands. This strategy is supported by a competitive advantage in retrofitting equipment with advanced technology, expanding its total addressable market. The company's commitment to high product quality and a strong product portfolio, including brands like Fendt and Massey Ferguson, translates into increased productivity and higher yields for farmers.

AGCO offers a wide array of agricultural machinery. This includes tractors, combines, hay tools, sprayers, and tillage equipment. These products are designed to meet the diverse needs of modern farming operations.

The company operates 13 major manufacturing facilities worldwide. Its distribution network includes over 3,000 independent dealers and distributors. This network spans more than 140 countries, ensuring broad market coverage.

AGCO prioritizes delivering innovative solutions tailored to farmers' needs. This approach is supported by a focus on retrofitting existing equipment with advanced technology. The company aims to enhance productivity and yield through its product offerings.

The company's product portfolio includes brands like Fendt, Massey Ferguson, and Valtra. A key competitive advantage is the ability to retrofit equipment with Precision Planting and PTx Trimble technology. This enhances the value proposition for farmers.

In 2024, tractors accounted for 61% of AGCO's net sales, demonstrating their significance. The company's supply chain integrates over 1,500 material suppliers and more than 70 logistics service providers, optimizing efficiency. AGCO's commitment to innovation and customer service places it at the forefront of the agricultural machinery sector, as detailed in Target Market of AGCO.

- Extensive global manufacturing presence with 13 major facilities.

- A robust dealer network with over 3,000 independent dealers and distributors.

- Focus on retrofitting technology to expand market reach and provide value to farmers.

- Strong emphasis on product quality and a diverse brand portfolio.

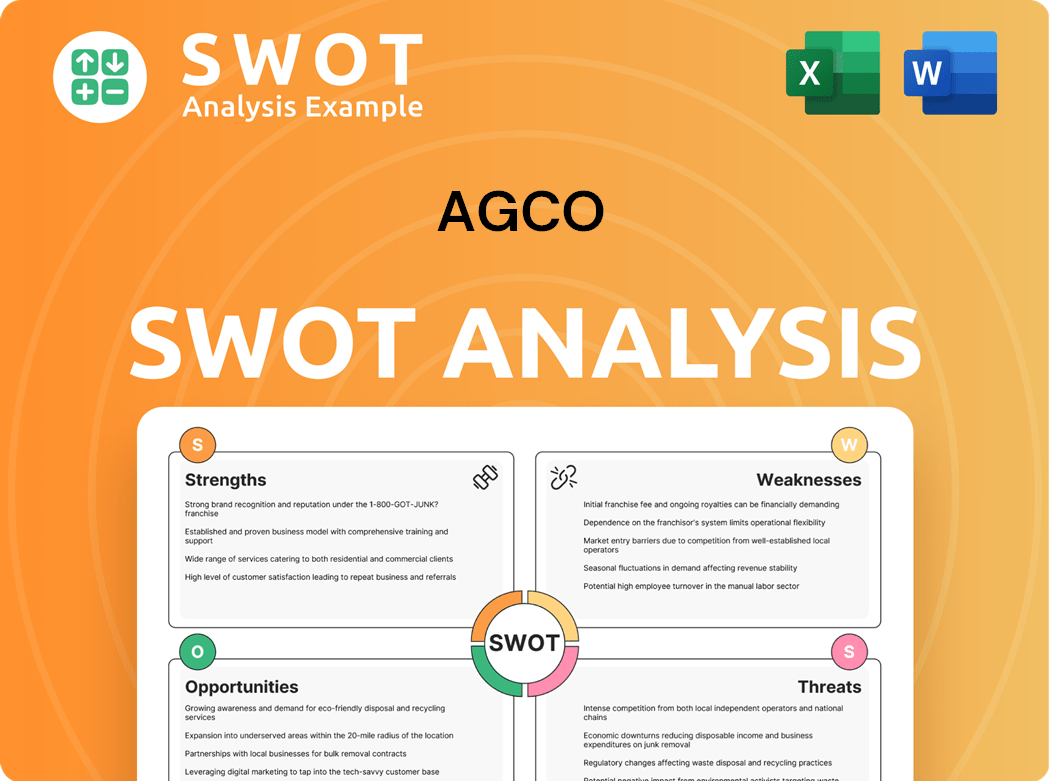

AGCO SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does AGCO Make Money?

The AGCO company generates revenue primarily through the sale of agricultural machinery and related replacement parts. This includes a wide range of products such as tractors, combines, and various implements. Understanding the revenue streams and monetization strategies of AGCO Corporation is key to grasping its financial health and future prospects.

In 2024, AGCO's net sales were approximately $11.7 billion, highlighting the scale of its operations. Tractors accounted for the largest portion of sales, at 61%, while replacement parts contributed 16%, demonstrating the importance of both new equipment sales and after-sales service.

For 2025, AGCO projects net sales of approximately $9.6 billion. The company's adjusted operating margins are projected to be between 7.0% and 7.5% for 2025. AGCO's Q1 2025 revenue was $2.1 billion.

The company is focused on expanding high-margin growth levers, including the Fendt brand and Precision Ag sales. This strategic focus aims to boost profitability and market share. For more insights, check out the Growth Strategy of AGCO.

- Fendt Brand Expansion: The company aims to grow Fendt sales in North and South America to $1.7 billion by 2029.

- Precision Agriculture: Precision agriculture sales are targeted to reach $2.0 billion by 2029.

- Parts Sales: Parts sales are targeted to reach $2.3 billion.

- PTx Brand: The PTx brand for smart farming solutions plans to launch 3-5 new products annually and implement a new FarmerCore distribution model, which takes the business directly to the farm.

- Divestiture: AGCO recently divested the majority of its Grain & Protein business in 2024 to focus on core competencies and enhance its precision agriculture technology offerings.

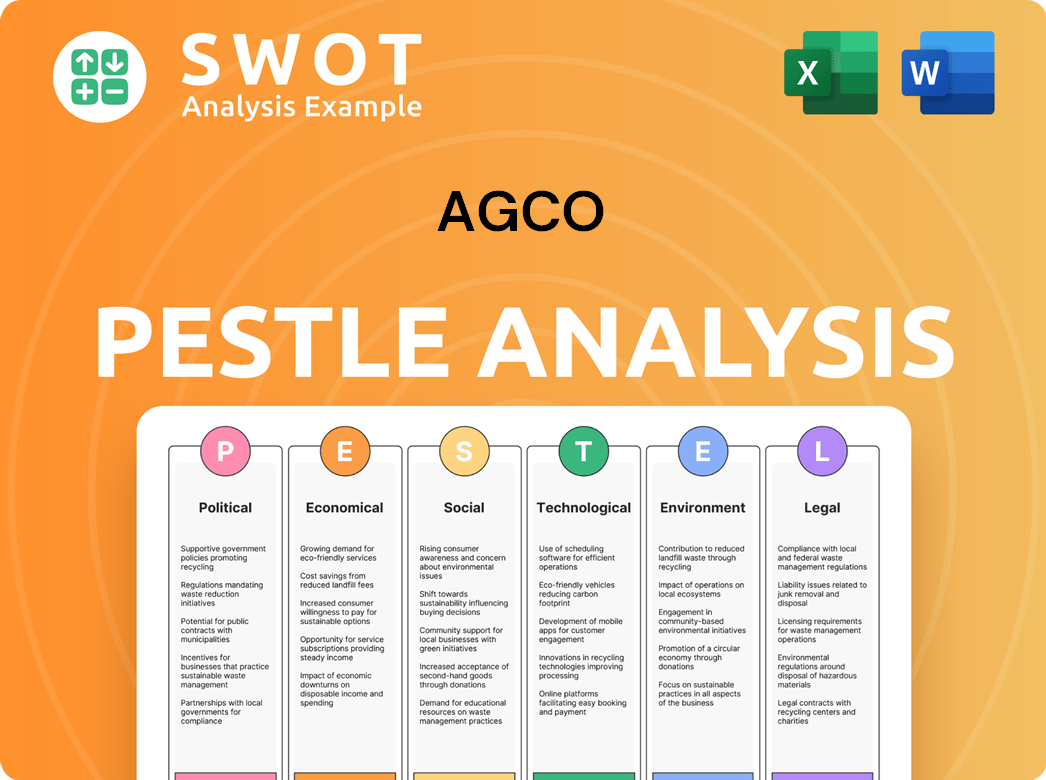

AGCO PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped AGCO’s Business Model?

The Brief History of AGCO reveals a company that has undergone significant strategic shifts and operational adjustments. In 2024, the company focused on strengthening its position in precision agriculture while streamlining its operations to address market challenges. These moves reflect AGCO's ongoing efforts to adapt to the evolving demands of the agricultural industry and maintain its competitive edge.

A key strategic move in 2024 was entering into the PTx Trimble joint venture and divesting the majority of its Grain & Protein business. This strategic realignment allowed AGCO to concentrate on its core competencies, particularly in precision agriculture technology. The launch of the PTx brand, incorporating technologies from Precision Planting and the PTx Trimble joint venture, underscores AGCO's commitment to providing advanced solutions for farmers. AGCO aims to equip all its North American production agriculture dealerships with PTx Trimble guidance and steering solutions by the end of 2025.

Operational challenges, including weakening demand in the agricultural sector, led AGCO to implement a restructuring program in 2024. This program aims to reduce structural costs and streamline the workforce, with expected annual benefits of approximately $100 million to $125 million. Additionally, AGCO reduced global production by 20-25% in 2024, including a 57% reduction in South America, to align inventory with market demand. In Q1 2025, production hours were cut by 33% year-over-year. Despite these challenges, AGCO improved cash usage in Q1 2025, achieving a 44% reduction compared to Q1 2024, due to enhanced working capital management and reduced capital expenditures. Furthermore, AGCO is shifting some production to Mexico in 2025 to streamline operations.

AGCO's key milestones include strategic partnerships and divestitures. The PTx Trimble joint venture and the divestiture of the Grain & Protein business in 2024 are significant. The company is focused on precision agriculture and streamlining operations.

AGCO's strategic moves involve focusing on core competencies. Entering the PTx Trimble joint venture and launching the PTx brand are crucial. Production adjustments and restructuring programs aim to improve efficiency.

AGCO's competitive advantages include brand strength and technological leadership. The ability to retrofit 'almost any make or model' with Precision Planting and PTx Trimble technology is a key differentiator. Economies of scale also provide a significant advantage.

Weakening demand in the agricultural industry poses challenges. The restructuring program aims to address these challenges. Production cuts and shifts are implemented to manage inventory and streamline operations.

AGCO's competitive advantages are rooted in its established brand recognition, technological innovation, and economies of scale. The company's brands, such as Fendt, Massey Ferguson, and Valtra, are globally recognized. AGCO's capacity to retrofit 'almost any make or model' with Precision Planting and PTx Trimble technology offers a unique competitive edge in precision agriculture. Furthermore, the company benefits from economies of scale in manufacturing, purchasing, and distribution, which act as significant barriers to entry for new competitors.

- Established Brand Strength: Fendt, Massey Ferguson, and Valtra are globally recognized.

- Technological Leadership: Retrofitting capabilities with Precision Planting and PTx Trimble.

- Economies of Scale: Advantages in manufacturing, purchasing, and distribution.

- Innovation: Launching 3-5 new PTx brand products annually.

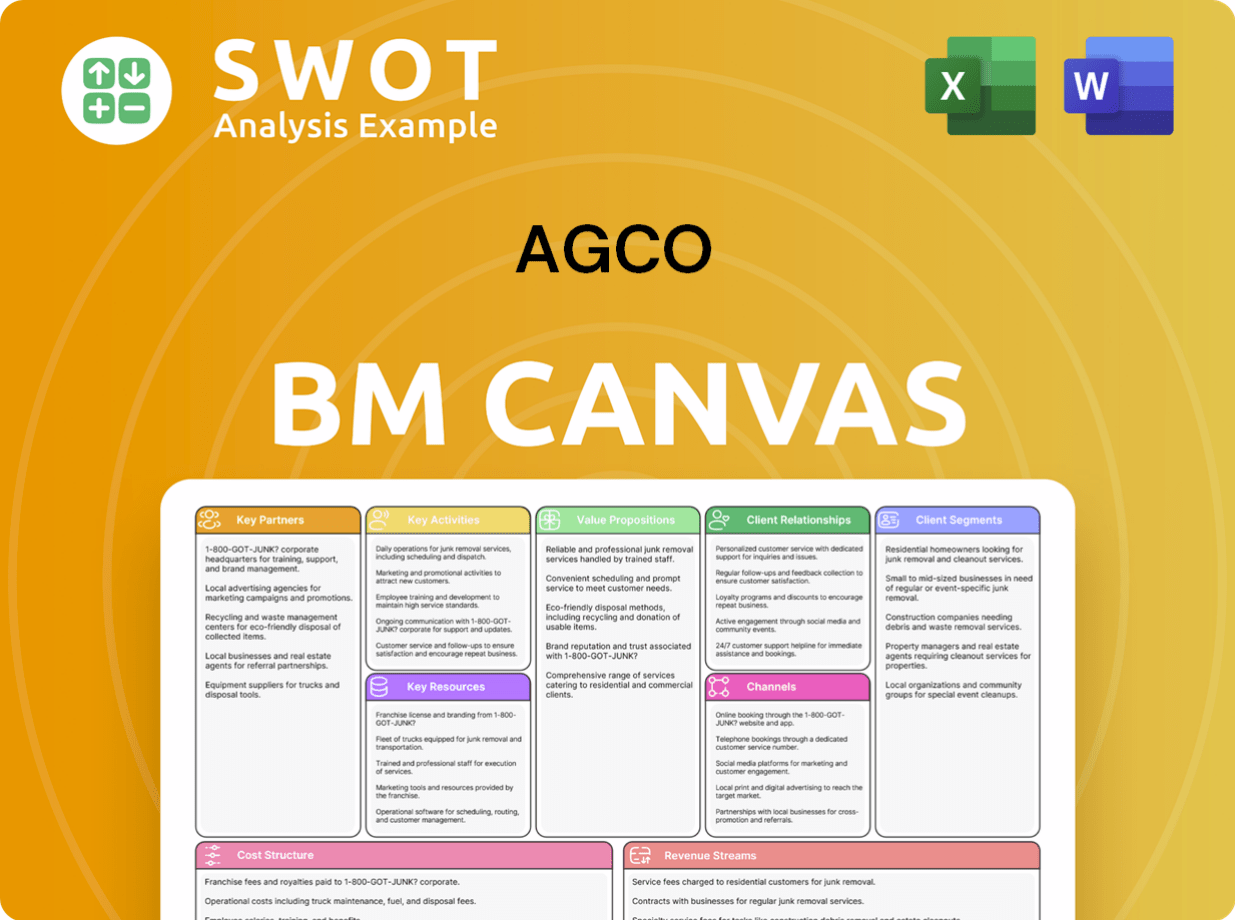

AGCO Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is AGCO Positioning Itself for Continued Success?

The AGCO company holds a notable position within the global agricultural machinery sector, although it's positioned as a smaller competitor compared to industry leaders like Deere & Company and CNH Industrial. In 2022, AGCO Corporation held approximately a 15% share of the agricultural equipment market worldwide. The company has a strong international footprint, with a significant presence in Europe, North America, and South America.

The AGCO company's operations and revenue face several risks, including the cyclical nature of the agricultural industry, which is affected by farm income, commodity prices, and weather. Geopolitical factors, such as tariffs and trade restrictions, along with supply chain disruptions, also pose market risks. Moreover, the integration of acquired businesses and the market acceptance of new offerings present additional challenges. Dealer inventory adjustments and softening demand, particularly in North America and Western Europe, have contributed to sales declines.

In 2024, Europe accounted for 55% of AGCO's net sales, with North America at 24%, South America at 11%, and the Rest of the World at 10%. AGCO maintains customer loyalty through its strong brand portfolio and a global distribution network exceeding 3,000 independent dealers.

Key risks include the cyclical nature of the agricultural industry, influenced by factors like farm income and weather. Geopolitical factors and supply chain disruptions also pose market risks. Dealer inventory destocking and softening demand have led to sales declines in Q1 2025.

AGCO projects net sales of approximately $9.6 billion and adjusted earnings per share between $4.00 and $4.50 for 2025. The company expects a market recovery in the second half of 2025, focusing on strategic investments and cost control.

AGCO is focusing on strategic investments and cost control. This includes a restructuring program expected to yield $100 million to $125 million in annual benefits. The innovation roadmap includes new product launches and a full rollout of its PTx data platform by 2027.

AGCO is expanding its PTx dealer network in North America, aiming to equip all production agriculture dealerships with PTx Trimble guidance and steering solutions by the end of 2025. A new partnership with SDF, starting mid-2025, will strengthen Massey Ferguson's low-mid horsepower tractor portfolio.

- Focus on manufacturing cost optimization.

- Aiming for economies of scale.

- Continued investment in innovation, with 3-5 new PTx brand products annually.

- Full rollout of the PTx data platform by 2027.

AGCO Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AGCO Company?

- What is Competitive Landscape of AGCO Company?

- What is Growth Strategy and Future Prospects of AGCO Company?

- What is Sales and Marketing Strategy of AGCO Company?

- What is Brief History of AGCO Company?

- Who Owns AGCO Company?

- What is Customer Demographics and Target Market of AGCO Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.