AirBnB Bundle

Can Airbnb Continue Its Dominance in the Travel Industry?

Airbnb's journey from air mattresses to a global travel giant is a testament to its disruptive business model. Born from a simple idea, the company has reshaped how we travel and experience the world. But what does the future hold for this innovative platform, and how does it plan to maintain its leading position?

This AirBnB SWOT Analysis delves into the core of Airbnb's evolution and explores its ambitious plans for the future. We'll dissect the company's AirBnB growth strategy, examining its competitive advantages and disadvantages within the dynamic travel industry. Furthermore, we'll explore the AirBnB future prospects, providing actionable insights for investors and business strategists alike, considering factors like AirBnB market share and emerging industry trends.

How Is AirBnB Expanding Its Reach?

To fuel future growth, the company is aggressively pursuing expansion initiatives. These efforts involve entering new markets and diversifying its offerings beyond traditional accommodations. This strategic approach is crucial for the company's long-term success and aims to capitalize on emerging opportunities within the travel and experience sectors. Understanding the company's expansion initiatives is key to assessing its potential for growth and its ability to adapt to changing market dynamics.

A significant aspect of this strategy includes substantial investments in new business ventures. Plans are in place to allocate between $200 million and $250 million in 2025 towards these initiatives. These investments are designed to enhance the guest experience and increase engagement by introducing services such as tours, classes, and workshops. A major rollout of these new offerings is anticipated in May 2025, highlighting the company's commitment to expanding beyond its core business model.

The company's move into the 'experience economy' is expected to significantly contribute to revenue. Projections indicate that these new businesses could generate $1 billion or more in annual revenue. This diversification strategy aims to capture a larger share of the travel market and provide more comprehensive services to its users. This expansion is a key component of the company's overall growth strategy.

While the core business is concentrated in five key markets (United States, United Kingdom, Canada, France, and Australia), which account for about 70% of its gross booking value, the company is aggressively investing in expansion markets. These markets include Brazil, Mexico, Germany, Italy, Spain, Japan, South Korea, China, and India.

The company is exploring new verticals like car sharing and expanding its real estate programs internationally. This includes initiatives like the Airbnb-Friendly Apartments program, indicating a broader strategy to integrate various travel and lifestyle services.

The Co-Host Network, which managed nearly 100,000 listings by early 2025, is also being expanded. Plans include extending the network to Japan and Korea, further supporting hosts and enhancing the overall user experience. This expansion is crucial for maintaining and improving the quality of listings.

The company's investment in new experiences, such as tours and workshops, is a critical part of its strategy to diversify revenue streams and enhance user engagement. This move is expected to generate significant revenue and improve the overall value proposition.

The company's expansion initiatives are multifaceted, encompassing market diversification, new service offerings, and strategic partnerships. These efforts are designed to strengthen its position in the travel industry and drive future growth. To learn more about the company's marketing tactics, check out the Marketing Strategy of AirBnB.

- Focus on high-growth markets like Brazil and India.

- Investment in new ventures, including tours and workshops.

- Expansion of the Co-Host Network to support hosts.

- Exploration of new verticals such as car sharing.

AirBnB SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does AirBnB Invest in Innovation?

Technology and innovation are central to the AirBnB company analysis and its strategy for sustained growth. The company has revamped its technology infrastructure to facilitate quicker innovation and broaden its scope beyond short-term rentals. This focus is crucial for maintaining its competitive edge and capitalizing on emerging opportunities within the travel industry.

The integration of technologies like AI, automation, and smart security systems is a key part of optimizing guest experiences and streamlining host operations. This approach aims to enhance user satisfaction and operational efficiency, supporting the company's long-term growth potential. These advancements are designed to address the evolving needs of both hosts and guests, ensuring a seamless and secure platform.

The company is initially focusing on AI to improve customer service, aiming to handle millions of guest and host inquiries in multiple languages. The goal is to evolve into a full AI-powered travel and living concierge by the summer of 2025. This initiative is expected to significantly enhance user experience and operational efficiency.

AI is being leveraged to enhance customer service, with the goal of handling millions of inquiries in multiple languages. This will eventually evolve into a full AI-powered travel and living concierge by summer 2025, improving user experience and operational efficiency.

AI and machine learning are being used for fraud detection, search optimization, and customized features. These technologies also enhance community support, contributing to a safer and more personalized user experience.

The company uses extensive data on user behavior to provide personalized recommendations. This data could also power an AI assistant capable of predicting user needs, enhancing the overall user experience and driving engagement.

A Host Service Marketplace is being developed to connect hosts with third-party service providers. The launch is expected in 2025, which will streamline host operations and improve service quality.

Data plays a crucial role in the company's strategy. It leverages its extensive data on user behavior to offer personalized recommendations and potentially power an AI assistant capable of predicting user needs. The company is also investing in developing its proprietary datasets, which will further enhance its ability to understand and cater to its users. Furthermore, the company is developing a Host Service Marketplace, a platform to connect hosts with third-party service providers for various operational needs, with an expected launch in 2025.

The company's technology strategy focuses on AI, data analytics, and platform development to enhance user experience and operational efficiency. These initiatives are crucial for the company's future prospects and maintaining its competitive advantage.

- AI-driven customer service and concierge services.

- Use of AI and machine learning for fraud detection and search optimization.

- Data-driven personalization through user behavior analysis.

- Development of a Host Service Marketplace to support hosts.

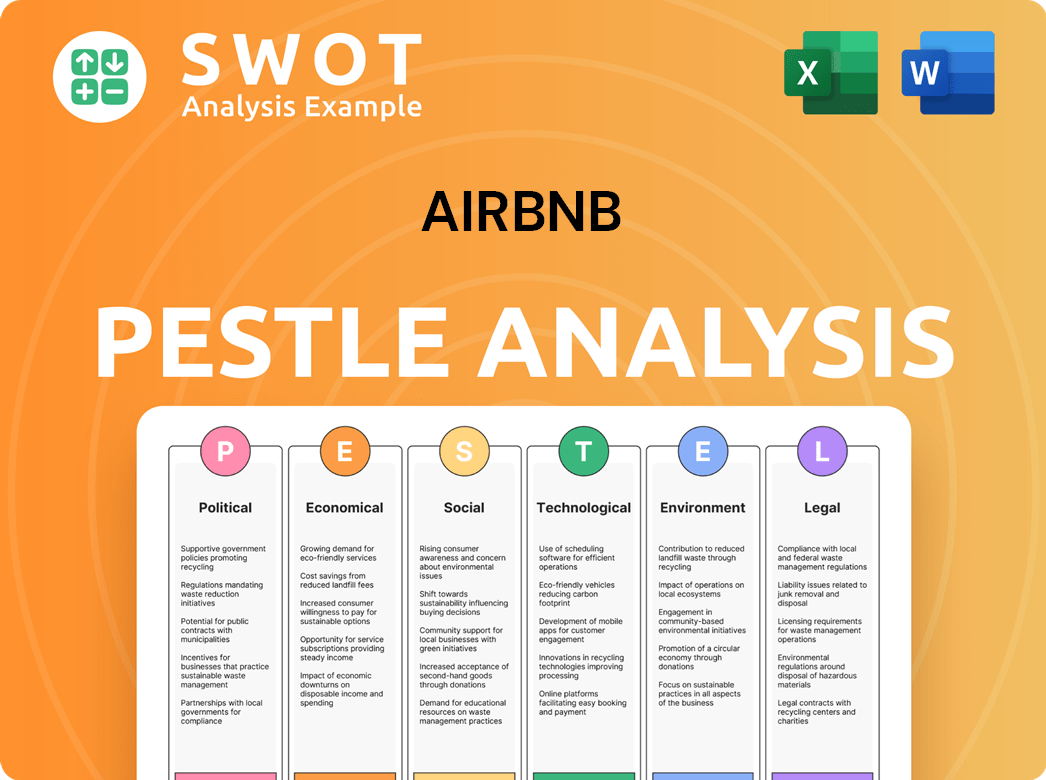

AirBnB PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is AirBnB’s Growth Forecast?

The financial performance of the company in 2024 showcases robust growth, with record revenue and strong profitability. This performance is a key indicator of the company's solid position within the travel industry. Understanding these financial trends is crucial for assessing the long-term viability and potential of the company, especially when considering its AirBnB growth strategy.

The company's ability to generate substantial free cash flow further underscores its financial health. This financial strength supports investments in future growth initiatives and enhances its resilience against market fluctuations. The company's financial outlook and strategic initiatives are critical in understanding the AirBnB future prospects.

The company's strategic financial management and focus on profitability provide a foundation for sustained expansion. The company's financial data is essential for a comprehensive AirBnB company analysis, enabling stakeholders to make informed decisions about the company's future.

In 2024, the company achieved record revenue of $11.1 billion, marking a 12% year-over-year increase. This significant revenue growth demonstrates strong market demand and operational efficiency. This performance highlights the success of the company's Airbnb business model.

The company reported a net income of $2.65 billion for 2024, reflecting substantial profitability. The fourth quarter of 2024 saw a net income of $461 million. These figures indicate effective cost management and strong financial performance, which is key to understanding Airbnb market share.

Revenue for Q4 2024 was $2.5 billion, also up 12% year-over-year. Adjusted EBITDA for Q4 2024 was $765 million, with a 31% margin. This strong performance in the final quarter of the year underscores the company's consistent growth trajectory and its ability to adapt to Airbnb industry trends.

The company generated $4.5 billion in free cash flow for the full year 2024, representing a 40% margin. This robust free cash flow generation provides the company with significant financial flexibility for future investments and strategic initiatives. For more insights, check out Revenue Streams & Business Model of AirBnB.

The company anticipates Q1 2025 revenue to be between $2.23 billion and $2.27 billion, reflecting 4%-6% year-over-year growth, or 7%-9% excluding foreign exchange headwinds. This outlook indicates continued growth, though at a slightly moderated pace due to seasonal factors and currency impacts.

The company expects an adjusted EBITDA margin decline in Q1 2025 compared to Q1 2024 due to calendar and FX headwinds. However, the company anticipates margins to remain stable year-over-year excluding these factors. Management aims for a full-year adjusted EBITDA margin of at least 34.5% for 2025.

New businesses launching in 2025 are expected to contribute to long-term revenue growth. These initiatives are part of the company's strategy to diversify its offerings and capture new market opportunities, which is key to understanding What is AirBnB's expansion strategy.

The company's ability to maintain strong margins and generate significant free cash flow demonstrates effective financial management. This financial discipline supports the company's investment in growth and its ability to navigate economic uncertainties, which is crucial for How does AirBnB plan to grow in the future.

The company's focus on new business ventures and its robust financial performance highlight its long-term growth potential. The strategic initiatives and financial health position the company well for sustained expansion in the travel industry, which is crucial for AirBnB's long-term growth potential.

The company's financial outlook for 2025 is positive, with expectations of continued revenue growth and strong profitability. The company's financial strategy, combined with its market position, supports its ability to capitalize on AirBnB's challenges and opportunities.

AirBnB Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow AirBnB’s Growth?

The path forward for the company, while promising, is not without its hurdles. Understanding these potential roadblocks is crucial for assessing the long-term viability of the company and its ability to maintain its current growth trajectory. A thorough analysis of these risks is essential for both investors and stakeholders.

The company's success hinges on navigating a complex landscape of competition, regulations, and economic factors. The company must adapt to these challenges to maintain its position in the market. Furthermore, the company's ability to innovate and respond to changing consumer preferences will be critical for its continued success.

The company faces significant challenges in a competitive market. Several major players, including VRBO and Booking.com, as well as traditional hotel chains, are actively competing for market share. These competitors often have established brand recognition and resources. The company's ability to differentiate itself and maintain its competitive edge is crucial for sustained growth.

Stricter regulations on short-term rentals are emerging in many cities, impacting the company's operations. These regulations can limit permits, impose higher taxes, and cap rental nights. These changes can reduce the supply of available rentals and increase operational costs.

Economic downturns and uncertainties could reduce discretionary travel spending, affecting demand. The travel industry is sensitive to economic fluctuations. A decrease in consumer spending can directly impact booking volumes and revenue.

Shorter booking windows and last-minute travel decisions create demand volatility. This makes it harder to predict bookings, especially during peak seasons. The company needs to adapt its strategies to manage fluctuating demand effectively.

Managing a global platform with diverse hosts and guests presents operational complexity. Ensuring consistent quality and compliance across various regulations is a constant challenge. This complexity can lead to increased operational costs and potential issues.

The integration of AI is in its early stages and hasn't yet shown measurable productivity gains. The company is investing in AI to improve various aspects of its platform. However, the impact of these investments on operational efficiency and user experience remains to be fully realized.

The company faces strong competition from established players like VRBO and Booking.com, as well as traditional hotel chains. These competitors invest heavily in marketing and offer similar services. This competition can pressure pricing and reduce profit margins. The company needs to constantly innovate and differentiate to maintain its market share.

Regulatory changes can significantly impact the company's business model. Cities worldwide are implementing stricter rules on short-term rentals. These regulations can include restrictions on the number of rental properties, limits on the duration of rentals, and increased taxes. For example, New York City's Local Law 18, which went into effect in September 2023, requires hosts to register with the city and limits short-term rentals. This law has already led to a significant decrease in the number of listings. The company must actively engage with regulators and adapt to evolving legal landscapes to mitigate these risks. The company needs to ensure compliance with varying local regulations.

Economic downturns pose a significant threat to the travel industry. During periods of economic uncertainty, consumers tend to reduce their discretionary spending, which includes travel. For instance, during the 2008 financial crisis, the travel industry experienced a sharp decline in bookings. The company's revenue is highly dependent on consumer spending on travel. The company needs to develop strategies to attract budget-conscious travelers and diversify its offerings to remain resilient during economic downturns. The company needs to monitor economic indicators closely and adjust its strategies accordingly. In 2024, the company's financial performance may be affected by global economic conditions.

To understand the company's journey, you can read a Brief History of AirBnB. Addressing these potential risks and obstacles proactively is crucial for the company's long-term success and ability to achieve its growth strategy.

AirBnB Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AirBnB Company?

- What is Competitive Landscape of AirBnB Company?

- How Does AirBnB Company Work?

- What is Sales and Marketing Strategy of AirBnB Company?

- What is Brief History of AirBnB Company?

- Who Owns AirBnB Company?

- What is Customer Demographics and Target Market of AirBnB Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.