AirBnB Bundle

How Does AirBnB Stay Ahead in the Travel Game?

Airbnb has revolutionized travel, connecting hosts with guests worldwide and offering unique accommodations. From its humble beginnings, the company has become a dominant force, reshaping the hospitality industry. With impressive 2024 revenue figures and millions of bookings, understanding how AirBnB works is crucial for anyone interested in the travel sector.

This analysis will explore the AirBnB SWOT Analysis, delving into the core of the AirBnB business model, examining its revenue streams, and key strategies. We'll uncover how AirBnB platform operates, including the booking process, service fees, and the roles of both AirBnB hosts and guests. Furthermore, we'll investigate the company's current market position and its future prospects, providing valuable insights for investors and industry observers alike.

What Are the Key Operations Driving AirBnB’s Success?

The core operation of AirBnB centers around its online marketplace, which connects property owners (hosts) with travelers (guests). This AirBnB business model facilitates the listing, discovery, and booking of accommodations, offering a wide array of options from private rooms to entire homes. The company's value proposition lies in providing unique and authentic travel experiences, differentiating itself from traditional hotels.

How AirBnB works is primarily through its digital platform, where hosts list their properties, manage bookings, and communicate with guests. The AirBnB platform provides tools for hosts, including a simplified listing creation process and a reservations management tab. The platform also leverages data science and AI to help hosts set optimal prices through its Smart Pricing tool, which considers factors like seasonal demand and competitor rates.

AirBnB's asset-lite business model allows for rapid scaling by not owning the properties listed. The company relies on a decentralized network of individual hosts and property managers. Partnerships include collaborations with local governments to navigate regulations and develop compliance tools for hosts. AirBnB also focuses on expanding its distribution networks, potentially integrating more hotels and fostering direct bookings for hosts. This focus on community and authentic local experiences translates into benefits for guests.

The AirBnB platform enables hosts to list properties, manage bookings, and communicate with guests. The platform provides tools for hosts, including a simplified listing creation process and a reservations management tab. The platform also leverages data science and AI to help hosts set optimal prices through its Smart Pricing tool.

AirBnB hosts are responsible for managing their properties, including setting prices, managing bookings, and ensuring guest satisfaction. They utilize the platform to create listings, upload photos, and describe their properties. Hosts are also responsible for guest communication and providing a positive guest experience.

AirBnB guests use the platform to search for accommodations, view listings, and make bookings. The platform offers a wide variety of options, from private rooms to entire homes. Guests can read reviews, communicate with hosts, and manage their bookings through the platform.

AirBnB generates revenue primarily through service fees charged to both hosts and guests. These fees vary depending on the booking and can include host service fees and guest service fees. The company also generates revenue through other services, such as experiences and adventures.

AirBnB's success is built on several key differentiators. These include a user-friendly platform, diverse listing options, a host guarantee program, and community-driven reviews. These features help to foster trust and transparency within the ecosystem, setting it apart from competitors.

- User-Friendly Platform: Easy navigation and booking process.

- Diverse Listings: Wide range of accommodation options.

- Host Guarantee Program: Provides protection for hosts.

- Community-Driven Reviews: Fosters trust and transparency.

AirBnB SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does AirBnB Make Money?

The AirBnB business model primarily relies on a commission-based revenue structure, charging both AirBnB hosts and AirBnB guests service fees for each transaction. This strategy has proven successful, with fees typically ranging from 3% to 20% of the booking value. This approach allows the AirBnB platform to generate revenue without owning any properties, making it a scalable and efficient model.

In Q4 2024, AirBnB reported revenue of $2.5 billion, a 12% increase year-over-year. This contributed to a full-year 2024 revenue of $11.1 billion, also up 12% from the previous year. The company's Adjusted EBITDA for 2024 was $4.0 billion, an 11% increase year-over-year, representing a 36% Adjusted EBITDA Margin. These figures highlight the financial health and growth trajectory of the company.

AirBnB continues to innovate its monetization strategies. Beyond standard booking fees, the company has expanded into areas like guest travel insurance and cross-currency booking fees, which contributed to its 2024 revenue. The platform also leverages dynamic pricing tools, such as Smart Pricing, to optimize listing prices, thereby increasing bookings and revenue for both the platform and AirBnB hosts.

AirBnB is strategically expanding its revenue sources. A significant move for 2025 is the investment of $200 million to $250 million in new businesses aimed at becoming a 'one-stop shop for travel.' This will include revamping its 'Experiences' program to offer more local activities and launching a host service marketplace. These initiatives are expected to add $1 billion or more in annual revenue, diversifying the company's income and enhancing the user experience. For more insights, see Marketing Strategy of AirBnB.

- The company is focusing on long-term stays (28+ days), which already account for nearly 20% of its bookings.

- Expanding real estate programs like 'AirBnB-Friendly Apartments' and 'AirBnB-Friendly Condos' is another key strategy.

- The host service marketplace will connect AirBnB hosts with tech service providers.

- The 'Experiences' program will be revamped to offer more local activities.

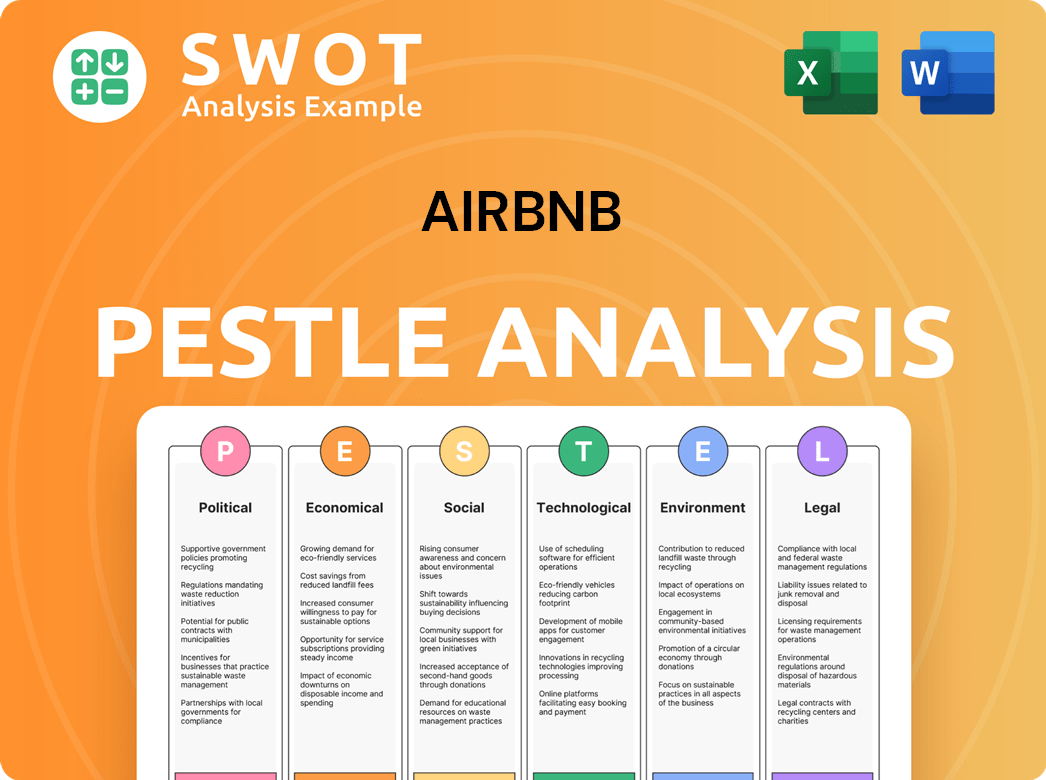

AirBnB PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped AirBnB’s Business Model?

The journey of the company has been marked by significant milestones and strategic shifts, fundamentally altering its operations and financial performance. A pivotal moment was its initial public offering (IPO) in 2020, which has since fueled substantial growth, tripling both its revenue and Gross Booking Value (GBV). The company's ability to outperform the travel industry's expansion in 2024, achieving over 491 million Nights and Experiences Booked and nearly $82 billion in GBV, underscores its robust market position.

A core strategic focus has been refining its core service, accelerating growth in global markets, and introducing and scaling new offerings. This multi-faceted approach has been critical to navigating the dynamic travel landscape. The company's resilience and adaptability are evident in its response to operational and market challenges, such as the COVID-19 pandemic and evolving regulatory environments.

The company's success is also driven by its ability to adapt to new trends and technological shifts. It is currently focusing on sustainability, eco-friendly rentals, and streamlined booking processes. The company is also investing in new verticals like car sharing and real estate programs to maintain its competitive edge.

The 2020 IPO was a major turning point, leading to significant financial growth. The company has expanded its global presence to over 220 countries and regions. The company has achieved over 491 million Nights and Experiences Booked in 2024.

The company has focused on perfecting its core service and accelerating growth in international markets. It has adapted to the COVID-19 pandemic by emphasizing longer-term stays and implementing rigorous cleaning protocols. The company is actively collaborating with local governments to address regulatory challenges.

The company's asset-lite business model allows for rapid scaling. The company's user-friendly platform and mobile app provide a seamless experience for both hosts and guests. The company leverages its extensive data on user behavior to power AI-driven personalization.

The company's GBV reached nearly $82 billion in 2024. The company's revenue has tripled since its IPO. The company is focused on sustainable growth and profitability.

The company's competitive advantages stem from its asset-lite model, vast global network, and user-friendly platform. Unique offerings, such as diverse properties and authentic local experiences, set it apart. The company is constantly working on improving the platform and implementing new features.

- Asset-lite business model enables rapid scaling.

- Global presence in over 220 countries and regions.

- User-friendly platform and mobile app.

- Diverse properties and authentic local experiences.

AirBnB Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is AirBnB Positioning Itself for Continued Success?

The company holds a dominant position in the online accommodation marketplace, operating a robust global presence. In 2024, online and platform-based bookings represented approximately 73% of the global short-term rental market, valued at over $130 billion, with the company being a key driver of this growth. Its strategic focus on community building, facilitated by guest reviews and ratings, strengthens its market position.

However, the company faces several risks. Regulatory changes, including stricter rules on short-term rentals, and increased competition from traditional hotels and other platforms pose threats. Macroeconomic uncertainties and natural disasters also create challenges. Unpredictable guest behavior presents operational challenges for hosts. For a broader understanding, you can explore the Competitors Landscape of AirBnB.

The company has a strong market share, particularly in the online accommodation sector. Its platform-based bookings have been a significant factor in the growth of the short-term rental market. The company's focus on guest reviews and ratings fosters trust and loyalty.

Regulatory changes, such as stricter rules on short-term rentals, pose a significant risk. Increased competition from hotels and other platforms is another challenge. Macroeconomic uncertainties and natural disasters can also impact the business. Unpredictable guest behavior adds operational complexity.

The company is expanding beyond accommodation to become a comprehensive lifestyle platform. It plans to invest significantly in new businesses and AI integration for personalized recommendations. The company anticipates continued revenue growth, aiming for a full-year adjusted EBITDA margin of at least 34.5%.

Key initiatives include revamping the 'Experiences' program and launching a host service marketplace. The company aims to integrate housing, transportation, and community engagement. AI integration is a major focus for personalized recommendations and efficiency.

For Q2 2025, the company projects revenue growth of 9%–11%, targeting between $2.99 billion and $3.05 billion. The company expects to maintain a full-year adjusted EBITDA margin of at least 34.5%. These projections reflect the company's strategic initiatives and market position.

- Expansion into new verticals such as car sharing.

- Focus on AI integration for personalized recommendations.

- Continued investment in the 'Experiences' program.

- Aim to maintain a strong EBITDA margin.

AirBnB Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AirBnB Company?

- What is Competitive Landscape of AirBnB Company?

- What is Growth Strategy and Future Prospects of AirBnB Company?

- What is Sales and Marketing Strategy of AirBnB Company?

- What is Brief History of AirBnB Company?

- Who Owns AirBnB Company?

- What is Customer Demographics and Target Market of AirBnB Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.