AirBnB Bundle

Who Really Owns Airbnb?

Unraveling the AirBnB SWOT Analysis reveals a complex ownership structure. Understanding who owns Airbnb is crucial for investors and anyone interested in the company's trajectory. Since its 2020 IPO, the company's ownership has evolved significantly, impacting its strategic direction and market performance.

This exploration into AirBnB ownership will dissect the company's structure, examining the influence of its founders, the role of major shareholders, and the impact of its public listing. From its humble beginnings to its current status as a global leader, understanding the AirBnB parent company and its key stakeholders provides invaluable insights into the forces shaping its future, including its executives and investors.

Who Founded AirBnB?

The story of AirBnB's ownership begins with its founders: Brian Chesky, Joe Gebbia, and Nathan Blecharczyk. They launched the company in 2008, but the initial idea took shape in 2007 when Chesky and Gebbia offered air mattresses for rent during a design conference. This simple act marked the genesis of what would become a global hospitality giant.

From its inception, the founders held the majority of the company's equity. This early control was crucial, allowing them to shape the company's direction and culture. They were able to steer the business according to their vision of a community-driven platform.

Early investments played a pivotal role in AirBnB's growth. Angel investors, including Paul Graham from Y Combinator, provided initial seed funding. Sequoia Capital also became an early institutional investor, injecting significant capital to help the company scale its operations and expand its reach. These early investments were critical in transforming the initial concept into a viable business.

AirBnB was founded by Brian Chesky, Joe Gebbia, and Nathan Blecharczyk. They started the company in 2008, with the idea originating in 2007. The founders initially held the majority of the company's equity.

Early funding came from angel investors like Paul Graham and institutional investors such as Sequoia Capital. These investments were critical for the company's early growth and expansion. Funding helped transform the initial idea into a viable business.

The founders' control over the company was essential to align the company's development with their original ethos. Early agreements likely included standard startup provisions such as vesting schedules to ensure founder commitment over time, and potentially buy-sell clauses to manage future equity transfers.

The initial concept of AirBnB was to offer an alternative to traditional hotels. The founders offered air mattresses in their living room during a design conference. This innovative approach laid the foundation for the company's future success.

The founders' vision was to create a global community where anyone could belong anywhere. This vision was intrinsically linked to their control over the nascent company. They aimed to build a platform that fostered a sense of belonging and community.

The exact initial equity split among the three founders is not publicly detailed. However, it is understood that they held the vast majority of the company's equity in its earliest days. This structure allowed them to make key decisions.

Understanding AirBnB's early ownership provides insights into its foundational values and strategic direction. The founders' control and early investment from key players were instrumental in shaping the company. For more on how AirBnB built its brand, consider exploring the Marketing Strategy of AirBnB.

- The founders, Brian Chesky, Joe Gebbia, and Nathan Blecharczyk, were the primary owners in the early stages.

- Early investors like Paul Graham and Sequoia Capital provided crucial funding for growth.

- The founders' control allowed them to align the company's development with their vision.

- AirBnB's initial concept was to offer an alternative to traditional hotels.

- The company's success is rooted in its community-driven approach.

AirBnB SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has AirBnB’s Ownership Changed Over Time?

The evolution of AirBnB's ownership has been a dynamic journey, starting with its inception and progressing through various funding rounds before culminating in a public offering. Initially, the company relied on venture capital and private equity investments to fuel its expansion and product development. Key investors like Andreessen Horowitz and Sequoia Capital played pivotal roles in these early stages, providing the necessary capital for growth. The decision to go public marked a significant turning point, transforming the ownership landscape and introducing a diverse group of shareholders.

The initial public offering (IPO) on December 10, 2020, under the ticker symbol 'ABNB' on the Nasdaq, was a landmark event. With an opening share price of $146, well above the IPO price of $68, the company's market capitalization reached approximately $47 billion. This transition to a publicly traded entity broadened the ownership base, including institutional investors, mutual funds, and individual insiders. This shift has influenced the company's strategic direction, balancing the interests of a diverse shareholder base while pursuing continued growth and profitability.

| Event | Date | Impact on Ownership |

|---|---|---|

| Founding | 2007 | Initial ownership by founders Brian Chesky, Joe Gebbia, and Nathan Blecharczyk. |

| Series A Funding | 2009 | Introduction of venture capital investors, diluting founders' stakes. |

| IPO | December 10, 2020 | Public offering; diversification of ownership to include institutional and retail investors. |

As of early 2025, the major stakeholders in AirBnB include a mix of institutional investors, mutual funds, and individual insiders. The Vanguard Group, Inc. held 7.51% of AirBnB's shares as of March 31, 2024, and BlackRock, Inc. held 6.13%. The founders, Brian Chesky (CEO), Joe Gebbia, and Nathan Blecharczyk (Chief Strategy Officer), still retain significant individual stakes. Their continued influence is often maintained through super-voting shares, a common practice among tech companies post-IPO. Understanding the AirBnB ownership structure is crucial for anyone looking to understand the company's trajectory. To learn more about the company's financial aspects, check out Revenue Streams & Business Model of AirBnB.

AirBnB's ownership structure has evolved significantly since its founding, transitioning from private funding to a public company.

- The founders, Brian Chesky, Joe Gebbia, and Nathan Blecharczyk, still hold substantial stakes.

- Major institutional investors like Vanguard and BlackRock hold significant shares.

- The IPO in December 2020 marked a major shift in ownership.

- The company is headquartered in San Francisco, California.

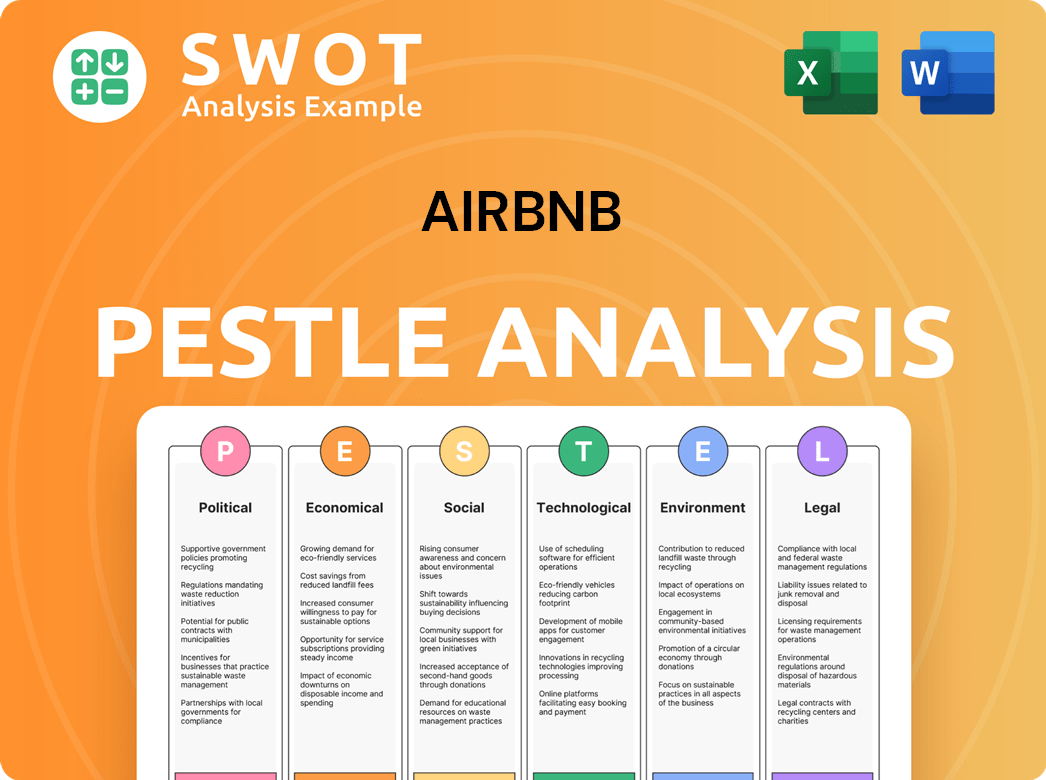

AirBnB PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on AirBnB’s Board?

As of early 2025, the Board of Directors of the company includes a blend of founders, representatives from significant shareholders, and independent directors. This structure is designed to balance internal leadership with external oversight. Brian Chesky currently serves as the Chairman of the Board and CEO, while Joe Gebbia also remains on the board. The board benefits from independent directors with diverse backgrounds in technology, finance, and hospitality, which offers varied perspectives on corporate governance. Understanding the Growth Strategy of AirBnB is also crucial for grasping the company's trajectory.

The composition of the board reflects the company's evolution and its commitment to maintaining a balance between founder influence and independent oversight. While Nathan Blecharczyk is not listed as a current board member, the presence of Chesky and Gebbia, along with independent directors, ensures a mix of experience and perspectives to guide the company's strategic direction. The board's structure and the roles of its members are key aspects of understanding the company's governance and decision-making processes.

| Board Member | Title | Key Role |

|---|---|---|

| Brian Chesky | Chairman of the Board and CEO | Oversees overall strategy and operations. |

| Joe Gebbia | Board Member | Contributes to strategic direction and company vision. |

| Independent Directors | Various | Provide external oversight and diverse perspectives. |

The company employs a dual-class share structure, which gives its founders and early investors significant voting power compared to regular public shareholders. Class B shares, largely held by the founders and certain early investors, carry 10 votes per share, whereas Class A shares, held by the public, carry one vote per share. This structure ensures that Brian Chesky and Joe Gebbia maintain substantial control over the company's strategic decisions and future direction, even as their economic ownership may be diluted over time. As of April 1, 2024, Brian Chesky held 22.9% of the total voting power, and Joe Gebbia held 19.3%. This concentrated voting power helps mitigate the influence of activist investors, allowing the company to pursue long-term strategies without immediate pressure from short-term market fluctuations. The company's structure and the voting power distribution are important aspects of understanding who controls AirBnB's decisions.

The company's dual-class share structure grants founders and early investors outsized voting power.

- Class B shares have 10 votes per share, while Class A shares have one.

- Brian Chesky and Joe Gebbia maintain significant control.

- This structure helps in pursuing long-term strategies.

- Understanding the AirBnB ownership structure is key.

AirBnB Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped AirBnB’s Ownership Landscape?

In the past few years (2022-2025), the AirBnB ownership structure has evolved, mainly due to market trends and strategic moves. As a publicly traded company, its focus on growth and profitability indirectly affects investor sentiment and, consequently, ownership. There haven't been significant share buybacks or secondary offerings that have drastically changed the fundamental ownership structure.

A notable trend is the increase in institutional ownership. Large asset managers and index funds have been accumulating shares, driven by AirBnB's inclusion in major market indices. This shift leads to more diversified ownership among individual investors. The founders' influence is maintained through a dual-class share structure, ensuring their continued control despite the economic dilution that comes with public ownership. The AirBnB parent company continues to navigate the complexities of a dynamic market.

| Ownership Category | Approximate Percentage | Details |

|---|---|---|

| Institutional Investors | ~60-70% | Includes large asset managers and index funds. |

| Retail Investors | ~20-30% | Comprises individual shareholders. |

| Insiders (Founders & Executives) | ~10-20% | Includes founders and key AirBnB executives, holding shares through dual-class structure. |

There have been no major leadership changes that would significantly shift the ownership landscape recently. The founders remain actively involved in the company's leadership and strategic direction. Industry trends suggest a continued focus on profitability and sustainable growth for mature tech companies. For further insights, you can read more about the company's history and structure in this article about AirBnB. While there have been no public statements by AirBnB regarding future ownership changes, planned succession, or potential privatization, the company's performance and strategic decisions will continue to shape its investor base and AirBnB investors in the coming years.

AirBnB was founded in 2007 by Brian Chesky, Joe Gebbia, and Nathan Blecharczyk. The company started as a way for the founders to provide lodging during a conference.

The current CEO of AirBnB is Brian Chesky, one of the co-founders. He has led the company since its inception and continues to shape its strategic direction.

Major shareholders include institutional investors like Vanguard, BlackRock, and various investment funds. The founders also hold significant shares.

AirBnB is a publicly traded company, operating independently. It is not under the ownership of another major corporation.

AirBnB Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AirBnB Company?

- What is Competitive Landscape of AirBnB Company?

- What is Growth Strategy and Future Prospects of AirBnB Company?

- How Does AirBnB Company Work?

- What is Sales and Marketing Strategy of AirBnB Company?

- What is Brief History of AirBnB Company?

- What is Customer Demographics and Target Market of AirBnB Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.