Akamai Technologies Bundle

Can Akamai Technologies Maintain Its Leading Edge?

Akamai Technologies, a pioneer in content delivery and cybersecurity, has evolved significantly since its inception in 1998. Born from a need to solve internet traffic congestion, Akamai has become a global force, powering much of the internet's performance and security infrastructure. Understanding the Akamai Technologies SWOT Analysis is crucial to grasping its current standing and future potential.

This analysis delves into Akamai's Akamai Technologies Growth Strategy, examining its strategic expansions and technological innovations within the dynamic landscape of Content Delivery Network (CDN) services, Cybersecurity Solutions, and Cloud Computing Services. We'll explore the Akamai Future Prospects, assessing its ability to capitalize on emerging trends like edge computing and the evolving needs of online video streaming, alongside a comprehensive Akamai Company Analysis to provide actionable insights for investors and strategists alike.

How Is Akamai Technologies Expanding Its Reach?

Akamai's growth strategy centers on expanding its cloud computing services and cybersecurity solutions, aiming to capitalize on the increasing demand for digital content delivery and online security. The company focuses on geographical expansion and strategic acquisitions to broaden its market reach and service offerings. This multi-faceted approach is designed to foster revenue growth and maintain a competitive edge in the evolving technology landscape.

The company's expansion initiatives are driven by the need to meet evolving customer needs and adapt to the rapidly changing technological environment. By investing in edge computing and cybersecurity, Akamai aims to capture new revenue streams and solidify its position as a leader in content delivery and security solutions. These efforts are crucial for sustaining long-term growth and delivering value to its stakeholders.

Akamai's future prospects are closely tied to its ability to execute these expansion strategies effectively. The company's focus on innovation and strategic investments positions it well to capitalize on emerging trends, such as the growth of edge computing, the increasing importance of cybersecurity, and the continued demand for high-performance content delivery. This proactive approach is critical for ensuring sustained growth and profitability.

Akamai is significantly expanding its cloud computing services, particularly in edge computing. This expansion is designed to meet the rising demand for distributed applications and data processing closer to end-users. The development of the Akamai Connected Cloud is a key initiative, offering a massively distributed edge and cloud platform.

Geographical expansion is a crucial element of Akamai's growth strategy. The company is actively strengthening its presence in various regions to serve a global customer base. This includes targeted investments in infrastructure and sales and marketing efforts to increase market penetration worldwide.

Akamai is broadening its security solutions portfolio, including application and API security, and bot management. This expansion reflects the growing importance of cybersecurity in the digital age. These initiatives are designed to protect businesses from evolving cyber threats and secure their online assets.

Strategic acquisitions play a role in Akamai's growth strategy, enabling the company to acquire new technologies and expand its market presence. These acquisitions are carefully selected to complement existing offerings and accelerate growth in key areas. This approach allows Akamai to stay competitive and meet evolving customer needs.

Akamai's expansion into cloud security and edge computing is a direct response to market demands. The company's focus on these areas is expected to drive significant revenue growth in the coming years. According to recent reports, the global edge computing market is projected to reach significant value by 2027, presenting a substantial opportunity for Akamai. Akamai's investments in these areas are designed to capitalize on this growth and strengthen its position in the market. The company's ability to adapt and innovate in response to market trends will be crucial for its long-term success. For detailed insights on Akamai's financial performance and strategic moves, you can explore a comprehensive analysis of the company's business model.

Akamai's expansion strategy focuses on several key initiatives to drive growth and maintain its competitive edge. These initiatives are designed to address the evolving needs of its customers and capitalize on emerging market opportunities. The company is actively investing in these areas to ensure long-term sustainability and success.

- Edge Computing: Expanding its edge computing infrastructure and services to support distributed applications.

- Cybersecurity: Enhancing its cybersecurity solutions to protect against evolving threats.

- Geographical Expansion: Strengthening its presence in various regions to serve a global customer base.

- Strategic Acquisitions: Acquiring companies to expand its technology portfolio and market reach.

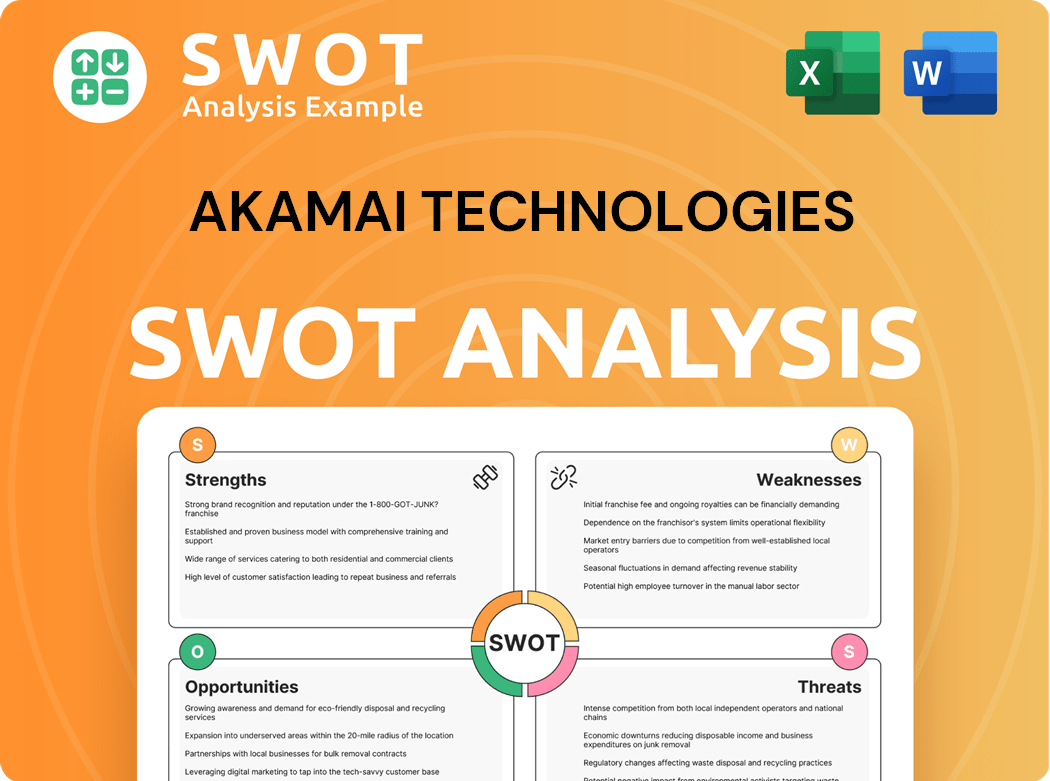

Akamai Technologies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Akamai Technologies Invest in Innovation?

Innovation forms the bedrock of Akamai's strategy, driving its sustained growth trajectory. The company consistently invests in research and development (R&D) to enhance its current services and pioneer new, advanced technologies. This commitment is vital for maintaining a competitive edge in the dynamic digital landscape.

A primary focus area is the advancement of its edge network capabilities. Akamai leverages technologies like artificial intelligence (AI) and automation to optimize content delivery, bolster security measures, and enable new edge computing applications. This approach is crucial for meeting the evolving demands of the digital world and ensuring superior performance for its clients.

Akamai's dedication to digital transformation involves continuous upgrades to its platform and infrastructure, aiming to provide more scalable, resilient, and high-performing services. The development of the Akamai Connected Cloud exemplifies this commitment, offering a platform for developers to build and deploy applications closer to users. This focus on technological leadership is key for Akamai's future prospects.

Akamai allocates a significant portion of its revenue to R&D. In fiscal year 2023, the company invested approximately $600 million in R&D, demonstrating its commitment to innovation and technology advancement.

Akamai's edge network, a crucial part of its content delivery network (CDN), is continuously upgraded. These enhancements include AI-driven optimizations that improve content delivery speeds and reduce latency, crucial for applications like online video streaming.

Akamai integrates advanced cybersecurity solutions into its platform. This includes web application firewalls (WAFs), bot management, and DDoS protection, ensuring comprehensive security for its clients. This is a key part of Akamai's growth strategy in cybersecurity.

Akamai is expanding its cloud computing services to offer a more comprehensive platform for developers. This includes edge computing capabilities, allowing applications to be deployed closer to end-users, enhancing performance and reducing costs.

The Akamai Connected Cloud is a key initiative, providing a distributed platform for developers. This platform supports various services, including compute, storage, and database, enabling developers to build and deploy applications with improved performance and security.

Akamai maintains a strong position in the CDN and cybersecurity markets. Its market share analysis indicates a continued leadership role, driven by its technological advancements and comprehensive service offerings. This is a key factor in Akamai's long-term growth potential.

Akamai's innovation strategy is closely tied to its business model, which focuses on providing scalable and secure solutions for content delivery and cybersecurity. The company's ability to adapt to changing market demands and technological advancements, as highlighted in Brief History of Akamai Technologies, is crucial for its future prospects. This includes expanding its cloud security offerings and exploring opportunities in emerging areas like the Metaverse, ensuring its continued relevance and growth in the digital ecosystem.

Akamai's technological advancements are central to its competitive advantage. These advancements drive its ability to offer high-performance, secure, and scalable services. The company's focus on innovation is designed to meet the evolving demands of its customers and the broader digital landscape.

- AI and Automation: Leveraging AI and automation to optimize content delivery and security.

- Edge Computing: Expanding edge computing capabilities to enable new use cases and improve performance.

- Cloud Security: Enhancing cloud security offerings to protect against evolving cyber threats.

- Platform Upgrades: Continuously upgrading its platform and infrastructure for improved scalability and resilience.

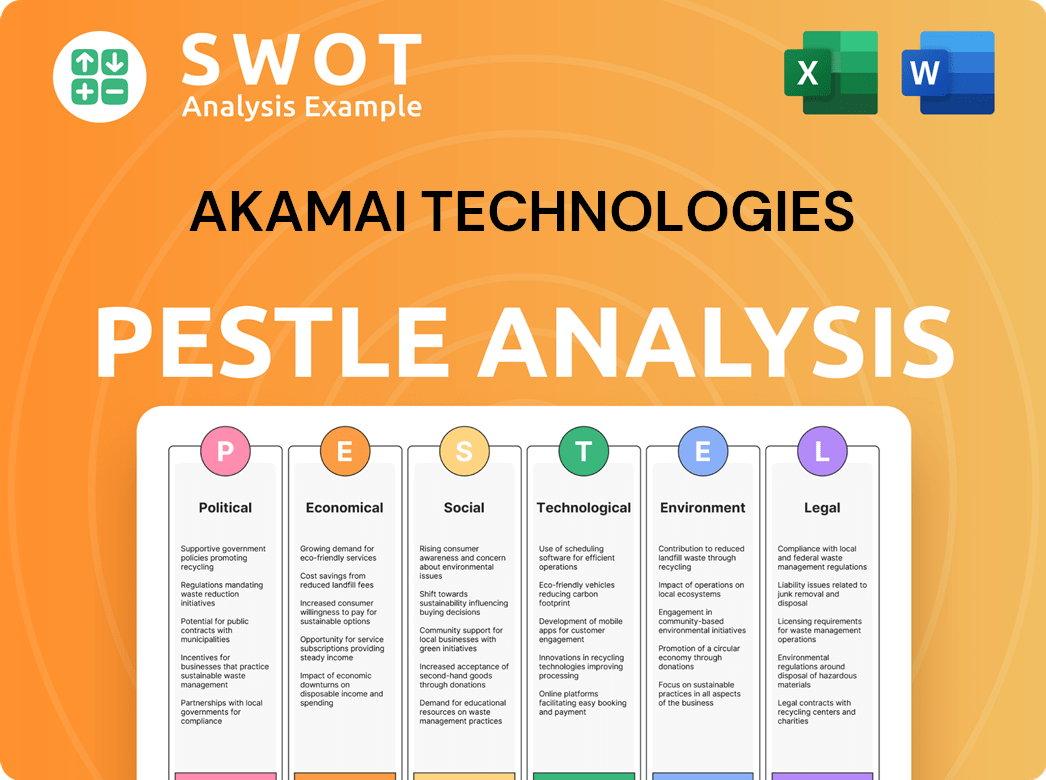

Akamai Technologies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Akamai Technologies’s Growth Forecast?

The financial outlook for Akamai Technologies is closely tied to its strategic initiatives and market position. The company has consistently generated revenue from its core content delivery network (CDN) and cybersecurity businesses. As Akamai expands its cloud computing services, particularly in the high-growth edge computing market, it anticipates new avenues for revenue growth. This expansion is a key part of the Akamai Technologies Growth Strategy.

Recent financial reports and analyst forecasts often highlight the potential for continued growth, driven by the increasing reliance on digital infrastructure and the growing need for robust cybersecurity solutions. Akamai's focus on expanding its higher-margin cloud and security services is expected to positively impact its profitability. This focus is crucial for evaluating Akamai Future Prospects.

The company's financial strategy supports its investment in technology and infrastructure to fuel future expansion. This includes strategic acquisitions and internal development to enhance its service offerings and maintain a competitive edge in the market. Understanding these investments is critical for any Akamai Company Analysis.

Akamai's revenue growth is influenced by several factors, including its CDN services and cybersecurity solutions. The company’s ability to adapt to market demands and expand into new services, such as cloud computing, plays a vital role in revenue generation. The demand for Content Delivery Network (CDN) services and cybersecurity solutions is expected to remain strong, supporting revenue growth.

Profitability for Akamai is affected by its revenue mix, operating expenses, and strategic investments. The company's focus on higher-margin services, such as cloud and security offerings, is designed to improve overall profitability. Efficient cost management and operational efficiencies also contribute to maintaining and improving profit margins. The company's financial performance is crucial for Akamai Technologies financial performance.

Akamai's financial strategy supports its investment in technology and infrastructure to fuel future expansion. This includes strategic acquisitions and internal development to enhance its service offerings and maintain a competitive edge in the market. These investments are vital for Akamai's long-term growth potential.

The competitive landscape and market dynamics significantly impact Akamai's financial outlook. The company faces competition from other CDN providers, Cybersecurity Solutions vendors, and cloud computing companies. Market trends, such as the increasing demand for edge computing and cybersecurity, create both opportunities and challenges. For insights into the competitive environment, see Competitors Landscape of Akamai Technologies.

Several key financial metrics are crucial for evaluating Akamai's performance and future prospects. These include revenue growth, gross margin, operating margin, and free cash flow. Analyzing these metrics provides insights into the company's financial health and its ability to generate value.

- Revenue Growth: The company's revenue growth rate is a key indicator of its performance. In recent quarters, Akamai has demonstrated steady revenue growth, driven by the increasing demand for its services.

- Gross Margin: Gross margin reflects the profitability of Akamai's core services. The company aims to maintain or improve its gross margin through efficient operations and a focus on higher-margin services.

- Operating Margin: Operating margin measures the company's profitability after accounting for operating expenses. Improvements in operating margin indicate effective cost management and operational efficiency.

- Free Cash Flow: Free cash flow is a measure of the cash generated by Akamai's operations. Strong free cash flow allows the company to invest in growth initiatives, return value to shareholders, and reduce debt.

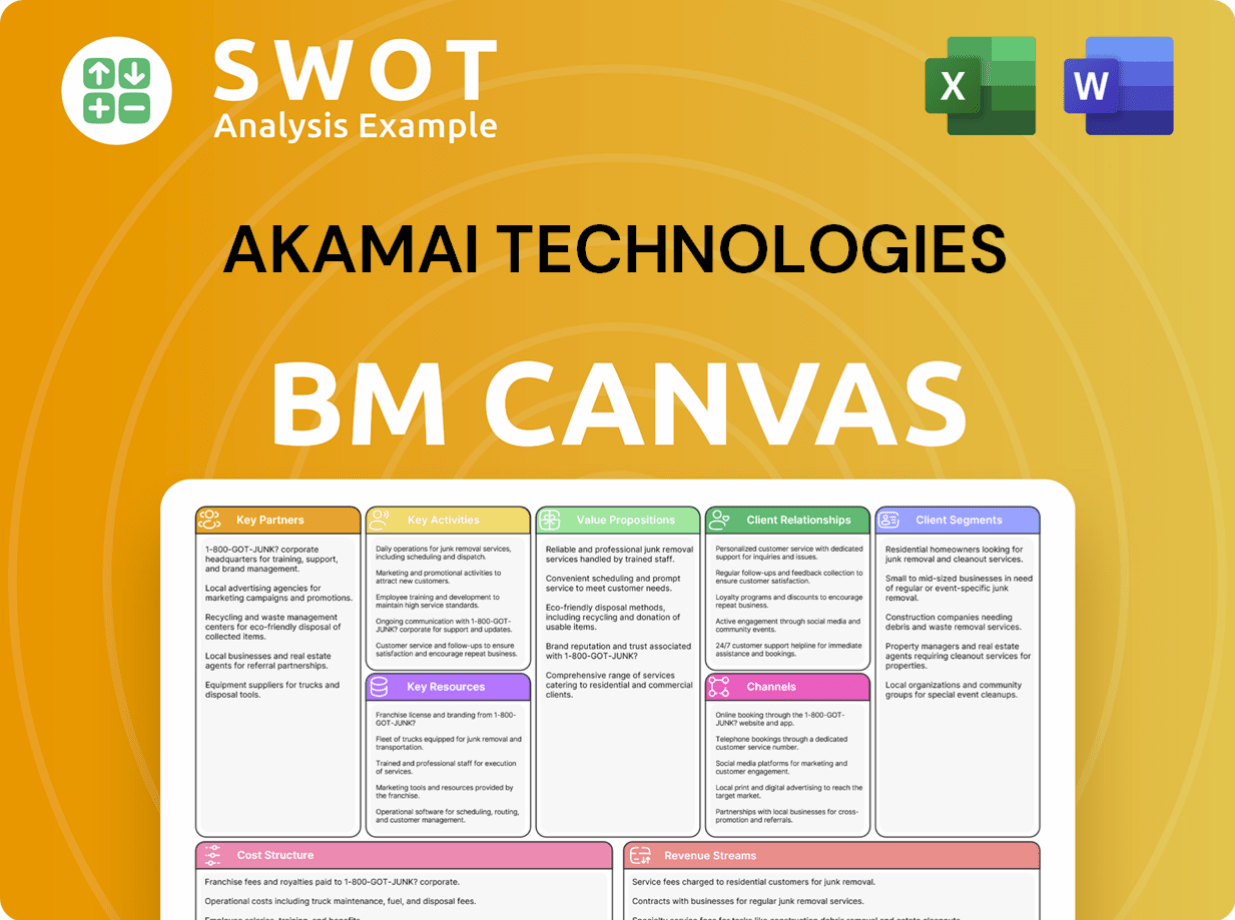

Akamai Technologies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Akamai Technologies’s Growth?

Assessing the future of a company like Akamai Technologies requires a careful look at potential risks and obstacles. The company's growth, particularly in areas like Content Delivery Network (CDN) services and cybersecurity, faces several hurdles. Understanding these challenges is crucial for any Akamai Company Analysis.

The market for content delivery, cloud services, and cybersecurity is intensely competitive. Established players and emerging companies constantly vie for market share, which can pressure pricing and margins. Rapid technological advancements also present a continuous need for investment in research and development to stay ahead of the curve.

Regulatory changes in data privacy and internet governance across different regions pose another challenge. These shifts can impact Akamai's operations and necessitate adaptations to maintain compliance. Furthermore, supply chain vulnerabilities, while perhaps less direct than for hardware-focused firms, could still affect the deployment and upkeep of its global network infrastructure.

The CDN market is highly competitive, with Akamai facing rivals like Cloudflare and Fastly. These competitors constantly innovate, putting pressure on Akamai's market share. This competitive environment requires continuous strategic adjustments.

The rapid evolution of technology, especially in areas like edge computing and cybersecurity, demands significant investment in R&D. Staying ahead of technological changes is vital for Akamai's long-term success and Akamai Future Prospects.

Changes in data privacy regulations, such as GDPR and CCPA, require constant adaptation. Compliance costs and potential penalties can impact Akamai's financial performance. Adapting to these changes is essential for global operations.

Disruptions in the supply chain can affect the deployment and maintenance of Akamai's global network infrastructure. Ensuring a resilient supply chain is crucial for maintaining service availability. This is a key consideration for Akamai Technologies Growth Strategy.

Economic downturns can lead to reduced IT spending by businesses, impacting demand for Akamai's services. Managing costs and maintaining customer relationships during economic uncertainty is crucial for sustained revenue.

The increasing sophistication of cyberattacks poses a constant threat to Akamai's cybersecurity solutions. Continuous investment in threat detection and prevention is necessary to protect clients and maintain trust. A proactive approach is vital for Akamai's mission.

Akamai addresses risks through diversifying its service offerings. This includes expanding into cloud security and edge computing to reduce reliance on any single market segment. Diversification helps mitigate the impact of specific market fluctuations.

Implementing robust risk management frameworks is crucial. This includes continuously monitoring the market and regulatory landscape to identify and respond to emerging challenges. Proactive risk management is key to long-term stability.

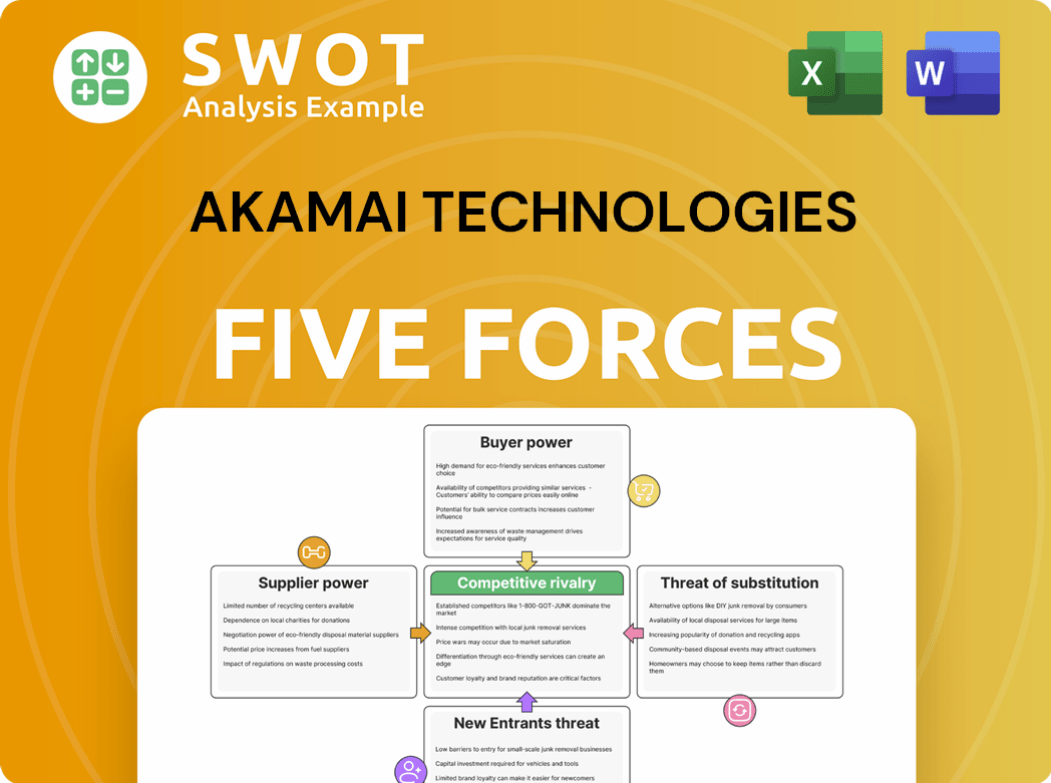

Akamai Technologies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Akamai Technologies Company?

- What is Competitive Landscape of Akamai Technologies Company?

- How Does Akamai Technologies Company Work?

- What is Sales and Marketing Strategy of Akamai Technologies Company?

- What is Brief History of Akamai Technologies Company?

- Who Owns Akamai Technologies Company?

- What is Customer Demographics and Target Market of Akamai Technologies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.