Arlo Technologies Bundle

Can Arlo Technologies Thrive in the Booming Smart Home Security Market?

In the dynamic world of Arlo Technologies SWOT Analysis, understanding a company's growth strategy is crucial for investors and strategists alike. Arlo Technologies (ARLO), a leader in Smart Home Security, has consistently innovated since its 2018 spin-off, focusing on user-friendly solutions. With the global market projected to nearly double by 2029, Arlo's future hinges on its ability to capitalize on this expansive opportunity.

This analysis dives deep into Arlo's Growth Strategy, exploring its transition to a subscription-based model and its impact on Arlo Future prospects. We'll examine the company's expansion plans, technological advancements in Security Cameras, and financial performance, providing a comprehensive view of its competitive landscape and potential for long-term success. Understanding the key drivers behind Arlo Technologies's revenue model and market share is essential for anyone seeking to make informed decisions in the smart home security sector.

How Is Arlo Technologies Expanding Its Reach?

The company is actively pursuing several expansion initiatives to broaden its market reach and diversify its revenue streams. A core strategy involves expanding its service and subscription tiers to drive higher engagement and conversion rates among its growing customer base. The company aims to reach 10 million paid accounts by 2030.

Geographically, the company is expanding its global footprint. While the Americas region experienced an 11.7% decline in revenue in fiscal year 2024, the EMEA region saw a significant 34.0% increase, demonstrating successful international penetration. The company aims to bring advanced emergency response services to new regions through partnerships, fueling international expansion of its premier subscription plan. To understand more about the company, you can check out Owners & Shareholders of Arlo Technologies.

In terms of product and service expansion, the company plans its largest device lineup launch in company history for the 2025 holiday season, with over 100 new SKUs. These new products are expected to extend technology differentiation and achieve a 20% to 35% cost reduction. The company has also introduced a new generation of its home security subscription service featuring new AI-powered innovations.

The company is focused on expanding its service and subscription tiers. As of Q3 2024, the company had 4.2 million paid subscribers, a 70.3% year-over-year increase from Q3 2023. This growth is a key driver for the company's revenue model.

The company is strategically expanding its global presence, particularly in the EMEA region. This expansion is supported by partnerships and the introduction of advanced services. The company's focus on international growth is a key element of its business strategy.

The company is planning a significant expansion of its product line. This includes a complete refresh of all camera lines in 2025-2026, followed by the introduction of a next-generation ecosystem in 2026-2027. These new products are expected to extend technology differentiation.

The company is developing opportunities in adjacent markets through strategic partnerships. These collaborations are crucial for accessing new customers and staying ahead of industry changes. These partnerships will help the company to achieve its growth strategy.

The company's expansion strategy focuses on several key areas to drive growth and increase market share. These initiatives are designed to enhance customer engagement and revenue streams.

- Expansion of subscription services with new tiers and features.

- Geographic expansion, particularly in the EMEA region.

- Product innovation with new device launches and ecosystem development.

- Strategic partnerships to enter new markets and enhance product offerings.

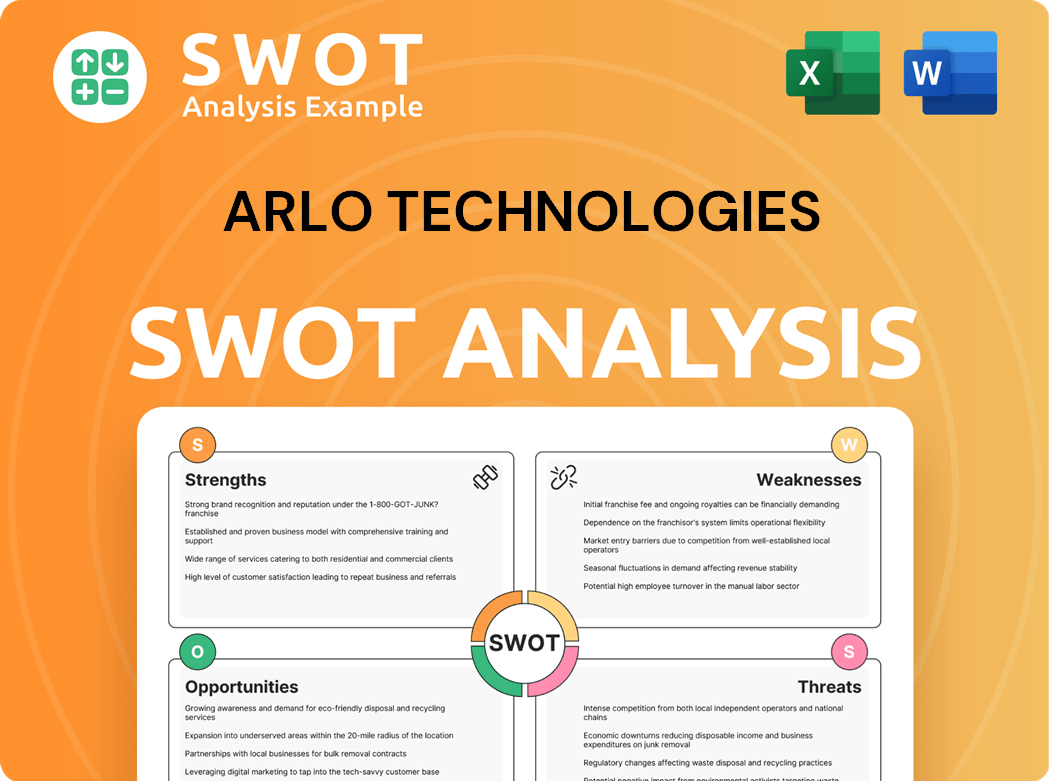

Arlo Technologies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Arlo Technologies Invest in Innovation?

Arlo Technologies' growth strategy heavily relies on innovation and technological advancements, particularly focusing on its cloud-based platform and AI capabilities. The company consistently invests in research and development to introduce new products and enhance its existing services, aiming to maintain a competitive edge in the smart home security market. This commitment is crucial for capturing a larger share of the growing market and meeting evolving customer needs.

The company's approach to innovation is evident in its product roadmap, which includes a complete refresh of all camera lines in 2025-2026 and the introduction of a next-generation ecosystem in 2026-2027. This proactive strategy ensures that Arlo remains at the forefront of technological advancements in the security camera industry, attracting new customers and retaining existing ones. These initiatives are critical for sustaining long-term growth and solidifying its position in the competitive landscape.

A significant aspect of Arlo's strategy is its deep expertise in AI- and computer vision (CV)-powered analytics. The company's AI-driven Arlo Secure 5.0 and the recently announced Arlo Secure 6 have demonstrated the success of its platform launches, resulting in significant premium subscriber additions. This focus on AI not only enhances the functionality of its products but also creates a strong value proposition for consumers seeking advanced security solutions. This strategy is crucial for driving revenue growth and improving customer satisfaction.

Arlo's AI-driven analytics, such as those in Arlo Secure 6, include fire detection, advanced audio detection, and detailed video event descriptions. These features enhance the user experience by providing more accurate and informative security alerts. These advanced capabilities contribute to increased customer satisfaction and loyalty.

The company plans a complete refresh of all camera lines in 2025-2026 and the introduction of a next-generation ecosystem in 2026-2027. This roadmap demonstrates Arlo's commitment to continuous innovation and staying ahead of market trends. These product launches are essential for maintaining a competitive edge.

Arlo's collaborations with Origin Wireless and Samsung SmartThings enhance its product offerings and expand its market reach. These partnerships integrate Arlo's technology into broader ecosystems, increasing its value proposition. These collaborations are key to expanding its market share.

Arlo Secure 6, launched in May 2025, introduces AI-powered innovations such as fire detection and advanced video search capabilities. The launch of Arlo Secure 6 has led to an increase in premium subscriber additions. This demonstrates the effectiveness of its platform launches.

Arlo emphasizes its privacy pledge, ensuring industry standards for data protection and user control, and explicitly states it does not monetize personal data. This commitment builds trust with customers and strengthens its brand reputation. This is important for maintaining customer trust.

The collaboration with Origin Wireless integrates verified human presence technology using existing Wi-Fi devices. This technology helps reduce false alarms and creates new business opportunities. This partnership is a key element of its innovation strategy.

Arlo's approach to digital transformation is further highlighted by its strategic partnerships. These collaborations enhance its product offerings and expand its market reach. The partnerships with Origin Wireless and Samsung SmartThings are key examples of this strategy.

- Origin Wireless: Integration of verified human presence technology using existing Wi-Fi devices to predict human presence, reducing false alarms. Arlo has secured global exclusive rights to this technology.

- Samsung SmartThings: Expanded partnership with enhanced security features, including two-way audio, event snapshots, and AI-powered object detection, seamlessly integrating Arlo's capabilities within the SmartThings ecosystem.

- Privacy Focus: Arlo emphasizes its privacy pledge, ensuring industry standards for data protection and user control, and explicitly states it does not monetize personal data.

- Arlo Secure 6: Launched in May 2025, introduces new AI-powered innovations such as fire detection, advanced audio detection, detailed video event descriptions, and powerful video search capabilities.

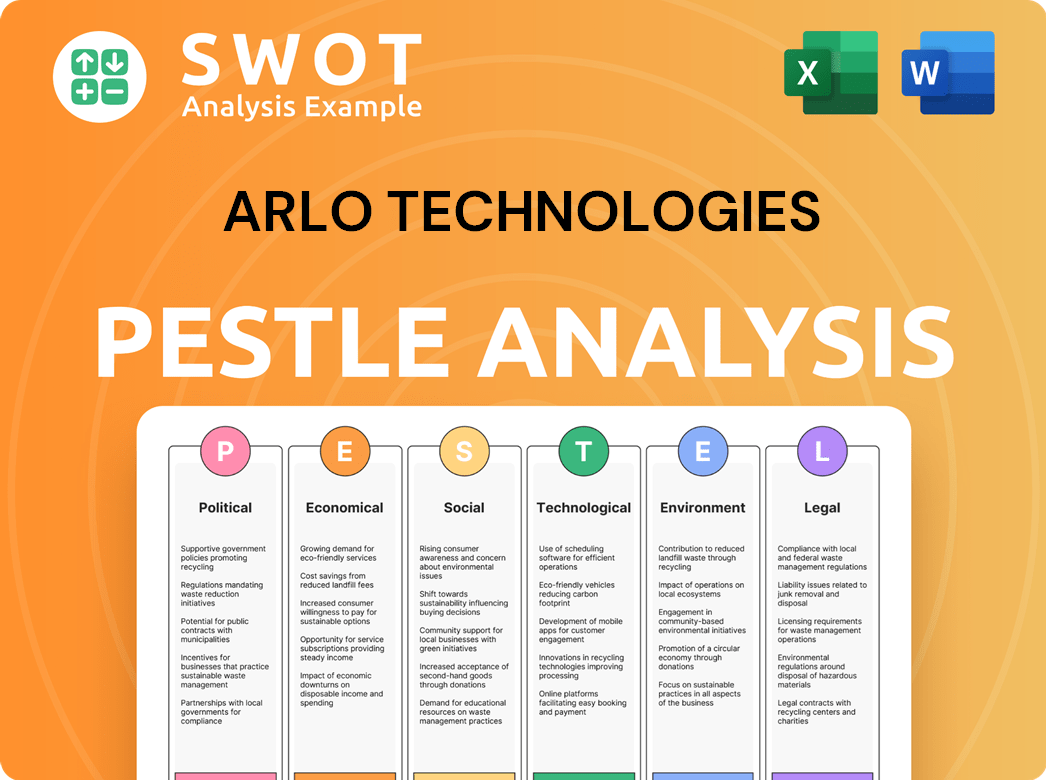

Arlo Technologies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Arlo Technologies’s Growth Forecast?

The financial outlook for Arlo Technologies is significantly influenced by its strategic shift towards a subscription-based service model. This transition is designed to boost profitability and provide more predictable revenue streams. This shift is crucial for long-term success in the competitive Smart Home Security market.

In 2024, the company demonstrated positive financial performance, with total revenue increasing and service revenue showing substantial growth. The focus on high-margin services is a key element of their Growth Strategy, aiming to improve overall financial health and market position. The company's financial strategy is designed to capitalize on the increasing demand for home security solutions.

Arlo Technologies saw a 4.0% increase in total revenue, reaching $510.9 million. Service revenue increased by 20.8%, hitting a record $243.0 million. This growth was driven by the increasing adoption of subscription services.

Service revenue accounted for 48% of total revenue in 2024, and 53% in Q4 2024. This shift towards services is crucial for improving profitability. This revenue model is a key component of Arlo's Future.

The service segment achieved a gross margin of 73.7% in 2023, significantly higher than the product gross margin of 10.5%. For Q4 2024, the GAAP service gross margin was 81.2% and the non-GAAP service gross margin was 81.7%. This highlights the profitability of the service model.

For 2025, Arlo anticipates consolidated revenue between $510 million and $540 million. Service revenue is expected to exceed $300 million, representing over 20% year-over-year growth. The company projects non-GAAP net income per diluted share to be between $0.56 and $0.66.

Arlo Technologies is focused on expanding its market presence and enhancing its service offerings. The company is also concentrating on customer acquisition and retention to drive long-term growth. For more information on their target market, check out this article on the Target Market of Arlo Technologies.

Non-GAAP operating income in 2024 was $37.9 million, a 52% increase year-over-year. Free cash flow reached $48.6 million, up 37% from the previous year. The free cash flow margin was 9.5%.

As of December 31, 2024, Arlo had $151.5 million in cash and short-term investments. The company has no short-term or long-term debt, which provides financial flexibility.

Analysts predict that Arlo will become profitable in 2025, with projected profits of $35 million. This positive outlook is supported by the company's strategic initiatives.

Arlo has set ambitious goals for 2030, including 10 million paid accounts. They aim to achieve $700 million in Annual Recurring Revenue (ARR) and an operating margin of over 25% on a non-GAAP basis. These targets reflect the company's long-term Business Strategy.

Arlo projects a non-GAAP service gross margin of greater than 80% throughout 2025. This high margin underscores the profitability of their service offerings and is crucial for sustainable growth.

The company's focus on subscription services is reflected in its financial metrics, with a strong emphasis on recurring revenue. This is a key element of Arlo's Growth Strategy.

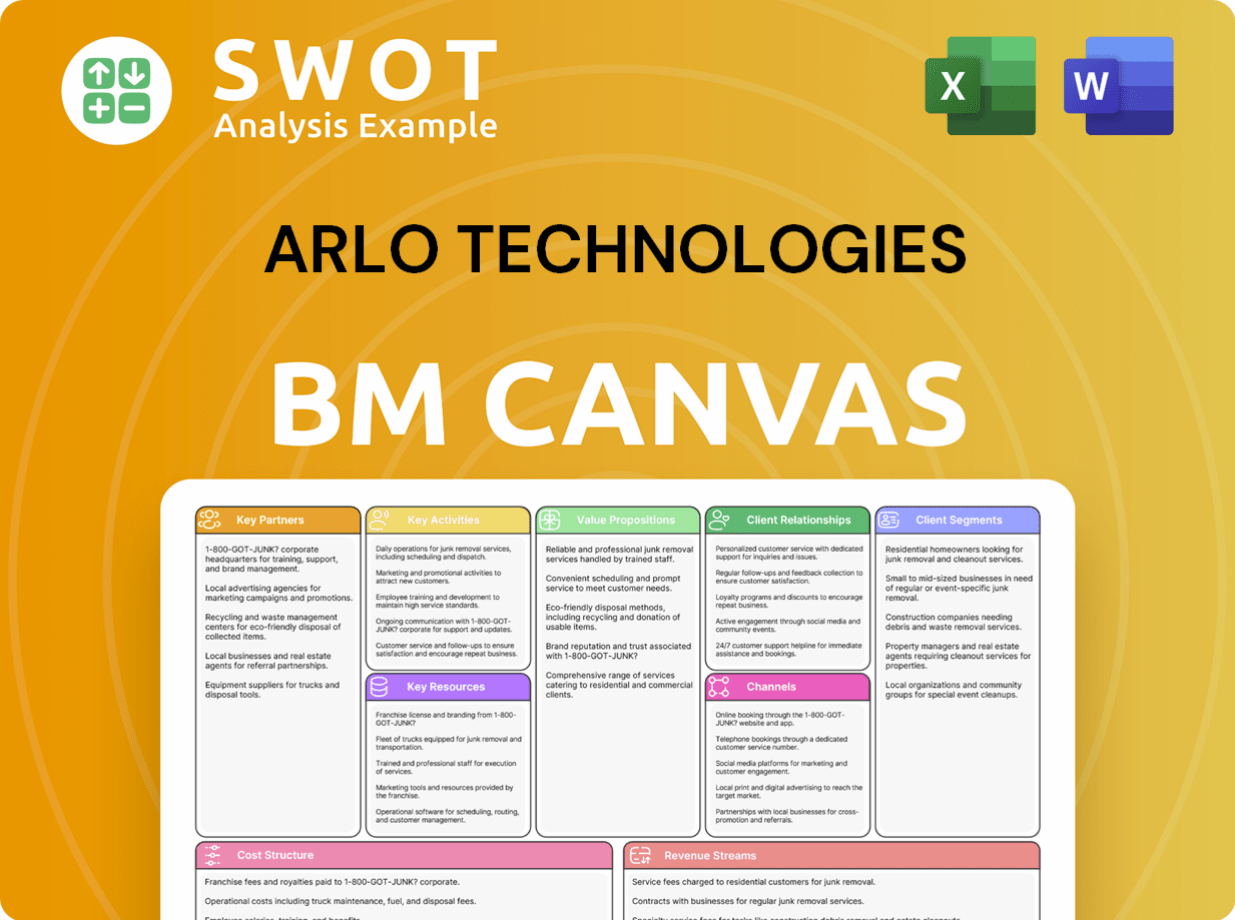

Arlo Technologies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Arlo Technologies’s Growth?

The future of Arlo Technologies hinges on navigating several significant risks and obstacles in the competitive Smart Home Security market. These challenges include intense competition, operational vulnerabilities, regulatory pressures, and the ever-present threat of technological disruption. Understanding these potential pitfalls is crucial for assessing Arlo's long-term growth prospects.

Arlo's Growth Strategy is impacted by external factors such as macroeconomic conditions and consumer behavior. The company's ability to adapt to these challenges will be critical for its success. Furthermore, its reliance on specific suppliers and third-party manufacturers exposes it to supply chain disruptions, which could hinder product delivery and increase costs.

Regulatory compliance, particularly regarding data privacy and security, presents another major hurdle. Non-compliance with evolving laws could lead to substantial financial penalties and reputational damage, impacting Arlo's Business Strategy and market position.

Arlo Technologies faces fierce competition from larger companies with greater resources, which can lead to price wars and decreased market share. The presence of Amazon, both as a competitor and a distribution channel, further complicates the competitive landscape. To counter this, Arlo has adjusted pricing on certain products to offer better customer value.

Relying on a limited number of suppliers and third-party manufacturers poses operational risks. This concentration can lead to supply chain disruptions, increased costs, and delays in getting products to consumers. Arlo is actively working to diversify its supplier and manufacturing base to mitigate these risks.

Evolving data privacy and security regulations across various regions present a significant threat. Non-compliance could result in considerable fines, legal battles, and harm to Arlo's reputation. Arlo emphasizes its commitment to user privacy, stating it does not monetize personal data and adheres to industry standards for data protection.

Reliance on third-party cloud-based systems and IT infrastructure makes Arlo vulnerable to service interruptions or security breaches. The company addresses this through a vendor management program that includes risk assessments and security reviews for its providers. Continuous innovation and adaptation are vital to stay ahead.

Economic factors such as consumer spending, confidence, and interest rates can influence the demand for Arlo's products. Arlo's strategy to launch its largest device lineup in 2025, aiming for significant cost reductions, is designed to counter these pressures and maintain competitiveness. For further insight, you might find the discussion on Mission, Vision & Core Values of Arlo Technologies helpful.

The Smart Home Security market is highly competitive, with major players like Amazon, Google, and Samsung. According to recent market analysis, the global home security market was valued at approximately $53.6 billion in 2023 and is projected to reach $88.3 billion by 2028, growing at a CAGR of 10.5% from 2023 to 2028. Arlo must differentiate itself through innovation, pricing, and customer service to maintain and grow its market share.

Supply chain disruptions can significantly impact Arlo's ability to deliver products. Recent reports indicate that supply chain issues have caused delays and increased costs for many tech companies. Arlo's efforts to diversify its supply chain and manufacturing partners are crucial for mitigating these risks and ensuring product availability. In 2024, companies are focusing on building more resilient supply chains.

Arlo Technologies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Arlo Technologies Company?

- What is Competitive Landscape of Arlo Technologies Company?

- How Does Arlo Technologies Company Work?

- What is Sales and Marketing Strategy of Arlo Technologies Company?

- What is Brief History of Arlo Technologies Company?

- Who Owns Arlo Technologies Company?

- What is Customer Demographics and Target Market of Arlo Technologies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.