Arlo Technologies Bundle

Who Really Owns Arlo Technologies?

Ever wondered who steers the ship at Arlo Technologies, the company behind those popular Arlo Technologies SWOT Analysis security cameras? Understanding Arlo's ownership structure is key to grasping its strategic moves and future potential. From its roots as a spin-off to its current standing in the smart home market, the story of who owns Arlo is a fascinating one.

This exploration into Arlo ownership will reveal the influence of its major shareholders, the role of its board, and the evolution of its relationship with its original parent company. Knowing who owns Arlo provides vital insights into its financial health and how it navigates the competitive landscape, including its market share and its competitors. Whether you're curious about Arlo's company history, its investor relations, or even who founded Arlo security, this analysis will provide clarity.

Who Founded Arlo Technologies?

Understanding the ownership structure of Arlo Technologies, requires looking back at its origins. Unlike many companies, Arlo didn't start with a single founder or a small group of investors. Instead, its story begins as a business unit within NETGEAR, Inc.

Arlo's journey to becoming a standalone company is a key part of its ownership narrative. This unique path shaped its initial ownership and set the stage for its future as a publicly traded entity.

The initial ownership of Arlo was primarily held by NETGEAR. This structure was a direct result of its origins as a business unit within NETGEAR, a publicly traded company. The separation and subsequent Initial Public Offering (IPO) in August 2018 marked a significant shift in its ownership.

Arlo was established as a business unit within NETGEAR in 2014. This early structure is key to understanding its initial ownership.

The spin-off and IPO in August 2018 transformed Arlo into a separate public company. This event was crucial for its ownership structure.

NETGEAR distributed approximately 62.5% of Arlo's stock to its shareholders. NETGEAR retained around 37.5% of Arlo's stock.

The separation agreement between Arlo and NETGEAR was essential. It outlined the terms of the spin-off, including asset transfers and commercial relationships.

Arlo's history does not include traditional founders. Its development was a strategic decision by NETGEAR.

The creation of Arlo as a standalone company allowed for a dedicated focus on smart home security. This specialization was a strategic move.

The initial ownership of Arlo was largely shaped by its parent company, NETGEAR. Understanding the relationship between Arlo and NETGEAR is crucial for grasping the early ownership structure. The spin-off allowed NETGEAR to unlock value for its shareholders. For more insights, you can read about the Growth Strategy of Arlo Technologies.

- Arlo's early ownership was primarily held by NETGEAR.

- The spin-off in 2018 distributed shares to NETGEAR shareholders.

- The separation agreement detailed the terms of the spin-off.

- Arlo's focus on smart home security was a key strategic decision.

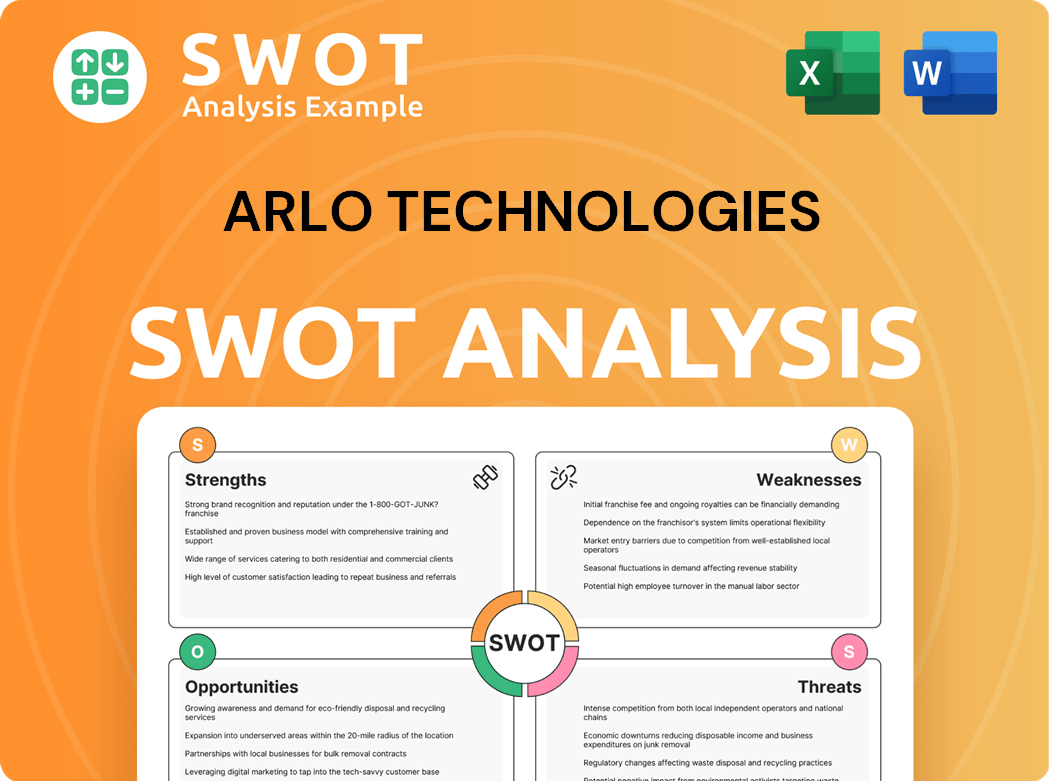

Arlo Technologies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Arlo Technologies’s Ownership Changed Over Time?

The evolution of Arlo Technologies' ownership is marked by its spin-off from NETGEAR and subsequent transition into a publicly traded company. The initial public offering (IPO) in August 2018 established Arlo as an independent entity, reflecting its position in the smart home security market. Following the IPO, NETGEAR gradually divested its stake, culminating in complete separation by February 2019. This shift transformed Arlo into a fully independent public company.

Since becoming independent, Arlo's ownership has been primarily distributed among institutional investors and individual shareholders. This structure has influenced the company's strategic direction and governance, with major stakeholders playing a significant role in shaping its future. Understanding the distribution of shares among these entities provides insight into the company's financial health and strategic focus. For more information on Arlo's target market, you can read this article: Target Market of Arlo Technologies.

| Ownership Milestone | Date | Details |

|---|---|---|

| Spin-off from NETGEAR | Prior to August 2018 | Arlo operated as a division of NETGEAR. |

| IPO | August 2018 | Arlo became a publicly traded company. |

| NETGEAR Divestiture Complete | February 2019 | NETGEAR sold its remaining stake, making Arlo fully independent. |

As of early 2025, key institutional investors hold significant positions in Arlo. As of March 31, 2024, The Vanguard Group, Inc. held a substantial stake, with 5,833,267 shares, representing 6.87% of the company. BlackRock Fund Advisors held 4,375,190 shares, or 5.15% ownership. Other notable investors include Renaissance Technologies LLC, holding 2,829,350 shares (3.33%), and Geode Capital Management, LLC, with 2,059,206 shares (2.42%). These holdings are subject to change based on market dynamics and investment strategies, influencing Arlo's strategic direction.

Arlo Technologies is a publicly traded company with ownership primarily held by institutional investors and individual shareholders.

- The company's independence was established through a spin-off from NETGEAR and subsequent IPO.

- Major institutional investors include The Vanguard Group, BlackRock Fund Advisors, and others.

- Changes in ownership structure can influence company strategy and governance.

- Understanding the ownership structure provides insights into Arlo's financial health and strategic focus.

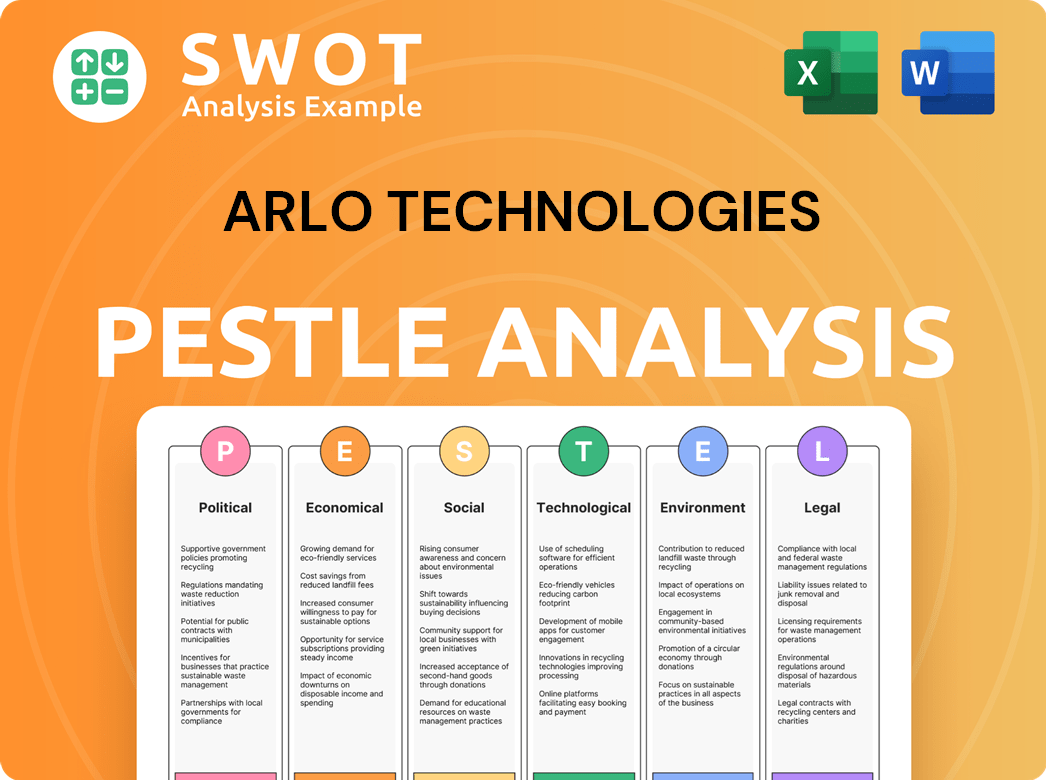

Arlo Technologies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Arlo Technologies’s Board?

The Board of Directors of Arlo Technologies plays a crucial role in the company's governance, overseeing strategic direction and representing shareholder interests. As of early 2025, the board includes a mix of independent directors and individuals with significant executive experience in the technology and consumer electronics sectors. The board's composition is designed to ensure a balance of expertise and independence, which is vital for guiding the company's strategic initiatives. While specific board members representing major shareholders like Vanguard or BlackRock are not typically appointed to the board as direct representatives, these institutional investors exert influence through their voting power during director elections.

Current board members include Matthew McRae, who serves as the Chief Executive Officer and is also a member of the board, providing direct operational insight. Other directors typically hold independent seats, bringing diverse expertise in areas such as finance, marketing, and corporate governance. The board's focus remains on driving shareholder value through strategic initiatives such as expanding the subscriber base for Arlo Secure services, innovating product offerings, and optimizing operational efficiency. The independence of a majority of the board members is a key aspect of Arlo's corporate governance, aimed at ensuring decisions are made in the best interest of all shareholders. For more insights into the company's strategic direction, you can explore the Growth Strategy of Arlo Technologies.

| Board Member | Title | Key Experience |

|---|---|---|

| Matthew McRae | CEO & Director | Extensive experience in technology and consumer electronics |

| Independent Directors | Various | Expertise in finance, marketing, and corporate governance |

| Institutional Investors | Shareholders | Vanguard, BlackRock (Influence through voting power) |

Arlo Technologies operates under a one-share-one-vote structure for its common stock. This standard voting structure ensures that voting power is directly proportional to ownership stakes, promoting a more democratic governance model among shareholders. There are no indications of dual-class shares or special voting rights that would grant outsized control to specific individuals or entities. This structure supports a fair and transparent approach to corporate governance, ensuring that all shareholders have a voice in the company's decisions.

Arlo's board consists of experienced executives and independent directors. The company follows a one-share-one-vote system.

- Board members include the CEO and independent directors.

- Institutional investors like Vanguard and BlackRock hold significant voting power.

- The company's governance structure promotes shareholder democracy.

- The board focuses on driving shareholder value through strategic initiatives.

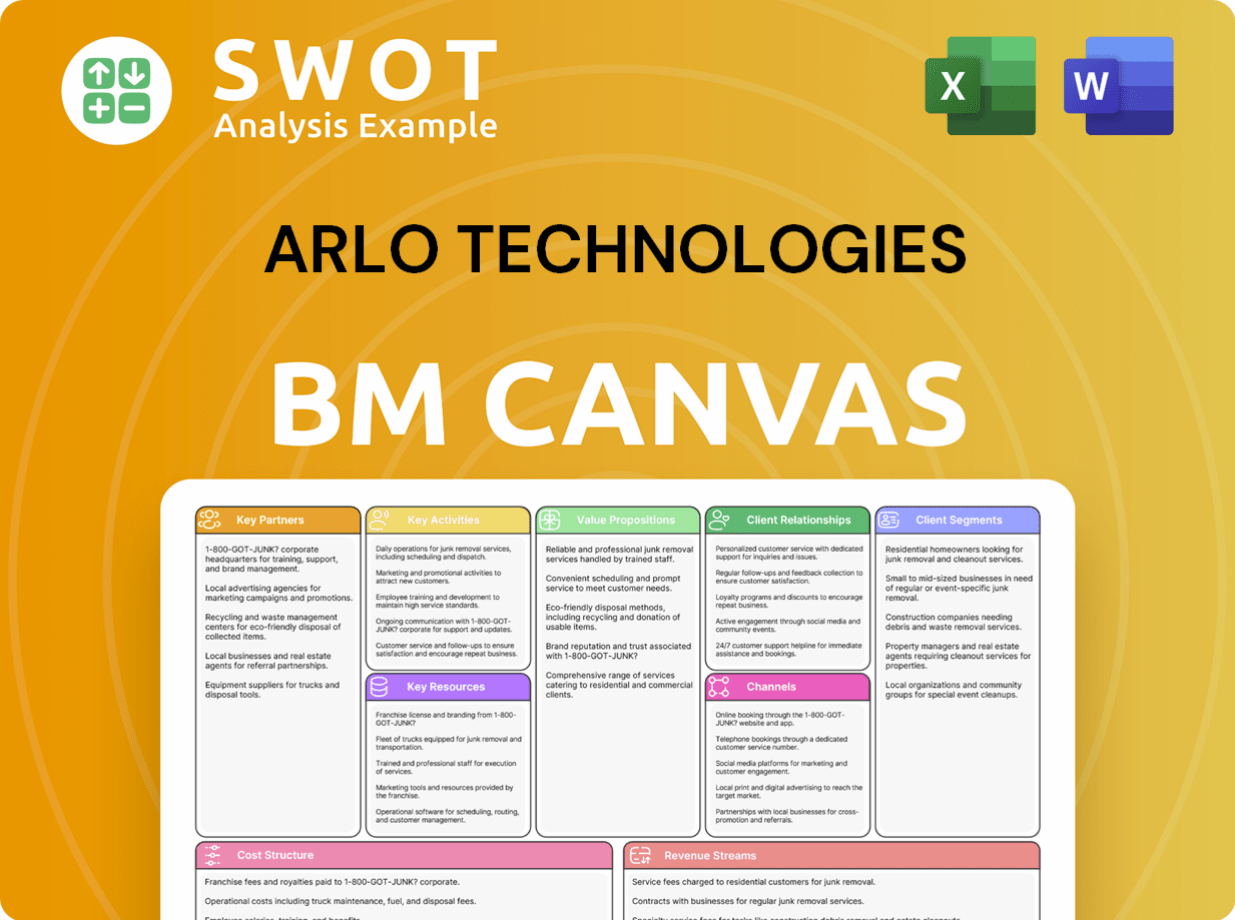

Arlo Technologies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Arlo Technologies’s Ownership Landscape?

Over the past few years, several significant developments have shaped the ownership landscape of Arlo Technologies. A key focus has been the growth of its subscription services, particularly Arlo Secure, which has become a major driver of revenue and investor interest. This shift towards a services-led model has influenced investor perceptions and, consequently, ownership. The company's strategic moves and financial performance directly impact investor sentiment and trading activity, leading to shifts in ownership percentages among various investor types. For example, the increasing emphasis on recurring revenue models, a trend across the smart home industry, has attracted investors who prioritize predictable revenue streams and long-term customer relationships. This focus is evident in Arlo's consistent emphasis on subscriber growth in its earnings calls and investor presentations.

One notable trend is the continued increase in institutional ownership. As of May 2024, institutional ownership of Arlo stood at approximately 80.08%. This demonstrates a strong institutional presence, reflecting confidence in Arlo's business model and future prospects. However, it also implies increased scrutiny and potential influence from these large investors. Leadership changes, such as executive appointments or departures, can also indirectly impact ownership dynamics, though no founder departures directly impacting ownership structure have been prominent in this period, given Arlo's spin-off origin. The competitive landscape and the potential for future partnerships or acquisitions also play a role, though Arlo has not been involved in major M&A activity recently.

| Ownership Category | Percentage (Approximate, May 2024) | Notes |

|---|---|---|

| Institutional Investors | 80.08% | Includes firms like The Vanguard Group and BlackRock. |

| Other Investors | Remaining Percentage | Includes retail investors and other entities. |

| Insider Ownership | Varies | Reflects holdings by company executives and board members. |

Arlo's journey, from its origins to its current market position, is detailed in Brief History of Arlo Technologies. The company's evolution has been marked by strategic shifts and responses to market dynamics, influencing its ownership profile.

Arlo's ownership structure is primarily influenced by institutional investors. These large firms hold a significant portion of the company's shares. This reflects confidence in Arlo's business model and future growth potential.

The shift towards subscription services has become a major focus. Institutional ownership continues to be a dominant factor. Market trends and competitive landscapes also play a role in shaping Arlo's ownership.

Institutional investors often seek stable growth and long-term value. Their substantial stakes indicate confidence in Arlo's future. This also means increased scrutiny and potential influence from these investors.

The company's financial performance will continue to influence investor sentiment. Strategic announcements and market trends will also affect ownership. The focus on subscriber growth is a key factor.

Arlo Technologies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Arlo Technologies Company?

- What is Competitive Landscape of Arlo Technologies Company?

- What is Growth Strategy and Future Prospects of Arlo Technologies Company?

- How Does Arlo Technologies Company Work?

- What is Sales and Marketing Strategy of Arlo Technologies Company?

- What is Brief History of Arlo Technologies Company?

- What is Customer Demographics and Target Market of Arlo Technologies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.