Bayer Bundle

Can Bayer's Growth Strategy Propel It Forward?

Bayer, a titan in pharmaceuticals and life sciences, has a rich history dating back to 1863, evolving from dye production to a global leader. With 2024 sales reaching €46.6 billion, and a substantial €6.2 billion invested in research and development, Bayer's impact is undeniable. This Bayer SWOT Analysis will delve into the company's complex journey.

This analysis will dissect Bayer's growth strategy, exploring its strategic initiatives in 2024 and beyond, including its expansion into emerging markets. We'll examine Bayer's future prospects, considering its financial forecast and outlook within the competitive landscape of the pharmaceutical industry and agricultural business. Understanding Bayer's market share in pharmaceuticals and its innovation in crop science is crucial to understanding its long-term growth potential and its impact on global health.

How Is Bayer Expanding Its Reach?

The Bayer growth strategy centers on significant expansion initiatives across its divisions, including Pharmaceuticals and Crop Science. These initiatives are designed to drive revenue growth, improve profitability, and strengthen market positions. The company is also focused on strategic restructuring to streamline operations and reduce costs, ensuring a sustainable future.

Bayer's future prospects look promising, with a robust pipeline of new product launches and strategic investments in key areas. The company's commitment to innovation and sustainability, along with its focus on operational efficiency, positions it well for long-term success. This strategic approach aims to capitalize on opportunities within the Pharmaceutical industry and the Agricultural business.

A detailed Bayer company analysis reveals a company undergoing significant transformation, with a clear focus on growth and efficiency. The company's strategic initiatives are designed to address both current challenges and future opportunities, ensuring its continued relevance and competitiveness in the global market.

2025 is a pivotal year for the Pharmaceuticals division, marked by several key product launches. These include Beyonttra (acoramidis) for heart conditions, and elinzanetant, a non-hormonal treatment for menopause symptoms. Additionally, new indications for Nubeqa (darolutamide) and Kerendia (finerenone) are expected in the second half of 2025.

The Crop Science division has a five-year plan to boost profitability and market share. This includes launching ten 'blockbuster' products over the next decade, such as the fungicide Iblon and insecticide Plenexos. Bayer is also expanding regenerative agriculture production globally, with a goal of over 400 million acres by the mid-2030s.

Bayer is implementing the 'Dynamic Shared Ownership' (DSO) model to reduce management layers and streamline operations. This initiative aims to generate €800 million in savings in 2025, building on €500 million realized in 2024. The DSO model is a key element of Bayer's operational efficiency strategy.

Nubeqa and Kerendia are projected to achieve combined sales exceeding €2.5 billion in 2025. The Crop Science division aims for an annual contribution of more than €1 billion to profits by 2029, with €3.5 billion in new revenues from innovation. These financial targets underscore the ambitious nature of Bayer's expansion plans.

Bayer's strategic initiatives are multifaceted, encompassing new product launches, market penetration, and operational restructuring. The company's focus on innovation in both pharmaceuticals and crop science, coupled with its efficiency-driven restructuring, positions it for sustained growth. For a deeper dive into the company's target market, consider reading about the Target Market of Bayer.

Bayer's expansion strategy focuses on several key areas to drive growth and profitability. These include new product launches in pharmaceuticals, innovation in crop science, and operational restructuring to improve efficiency.

- Pharmaceuticals: Launch of Beyonttra, elinzanetant, and new indications for Nubeqa and Kerendia.

- Crop Science: Launch of new products like Iblon and Plenexos, and expansion of regenerative agriculture.

- Operational Efficiency: Implementation of the DSO model to reduce costs and streamline operations.

- Financial Goals: Achieving combined sales of over €2.5 billion for Nubeqa and Kerendia in 2025.

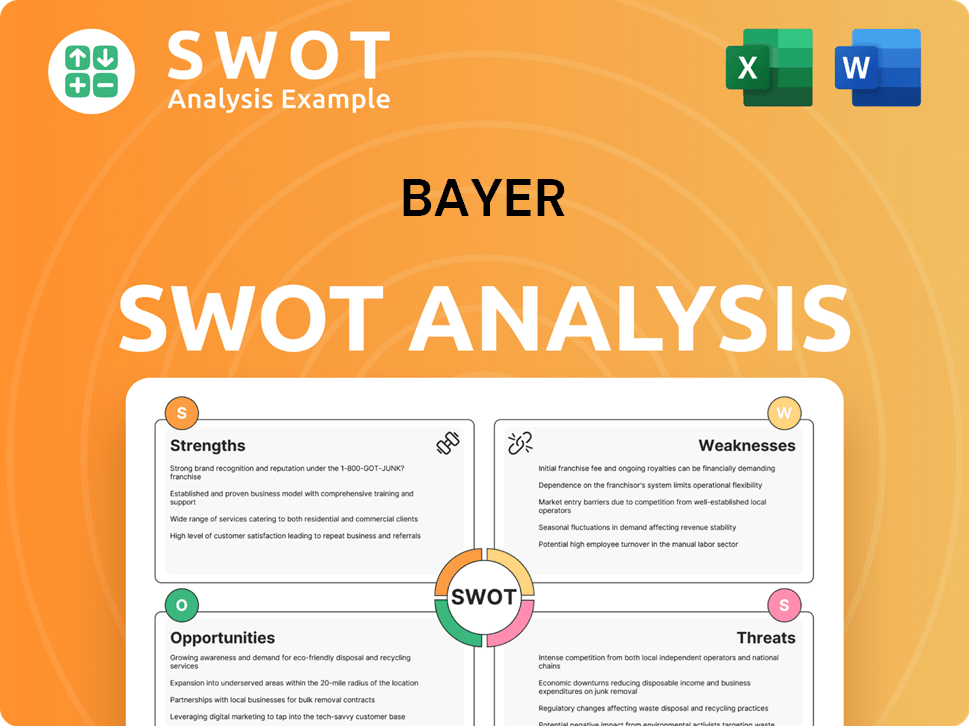

Bayer SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Bayer Invest in Innovation?

Bayer's growth strategy is heavily reliant on innovation and the strategic use of technology across its core business segments. The company's commitment to Research and Development (R&D) is substantial, driving the development of new products and solutions. This focus is crucial for maintaining its competitive edge in the pharmaceutical and agricultural sectors.

The company's approach to innovation is multifaceted, encompassing internal R&D efforts, strategic partnerships, and acquisitions. This comprehensive strategy allows Bayer to address evolving market demands and capitalize on emerging opportunities. The company's financial performance and future prospects are closely tied to its ability to successfully bring new products to market and expand its existing portfolio.

Bayer's strategic initiatives for 2024 and beyond are centered around advancing its pipeline of innovative products. This includes a focus on areas such as oncology, cardiovascular diseases, and regenerative agriculture. The company's investment in R&D, which reached €6.2 billion in 2024, underscores its dedication to long-term growth and its ability to adapt to the dynamic changes within the pharmaceutical industry and agricultural business.

In the Pharmaceuticals division, Bayer is advancing over 20 clinical-stage R&D programs. The company is focusing on developing new treatments and expanding the indications for existing growth drivers. This includes exploring advanced therapeutic areas such as cell and gene therapy, with significant clinical milestones reached in treating Parkinson's disease.

Key innovations include the development of new treatments like Beyonttra for transthyretin amyloid cardiomyopathy and elinzanetant for menopause symptoms, both expected to launch in 2025. Bayer is also expanding the indications for existing growth drivers like Nubeqa and Kerendia.

For its Crop Science division, Bayer is focusing on innovations that support regenerative agriculture and improve productivity while reducing environmental impact. This includes new seed products and crop protection registrations. The company is leveraging technology platforms such as gene editing, precision breeding, small molecules, and biologicals to deliver new products.

Bayer utilizes technology platforms like gene editing and precision breeding to deliver new products. Examples of upcoming innovations include the Preceon Smart Corn System and Vyconic soybeans. The company aims to generate more than €3.5 billion in additional sales from innovation in Crop Science by 2029.

Bayer's significant investments in R&D, reaching €6.2 billion in 2024, are a testament to its commitment to innovation. These investments are critical for developing a differentiated pipeline across key therapeutic areas. The focus is on both internal development and external collaborations to enhance its product offerings.

Bayer's Crop Science division aims to generate more than €3.5 billion in additional sales from innovation by 2029. This ambitious target highlights the company's strategic focus on driving growth through new product launches and technological advancements. This is a significant part of the overall Revenue Streams & Business Model of Bayer.

Bayer's strategic approach to innovation involves leveraging cutting-edge technologies in both pharmaceuticals and crop science. This includes advanced therapeutic areas such as cell and gene therapy, alongside precision breeding and gene editing in agriculture. These advancements are crucial for the company's long-term growth potential and its ability to address evolving market needs.

- Focus on regenerative agriculture to improve environmental impact.

- Development of new seed products and crop protection registrations.

- Leveraging technology platforms like gene editing and precision breeding.

- Aiming for over €3.5 billion in additional sales from innovation in Crop Science by 2029.

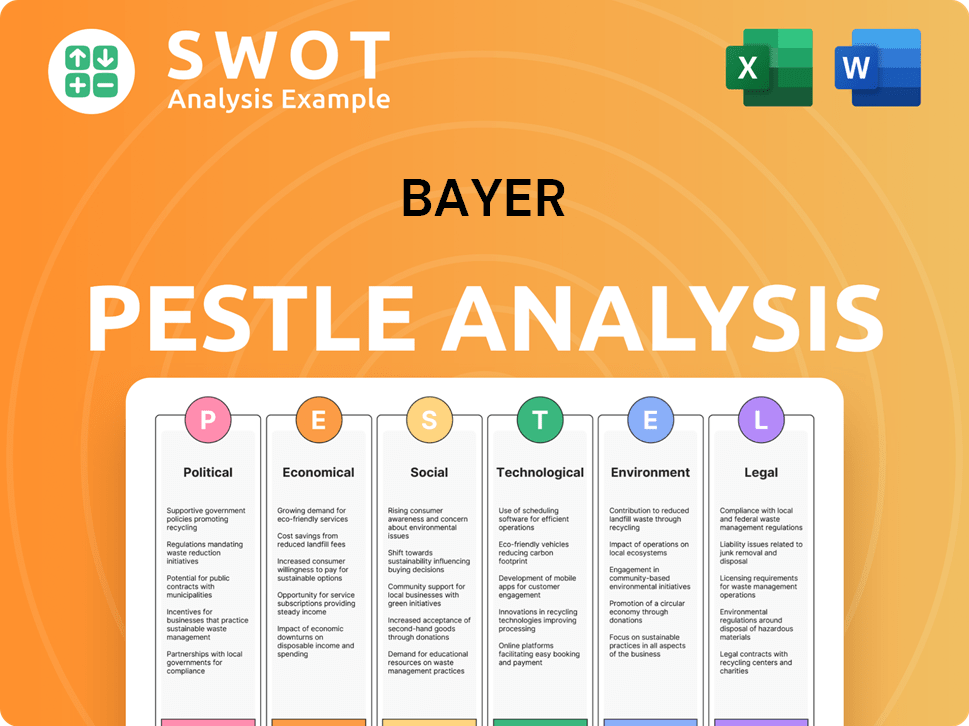

Bayer PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Bayer’s Growth Forecast?

The financial outlook for Bayer in 2025 is projected to be challenging, according to CEO Bill Anderson. The company anticipates that 2025 will be 'the toughest year in our turnaround.' This assessment is crucial for understanding the Bayer growth strategy and Bayer future prospects.

Bayer's financial performance in 2025 is expected to show sales figures 'roughly in line' with 2024, which were at €46.6 billion. However, earnings are anticipated to be lower. This financial forecast is a key element of the Bayer company analysis.

Specifically, Bayer forecasts 2025 sales to be between €45 billion and €47 billion on a currency-adjusted basis, representing a change of -3% to +1% currency and portfolio-adjusted. The company's strategic initiatives for 2024 and beyond are designed to navigate these financial challenges.

Bayer's 2025 sales are projected to be between €45 billion and €47 billion. This reflects a currency-adjusted change of -3% to +1%. These projections are vital for assessing the Bayer's financial performance.

EBITDA before special items is expected to range from €9.5 billion to €10.0 billion in 2025. This forecast is a critical indicator of Bayer's operational profitability.

Core earnings per share are projected to be between €4.50 and €5.00. This metric is essential for evaluating shareholder value and the Bayer's long-term growth potential.

Free cash flow is expected to be between €1.5 billion and €2.5 billion in 2025. This figure is crucial for understanding Bayer's financial flexibility.

As of March 31, 2025, Bayer's net financial debt stood at €34.25 billion, a 5.0% increase from the end of 2024. This rise was due to seasonal cash outflows, but it represented an 8.6% decrease compared to March 31, 2024. Bayer's goal is to reduce this debt and regain an A-rating. The Pharmaceutical industry and Agricultural business sectors are key to Bayer's financial health.

The Pharmaceuticals division is expected to achieve robust annual sales growth of 3% to 5% through 2023. However, a low- to mid-single digit percentage decline is predicted for 2024 due to patent losses on Xarelto and Eylea. This division is expected to return to sustainable growth in 2025.

The Crop Science division is targeting an EBITDA margin before special items to reach an average of 20% by 2029. This division plays a crucial role in Bayer's overall strategy.

Operational belt-tightening efforts are expected to generate €800 million in savings in 2025, following €500 million in 2024. These savings are part of Bayer's strategy to improve its financial standing.

Bayer aims to reduce its net financial debt and return to an A-rating category. This is a key financial goal for the company.

The company faces challenges, including patent losses and the need to navigate the competitive landscape. Understanding Bayer's competitive landscape analysis is essential.

Bayer's strategic focus includes innovation in crop science, digital transformation, and expansion into emerging markets. The company is also committed to Bayer's sustainability goals and initiatives.

For more insights into Bayer's market strategies, consider reading about the Marketing Strategy of Bayer. The company's financial performance is closely tied to its strategic initiatives and its ability to adapt to the evolving market dynamics.

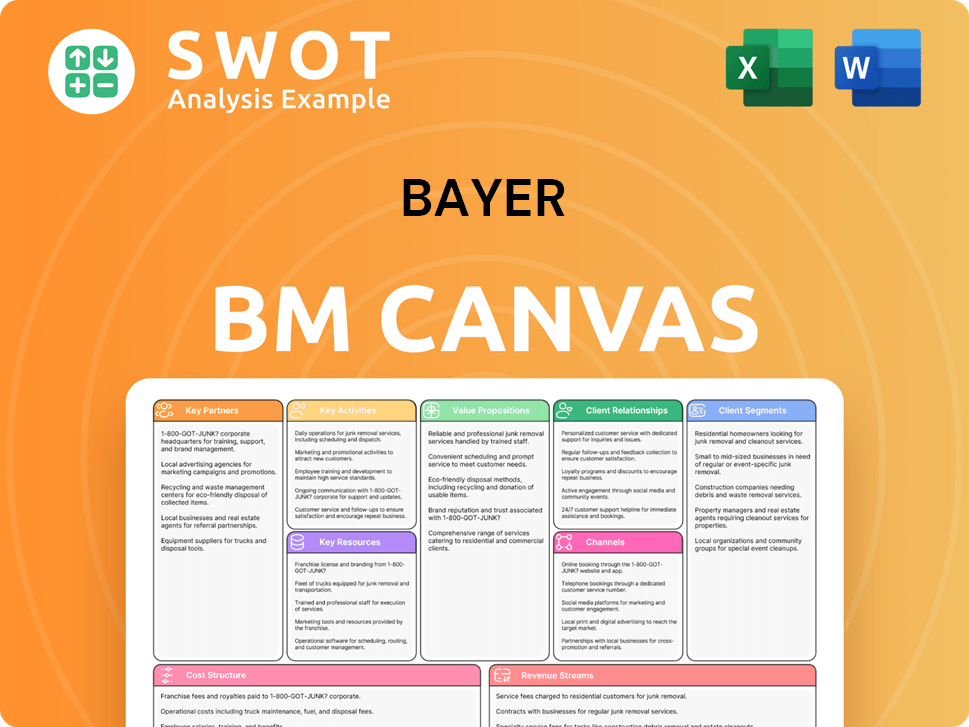

Bayer Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Bayer’s Growth?

The company faces a complex array of risks that could significantly hinder its Bayer growth strategy and overall performance. These challenges span legal, market, and operational domains, requiring proactive management to safeguard its future prospects. Addressing these obstacles is critical for maintaining investor confidence and achieving long-term financial success.

One of the most pressing issues is the ongoing Roundup glyphosate litigation, which has already cost the company billions. The increasing generic competition for key pharmaceutical products also poses a significant threat. The company's Bayer company analysis reveals a need for strategic adjustments to navigate these turbulent waters.

In the Crop Science division, the company is grappling with weak agricultural markets, regulatory changes, and pricing pressures from generic competitors. These factors contributed to a 3.3% decrease in Crop Science sales in Q1 2025. The company is actively lobbying for legal immunity from glyphosate claims to protect future innovation.

The Roundup glyphosate litigation remains a substantial risk, with billions already spent on settlements. CEO Bill Anderson has set a 2026 deadline for resolution. The company is seeking shareholder authorization to raise billions of euros as a contingency for these legal challenges.

The Pharmaceutical industry faces increasing generic competition, particularly for Xarelto and Eylea. These two drugs accounted for 37% of Bayer's prescription drug sales in 2024. This pressure is expected to negatively impact sales and margins, with recovery not anticipated until 2027.

The Crop Science division faces weak agricultural markets and regulatory hurdles. Regulatory impacts in the U.S. and Europe, including the loss of the dicamba label in the US and the expiration of Movento registration in Europe, are affecting sales. Supply chain vulnerabilities and fluctuating exchange rates also present ongoing challenges.

Bayer is implementing various strategies to mitigate these risks. These include diversifying its product portfolio and executing its 'Dynamic Shared Ownership' operating model. The company is also actively lobbying for legal immunity from glyphosate claims to protect future innovation.

The financial implications of these risks are significant, potentially affecting Bayer's financial performance. The company has already incurred substantial costs related to the Roundup litigation. Generic competition and market pressures are expected to impact sales and profitability in the near term.

The company’s ability to successfully navigate these challenges will determine its Bayer future prospects. Strategic initiatives, such as portfolio diversification and operational efficiency, are crucial for long-term growth. For more information on the company's financial structure, you can find additional insights from Owners & Shareholders of Bayer.

The main challenges include the Roundup litigation, generic competition, and weak agricultural markets. These factors are impacting the company's financial performance and require strategic responses. The successful resolution of these issues will be crucial for future growth.

Bayer is responding with portfolio diversification, risk management frameworks, and the 'Dynamic Shared Ownership' model. Lobbying for legal immunity from glyphosate claims is also a key strategy. These initiatives aim to improve efficiency and reduce the impact of these risks.

The litigation and generic competition are expected to negatively impact sales and margins. The pharma business is not expected to recover until 2027. The company’s financial health will depend on how effectively it manages these financial pressures.

The company's ability to overcome these challenges will determine its long-term success. Strategic initiatives and effective risk management are crucial for achieving sustainable growth. The Agricultural business is also facing significant headwinds.

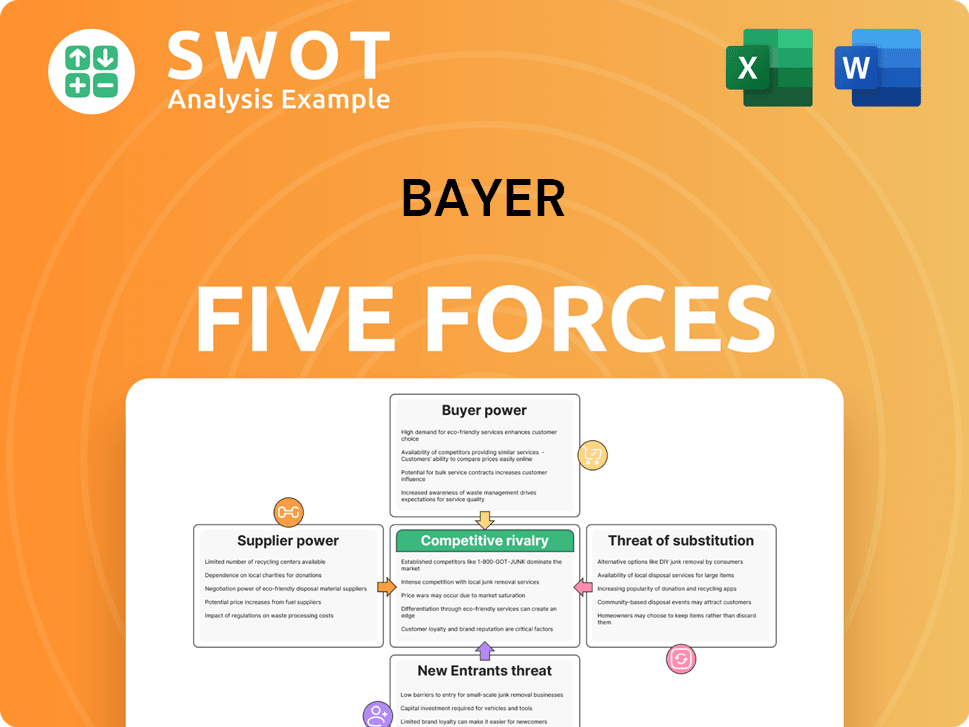

Bayer Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bayer Company?

- What is Competitive Landscape of Bayer Company?

- How Does Bayer Company Work?

- What is Sales and Marketing Strategy of Bayer Company?

- What is Brief History of Bayer Company?

- Who Owns Bayer Company?

- What is Customer Demographics and Target Market of Bayer Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.