Bayer Bundle

How Does the Bayer Company Thrive?

Bayer, a titan in the life sciences industry, touches lives globally through its pharmaceuticals, consumer health products, and agricultural solutions. With a reported €46.6 billion in sales in 2024, the company's impact is undeniable. But how does this global powerhouse actually operate, and what drives its financial success?

This exploration of the Bayer SWOT Analysis will dissect the core elements of the Bayer business model, providing insights into its operational structure, revenue streams, and strategic direction. We'll investigate the inner workings of this pharmaceutical company, from its research and development processes to its global market presence. Understanding Bayer's key business segments and its approach to sustainability is crucial for anyone looking to understand the company's long-term prospects.

What Are the Key Operations Driving Bayer’s Success?

The core operations and value proposition of the Bayer company revolve around its three main divisions: Pharmaceuticals, Consumer Health, and Crop Science. Each division focuses on distinct areas, offering a diverse portfolio of products and services. This structure allows Bayer to address a wide range of healthcare and agricultural needs globally.

The Bayer business model is built on innovation, research, and development, manufacturing, and global distribution. The company invests heavily in R&D to create new products and improve existing ones. Bayer's global presence ensures its products reach customers worldwide, supporting its financial performance and market reach.

The Bayer company creates value by developing and delivering innovative healthcare and agricultural solutions. This includes prescription drugs, over-the-counter medicines, dietary supplements, crop protection products, and plant biotechnology. The company's commitment to sustainability and operational efficiency further enhances its value proposition.

The Pharmaceuticals division focuses on prescription drugs. Key therapeutic areas include oncology, cardiovascular diseases, neurology, rare diseases, and immunology. Notable products include Nubeqa (for cancer) and Kerendia (for kidney disease). Nubeqa achieved global blockbuster status in September 2024.

This division offers over-the-counter medicines, dietary supplements, and self-care products. Well-known brands like Aspirin are part of this segment. This division focuses on providing accessible healthcare solutions to consumers worldwide.

The Crop Science division provides crop protection products and plant and seed biotechnology. It aims to deliver innovative solutions for sustainable agriculture. Products include pesticides, herbicides, fungicides, and advanced seed technologies.

Operational processes involve extensive research and development, manufacturing, supply chain management, and global distribution. Bayer invested €6.2 billion in R&D in 2024. The company is restructuring with a 'Dynamic Shared Ownership' model to streamline operations.

The company is implementing a 'Dynamic Shared Ownership' model to reduce bureaucracy and streamline operations, aiming for €800 million in savings in 2025. This model aims to accelerate innovation and improve financial performance. The supply chain and distribution networks are global.

- Focus on regenerative agricultural solutions, such as the Preceon Smart Corn System and Vyconic soybeans.

- Global distribution networks serving Europe/Middle East/Africa, North America, Asia/Pacific, and Latin America.

- Emphasis on environmental sustainability and market differentiation through innovative agricultural solutions.

- The company's history is also interesting, as you can read in the Brief History of Bayer.

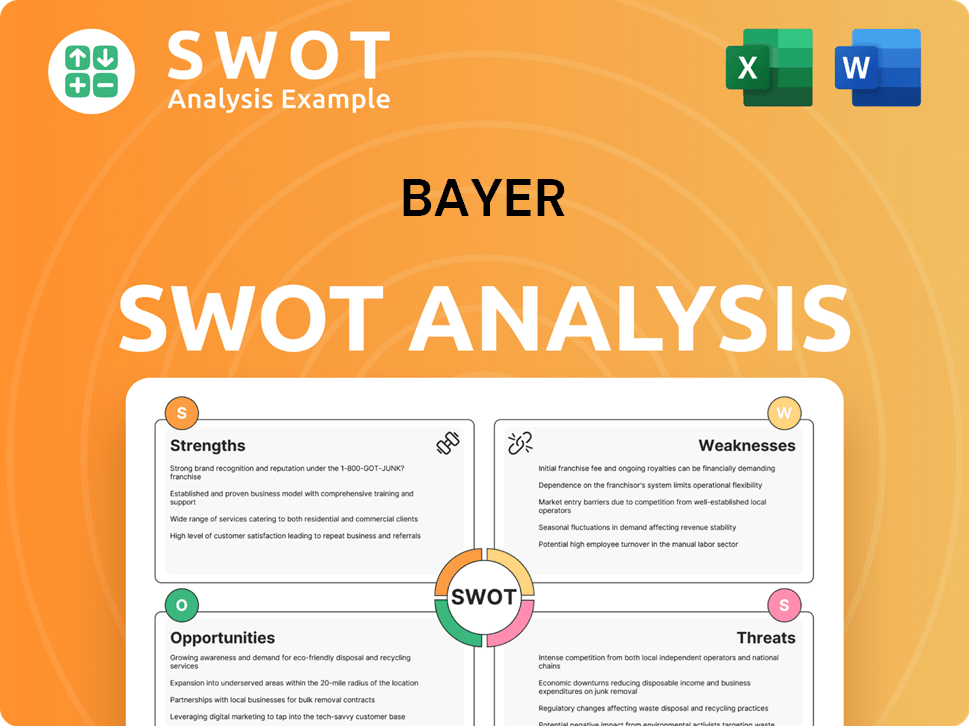

Bayer SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Bayer Make Money?

The Bayer company generates revenue through the sale of products across its Pharmaceuticals, Consumer Health, and Crop Science divisions. This diversified approach allows Bayer to tap into various markets and mitigate risks. In the first quarter of 2025, the company's total sales reached €13.738 billion.

The Bayer business model relies heavily on its ability to innovate and bring new products to market. The Pharmaceuticals division saw growth driven by new products like Nubeqa and Kerendia. The Consumer Health segment also contributed positively, with growth in key regions and product lines. However, the Crop Science division faced challenges, impacting overall sales.

The company's monetization strategies include direct product sales and a focus on innovation to drive incremental sales. For instance, Bayer aims to generate over €3.5 billion in incremental sales from innovation in its Crop Science division by 2029. The combined sales of Nubeqa and Kerendia in the Pharmaceuticals division are expected to increase from around €2 billion to more than €2.5 billion in 2025.

The revenue streams for Bayer are primarily divided into three main segments, each contributing differently to the overall financial performance. Understanding these segments is crucial for assessing Bayer's financial health and future prospects.

- Pharmaceuticals: This segment focuses on prescription drugs and generates revenue from sales of these products. In Q1 2025, sales increased by 4.1%, driven by new products.

- Consumer Health: This division sells over-the-counter medications and health products. The Consumer Health area grew by 2.5% in Q1 2025.

- Crop Science: This segment provides products for agriculture, including seeds, crop protection products, and digital farming solutions. Adjusted sales decreased by 3.3% in Q1 2025.

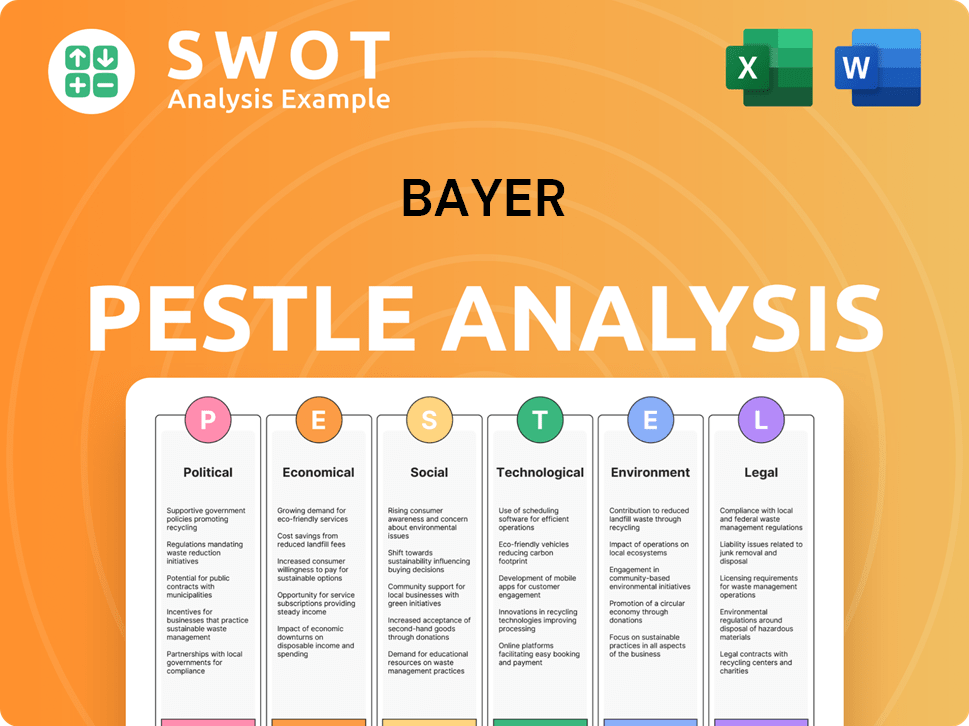

Bayer PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Bayer’s Business Model?

The Bayer company has navigated significant strategic shifts and challenges in recent years. A major issue is the ongoing Roundup litigation, costing billions. Simultaneously, Bayer is implementing operational restructuring and focusing on innovation in its Pharmaceuticals division to maintain its competitive edge. The company's ability to adapt and innovate is crucial for its future.

Under CEO Bill Anderson, Bayer is undergoing a significant restructuring, adopting a new operating model called 'Dynamic Shared Ownership'. This initiative is designed to reduce bureaucracy and streamline operations, with expected savings of €800 million in 2025, building on €500 million realized in 2024. The company is also streamlining its Crop Science portfolio and optimizing its production network to improve profitability, demonstrating its commitment to operational efficiency.

The Bayer business model relies on a strong R&D pipeline and global presence. The company invests heavily in research and development, with expenditures reaching €6.2 billion in 2024. This investment supports the development of novel products and maintains a differentiated pipeline, which is key to its long-term success. For an in-depth look at Bayer's target audience, check out this article about the Target Market of Bayer.

In February 2025, Beyonttra (acoramidis) received EU approval for transthyretin amyloidosis cardiomyopathy, with European launches starting in April 2025. Bayer anticipates launching elinzanetant, a hormone-free treatment for menopause symptoms, in late summer 2025. They also expect a new treatment option for heart failure patients by the end of 2025.

The company is actively pursuing legal strategies to address the Roundup litigation, including lobbying for federal preemption legislation. Bayer is also exploring glyphosate-free alternatives. The restructuring under CEO Bill Anderson, with the 'Dynamic Shared Ownership' model, aims to streamline operations and reduce costs.

Bayer's competitive advantage comes from its strong R&D capabilities and global presence. Its continuous investment in innovation, evidenced by €6.2 billion in R&D in 2024, allows it to develop novel products and maintain a differentiated pipeline. The company is focused on addressing unmet medical and agricultural needs.

The expiration of patents on drugs like Xarelto is expected to impact 2025 sales by €1 billion to €1.5 billion. The Roundup litigation continues to be a significant financial burden. Navigating these challenges requires strategic innovation and operational efficiency to maintain profitability and market position.

Bayer's financial performance is significantly influenced by its strategic moves and market dynamics. The company's investments in R&D and its restructuring efforts are designed to improve long-term profitability.

- Expected savings of €800 million in 2025 from restructuring.

- Impact of Xarelto patent expirations: €1 billion to €1.5 billion sales reduction in 2025.

- R&D expenditure in 2024: €6.2 billion.

- EU approval and launches of Beyonttra in 2025.

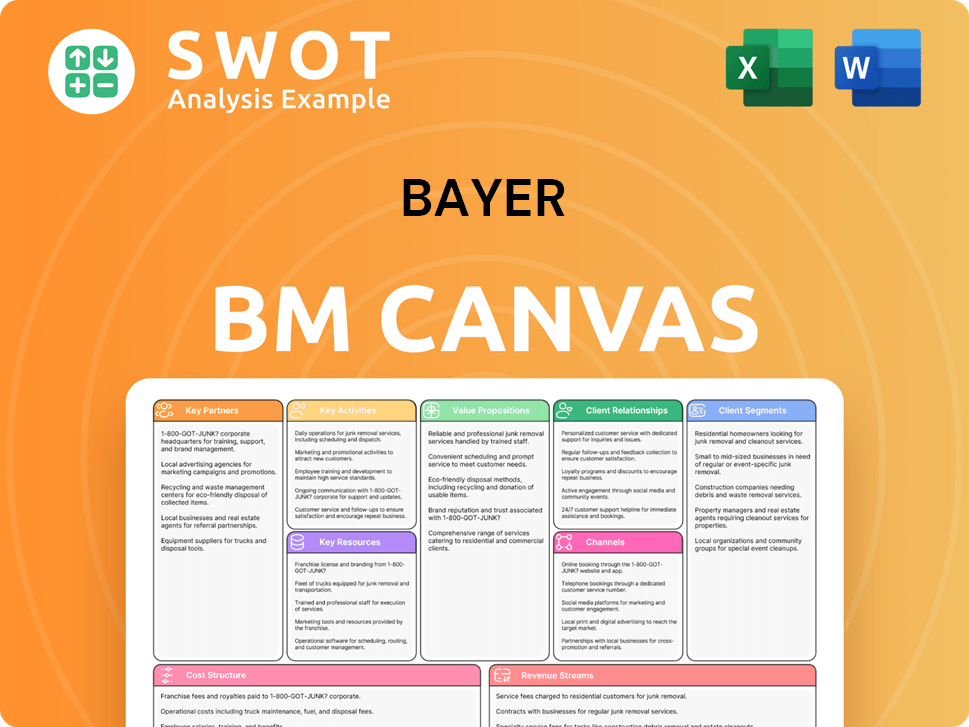

Bayer Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Bayer Positioning Itself for Continued Success?

The Bayer company holds a significant position within its diverse sectors, though it navigates various competitive landscapes and risks. The Bayer business model is structured across pharmaceuticals, crop science, and consumer health, each facing unique challenges and opportunities. The company is actively managing risks, including litigation related to Roundup, and is focused on strategic initiatives to drive future growth and profitability.

Bayer's outlook for 2025 is pivotal, with expectations of flat sales and potentially lower earnings. However, the company anticipates improved performance from 2026 onwards. The company is committed to reducing its net financial debt, which stood at €34.255 billion as of March 31, 2025, and aims to return to an A-rating category. Bayer's innovation roadmap includes new product launches and a focus on regenerative agriculture, demonstrating its long-term strategy for sustained growth and value creation.

In pharmaceuticals, Bayer is driving growth with new products like Nubeqa and Kerendia. The Crop Science division is implementing a five-year plan to boost profitability, aiming for over €3.5 billion in incremental sales from innovation by 2029. The Consumer Health segment shows robust growth, focusing on volume increases in 2025. The company's position is being impacted by generic competition and regulatory challenges.

Key risks include ongoing litigation related to Roundup, which incurred special charges of €587 million in Q1 2025. Foreign exchange headwinds could affect net sales. The crop science business is highly variable, influenced by weather and commodity prices. These factors can significantly impact the company's financial performance and market position.

2025 is a 'pivotal' year, with flat sales expected. Improved performance is anticipated from 2026 onwards. Bayer aims to return its Pharmaceuticals division to sales growth from 2027 and expand margins from 2028. The company is focused on reducing net financial debt and returning to an A-rating. The company is investing in innovation and regenerative agriculture.

Bayer's financial strategy includes reducing net financial debt, which was €34.255 billion as of March 31, 2025. The company is working to improve profitability and aims to achieve its financial goals through strategic initiatives. These efforts are designed to ensure long-term financial stability and growth. You can learn more about the Owners & Shareholders of Bayer.

Bayer's strategy includes new product launches and a focus on regenerative agriculture. The company is working to contain risks, particularly those related to litigation. These initiatives are central to Bayer's long-term strategy.

- Pharmaceuticals: New product launches and expansion of existing product lines.

- Crop Science: Focus on innovation and sustainable agricultural practices.

- Consumer Health: Growth through volume increases and market expansion.

- Financial Goals: Reduce net debt and improve profitability.

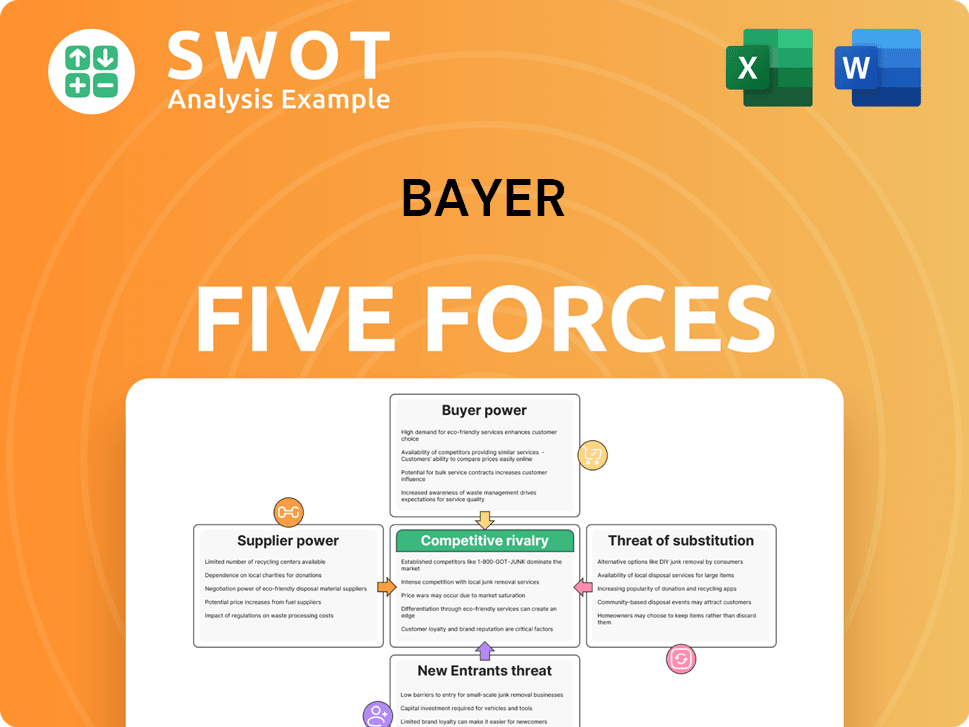

Bayer Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bayer Company?

- What is Competitive Landscape of Bayer Company?

- What is Growth Strategy and Future Prospects of Bayer Company?

- What is Sales and Marketing Strategy of Bayer Company?

- What is Brief History of Bayer Company?

- Who Owns Bayer Company?

- What is Customer Demographics and Target Market of Bayer Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.