BELIMO Holding Bundle

Can BELIMO Holding Continue to Dominate the Smart Building Revolution?

As the world increasingly demands energy-efficient and intelligent building solutions, understanding the BELIMO Holding SWOT Analysis is crucial. BELIMO Holding, a key player in the HVAC industry, has consistently innovated, impacting building automation. This article dives into BELIMO's growth strategy, exploring how it plans to capitalize on future opportunities.

BELIMO's journey from a Swiss startup to a global leader in actuators and building automation is a testament to its strategic foresight. This analysis will explore BELIMO Holding's future outlook, focusing on its expansion plans and product innovation within the competitive HVAC industry. We will examine BELIMO Holding's financial performance, market share, and long-term goals to assess its investment potential and growth opportunities, particularly in regions like Asia.

How Is BELIMO Holding Expanding Its Reach?

The expansion initiatives of BELIMO Holding are central to its growth strategy, focusing on both geographical and product portfolio diversification. The company aims to strengthen its market position in the HVAC industry by leveraging innovation and strategic partnerships. These efforts are designed to capitalize on the increasing demand for energy-efficient and smart building solutions worldwide.

BELIMO's approach includes a blend of organic growth and potential strategic acquisitions to achieve its long-term goals. The company's commitment to sustainability and the development of innovative products positions it well to meet evolving market demands. Understanding the BELIMO prospects requires a close look at these expansion strategies and their potential impact on the company's future performance.

The company's strategic moves are geared towards enhancing its global presence and market share. This involves a continuous effort to adapt to regional standards and customer needs. The company's focus on sustainable solutions and technological advancements in building automation is a key driver of its expansion plans.

BELIMO Holding is expanding its global footprint, with a particular emphasis on emerging markets. While specific details about new market entries for 2024-2025 are not always publicly available, the company historically strengthens its presence in key regions. The company focuses on adapting its products to meet regional standards and customer requirements.

BELIMO consistently develops new products and enhances existing ones to meet industry demands. This includes expanding its range of IoT-enabled sensors and intelligent valves. The company's commitment to innovation suggests a steady pipeline of new products. Strategic partnerships are also being explored to create more integrated solutions.

BELIMO actively seeks partnerships with building management system providers and other industry players. These collaborations aim to create more integrated and comprehensive solutions. Such partnerships help diversify revenue streams and increase market penetration. These partnerships are a key element of its overall growth strategy.

While not always highlighted, acquisitions remain a potential avenue for rapid market entry or technology acquisition. This approach aligns with the company's long-term growth objectives. The company's strategic acquisitions can boost its market share. This contributes to the company's ability to maintain its competitive edge.

BELIMO Holding is actively pursuing several key expansion initiatives to drive its growth strategy. These initiatives are designed to strengthen its market leadership and capitalize on emerging opportunities in the HVAC industry. The company's focus on innovation and strategic partnerships is crucial for its future success.

- Geographical expansion, particularly in Asia and North America, is a key focus.

- Product portfolio expansion with a focus on IoT-enabled solutions.

- Strategic partnerships to create integrated solutions.

- Potential strategic acquisitions to accelerate market entry.

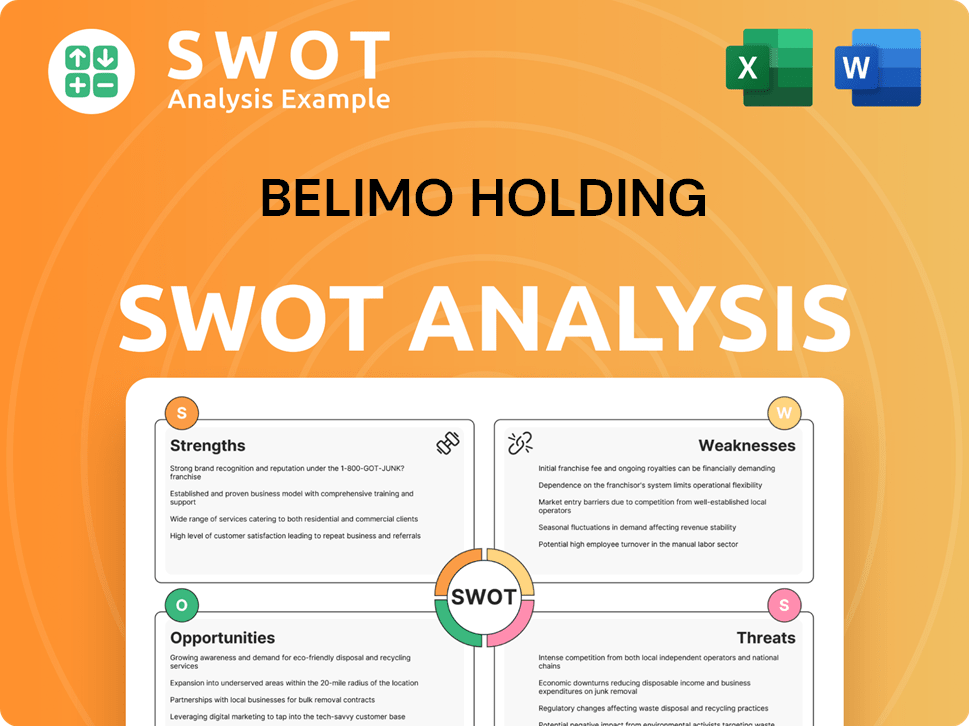

BELIMO Holding SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does BELIMO Holding Invest in Innovation?

BELIMO Holding AG's sustained growth is significantly driven by its innovation and technology strategy. This strategy focuses on leveraging advanced technologies to maintain its competitive edge and foster sustainable expansion. The company consistently invests in research and development (R&D), both internally and through collaborations, to stay at the forefront of technological advancements.

A key element of BELIMO's strategy is digital transformation, especially in the realm of smart solutions for HVAC systems. This includes integrating technologies like the Internet of Things (IoT) into its products, enabling real-time monitoring and predictive maintenance. Sustainability is also a core focus, with BELIMO developing energy-efficient products that contribute to greener buildings and reduced carbon footprints.

BELIMO's commitment to innovation is frequently recognized through industry accolades and breakthroughs. These advancements, such as in pressure-independent control valves and flow sensors, directly support growth objectives by enhancing performance, user experience, and aligning with global trends towards smart and sustainable building infrastructure. The company's focus on the HVAC industry, building automation, and actuators positions it well for future opportunities.

While specific R&D expenditure figures for 2024-2025 are not publicly available, BELIMO's historical investment in R&D demonstrates its commitment to technological leadership. This ongoing investment is crucial for maintaining its competitive advantage in the market.

BELIMO is actively integrating IoT into its products. This enables real-time monitoring and data-driven insights. The company's cloud-connected sensors and actuators facilitate remote control for facility managers.

BELIMO focuses on developing energy-efficient products. These products contribute to greener buildings and reduced carbon footprints. This aligns with global trends towards sustainable building practices.

Innovations in pressure-independent control valves and flow sensors are key. These advancements enhance HVAC system efficiency and performance. This directly contributes to the company's growth objectives.

BELIMO's innovations align with the growing demand for smart and sustainable building infrastructure. This positions BELIMO well for future growth. The company's focus on the HVAC industry supports this alignment.

BELIMO's technology strategy helps maintain its competitive edge. This is achieved through continuous innovation and investment in R&D. The company's focus on actuators and building automation is crucial.

BELIMO's dedication to innovation and technology is pivotal for its growth strategy. The company's focus on the HVAC industry, building automation, and actuators has positioned it for sustained success. BELIMO's ability to integrate cutting-edge technologies, such as IoT, into its products, enhances its market position and drives expansion. For more insights, you can explore the Competitors Landscape of BELIMO Holding.

- IoT Integration: Implementing IoT in products for real-time monitoring and predictive maintenance.

- Sustainable Solutions: Developing energy-efficient products to support green building initiatives.

- Product Enhancements: Advancements in pressure-independent control valves and flow sensors for improved HVAC efficiency.

- Strategic Acquisitions: Exploring strategic acquisitions to expand its product portfolio and market reach.

- Global Expansion: Targeting growth opportunities in regions like Asia to increase its global presence.

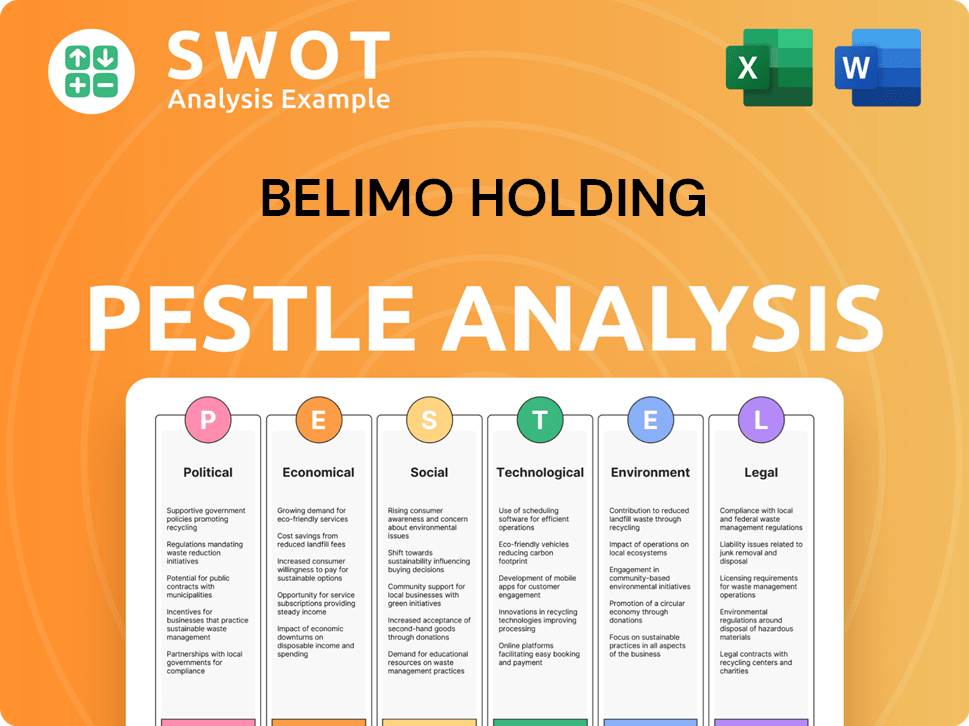

BELIMO Holding PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is BELIMO Holding’s Growth Forecast?

The financial outlook for BELIMO Holding appears promising, supported by its consistent performance and strategic initiatives. The company's strong financial health is evident in its historical data, which provides a solid base for future growth. This includes a focus on sustainable growth, operational efficiency, and a robust balance sheet to support expansion and innovation.

BELIMO Holding's financial performance is typically detailed in its annual reports, which include comprehensive financial statements. For instance, the 2023 annual report showed net sales of CHF 775.2 million, marking a 3.3% increase in local currencies compared to the previous year. This indicates a steady growth trajectory, even amidst economic fluctuations.

The company's investment levels are generally aligned with its R&D and expansion initiatives, which indicates a dedication to long-term growth rather than short-term gains. Analyst forecasts often project continued steady growth for BELIMO, driven by the increasing global demand for energy-efficient building solutions and smart HVAC systems. For a deeper understanding of BELIMO's market positioning, consider reading about the Target Market of BELIMO Holding.

BELIMO Holding demonstrates a solid financial foundation, which is crucial for sustaining long-term growth. This financial stability allows the company to invest in research and development, as well as expand its market presence. The company's historical financial performance, including consistent profit margins, underpins its ability to navigate economic uncertainties.

BELIMO has shown consistent revenue growth, driven by the increasing demand for its products in the HVAC industry. The company's ability to maintain and grow its revenue streams is a key indicator of its success. This growth is supported by its focus on innovation and expansion into new markets.

Strategic investments in R&D and expansion are central to BELIMO's growth strategy. These investments are designed to enhance product offerings, improve operational efficiency, and broaden market reach. Such investments reflect a commitment to long-term value creation.

BELIMO holds a strong market position, which supports its financial outlook. Its reputation for quality and innovation in the Building automation sector helps it maintain a competitive edge. This leadership position is a key factor in its ability to generate consistent financial results.

Key financial indicators highlight BELIMO's strong performance and future potential. These indicators provide insights into the company's financial health and its ability to sustain growth. Understanding these indicators is crucial for evaluating the company's investment potential.

- Revenue Growth: Consistent increases in revenue, demonstrating the company's ability to capture market share.

- Profit Margins: Healthy profit margins, reflecting the premium nature of BELIMO's offerings and efficient operations.

- R&D Investments: Significant investments in research and development, driving innovation and future product development.

- Market Share: A strong market share, indicating a competitive advantage and customer loyalty.

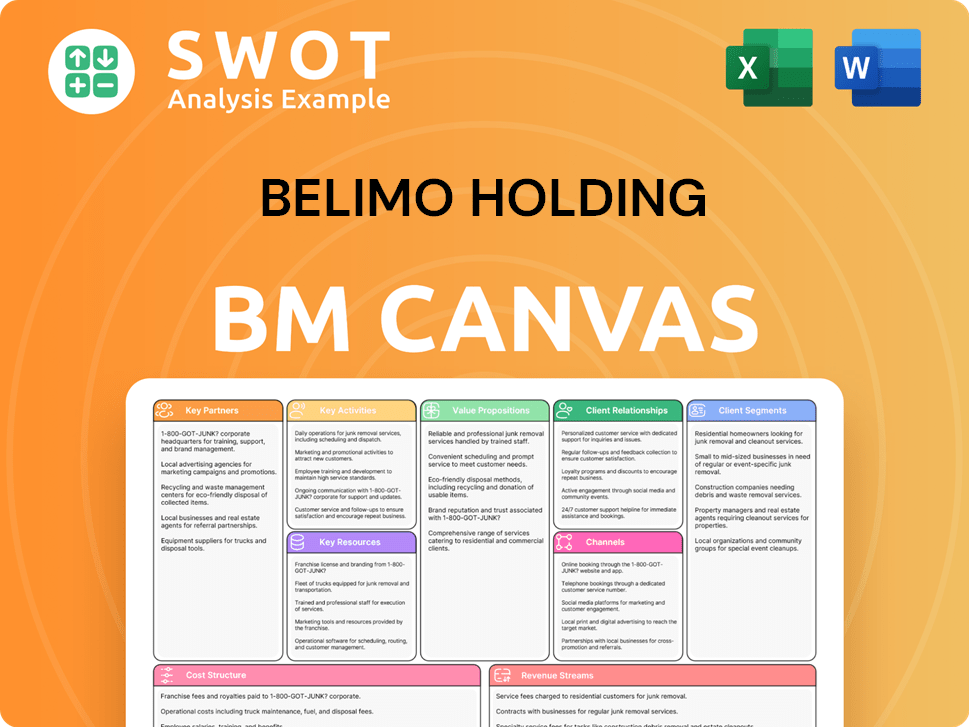

BELIMO Holding Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow BELIMO Holding’s Growth?

Several potential risks and obstacles could affect the future of BELIMO Holding. The company must navigate a competitive landscape, adapt to regulatory changes, and manage potential supply chain disruptions. Technological advancements also pose a challenge, requiring continuous innovation to maintain market leadership.

BELIMO's growth strategy faces challenges from competitors in the HVAC industry, who may offer similar products at lower prices or introduce new technologies. The company also needs to be prepared for changes in building codes, energy efficiency standards, and environmental regulations, which could require adjustments to its products and manufacturing processes. Supply chain issues and technological disruptions add further complexity.

To mitigate these risks, BELIMO employs several strategies. These include diversifying its product portfolio, implementing robust risk management frameworks, and closely monitoring market and regulatory developments. The company's focus on in-house R&D is also key to staying ahead of technological shifts, as highlighted in the Marketing Strategy of BELIMO Holding. Emerging risks, like cybersecurity threats, will continue to shape BELIMO's future.

The HVAC industry is highly competitive, with both established and new players vying for market share in the building automation sector. Competitors may introduce similar products at lower prices, or develop disruptive technologies that could impact BELIMO's market position. BELIMO must continually innovate and differentiate its offerings to maintain a competitive edge. For example, in 2024, the global HVAC market was valued at approximately $120 billion, with significant growth projected in the coming years, intensifying competition.

Changes in building codes, energy efficiency standards, and environmental regulations can create obstacles for BELIMO. Adapting product offerings and manufacturing processes to meet these evolving standards requires significant investment and strategic planning. The increasing emphasis on sustainable building practices, driven by regulations like the European Union's Energy Performance of Buildings Directive (EPBD), necessitates continuous product innovation. Compliance costs can also impact profitability; for instance, the cost of complying with new energy efficiency standards can increase product development expenses by up to 10-15%.

Disruptions in the supply chain, particularly concerning raw materials and electronic components, can lead to production delays and increased costs. Recent global events have highlighted the fragility of supply chains, impacting the availability of critical components. Managing these vulnerabilities requires diversified sourcing strategies and robust inventory management. For example, the semiconductor shortage in 2021-2022 significantly impacted the electronics industry, causing delays and cost increases that affected companies like BELIMO. The company's ability to navigate these challenges will be crucial for its BELIMO prospects.

Rapid advancements in technology can disrupt the HVAC control landscape, potentially rendering existing solutions less competitive. The emergence of new technologies, such as advanced sensors, cloud-based control systems, and AI-driven automation, requires BELIMO to continuously innovate and adapt its product offerings. Investment in R&D is critical to staying ahead of technological shifts. In 2024, the smart building market, which includes HVAC controls, was projected to reach $80 billion, illustrating the importance of technological adaptation.

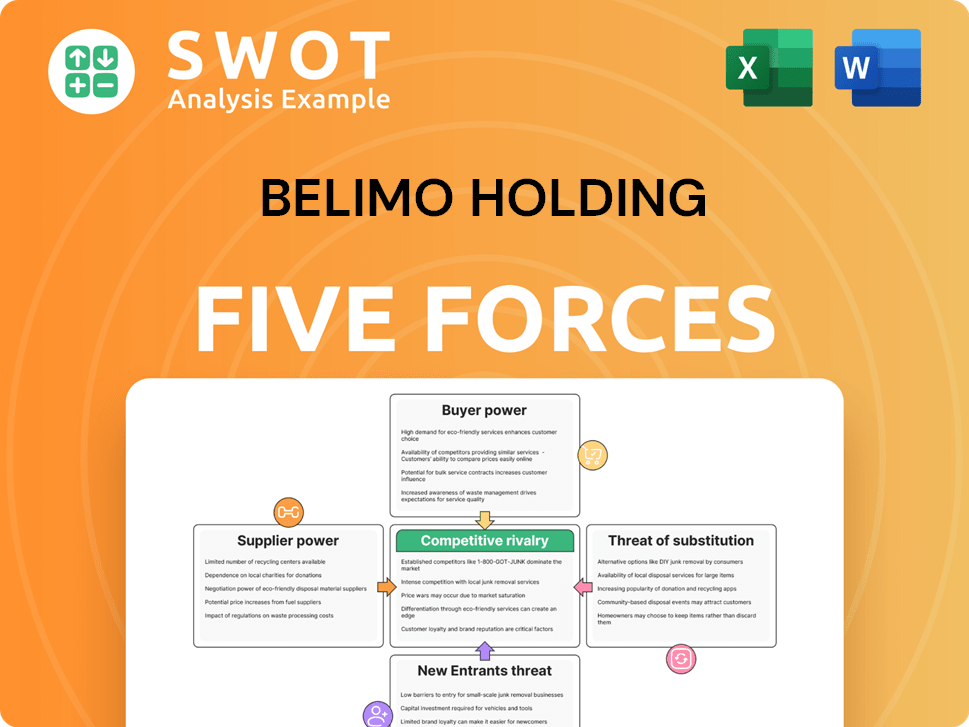

BELIMO Holding Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of BELIMO Holding Company?

- What is Competitive Landscape of BELIMO Holding Company?

- How Does BELIMO Holding Company Work?

- What is Sales and Marketing Strategy of BELIMO Holding Company?

- What is Brief History of BELIMO Holding Company?

- Who Owns BELIMO Holding Company?

- What is Customer Demographics and Target Market of BELIMO Holding Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.