BELIMO Holding Bundle

How Does BELIMO Holding Thrive in the HVAC Industry?

BELIMO Holding AG stands as a global powerhouse, dominating the HVAC sector with its innovative electric actuators, control valves, and sensors. In 2024, the company showcased remarkable financial success, achieving record-breaking net sales of CHF 943.9 million, highlighting its robust growth. This success story is built on strategic alignment with key market trends and a commitment to sustainable building solutions.

To understand the inner workings of this industry leader, we'll explore BELIMO Holding SWOT Analysis, its core operations, and its strategic approach. We'll also examine how the company's innovative BELIMO products and BELIMO actuators contribute to its financial performance and market dominance. This analysis will provide valuable insights for investors and industry professionals seeking to understand the BELIMO Company and its BELIMO business model.

What Are the Key Operations Driving BELIMO Holding’s Success?

The core of BELIMO Holding's operations revolves around the development, production, and sale of intelligent field devices tailored for HVAC systems. These include a range of BELIMO products, such as damper actuators, control valves, sensors, and meters. The company's focus is on optimizing building automation for energy efficiency and enhancing comfort across various customer segments, from residential buildings to industrial facilities.

BELIMO Company employs a lean business model that emphasizes final assembly, rigorous testing, and customization. This approach allows for efficient handling of downstream processes, resulting in short lead times, a significant competitive advantage. The company's strategic focus on supply chain management and demand forecasting further enhances its operational efficiency.

The BELIMO business model prioritizes customer and supplier partnerships, which have proven to be valuable, even amidst challenging market conditions. With planning centers strategically located across APAC, America, and Europe, BELIMO operations ensure a stable sales base and adaptability to market changes. The ability to offer both standardized solutions and customer-specific adaptations, coupled with early adoption of IoT-enabled devices, sets BELIMO Holding apart.

BELIMO specializes in intelligent field devices. These devices include damper actuators, control valves, sensors, and meters. These products are designed to optimize building automation, focusing on energy efficiency and comfort.

BELIMO's lean business model focuses on final assembly, rigorous testing, and customization. Sourcing accounts for approximately 88% of manufacturing costs. Assembly and customizing & distribution each contribute 6%. This approach results in short lead times.

The company prioritizes supply chain management and demand forecasting. BELIMO cultivates strong customer and supplier partnerships. Planning centers are located in APAC, America, and Europe.

BELIMO offers both standardized and customer-specific solutions. Early expansion into IoT-enabled devices provides comprehensive building control solutions. This translates into energy savings, improved indoor air quality, and enhanced building performance for customers.

BELIMO Holding's strategic advantages include its focus on efficient operations, strong supply chain management, and a customer-centric approach. The company's investment in advanced planning and scheduling software helps to achieve greater precision in demand forecasts, especially for components with long delivery times. This focus supports BELIMO's ability to adapt to market changes and provide high-quality solutions.

- Efficient Operations: Lean business model with a focus on final assembly and customization.

- Supply Chain Management: Prioritized with accurate demand forecasting.

- Customer-Centric Approach: Offers both standardized and customer-specific solutions, including IoT-enabled devices.

- Global Presence: Planning centers in APAC, America, and Europe.

- Partnerships: Strong customer and supplier relationships.

For more insights into BELIMO Holding's growth strategy, you can explore the Growth Strategy of BELIMO Holding.

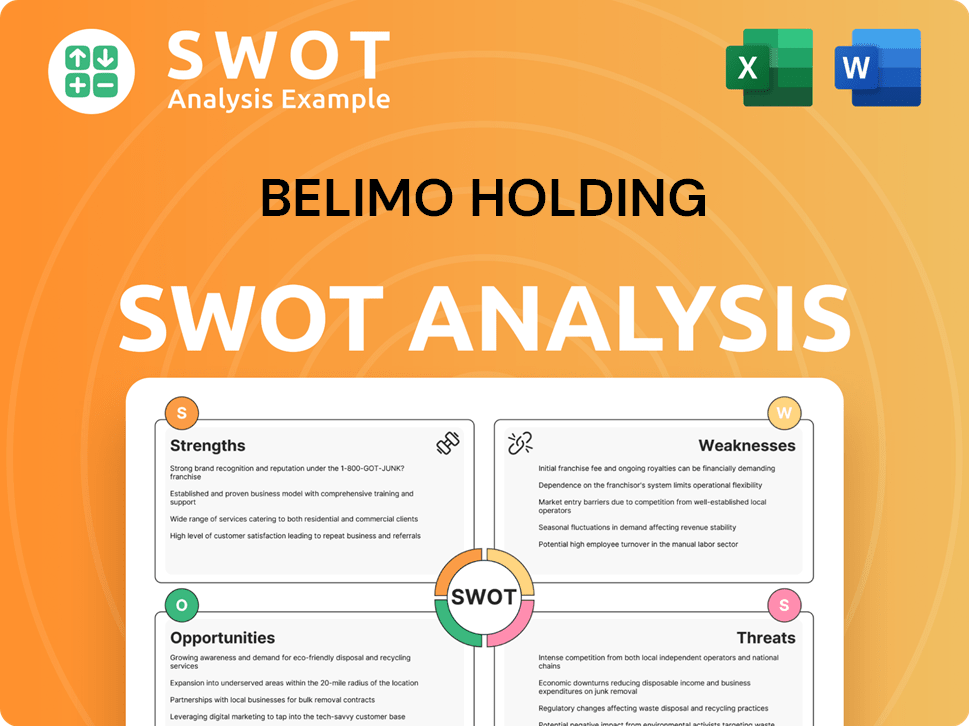

BELIMO Holding SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does BELIMO Holding Make Money?

The core revenue streams for BELIMO Holding stem from the sale of its BELIMO products, primarily damper actuators, control valves, and sensors and meters. In 2024, the company's financial success was evident, with net sales reaching CHF 943.9 million. This represents a substantial increase, reflecting a 9.9% rise in Swiss francs and a 13.1% increase in local currencies.

The company's BELIMO business model is centered on providing essential components for HVAC systems, focusing on efficiency and innovation. Strategic initiatives and market trends significantly influence BELIMO operations, driving revenue growth and market share gains. The company's focus on innovation and strategic market positioning is key to its financial performance.

Monetization strategies at BELIMO Company include leveraging positive pricing effects and a favorable product and customer mix. These strategies helped offset negative foreign exchange impacts in 2024. The company's focus on the renovation market and expansion into IoT-based HVAC systems showcases its commitment to innovation and growth.

The revenue of BELIMO Company is diversified across several key business lines. The company's financial performance is driven by strong growth in key segments, particularly control valves and sensors and meters. The company's strategic initiatives include a focus on the renovation market and data centers.

- Control Valves: This segment contributed 50% of total net sales, reaching CHF 468.0 million. The segment experienced robust growth of 15.4% in local currencies.

- Damper Actuators: This segment accounted for 46% of total net sales, with CHF 431.7 million. It saw a modest growth of 9.7% in local currencies.

- Sensors and Meters: This category showed impressive growth, recording a 25.0% increase in local currencies and contributing 5% of total net sales (CHF 44.2 million).

- Strategic Initiatives: The 'RetroFIT+' initiative targeting the renovation market gained strong momentum in 2024, and the company added 'Data Centers' as a new strategic initiative effective January 1, 2025.

Regional performance highlights strong growth in the Americas, which became BELIMO Holding's largest revenue-contributing region in 2024. The Asia Pacific region also showed substantial growth, fueled by gains in India and China. For more insights into the company's approach, consider the Marketing Strategy of BELIMO Holding.

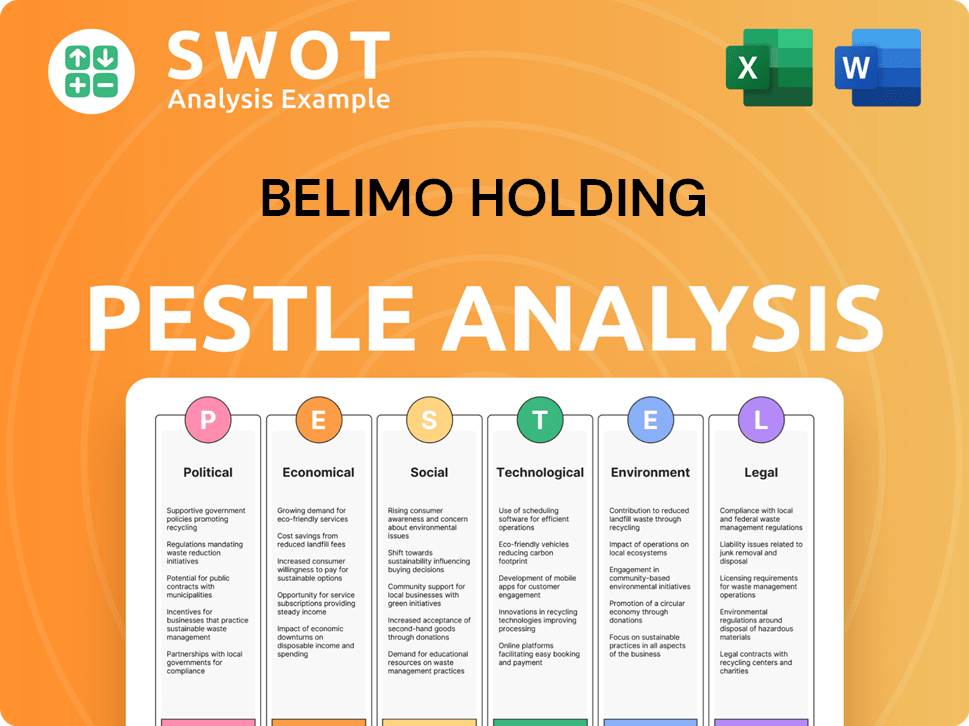

BELIMO Holding PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped BELIMO Holding’s Business Model?

The BELIMO Holding has consistently demonstrated strategic prowess, marked by significant milestones and adaptive maneuvers. In 2024, the company achieved record net sales of CHF 943.9 million, reflecting robust growth and successful execution of its strategic initiatives. These achievements underscore the company's ability to navigate market dynamics and capitalize on emerging opportunities, solidifying its position in the building automation sector.

Key strategic moves include product launches, such as the JR butterfly control valve and the Belimo Assistant App 2 in 2024, and plans for new actuator models in 2025. The company has also strategically focused on segments like data centers and building renovation to mitigate challenges in new construction, particularly in regions like EMEA and China. These initiatives reflect a proactive approach to market changes and a commitment to innovation.

The BELIMO Company's competitive edge is multifaceted, stemming from its leadership in actuators, valve solutions, and sensors for building automation. Its ability to offer both standardized and customized solutions, coupled with early expansion into sensors and IoT devices, sets it apart. The company's high investment in innovation and customer-centric approach further enhance its market position.

The company achieved record net sales of CHF 943.9 million. This was driven by strong growth in local currencies. The company also launched new products, including the JR butterfly control valve and Belimo Assistant App 2.

Responding to market challenges, BELIMO operations focused on data centers and building renovation. The 'RetroFIT+' initiative gained strong momentum throughout 2024. Future plans include the launch of new actuator models for high-performance applications.

Leading global market position in actuator and valve solutions. Offers both standardized and customer-specific solutions. Early expansion into sensors, meters, and IoT-enabled devices.

Strong pricing power and operational efficiency, with an increased EBIT margin of 19.2% in 2024. High equity ratio of 76% in 2024. Global diversification across Europe, America, and Asia.

The company is adapting to new trends, including a strategic focus on data centers and a commitment to the Science Based Targets initiative (SBTi). This initiative aims for net-zero greenhouse gas emissions by 2050. These efforts highlight the BELIMO Holding's commitment to long-term sustainability and market leadership.

- Focus on data centers as a new initiative effective January 1, 2025.

- Commitment to the Science Based Targets initiative (SBTi) in 2024.

- Aiming for net-zero greenhouse gas emissions by 2050.

- Continued investment in innovation and customer-centric methods.

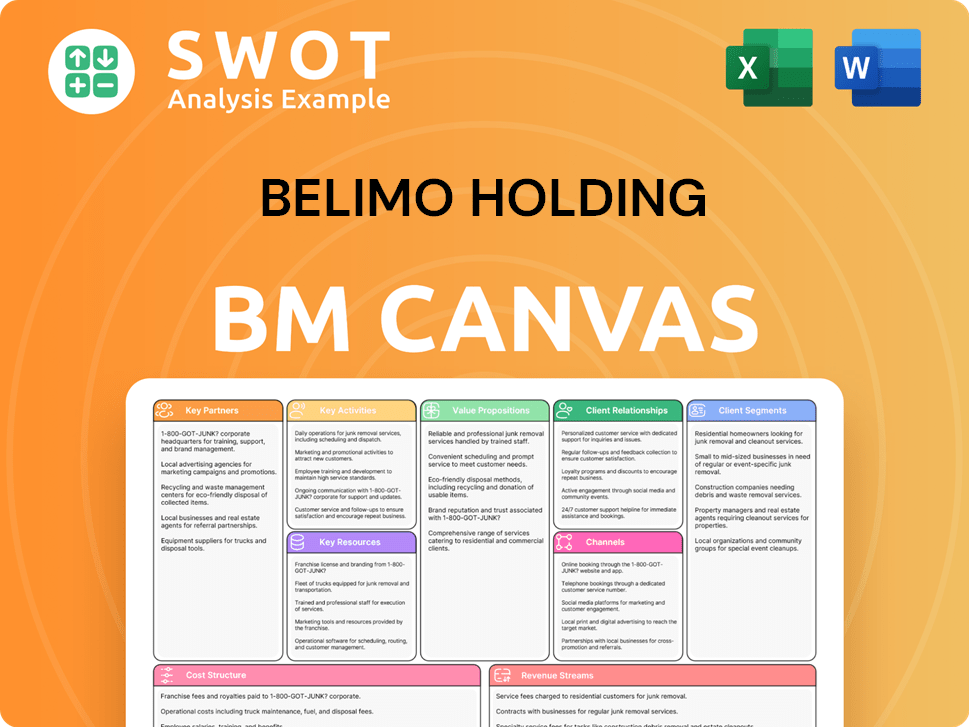

BELIMO Holding Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is BELIMO Holding Positioning Itself for Continued Success?

BELIMO Holding AG firmly holds its position as a global leader in the development, production, and sales of field devices for energy-efficient control within heating, ventilation, and air conditioning (HVAC) systems. Its core focus on damper actuators, control valves, sensors, and meters underpins its market leadership. The company continues to demonstrate robust performance, with the Americas becoming its largest revenue contributor in 2024.

Despite its strong market position, BELIMO faces certain risks, including challenges in new non-residential construction, particularly in key markets such as Germany and China. Geopolitical changes and procurement risks also pose challenges. However, the company is actively addressing these issues through strategic initiatives and operational adjustments.

BELIMO excels as a global leader in HVAC field devices, focusing on energy-efficient control. The company's product range includes actuators, valves, sensors, and meters. The Americas region led revenue growth in 2024, with a 19.8% increase in local currencies.

BELIMO faces risks from challenging construction markets, especially in Germany and China. Geopolitical factors and tariffs necessitate price increases starting in July 2025. Procurement risks are also present, as suppliers provide 88% of manufacturing costs.

BELIMO anticipates sustained growth in 2025, driven by new construction and renovation activities. Demand in the data center market is expected to accelerate. The company projects net sales growth exceeding its five-year average, with an EBIT margin between 18% and 20%.

Strategic initiatives include expanding the Americas Headquarters and enhancing R&D. BELIMO is committed to sustainability, subscribing to the Science Based Targets initiative (SBTi) in 2024. The company aims for net-zero greenhouse gas emissions by 2050. You can discover more about the Growth Strategy of BELIMO Holding.

BELIMO's strong market position is supported by innovation in HVAC controls. The company is navigating risks through strategic adjustments and a focus on sustainable practices. The future outlook is positive, with growth driven by market trends and strategic investments.

- Strong market position in HVAC field devices

- Focus on energy efficiency and digital solutions

- Expansion of Americas Headquarters

- Commitment to sustainability and net-zero emissions by 2050

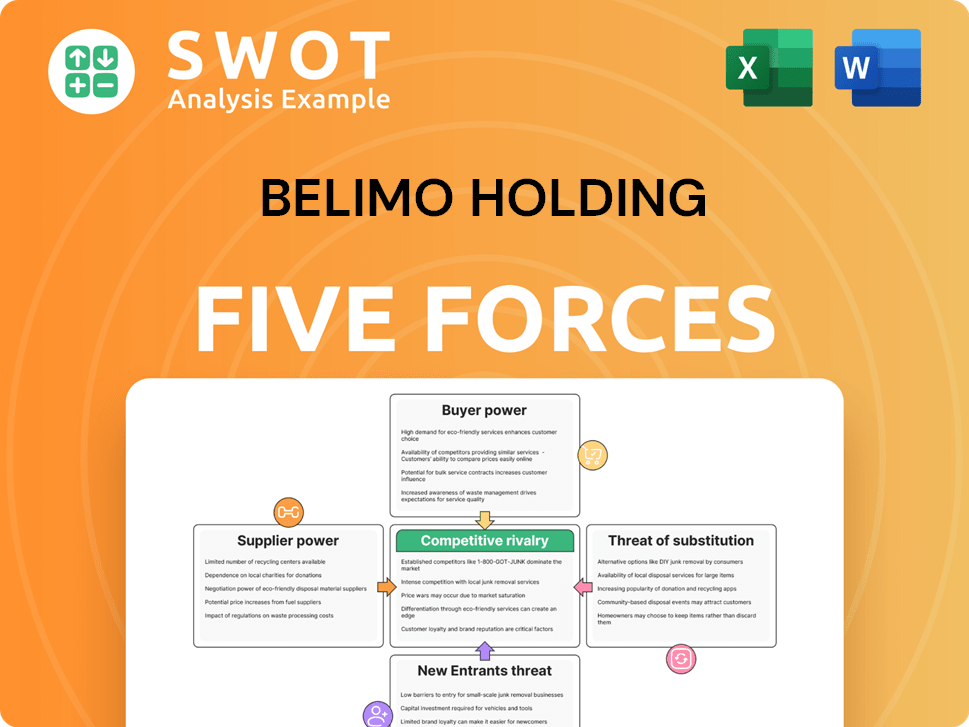

BELIMO Holding Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of BELIMO Holding Company?

- What is Competitive Landscape of BELIMO Holding Company?

- What is Growth Strategy and Future Prospects of BELIMO Holding Company?

- What is Sales and Marketing Strategy of BELIMO Holding Company?

- What is Brief History of BELIMO Holding Company?

- Who Owns BELIMO Holding Company?

- What is Customer Demographics and Target Market of BELIMO Holding Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.